Intro: Stop guessing “which crypto to invest in” - use sectors

If you’re still asking “invest in what crypto?” or “invest in which crypto?”, you’re asking the wrong question. In 2025, returns don’t cluster by random coin lists - they rotate by sector. A sector framework turns chaos into a plan, so you know where to look, what to track, and when to act.

"Application-layer fee revenue has now exceeded $10 billion on an annualized basis in Q3 2025." - Source

Why a sector framework beats coin lists in 2025

The market is too broad for one-off picks; sectors cluster catalysts, cash flows, and risks.

Align your research with how returns actually rotate:

L1s/L2s

Financials

DeFi/Stablecoins

AI/DePIN

Infra/Data

RWAs/Payments

Sector views let you build a “where next” roadmap instead of chasing lagging winners. Once a sector’s KPIs inflect, you can drill down to the best tokens within it.

What you’ll learn

A simple, repeatable way to decide which crypto to invest in (keywords: invest in what crypto, invest in which crypto, crypto how to invest) using a sector-first decision tree.

The monthly KPIs that matter by sector - and exactly how to map them to entries/exits.

Tokenomics diligence and portfolio blueprints designed to target investments that have high returns without overexposure.

Fast take: 2025 tailwinds and traps

Tailwinds:

Policy clarity on stablecoins and improving fiat on/off-ramps.

Rising application-layer fee capture and real usage in DeFi rails.

Better infra for data, agents, and cross-chain UX.

Traps to avoid:

Illiquid small caps and thin order books that magnify downside.

Reflexive emissions that dump on holders and suppress price.

Unsustainable yields masking insolvency risk.

Opaque treasuries and governance that can’t be audited.

At Zemyth, we translate this sector map into action. Milestone-gated rounds let you aim at the right sectors at the right time, while our Fund Nest provides a liquid yield base layer so your capital compounds even between moves.

The 2025 Crypto Sector Map (and how to use it to pick winners)

Stop asking “invest in what crypto” and start asking “which sector has the next catalyst?” Winners in 2025 concentrate where policy, cash flows, and adoption converge - not in random coin lists.

"Crypto Sectors organizes the market into six segments covering 261 tokens and roughly $3.5 trillion in market cap (as of Sept 23, 2025)." - Source

The six segments we’ll track

Smart Contract Platforms (L1s/L2s)

Execution layers where apps and stablecoins live; throughput, fees, and dev traction drive value.

Financials (CEX tokens, perps venues, payment rails)

Exchange volume, buyback/burn mechanics, and payment corridor growth are key cash flow drivers.

DeFi & Stablecoins (DEXs, lending, stablecoin issuers)

Fee revenue, TVL quality, stablecoin supply growth, and risk controls separate leaders from yield traps.

AI, Data & DePIN (compute networks, agent platforms, indexing)

GPU utilization, agent activity, dataset liquidity, and inference demand are your signals.

Infrastructure & Services (oracles, bridges, wallets, dev tooling)

Security track record, integration depth, and monetization (subscription/fees) matter most.

RWAs & Payments (tokenized assets, settlement networks)

Compliance progress, institutional pilots, and settlement volumes flag traction ahead of scale.

Why this beats coin-picking

Sectors bundle similar cash flow drivers, policy risk, and adoption curves - so your research compounds.

Rotation-friendly: move weight as KPIs and liquidity migrate across segments instead of chasing stale pumps.

Clearer risk budgeting: each sector carries distinct drawdown and regulatory profiles you can size against.

How to read the map in practice

Match catalysts to sectors first; shortlist tokens second.

Example: If stablecoin legislation rolls out, overweight Smart Contract Platforms + DeFi/Stablecoins before picking specific L2s, DEXs, and issuers.

Use a KPI stack (adoption, liquidity, token design) before any buy:

Adoption: users, volumes, fee revenue, on-chain activity.

Liquidity: exchange depth, circulating float vs. emissions, unlock calendar.

Token design: value capture (fees/burns/staking), treasury runway, governance clarity.

Translate “crypto how to invest” into a decision tree:

Sector tailwind → KPI inflection → Tokenomics pass → Entry plan and risk limits.

