TL;DR - Work for Your Money vs Let Money Work (and when each wins)

"The best investment you can make is in yourself." - Warren Buffett. - CNBC interview

The quick answer

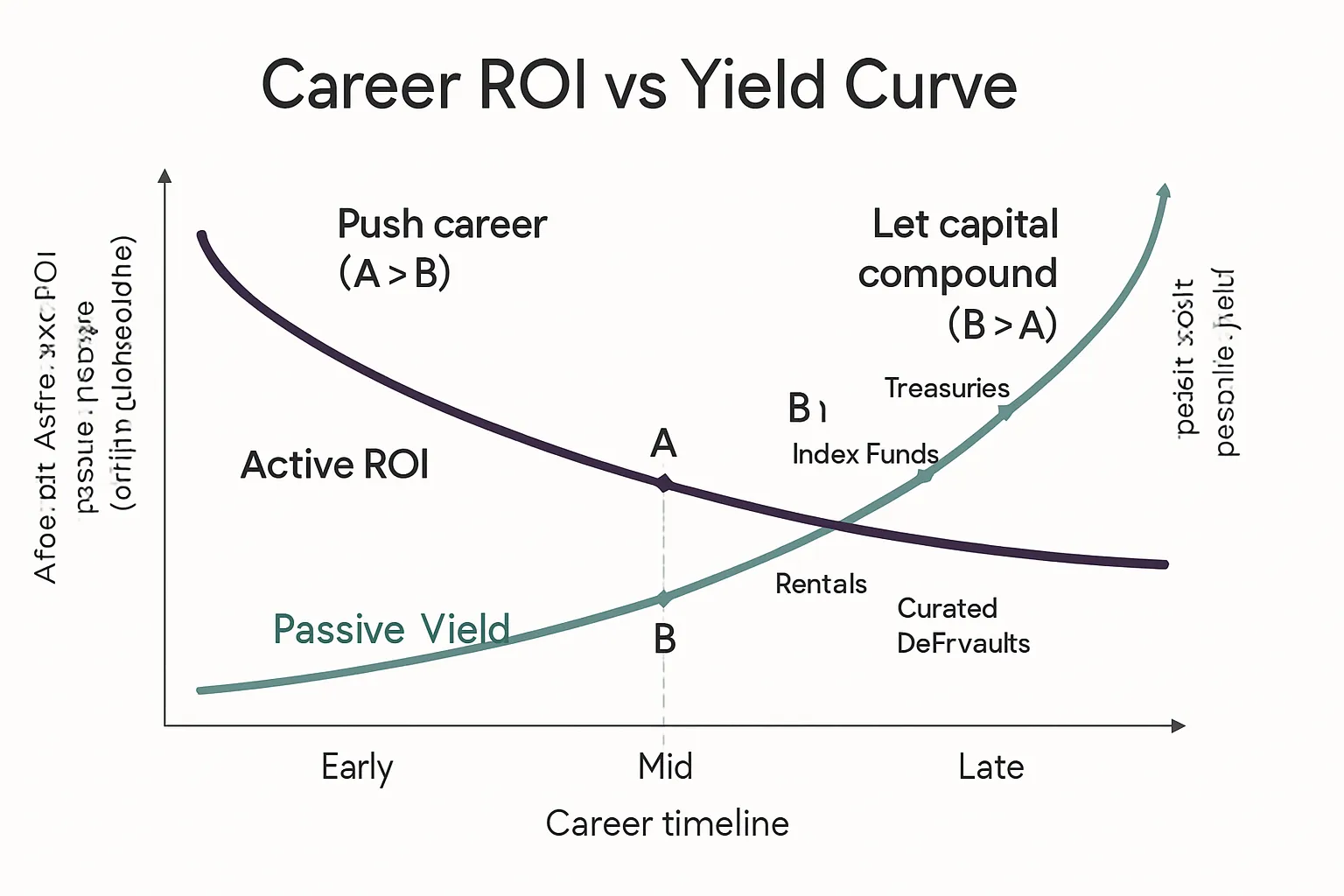

Early career or anytime your after-tax ROI on skills/promotions > realistic passive yields: prioritize active income (work for your money).

Once your career ROI decays below conservative yields: tilt toward letting money work (index funds, real estate, curated DeFi vaults).

Use a staged plan: 1) Raise human-capital income, 2) Automate saving/investing, 3) Layer safe/base yields, 4) Select targeted risk for excess return, 5) Rebalance and de-risk as your freedom number nears.

What this guide covers

Simple math to decide when to push career vs chase yield

A sequencing plan by career stage

The smart toolbox of passive yield (from plain-vanilla to on-chain)

Real-world case studies

How Zemyth helps you blend both sides: work-to-earn + yield, milestone-gated venture, and compounding tokenomics

CTA

Ready to turn your work and capital into a compounding flywheel? Start at https://zemyth.app

Keywords to expect throughout: money from work, work for your money, let money work for you, ways to have your money make money.

