TL;DR - USD funds, stable returns, daily liquidity

"Global FX trading averaged $7.5 trillion per day in April 2022." - Source

If you hold investment USD, keep it in USD funds that earn from treasuries, repo, or stablecoin swap fees. Aim for stable returns, usd daily access, and low friction - without leverage.

What you’ll learn in 5 bullets

Why USD-denominated funds help dampen currency noise while keeping your money working.

What “USD funds” actually are: money market funds, T‑bill ETFs, cash‑plus accounts, and on‑chain stablecoin pools.

Where yield really comes from (treasuries, repo, trading fees) - and what risks you’re not taking when you pick the right vehicle.

How to get USD daily yield and same‑day (or faster) liquidity without chasing leverage.

How Zemyth’s FundNest “Zero Risk” pool targets stable returns from stablecoin swap fees - with optional boosts via ZEM.

Who this is for

USD savers who want higher, steadier yield without extra risk.

Crypto‑curious investors who want clear guardrails for stablecoin yields.

Global investors with USD “life liabilities” (rent, payroll, tuition) seeking to neutralize currency drag.

Quick actions

Match assets to liabilities: keep cash you’ll spend in USD inside USD funds.

Prioritize daily liquidity and transparent underlying assets.

Compare cash‑like options side‑by‑side (see Section 4) before moving dollars.

TL;DR one‑liner

Park your investment USD in vehicles that earn from treasuries, repo, or stablecoin trading fees - not leverage - and keep withdrawal friction near zero.

Ready to put idle USD to work? Explore Zemyth FundNest Zero Risk for stable returns with usd daily access: https://zemyth.app

