TLDR + Why Narratives and Catalysts Create the Next Big Investment

TLDR

The next big investment is born where an emerging narrative meets imminent catalysts. Spot both early using a repeatable, data‑driven playbook.

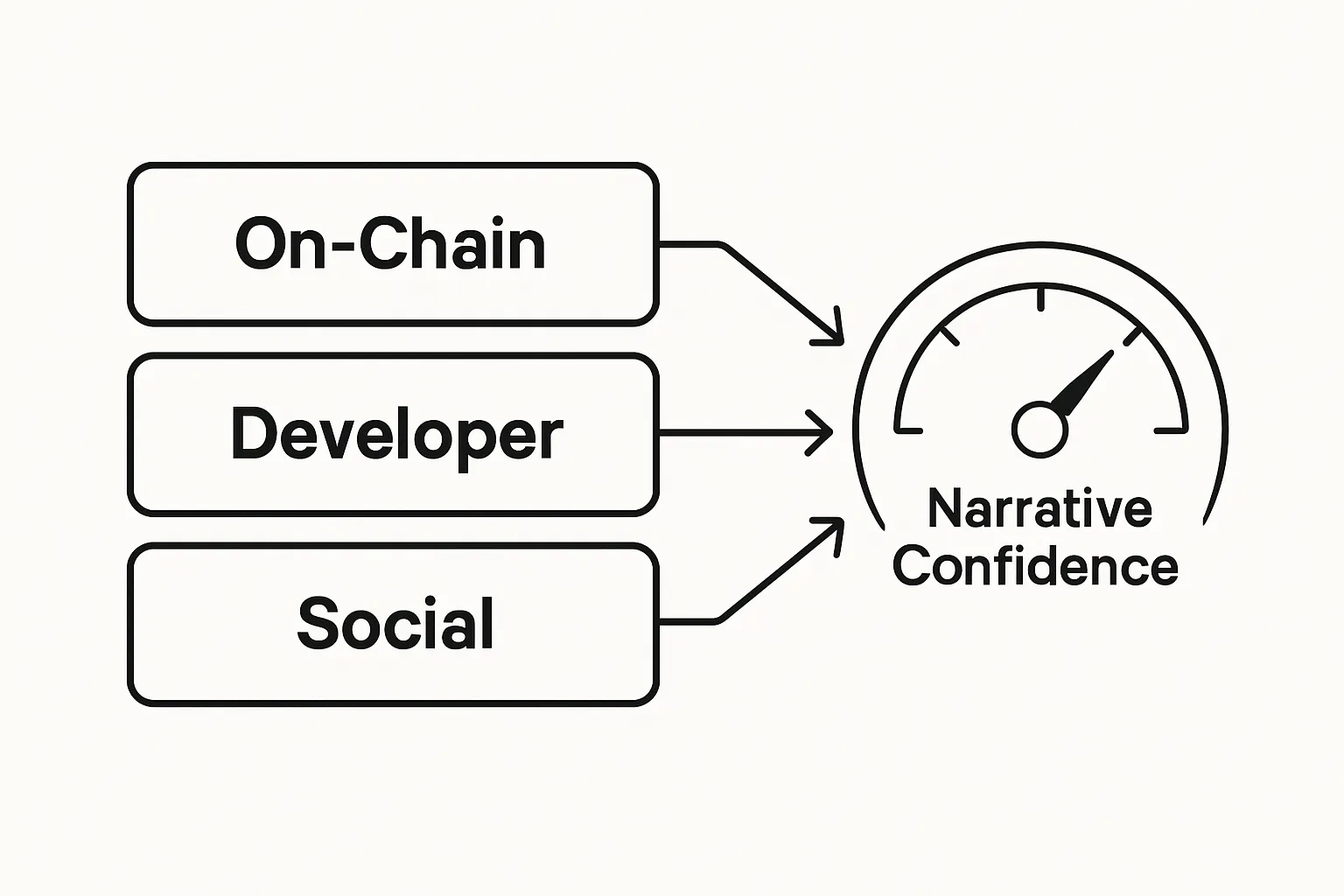

Triangulate three signal streams: on‑chain traction, developer activity, and roadmap catalysts. This surfaces start up companies to invest in before the herd.

Convert signals into a high‑growth investment strategy with a weighted scorecard, probability‑impact matrix, and time‑discounted entry/exit rules.

