Invest With Confidence: What the Rule of Investment Really Means

Confidence isn’t a feeling; it’s a system. The real “rule of investment” is that rules - not hunches - compound outcomes. When you codify how you deploy capital, size positions, and react to volatility, you remove guesswork and build a repeatable edge. That’s how you invest with confidence - especially in fast, noisy markets like crypto and early‑stage ventures.

At Zemyth, we design the environment around those rules: milestone‑gated startup rounds so capital follows execution, not hype; a liquid Fund Nest that compounds daily so your dry powder isn’t idle; and on‑chain transparency so proof is visible, not promised. Your rule investment playbook meets rails that enforce it.

"Rule No. 1: Never lose money. Rule No. 2: Never forget rule No. 1." - Warren Buffett - Source

That’s the spirit behind this guide. We’ll turn vague advice into ten concrete principles you can apply across public markets, crypto, and tokenized venture - so your rule money decisions are consistent, defensible, and scalable.

Why “rules” beat moods and market noise

Markets will always test your patience, your ego, and your timeline. Rules are how you beat that:

They pre‑commit your actions before emotions spike. Position sizing, max drawdown limits, and predefined exit criteria protect you from impulse.

They transform uncertainty into checklists: If X, then Y. If a founder ships milestones on schedule, you release the next tranche. If they miss, you pause. No drama.

They compound learning. Documented rules evolve. You keep what works, strip what doesn’t, and your process gets sharper each cycle.

They scale. You can’t personally vet every tick or every tweet, but you can enforce a framework that filters signal from noise.

On Zemyth, rules are baked into the rails:

Milestone‑gated tranches align funding with proof - builds shipped, users acquired, revenue hit.

The Fund Nest offers a dependable, lower‑risk base that smooths cash flow between rounds, so you don’t force bad entries.

Solana settlement and on‑chain updates provide verifiable progress - your rules run on transparent data.

The rule of investment vs. one-off tips

Tips are tactics without context. Rules are durable principles that survive new narratives, new tokens, new cycles.

One‑off tips: “Buy this coin.” “Rotate into AI this week.” They might pop once, then vanish.

Rules: “Size positions by conviction and liquidity.” “Require verifiable proof before adding.” “Diversify across uncorrelated bets while maintaining a stable base.”

A rule‑driven process looks like this:

Define your goals and horizon.

Allocate a core base to stable, liquid yield (e.g., Fund Nest) to compound while you research.

Direct a defined risk budget toward higher‑variance venture exposure (e.g., Startup Nest) only when founders deliver proof, not promises.

Review on a set cadence. Adjust rules - not based on headlines, but on performance data.

This is how you avoid chasing stories and instead build a system that compounds.

Who this playbook is for (new, intermediate, and crypto‑curious investors)

New investors who want a clear, simple rule set to avoid common mistakes and overtrading.

Intermediate investors who have felt the pain of drawdowns and want a process that protects the downside while staying in the compounding game.

Crypto‑curious investors who want venture‑style upside with guardrails: milestone‑gated funding, liquid parking for idle capital, and on‑chain transparency.

Angels, DAOs, and community leads who want to professionalize deal flow and apply consistent evaluation rules.

If you recognize the cost of improvisation, this playbook is for you.

How to use these 10 principles to invest with confidence

Here’s how to turn the ideas into action as you move through this guide:

Set your base. Decide what percentage of your portfolio stays in a liquid, lower‑risk yield layer to stabilize cash flow while you scout (Fund Nest can be your base).

Define your risk budget. Pre‑set a maximum allocation for higher‑variance bets across tokenized venture rounds and public crypto.

Demand proof. Commit to milestone‑gated participation only - tranches unlock when founders ship, grow users, or hit revenue (Startup Nest enforces this by design).

Size rationally. Use conviction, liquidity, and correlation to size positions. Cap maximum exposure per deal.

Timebox decisions. Work to a cadence: weekly review, monthly rebalance, quarterly rule revisions. No mid‑scroll impulsivity.

Record everything. Journal entries, exits, thesis, and rule changes. Data or it didn’t happen.

Automate what you can. Use platform guardrails (tranche logic, on‑chain updates) to hard‑code your rules and reduce emotional overrides.

Diversify deliberately. Spread across founders, sectors, and stages - but keep a coherent thesis to avoid dilution of attention.

Protect the downside first. The compounding math is ruthless; minimizing big losses keeps your curve intact.

Keep learning loops tight. Evaluate results against rules, iterate, and compound improvements.

Keep reading to build your personal “rule of investment” stack - and leverage Zemyth’s rails to make those rules automatic. That’s how you invest with confidence, cycle after cycle.

Principles 1–3: Allocate First, Automate Everything, Defend Against Risk

The fastest way to invest with confidence is to decide your rules before you deploy $1. These first three principles hard‑code discipline into your portfolio so you stop guessing, start compounding, and keep risk where it belongs - contained.

Key takeaways from the explainer:

Allocation drives outcomes more than stock picking or timing; risk and return come from mix, not moods.

Diversify broadly across asset classes; don’t concentrate your future on one story.

Match allocation to time horizon and drawdown tolerance; longer runway can take more equity/venture risk.

Rebalance on a cadence or by drift bands to keep risk from creeping up unnoticed.

Keep fees low, automate contributions, and stick to your plan through cycles.

"Investment policy (asset allocation) explained on average 93.6% of the variation in total plan return across 91 U.S. pension funds (1974–1983)." - Source

Principle 1 - Asset allocation is the rule of investment

Asset allocation is the foundation of every rule investment framework. It sets expectations, caps regret, and defines how you earn your return.

