TLDR + Why a Barbell Now (Stable Fund + High‑Growth Asymmetry)

TLDR

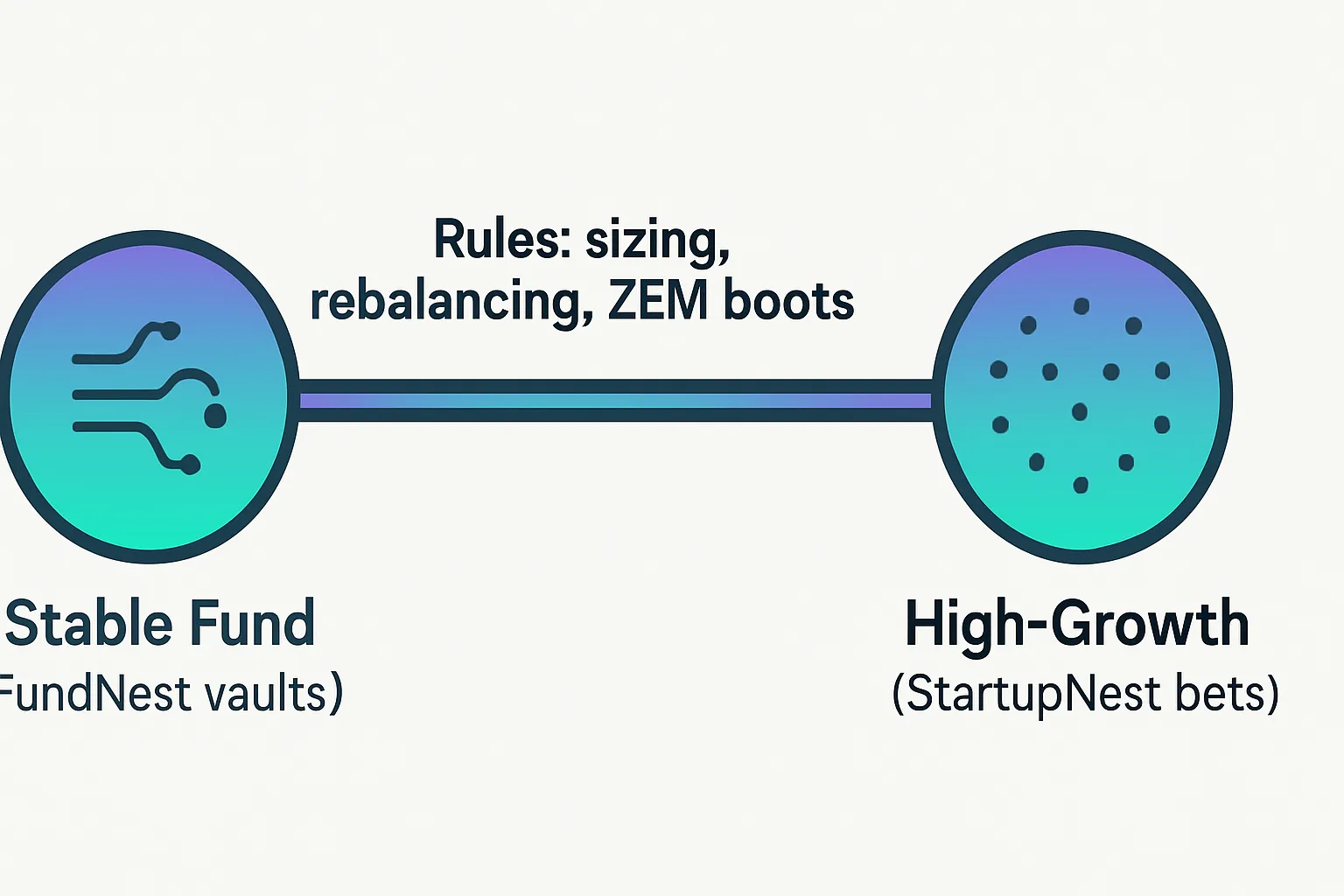

Pair a stable fund core (yield, liquidity, low volatility) with selectively sized high‑growth investments (asymmetric upside).