Active income vs passive yield - definitions, tradeoffs, and the break-even intuition

Definitions that matter

Active income (money from work): salary, consulting, contractor income, or business operating profit that scales with your time/effort. This is where you work for your money.

Passive yield (ways to have your money make money): index funds/dividends, bonds/treasuries, rental real estate, curated DeFi vaults, and revenue shares. This is where you let money work for you.

Core tradeoffs in one view

Dimension | Active Income (examples, pros/cons) | Passive Yield (examples, pros/cons) | Notes (taxes/volatility) |

|---|---|---|---|

Time demand | High and ongoing; hours-for-dollars; entrepreneurship adds management intensity | Low-to-moderate; upfront diligence, then periodic monitoring | Active demands calendar time; passive demands decision time |

Predictability | Paychecks are stable; business income can be lumpy | Bonds/treasuries stable; equities/real estate/DeFi vary | Bonds taxed as ordinary income; equities vary with markets |

Scalability | Limited by your hours; some leverage via teams/process | Highly scalable once capital is deployed | Scaling passive requires capital, not more hours |

Tax treatment | Ordinary income tax rates; payroll taxes apply | Dividends/cap gains often lower; rental depreciation; staking/yield varies by jurisdiction | Documentation is key; seek tax advice for DeFi/crypto |

Volatility | Job loss risk; business cyclicality | Market-driven; ranges from low (T-bills) to high (equities/DeFi) | Match risk to horizon and liquidity needs |

Drawdown risk | Income shock if laid off or a product fails | Asset price drawdowns; yield variability | Diversify both income sources and asset classes |

The break-even idea

If an extra hour of career leverage raises your annual after-tax compensation by more than a realistic, risk-adjusted yield on your invested capital, prioritize the work side (money from work).

Otherwise, direct surplus into yield engines you understand and can hold through volatility.

Simple intuition: if $25k of annual effort unlocks a $10k raise (40% ROI on time), keep pushing. If raises slow to 3–5% and you can earn 5–7% conservatively, tilt toward compounding capital.

"Over the 10 years ending 2023, 85% of U.S. large‑cap active equity funds underperformed the S&P 500." - Source

Why most people should blend both

Build the income engine first: upgrade skills, negotiate promotions, systemize a business - this is where you work for your money.

Pipe cash into diversified, rules-based yield: index funds, treasuries, rentals you can manage, and curated on-chain vaults - these are ways to have your money make money.

Over time, rebalance from human capital (your labor) to financial capital (your portfolio) as your career ROI decays and your freedom number approaches - so you can consistently let money work for you.

When working for your money beats letting money work - a simple decision framework

The ROI test (rule of thumb)

Compare: (A) After-tax expected salary/fee increase or business profit uplift from your next 100 hours vs (B) after-tax, risk-adjusted annual yield on your current investable assets.

If A >> B: double down on work/career leverage; if A ≤ B: allocate more to passive yields.

Frame it quarterly: re-run A and B every 90 days as market rates and your pipeline change.

Thresholds and timing

Early career: highest marginal return from skill stacking, negotiation, switching roles; this is the prime “work for your money” zone.

Mid-career: blend - invest windfalls and raises into diversified yield, keep a few high-ROI career shots (scope expansions, domain depth, equity).

Late career: capital preservation + dependable income streams dominate; gradually let money work for you.

Practical inputs for A and B

A: market rates for your role, promotion odds/timeline, client acquisition costs and win rates, pricing power, utilization and billable mix, equity/bonus upside.

B: base rates for treasuries/IG bonds, equity risk premium for broad indexes, local real estate cap rates/net yield after expenses, curated on-chain vault APYs net of fees and expected drawdowns.

"Atlanta Fed Wage Growth Tracker shows job switchers’ wage growth outpacing stayers (e.g., ~7–8% vs ~5–6% across 2022–2023)." - Source

Decision guardrails

Underwrite downside first: maintain 6–12 months’ runway, appropriate insurance, and an emergency cash buffer before chasing extra yield.

Avoid over-optimizing tiny yield while ignoring big levers: a 5% raise or better pricing beats squeezing 30 bps from a bond ladder.

Sequence matters: build the income engine, then feed the yield engines you can actually hold through volatility.