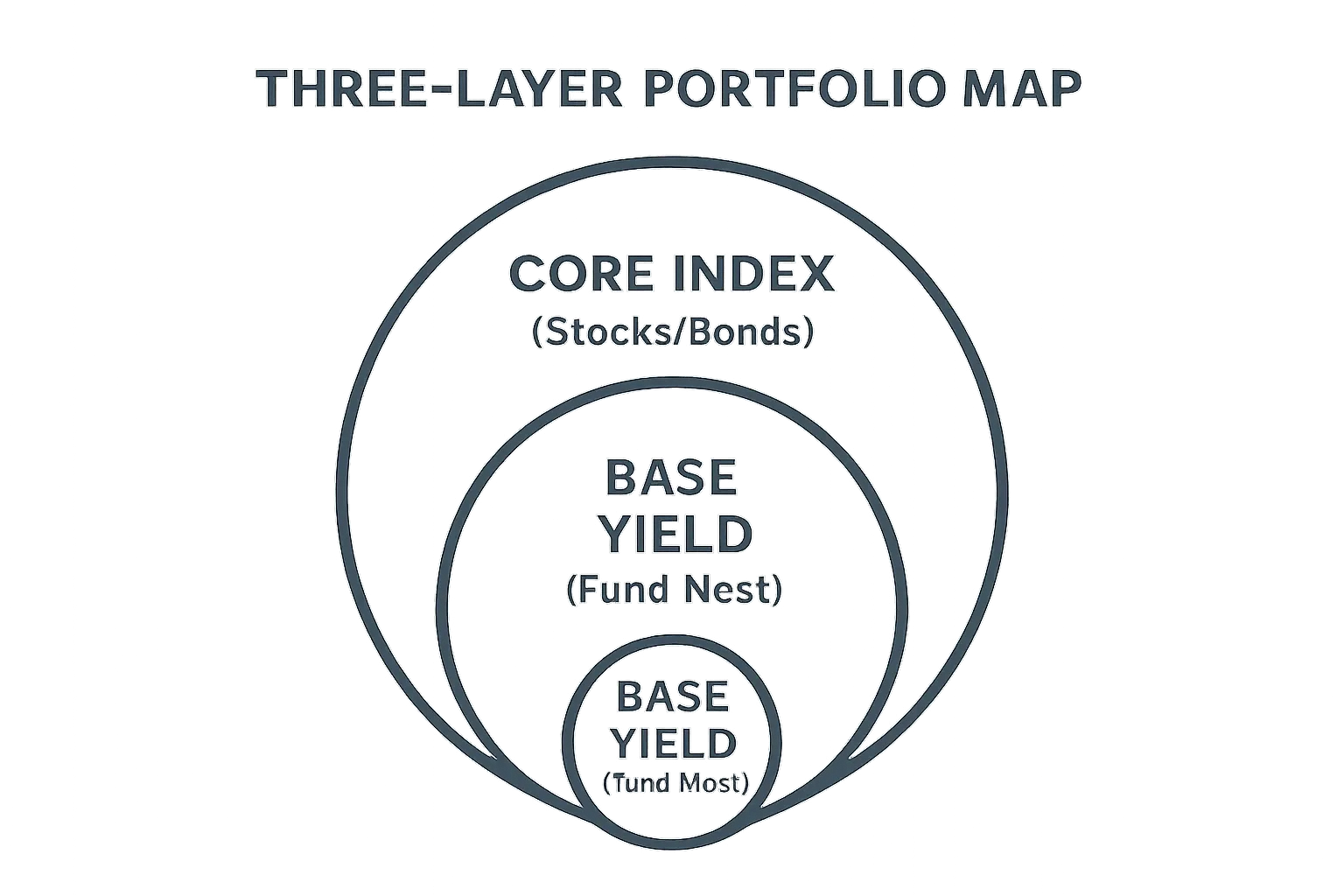

Define your base layer (cash/yield), core (broad index), and satellite (venture/alternatives)

Base Yield (stability and liquidity): A dependable, lower‑volatility layer to park cash, earn daily yield, and smooth cash flow. On Zemyth, Fund Nest is purpose‑built for this role so your dry powder isn’t idle between rounds.

Core Index (long‑run growth): Broad stock/bond exposure that compounds market beta over years. Think global equity and high‑quality bonds sized to your runway and risk capacity.

Satellite Venture (asymmetric upside): Smaller, higher‑variance positions with clear rules. On Zemyth, Startup Nest unlocks tranches only when founders deliver milestone proof - so capital follows execution, not hype.

Map allocation to time horizon and drawdown tolerance

0–3 years: Maximize capital stability and liquidity. Larger Base Yield, defensive Core, tiny Satellite (if any).

3–7 years: Balanced risk. Moderate Base, diversified Core, small Satellite for asymmetric optionality.

7+ years: Growth‑tilted. Leaner Base, equity‑heavy Core, measured Satellite for venture exposure.

Personal tolerance matters. If a 30–40% drawdown would make you abandon the plan, you’re overallocated to risk assets. Re‑size until you can sleep at night and stay invested.

Principle 2 - Automate contributions and rebalancing

Consistency beats intensity. Automation turns your rule of investment into habit so emotions can’t hijack you.

DCA cadence

Dollar‑cost average on a fixed cadence (weekly/biweekly/monthly) into Base, Core, and, when conditions and milestones are met, Satellite.

Let Fund Nest compound while you evaluate Startup Nest deals; deploy from yield to milestones - not headlines.

