TL;DR: your daily investment routine in 60 seconds

"In 2023, plans with automatic enrollment had a 94% participation rate vs 67% for voluntary enrollment." - Source

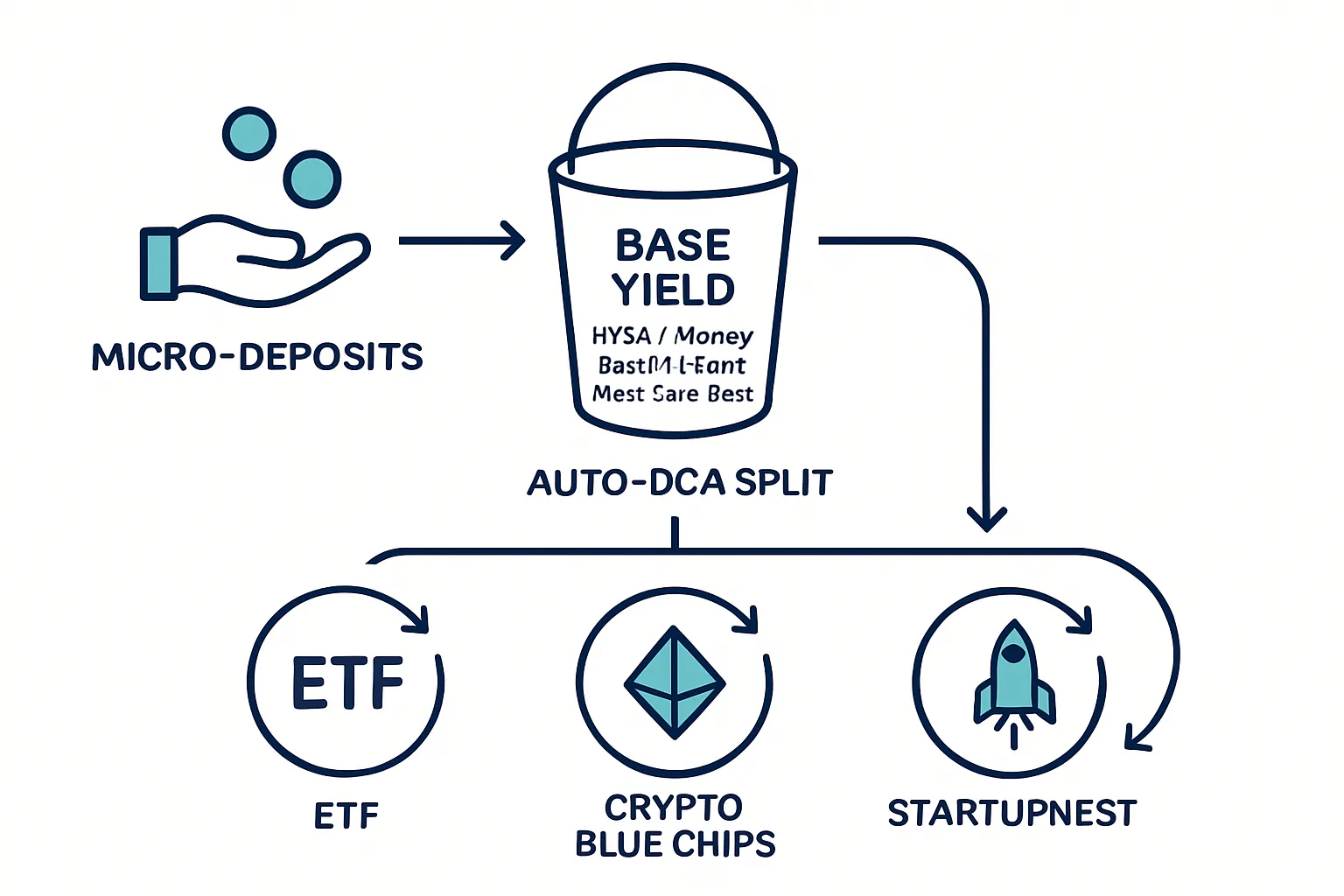

Micro-deposit $5–$20/day → automate into a base yield bucket for daily accruals (HYSA/money market/FundNest Zero Risk).