Sequence the blend by career stage: from ‘money from work’ to ‘let money work’

Stage 1: Launch (0–3 years in)

Maximize salary trajectory: skill stacking, certifications, negotiation, targeted role moves

Automate saving 20%+: build emergency fund, kill high-interest debt

Zemyth-friendly: Learn the ropes in the Academy, observe StartupNest deals (no rush), park cash in low-risk FundNest to earn a base while you upskill

Stage 2: Lift (3–7 years)

Systems for income: recurring clients, pricing power, management lever

Base yields: broad index funds, T‑bills/short-duration bonds, first rental or REIT exposure

Zemyth-friendly: Begin participating in milestone‑gated StartupNest rounds; use FundNest zero‑risk vaults for cash management; consider small ZEM holdings for fee discounts

Stage 3: Leverage (7–15 years)

Barbell: dependable base yield + selective higher-return bets

Advance to ownership: equity comp, profit share, advisory revenue, niche products

Zemyth-friendly: Stake ZEM to boost FundNest yields; back high‑conviction StartupNest projects with Investment NFTs; use CollabNest to turn skills into tokenized equity (cNFTs)

Stage 4: Freedom design (15+ years)

Shift from growth to reliability: floor income, diversification, risk caps, tax planning

Optionality: sabbaticals, part-time, new ventures funded by yield

Zemyth-friendly: Rebalance toward zero/low‑risk FundNest, harvest StartupNest wins post‑TGE, use ZEM for priority access and fee savings while you simplify

Career-stage sequencing plan

Stage | Primary Goal | 60–90 Day Moves | Core ‘Work’ Levers | Core ‘Money Works’ Levers | Risk Guardrails | Zemyth Tools to Consider |

|---|---|---|---|---|---|---|

Launch (0–3 yrs) | Steepen salary slope; build runway | Ship a cert/skill; re-write resume/portfolio; run 3 targeted interviews; auto-save 20%+; pay off high‑interest debt | Skill stacking, interview loops, compensation benchmarking, switching roles for 20–30% jumps | T‑bill ladder; broad index fund DCA; high‑yield cash; micro‑REIT or REIT ETF toe‑dip | 3–6 months emergency fund; avoid leverage; keep allocation simple (e.g., 80/20) | FundNest Zero‑Risk vaults for base yield; follow StartupNest watchlist; small ZEM for fee discounts |

Lift (3–7 yrs) | Systemize income and raise prices | Productize services; set retainers; negotiate title/comp; pre‑approve mortgage if rental; automate investments on payday | Recurring clients, utilization discipline, pricing power, early leadership track | Core index allocation; short‑duration bonds; first rental or fractional; start tax‑advantaged accounts | 6–9 months runway; landlord reserve (3–6 months PITI); position sizing rules | StartupNest selective entries; FundNest Zero/Low‑Risk; accumulate ZEM for boosts/priority |

Leverage (7–15 yrs) | Own upside; barbell risk | Scope for equity/profit share; launch niche product; formal advisory; tax strategy tune‑up | Equity comp, profit share, advisory retainers, scalable products | Base: index + treasuries; Plus: rentals with pro mgmt; curated DeFi vaults sized by risk; factor tilts | Cap any single risk to <5–10% of NW; insurance review; stress‑test cash flows | FundNest Low/Medium‑Risk vaults with ZEM boosts; stake Investment NFTs + ZEM; CollabNest cNFT earnings |

Freedom design (15+ yrs) | Reliability, tax efficiency, optionality | Map floor income; liability matching (bond ladder); simplify holdings; estate/charitable plan | High‑leverage work optional; part‑time/consulting by choice | Floor: treasuries/IG bonds; Core: diversified equity; Select: stabilized real estate; wind down higher‑vol bets | 12+ months liquidity; de‑risk sequence‑of‑returns; tax loss/harvest planning | FundNest Zero/Low‑Risk for floor; harvest StartupNest TGEs; ZEM for fee cuts and priority without complexity |

Notes:

Early years emphasize money from work: compounding human capital and negotiation beats chasing tiny yield.

Mid years blend in dependable yield and a few targeted, higher‑return bets you can stick with.

Later years let money work for you: reliability, distribution planning, and risk caps matter more than maximizing upside.

The passive-yield toolbox, done right (from plain-vanilla to on-chain)

"Don’t look for the needle in the haystack. Just buy the haystack." - John C. Bogle. - Source