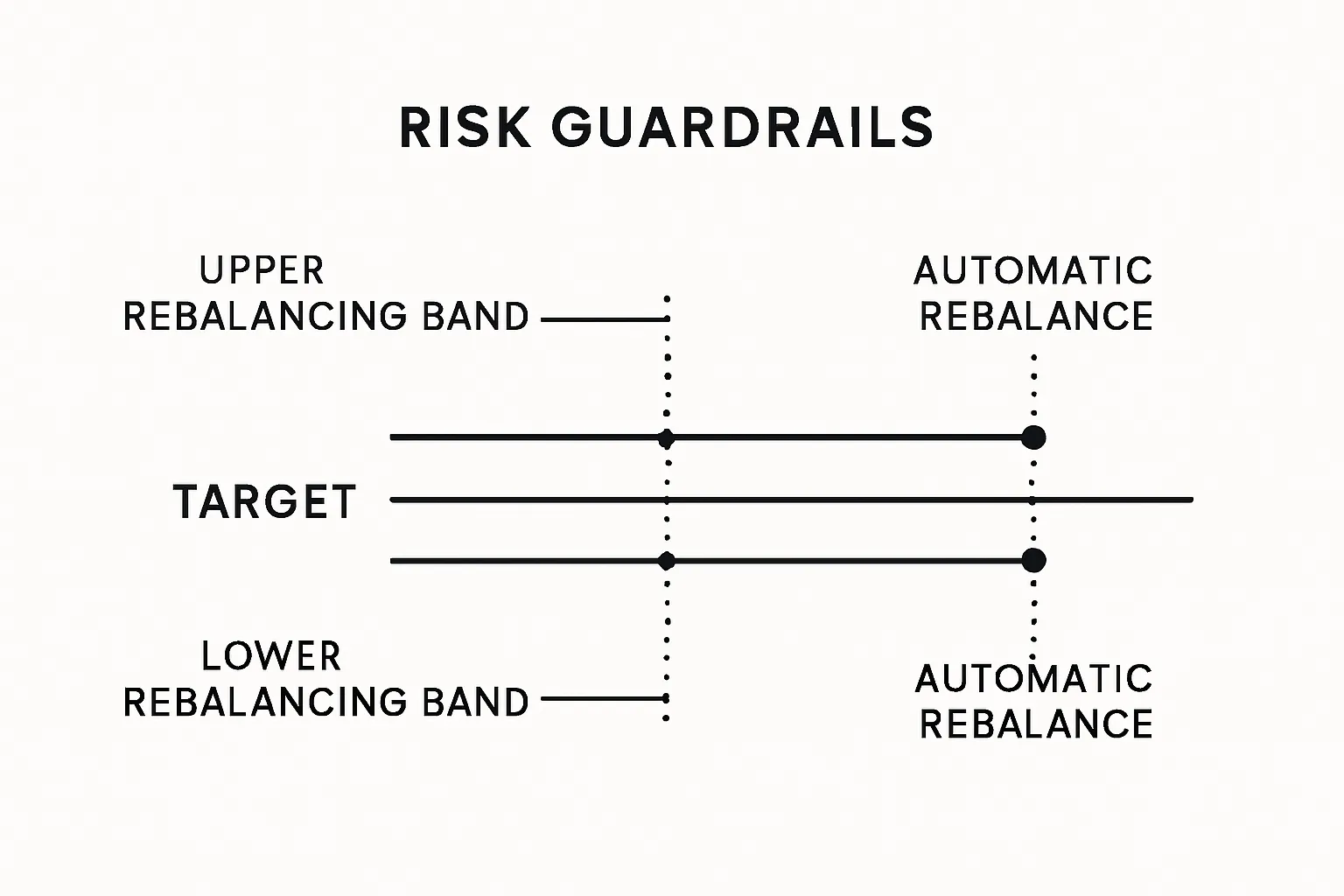

Calendar vs. drift‑based rebalancing

Calendar rebalancing: Quarterly or semiannual. Simple, predictable, tax‑aware.

Drift‑based rebalancing: Rebalance when an asset class deviates by a threshold (e.g., ±5% or ±20% of target weight). This defends your risk budget when markets run hot or cold.

Hybrid approach: Check monthly; act when drift exceeds bands or at quarter‑end, whichever comes first.

Automate tax‑efficient placements

Place yield‑generating assets in tax‑advantaged accounts when possible; keep high‑volatility growth in taxable accounts for loss harvesting opportunities (jurisdiction dependent).

Batch rebalances to minimize realized gains, use new contributions and Base Yield flows to “rebalance by addition” before selling.

Use platform rules to schedule deposits, set drift bands, and pre‑authorize tranche participation only when on‑chain milestones are verified.

Principle 3 - Build downside rules before upside dreams

Defense is rule money discipline. Protecting capital keeps your compounding curve intact.

Position sizing

Cap single‑position exposure (e.g., 2–5% per venture deal; 10–20% per broad index sleeve).

Size by conviction and liquidity: higher proof, higher liquidity → slightly larger; early, illiquid → smaller and staged.

Stop‑loss/volatility bands

For liquid assets, define volatility bands or soft stops (e.g., reduce if 20‑day realized volatility exceeds X, or if thesis‑breaking news triggers a rule‑based exit).

For venture/tranche deals, your stop is structural: if milestones slip or proof is absent, you pause further funding. No pleading, no “just one more month.”

Emergency fund

3–6 months of expenses in Base Yield so you never liquidate risk assets at the worst moment.

If income is volatile, extend to 9–12 months. Your Base layer is a shock absorber, not a yield chase.

Custody/security basics

Use hardware wallets, multisig for team funds, and unique addresses per strategy.

Segment hot vs. cold storage, avoid key reuse, and practice restores.

Monitor on‑chain activity. On Zemyth, project progress lives on Solana - verify proof before releasing tranches.

Sample Allocation Templates by Risk Profile and Time Horizon

Profile | Time Horizon | Base Yield % | Core Index % | Satellite Venture % | Rebalancing Rule |

|---|---|---|---|---|---|

Conservative | 0–3y | 60% | 35% | 5% | Calendar: Semiannual; Drift bands ±5% |

Moderate | 3–7y | 40% | 50% | 10% | Hybrid: Quarterly or when drift > ±7% |

Growth | 7y+ | 25% | 65% | 10% | Drift: Rebalance at ±10% from target |

Barbell Moderate‑Growth | 3–7y | 45% | 40% | 15% | Calendar: Quarterly; prioritize “rebalance by addition” |

How this plays with Zemyth:

Base Yield: Park reserves in Fund Nest to earn daily yield while you scout and evaluate. It stabilizes cash flow and funds your rebalances.

Satellite Venture: Join Startup Nest rounds with tranche unlocks tied to shipped product, user growth, or revenue. If proof stalls, your capital waits.

Automation: Pre‑set allocation targets, contribution cadence, and drift bands so your plan runs even when markets get loud.

Allocate first, automate the follow‑through, and defend the downside. That’s how you invest with confidence in any cycle.

Principles 4–5: Pay Less, Stay Longer

Cut friction, extend your timeline, and your edge compounds. These two principles hard‑wire the simplest rule of investment: control what you can - fees, taxes, and time in market - and let compounding do the heavy lifting.

Principle 4 - Costs compound too (keep fees and taxes low)

Every basis point you pay in fees or leak in taxes is a basis point that doesn’t compound. Over years, that’s the difference between “fine” and financial freedom.

Use broad, low‑cost index funds

Favor total‑market or broad factor‑light funds with razor‑thin expense ratios.

For crypto beta, avoid high‑fee wrappers where possible; understand staking/bridging costs before you click.

Minimize turnover

Rebalance with new contributions first (rebalance‑by‑addition) to avoid unnecessary sales.

Keep a rules‑based cadence or drift band so you’re not churning on headlines.

Be tax‑aware by design

Place yield‑heavy assets in tax‑advantaged accounts when available; place high‑volatility growth in taxable accounts for loss harvesting (jurisdiction dependent).

Batch sales, use long‑term holding periods, and harvest losses during drawdowns without breaking your asset allocation.

In a Web3 stack, watch gas, slippage, and bridging fees; they are stealth taxes on performance.

"Over the 10-year period ending Dec. 31, 2024, 84.34% of actively managed U.S. large-cap funds underperformed the S&P 500; over 15 years, 89.50% underperformed." - Source

Zemyth angle: keep your base yield working while you evaluate higher‑variance opportunities. Fund Nest compounds daily so you’re not paying opportunity cost while you wait for Startup Nest milestones to be verified on‑chain.