USD funds 101 - what they are and why they matter now

Define the landscape

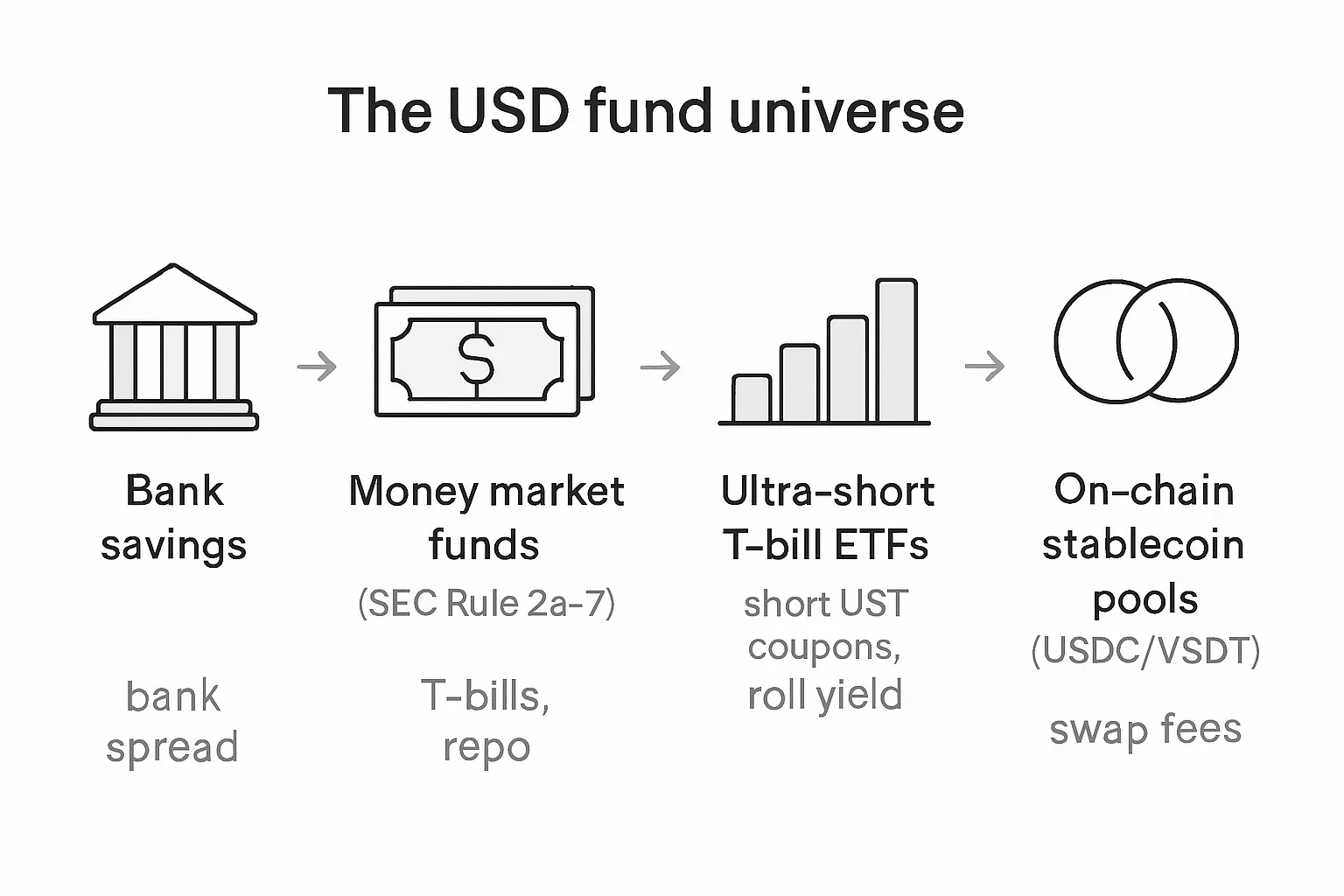

The USD fund universe spans traditional cash vehicles and crypto‑native cash equivalents. Each aims for stable returns with usd daily access and minimal complexity.

Money market funds (SEC Rule 2a‑7): Institutional and retail MMFs that hold short‑dated U.S. Treasuries, government repo, and highly rated short paper. Objective: preserve principal, offer daily fund liquidity, and pass through front‑end yields.

Ultra‑short T‑bill ETFs: Exchange‑traded funds that hold bills at the very front of the curve. Think of them as a simple, liquid “investment usd” wrapper with intraday tradability.

Cash management accounts: Broker or fintech sweep programs that “fund usd” into bank networks for FDIC/insured coverage tiers. Yield comes from the bank spread.

On‑chain USD stablecoin pools (USDC/USDT): Crypto‑native cash equivalents earning swap fees from stable‑to‑stable trades. Same idea as MMFs’ “earn while parked,” but yield source is trading fees, not coupons.

Why now?

Elevated front‑end rates mean your cash can finally pull its weight. A modern usd fund is no longer an afterthought - it’s a flexible base layer for stable returns.

Global currency volatility makes USD‑denominated parking more attractive when your near‑term liabilities are USD (rent, payroll, tuition). Keeping your investment usd aligned to spend currency removes FX noise from outcomes.

"Currency risk refers to the potential for either better or worse financial performance due to the fluctuation of foreign exchange rates between your home currency and another where you have exposure." - Source

Core benefits and trade‑offs

Benefits:

Daily liquidity and low friction exits (usd daily access for cash needs).

Stable NAV (MMFs) or very low volatility (T‑bill ETFs); crypto pools target tight pegs.

Simple tax handling for many jurisdictions (ordinary income from coupons/fees; check your local rules).

Trade‑offs:

Yields drift with front‑end rates; as policy shifts, so does a daily fund’s APY.

Some MMFs can impose fees or redemption gates under stress (rare, rule‑bound).

Stablecoin pools introduce smart‑contract risk and stablecoin peg risk; custody and platform diligence matter.

Bottom line: pick the usd fund that matches your needs - same‑day liquidity, transparent assets, and a clear, non‑levered source of yield. For crypto‑native parking with guardrails, Zemyth’s FundNest “Zero Risk” pool targets stable returns from USDC/USDT swap fees while keeping withdrawal friction low and optional ZEM boosts available.

Where the yield comes from (without hidden leverage)

Traditional rails

U.S. Treasury bills: Earn via coupon and discount yield, with price stability at very short maturities.

Repurchase agreements (repo): Short‑term, over‑collateralized lending to dealers; collateral typically U.S. Treasuries.

Bank deposits: Generally lower yields; insured up to legal caps and convenient for payments.

On‑chain rails

Stablecoin swap fees: Deep USDC/USDT pools generate fee income from stable‑to‑stable trades; revenue varies with trade volume and spread.

No borrow‑lend leverage: A purely fee‑based pool design targets stable returns from activity, not from leverage.

Controls that keep risk low

MMF guardrails: WAM/WAL caps and mandated daily/weekly liquidity buffers.

Repo discipline: High‑quality collateral, conservative haircuts, short durations.

On‑chain prudence: Stablecoin design and mint/redeem mechanics, venue diversification, and conservative pool selection.

"Rule 2a‑7 requires money market funds to hold at least 25% in daily liquid assets and 50% in weekly liquid assets, with portfolio limits of WAM ≤ 60 days and WAL ≤ 120 days." - Source

Zemyth angle

FundNest “Zero Risk” deploys into curated USDC/USDT swap venues to earn fee‑driven APY with daily withdrawals. No embedded leverage; optional veZEM boosts for higher effective yield.