Keep SEO intent aligned: when you think “invest in which crypto,” start with the sector that shows improving fundamentals and policy air cover.

12-month catalysts to watch

U.S. market structure legislation and new ETP listings expanding regulated access.

Stablecoin legislation roll-out boosting settlement and on-chain payment flows.

L2 expansion and account abstraction improving UX and throughput for consumer apps.

Decentralized compute demand (AI/DePIN) driving GPU utilization and fee capture.

RWA pilots with instant settlement moving from sandbox to production with real volume.

At Zemyth, we operationalize this map: allocate toward sectors with verified milestones, gate startup funding by on-chain progress, and park idle capital in the Fund Nest to compound between rotations - so you can pursue investments that have high returns without overexposure.

Your monthly sector dashboard: the signals that matter

1) Adoption & activity

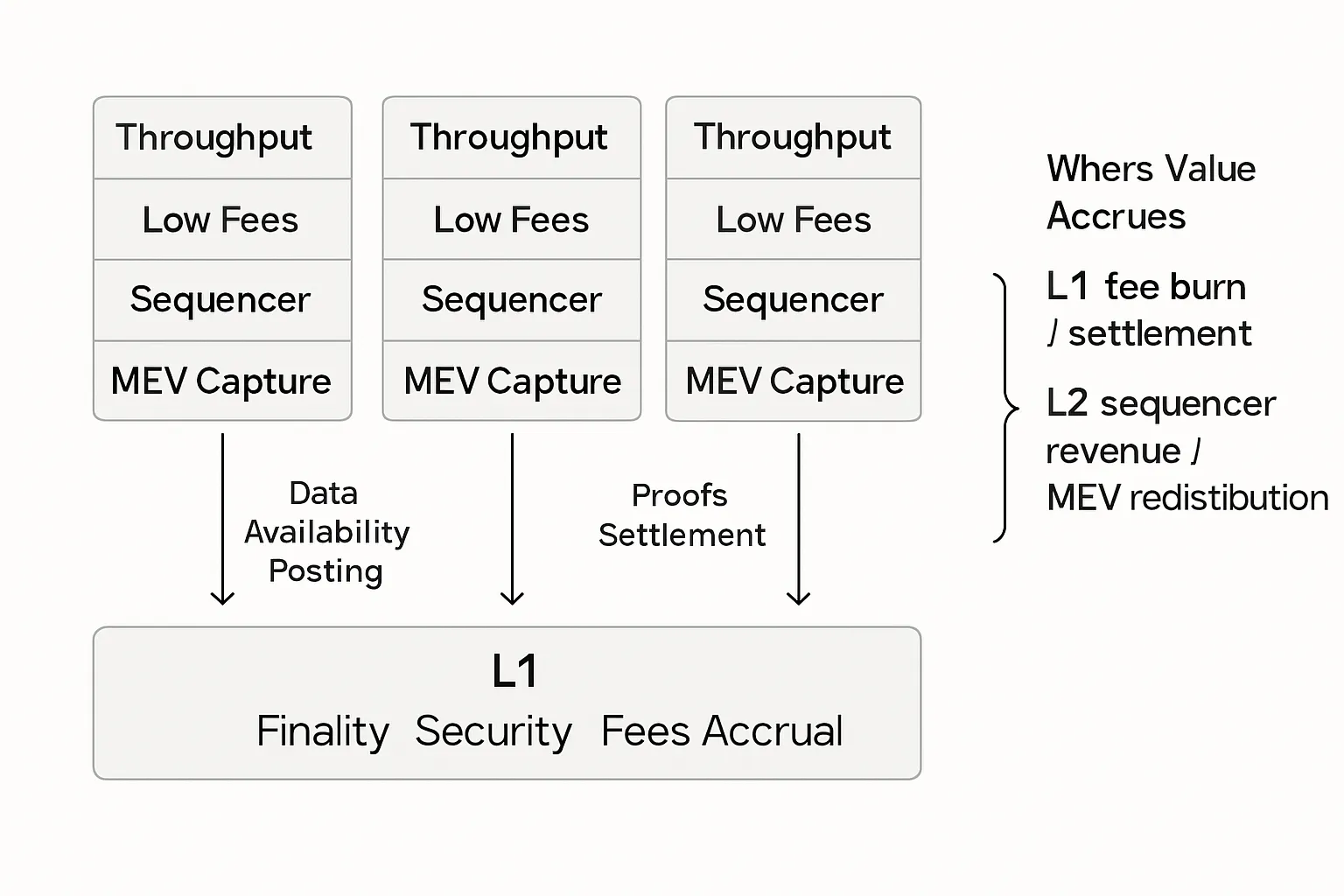

L1/L2: active addresses, transaction fees, rollup proof posts, data availability usage/throughput.

