TL;DR: Stake startup tokens for yield - quick start

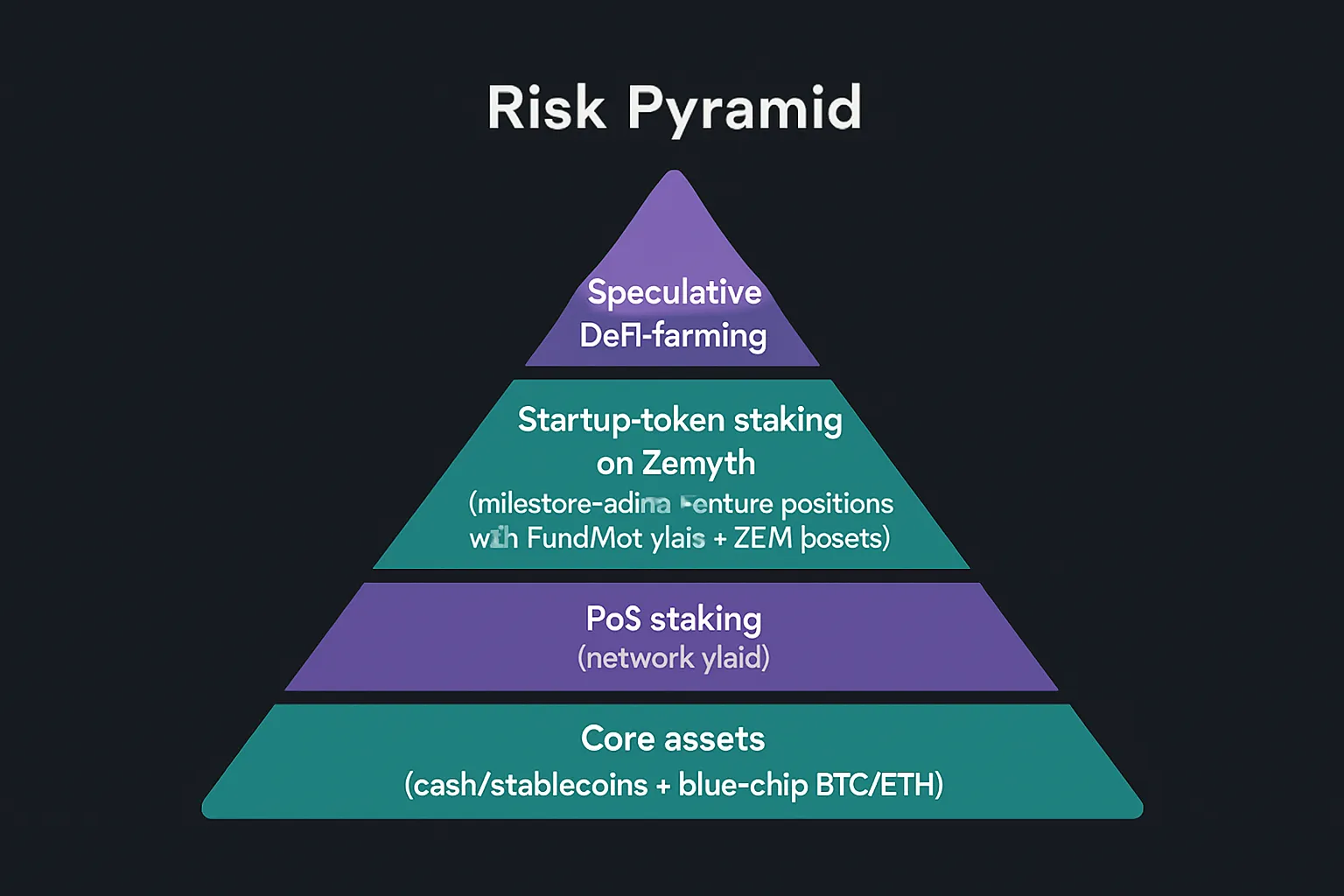

Stake startup tokens on Zemyth to earn and invest in real projects with milestone-gated safety. Unlike PoS staking (you help secure a chain) or DeFi yield farming (you provide liquidity to AMMs/lending markets), StartupNest staking lets you back founders, earn token distributions at TGE, and compound escrow yield via FundNest - then boost everything with ZEM for higher returns. If you’re looking to earn money from investment with transparent rules and risk controls, this is your fastest path to investment growth without day trading.

What this guide covers

Plain-English overview of startup-token staking vs. PoS staking vs. DeFi yield farming:

Startup-token staking (Zemyth): invest in milestone-based rounds, stake your Investment NFT + ZEM for boosts, claim tokens at TGE.

PoS staking: lock a single token to help secure a network; yields depend on validator performance.

