TL;DR: What ‘ve’ Means in DeFi and why it matters for investment returns

Quick definition

“ve” = vote-escrow: you lock a token for time to get a non-transferable voting power (veToken) and economic perks.

Why investors care

Locking aligns incentives: you get more voting power, a share of fees, and boosted APRs; but you take on duration risk and crypto market beta.

Returns = fee flow + bribes + boosts − (dilution from emissions).

"The cryptocurrency market exerts the strongest influence on DeFi returns, with evidence of bidirectional causality between BTC and DeFi token returns." - Source

Where it fits in your portfolio

Treat ve positions like a “ve fund” sleeve: a curated basket of time-locked governance exposures designed to invest, earn, and compound protocol cash flows - while actively managing lockup duration and market cycles for better investment returns (and even opportunistic investment re strategies).

What you’ll learn in this guide

How ve models (Curve, Solidly/ve(3,3), Frax, Pendle) work

A simple P&L model for ve returns

Risks, market regimes, and a checklist before you lock

How Zemyth’s veZEM and revenue-linked emissions are designed for sustainable boosts

Ready to turn governance into cash flow? Start compounding with Zemyth: https://zemyth.app

How veTokenomics work: locks, votes, fees, emissions, and boosts

TL;DR: Lock base tokens to mint veTokens, vote to steer emissions, and capture fees/bribes/boosts; your real investment returns depend on whether those cash flows outrun dilution from emissions.