Run auto-DCA to growth (broad ETFs/crypto blue chips) on a daily or every-2–3-day cadence.

5-minute daily check: contributions succeeded, no alerts triggered, skim wins to cash buffer.

30-minute weekly review: rebalance tiny drifts, queue next week’s deposits.

Monthly audit: raise contribution 1–2%, tighten risk guardrails, and review performance.

What “invest daily” is (and isn’t)

It’s not day-trading; it’s small, automated, repeatable deposits plus periodic reviews.

Daily accruals come from interest/yield buckets; growth engines compound over time.

Want a DeFi-native way to earn daily? See FundNest’s Zero Risk pool on Zemyth.

Why this works

Automation reduces timing mistakes and inconsistency.

Routine turns compounding into a behavior, not a bet.

Ready to put your daily investment routine on autopilot? Start with Zemyth at https://zemyth.app.

Step 1 - Build the automation layer

"Time in the market beats timing the market." - Source

Short walkthrough: linking a bank, scheduling daily transfers, enabling ETF/crypto DCA, and previewing a Zemyth FundNest Zero Risk deposit.

Map cash flow and pick your base yield bucket

Your base layer is the “always-on” bucket that accrues daily investment and returns with low friction. Map your income and bills first (payday in, essentials out), then route your surplus into one base yield bucket.