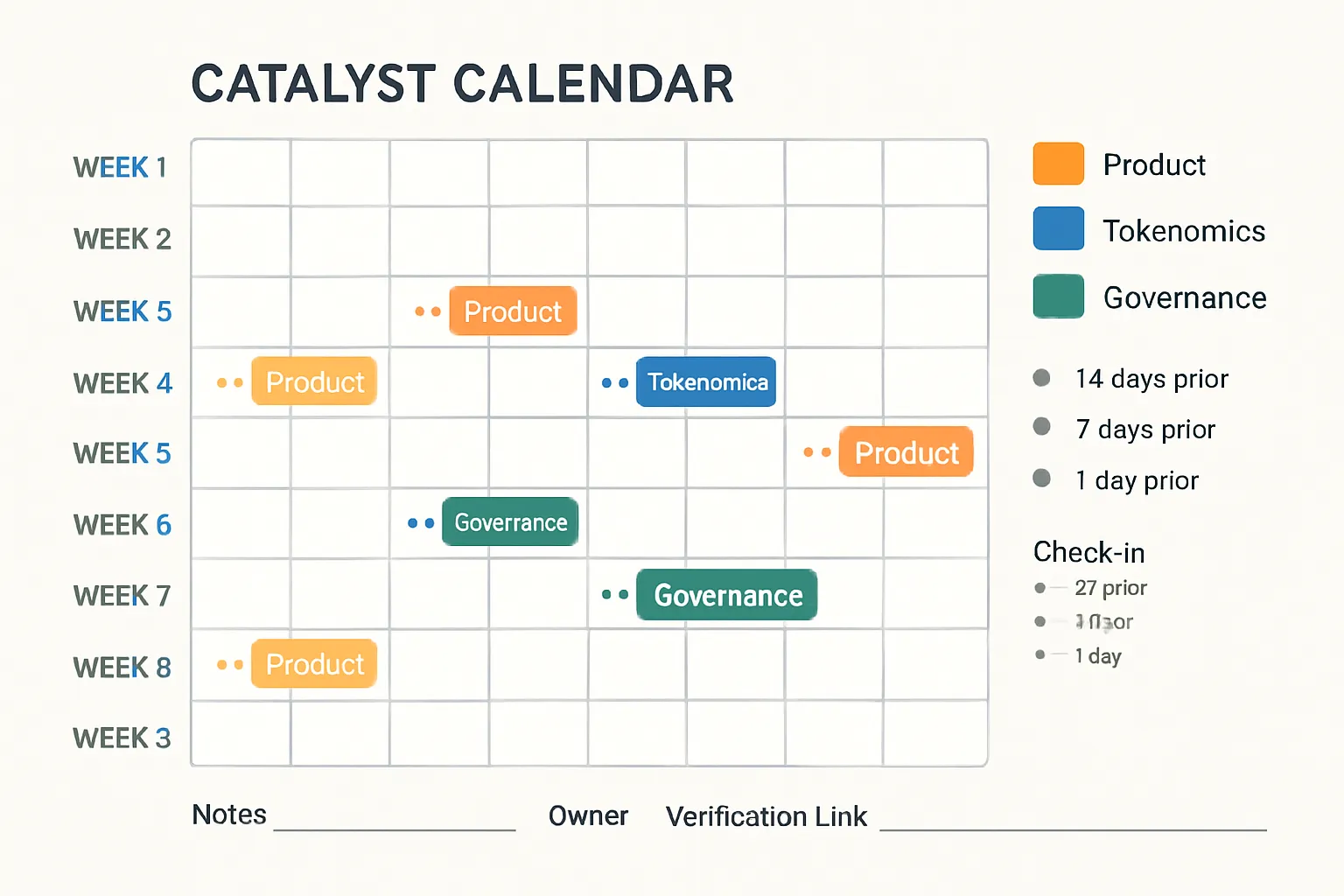

Build a catalyst calendar so you’re always positioned before unlocks, mainnets, listings, and governance votes move price and liquidity.

Operationalize this process on Zemyth: discover milestone‑gated raises (StartupNest), park idle capital for yield (FundNest), and boost outcomes via ZEM.

CTA: Start building your edge today at https://zemyth.app

"Approximately 6% of VC deals produced about 60% of total returns (Horsley Bridge analysis, 1985–2014)." - Source

What this guide covers (and why it beats the usual takes)

Goes beyond macro headlines and analyst notes to the earliest on‑chain and dev signals that precede mainstream coverage.

A practical framework: scoring model, tables, checklists, and a calendar workflow you can deploy in under an hour.

Ties catalysts directly to milestone‑based venture funding so you can align capital with execution, not hope.

Built to help you consistently spot the next big investment and convert it into a disciplined, high growth investment strategy using Zemyth.

Why narratives + catalysts matter now

2026 likely brings modest index returns - alpha shifts to earlier theme discovery and disciplined catalyst timing. When narratives inflect and catalysts hit, multiple expansion + liquidity events can compress years of returns into weeks.

Reflexive loops (attention → usage → price → more attention) are strongest in frontier markets like crypto and tokenized startups - perfect terrain for early signal hunting. Zemyth turns those signals into action: back execution via StartupNest, keep idle funds productive in FundNest, and amplify outcomes with ZEM - all before the herd arrives.

The Meta‑Framework: Narratives, Catalysts, and Reflexivity (Setups that lead to high‑growth outcomes)

Want a repeatable way to find the next big investment before the crowd? Anchor on the story, timestamp the triggers, and ride the reflexive loop - then operationalize it on Zemyth so your capital is aligned with execution, not hope.

"Owning securities with catalysts for value realization reduces risk by increasing the odds and speed of value recognition." - Source

Define the moving parts

Narrative: the forward story markets are willing to fund (why this can be the next big investment). Strong narratives frame the “why now”: a new market, a step‑function in cost/performance, or a regulatory opening that unlocks adoption.

Catalyst: dated trigger that forces repricing (product launch, mainnet/TGE, listing, token unlock, governance vote, major partnership, regulatory greenlight). Catalysts compress time - when they hit, price, liquidity, and attention shift fast.

Reflexivity flywheel: story → users → metrics → price → stronger story. As usage data validates the story, multiples expand; expansion pulls in more users, partners, and developers. In frontier domains (crypto, tokenized startups), this loop can compound quickly.