DeFi: protocol fees (DEX, perps, lending), TVL quality (stablecoin share), unique traders/borrowers.

AI/DePIN: paid inference/jobs, GPU hours rented, agent MAUs and retention.

2) Liquidity & flows

CEX/DEX volumes, stablecoin net supply, ETP inflows, perp open interest and basis.

3) Token design & supply

Emissions schedule and unlocks, buyback/burn or fee share, real yield split to stakers/LPs, treasury runway and transparency.

4) Narrative & policy catalysts

Legislation milestones, major mainnets/upgrades, enterprise pilots, exchange listings and ETP approvals.

2025 Sector KPI Matrix

Sector | Adoption KPIs | Liquidity KPIs | Token Design Checks | 2025 Catalysts | Common Red Flags |

|---|---|---|---|---|---|

L1/L2 | Active addresses, tx fees, TPS/throughput, rollup proof posts/week, DA block utilization, developer activity | Native token CEX/DEX depth, perp OI, staking/liquid staking ratio, bridge volumes | Inflation vs staking APR, fee burn/capture, unlock calendar, validator decentralization, foundation treasury policy | L2 expansion, account abstraction, DA module upgrades, stablecoin integrations, gas-fee reductions | Sequencer downtime, bridge exploits, runaway emissions, validator concentration, wash activity |

Financials | Exchange DAUs, spot/perps volume, payment corridor TPS, on/off-ramp conversions | Order-book depth, fee tier migration, exchange-token market depth, buyback/burn wallet activity | Revenue share/burn mechanics, utility (fee discounts/collateral), compliance posture, PoR cadence | U.S. market structure rules, new ETP listings, buyback programs, new jurisdictional licenses | Enforcement actions, inflated/wash volume, custodial insolvency risk, opaque reserves |

DeFi/Stablecoins | Protocol fees (DEX/perps/lending), unique traders/borrowers, utilization rates, stablecoin supply/peg health | TVL quality (stablecoin share, blue-chip collateral), DEX market share, Curve/pool depth, cross-chain liquidity | Emissions slope and sink, fee switch/real yield, bribe/gauge sustainability, treasury runway and audits | Stablecoin legislation rollout, L2 deployments, RWAs as collateral, cross-chain DEX/AMM upgrades | Reflexive emissions, under-collateralized pegs, oracle manipulation, admin-key/control risk |

AI/DePIN | Paid inference/jobs, GPU hours rented, model/agent MAUs, dataset listings, uptime | Settlement volumes for compute/data, token sinks for inference, provider collateral/stake, CEX/DEX volume | Value capture (fee share/burn per inference), provider rewards vs dilution, emissions to supply-side, slashing | Enterprise inference partnerships, model hosting releases, dataset marketplaces, DePIN expansions | Fake job spam, unsold GPU capacity, unverifiable benchmarks, centralization of providers |

Infra/Services | Oracle calls/day, bridge tx count/volume, wallet MAUs, RPC requests, dev tooling usage | Subscription revenue, protocol fee accrual, token velocity, cross-chain volumes | Fee accrual to token, slashing/insurance design, upgrade safety (timelocks), multisig transparency | Major integrations (L1s/exchanges), wallet feature launches, cross-chain standards adoption | Bridge hacks, oracle outages, unaudited upgrades, governance capture/low quorum |

RWAs/Payments | Tokenized AUM, on-chain settlement volume, issuers onboarded, merchant acceptance, KYC’d wallet counts | Redemption windows/liquidity, secondary market depth, fiat rails throughput, spread stability | Legal wrapper clarity, custody segregation, cash flow distribution to holders, access control lists | Regulator/CBDC pilots, DvP settlements, bank/fintech integrations, compliant stablecoin rails | NAV mismatch, redemption gates, jurisdiction risk, off-chain data opacity |

How to use the dashboard

Green across Adoption + Fees + Liquidity = increase weight. That’s your “invest in which crypto” roadmap by sector, not by hype.