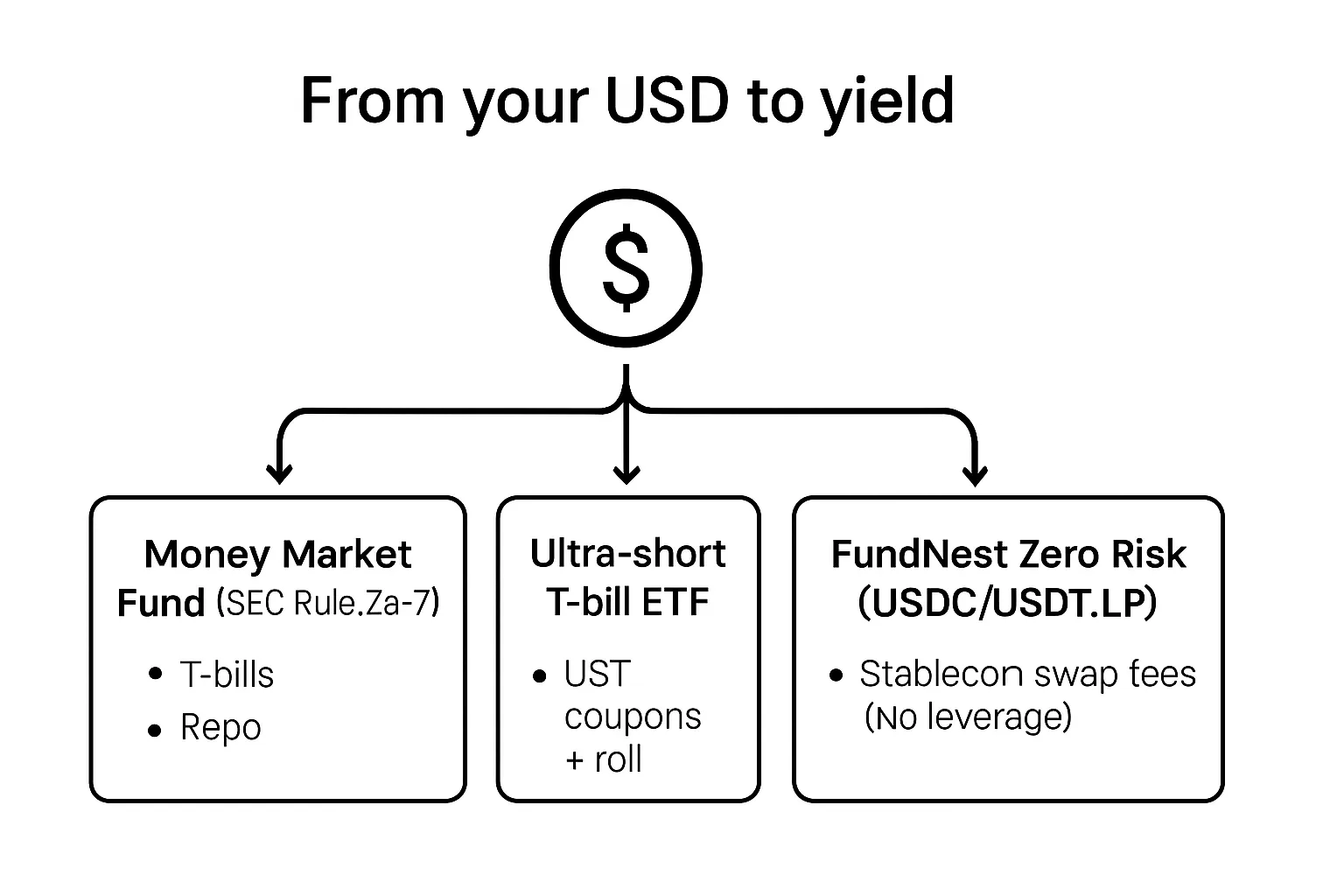

Compare your cash options side‑by‑side (yields, risk, liquidity)

"In 2023, U.S. money market fund assets reached ~$5.5 trillion (ICI)." - Source

What belongs in the comparison

High‑yield savings, CDs.

Money market funds (prime vs government), ultra‑short T‑bill ETFs.

On‑chain “Zero Risk” stablecoin pools (fee‑only LP), CeFi yield accounts (with caution).

What to look for

Source of yield (how the usd fund actually earns).

Liquidity promise (T+0/T+1), cutoff times, settlement mechanics.