The early‑edge checklist (before price)

Evidence of real adoption (on‑chain usage, not vanity followers).

Track active addresses, retention, transaction count, fee share, TVL, or cohort curves. If users stick, the story sticks.

Code shipping cadence (dev velocity and contributors beyond the core team).

Watch GitHub commits, issue velocity, releases, and unique contributor growth - especially third‑party builders - that’s durable momentum for a high growth investment strategy.

Dated roadmap items with objective acceptance criteria.

Mainnet dates, TGEs, exchange listings, governance proposals with clear pass thresholds. Time‑bound + verifiable = tradable setup.

From macro to micro (where most miss it)

Macro sets the wind; catalysts set the sail.

Use macro only to weight probabilities (liquidity regime, rate cuts, risk appetite). Don’t build a thesis on macro alone - anchor it to concrete, near‑dated micro catalysts that can reprice a specific asset or protocol.

Anchor valuation to cash flows or token value accrual, then let catalysts be the path to that value.

For equities: cash yield, unit economics, free cash flow growth. For tokens: fee capture, emissions vs. burns, staking demand, protocol take‑rate. Catalysts (mainnet, listings, partnerships) are how you close the gap from intrinsic value to market value.

How Zemyth turns this into action for start up companies to invest in:

StartupNest aligns capital with dated execution (milestones, votes, unlocks) so you can systematically position ahead of catalysts.

FundNest keeps idle tranches productive while you wait, reducing time drag between events.

ZEM boosts and fee discounts amplify your edge when you size into high‑conviction, catalyst‑rich deals - the practical way to source the next big investment from narrative + catalyst + reflexivity setups.

Where to Harvest Early Signals: On‑Chain Data, Developer Activity, and Social Graphs

Early signal harvesting is how you consistently spot the next big investment before headlines catch up. Triangulate three stacks - on‑chain, developer, and social - to separate durable traction from narrative noise and build a high growth investment strategy you can actually execute.

On‑chain traction (leading indicators)

Daily active addresses (DAA) and transactions per user: rising DAA with stable or increasing tx/user = real utility, not bot churn.

Retention cohorts: 7/30/90‑day wallet retention curves; sticky cohorts beat one‑off spikes.

Fee share vs. peers: growing share of protocol or L2/L3 fees signals product‑market fit and willingness to pay.

TVL quality: map organic net flows (stablecoin/native deposits) vs. mercenary yield (incentive‑driven, time‑boxed liquidity).

App‑level funnel: wallet connect → first tx conversion → 7/30‑day repeat usage; improving funnel conversion speeds time‑to‑value.

Developer activity (durable moats)

Monthly active developers (MAD): sustained growth across core + external contributors reduces key‑person risk.

Commit velocity and release cadence: weekly commits, tagged releases, and issue closure rates reflect shipping culture.

New repo spin‑ups and SDK/package downloads: rising npm/pip/cargo downloads and example apps = early demand proxy.

PR review/merge times and contributor diversity: fast reviews, broad reviewer base, and low bus‑factor de‑risk roadmap delivery.

"Developers with 2+ years’ experience now contribute roughly 70% of code commits - key to resilience and value creation through cycles." - Source

Social and community proof (but verify)

Unique contributor growth (forums/Discord/GitHub issues) > follower counts: measure builders, not spectators.

Governance health: proposal volume, voter turnout, and delegate concentration; watch for capture risk or improving decentralization.

Qualitative signal: partner/BD announcements with on‑chain follow‑through (usage uptick within 14–30 days), not just press releases.

Triangulation template

Require 2 of 3 signal stacks to trend up before you size the bet; all 3 = green‑light zone.

Weight signals by durability:

Developer > On‑chain usage > Social for long‑run compounding,

On‑chain spikes + near‑dated catalysts for tactical entries.

Tie it back to catalysts: only scale when there’s a dated trigger (mainnet/TGE, listing, unlock, governance vote) to compress time to repricing.

How Zemyth helps you act on these signals:

Source start up companies to invest in with verifiable on‑chain and dev momentum via StartupNest’s milestone‑gated raises.

Park capital between catalysts in FundNest’s risk‑tiered vaults so your cash compounds while you wait.

Boost outcomes with ZEM fee discounts and yield multipliers when conviction is highest.

Build a Narrative Signal Scorecard (Step‑by‑Step)

A quantified scorecard turns scattered signals into conviction. Use it to rank start up companies to invest in, time entries around catalysts, and operationalize a high growth investment strategy on Zemyth.