Core: park 60–85% in a stable fund strategy (e.g., FundNest Zero Risk vaults on Solana) for dependable yield and dry powder.

Growth sleeve: allocate 15–40% across 5–15 high‑growth bets (0.5–2% each) via milestone‑gated StartupNest deals.

Rules-based rebalancing: top‑slice winners back to the stable core and cut losers quickly; keep a minimum “core floor” (e.g., 60%).

Boosters: stake ZEM for yield boosts, fee discounts, and deal access priority.

What this article covers

The barbell framework adapted to crypto/DeFi

How to implement a stable fund + high‑growth strategy on Zemyth

Model allocations, sizing rules, and rebalancing triggers

Risk guardrails and a 12‑month sample playbook

Why a barbell works in volatile markets

Focuses on extremes: dependable stability + convex upside

Maintains liquidity to buy dips while holding upside exposure

Works well when dispersion across assets is high

"In 'Do Stocks Outperform Treasury Bills?' (2018), Bessembinder finds that the top-performing ~4% of U.S. stocks since 1926 generated the entire net stock market wealth creation; the rest collectively matched one‑month T‑bills." - Source

This concentration justifies a barbell that uses a stable fund core for capital protection and many small, high‑growth investments to capture the few outliers that drive most wealth.

Key outcomes vs competitors

Concrete on‑chain tooling (FundNest stable fund vaults + StartupNest milestone‑gated high‑growth deals)

Clear sizing/rebalancing math to operationalize your growth investment strategy

Yield boosts, fee discounts, and priority deal access via ZEM integrations

Ready to put this fund strategy to work? Start your barbell on Zemyth: https://zemyth.app

The Barbell Blueprint on Zemyth (Stable Fund Core + High‑Growth Sleeve)

Suggested cue (10–20s): 00:40–00:55 - Definition of the barbell: pairing very safe “stable investments” with highly speculative, high‑growth investments.

"Indeed I want to have it both ways: guaranteed floor and maximal upside - the barbell strategies I propose; the right mixture of greed and paranoia." - Source

Core (Stable Fund)

Objective: preserve principal, generate steady yield, stay liquid

Tooling: FundNest risk‑tiered vaults (focus on Zero Risk as core)