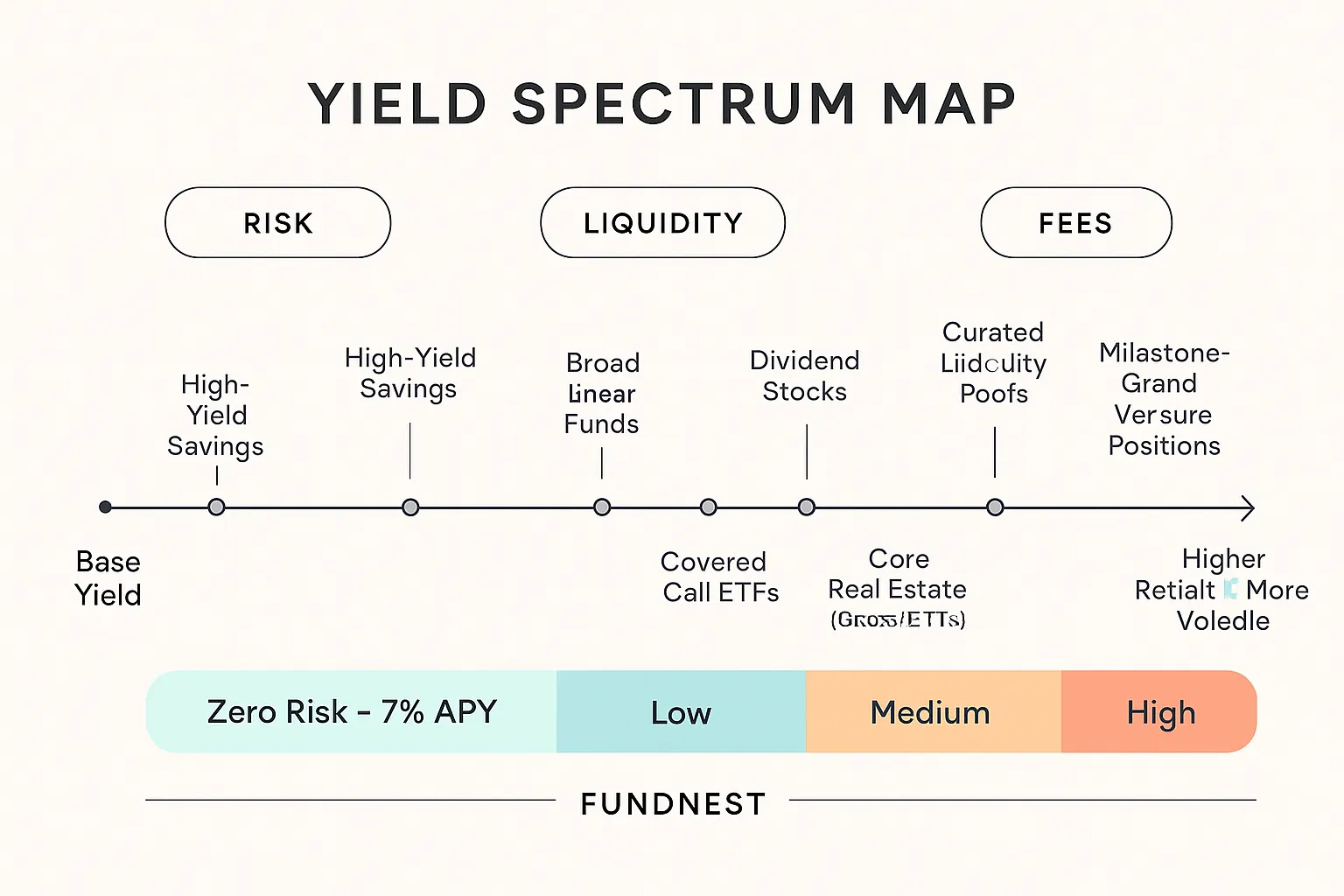

Base layer (sleep-well yields)

High-yield savings, T‑bills/short-duration bond funds, broad market index funds

Purpose: low-volatility ballast and liquidity that keeps compounding while you focus on money from work

Income plus growth

Dividend equities, covered-call ETFs (understand income-for-upside tradeoff), core real estate (direct or REITs)

Purpose: raise portfolio cash flow without abandoning long-run growth engines

Alternative and on-chain opportunities

Curated liquidity pools, revenue-sharing tokens, milestone-gated venture positions

Why curation, escrow, and risk tiers matter: underwriting protocols, custody, and slippage; avoid “set and forget” myths - yields move, risks evolve, liquidity can tighten

Fees, liquidity, tax, and platform risk

Compare net yield after fees, slippage, and taxes; weigh lockups and counterparty/platform risk

Common pitfalls: chasing headline APY, ignoring smart-contract risk, neglecting tax-lot strategy and wash-sale rules

Where Zemyth slots in

FundNest risk tiers and target APYs: Zero Risk (~7% APY) for stables, and tiered pools for Low/Medium/High risk as you graduate up the spectrum

Escrowed capital efficiency: idle StartupNest funds earn yield in Zero Risk until milestones unlock, improving overall portfolio IRR

Investor protections: milestone-gated venture via StartupNest, cNFT work-to-earn via CollabNest, and ZEM boosts/fee discounts to compound outcomes

Taxes, risk, and behavior - the unsexy edge that compounds

Taxes that hit active vs passive differently

Earned income (money from work): subject to ordinary income rates and payroll taxes (Social Security/Medicare). This is your “work for your money” bucket.

Capital gains/dividends: qualified dividends and long-term gains can be taxed at lower rates than salary; short-term gains are taxed as ordinary income.

Real estate: depreciation shields rental income; 1031 exchanges can defer capital gains; keep precise records of basis, improvements, and passive loss carryforwards.

Net Investment Income Tax (NIIT): higher earners may owe NIIT on passive income; plan ahead with asset location and harvesting.

Asset location tip: place tax-inefficient assets (high-turnover funds, ordinary-income bond funds, covered-call strategies) in tax-advantaged accounts; hold broad index funds and long-term real estate in taxable for better after-tax outcomes.