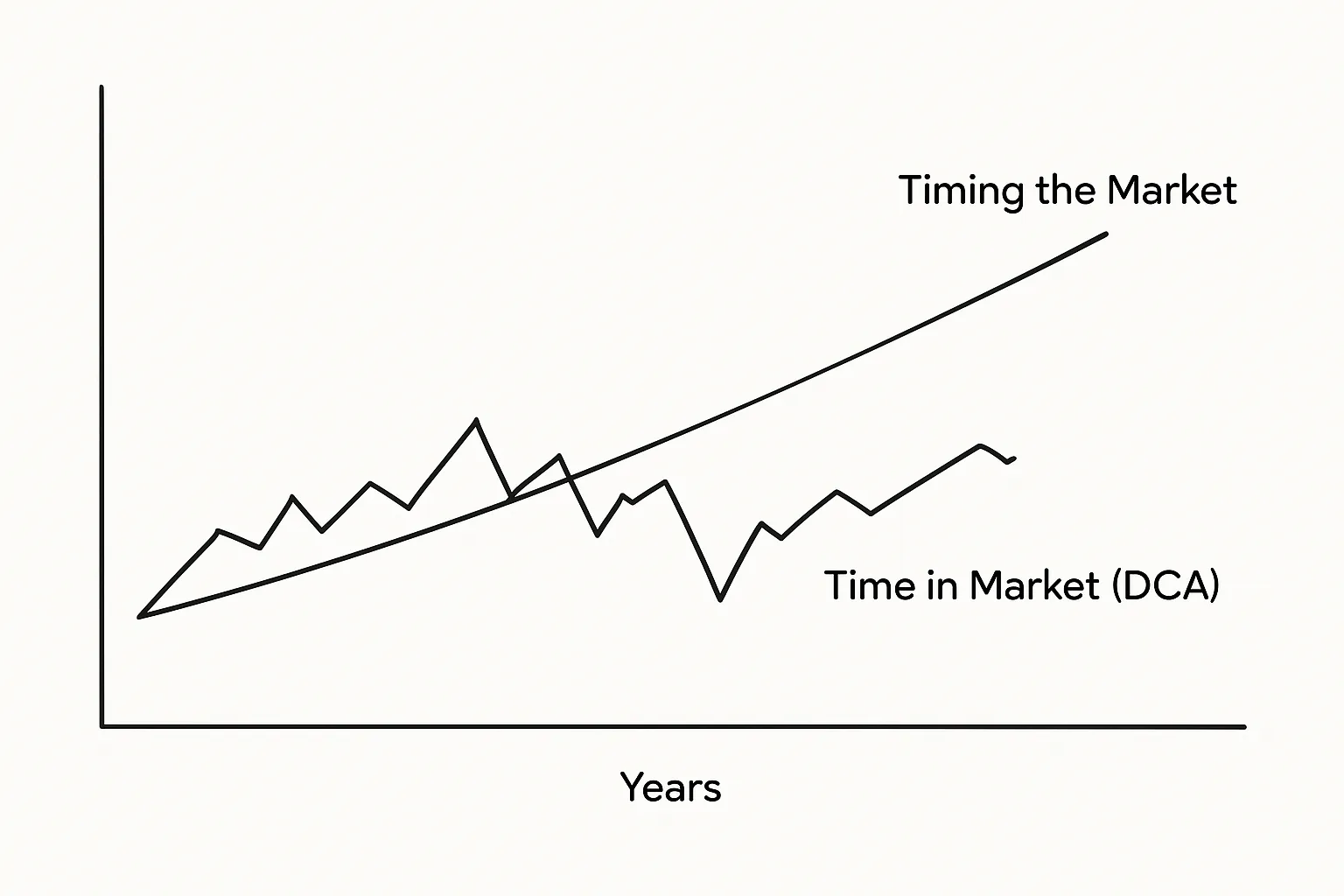

Principle 5 - Time in the market beats timing the market

Perfect entries are a mirage. Process beats prediction. Staying invested with a disciplined DCA and rebalance plan is the rule investment move that lets compounding show up.

DCA resilience

Automate contributions on a fixed cadence (weekly/biweekly/monthly). You’ll buy more when prices are low and less when they’re high - without thinking about it.

Keep your Base Yield flowing so dry powder isn’t idle; deploy from the base to core/satellite as rules trigger.

Stay invested through cycles

Missing just a handful of the best days can crater long‑term returns; those days often sit next to the worst days.

Predefine rebalance bands to add to underperformers and trim winners - rules over feelings.

Bear‑market playbook

Cash flow first: maintain 3–6 months of expenses in Base Yield so you never sell risk assets in a panic.

Rebalance into weakness per your drift bands; harvest losses where appropriate to improve tax efficiency.

For venture exposure, stick to milestone‑gated tranches. If proof stalls, you pause. If progress is real, you add - no hero calls required.

Journal your thesis and rule changes; upgrade the system, not the story.

Pay less. Stay longer. That’s how you invest with confidence. Minimize drag, maximize time in market, and let your rule of investment do what it’s designed to do: protect the downside, capture the upside, and keep compounding.

Principles 6–7: Define Risk Rules and Rebalance on Rails

If you want to invest with confidence, stop negotiating with yourself mid‑volatility. Codify your risk rules, then let rebalancing run on rails. That’s the rule of investment in practice: rules over vibes, process over prediction.

Howard Marks - co‑founder of Oaktree and author of The Most Important Thing - reminds us:

"We can’t predict, but we can prepare." - Source

Principle 6 - Pre‑commit risk guardrails

Write your defense before you write your growth story. Risk guardrails prevent small mistakes from becoming portfolio‑level problems.

Max drawdown per position

Define a maximum loss per position (e.g., 10–20% for liquid assets) that triggers a trim, thesis review, or exit.

For venture or milestone‑based deals, the “stop” is structural: if proof slips, funding pauses. No overrides.

Position sizing matrix

Size by three inputs: conviction, liquidity, and proof.

High proof + high liquidity → larger size within cap (e.g., 3–5%).

Early stage + low liquidity → smaller, staged entries (e.g., 0.5–1% tranches).

Cap aggregate exposure by sleeve (e.g., Satellite ≤ 10–20% of total) to keep tail risk bounded.

Volatility bands

For liquid assets, reduce when realized volatility breaches a threshold, add back when it normalizes.

Use ATR/realized vol bands to modulate adds/trims instead of gut feelings.

On Zemyth, these guardrails are embedded in the rails:

Startup Nest uses milestone‑gated tranches - capital follows execution, not hype.

Fund Nest provides a liquid base so you never sell risk assets for cash needs.

Principle 7 - Rebalance on rules, not vibes

Rebalancing is how you keep your true risk on target. Pick a rule - calendar, threshold, or hybrid - and stick to it. That is rule money discipline.

Calendar (semiannual/annual) vs. threshold (5% absolute or 20% relative drift)

Calendar: simple, predictable, easy for tax planning.

Threshold: acts when risk actually drifts, better drawdown control in fast markets.

Hybrid: check on a cadence; act when drift exceeds bands or at set dates - whichever comes first.

Tax‑aware execution

Rebalance by addition first (direct new contributions and Base Yield toward underweights).

Batch trims to stay in long‑term gains, harvest losses where appropriate, and consider lot selection.

In crypto, minimize slippage/fees; use stable, liquid rails to stage moves.