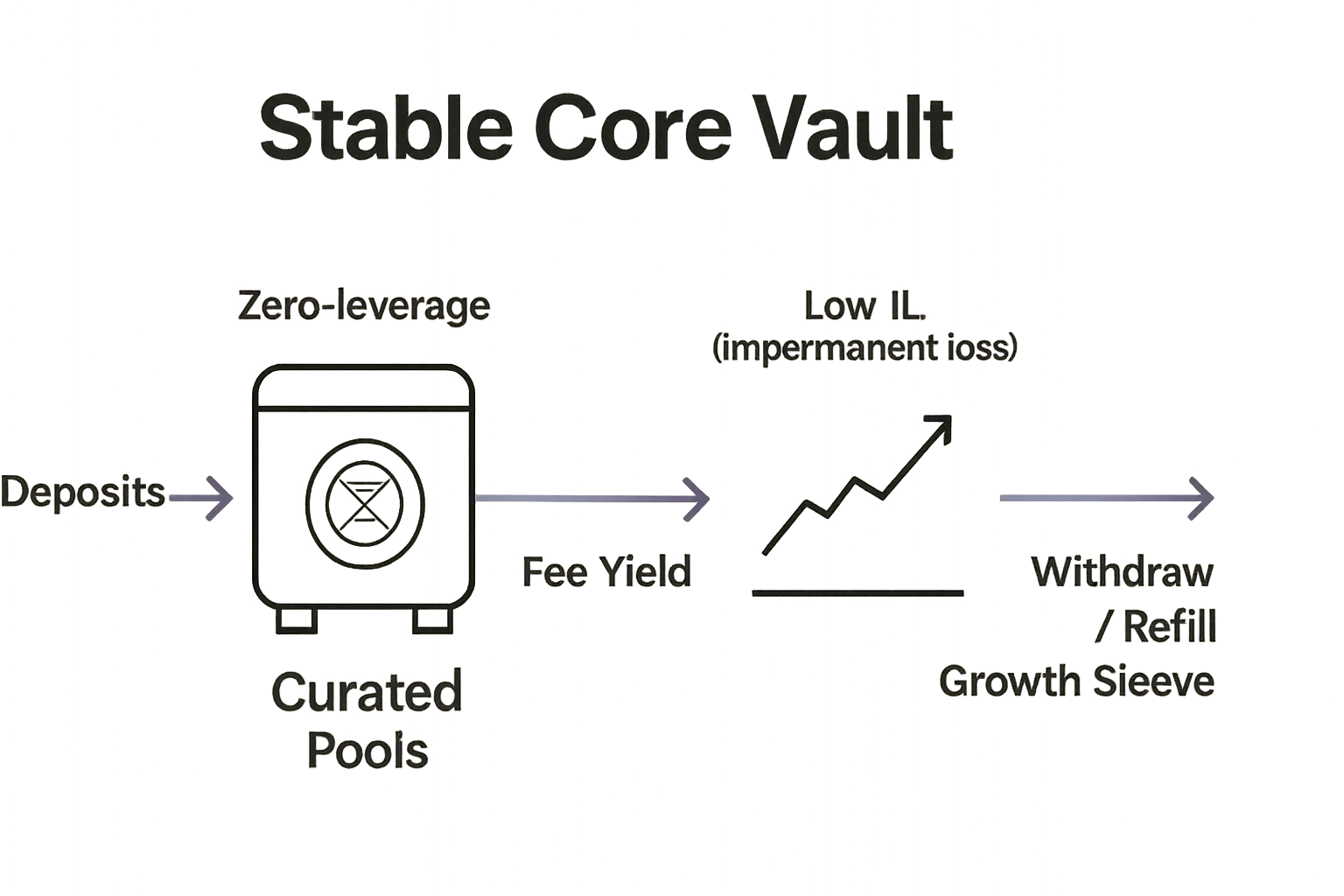

Build your base with a stable fund allocation that targets dependable yield and low volatility while keeping liquidity high. On Zemyth, FundNest Zero Risk vaults on Solana deploy into curated stablecoin pools to deliver a predictable yield stream without leverage - ideal for a “core floor” in your fund strategy. This stable fund core is where 60–85% of capital typically lives, earning yield and staying liquid so you can buy dips and rebalance into opportunity.

Why it matters:

Stability first: anchor returns with a low‑volatility, rules‑based yield engine.

Liquidity on tap: fast withdrawals keep dry powder ready for high‑growth investment entries.

Fee efficiency: ZEM staking can boost yields and reduce platform fees.

Growth sleeve (Asymmetric Upside)

Objective: capture convex outcomes with small, controlled positions

Tooling: StartupNest milestone‑gated venture deals (escrow + voting)