Fees and potential gates/redemption fees in stress.

Counterparty risk (banks, dealers) and smart‑contract/peg risk on‑chain.

Tax treatment basics (ordinary income vs capital gains; jurisdiction‑specific).

Head‑to‑head matrix

Option | Expected Yield Driver | Indicative Yield Range | Liquidity (Cutoff/Settlement) | Principal Stability | Counterparty/Protocol Risk | Fees | Min/Access |

|---|---|---|---|---|---|---|---|

Bank Savings (High‑Yield) | Bank spread/IOR; promotional APY | ~0.5–5.0% APY (bank‑dependent) | T+0; ACH/wire cutoffs; intraday access | Stable; insured up to legal caps | Bank credit risk up to insurance limits | Typically none; transfer limits possible | Low min; retail accounts |

Certificates of Deposit (CDs) | Term premium at fixed rate | ~3.0–6.0% APY (by term/institution) | Locked to maturity; early withdrawal penalty | Stable if held to maturity; insured up to caps | Bank credit; insured up to caps | Early withdrawal penalties | Low–moderate min; laddering optional |

Government MMFs (Rule 2a‑7) | T‑bill coupons + government repo | ~3.5–6.0% variable (tracks front‑end rates minus ER) | T+0; same‑day redemptions; note possible fees/gates in stress (rule‑bound) | Stable NAV target; very low volatility | Underlying U.S. gov/repo counterparties; fund sponsor not a guarantor | Expense ratio ~0.10–0.40% | Low min via brokers/401(k) |

Ultra‑short T‑bill ETFs | UST coupons/discounts; roll | ~3.5–6.0% (SEC yield equivalent; variable) | Intraday trading; T+2 settle (brokerage) | Low duration; slight price movement | Sovereign (UST); ETF wrapper operational risk | ER ~0.03–0.20%; brokerage fees if any | 1 share; standard brokerage |

FundNest Zero Risk (USDC/USDT fee pool) | Stablecoin swap fees in deep pools (fee‑only) | Target ~7% APY; varies with volume/spread; optional veZEM boosts | T+0; on‑chain withdrawals; network confirmation times | Aims for $1‑like exposure; depends on peg/pool design | Smart‑contract risk; stablecoin issuer/peg; venue diversification mitigates | Protocol/platform fees; network gas | Low min; wallet required |

CeFi Yield Accounts (Caution) | Lending/rehypothecation; opaque strategies | 0–10%+; platform‑dependent, non‑guaranteed | Varies; may impose lockups/withdrawal limits | Not insured; platform failure risk | High centralized counterparty risk; rehypothecation | Embedded/withdrawal fees possible | Varies; platform‑specific |

Notes:

MMFs: Liquidity fees/redemption gates may be applied under stress per regulation; review each prospectus.

T‑bill ETFs: Price can fluctuate; expect modest NAV movement around ex‑div and rate shifts.

On‑chain pools: Conduct venue/smart‑contract due diligence; diversify across venues when possible.

Decision shortcut

If you need usd daily spending and stable returns: prefer government MMFs, ultra‑short T‑bill ETFs, or fee‑only stablecoin pools with transparent venues (a simple, daily fund approach to park and access cash).

If you’re rate‑hunting with lockups: CDs may win on headline APY, but mind early withdrawal penalties and timing risk.

Want a transparent, fee‑only way to fund usd on‑chain for investment usd needs? Explore Zemyth FundNest Zero Risk for daily access and non‑levered yield drivers: https://zemyth.app