Rebalancing Trigger Cheatsheet

Trigger Type | When It Fires | Pros | Cons | Best For |

|---|---|---|---|---|

Calendar – Quarterly | Every 3 months on a set date | Simple, predictable; easy to batch for taxes | Can let risk drift too far between dates | Taxable accounts needing simplicity and planning |

Calendar – Semiannual/Annual | Every 6–12 months | Minimizes transactions and taxes | Higher interim drift; slower risk correction | Long‑horizon portfolios with low turnover preference |

Threshold – 5% Absolute Drift | When a sleeve deviates ±5 percentage points from target (e.g., 60% → rebalance at 55% or 65%) | Tight risk control; reacts to markets | More trades in volatile periods | Higher‑volatility mixes; risk‑sensitive investors |

Threshold – 20% Relative Drift | When a sleeve moves ±20% of its target weight (e.g., 60% equity triggers at 72% or 48%) | Scales with target size; fewer false positives | Less intuitive; may react late in quiet markets | Larger, diversified portfolios with clear targets |

Hybrid – Monthly Check + Threshold | Review monthly; trade only if absolute drift > ±5% or at quarter‑end | Balances control and efficiency | Requires monitoring discipline | Most investors seeking rules without overtrading |

Cashflow‑Based Hybrid | Direct new contributions/Base Yield to underweights; sell only if drift persists | Tax‑ and fee‑efficient; minimal churn | Slow to correct large drifts without sales | Investors with ongoing contributions or liquidity flows |

Rebalancing on rails lets you invest with confidence. Set the rules, automate the actions, and keep your risk where you intended - not where the market shoved it. That’s the rule investment edge that compounds.

Principles 8–9: Separate Core from Bets; Demand Real‑World Proof

Your portfolio runs on two engines: a dependable core that compounds quietly, and a focused satellite that hunts asymmetric upside. Protect the engine. Size the edges. That’s the rule of investment that lets you invest with confidence - through any cycle.

Principle 8 - Core vs. satellite: protect the engine, size the edges

Core = broad, low‑cost indexes. Satellite = clearly sized, thesis‑driven bets. Don’t confuse them, and don’t let satellites take over the cockpit.

What belongs in the Core

Broad, low‑cost index funds that capture market beta (global equities, investment‑grade bonds).

Simple, tax‑aware structure with minimal turnover and ruthless cost control.

Purpose: reliability, diversification, and long‑term compounding.

What belongs in the Satellite

Clearly defined, thesis‑driven positions with an evidence standard (early‑stage venture, thematic crypto, specialty assets).

Smaller position sizes, staged entries, explicit exit/milestone rules.

Purpose: calculated, asymmetric optionality without jeopardizing the engine.

Sizing rules that keep you honest

Core typically 70–90% for most investors; Satellite 10–30% depending on horizon and drawdown tolerance.

Per‑position caps for Satellite (e.g., 1–5% each), with smaller sizes for earlier, less liquid deals.

Fund with discipline: rebalance adds/trim via rules, not vibes.

The Zemyth way

Core stays efficient, low‑cost, and long‑term. Meanwhile, Zemyth’s Fund Nest can serve as your base yield layer - daily compounding so your cash isn’t idle while you research.

Your Satellite hunts venture upside via Startup Nest, with positions gated by milestones to keep risk contained.

This split is the essence of rule investment: protect the base that powers compounding, and express conviction at the edges with guardrails.

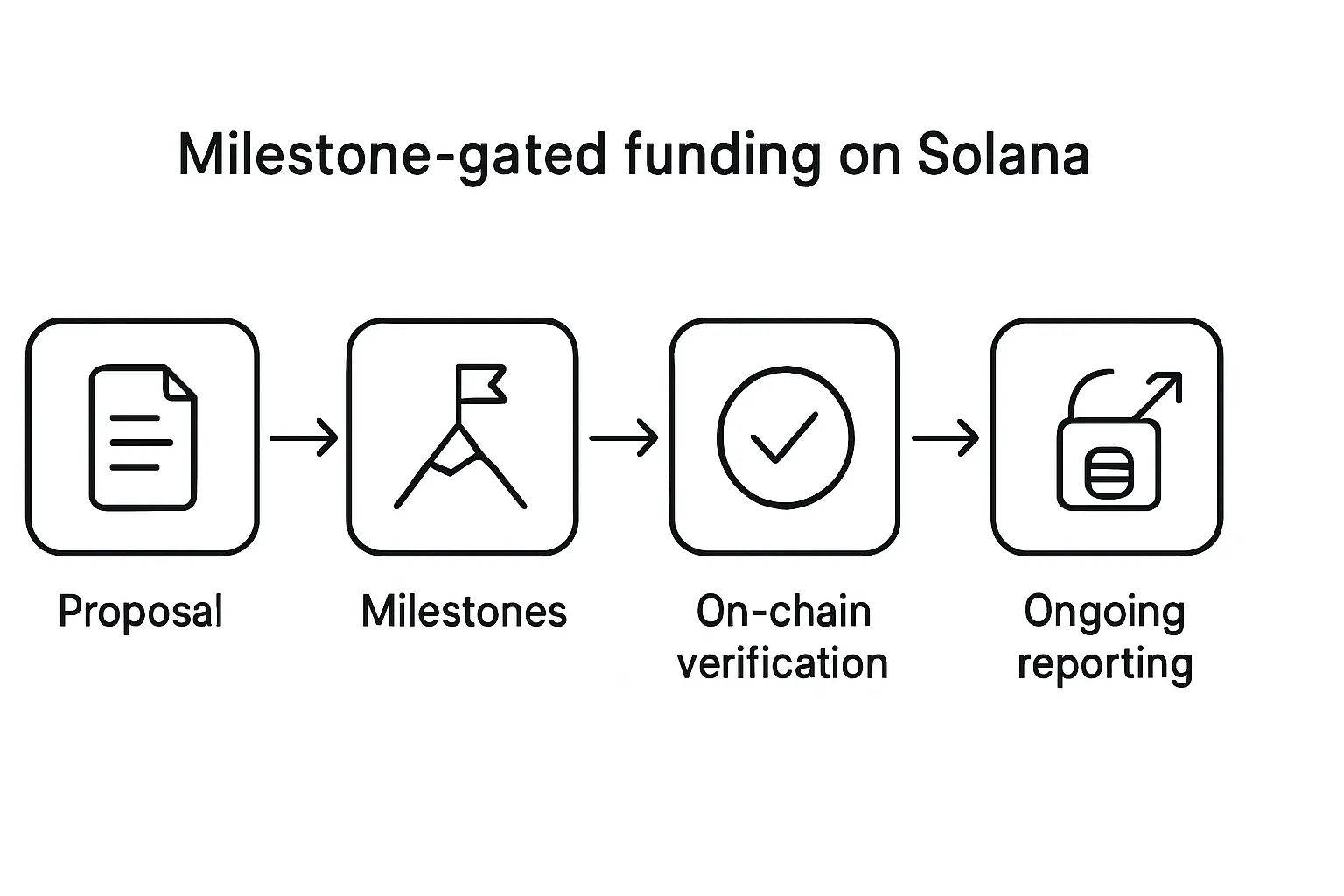

Principle 9 - Tie capital to milestones, not marketing

In venture and crypto, the signal is shipped product, users, and revenue - not deck design or social buzz. Tie your dollars to proof.