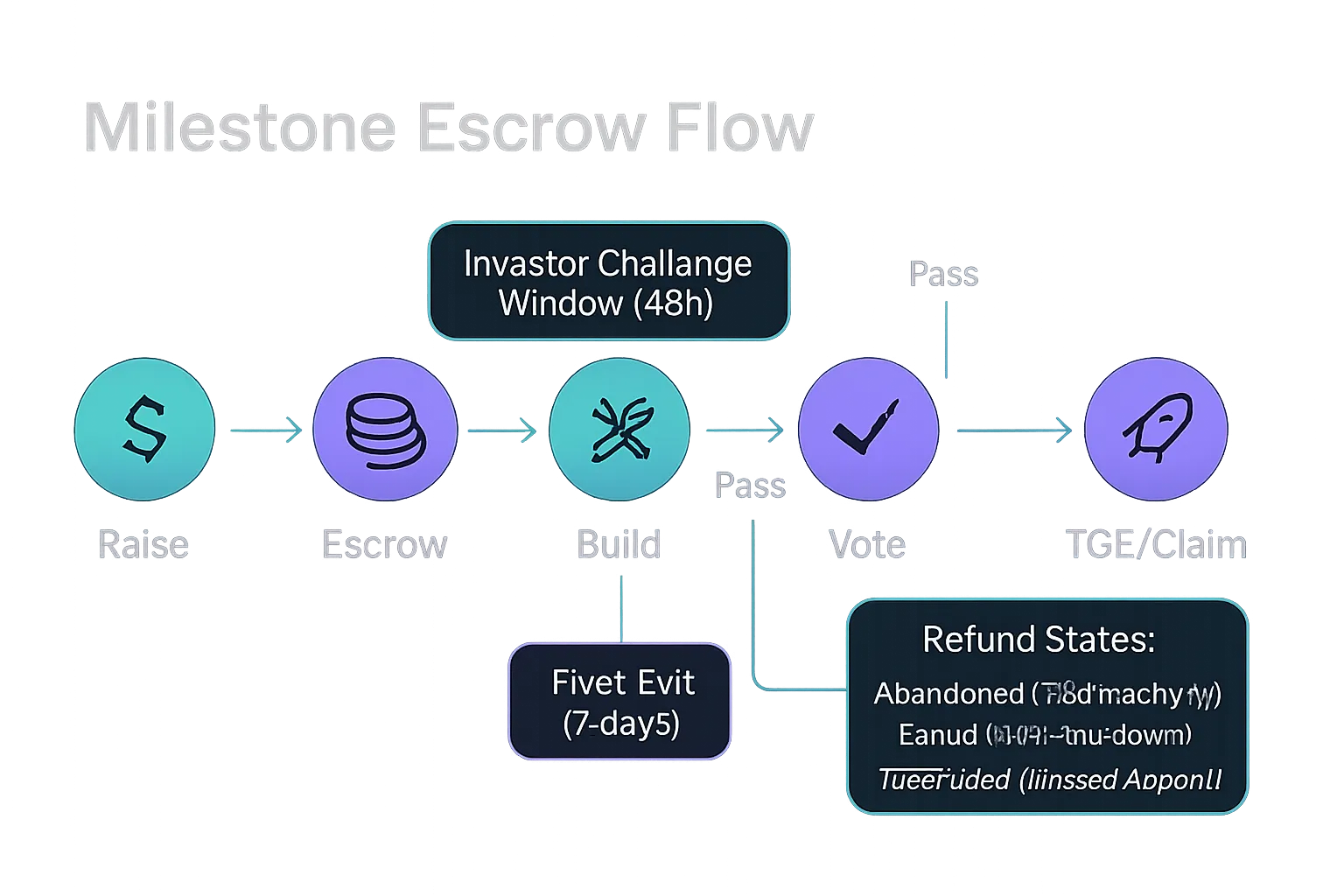

Your growth investment strategy should be convex by design: size positions small (typically 0.5–2% each) across 5–15 high‑growth bets. StartupNest protects downside with on‑chain escrow, milestone gates, and investor voting - so funds only unlock when real progress is delivered. Investment NFTs encode voting rights, claims at TGE, and optionality to exit in defined windows, allowing you to compound winners and cut losers with discipline.

Why it matters:

Many shots on goal: diversify across high‑growth sectors and stages without diluting risk controls.

On‑chain accountability: milestone votes, unlock gates, and challenge windows reduce tail‑risk.

Asymmetry: small sizing caps downside; rare outliers can dominate upside.

Platform synergy (Flywheel)

Idle escrow earns yield via FundNest

Vote‑to‑earn + ZEM staking creates engagement and boosts

On‑chain accountability: milestone votes, unlock gates, TGE distribution

The Zemyth flywheel compounds outcomes:

While founders build, StartupNest escrow can be parked in FundNest Zero Risk vaults to earn yield - improving total return for both builders and backers.

Vote‑to‑earn rewards keep investors engaged in milestone reviews; ZEM staking boosts FundNest yields and unlocks fee discounts and priority access to deals.

TGE claims flow through Investment NFTs, aligning contributors, founders, and investors under verifiable, on‑chain rules.