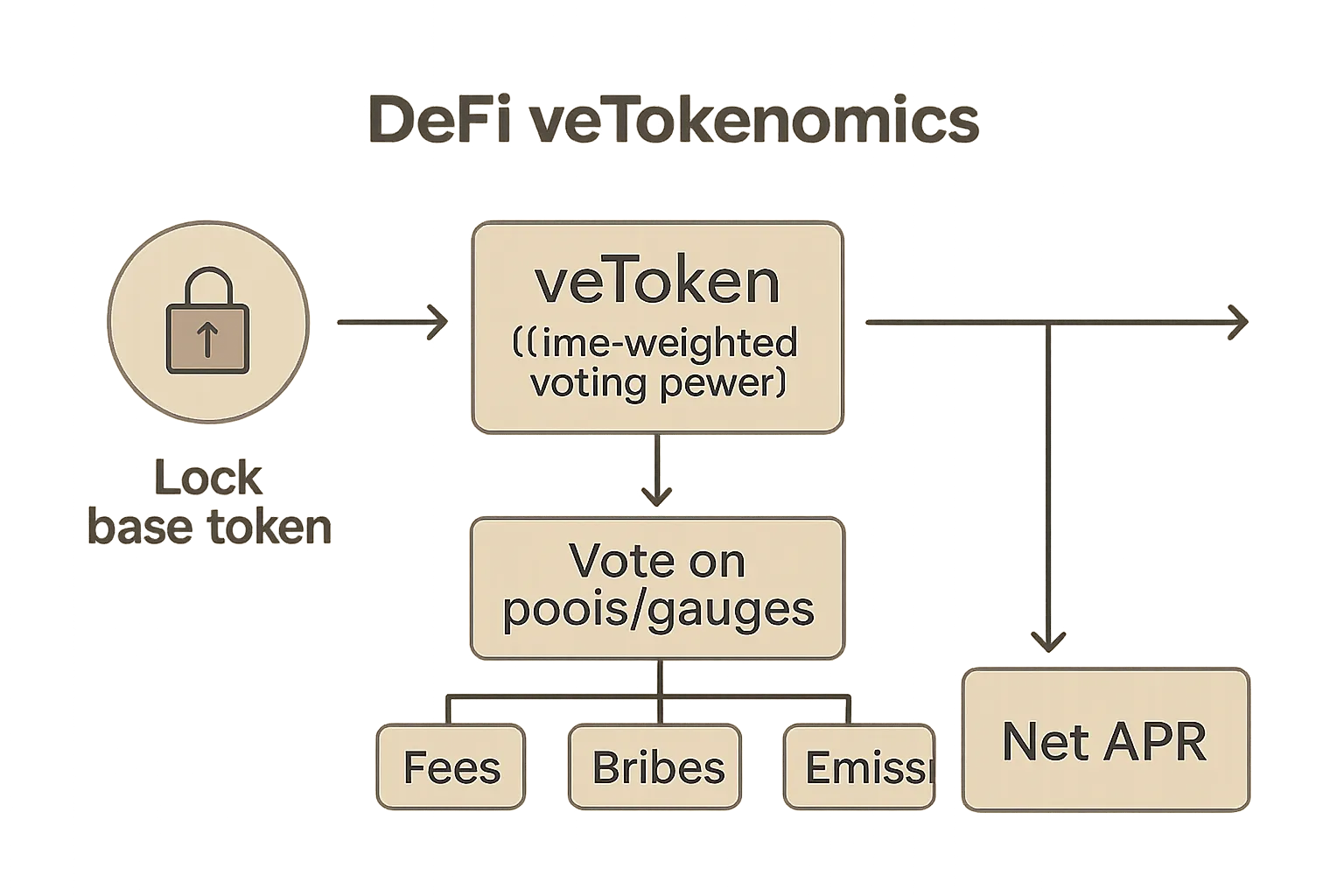

The core flywheel

Lock base token → receive veToken (time-weighted voting power)

Vote on gauges/pools → direct emissions

Earn fee share + bribes from voted pools

Get boosted yields on your LP/stakes

What changes the APR you actually pocket

Trading volume (fees), bribe intensity, your lock length/decay, and token emissions policy

Dilution risk vs. rebase/anti-dilution mechanics

"Boost your CRV rewards by up to 2.5× by vote-locking (veCRV)." - Source

Video explainer (1x only)

Short, vendor-neutral overview of ve models (Curve → Solidly/ve(3,3) → Pendle/Frax)

Practical takeaway

ve ≠ just “governance”. It’s an income engine if fees/bribes/boosts outpace dilution - or a drag if emissions dominate. Treat ve exposures like a focused “ve fund” sleeve: allocate, lock, vote, and reinvest to systematically invest, earn, and compound protocol cash flows while managing duration and market beta.

Start compounding smarter with Zemyth ve boosts and revenue-linked tokenomics: https://zemyth.app

The main ve models compared: Curve, Solidly (ve(3,3)), Frax, Pendle

Archetypes at a glance

Curve (veCRV): fee share + boosts; decaying vote power; bribing via gauges.

Solidly/ve(3,3): all trading fees to voters; bribes built-in; rebase for early lockers; NFT ve-positions.

Frax (veFXS): hybrid utility + cash-flow sharing across the broader Frax stack.

Pendle (vePENDLE): share of swap fees + protocol yield; directs incentives; 2-year decaying lock.

Why the design matters

Lock length, decay, and who earns fees vs. emissions shape your realized APR, duration risk, and ultimate investment returns. Treat your allocations like a “ve fund” sleeve to invest, earn, and compound where mechanics favor holders.

Feature-by-feature comparison

Protocol | Token | Max lock length | Vote power decay | Fee share to lockers | Bribes enabled | Emissions guardrails/rebase | ve transferability (NFT?) | Typical boost range |

|---|---|---|---|---|---|---|---|---|

Curve | CRV → veCRV | 4 years | Linear decay to expiry | Admin fee share to veCRV; LPs earn trading fees | Yes (via gauges/bribe markets) | Emissions decay over time; no rebase | No (non-transferable) | Up to ~2.5× LP reward boost |

Solidly/ve(3,3) | SOLID (fork variants) → veNFT | 4 years (varies by fork) | Linear decay | 100% of trading fees to voters (varies by fork) | Yes (built-in) | Weekly rebase favors early lockers; emissions decay | Yes (NFT; merge/split/transfer) | N/A (returns via fees + bribes) |

Frax | FXS → veFXS | 4 years | Linear decay | Protocol cash flows across Frax stack to lockers (varies) | Yes (Frax gauges) | Emissions programmatic; no rebase | No (non-transferable) | ~1.1×–2.0× depending on pool/design |

Pendle | PENDLE → vePENDLE | 2 years | Linear decay | 80% swap fees from voted pools + share of protocol yield | Yes | Low, controlled emissions; no rebase | No (non-transferable) | Up to ~2.5× LP/yield boosts |

Visual: the veTokenomics flow

Lock → veToken → Vote on pools → Fees + Bribes + Emissions → Net APR

Your net APR is a function of trading volume, bribe intensity, emissions schedule, and anti-dilution mechanics (rebases/decay).