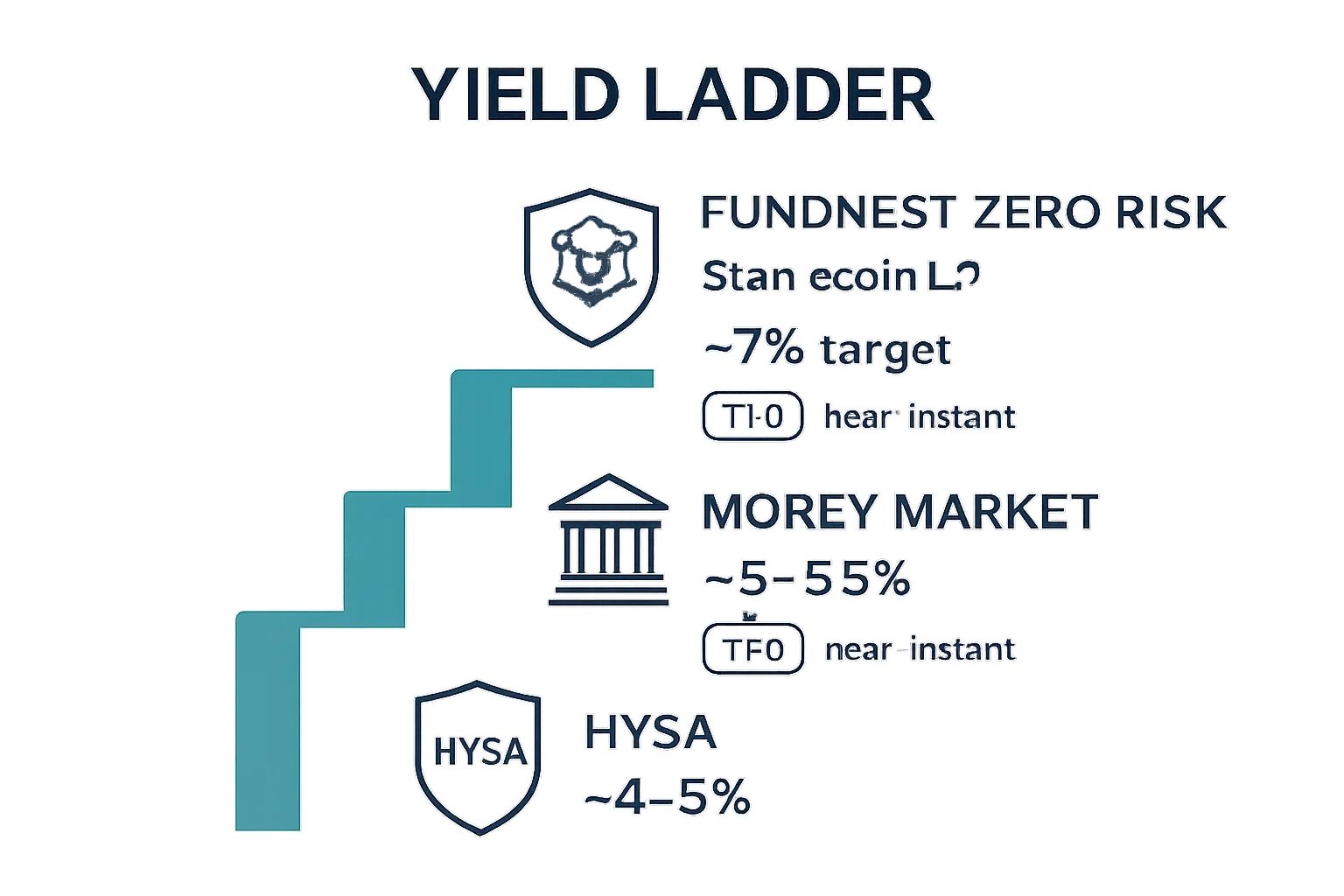

Choose one: HYSA, money market fund, or Zemyth FundNest Zero Risk (stablecoin LP yield, 7% target APY per docs).

Goal: keep this as your dependable “earn daily” engine while you DCA separately into growth.

Tips:

Set a fixed transfer the day after payday so cash is available for bills.

Keep base yield liquid enough to move when goals or markets change.

Turn on micro‑deposits & auto‑DCA

Daily consistency beats occasional intensity. Automate small, frequent contributions to create a true “invest and earn daily” cadence.

Daily/alternate‑day transfers ($5–$20) into the base bucket.

Auto‑DCA rules for ETFs/crypto blue chips (small, frequent buys).

Example: $10/day to base yield + $10 every 2–3 days to a broad market ETF or crypto blue chip.

Why it works:

Smooths timing risk and reduces decision fatigue.

Builds an investment day routine you’ll actually keep.

Connect your tools

Make money flow with minimal taps by connecting accounts once, then letting rules run.

Bank → brokerage → wallet.

Zemyth setup: connect Solana wallet, select FundNest tier, preview yields and fees.

Set alerts for failed transfers or low balances to keep the automation tight.

Workflow idea:

Bank paycheck → auto-transfer to HYSA or FundNest Zero Risk → scheduled DCA orders at brokerage/crypto exchange → weekly check-in to confirm everything executed.

Risk primer before you go

Stay conservative on the foundation so you can take measured risk in growth.

Keep an emergency buffer. Separate “yield base” from “growth DCA.”

Stablecoins carry different risks than insured deposits; understand tradeoffs.

Revisit contribution levels monthly; small 1–2% bumps compound a lot over a year.

Ready to automate your base and start the daily invest-and-earn flywheel? Set it up in minutes at https://zemyth.app.

Step 2 - The daily/weekly/monthly investing routine

Daily (5–20 minutes)

Confirm micro‑deposit hit and auto‑DCA executed.

Quick P&L glance (no reactions). Check alerts for drawdown or position limits.

Skim small wins to your base bucket (optional 1–2% profit‑skim rule).

Weekly (30–45 minutes)

Rebalance tiny drifts (±2–5% bands). Refresh watchlists. Queue next week’s orders.

Review fees/yields: ensure net APY/returns align with plan.

Monthly (45–60 minutes)

Raise contribution rate 1–2% if budget allows.

Audit allocations, retest risk guardrails, and update goals.

Pro tip

Batch decisions on a set “investment day” to reduce noise and bias.