Divergence rules:

Price up, KPIs flat/down = wait or trim - momentum without fundamentals rarely sustains.

Price down, KPIs rising = accumulate cautiously with staged entries and tight risk.

This is your “crypto how to invest” system: scan sectors, confirm KPI inflections, then pick tokens that actually capture value. At Zemyth, we pair this with milestone‑gated rounds and a liquid yield base so you can pursue investments that have high returns without overexposure.

Smart Contract Platforms (L1s/L2s): where the users and fees settle

Thesis in one line

Own the base layers that capture fees from real applications and scale with L2 ecosystems.

What moves this sector

Throughput vs. cost, L2 growth (rollups, L3s), dev tooling, EVM/bytecode compatibility, validator economics.

How to assess

Fee sustainability (not spam), L2 posted data, sequencer decentralization timelines, MEV capture/redistribution, upgrade cadence.

Catalysts to track

Major protocol upgrades, DA layers adoption, enterprise/consumer app breakouts.

Risks

Centralization, bridge risk, governance capture, value leakage to L2s.

How to play it

Core allocation to top fee-capturing L1s; satellite bets on fast-growing L2s with real app flow.

Financials: exchanges, perps, and liquidity rails

"August 2025 saw the highest centralized exchange trading volumes of the year." - Source

Why this sector matters

Volume and listings drive fee revenue; some tokens add buybacks/burns.

Sub-segments

CEX tokens (utility, fee discounts, burns)

Perps DEXs (protocol-owned liquidity, insurance funds)

Payment gateways & broker routing

What to monitor

Spot/perps monthly volume, fee schedule changes, burn/buyback disclosures, security/insurance transparency, jurisdictional risk.

Risks

Regulatory actions, opaque treasuries, counterparty exposure.

Zemyth takeaway: when CEX volumes and perps open interest trend up alongside visible buyback/burn activity, this sector can lead. Size positions with jurisdictional diversification and strict counterparty rules.