Zemyth angle: FundNest base-tier yields can be used inside a broader plan; always model after-tax, net-of-fee returns for your jurisdiction. StartupNest outcomes (token distributions) and ZEM rewards can have varying tax treatment - log everything and consult a professional.

Risk management stacks

Liquidity runway: 6–12 months of essential expenses in cash/T‑bills before reaching for extra yield. This lets you stay invested when markets are messy.

Diversification: mix sources of return - salary/fees, index funds, treasuries, real estate, and curated liquidity pools - to avoid a single point of failure.

Position sizing: cap any single active bet (stock, startup, LP position, or on-chain vault) to 5–10% of net worth; size higher-volatility positions smaller.

Downside floors: match near-term liabilities with safe assets (laddered T‑bills/IG bonds); pre-commit exit criteria for speculative positions.

Counterparty/platform risk: evaluate custody, smart-contract audits, escrow mechanics, and challenge periods. Zemyth’s milestone-gated escrow and permissionless checks are designed to reduce “funds go missing” risk.

Behavioral discipline

Automate contributions: set-and-raise auto-transfers after each promotion or client price increase; make “ways to have your money make money” default.

Avoid performance-chasing: write a short Investment Policy Statement (IPS) with target mix, maximum drift bands, and simple rebalancing rules.

Review rhythm: once per quarter is enough - log decisions, reasons, and expected hold period; don’t make same-quarter reversals without a pre-written trigger.

Pre-commit to hold periods: broad index funds (multi-year), rentals (full cycle), curated on-chain vaults (per-risk tier with planned “checkpoints”).

Friction hacks: remove casino apps, limit portfolio look-ins to calendar events, and route windfalls straight to your allocation.

KPI dashboard

Savings rate: percent of gross income saved/invested; target 20%+ during growth years.

Income growth: rolling 12-month increase in active income (raises, utilization, pricing power).

Net-new investable cash: dollars added to the portfolio each quarter (excl. market gains).

Blended net yield: after-fee, after-tax expected yield across cash/bonds/equities/alternatives.

Drawdown tolerance: max peak-to-trough you can stomach without behavioral errors; align allocation to your real number, not a fantasy.

Capital efficiency: percent of idle capital earning at least a base yield (FundNest Zero Risk can help for parked cash and escrow).

Work the plan

Small, repeatable systems beat one-off heroics: auto-increase contributions, quarterly rebalance, yearly tax-loss harvest, and an annual risk audit.

Sequence matters: build the income engine first (work for your money), then pipe surplus to reliable yield engines and a few curated risk-on plays (let money work for you).

Use guardrails: write the rules when calm, execute them when markets shout.

Make it boring on purpose: predictable process is the unsexy edge that compounds.

Case studies: when ‘work first’ wins, when ‘money works’ wins (and how to blend)