DeFi yield farming: supply token pairs or lend assets for trading fees/incentives; higher complexity and IL risk.

Where the yield comes from on Zemyth:

Token distributions at TGE from projects you back (your “earn & invest” flywheel).

Escrow capital deployed into FundNest Zero Risk pools (stablecoin fees) for extra yield while milestones progress.

ZEM boosts: stake ZEM or lock as veZEM to amplify yields and unlock priority access.

Core risks and simple mitigations:

Lockups: respect milestone timelines; keep some liquidity in stablecoins for flexibility.

Project delivery risk: diversify across multiple projects/tiers; track milestone votes and updates.

Smart-contract risk: stick to vetted pools and risk tiers; avoid over-concentration in any single protocol.

"Across major PoS networks, typical staking rewards average ~3–10% APY depending on network and validator performance." - Source

3-step quick start on Zemyth

Create/connect your Solana wallet

Pick a StartupNest project and investment tier

Stake and monitor milestones; claim tokens at TGE

Tip: Use ZEM to boost yields for potentially higher, more consistent returns than basic PoS staking - while avoiding the impermanent loss that often hits DeFi yield farming.

Immediate next action

Start here: https://zemyth.app (priority access, beginner-friendly UI, milestone-gated safety).

CTA: Start staking startup tokens on Zemyth → https://zemyth.app

Startup-token staking vs. PoS staking vs. DeFi yield farming - what’s different (and why it matters)

"Staged financing mitigates agency problems by releasing capital contingent on milestone achievement." - Source

Definitions at a glance

Startup-token staking (Zemyth): stake into milestone-gated venture positions; earn project tokens at TGE + escrow yield + ZEM boosts.

PoS staking: lock native chain tokens to secure a network; earn protocol rewards.

DeFi yield farming: supply/borrow or LP in AMMs for variable fees + incentives.

Why startup-token staking exists

Aligns capital release with milestone delivery; reduces capital misuse; unlocks access for retail.

Introduces on-chain accountability: votes, challenge windows, and terminal states that prevent rollbacks.

Improves capital efficiency: escrowed funds earn base yield via FundNest Zero Risk pools while founders build.

Who it’s for

Angels/retail seeking venture-style upside with on-chain guardrails and steady base yield while waiting for TGE.

Community scouts and DAO treasuries wanting transparent, milestone-based exposure with optional ZEM boosts.

Builders who prefer investor alignment and predictable unlocks instead of opaque, lump-sum raises.

Quick outcomes

Lower operational overhead than active farming; higher upside potential than pure PoS; milestone-gated fund safety.

No impermanent loss vs. AMM LPing; clear unlock rules vs. open-ended token incentive programs.

Priority access and fee discounts for ZEM holders; boosted yields via veZEM and NFT + ZEM staking.