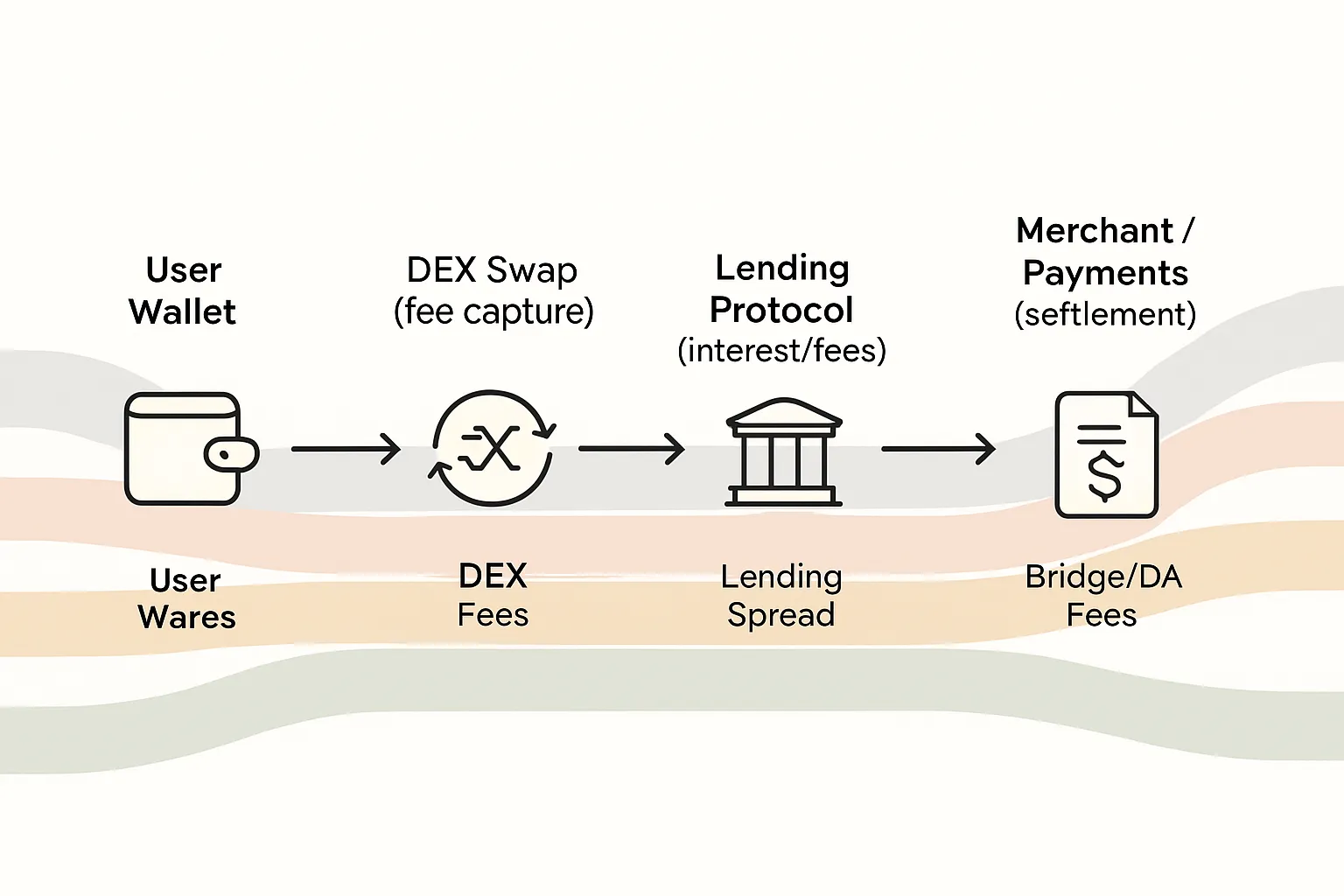

DeFi and Stablecoins: yield with guardrails, not guesswork

"After stablecoin legislation passed in July 2025, circulating supply rose roughly 16% in Q3, surpassing $290 billion." - Source

Where returns come from

Real fee capture (DEX swaps, perps funding, lending spreads) shared with tokenholders or stakers.

What to track

Stablecoin net supply, DEX fee revenue, unique borrowers/lenders, collateral quality, liquidation health, oracle sources.

Policy tailwinds

Stablecoin legislation improves on/off‑ramps and enterprise comfort, lifting settlement volumes on major smart contract platforms.

Risks

Oracle manipulation, reflexive emissions, undercollateralized stables, governance attacks.

Zemyth approach: prioritize protocols with transparent fee switches, audited treasuries, and stablecoin pools with deep liquidity and strong oracles - so yield is earned, not guessed.