Your routine at a glance

Frequency | Tasks | Tooling (Bank/Broker/Zemyth/Wallet) | Time Budget | Success Criteria |

|---|---|---|---|---|

Daily | Verify micro‑deposit and auto‑DCA; P&L glance; check alerts; optional 1–2% profit skim to base bucket | Bank (transfers), Broker (ETF DCA), Zemyth FundNest Zero Risk (base yield), Wallet (Solana) | 5–20 min | Deposits and DCA executed; no failed alerts; drawdown/position limits respected; skim applied when eligible |

Weekly | Rebalance within ±2–5% bands; refresh watchlists; queue next week’s orders; validate net APY/fees | Broker (rebalance, orders), Zemyth (yield/fees check), Bank (autotransfer review), Wallet (positions) | 30–45 min | Allocations back in band; orders scheduled; fees/yields on target; all alerts resolved |

Monthly | Increase contribution 1–2% (budget‑permitting); audit allocations; retest guardrails; update goals | Bank (budget + transfers), Broker (policy/IPS checks), Zemyth (tier/yield review), Wallet (security + limits) | 45–60 min | Contribution rate raised if feasible; portfolio within policy; guardrails current; goals synced to plan |

Lock in your daily investment and returns with a simple cadence - and let Zemyth’s FundNest Zero Risk do the daily accrual heavy lifting. Start now at https://zemyth.app.

Step 3 - Build your daily earnings layer

What counts as “earn daily”

HYSA and money market funds: interest accrues daily, credited monthly.

On‑chain stable LPs (e.g., Zemyth FundNest Zero Risk): fees accrue block‑by‑block; visible daily.

How to choose your base bucket

Safety first: insured cash vs stablecoin risk; maintenance effort; liquidity.

Net APY after fees and boosts (veZEM boosts in FundNest).

Operational friction: deposit/withdraw speed, minimums, and tax treatment.

Allocation idea

3–12 months expenses in safer buckets; anything beyond fuels growth DCA.

Examples:

Conservative: 12 months in HYSA/MMF; surplus into FundNest Zero Risk.

Balanced: 6 months in HYSA/MMF; 3–6 months in FundNest Zero Risk; rest to growth DCA.

Aggressive: 3 months in HYSA/MMF; larger share in FundNest Zero Risk to maximize daily accruals.

Lock in dependable daily accruals, then let DCA handle long‑term compounding. Spin up your base bucket at https://zemyth.app.

Step 4 - Growth that compounds: auto‑DCA

"Lump sum historically wins more often, but DCA reduces timing risk and behavioral errors." - Source

Core growth streams

Broad ETFs (low‑cost, diversified).

Crypto blue chips (e.g., BTC/SOL) with small daily/weekly DCA.