Ready to compare models and allocate where you can invest, earn, and compound? Start with Zemyth: https://zemyth.app

Modeling ve investment returns: a simple P&L you can actually use

TL;DR: Track one equation per epoch to decide whether to lock: fees + bribes + rebases + boosts must consistently outrun dilution from emissions. Treat ve as a “ve fund” sleeve to invest, earn, and compound protocol cash flows.

The base equation

Profit (epoch) ≈ Fees + Bribes − (Emissions − Rebases)

Read it like a business: fees and bribes are revenue; emissions are a cost unless rebased back to lockers (anti-dilution).

Translating to investor APR

Locker APR ≈ (Your share of voted pool fees + bribes + boosts + rebases) / Value of your locked position

Your share depends on:

Vote weight on the pool(s) you selected

Your lock length (which sets ve power) and its decay

Whether your LP/stake is eligible for boosts

Note: APR is realized in the base token or payout asset; your true investment returns also reflect token price moves (market beta).

What moves each term

Fees: driven by trading volume, spreads, pool mix (blue-chip vs long-tail), and aggregator routing. Higher volume and tighter spreads typically increase fee flow.

Bribes: determined by partner protocols’ capital efficiency (cost to attract emissions vs direct incentives). Bribe-rich epochs can plug fee shortfalls.

Emissions/Rebases: emissions schedule and decay; rebase or other anti-dilution mechanics that send part of emissions to lockers reduce net dilution.

Boosts: multiplier tied to ve holdings and lock duration; boosts amplify your yield capture from LP/stakes.

Worked mini-scenarios

Breakeven epoch

Example: Fees 50, Bribes 20, Emissions 70, Rebases 0 → Profit = 50 + 20 − (70 − 0) = 0

Wallet impact: Voting rewards feel “ok,” APR is mostly inflation-backed; token price depends on net buy/sell flows, but you’re not getting diluted on a net basis.

Profitable epoch

Example: Fees 60, Bribes 30, Emissions 70, Rebases 10 → Profit = 60 + 30 − (70 − 10) = 30

Wallet impact: Higher realized APR from fees/bribes, plus rebases offset dilution. If lockers reinvest, compounding accelerates. Price tailwind more likely.

Death-spiral epoch

Example: Fees 30, Bribes 10, Emissions 90, Rebases 0 → Profit = 30 + 10 − 90 = −50

Wallet impact: Dilution outpaces income. APRs look high but are mostly emissions; real purchasing power erodes and token price pressure builds. Consider exiting or reducing exposure.

Quick checklist before you lock

Lock ratio trend: Rising lock ratio typically lowers circulating sell pressure; falling ratio can precede APR decay.

Fee coverage vs. emissions: Coverage = (Fees + Bribes) / (Emissions − Rebases). Aim ≥ 1 for sustained investment returns.

Bribe competitiveness: How many $ of emissions per $ of bribe? Persistent favorable ratios signal healthy demand for your vote.

Token velocity and liquidity: Deep liquidity and reasonable turnover reduce price impact when you claim/swap rewards.

Emissions half-life and decay: Faster decay and clear caps reduce long-run dilution risk.

Anti-dilution mechanics: Rebases or direct revenue share to lockers meaningfully offset emissions.

Boost accessibility: Can you realistically hit the boost range with your position size?

Governance capture risk: Whale-dominated gauges can reroute emissions abruptly; diversify votes and monitor concentration.

Duration risk: Longer locks amplify boosts but raise exposure to market drawdowns; align lock length with your cycle view.

“ve fund” discipline: Reinvest when coverage > 1, rotate votes toward high-fee, high-bribe pools, and trim when coverage deteriorates.

Want a system that aligns boosts with real revenue so your compounding isn’t just emissions math? Start with Zemyth: https://zemyth.app

Risks that move your ve returns (and how to mitigate them)

"DeFi’s architecture concentrates risk in smart contracts, governance, oracles, and composability - vulnerabilities can cascade across interconnected protocols." - Source