How yields actually accrue on Zemyth startup positions

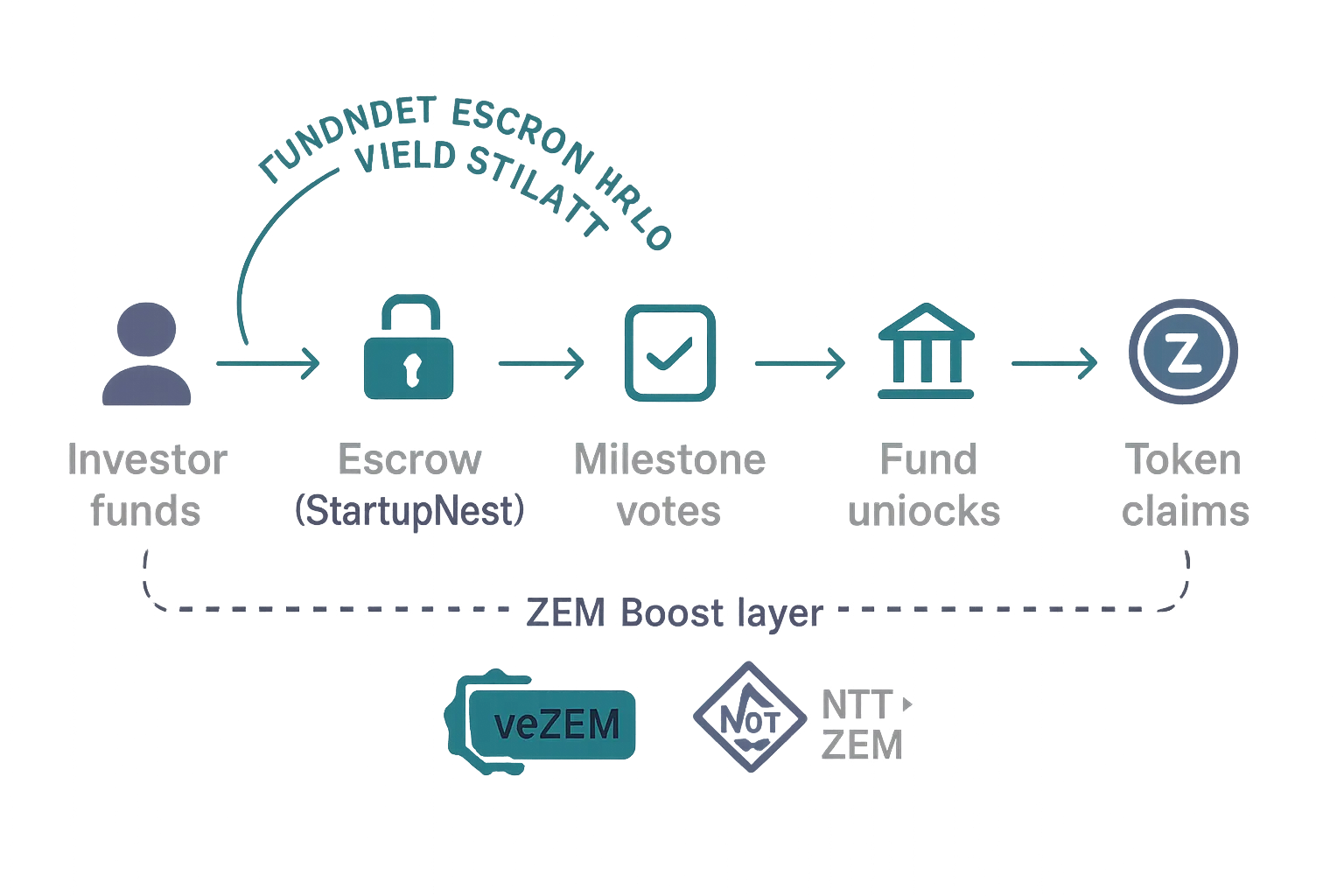

Zemyth turns “earn & invest” into a disciplined flow: capital sits in escrow earning base yield, milestones unlock tranches, and token distributions at TGE deliver upside - amplified by ZEM boosts. If you want to stake startup positions for investment growth without the babysitting of active farming, here’s exactly how the yield stacks.

1) Milestone-gated escrow yield (FundNest)

Unused tranches are parked in FundNest’s risk-tiered pools (e.g., Zero Risk stablecoin LPs) to earn daily yield while founders build.

Zero Risk targets steady, low-volatility fees (no leverage, minimal IL), making it ideal for escrow capital that must not lose principal.

Result: you earn money from investment even before TGE - your stake works while milestones progress.

2) Project token distributions at TGE

Each investment mints an NFT that encodes your token claim. After founders deposit tokens at TGE, holders claim their proportional allocation in one click.

Secondary market optionality: NFTs are transferable, so you can trade a position pre‑TGE if you want liquidity or to rotate.

3) ZEM integrations and boosts

veZEM boosts FundNest yields (up to 2.5×) for stronger base returns on escrowed capital.

NFT + ZEM staking delivers enhanced project distributions (e.g., 1.5× token reward boost with 12‑month lock).

Holding ZEM also unlocks fee discounts and priority access to high‑demand deals - helping you stake startup positions early and compound faster.

4) Realistic ranges & expectations

Blend base escrow yield with project token upside. Base yield from Zero Risk pools is designed to be steady; TGE token upside is variable and project‑dependent.

Expectation setting:

Base: think conservative, steady APY from stable pools while funds are escrowed.

Upside: milestone success and TGE drive token distributions; outcomes can range from muted to high returns depending on market conditions and project traction.

Time horizon: milestone cycles and TGE schedules are measured in weeks to months - align allocations accordingly.

5) What can delay or reduce yield

Missed milestones or slow execution extend the escrow period before unlocks.

TGE delays postpone token claims and may shift realized upside into a later window.

Market drawdowns can reduce the fiat value of distributed tokens.

Zemyth protections:

48‑hour challenge windows and >50% pass thresholds align capital release with delivered proof.

Abandonment/timeouts and TGE‑failure states trigger refund windows, reducing downside if things go off‑track.

Permissionless transitions and on‑chain votes add transparency and speed.