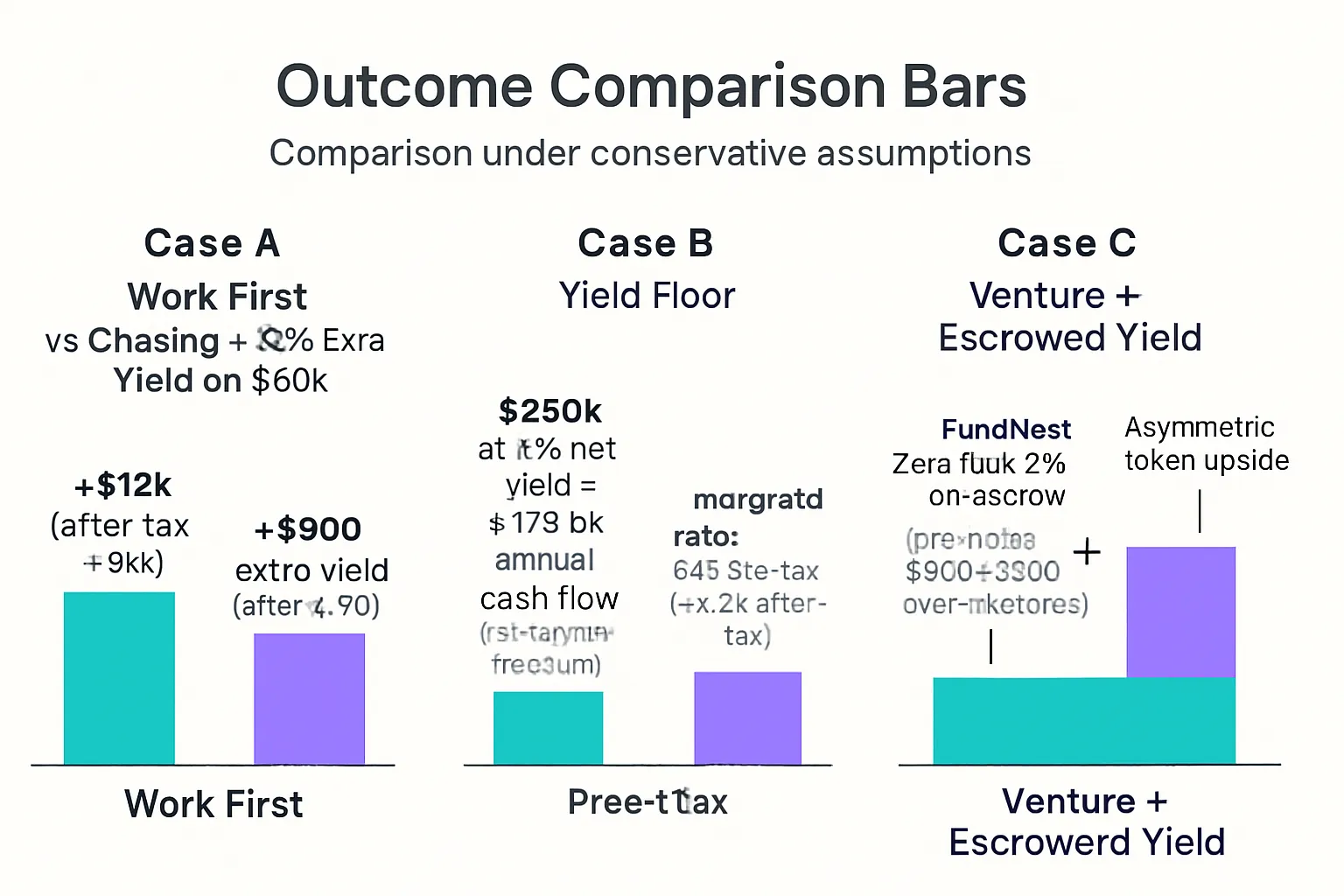

Caption (drivers):

Case A: 100 hours → +$12k/year raise (

$9k after tax) vs chasing an extra 1–2% on a $60k portfolio ($600–$1,200 pre‑tax).Case B: $250k at 5% dependable net yield = $12.5k/yr (

3 months of freedom) vs working extra for a marginal $6k raise ($4.2k after tax).Case C: $10k milestone‑gated venture position with escrow earning ~7% APY until unlocks (pro‑rated ~$200–$300), plus asymmetric token upside with downside guardrails.

Case A - The skill arbitrage

Scenario: You have a $60k portfolio and can invest 100 hours.

Work-first path: Use those hours to earn a certification, nail three targeted interviews, and negotiate a +$12k/year salary bump (assume ~25% tax → ~$9k net per year). That’s a recurring, compounding base the next raise builds on.

“Extra yield” path: Spend those hours hunting an extra 1–2% on $60k (via niche funds or complex vaults) → $600–$1,200 pre‑tax; after tax, ~$450–$900. One‑time and fragile.

Takeaway: Early career, money from work dominates. The ROI of skill stacking and negotiation usually crushes incremental yield. Work for your money first; you can let money work for you with the bigger base you just created.

Case B - The yield floor

Scenario: Mid‑career with $250k invested and stable comp.

Yield-first path: Allocate to dependable base yields (T‑bills/short-duration bonds, broad index funds, core real estate) targeting ~5% net → $12.5k/year, roughly three months of living expenses if your budget is ~$50k/yr.

Overwork path: Grind for a marginal $6k raise with more hours, on‑call, or stress (~$4.2k after tax). Behaviorally harder, less certain, and consumes your scarcest asset: time.

Takeaway: Once your career ROI decays below conservative yields, let money work for you by building a stable yield floor that buys time, focus, and option value.

Case C - Venture + escrowed yield

Scenario: You deploy $10k into a milestone‑gated venture via StartupNest while un‑unlocked capital sits in escrow.

Dual engine:

Base: Escrowed funds earn Zero‑Risk yield (~7% APY via FundNest) until each milestone unlocks (pro‑rated ~$200–$300 on $10k across typical timelines).

Upside: If milestones pass and TGE succeeds, you gain token allocations with potential asymmetric upside. If things stall, investor votes, challenge periods, and abandonment/TGE‑failure rules provide structured off‑ramps and refunds.

Takeaway: You get shots on goal without fully idling capital. This is “smart passive”: curated pools plus milestone‑gated venture, not set‑and‑forget speculation.

Synthesis

The blended policy that wins across regimes:

Launch: Prioritize career arbitrage (skills, promotions, pricing power). Route a fixed 20%+ of income to base yields so you never skip compounding.

Lift/Leverage: Keep a dependable yield floor (treasuries/IG bonds/index funds/REITs) and take a few targeted, sized‑right risk bets (e.g., milestone‑gated venture, curated liquidity pools).

Freedom Design: Max reliability. Let money work for you: floor income, diversification, risk caps, tax efficiency. Only swing at high‑conviction, pre‑underwritten opportunities.

Zemyth fit:

FundNest: Park idle cash and escrow in Zero/Low‑Risk tiers for daily, transparent yield.