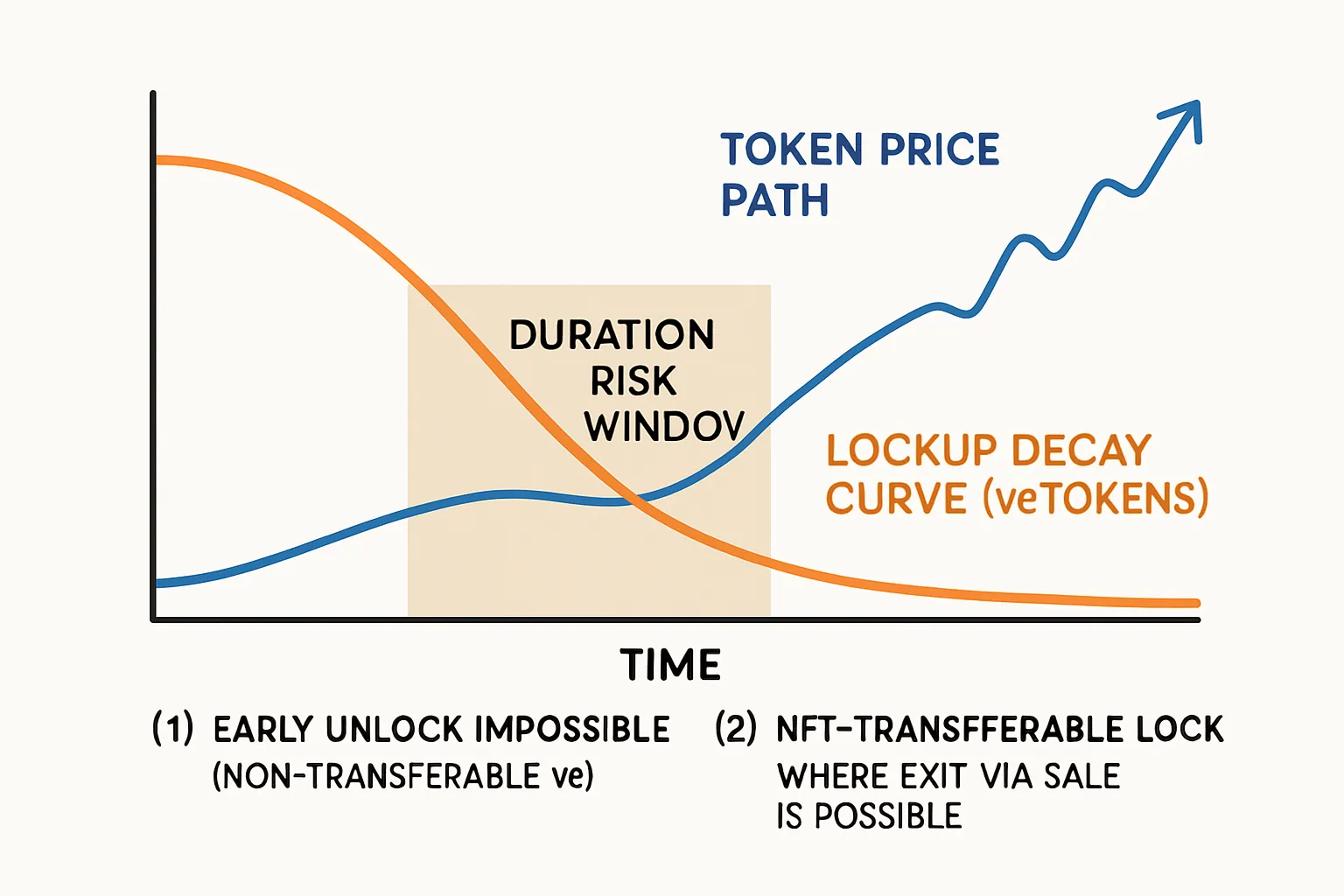

1) Time-duration (lockup) risk

The risk: Long locks amplify opportunity cost and price risk. If token price drops during your lock, ve power decays while your capital is stuck.

Mitigations:

Prefer protocols with NFT-escrowed ve positions (transferable exit via secondary market).

Ladder your locks (e.g., weekly/monthly tranches) to smooth duration risk.

Align lock length with market regime; shorten in late-cycle, lengthen when fee coverage > 1.

2) Market beta and liquidity risk

The risk: Crypto beta bleeds into ve APRs - volume fades in bear markets, fees shrink, bribes dry up, and emissions dominate.

Mitigations:

Monitor fee coverage: (Fees + Bribes) / (Emissions − Rebases) ≥ 1 over multiple epochs.

Favor deeper, blue‑chip pools during chop/bear to stabilize fee flow.

Keep a cash sleeve to rotate when liquidity thins; avoid forced selling of rewards.