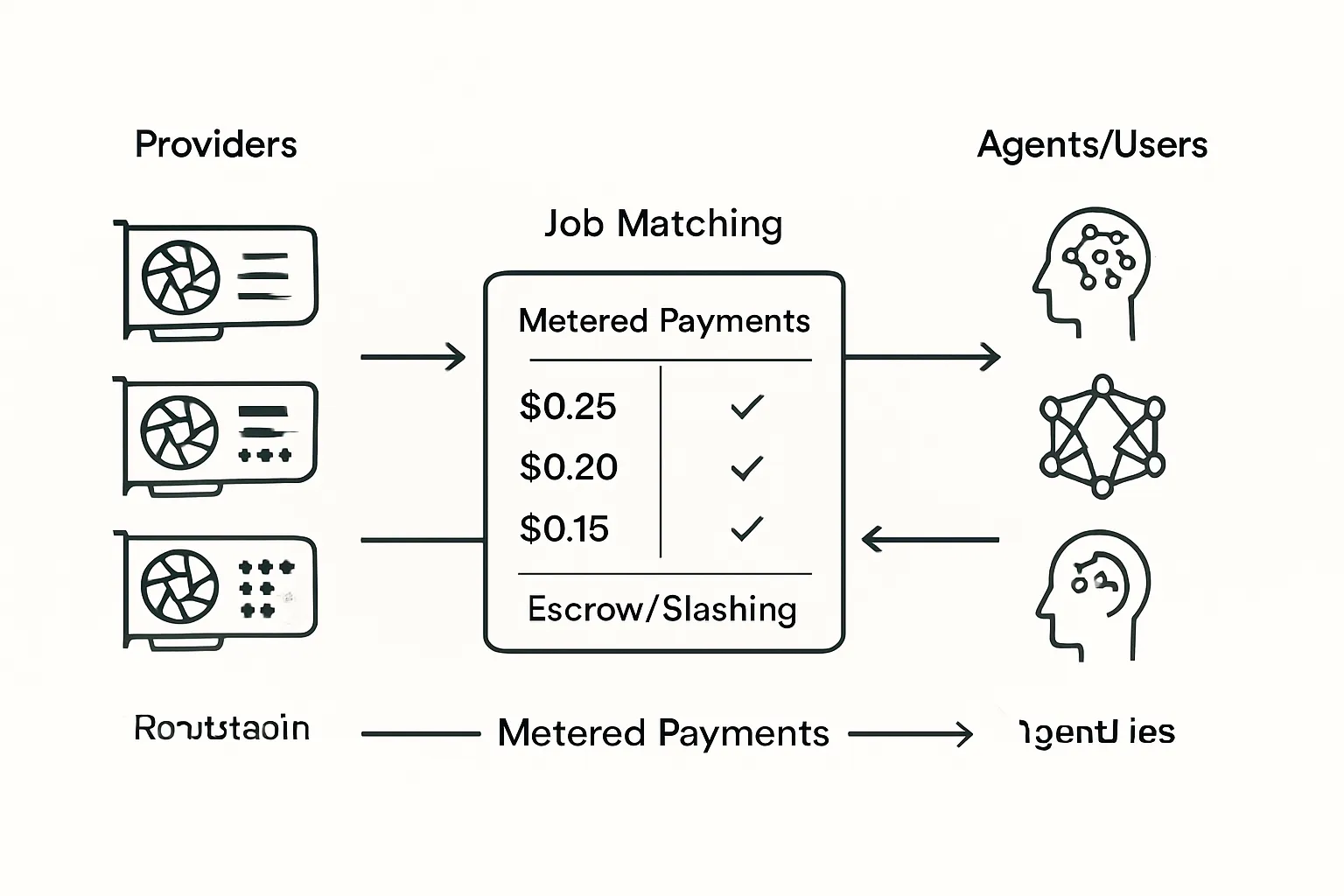

AI, Data, and DePIN: compute, agents, and indexing

Thesis

Own networks that monetize GPU time, inference calls, and data/services agents consume.

KPIs

Paid GPU hours, active subnets/agents, inference requests, data marketplace fees, developer growth.

Catalysts

Model upgrades, enterprise pilots, edge-device onboarding, SDK adoption.

Risks

Cyclical GPU supply, model commoditization, low switching costs, speculative agent tokens with no revenue.

Sizing guidance

Treat as higher-beta growth: smaller weight, tighten risk controls, focus on projects with measurable paid usage.

Zemyth angle: we prioritize AI/DePIN teams that report verifiable paid inference and transparent provider payouts, with milestone-gated unlocks tied to delivered compute or agent MAUs.

Infrastructure & Services + RWAs/Payments: the picks-and-shovels layer

What lives here

Oracles, indexers, bridges, wallets, developer tools.

RWAs and payment rails: tokenized assets, DvP (delivery-versus-payment) settlement, compliant stablecoin rails.

How to judge

Uptime and latency SLAs; incident response history and audit depth.

Security track record: bridge proofs, oracle resilience, upgrade timelocks, multi-sig transparency.

Enterprise integrations: banks/fintechs, PSPs, custodians, and major L1/L2 deployments.

Fee take-rate and unit economics: who pays, how much, and where value accrues (token vs. SaaS).

Governance transparency: voting power distribution, treasury reporting, and runway.

Catalysts

RWA pilots with atomic settlement moving to production (DvP at scale).

Wallet UX leaps (smart accounts, passkeys, native on/off‑ramps) driving mainstream conversion.