StartupNest: Back founders with NFT positions, milestone‑based unlocks, and investor voting.

CollabNest: Convert skills into tokenized equity (cNFTs) to augment both income and ownership.

ZEM: Boost yields, cut fees, and prioritize access - turn both your work and capital into a compounding flywheel.

Keywords to expect throughout: money from work, work for your money, let money work for you, ways to have your money make money.

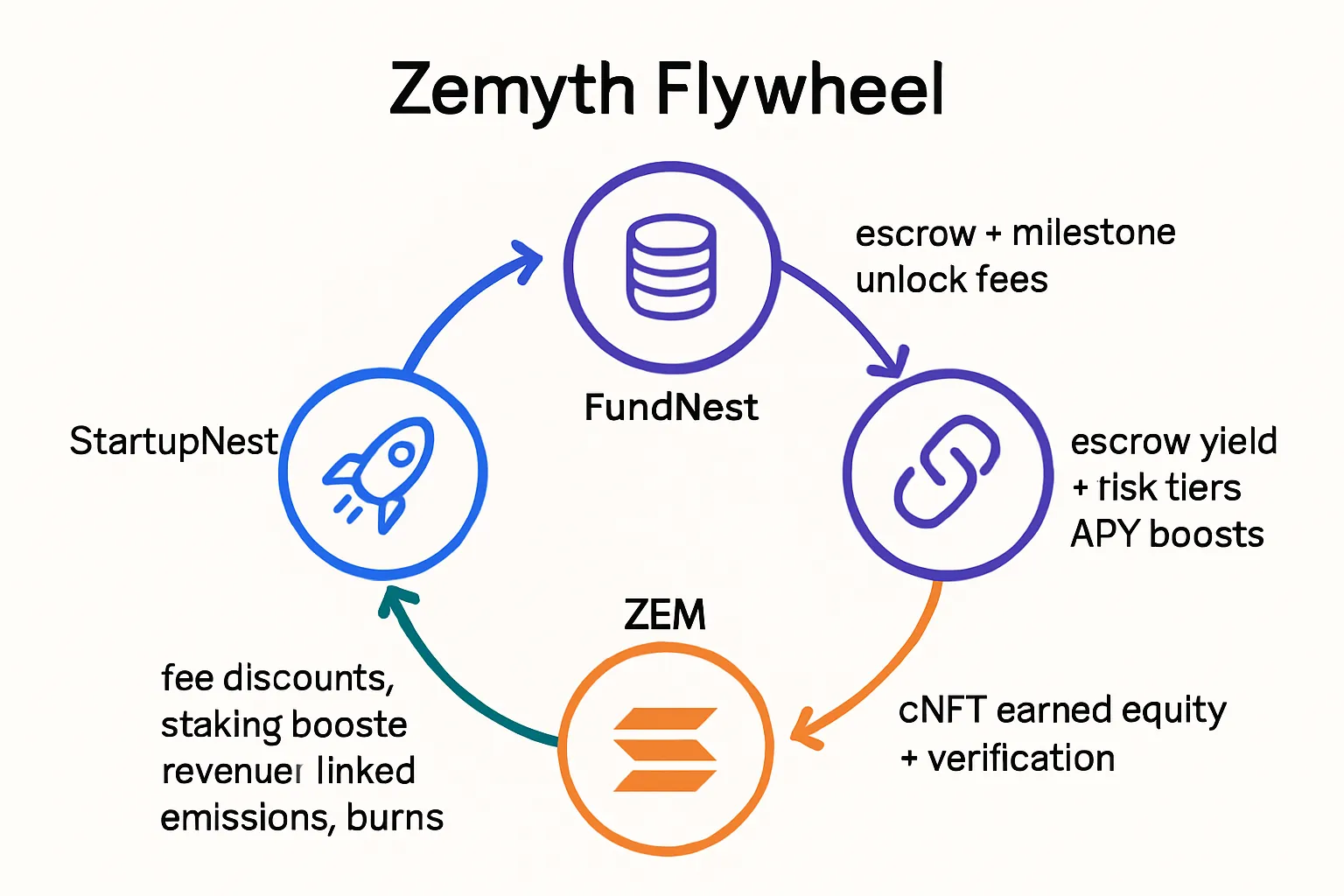

How Zemyth makes both sides easier: work-to-earn + yield + venture, stitched together

StartupNest - milestone-gated venture positions

Escrow protects capital until proof is delivered; investor voting on each milestone; funds unlock per roadmap; Investment NFTs hold voting rights and token claims at TGE.

Outcome: asymmetric upside with structured guardrails - your “money works” without blind trust.

FundNest - tiered vaults from zero to higher risk

Put idle cash to work in curated pools; Zero Risk for stables, with Low/Medium/High risk tiers for advanced users; APY boosts for ZEM lockers.

Bonus: StartupNest escrow can earn yield in Zero Risk pools until milestones unlock - capital efficiency by design.