3) Governance capture and whale concentration

The risk: Vote/fee capture by large lockers, mercenary bribe cycles, or cartelized gauges can redirect emissions away from your pools.

Mitigations:

Diversify votes across high-fee, high-bribe, high-liquidity pools.

Track voter concentration and gauge-level returns; rotate away from captured pools.

Prefer protocols with caps, quorum rules, or decay that reduce entrenchment.

4) Smart contract and operational risk

The risk: AMM math errors, rebase bugs, vote-window exploits, or oracle failures.

Mitigations:

Require multiple audits, public test history, and active bug bounties.

Favor mature infra (battle-tested AMMs, timelocked upgrades, transparent governance).

Avoid forks with material changes and thin audits; let others be the guinea pigs.

Playbook to de-risk

Staggered locks to manage duration.

Vote for high-fee, high-liquidity pools; rotate as coverage shifts.

Monitor bribe ROI vs. emissions weekly; don’t subsidize dead pools.

Keep exposure sized to liquidity; avoid under-audited forks and opaque upgrades.

Treat ve like a “ve fund” sleeve: systematic monitoring, rebalancing, and disciplined compounding.

Compound smarter with Zemyth’s revenue-linked boosts and transparent mechanics: https://zemyth.app

How market regimes affect ve performance: bull vs. sideways vs. bear

TL;DR: Your ve “income engine” rides market regimes. In bulls, fees and bribes expand and investment returns compound; in bears, emissions dominate unless throttled. Treat your allocation like a disciplined ve fund sleeve and rotate votes by regime.

Bull market

Rising volume/fees; bribes abundant; APRs expand; risk shifts to dilution control

Sideways market

Fees stabilize; bribes fill gaps; selection alpha matters (vote for the right pools)

Bear market

Volume pockets; bribes retreat; emissions dominate unless protocol throttles supply

Strategy snapshot

Rebalance pool votes by regime, cumulate fees in bull, be selective in bear

Regime matrix

Regime | Fees trend | Bribe intensity | Emissions pressure | Expected locker APR range (qualitative) | Key risks | Tactics for investors |

|---|---|---|---|---|---|---|

Bull | Expanding (higher volume, tighter spreads) | High (partners chase liquidity; bribe ROI attractive) | Manageable if emissions decay; rebases offset | High and rising (fees + bribes + boosts) | Overextension, lock-driven duration risk, governance capture | Concentrate votes in top-volume pools; reinvest (compound) fees/bribes; monitor coverage ≥ 1; ladder locks to manage duration |

Sideways | Flat to modestly rising | Medium (fills fee gaps) | Neutral to moderate | Mid-range, selection-driven | Capital rotation, vote fragmentation, fee stagnation | Vote where real volume persists; track bribe $ per emission $; rotate toward stable/blue-chip pools; maintain partial cash buffer |

Bear | Compressed (volume pockets, wider spreads) | Low (partners pull back) | Elevated unless protocol throttles | Low to compressed; can turn negative net of dilution | Emissions dominance, illiquidity, APR mirage, price drawdown | Shorten lock tenors/NFT exits where possible; prioritize deep-liquidity pools; demand audited, revenue-linked emissions; harvest in stables and wait for coverage to normalize |

Build a resilient ve fund approach to invest, earn, and compound across regimes - rebalance your votes, monitor fee/emissions coverage, and keep duration aligned to the cycle.

Ready to systematize regime-aware ve allocation? Start with Zemyth: https://zemyth.app

Case studies: Curve, a ve(3,3) DEX, and Pendle - what actually drives payouts

Curve (veCRV)

Boosted LP yields up to 2.5×; gauges + bribing decide emissions; fee share to lockers

What drives payouts: real trading volume in stable/blue‑chip pools, active bribe markets that steer emissions to productive gauges, and consistent relocks to sustain boost.