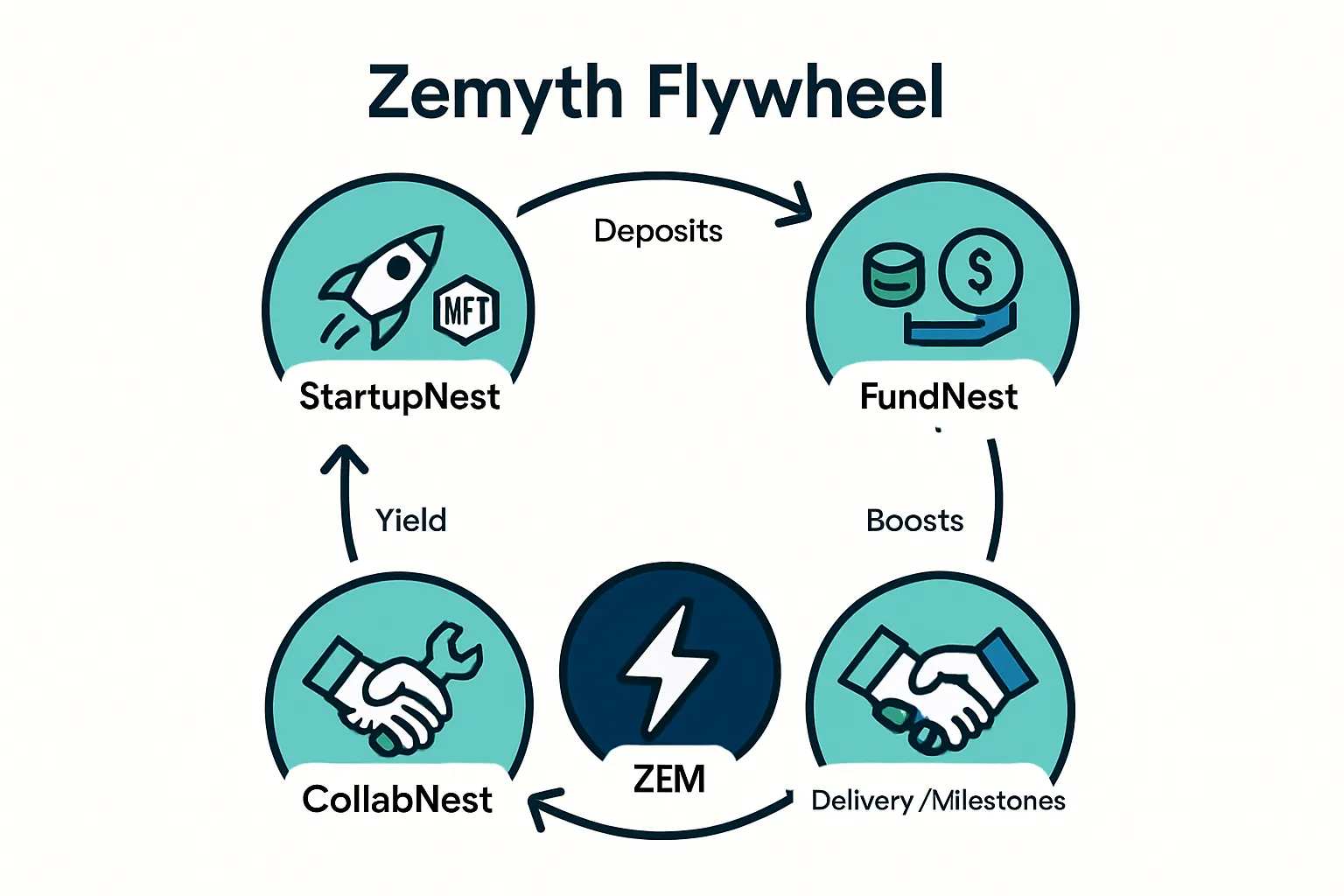

Venture exposure (Zemyth StartupNest tiers) with tiny, milestone‑gated positions.

Execution rules

Fixed‑amount or %‑of‑income DCA. Calendar‑based or threshold‑aware buys.

Rebalancing bands and “pause on extreme events” toggle.

Keep ticket sizes small and frequent; automate, then review weekly.

Why it works

Reduces regret and timing risk; keeps you invested through volatility.

Converts conviction into a repeatable process instead of one‑off bets.

Lets your base yield bucket do the daily accrual while growth legs compound over time.

Dial in your DCA once, then let it work. When you’re ready to add milestone‑gated venture exposure, explore StartupNest tiers at https://zemyth.app.

Step 5 - Micro‑deposits: consistency over intensity

Turn small, automatic contributions into a daily investment engine. Your goal: frictionless cashflow that funds “earn daily” buckets and steady growth without manual effort.

Set your skims and round‑ups

Round‑ups to nearest $1/$5 on every card purchase.

1% paycheck skim that moves on payday (before you see it).

End‑of‑day leftover sweep: clear checking down to a target floor; sweep the excess.

Why it works: you barely feel the cash leaving, but it compounds. This is the simplest way to invest and earn daily without changing your lifestyle.

Routing rules

60–80% to base yield (HYSA/money market/FundNest Zero Risk) for daily accruals.