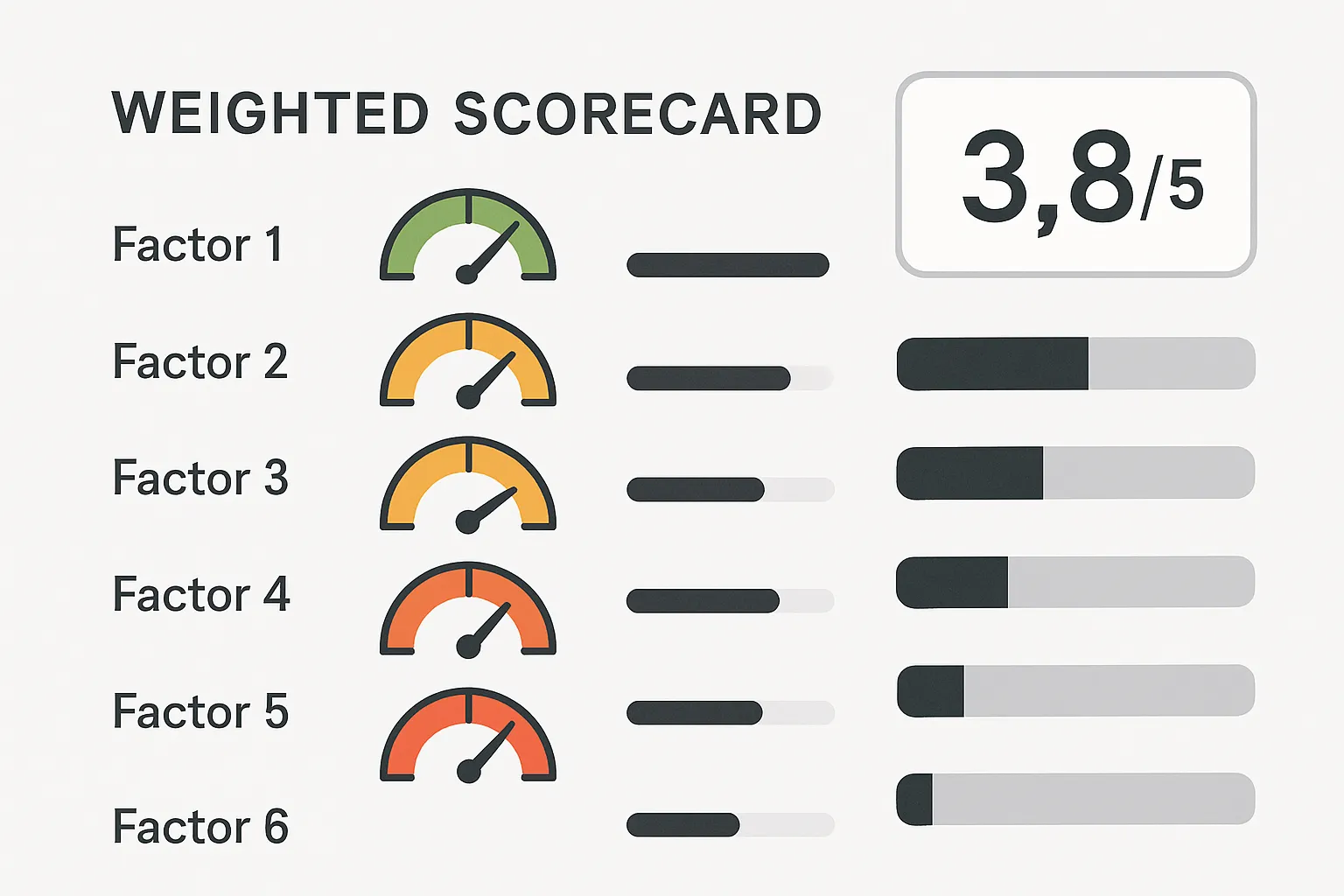

Step 1 - Select factors and weights (align to value accrual)

On‑chain adoption - 30%

Developer traction - 25%

Token/fee capture design - 15%

Roadmap catalysts - 15%

Community/governance health - 10%

Competitive moat - 5%

Why this mix works for the next big investment: it favors durable usage and dev velocity, then scores how well value actually flows to holders, with near‑dated catalysts compressing time to repricing.

Step 2 - Define measurable thresholds

30‑day DAU CAGR > 10% with stable or rising tx/user

Monthly active developers > 8 with 3+ external contributors

Next dated catalyst ≤ 90 days with objective success criteria

30% protocol fees returned to token/stakers (or equivalent burn)

Governance voter turnout > 15% with improving delegate dispersion

Peer‑relative fee share +5% QoQ and TVL quality > 60% organic flows

Step 3 - Score, sanity‑check, and rank

Score each factor 0–5, multiply by weight, sum to a composite.

Gate: only pursue opportunities with total score ≥ 3.6/5.

Sanity‑check the narrative vs. data: rising social buzz without on‑chain or dev follow‑through = delay sizing.