Cross‑chain messaging standards and DA layers adopted across top L1s/L2s.

Compliance-ready stablecoin rails embedded in payment processors and enterprise ERPs.

Risks

Bridge exploits and cross‑domain replay attacks.

Oracle failures, data manipulation, or downtime impacting DeFi solvency.

Legal uncertainty for asset tokenization and transfer restrictions across jurisdictions.

Value leakage if fees accrue off‑token (pure SaaS) or are captured by upstream L1/L2s.

Zemyth view: this is the compounding layer. We favor infra with verifiable uptime, defensible moats (network effects or regulatory approvals), and clear token value capture - plus RWA/payment networks with audited legal wrappers and measurable settlement volumes.

From research to portfolio: tokenomics checklist and allocation blueprints

Tokenomics diligence (10-point quick check)

Emissions schedule and unlocks

Real fee share vs. narrative

Treasury runway and reporting cadence

Buyback/burn mechanics

Validator/staker incentives vs. dilution

Governance (quorum, veto risks)

Customer concentration and churn

Multi-chain strategy and bridge risk

Compliance posture (esp. stables/RWAs)

Competitive moat and switching costs

Risk rules you can actually follow

Position sizing by liquidity and unlock calendar

Staggered entries (DCA + event-driven adds)

Stop-loss/invalidations tied to KPIs, not only price

Trim into spikes; add when KPIs strengthen on pullbacks

Model allocations (examples, not advice)

Conservative: L1/L2 + DeFi/Stablecoins core; tiny AI/DePIN tilt.

Balanced: Add Financials and Infra; selective RWAs/Payments.

High-beta: Heavier AI/DePIN and Financials; strict risk limits.

Portfolio Blueprints by Risk Profile

Profile | L1/L2 | Financials | DeFi/Stables | AI/DePIN | Infra/Services | RWAs/Payments | Cash/Yield Buffer | Notes |

|---|---|---|---|---|---|---|---|---|

Conservative | 35–40% | 5–10% | 25–30% | 0–5% | 10–15% | 5–10% | 10–15% | Focus on fee-capturing L1s/L2s and top DEX/lending; prioritize liquidity and audits. |

Balanced | 30–35% | 10–15% | 20–25% | 5–10% | 10–15% | 5–10% | 5–10% | Add exchange/perps exposure and robust infra; selective RWA rails with clear legal wrappers. |

High-Beta | 20–25% | 15–20% | 15–20% | 15–25% | 5–10% | 5–10% | 5–10% | Tilt to AI/DePIN and Financials; enforce strict unlock/risk controls and staged entries. |

Cash management while you wait

Park dry powder in liquid, lower-risk yield so you’re ready when catalysts hit (e.g., a base layer yield pool).

Zemyth advantage: milestone‑gated funding aligns unlocks with shipped proof, while our Fund Nest offers a liquid yield buffer - letting you pursue upside while keeping exposure disciplined.

Conclusion: Put this framework to work with Zemyth

Why Zemyth fits a sector-led strategy

Milestone-gated venture rounds align capital with real proof (builds shipped, users acquired, revenue hit) across L1s/L2s, Financials, DeFi/Stablecoins, AI/DePIN, Infra/Data, and RWAs/Payments - so you stop guessing “invest in which crypto” and start backing verified execution.

Fund Nest offers liquid, lower-risk daily yield to park capital between rounds - your base layer while you scout sectors, track KPIs, and plan entries. It’s a practical answer to “crypto how to invest” without sitting idle.

On-chain transparency on Solana with contributor reputation and verifiable progress means capital follows performance, not hype - ideal when you want investments that have high returns without overexposure.

Open access venture and an Affiliate network to surface credible founders, plus Academy playbooks to upskill quickly - so your sector watchlist turns into a repeatable sourcing and diligence engine.

Next steps

Build your sector watchlist and KPI dashboard using the signals in this guide (adoption, liquidity, token design, catalysts).

Park idle funds in Fund Nest to compound daily while you wait for catalysts - stay liquid and ready.

Join Startup Nest deals, contribute into tranches tied to execution milestones, and track everything on-chain.

Get started: https://zemyth.app