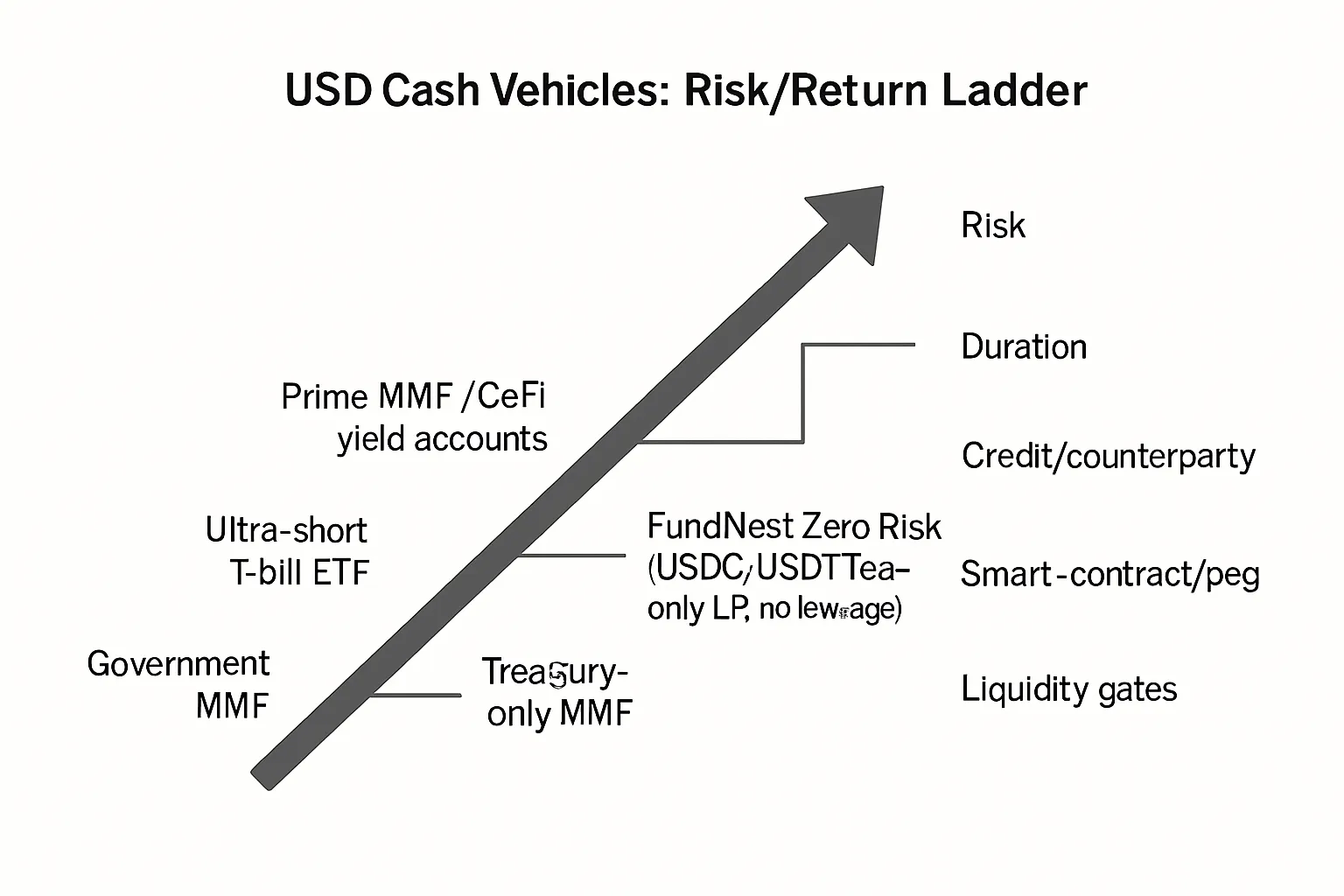

Risk lenses that actually matter for USD funds

Principal stability

NAV mechanics (MMFs): Government and treasury‑only MMFs target a stable $1 NAV with marked‑to‑market controls and WAM/WAL caps.

Price drift (ETFs): Ultra‑short T‑bill ETFs hug par with small fluctuations from rate moves and distribution timing.

Impermanent loss (LPs): For stable‑stable (USDC/USDT) pairs, IL is structurally minimal; the key variable is pool fee income and peg integrity.

Liquidity real‑talk

Cutoffs and settlement: T+0 for MMFs and savings; T+1 to T+2 brokerage settlement for ETFs; know redemption cutoffs.

Fees/gates: Rare but rule‑bound for MMFs in stress; read prospectus language on liquidity fees/redemption gates.

On‑chain exits: Wallet confirmations and venue withdrawal windows apply; gas costs and network congestion can extend timelines.

Counterparty and protocol

Traditional: Assess Treasury/backing quality, repo counterparties/haircuts, and bank exposure versus insurance caps.

DeFi: Review smart‑contract audits, oracle design, admin key policies (timelocks/multisig), and venue diversity to avoid single‑point failures.

Stablecoin specifics

Mint/redeem: Prefer assets with robust primary market pathways and transparent issuance/redemption.

Reserves: Look for monthly attestations, conservative collateral (T‑bills/overnight repo), and multi‑bank diversification.

Depeg lessons: Study historical depegs to understand operational and banking‑partner risks; diversify across venues/issuers when size warrants.

Practical checklist

Before you park investment USD, scan:

Holdings and concentration by asset type and maturity.

Liquidity ladder (daily/weekly buffers), redemption cutoffs, and any gate/fee policy.

Expense ratio and all-in platform fees.

Audit/attestation cadence and third‑party assurance.