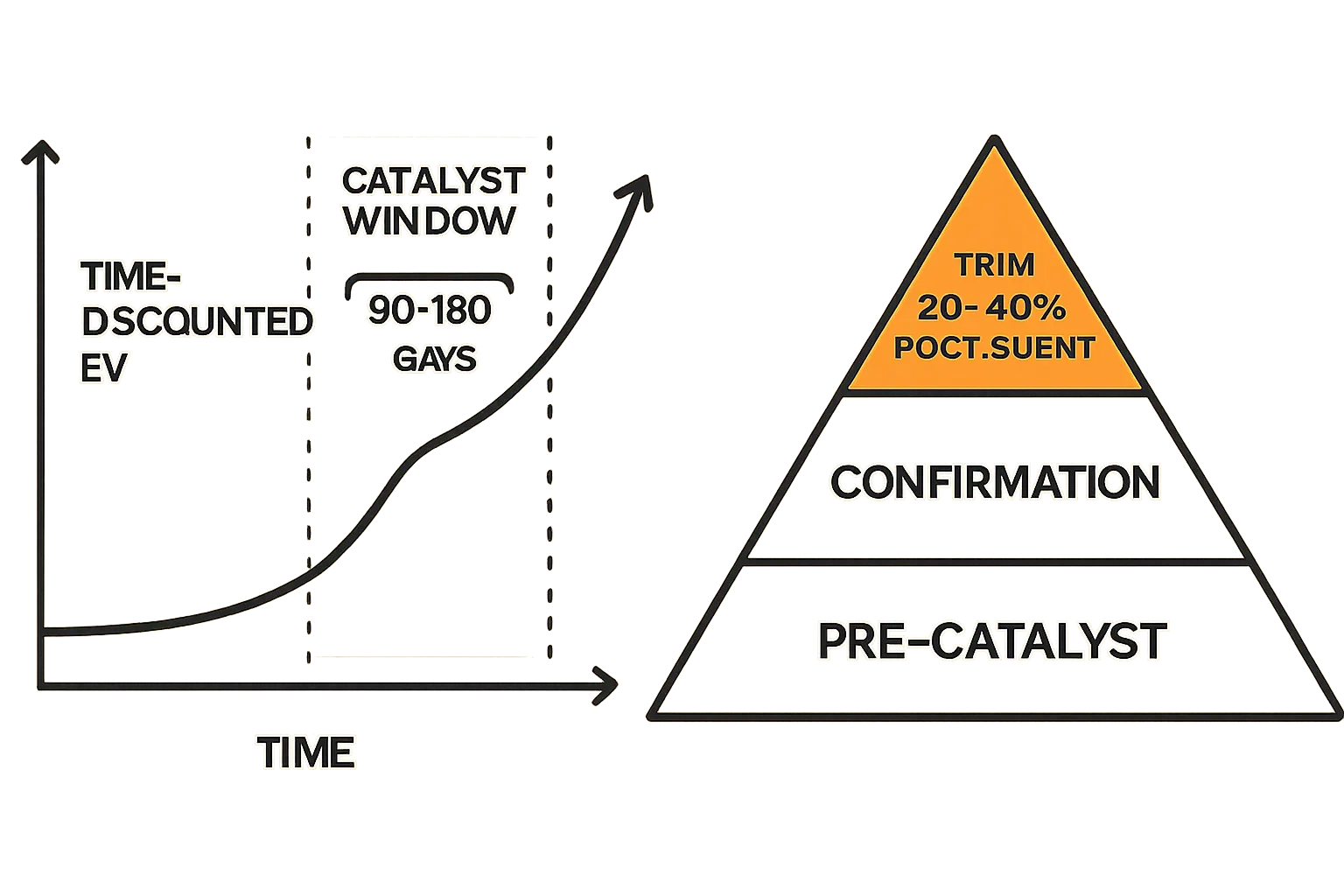

Step 4 - Link to trade plan

Pre‑catalyst entry bands: stagger buys at liquidity pockets; size up as 2 of 3 signal stacks trend up and a catalyst date is confirmed.

Post‑catalyst trim rules: take 20–40% off into first liquidity spike; let winners run if on‑chain/Dev momentum accelerates.

Invalidation: exit on threshold breaks (e.g., DAU CAGR < 0% over 30 days, catalyst delay > 60 days, dev contributors drop below 5 for two months).

Narrative Signal Scorecard (replicable template)

Factor | Metric | Source (Dune, GitHub, DefiLlama, governance forum) | Weight | Threshold | Score (0–5) |

|---|---|---|---|---|---|

On‑chain adoption | 30‑day DAU CAGR, tx/user, cohort retention | Dune | 30% | DAU CAGR > 10%; tx/user flat↑; 30‑day retention > 35% | 4 |

Developer traction | MA developers, commit velocity, external contributors | GitHub | 25% | MA devs > 8; 3+ external; weekly releases | 5 |

Token/fee capture design | Fee share to token/stakers; emissions vs. burns | DefiLlama | 15% | ≥ 30% fees to holders; net‑deflationary or neutral | 3 |

Roadmap catalysts | Mainnet/TGE/listing/unlock within 90 days, objective criteria | Governance forum | 15% | Dated ≤ 90 days; acceptance criteria defined | 4 |

Community/governance health | Voter turnout, delegate dispersion, contributor growth | Governance forum | 10% | Turnout > 15%; no single delegate > 25% | 3 |

Competitive moat | Fee share vs. peers, TVL quality, switching costs | DefiLlama | 5% | Fee share +5% QoQ; organic TVL > 60% | 3 |

How to use it on Zemyth:

StartupNest: attach the scorecard to each raise; milestone votes verify threshold progress before funds unlock.

FundNest: park pre‑catalyst capital in risk‑tiered vaults, then rotate into positions as composite scores cross 3.6/5.

ZEM: stake for fee discounts and boosts when your highest‑score opportunities approach catalysts.

Example phrasing for SEO intent

“How to build a high‑growth investment strategy for start up companies to invest in - using a quantified early‑signal scorecard.”

Pro tip: To consistently find the next big investment, require at least 2 of 3 signal stacks (On‑Chain, Developer, Social) to be trending up and a dated catalyst within 90 days before you size the bet.

Catalyst Mapping and Priority: From Roadmaps to Real Triggers

Catalysts are how narratives cash out. Map them, score them, and fund only what’s dated, verifiable, and material.

"Joel Greenblatt achieved ~50% average annual returns over a decade by focusing on event‑driven ‘special situations’ like spinoffs and restructurings." - Source

Catalog the catalyst types (Web3 and startup‑native)

Product: alpha → beta → mainnet/TGE, feature releases, integrations.