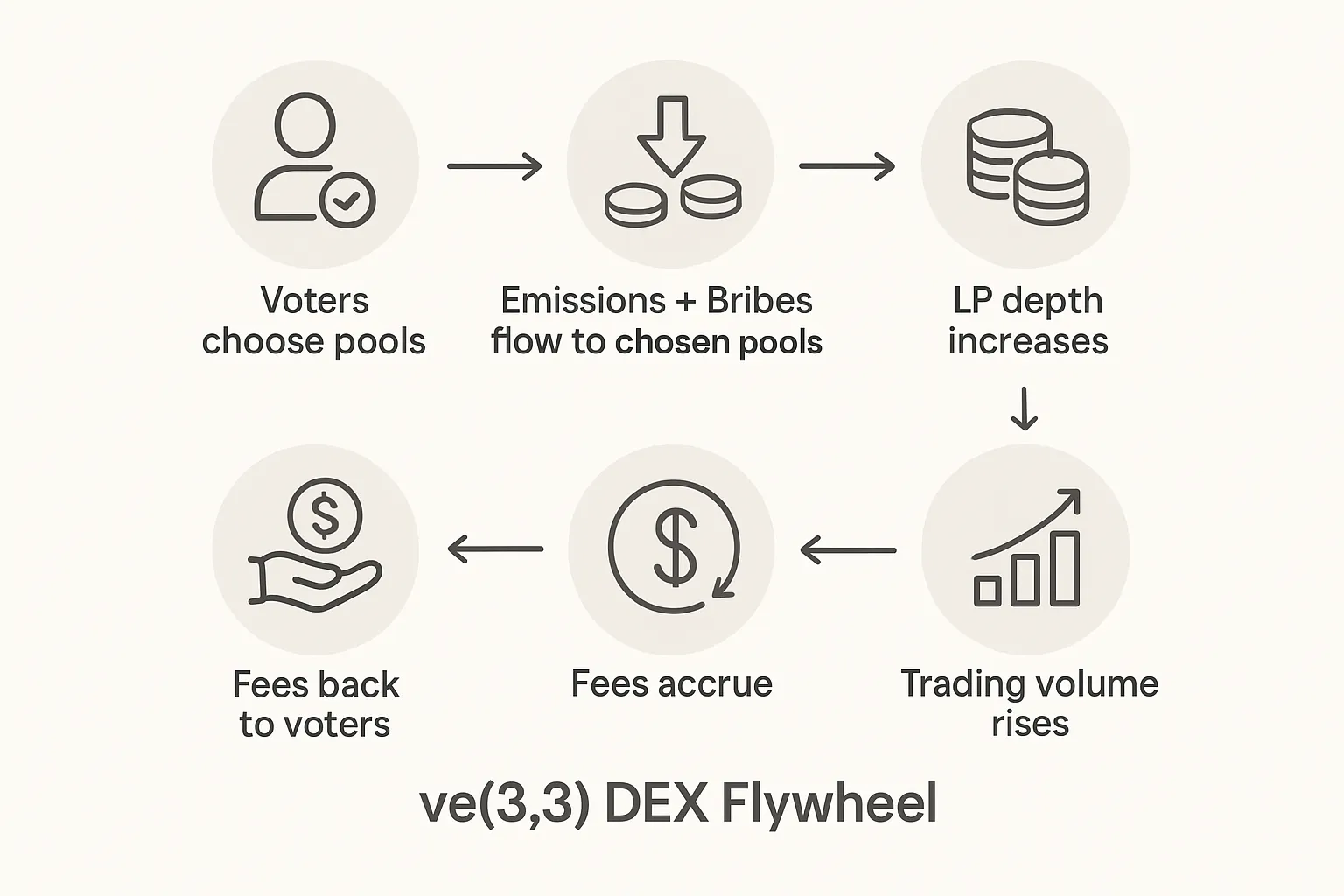

A ve(3,3) DEX archetype

All fees to voters; rebase anti-dilution; why bribing tends to close the fee–emissions gap when token health is intact

What drives payouts: fee generation from volume, plus bribes from partner protocols seeking capital-efficient liquidity; rebases reduce net dilution so long as token emissions and price remain balanced.

Pendle (vePENDLE)

2-year decaying lock; fee + yield share; incentive direction

What drives payouts: swap volumes on voted markets, protocol yield flowing through YT/PT mechanics, and efficient incentive routing via ve votes.

"vePENDLE voters earn ~80% of swap fees from voted pools and ~3% of protocol yield on yield tokens; locks last up to 2 years with linear decay." - Source

Lessons across models

When fees + bribes > emissions → sustainable income; otherwise expect dilution.

For investors: vote where volume is real, monitor bribe ROI, track fee coverage vs. emissions, and align lock duration with regime risk. Compound when coverage > 1; rotate or reduce exposure when dilution dominates.