Fund founders and projects with on‑chain proof

Product: code shipped, mainnet/testnet releases, feature flags on‑chain.

Users: active wallets, retention, cohort growth.

Revenue: on‑chain payments, protocol fees, fiat/crypto receipts verifiable via explorers or attestations.

Tranche releases on delivery

Define milestones up front: “X shipped by date Y,” “Z active users for N consecutive weeks,” “$R monthly revenue with churn under C%.”

Capital unlocks only when the milestone is verified on‑chain. If proof slips, funding pauses automatically.

What this looks like on Zemyth

Startup Nest structures rounds into milestone‑gated tranches on Solana. Founders propose, the community vets, and progress is logged on‑chain.

Contributors deploy capital that unlocks as execution is proven - so capital follows results, not hype.

You maintain liquidity and cash‑flow stability via Fund Nest between tranches, compounding while you wait.

Milestone‑gated playbook you can copy:

Proposal: Founder publishes plan, budgets, and milestone definitions with data sources.

Milestones: Product, user, and revenue checkpoints with dates and acceptance criteria.

On‑chain verification: Public updates, repo commits, contract events, analytics proofs.

Tranche unlocks: Funds release automatically when criteria are met; no milestone, no money.

Ongoing reporting: Monthly updates, KPI dashboards, variance explanations, and next‑milestone readiness.

This is rule money in action. Separate your core from your bets, and only fund what’s proven. The result: you invest with confidence, keep downside contained, and let real progress - not marketing - earn the next dollar.

Principle 10: Write Your One‑Page Policy (Your Personal Rule of Money)

A one‑page Investment Policy Statement (IPS) is your personal rule of investment. It tells you what to do when markets get loud, what not to do when emotions spike, and exactly how to invest with confidence. Keep it short. Make it actionable. Then automate it so your rule money runs on rails.

What goes in an Investment Policy Statement (IPS)

Your IPS should fit on one page and cover the following:

Goals

Primary: e.g., financial independence, house down payment, angel/venture sleeve growth.

Time horizons: near (0–3y), mid (3–7y), long (7y+).

Target real return and drawdown tolerance.

Constraints

Liquidity needs, taxes/jurisdiction, income variability, custody/security requirements.

Ethical/exclusion screens if any.

Target allocation

Base Yield (liquidity layer): % target and role (stability, cash‑flow buffer). On Zemyth: Fund Nest for daily compounding while scouting.

Core Index (engine): % across global stocks/bonds; low‑cost, broad exposure.

Satellite Venture (edges): % cap for higher‑variance, milestone‑gated deals. On Zemyth: Startup Nest with on‑chain proof.

Risk limits

Max drawdown per position and per sleeve.

Per‑position caps (e.g., 1–5% for venture), sector/thematic caps, correlation awareness.

Volatility bands or stop criteria for liquid assets; milestone‑based pauses for venture.

Contribution plan

DCA cadence (weekly/biweekly/monthly), deposit sources, and allocation split across Base/Core/Satellite.

Rule: rebalance by addition before selling.

Rebalance rules

Method: calendar (e.g., quarterly/semiannual) and/or drift thresholds (e.g., ±5% absolute or ±20% relative).

Tax‑aware instructions: use new cash first, harvest losses under defined conditions.

Exceptions

Predefined exception list and approval process (e.g., two‑day cooling‑off period or second‑party review).

Change log: document any IPS edits with date, reason, and expected impact.

Translate principles to habits

Turn the 10 principles into defaults you can actually follow:

Default DCA date

Example: 1st and 15th of each month; allocate X% to Base (Fund Nest), Y% to Core, Z% to Satellite if milestones are greenlit.

Drift thresholds

Example: act when sleeves deviate ±5 percentage points from target or ±20% relative; otherwise leave it alone.

Fee caps

Core funds: expense ratio ≤ 0.15% where available.

Execution costs: set maximum slippage and gas/bridge fees; avoid trades that exceed thresholds.

Venture sizing

Satellite cap: 10–20% of portfolio depending on horizon.

Per‑deal caps: 1–3% initial; add only on milestone verification.

Diversification: spread across founders/sectors/stages with a max sector cap.

Exit rules

Liquid assets: exit or trim on thesis break, violation of risk bands, or at scheduled rebalance.

Venture: pause capital when milestones slip; resume only on verifiable progress. No “just this once” overrides.

Process hygiene

Journal every entry/exit, thesis, and rule exception.

Quarterly review performance vs. IPS; adjust rules, not impulses.

On Zemyth, you can encode these habits: automate DCA into Fund Nest, subscribe to milestone updates on Startup Nest, and use on‑chain verification to trigger or pause tranches - so your rules run without second‑guessing.

Sign it, automate it, revisit annually

Sign it

Print the IPS. Sign and date it. Share it with a trusted partner or future‑you in a pinned note.

Store a PDF and a read‑only copy in your notes or repo. Include a simple change log.

Automate it

Schedule contributions on your DCA dates.

Set rebalancing reminders and drift alerts; use cash flows to correct first.

On Zemyth: keep reserves compounding in Fund Nest; only release Satellite tranches when Startup Nest milestones verify on Solana.

Revisit annually

Once a year, reconcile outcomes vs. rules: Did the allocation behave as expected? Were risk limits respected? Where did you break process?

Update targets if life changes: income, dependents, geography, tax status, or time horizon.

Re‑sign the updated IPS with a new date and a one‑sentence summary of what changed and why.

This one‑page IPS is your personal rule of investment. Write it, wire it into your workflow, and let it guide every decision. That’s how you invest with confidence - protecting the engine, sizing the edges, and compounding on purpose.

Turn Rules into Habits: Your Automation Stack

Confidence comes from execution on autopilot. When your rule of investment runs as a system - money flows, rebalancing, alerts, and custody - you remove hesitation and let compounding do the work. Here’s how to build an automation stack that turns rule money into daily habits.

Funding flows

Design a simple, repeatable pipeline that allocates every dollar with purpose. Default flow:

Paycheck → emergency fund top‑up → base yield layer → core index → satellite

How to set it up:

Step 1: Paycheck

Route salary to your primary account. Same day, auto‑transfer a fixed percentage to your investing rails.

Step 2: Emergency fund top‑up

Maintain 3–6 months of expenses. Until you hit target, siphon a fixed slice (e.g., 10–20%) of new contributions here. Once full, redirect that slice downstream.