Market: CEX/DEX listings, stablecoin rails, regional expansion, enterprise pilots.

Tokenomics: emissions changes, unlocks/vesting cliffs, buybacks/burns, staking upgrades.

Governance/Legal: parameter votes, treasury deployments, regulatory clarity.

Rank by probability and impact

Use a probability‑impact matrix to sort what deserves capital and attention.

Prioritize dated, verifiable items over soft promises.

Focus capital on High‑Probability × High‑Impact events; track Medium‑Probability × High‑Impact with smaller sizing or conditional orders.

Probability–Impact Matrix

Catalyst Type | Early Signal to Track | Probability (Low/Med/High) | Impact (1–5) | Timeframe | Monitoring Source (e.g., GitHub releases, governance forum, TokenUnlocks, CEX listings feed) |

|---|---|---|---|---|---|

Mainnet/TGE launch | Testnet stability, release candidates, audits passed | High | 5 | 2–8 weeks | GitHub releases, audit reports, governance forum |

Major integration/partnership | Joint PR + sandbox users, partner commits in repo | Med | 4 | 4–12 weeks | Partner press room, GitHub, product changelog |

CEX listing | API endpoint sightings, wallet tagging, market maker activity | Med | 5 | 1–6 weeks | CEX listings feed, exchange wallets on‑chain |

Token unlock/vesting cliff | Cliff schedule, insider comms, MM borrow rates | High | 4 | Dated | TokenUnlocks, vesting docs, lending/borrow dashboards |

Emissions change/burn | Draft proposal + temp checkpoints, burn address activity | Med | 4 | 2–6 weeks | Governance forum, on‑chain burn trackers |

Staking upgrade (yield/lock) | Testnet contracts, security review, SDK updates | Med | 3 | 3–10 weeks | GitHub, audit queue, dev Discord |

Treasury deployment | RFPs, shortlists, multisig signers scheduling | Med | 3 | 2–6 weeks | Governance forum, multisig trackers (Safe) |

Parameter vote (fees, incentives) | RFC → temperature check → formal vote | High | 3 | 1–4 weeks | Governance forum, Snapshot/Realms/Tally |

Regional expansion | Local entity registration, pilot customers, GTM hires | Low | 4 | 6–16 weeks | Careers page, compliance registry, LinkedIn |

Enterprise pilot → contract | Pilot SOW, POC metrics, procurement progress | Med | 5 | 8–20 weeks | Customer PR, vendor portals, founder updates |

Build a “Catalyst Dossier” per project

Create a one‑pager so you always know what to watch - and when to size up:

What: the precise event (e.g., “Mainnet v1 with audited staking module”).

When: target date and contingency windows.

How to verify: objective on‑chain or repo artifact (tx hash, release tag, audit report).

Success metric: acceptance criteria (e.g., ≥10 validators, <0.1% slashing incidents in 7 days).

Who’s accountable: core team owner, steward, or multisig signers.

Next check‑in: calendar date + blockers.

Why this wins for the next big investment:

Dated, verifiable catalysts compress time to value - a core edge in a high growth investment strategy.

The matrix keeps you honest on sizing and attention; the dossier keeps you early and accurate.

On Zemyth, attach the dossier to StartupNest milestones so unlocks only occur when success metrics pass, and park capital in FundNest between dates to avoid idle drag.

Prioritize like a pro:

Only allocate full size to High‑Probability events with Impact ≥ 4 and verifiable artifacts.

Track Medium‑Probability, High‑Impact items with alerts and conditional entries.

De‑prioritize Low‑Probability, Low‑Impact promises - narrative fuel without price force.

Timing, Sizing, and Risk: Turn Signals Into a High‑Growth Investment Strategy

Turn early signals into decisive action: time‑discount entries, size with probabilities, and protect the downside so you can compound into the next big investment.

Time‑discounted entries

The same upside in 3 months ≫ in 3 years. Discount targets by time to catalyst and demand a wider margin for far‑dated events.

Practical rule: for catalysts > 180 days out, require 20–40% more upside vs. nearer setups (to compensate for drift, dilution, and regime risk).

Only scale when a dated, verifiable trigger is inside 90–180 days and two of three signal stacks (On‑Chain, Developer, Social) are trending up.

Scenario math, not vibes

Map bull/base/bear outcomes with explicit probabilities and compute expected value (EV).

Enter only if price ≪ EV with a catalyst inside 90–180 days and clear acceptance criteria.

Upgrade probabilities as code ships, audits pass, partners integrate, or governance advances; cut if milestones slip.

Position sizing and trims

Pyramid as probability rises and price confirms usage:

Starter: 25–40% of target size pre‑catalyst when signals inflect.

Confirmation: add 30–50% as repos tag releases, audits finalize, or testnets stabilize.

Pre‑event finalize: top up remaining size when verification artifacts appear (RC build, Snapshot queued, listing hints).

Auto‑trim 20–40% into first post‑event liquidity spike; trail remainder if on‑chain metrics accelerate 7/30/90‑day.

Never let a winner become a fund‑killer: cap single‑name exposure (e.g., 8–12% max) even in strong trends.

Risk controls for frontier assets

Avoid unlock cliffs without offsetting burns/utility or escrow sinks; fade mercenary emissions.

Diversify across uncorrelated narratives (infra, DeFi, consumer, data, gaming) to reduce path dependency.