Who this fits

Angels/DAOs seeking a disciplined, rules‑based growth investment strategy with real on‑chain guardrails

Yield‑oriented investors needing a dependable base of stable investments with optional high growth sleeves

Founders/contributors who want transparent, milestone‑gated funding and liquid on‑chain markets

Put your blueprint to work now: https://zemyth.app

Step‑by‑Step: Build Your Barbell Portfolio (Model Allocations & Rules)

1) Define risk profile and core floor

Conservative: 80–85% stable fund core; 15–20% growth

Balanced: 65–75% stable core; 25–35% growth

Aggressive: 55–60% stable core; 40–45% growth

2) Choose your stable fund mix

Start with FundNest Zero Risk; optionally layer Low/Medium risk tiers for incremental yield

3) Size high‑growth bets

5–15 positions, 0.5–2.0% each

Milestone‑gated StartupNest projects with escrow and investor voting

4) Rebalancing bands

Top‑slice growth at +50–100% gains back to core

Refill core if it falls below your floor

5) Liquidity and ops cadence

Weekly: check milestones, vote windows, and deposits

Monthly/Quarterly: rebalance review and fee optimization (ZEM discounts)

Model allocations by risk profile

Profile | FundNest Zero Risk | FundNest Low Risk | FundNest Medium Risk | High‑Growth Sleeve (StartupNest) | Suggested # Growth Positions | Position Size Band (each) |

|---|---|---|---|---|---|---|

Conservative | 70% | 10% | 0–5% | 15–20% | 6–10 | 1.0–2.0% |

Balanced | 55% | 10–15% | 5% | 25–35% | 8–12 | 0.75–1.5% |

Aggressive | 45–50% | 10% | 5–10% | 40–45% | 10–15 | 0.5–1.25% |

Your Stable Fund Core: FundNest Vaults (Yield, Liquidity, Safety)

Why a stable fund core matters

Reduces portfolio volatility

Provides steady income and dry powder for dips

Keeps execution simple and automated

"FundNest 'Zero Risk' targets approximately 7% APY; actual yields vary and fees apply." - Source

FundNest tiers and use‑cases

Zero Risk (primary core): USDT/USDC stable pools with low impermanent loss, no leverage, target yield, and withdraw‑anytime liquidity

Optional Low/Medium tiers: add incremental yield with controlled risk for a small satellite allocation

Risk controls and transparency

Curated pools; no leverage in the core stable fund strategy

On‑chain accounting; clear vault shares and withdrawal flexibility

StartupNest escrow integration so idle capital earns yield until milestones unlock

Implementation tips

Ladder deposits weekly to smooth entry and reduce timing risk

Set an auto‑withdraw threshold to refill your core floor on volatility spikes

Use ZEM staking to boost FundNest yields and lower fees for efficient compounding

Build your stable investments core now with FundNest: https://zemyth.app

Your High‑Growth Sleeve: StartupNest (Milestones, Escrow, Asymmetric Upside)

How StartupNest reduces downside while preserving upside

Funds locked in escrow, milestone votes gate releases

Investor veto windows and pivot exit rights

Investment NFTs with on‑chain rights and secondary liquidity

What to look for in a high‑growth investment

Clear milestone definitions and evidence plan

Founder track record; shipping velocity; community traction

Tokenomics sanity: allocation, TGE plan, vesting, utility

Position building playbook

Start small (0.5–1.0%), scale only after milestone momentum

Diversify across 5–15 uncorrelated theses

Pre‑commit sell/trim rules post‑TGE

cNFTs and talent flywheel

Contributors earn cNFTs; verified work speeds milestones

Improves odds of timely unlocks and higher quality delivery

"S&P Global Market Intelligence projects the generative AI market to grow at a 40% CAGR from 2024 to 2029, reaching roughly $85 billion by 2029." - Source

Use secular growth waves like AI as one of many theses - StartupNest’s milestone‑gated design lets you size small, verify progress, and scale into the outliers.

Sizing, Guardrails, and Rebalancing: The Operating System

A disciplined operating system turns a good growth investment strategy into compounding results. Below are the rules Zemyth power users follow to keep a stable fund core intact while letting high‑growth investments run.