Put this into practice with Zemyth’s revenue-linked boosts and disciplined ve strategy: https://zemyth.app

The investor’s ve due‑diligence checklist (before you lock)

Use this pre‑lock playbook to protect principal, enhance investment returns, and run your ve sleeve like a disciplined “ve fund” that aims to invest, earn, and compound protocol cash flows.

Protocol health

Fee coverage vs. emissions trend

Track Coverage = (Fees + Bribes) / (Emissions − Rebases). Target ≥ 1.0 over multiple epochs; ≥ 1.2 is safer.

Watch trend, not snapshots: 4–8 consecutive epochs > 1 signals sustainable income vs. dilution.

Treasury runway and cost controls

Cash/Stable runway in months; emissions guardrails (decay, caps, emission halving).

Revenue diversification (trading fees, protocol services, partnerships).

Security posture

Independent audits (≥2), named firms, remediation reports, bug bounty live, time‑locked upgrades, on‑chain governance transparency.

Token mechanics

Lock length and decay math

Max duration (2y/4y), linear decay rules, and what happens at expiry.

Anti‑dilution and emissions

Rebases to lockers, emission decay schedule, max supply or hard caps, vesting sinks.

Transferability of ve

ve‑NFTs enable secondary exits (merge/split/transfer); non‑transferable locks raise duration risk.

Rewards cadence and assets

Payout frequency (epoch length), reward mix (fees, bribes, native emissions), auto‑compounder support.

Market position

Pool volumes and mixes

30/90‑day real volume, spread quality, blue‑chip vs. long‑tail exposure, aggregator routing share.

Bribe competitiveness

$ emissions per $ bribe (capital efficiency), depth of bribe markets, number of recurring bribers.

Partner integrations

Wallets, aggregators, perps, LST/LRT integrations; cross‑chain presence; stability of key partnerships.

TVL stickiness

Churn vs. retention, unlock cliffs, concentration (top‑5 pools), ve lock‑ratio trend.

Liquidity + exit options

Secondary markets for ve‑NFTs

Historic discount to intrinsic, sell‑through time, marketplace liquidity, escrow safety.

OTC and on‑ramp/off‑ramp

Trusted OTC desks, bonding/exit products, protocol buyback programs.

Unlock cadence and cliffs

Upcoming large expiries, whale unlock schedules, governance proposals that shift emissions/fees.

Position sizing & execution

Laddered locks

Split entries across weeks/months to average regime risk; roll the best‑performing tranches.

Vote selection

Prioritize high‑fee, high‑liquidity, high‑bribe pools; monitor weekly ROI and rotate decisively.

Reinvest vs. realize

Compound when Coverage ≥ 1; take profit in stables when coverage deteriorates or regime turns.

Risk limits

Max % of portfolio in long locks; chain/protocol diversification; set stop‑relock rules and review cadence (weekly epochs).

Turn your governance into cash flow with a system built to protect against dilution and align boosts with real revenue. Get started with Zemyth: https://zemyth.app