Disclosed counterparty, smart‑contract, and governance risks.

For on‑chain: chain choice, custody model, and emergency procedures.

Zemyth’s take: FundNest Zero Risk focuses on fee‑only, non‑levered USDC/USDT venues with venue diversification and daily withdrawals - keeping the base layer conservative while offering optional veZEM boosts for power users.

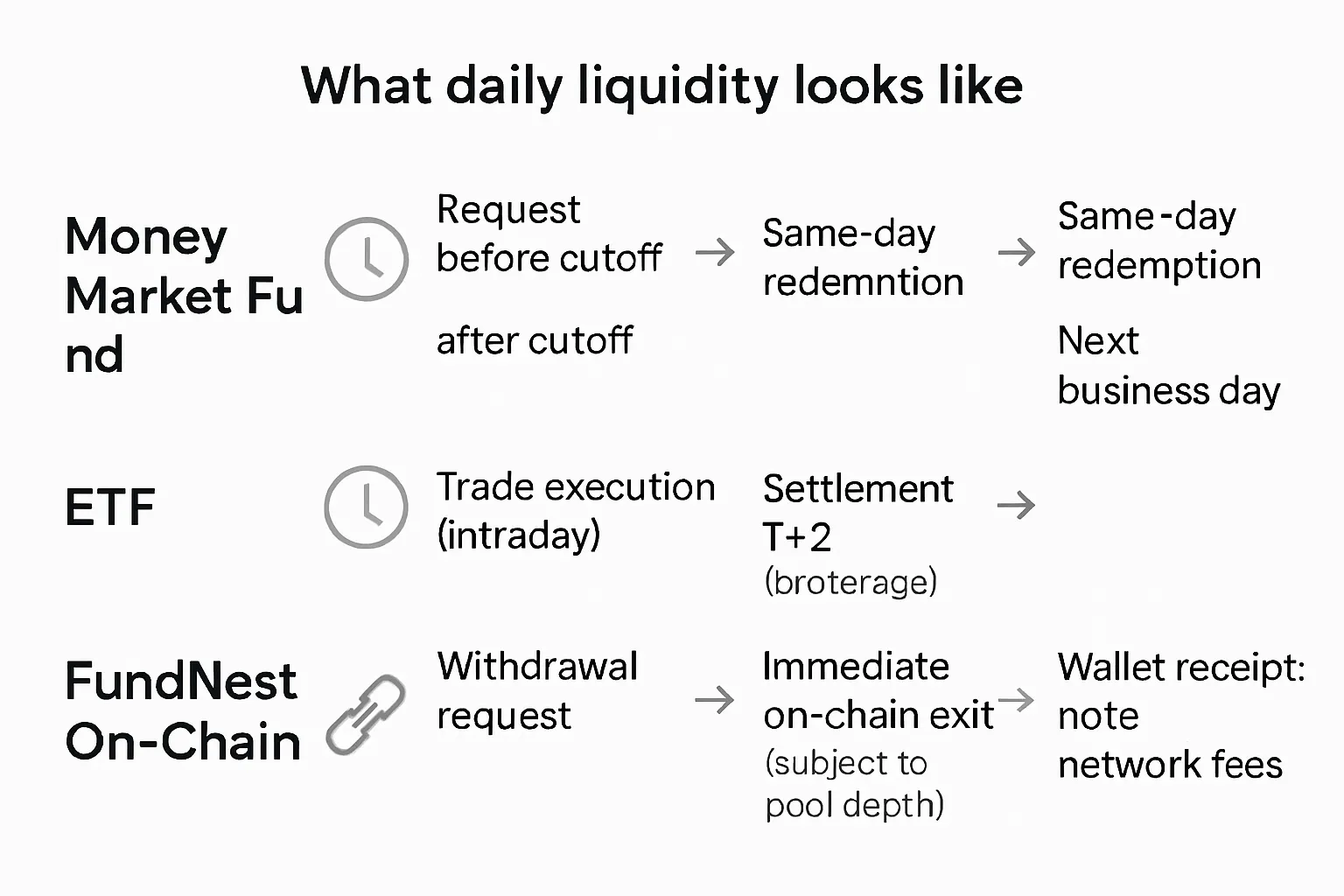

Daily liquidity: how fast can you actually get your USD back?

What “daily” means across vehicles

MMFs: Same‑day if you submit before the fund’s cutoff; otherwise funds arrive next business day. Some platforms batch orders - check your provider.

ETFs: Intraday market liquidity with immediate price discovery; cash settles on standard brokerage cycles (commonly T+2).