Sizing rules

Max single growth bet: 2% of portfolio at cost

Default ticket size: 1% per StartupNest position

Add only on progress: +0.5% after a milestone Pass (never add to deteriorating setups)

Cap exposure: hard cap 3% live weight per position after gains; trim excess back to core

Guardrails

Core floor (never breach): maintain 60–70% in stable investments (FundNest Zero Risk as primary)

Max drawdown alert: if portfolio DD >15%, pause new risk, rebuild stable fund core first

Cut rule: −40% from blended entry or milestone failure → exit or reduce to 0.25% “tracking” size

Liquidity health: avoid projects with repeated missed updates; three failed votes = consider exit

Rebalancing cadence

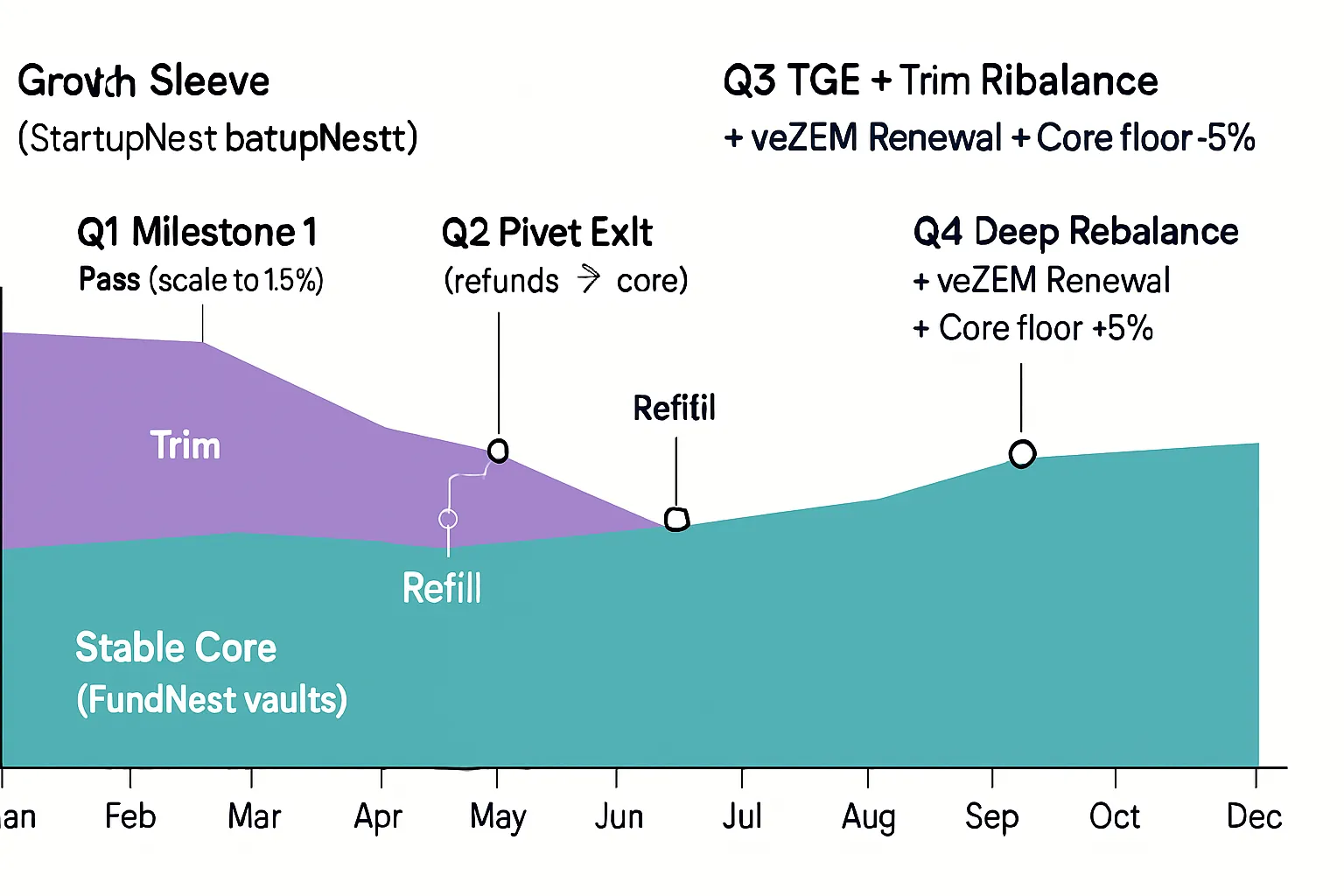

Monthly: light rebalance - trim outsized winners, refill core, redeploy yield

Quarterly: deep rebalance - reset to target bands, review position theses and milestone momentum