CollabNest - turn skills into earned equity

Ship work, get Contribution NFTs (cNFTs) that encode token allocations; verification and dispute resolution keep incentives honest; cNFTs are tradable for optional liquidity.

Outcome: your “work for your money” converts directly into equity - no paycheck required.

ZEM tokenomics - utility + revenue-linked emissions

Real revenue caps emissions; utility delivers fee discounts, staking boosts, and priority access; burns apply on TGEs and transactions to keep pressure deflationary.

Stake ZEM with Investment NFTs to amplify rewards and move up the priority ladder.

The flywheel

Capital + talent + yield reinforce each other:

StartupNest brings projects and escrowed capital.

FundNest turns that TVL into base yield.

CollabNest accelerates delivery with work-to-earn contributors.

ZEM ties it together via boosts, discounts, and aligned emissions.

Result: a single pane of glass to work for your money and let money work for you - on your terms.

Your 30/60/90-day plan to blend income power with yield power

Days 1–30

Audit your baseline

Income levers: role, skills stack, raise negotiation, client pipeline, billable utilization

Savings rate: target 20%+ of gross; list auto-deductions

Debt: kill anything >7–8% APR first

Runway: months of essential spend covered (goal 3–6)

Investable assets: cash, brokerage, retirement, on-chain

Tax posture: account types, brackets, NIIT exposure, loss carryforwards

Ship one income lever (work for your money)

Book the raise conversation with comparables and value proof

Or reprice a client/offer a retainer

Or enroll in a certification that unlocks +$10k+ salary band

Automate contributions (let money work for you)

Set payday auto-transfers to base-yield vehicles (T‑bills/short-duration bonds, broad index funds)

Route windfalls (bonuses, tax refunds) to your target mix on day one

Zemyth quick start

Park idle cash in FundNest Zero Risk to earn base yield while you focus on income

Create a StartupNest watchlist (no FOMO allocations yet)

Days 31–60

Secure the floor

Fund 3–6 months runway (cash/T‑bills)

IPS (Investment Policy Statement): goals, time horizons, target allocation, drift bands, rebalancing rules, position-size caps, exit rules

Choose 1–2 reliable yield tools

Pair a base (index funds/T‑bill ladder) with one income-plus-growth (REITs/dividend ETF) at small sizing

Define maximum drawdown you will tolerate and the rebalance trigger

Add a “work-to-earn” experiment

Explore a contribution bounty in your skill lane via CollabNest to convert effort into tokenized equity (cNFTs)

Zemyth integrations

Keep parked cash productive in FundNest; test a small ZEM position for fee discounts/boosts

Days 61–90

Evaluate and rebalance

Compare actual savings rate, income uplift, and net-new investable cash to plan

Rebalance to targets; prune what you won’t continue

Select a small, curated upside shot

Consider a milestone‑gated venture position (StartupNest) sized <5% of portfolio; rely on escrow + voting + unlock safeguards

Keep position-size rules and exit criteria written in your IPS

Document the next two quarters

Define 2–3 income experiments (raise, client mix, pricing) and 1–2 yield experiments (fund upgrades, risk-tier changes) with start/stop dates

Ongoing cadence

Quarterly review: KPI dashboard (savings rate, income growth, net-new cash, blended net yield, drawdown tolerance)

Annual re‑target: adjust allocation to match time horizon and career ROI; de‑risk as your freedom number nears

Systemize the flywheel: automatic contribution increases with each raise; route escrow/idle balances to base yield; keep 1–2 sized-right asymmetric bets

Mindset: build the income engine (money from work), then compound via dependable yields (ways to have your money make money). Repeat, don’t reinvent.

Ready to put this plan on rails and turn both your work and your capital into a compounding flywheel? Start at https://zemyth.app

Conclusion - stop waiting, start compounding (and why Zemyth helps you do both)

Key takeaways

Early: work for your money; mid/late: let money work; always blend the two so you’re never relying on one engine.

Use ROI math to choose your next move: if a focused 100 hours of effort beats your portfolio’s realistic, risk‑adjusted yield, lean into career leverage; otherwise, fund dependable yields.

Protect the downside (runway, insurance, position sizing) and automate the upside (auto‑contribute, rebalance, pre‑set exit rules).

Keep it boring and repeatable: small systems > one-off heroics. This is how your money from work becomes the capital that compounds - true ways to have your money make money.

What to do next

Pick one career lever and one yield lever to activate this week:

Career: schedule the raise conversation, reprice a client, or enroll in a cert that moves you up a band.

Yield: auto-route a fixed percentage of each paycheck into T‑bills/index funds; add one reliable income‑plus‑growth allocation at small size.

Build the habit: move cash from paycheck to purpose to passive yield - every pay cycle - without relying on willpower.

CTA

Put both engines under one roof. Explore milestone‑gated venture, yield vaults, and work‑to‑earn opportunities at Zemyth: https://zemyth.app