On‑chain pools: Instant withdrawals to your wallet when depth is available; confirmation times and network fees apply.

Hidden frictions to check

Redemption gates/fees: Rare but permitted for MMFs in stress events; read the prospectus.

Calendars and cutoffs: Holidays, bank wires, and platform batch windows can shift “daily” into “next day.”

On‑chain realities: Network congestion, RPC issues, and venue‑level withdrawal queues can slow exits temporarily.

Zemyth’s approach

FundNest targets immediate, non‑levered on‑chain exits during normal conditions.

Diversified venues to avoid single‑pool bottlenecks and maintain usd daily access.

Transparent telemetry on pool depth and expected slippage so you can plan redemptions confidently.

Ready to keep your investment USD liquid while earning stable returns? Get started at https://zemyth.app

Making your USD work harder with Zemyth FundNest

What it is

A curated, risk‑tiered liquidity platform designed to make your investment USD earn stable returns every day.

The “Zero Risk” option focuses on deep USDC/USDT pools that capture swap fees - a crypto‑native, cash‑equivalent approach to a usd fund with usd daily access.

How returns are generated

Pure trading fee capture from stable‑to‑stable swaps in high‑volume venues.

No borrow‑lend leverage, no opaque rehypothecation - a daily fund model that’s simple, transparent, and built for consistency.

Safety by design

Venue curation: Only deep, battle‑tested USDC/USDT pools make the list.

Guardrails: Conservative pool parameters and continuous monitoring of spreads, depth, and volumes.

Diversified deployment: Capital routed across multiple venues to avoid single‑pool concentration.

Liquidity you can plan around: Daily withdrawals with transparent telemetry on pool depth and expected slippage.

Extra upside with ZEM

Lock ZEM as veZEM to boost your FundNest yield - amplify fee‑driven returns without adding leverage.

Hold ZEM to unlock platform fee discounts, higher allocation priority on StartupNest deals, and broader ecosystem perks.

Who it’s for

USD holders who want a fund usd experience with on‑chain convenience, 24/7 access, and non‑levered, fee‑only yield.

Operators and treasurers seeking a scalable base layer for stable returns and reliable usd daily liquidity.

Crypto‑curious investors who want clear guardrails and transparency from a daily fund that doesn’t chase risk.

Quick start

Deposit USDC/USDT into the Zero Risk pool.

Track fee accrual and pool telemetry in real time.

Optional: stake ZEM for veZEM boosts to lift your effective APY.

Ready to put idle dollars to work? Start earning fee‑driven yield with daily access at https://zemyth.app

How much to allocate - simple playbooks

Align with your USD “life liabilities”

0–6 months cash needs → prioritize daily liquidity and ultra‑low volatility. Think government MMFs and T‑bill ETFs as your base, with optional fee‑only on‑chain overlay.

6–24 months runway → blend cash‑like with slightly higher‑beta cash‑plus to lift stable returns without giving up usd daily access.

Model mixes (illustrative, not advice)

Conservative USD Daily: 70% government MMF/T‑bill ETF, 30% FundNest Zero Risk (fee‑only USDC/USDT pool).

Balanced Cash‑Plus: 50% government MMF/T‑bill ETF, 40% FundNest Zero Risk, 10% short‑duration bond ETF.

On‑chain Native: 80% FundNest Zero Risk, 20% government MMF proxy via tokenized T‑bills (if available/allowed).

These are illustrations to help you decide how to fund usd needs with the right usd fund mix for your time horizon.

Implementation steps

Define time horizon and withdrawal cadence (weekly payroll, monthly bills, quarterly tax).

Pick one primary parking vehicle + one backup (e.g., MMF + FundNest Zero Risk).

Set alerts for rate changes, MMF prospectus updates, and pool telemetry (depth, volume, fees).

Notes on taxes & compliance (jurisdiction‑dependent)

MMFs/ETFs: Distributions may be ordinary income; capital gains possible for ETFs. Check local rules.

Stablecoin yields: Typically fee income; confirm characterization and reporting.

Reporting: Track 1099/K‑1 equivalents or local forms; wallet address bookkeeping for on‑chain activity.