Event‑driven: after TGE or major unlock, enforce pre‑committed trim/sell rules

Liquidity and slippage controls

Batch transactions (time‑weighted) and use tight ranges around deep‑liquidity hours

Stagger NFT exits where possible; avoid voting/challenge windows for secondary transfers

Prefer FundNest withdrawals during normal volatility; set buffers to avoid forced selling

Rebalancing trigger → action matrix

Trigger/Condition | Action | Rationale |

|---|---|---|

Core < floor (e.g., <60–70%) | Redirect all yield + new cash to FundNest Zero Risk until floor restored; pause new growth adds; optionally trim 5–15% from largest winners to refill core | Protects the base and preserves dry powder |

Core within floor but below target by 2–5% | Allocate incremental yield to core; allow limited 0.5% adds only after milestone Pass | Keeps base robust while still rewarding validated progress |

Growth position +75% from cost | Trim 25–50% back to stable fund core (take “cost out” when possible) | Harvest gains, de‑risk to house money |

Growth position +150% from cost and >3% live weight | Hard cap: trim to 2–2.5% live weight; route proceeds to core | Prevents single‑name risk concentration |

Milestone failed | Reduce to 0.25% tracking size or exit; re‑enter only after resubmission and Pass | Enforces downside discipline |

Three failed votes or 90‑day inactivity risk | Exit during permitted windows; recycle into higher‑velocity deals | Capital efficiency and risk hygiene |

Portfolio drawdown >15% | Halt new risk; top up core with yield and trims; resume adds only after core ≥ floor + 3% buffer | Survive first, compound later |

TGE event with fully vested claim | Execute pre‑set trim plan (e.g., 30–50% into core), retain residual for upside | Locks gains, keeps upside optionality |

Core > target by >5% band | Allow selective 0.5–1.0% adds into best‑momentum, underweight theses | Redeploy excess base into vetted growth |

Your operating system should be boringly consistent: prioritize the stable fund core, size high‑growth investments small and only on progress, and route gains back to the base. This fund strategy keeps you liquid, lowers volatility, and lets convex winners drive outcomes.

Boosting the Barbell with ZEM (Yield Multipliers, Access, and Fees)

Supercharge your barbell: use ZEM to amplify stable fund yield, upgrade access to high growth investments, and cut platform costs. This turns a solid fund strategy into a compounding growth investment strategy.

Yield and access utilities

veZEM boosts: lock ZEM to veZEM for up to 2.5× yield on FundNest vaults (1–4 year locks; longer = higher boost). Example: a 7% base in Zero Risk can boost toward ~17.5% with max veZEM.

NFT + ZEM staking: stake an Investment NFT together with ZEM to get 1.5× token distributions on StartupNest project payouts.

Priority access and engagement: higher ZEM tiers unlock early/guaranteed allocations in StartupNest deals; earn 10 ZEM per milestone vote (vote‑to‑earn, capped monthly) to stay engaged without sacrificing your core stable investments.

How this compounds:

Stable fund stays the heavy anchor, but veZEM makes the yield meaningfully larger.

The growth sleeve remains many small tickets, but NFT+ZEM staking boosts the upside on those winners you keep.

Cost optimization

Tiered fee discounts: hold ZEM to reduce platform fees across FundNest, StartupNest, and CollabNest.

1,000+ ZEM: 25% discount

10,000+ ZEM: 50% discount

50,000+ ZEM: 75% discount

Net effect: lower friction on deposits/withdrawals, rebalancing, and TGE‑related actions - more of your stable fund yield and high‑growth investment returns stay in your pocket.

Practical stack

Accumulate with yield: route a slice of your FundNest yield (e.g., 10–20%) to periodic ZEM buys until you reach your target lock tier; then convert to veZEM to boost stable fund APY.