20–40% to growth DCA (broad ETFs, crypto blue chips, StartupNest venture tiers).

Adjust by risk tolerance, liquidity needs, and your current emergency buffer.

Pro move: increase each route by 1–2% every month to accelerate compounding without stressing your budget.

Friction hacks

Separate “spend” vs “invest” accounts so daily investment and returns don’t leak into expenses.

Automate calendar holds for your “investment day” (weekly review + order queue).

Use alerts for failed transfers, low balances, and position limits to avoid manual checking.

With Zemyth

Convert skims to USDC/USDT and deposit into a FundNest vault for stable, daily accruals.

Keep a small portion routed to auto‑DCA growth.

Optionally allocate tiny, milestone‑gated lots into StartupNest deals when milestones open - so capital only advances as founders deliver.

Ready to put cashflow on autopilot and make daily invest-and-earn a habit? Start now at https://zemyth.app.

Step 6 - Guardrails for daily investing

"Over the 10 years ending 2023, the average investor earned 6.3% vs 7.3% for the average fund - a 1.1% annual behavior gap from poor timing." - Source

Allocation & sizing

Max position size (e.g., 5% per single equity/crypto; 1–2% for venture lots).

Core vs satellite buckets with target ranges.

Drawdown & profit rules

Portfolio drawdown stop (e.g., −10% pause on new buys; review).

Profit skim (e.g., skim 10–20% of gains over new highs back to base yield).

Liquidity rules

Keep 3–12 months expenses liquid; avoid lockups unless compensated.

Documentation

One‑page IPS (investment policy statement) taped to your monitor.

Fast guardrails setup

Guardrail | Rule | Parameter | Tool |

|---|---|---|---|

Max position size | Cap exposure per single equity/crypto | ≤5% of portfolio; venture lots 1–2% | Broker position limits; Wallet position view |

Rebalance band | Nudge allocations back to targets | ±2–5% bands by asset class | Broker rebalance; Zemyth allocation view |

Portfolio drawdown pause | Stop new buys and review plan after loss | Pause at −10% portfolio drawdown | Alerts on broker/Zemyth; spreadsheet tracker |

Profit skim | Move a slice of fresh gains to base yield | Skim 10–20% over new equity highs | Bank transfer rule; FundNest deposit |

Liquidity buffer | Maintain cash for expenses/emergencies | 3–12 months expenses liquid | HYSA/MMF/FundNest Zero Risk |

Venture lot cap | Limit speculative tickets | 1–2% per StartupNest deal | Zemyth StartupNest lot sizing |

Alert thresholds | Proactive notifications to prevent drift | Price moves ±7–10%; failed transfers; low balances | Broker alerts; Bank alerts; Wallet notifications |

Make these rules boring and automatic. Guardrails keep your daily investment and returns compounding - even when markets test your patience. Lock your IPS, automate skims and alerts, and let Zemyth’s base yield and milestone‑gated venture exposure keep you in the game: https://zemyth.app.

Step 7 - Track the signals that matter

Turn your routine into measurable momentum. Keep it simple, visual, and rules‑driven so your daily investment and returns keep compounding without guesswork.

Daily

Deposits executed: micro‑deposit and auto‑DCA fired (no failures).

Cash buffer level: above your floor (e.g., 3–6 months of expenses).

Alerts/triggers: drawdown alerts, failed transfer notices, position limit flags - resolve same day.

What good looks like:

100% success on transfers.

Buffer never breached.

No “reaction trades” - only rule‑based actions.

Weekly

Allocation vs targets: within ±2–5% bands for each bucket (base yield, ETFs, crypto, venture).

Realized fees/yield: check net APY in base bucket and trading/withdrawal fees didn’t spike.

Rebalancing needs: queue top‑ups or trims for next week’s “investment day.”

What good looks like:

Allocations back in band.

Net yield on plan (e.g., FundNest Zero Risk near target).

Next week’s orders ready to go.

Monthly/Quarterly

Contribution growth %: lift micro‑deposit rules +1–2% if budget allows.