Step 3: Base yield layer

Park reserves in a liquid, lower‑risk base to smooth cash flow while you scout. On Zemyth, Fund Nest compounds daily so dry powder isn’t idle between rounds.

Step 4: Core index engine

Auto‑buy broad, low‑cost index exposure on your DCA cadence (weekly/biweekly/monthly). Keep fees microscopic and turnover minimal.

Step 5: Satellite venture sleeve

Allocate a pre‑set percentage to a satellite queue. On Zemyth, deploy into Startup Nest only when milestones are verified on‑chain - tranche unlocks tied to shipped product, users, and revenue. No proof, no release.

Make it If‑Then simple:

If emergency fund < target → direct X% of contributions to refill.

If Base Yield < target % → top up Fund Nest first.

If Satellite milestones verified → release tranche; else hold in Base Yield.

If drift > threshold → rebalance by addition from next deposit.

Autopilot toolkit

Operationalize your rule investment so you invest with confidence without constant micromanagement.

Broker automation

Recurring buys for core index funds on a set day and time.

Dividend/interest reinvestment toggled on.

Tax‑lot selection defaults (minimize realized gains; harvest losses under rules).

Stablecoin rails

Recurring on‑ramp to stablecoins for predictable liquidity.

Scheduled transfers to Solana for low‑cost settlement. Keep buffers in Base Yield to batch transactions efficiently.

Recurring buys and rebalancing

DCA rules: fixed contributions to Base/Core, conditional releases to Satellite.

Drift monitors: trigger alerts at ±5 percentage points absolute or ±20% relative drift; rebalance by addition first, then trims if needed.

Alerting and monitoring

Allocation drift alerts, volatility bands breached, and fee/slippage warnings at trade time.

Milestone alerts from Startup Nest: shipped features, active user thresholds, revenue proofs - so tranche decisions are event‑driven, not emotional.

Cash runway alerts: notify when Base Yield cushion drops below X months of expenses.

Playbook templates (copy/paste for your IPS)

Contribution cadence: 1st and 15th each month.

Rule: 40% to Base Yield (Fund Nest) until target met, 50% to Core index, 10% to Satellite queue; release to Satellite only on verified milestones.

Rebalance: monthly check; execute at quarter‑end or when drift exceeds thresholds.

Security and custody

Automation without security is a liability. Separate roles, harden keys, and rehearse recovery.

2FA and access hygiene

Enforce app‑based 2FA (not SMS), passkeys where supported, and unique passwords in a manager.

Restrict logins to trusted devices; enable login alerts and geofencing if available.

Hardware wallets and key management

Use hardware wallets for cold storage; hot wallets only for operational funds.

Multisig for team/DAO funds; require at least 2‑of‑3 approvals for releases.

Secure seed phrases offline in redundant, fire/water‑resistant storage. Test recovery on a spare device annually.

Role separation: hot vs. cold

Hot wallet: small, operational balance for routine transactions and gas.

Warm wallet: staging for upcoming allocations.

Cold storage: long‑term holdings and emergency reserves; never used for daily ops.

Transaction discipline

Pre‑trade checklist: verify contract, chain, slippage, and fees.

Post‑trade journaling: record thesis, rule, and hash - if it’s not documented, it didn’t happen.

Permissions review: quarterly audit of connected apps, approvals, and allowances; revoke what you don’t need.

Turn the rule of investment into muscle memory. Automate your flows, codify alerts, and protect the keys. With Fund Nest compounding your base and Startup Nest gating your satellite by on‑chain proof, you invest with confidence - because your system does the heavy lifting.

Scenario Playbooks to Invest with Confidence

A great plan survives contact with reality because it’s built from rules, not vibes. Use these scenario playbooks to operationalize your rule of investment so you can act fast, protect the downside, and let compounding work.

Starting from zero (first 90 days)

You’re beginning from scratch. Your goal is to get stable, automate cash flow, and deploy with a simple, repeatable process.

Days 0–30: Stabilize and set rails

Open accounts: brokerage for Core, on‑chain wallet for Satellite (hardware wallet preferred), and a Base Yield rail for cash flow.

Emergency fund: set a target of 3–6 months’ expenses. Start routing contributions here first.

Choose a simple allocation: Base/Core/Satellite, e.g., 40/55/5 for beginners.

Automate DCA: pick two dates per month (e.g., 1st and 15th). Contributions auto‑split to Base and Core; Satellite stays queued.

Security: enable app‑based 2FA, store seed phrases offline, and separate hot (operational) from cold (savings) wallets.

Days 31–60: Codify rules and start the engine

Rebalance rules: calendar quarterly + drift bands (±5 percentage points absolute or ±20% relative).

Fee caps: select low‑cost index funds for Core and set max slippage for crypto trades.

Venture guardrails: cap Satellite at 10% (or less to start) with 1–2% per position. Require milestones before adding.

Monitoring: set alerts for allocation drift, cash buffer threshold, and milestone updates on projects you track.

Days 61–90: Execute and review

Keep DCA humming. Do not tinker.

Fund Nest as Base: park reserves to compound daily while scouting deals - your cash isn’t idle.

Satellite via Startup Nest: only deploy tranches when on‑chain proof is verified (shipped product, user growth, revenue).

Review: 30‑minute monthly check - update journal, confirm rules, fix drift by addition before any selling.

Outcome: a functioning rule investment system you can run in minutes per week - and invest with confidence, even as markets swing.

Deploying a windfall (lump sum vs. staged DCA)

A large deposit is emotional. Use rules to neutralize the moment.

Decision framework

Horizon: if your runway is 7+ years, favor faster deployment to Core.

Risk tolerance: if a 20–30% drawdown would trigger regret, stage it.

Valuation/volatility context: wide bands? Tilt toward staging; quiet markets? Tilt toward lump sum.

Taxes and fees: minimize frictions; deploy via low‑cost vehicles and batch trades.

Three practical approaches

Lump Sum with Guardrails

Immediately allocate to target Base/Core/Satellite.

Add a “cool‑off” rule: no trades for 14 days unless drift breaches bands.

Staged DCA (6–12 tranches)

Move 1/N of the windfall on a fixed cadence (weekly/biweekly/monthly) into Core.

Keep undeployed funds in Base Yield (e.g., Fund Nest) to earn daily yield while you stage.

Hybrid (often best)

Deploy 40–60% now to Core + Base; DCA the rest over 3–6 months.

Satellite remains gated: release venture tranches only on milestone verification; otherwise, stay parked in Base Yield.

Execution checklist

Set automation first (dates, amounts, drift bands).

Journal your plan (why this mix, how long you’ll stage).

Confirm fee caps and tax‑lot defaults.

Press go, then let the rails work.

Bear markets (what to do when everything is red)

Down cycles are where rule money earns its keep. Your job is to stay solvent, stay invested, and buy quality per plan.