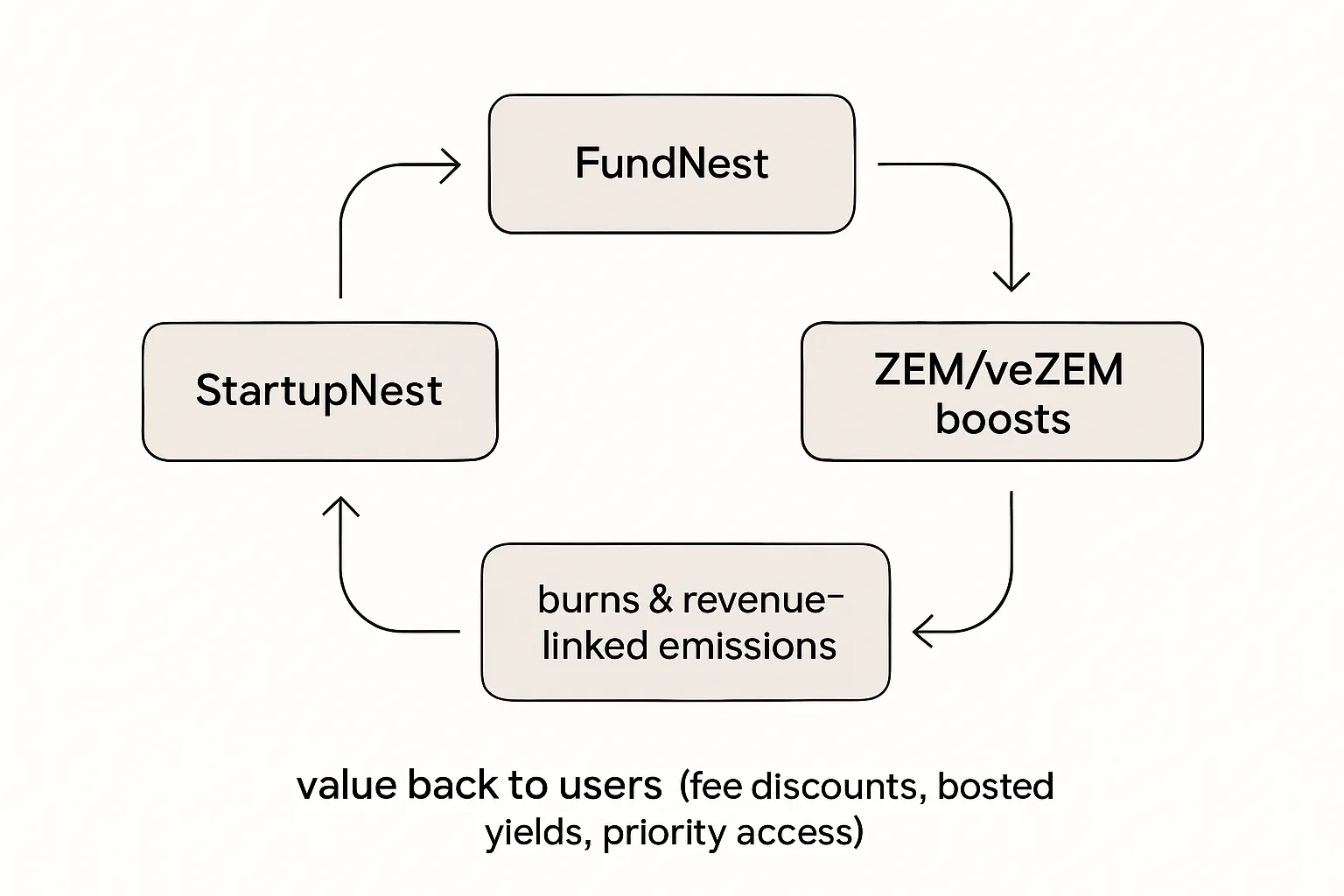

Where Zemyth fits: veZEM boosts, revenue‑linked emissions, and a practical ve ‘fund’ strategy

How veZEM works on Zemyth

Lock ZEM → veZEM → boost FundNest yields (up to 2.5× target boosts), fee discounts, priority access to StartupNest deals.

Revenue-linked emissions: ZEM emissions are bounded by real platform revenue to avoid over‑incentivization and dilution spirals.

Why it matters for returns

Your ‘ve fund’ sleeve on Zemyth = Base yield from FundNest + veZEM boost + ZEM staking APR.

StartupNest + CollabNest create on‑chain activity that drives protocol fees and periodic ZEM burns, reinforcing yield and reducing supply over time.

The goal: compound fee‑driven income instead of relying on pure emissions.

A simple Zemyth allocation idea (illustrative, not advice)

Park stablecoins in FundNest ‘Zero Risk’ to earn base yield.

Lock a tranche of ZEM for veZEM boosts and fee discounts.

Use priority access to rotate into StartupNest deals you’ve diligenced; optionally stake Investment NFTs with ZEM for higher reward multipliers.

CTA

Build your ve sleeve with Zemyth and compound fee-driven income rather than pure emissions. Start now: https://zemyth.app

Conclusion: Ready to invest, earn, and compound? Start with Zemyth

Key takeaways

ve turns governance into a cash-flow engine - when fees + bribes outpace dilution, your investment returns are real, not just emissions math.

Your real return depends on market regime, emissions policy, and lock mechanics; duration risk management is non‑negotiable.

Treat ve exposures like a ‘ve fund’: size positions, diversify votes, and rebalance by regime to invest, earn, and compound.

TL;DR (again)

Lock for voting power and fee share; analyze fee coverage vs. emissions; mind duration risk; favor protocols with revenue‑linked incentives for sustainable investment re and yield.

Next step

Start building a sustainable, boosted base with Zemyth. Connect wallet and explore: https://zemyth.app