Time locks with the calendar: align veZEM lock periods with your known StartupNest milestone/TGE windows so boosts, fee discounts, and access overlap your heaviest activity periods.

Pair staking with conviction: only apply NFT+ZEM 1.5× boosts to positions that have passed early milestones and show delivery velocity; keep risk managed by avoiding boosts on unproven bets.

Maintain liquidity buffers: even with locks, keep a healthy un‑locked ZEM tranche for opportunistic fee tiering and to avoid forced actions during volatile windows.

Bottom line: ZEM is the multiplier layer. It boosts stable fund yield, enhances high growth investment outcomes, and slashes fees - so your barbell compounds faster. Launch your boosted barbell now: https://zemyth.app

12‑Month Walkthrough (Hypothetical): From Deposit to TGEs and Rebalance

Starting point

$50,000 portfolio, Balanced profile: 70% core / 30% growth

10 growth positions at 1% each; 20% reserve within core for dips

Timeline highlights

Q1: core yield accrual; 2 projects hit Milestone 1 → scale to 1.5%

Q2: 1 pivot window → partial exits; core refilled

Q3: first TGE → top‑slice 50% gain back to core; add new 1% position

Q4: deep rebalance; veZEM boost renewed; core floor raised by 5%

Outcome framing (illustrative)

Core delivers steady yield and funds rebalancing

A few winners pay for many small losers; volatility stays contained

Fees reduced via ZEM; access to better deals improves

Ready to run the playbook? Start at https://zemyth.app

FAQs and Common Mistakes to Avoid

FAQs

How many growth positions is ‘enough’? (aim 5–15)

Aim for 5–15 high‑growth positions sized 0.5–2.0% each. This gives you enough shots to catch outliers while keeping any single loss immaterial. Add only after milestone progress to maintain asymmetric upside.

Do I need to rebalance monthly? (light monthly, deep quarterly)

Yes - light monthly trims/refills keep your stable fund core on target; quarterly deep rebalances reset bands, review theses, and enforce your growth investment strategy rules (top‑slice winners, exit laggards).

What if a project stalls? (abandonment/pivot protections; exit windows)

StartupNest encodes protections: investor veto windows, pivot exit windows, and abandonment/failed states. Use these windows to reduce or exit stalled positions and recycle capital to the stable core or better opportunities.

How do FundNest tiers affect risk? (add Low/Medium in small increments)

Treat FundNest Zero Risk as the stable fund anchor. Add Low/Medium tiers in small satellite increments for higher yield, but keep the core floor intact to preserve liquidity and low volatility.

Mistakes

Oversizing a single high‑growth investment

Fix: Cap any one position at 2% at cost and 3% live weight; trim excess back to the stable core.

Ignoring the core floor during rallies

Fix: Maintain your core floor (e.g., 60–70%) at all times. Harvest gains into the core to keep dry powder and stability.

Chasing narratives without milestone evidence

Fix: Require clear milestones, evidence plans, and on‑chain delivery before adding size; scale only after a milestone Pass.

Skipping ZEM boosts/discounts that improve net returns

Fix: Use veZEM to boost FundNest yield and stake Investment NFTs + ZEM to enhance distributions. Fee discounts (25–75%) improve your net compounding.

Have more questions or ready to deploy your barbell fund strategy? Get started at https://zemyth.app

Conclusion: Start Your Barbell on Zemyth

Recap

A disciplined barbell pairs a reliable, liquid stable fund core with many small high‑growth shots.

Rules and guardrails matter more than hot picks - position sizing, floors, trims, and exits define the outcome.

Zemyth gives you the rails: FundNest for stability (your stable fund core and stable investments), StartupNest for growth (curated, milestone‑gated deals), and ZEM for boosts (yield multipliers, access, and fee cuts).

Next steps

Define your core floor and growth sleeve based on your risk profile.

Open FundNest core positions; shortlist 5–10 StartupNest deals; set rebalancing rules that fit your fund strategy.

Activate ZEM boosts and vote‑to‑earn to amplify your growth investment strategy while lowering costs.

CTA

Build your barbell today at https://zemyth.app - take the balanced path to asymmetric upside.