Immediate priorities

Liquidity first: ensure 3–6 months’ expenses in Base Yield. Extend to 9–12 months if income is uncertain.

IPS review: read your policy. Do what it says. Do not write new rules in panic.

Playbook

Rebalance by rules: add to underweights when drift bands breach; use new cash first.

Harvest losses where appropriate to improve tax efficiency; maintain target exposure.

DCA continues on schedule. If you cut contributions, set a date to restore them.

Venture discipline: fund only milestone‑gated tranches. If execution slows, capital pauses automatically; no “averaging down” without proof.

Volatility bands: if liquid assets exceed your vol thresholds, trim per policy; redeploy from Base when volatility normalizes.

Learning loop: write a short post‑mortem monthly - what worked, what didn’t, what rule you’ll improve.

Mindset anchors

Losses feel worse than gains feel good - your policies exist to protect you from this bias.

The best days often cluster near the worst days; time in market matters more than perfect timing.

Your edge is preparation and patience. Keep compounding.

Venture exposure without sitting idle (parking in yield layer between deals)

You want upside without dead cash. Solve it with a yield‑first pipeline and milestone‑gated deployment.

The pipeline

Park in Base Yield: hold unallocated capital in a liquid, lower‑risk yield layer (Fund Nest) to compound daily.

Qualify deals: shortlist founders/projects with transparent roadmaps, repos, users, and revenue potential.

Define milestones: product, users, revenue; set acceptance criteria and verification methods (on‑chain events, analytics, attestations).

Stage tranches: pre‑approve tranche sizes per milestone. Example: 1% on MVP shipped, 1% on 1,000 WAU, 1% on $10k MRR.

Verify on‑chain: when conditions hit, release from Base to the deal. No proof, no unlock.

Risk and ops rules

Cap Satellite sleeve (e.g., 10–20% of portfolio) and per‑deal size (1–3% initial).

Diversify across founders, sectors, and stages; avoid stacking correlated bets.

Keep an exit policy: pause capital on missed milestones; recycle back to Base Yield.

Document every decision: thesis, size, milestone, hash - tight feedback loops compound judgment.

Result: you maintain liquidity, earn daily yield between opportunities, and only fund real progress. That’s how you invest with confidence: protect the engine, size the edges, and let your rule of investment run on rails.

Where Zemyth Fits: Applying the 10 Rules to Decentralized Venture

Zemyth turns your rule of investment into rails you can actually use. Milestone‑gated venture rounds, a liquid base yield layer, and on‑chain verification let you invest with confidence - because capital follows execution, not hype.

Map the base‑core‑satellite to Zemyth

Base: Fund Nest for liquid, lower‑risk daily yield

Your cash buffer and dry powder park here to earn daily yield while you research deals or stage tranches.

Acts as the shock absorber that powers DCA, rebalancing by addition, and runway stability.

Core: Your long‑run index engine (off‑platform)

Keep broad, low‑cost index exposure in traditional accounts for compounding market beta.

Zemyth complements this, it doesn’t replace it.

Satellite: Startup Nest for milestone‑gated venture exposure

Tranches unlock only when founders deliver proof - builds shipped, users acquired, revenue milestones.

You size positions by conviction, liquidity, and delivered proof, keeping tail risk contained.

This clean base‑core‑satellite mapping is the rule investment blueprint that protects the engine and sizes the edges.

Invest with confidence through transparency

On‑chain progress

Milestones, updates, and unlocks are recorded on Solana - verifiable activity replaces hand‑waving.

Contributor reputation

Track record and participation build reputational signal, improving signal‑to‑noise for deal flow and diligence.

Tranche unlocks tied to proof

Funds release when predefined criteria are met. If a milestone slips, capital pauses automatically. That’s rule money discipline enforced by the platform.

Community and education

Affiliate‑driven deal flow

Communities and creators surface credible founders and earn rewards, increasing quantity and quality of opportunities.

Academy playbooks

Step‑by‑step guides to evaluate founders, define milestones, read on‑chain proof, and structure rule‑based participation - so newcomers and pros can operate from the same playbook.

Practical workflow

Park idle capital in Fund Nest → Review Startup Nest milestones → Commit tranche‑based, rule‑sized allocations

A simple, repeatable loop:

Set your portfolio rules: base/core/satellite targets, risk limits, and per‑deal caps.

Park reserves in Fund Nest to earn daily yield while you scout and evaluate.

Filter Startup Nest by thesis fit; subscribe to milestone updates.

Review milestone definitions: product, user, and revenue KPIs with clear acceptance criteria and verification sources.

Pre‑size allocations: e.g., 1–3% per deal, staged across milestones; cap satellite exposure (10–20%).

Commit tranches that unlock only on delivered proof; if proof stalls, capital waits in Fund Nest.

Monitor on‑chain progress and contributor notes; rebalance on your calendar or drift rules.

Journal outcomes and refine your rules each quarter - iterate the system, not your emotions.

This is how Zemyth operationalizes the rule of investment for decentralized venture: a liquid base that never sits idle, a satellite that only funds real progress, and transparent rails that let you invest with confidence across cycles.

Conclusion: Invest with Confidence - Start with Zemyth

Confidence comes from rules you trust and rails that enforce them. The rule of investment isn’t a slogan - it’s a system you can run in minutes per week to protect the downside, capture upside, and compound on purpose.

Recap: the 10 rules that compound results

Allocate first: build your base‑core‑satellite.

Automate contributions and rebalancing.

Defend the downside before chasing upside.

Pay less: keep fees and taxes low.

Stay longer: time in market beats timing.

Pre‑commit risk guardrails.

Rebalance on rules, not vibes.

Separate core from bets; protect the engine.

Tie capital to milestones, not marketing.

Write a one‑page policy - your personal rule of money.

These principles let you invest with confidence through any cycle. They’re the rule investment backbone that turns intent into results.

Your next three steps

Write your one‑page policy

Define goals, allocation, risk limits, contribution cadence, rebalance and exception rules.

Automate contributions and rebalancing

DCA on fixed dates, drift alerts, rebalance by addition first, then trims.

Allocate your base layer, then size your satellite bets

Park liquidity in a yield base, keep a low‑cost core engine, and size satellite positions with strict caps and milestones.

Why start with Zemyth now

Milestone‑gated rounds, Fund Nest liquidity, on‑chain transparency

Fund Nest compounding for your base layer; Startup Nest tranches unlock only when founders deliver real proof on Solana.

Open access venture with education built in

Affiliate‑driven deal flow surfaces credible founders; Academy playbooks help you evaluate and operate with a clear rule investment process.

Together, this is rule money on rails: transparent, disciplined, and designed to help you invest with confidence.

Call to action

Create your plan and put it on rails at Zemyth: https://zemyth.app

Build your base, automate the follow‑through, and only fund what’s proven. Start now and let your rules compound.