Net returns vs benchmark: compare to a blended benchmark that matches your mix (e.g., 60/30/10 or your chosen ETF/crypto weights).

Tax‑aware moves: loss/gain harvest calendar, holding period checks, and ex‑div dates; avoid short‑term tax stings.

What good looks like:

Contributions trending up.

Tracking closely to your benchmark with lower volatility than ad‑hoc buys.

Harvested losses booked without breaking your target allocation.

Zemyth boosts

veZEM and staking boosts: confirm your lock level and boost multipliers are active.

FundNest: verify current APY, fees, and vault utilization; redeploy idle cash if above buffer.

StartupNest: review milestone updates; keep venture lots within cap and only add when milestones pass.

Ready to turn tracking into compounding? Centralize your daily yield and milestone‑gated growth at https://zemyth.app.

Step 8 - 30 days to a working daily investment routine

Week 1 - Setup

Open/confirm accounts; connect Solana wallet; seed base bucket; write IPS; set alerts.

Decide your base yield bucket (HYSA/MMF or FundNest Zero Risk) and map cash flow.

Week 2 - Automate

Turn on micro‑deposits and auto‑DCA; fund FundNest Zero Risk; test tiny StartupNest lot.

Create your weekly “investment day” slot and queue next week’s orders.

Week 3 - Optimize

Add veZEM/ZEM staking for boosts; adjust allocation split; rehearse the weekly review.

Tighten guardrails: rebalance bands, profit‑skim %, and drawdown pause.

Week 4 - Scale

Increase contribution 1–2%; expand watchlist; document lessons learned.

Revisit goals; confirm liquidity buffer and tax‑aware actions.

Expected outcomes

Daily accruals in base yield; consistent DCA; lower stress; measurable progress.

A clean dashboard routine you can run in 20 minutes a day, plus weekly/monthly drills.

Ready to put this plan into motion? Spin up the flywheel at https://zemyth.app.

Step 9 - FAQs: daily investment and returns

Can I really earn daily?

Yes. Daily investment returns typically come from “yield buckets” (HYSAs, money market funds, or on‑chain stablecoin LPs like FundNest Zero Risk) that accrue interest or fees daily and credit monthly. Your growth legs (ETFs, crypto blue chips, StartupNest venture lots) compound over weeks and months - stick to the routine.

How small can I start?

Even $5/day works if you automate micro‑deposits and auto‑DCA. Scale contributions 1–2% per month as income allows to steadily increase your daily invest‑and‑earn cadence.

What about risk?

Use guardrails: cap position sizes, keep a 3–12‑month liquidity buffer, and set a portfolio drawdown pause (e.g., −10%). Separate your safe yield base from higher‑volatility DCA so emergency cash is never at risk.

Where does Zemyth fit?

FundNest for daily yield accrual on stablecoins (your dependable “earn daily” base).

StartupNest for milestone‑gated venture exposure (tiny, risk‑capped lots that unlock only as founders deliver).

ZEM/veZEM for fee savings, staking yield, and FundNest boosts to lift net APY.

Want a turnkey way to invest and earn daily with on‑chain transparency? Start with Zemyth: https://zemyth.app.

Conclusion - Make daily investing your unfair advantage

The mindset

Small deposits, strict guardrails, relentless consistency.

Treat “invest and earn daily” as a habit, not a hunch. Your edge is discipline.

The toolkit

Base yield to earn daily (HYSA/money market/FundNest Zero Risk).

Auto‑DCA for growth (broad ETFs, crypto blue chips, StartupNest venture lots).

Scheduled reviews: 5–20 minutes daily, 30–45 minutes weekly, monthly tune‑ups.

Take action now

Create your routine today. Connect your wallet and start with a small deposit.

TL;DR recap: automate deposits, DCA to growth, review weekly, raise monthly.

Make daily investment and returns a repeatable system - let Zemyth do the heavy lifting.

CTA

Start now with Zemyth: https://zemyth.app