Use objective invalidations:

DAU/tx‑per‑user trend flips negative for 4 consecutive weeks.

Dev contributors drop below threshold for 2 months.

Governance fails critical vote or catalyst delayed > 60 days.

Pre‑define stop‑outs at or just beyond invalidation; don’t renegotiate with the market.

Capital efficiency while you wait

Park idle pre‑catalyst cash in yield strategies sized to your risk band; Zemyth’s FundNest zero‑risk tier fits conservative sleeves, keeping dry powder productive.

Ladder entries around expected verification windows; avoid all‑at‑once fills in illiquid names.

How this becomes a high growth investment strategy for start up companies to invest in:

Time‑discounted EV lets you compare near‑dated vs. far‑dated opportunities on equal footing.

Probability‑based sizing concentrates capital into catalysts most likely to reprice.

Systematic trims and objective invalidations protect gains and recycle capital into the next big investment.

Case Study Playbook: Finding the Next Big Investment Theme Before the Herd

Hypothetical theme: Consumer‑grade Solana apps + RWAs (2026 window)

Signals: rising unique wallets with 7/30‑day repeat usage; dev repos for RWA oracle bridges and asset registries; governance activity clustering around stablecoin rails, fiat on‑ramps, and KYC‑lite flows.

Why it can be the next big investment: consumer‑friendly UX on Solana plus tokenized treasuries/real‑world assets (RWAs) unlocks mainstream utility and fee capture.

Apply the scorecard

On‑chain adoption: 30‑day DAU CAGR > 10%, tx/user steady↑, fee share vs. peers improving.

Developer cadence: MA devs > 8; 3+ external contributors; weekly releases; SDK downloads trending up.

Token value capture: ≥ 30% fees to token/stakers, emissions neutral/deflationary after TGE.

Roadmap catalysts: dated mainnet/TGE, CEX/DEX liquidity prep, staking upgrade vote ≤ 90 days.

Governance health: turnout > 15%, delegate dispersion improving; treasury deployments tied to growth KPIs.

Moat: organic TVL > 60%; integration depth with payment partners and oracle networks.

Build the catalyst dossier

Dated items:

Mainnet for RWA primitive with audited custody and oracle feeds (target: Q2 2026).

CEX listing rumor corroborated by market maker wallet seeding and DEX liquidity bootstraps (observed 4–6 weeks pre‑listing).

Staking model upgrade vote (shift to real‑yield split; Snapshot slated within 30 days).

Verification artifacts: release tags + audit PDFs; on‑chain pool IDs and LP depth; governance proposal URL with quorum/thresholds.

Success metrics: ≥ 10K daily active wallets within 14 days post‑mainnet; 30‑day cohort retention ≥ 35%; ≥ 25% protocol fees routed to stakers at launch.

Trade plan (example)

Entry: begin 60–90 days pre‑mainnet when 2/3 signal stacks (On‑Chain, Developer, Social/Gov) inflect; start at 30–40% of target size.

Size‑up: add 30–50% on testnet→mainnet confirmation (RC tag + audits passed) and evidence of CEX/DEX liquidity prep.

Post‑event: trim 30% into first listing/liquidity spike; restake core if on‑chain usage accelerates (7/30/90‑day).

Recycling: rotate trimmed capital into the next catalyst in the dossier (e.g., staking upgrade) or park in FundNest until the next dated trigger.

What would invalidate

User retention fails: 30‑day cohort retention < 25% for 4 consecutive weeks; DAU trend turns negative.

Governance delays unlocks or fee routing with no offsetting burn/utility; proposal fails quorum.

Dev contributors shrink for 8+ weeks; release cadence stalls; critical audits delayed beyond 60 days.

Liquidity prep absent: no MM wallets provisioning, shallow DEX depth, or pulled listings.

Why this beats reactive strategies

You fund proof, not promises: capital follows shipped code, verified data, and dated votes.

Catalysts bound time: a 90‑day window compresses the path to repricing - a core edge in any high growth investment strategy.

Discipline prevents bag‑holding hype: scorecard gates entries, dossiers remove guesswork, trims systematize profit‑taking on the way to the next big investment.

Turn this playbook into action on Zemyth:

Source and back start up companies to invest in via StartupNest’s milestone‑gated rounds, track catalyst dossiers on‑chain, and keep idle cash productive in FundNest while you wait. Boost outcomes with ZEM when conviction is highest.

Start building your edge today at https://zemyth.app

Your Research Stack and Workflow Automation (Build a Catalyst Calendar)

The edge isn’t just finding signals - it’s systematizing them. Build a catalyst calendar so you’re always positioned before unlocks, mainnets, listings, and votes move price and liquidity.

Tools by job‑to‑be‑done

On‑chain: Dune, Flipside, DeFiLlama (custom dashboards for DAU/retention/fees).

Dev: GitHub (MA devs, commits, PRs), package managers (npm/pip/rust crates downloads).

Tokenomics/catalysts: TokenUnlocks, GeckoTerminal, governance forums, Snapshot/Tally, exchange listing feeds.

Social: X/TG/Farcaster for contributor growth; forum analytics for unique participants and proposal commenters.

Automation

Set weekly scrapers/alerts for each signal; route to a Notion/Sheets tracker with tags (Narrative, Stage, Next Catalyst).