Goal → Vehicle fit

Objective | Suggested Vehicles | Target Liquidity | Key Risks to Check | Operational Notes |

|---|---|---|---|---|

Emergency cash (household/treasury buffer) | Government MMF; T‑bill ETF (secondary) | MMF: T+0 (cutoffs apply); ETF: trade intraday, settle T+2 | MMF liquidity fees/gates (rare); ETF price drift | Set transfer cutoffs; auto‑sweep into MMF; keep a checking float for instant bills |

Payroll float (1–4 weeks) | Government MMF + FundNest Zero Risk (fee‑only) | MMF: same‑day; FundNest: on‑chain near‑instant (subject to pool depth) | MMF gates; on‑chain peg/smart‑contract risk | Schedule redemptions; multi‑venue LP diversification; maintain USD bank rail for last‑mile |

Treasury management for DAOs | FundNest Zero Risk core; MMF/T‑bill ETF as off‑chain anchor (where permissible) | On‑chain exits: near‑instant; Off‑chain: T+0/T+2 mix | Smart‑contract, oracle/admin keys; custody/ops risks | Use multisig and timelocks; monitor telemetry; define emergency runbooks and signers |

On‑ramp buffer (exchange/fiat timing) | FundNest Zero Risk; Government MMF (via broker) | FundNest: instant wallet receipt; MMF: T+0 | Network congestion; bank/ACH cutoffs | Pre‑fund wallets; batch conversions; monitor gas and pool depth before large moves |

Pro tip: If your investment usd needs are truly “daily fund” level, keep your base in government MMFs or T‑bill ETFs and layer FundNest Zero Risk for fee‑only upside and 24/7 flexibility.

TL;DR

Align allocations with spend timelines: short cash windows in MMFs/T‑bill ETFs, flexible surplus in fee‑only stablecoin pools. Keep two rails (off‑chain + on‑chain) so your usd fund stays liquid and productive.

Ready to make your USD work harder with stable returns and usd daily access? Get started at https://zemyth.app

FAQs - USD funds and stable returns

Do USD funds eliminate all risk?

No. A usd fund aims to minimize volatility and credit risk, but not eliminate risk. Government MMFs can impose liquidity fees/gates in stress; T‑bill ETFs can drift around par as rates move; on‑chain fee pools face smart‑contract, venue, and peg risks. Treat them as low‑risk, not risk‑free.

MMF vs T‑bill ETF vs FundNest Zero Risk?

MMF (government/treasury): Cash‑like, regulated liquidity ladders (T+0 if before cutoff), stable returns that track front‑end rates minus fees.

T‑bill ETF: Intraday tradability, slight price moves as yields change, T+2 settlement; efficient for larger “investment usd” allocations.

FundNest Zero Risk: On‑chain, fee‑only USDC/USDT LP yield with 24/7 access; no borrow‑lend leverage; usd daily access subject to pool depth.

What about FDIC insurance?

Bank deposits are insured up to legal caps (e.g., FDIC/NCUA in the U.S.). MMFs and ETFs are investment products, not deposits, and are not FDIC‑insured. On‑chain pools are also not bank‑insured.

How do stablecoins keep $1?

Via reserves and mint/redeem mechanics. Still evaluate issuer quality, reserve composition and attestation cadence, banking partners, and venue risk. Diversification across venues/issuers can reduce single‑point failure risk.

Can I lose money?

Yes, in edge cases. Examples: temporary depegs, extreme market stress (MMF fees/gates), ETF price moves during rate shocks, or operational failures (custody, smart contracts). The design goal is “minimize,” not “eliminate.”

Who should consider Zemyth?

USD holders who want transparent, fee‑driven on‑chain returns with daily access, plus optional ZEM boosts and broader ecosystem perks. Ideal for treasuries and individuals who value 24/7 access and non‑levered, stable returns.

Want stable returns with usd daily access? Start with Zemyth FundNest Zero Risk: https://zemyth.app

Conclusion - Park your USD where it works every day (Start with Zemyth)

The bottom line

Keep USD earmarked for USD spending in USD funds that earn from treasuries, repo, or stablecoin fees - not from hidden leverage.

Favor daily liquidity and transparent mechanics so your dollars are always within reach.

Align investment USD with your near‑term USD liabilities to neutralize FX noise and preserve stable returns.

Treat “daily fund” access (T+0/T+1) as a hard requirement for operating cash.

Why start with Zemyth

FundNest “Zero Risk” targets fee‑driven returns from USDC/USDT swaps - transparent, non‑levered, and tuned for usd daily access.

Venue curation, monitoring, and diversified deployment keep core risk low while your dollars keep working.

Optional ZEM/veZEM boosts amplify net APY, plus ecosystem perks like fee discounts and priority access.

Next step (CTA)

TL;DR: Put your investment USD to work today with Zemyth. Visit https://zemyth.app and start earning daily, without extra risk.

Note

This is educational content, not financial advice. Always review your jurisdiction’s regulations and tax rules before allocating capital.