Maintain a rolling 90‑day catalyst calendar with check‑ins 14/7/1 days before each event; confirm verification artifacts (release tag, tx hash, proposal URL) at T‑1.

Auto‑flag slippages > 14 days and route to review: reduce position or move to watchlist until dates are reconfirmed.

Integrate with Zemyth

Use StartupNest milestones as your catalyst backbone (objective, on‑chain verified); attach acceptance criteria and verification links to each milestone.

Park idle pre‑event capital in FundNest’s zero‑risk pool to keep dry powder productive; ladder entries as catalysts approach.

Stake ZEM for fee discounts and yield boosts when conviction is highest and you’re sizing into dated, verifiable catalysts.

SOP for each new idea

30‑minute pre‑screen → add to watchlist → build dossier → scorecard → schedule catalysts → decide go/no‑go.

If go: set entry bands, size targets, trim rules, and invalidations. If no‑go: archive with reason codes for learning loops.

Review the calendar every Monday; re‑rank by time‑discounted EV and probability. Recycle capital into the next big investment before the herd.

Red Flags and Narrative Traps to Avoid

Vanity over validity

Paid followers, airdrop farmers, wash‑traded volumes; insist on retention and unique payers.

Check: 7/30/90‑day cohort retention, unique fee‑paying wallets, tx/user stability. If DAU up but payers flat or down, it’s noise - not the next big investment.

Verify source quality: distinguish organic TVL from incentive‑driven flight capital; tag deposit origins to catch mercenary loops.

Tokenomics cliffs

Large unlocks without offsetting burns/utility; emissions untied to revenue.

Check: unlock schedule vs. circulating float, emissions-to-revenue ratio, fee capture routed to holders (or real burn). If unlocks > 20% of float with no sink, size small or pass.

Watch incentives: staking “APY” that’s just dilution, not cash flow. High growth investment strategy ≠ high emissions.

Dev theater

Bursty commits before raises; look for sustained external contributors and merged PRs.

Check: MA developers trend, external contributor share, PR review/merge times, release cadence. One repo hero + pre‑raise commit spikes = risk.

Bus‑factor test: does progress continue if the top 1–2 contributors go dark?

Governance capture

Delegate cartels, low quorum, rushed proposals; discount narratives without broad, credible participation.

Check: voter turnout trend, delegate concentration (>25% in one cohort = red flag), proposal windows (<72h vote windows = rushed), on‑chain execution transparency (multisig signer distribution).

Treasury safety: opaque deployments, missing reporting, or ad‑hoc spending = avoid.

Over‑indexing on rumor catalysts

Listings, partnerships, or buyouts without verifiable signals - size small or pass.

Verify: exchange wallet provisioning, market maker inventory, partner code commits/integration IDs, governance RFC→vote sequencing, on‑chain usage uptick within 14–30 days of any “announcement.”

Rule of thumb: no date, no artifact, no size. Catalysts need timestamps and proof.

Additional traps to side‑step

KPI laundering: cherry‑picked metrics (e.g., “transactions” inflated by micro‑tx spam). Normalize by tx/value and unique payers.

Oracle/infra single‑points‑of‑failure: centralization masked as “efficiency.” Demand credible redundancy.

Legal/reg blind spots: assets marketed as yield with no disclosures or custody clarity - treat as a hard pass for start up companies to invest in.

How to stay clean and early:

Require two of three signal stacks (On‑Chain, Developer, Social/Governance) trending up before sizing.

Tie capital to dated, verifiable catalysts; if timelines slip > 60 days or thresholds break (retention, contributors, quorum), de‑risk.

Use milestone‑gated funding and on‑chain verification to avoid narrative drift - fund proof, not promises.

Conclusion - Put This Framework to Work with Zemyth

TLDR

You now have a quantified, repeatable method to spot the next big investment before the herd - score signals, map catalysts, and execute a high‑growth investment strategy with clear entries, trims, and invalidations.

Operationalize it on Zemyth: milestone‑gated raises (StartupNest), yield while you wait (FundNest), and outcome boosts via ZEM.

What you now have

A quantified way to spot narratives early, rank catalysts by probability and impact, and turn them into disciplined entries/exits.

A working scorecard, probability‑impact matrix, and time‑discounting rules to compare near‑dated vs. far‑dated opportunities on equal footing.

A catalyst dossier template that turns “roadmaps” into verifiable, dated triggers - so you fund proof, not promises.

Make it actionable today

Build your scorecard and 90‑day catalyst calendar; require 2 of 3 signal stacks (On‑Chain, Developer, Social/Governance) to trend up before sizing.

Focus on start up companies to invest in with dated milestones, objective acceptance criteria, and clear value accrual (fees to holders, burns, or real yield).

Set entry bands 60–90 days pre‑catalyst, size up on verification artifacts (release tags, audits, governance votes), trim 20–40% into first liquidity spikes, and recycle into the next dated event.

Why Zemyth

StartupNest aligns capital to execution with milestone‑gated tranches - your catalysts, on‑chain and investor‑verified.

FundNest turns waiting time into yield with risk‑tiered vaults (zero‑risk tier for conservative sleeves), improving capital efficiency between events.

ZEM boosts and burns tie rewards to real usage: fee discounts, staking boosts, and deflationary pressure as activity scales - amplifying your edge on the next big investment.

CTA

The next big investment is built before it’s obvious. Start your high‑growth investment strategy on Zemyth now: https://zemyth.app