Comparison: Startup-token staking vs. PoS staking vs. DeFi yield farming

Method | Source of yield | Typical APY range | Lockup/Liquidity | Key risks | Effort level | Upside potential |

|---|---|---|---|---|---|---|

Startup-token staking (Zemyth) | FundNest escrow yield + TGE token distributions + ZEM boosts | Base ~5–10% from escrow; total variable with token upside | Milestone-gated; exit/refund windows; NFT transferable; claims at TGE | Project delivery risk, TGE delays, smart-contract risk, market risk | Low–Moderate (monitor milestones) | High (venture-style) with guardrails |

PoS staking | Protocol inflation + network fees | ~3–10% APY (network-dependent) | Unbonding periods (days–weeks); liquid staking variants | Slashing, validator performance, token price | Low | Low–Moderate (primarily token price β) |

DeFi yield farming | Trading fees, lending/borrowing interest, token incentives | ~5–100%+ (high variance) | Often flexible; some lockups/penalties; IL risk when LPing | Impermanent loss, smart-contract exploits, incentive decay/rugs | High (active management) | High but volatile |

Bottom line: if you want to stake startup positions with on‑chain safeguards, earn investment yield while you wait, and keep upside for high returns at TGE - Zemyth’s milestone‑gated design gives you a cleaner path to “earn & invest” than pure PoS or active farming.

Risk, lockups, and liquidity - and how Zemyth mitigates them

"Crypto hacks and exploits totaled roughly $2.2 billion in 2024, underscoring the need for robust smart-contract risk management." - Source

Smart-contract and platform risk

Zemyth employs third‑party audits, extensive test coverage, and conservative defaults across vaults and escrows.

One‑way state machines prevent rollbacks: funds only move forward (escrow → founder) after conditions are met.

Permissionless triggers let anyone execute inactivity checks, TGE verification, and refund transitions - no centralized gatekeeper.

Practical takeaways:

Treat on‑chain interactions like production systems: verify contract addresses, avoid unknown “boost” contracts, and keep hot‑wallet balances minimal.

Size positions assuming a non‑zero chance of contract issues; never over‑concentrate.

Project delivery risk

Milestone voting: each tranche unlocks only after a >50% “Good” vote within a 14‑day window.

48‑hour challenge/veto window: even after “Pass,” 30% aggregate weight can veto a withdrawal.

Graduated protection:

Repeated failures → exit windows and optional shutdown vote (66% threshold).

90‑day inactivity → Abandoned state with a 14‑day refund window.

What this means: your capital release is contingent on shipped proof, not promises - aligning incentives and reducing misuse.

Token price and unlock risk

Volatility at TGE can swing token values; Zemyth requires founders to deposit tokens and escrows 10% of tokens for 30 days post‑TGE to deter immediate rugs.

TGE‑failure path refunds final milestone amounts if tokens aren’t deposited by the deadline.

Practical takeaways:

Plan exits over time instead of a single TGE dump; consider staking NFTs with ZEM for boosted distributions if you’re long‑term.

Use allocation caps per project to manage idiosyncratic risk.

Liquidity and exit paths

Pivot exits: a 7‑day window lets investors withdraw proportionally from remaining escrow if the roadmap changes.

Inactivity refunds: auto‑abandonment after 90 days of no progress triggers refunds.

Secondary market: Investment NFTs are transferable, enabling pre‑TGE liquidity and portfolio rotation.

Practical takeaways:

Keep a portion of your portfolio liquid (stables) so you can act during exit windows without forced selling elsewhere.

Practical risk controls you can use today

Diversify across projects and tiers; avoid >5–10% of your portfolio in any single startup.

Prefer Zero Risk pools for escrow exposure; use veZEM to boost base yields without adding IL/leverage.

Set allocation caps per project and per sector; rebalance quarterly around milestone events.

Monitor milestones and voting timelines; act during challenge or exit windows when new information appears.

Use hardware wallets and delegate voting from cold storage where possible.

CTA: Start staking startup tokens with milestone‑gated safety on Zemyth → https://zemyth.app

Position sizing for beginners - a simple, repeatable framework

Start with a risk budget

Define a risk bucket for venture-style starter positions: generally 5–15% of your total portfolio.

Keep the rest in core assets (stables/BTC/ETH) and PoS staking to anchor volatility.

Cap per-project exposure

Beginners: 0.5–2% of portfolio per project; step in via tiers (ladder across milestones).

Use Investment NFTs to spread across projects and sizes (Bronze/Silver/Gold, etc.).

Time/lockup alignment

Map milestone timelines to your liquidity needs. If you need flexibility, prefer shorter milestone sequences and avoid long unbonding.

Keep a stablecoin buffer for pivot/exit windows so you’re not forced to sell elsewhere.

DCA and rebalance cadence

Automate entries (weekly/biweekly). Review quarterly around major milestone votes or TGE.

Rebalance back to target caps; trim outsized winners and re‑deploy into early phases you understand.

Examples

Conservative: 5% total venture bucket; 0.5% per project; Zero Risk pools preferred; 1–3 month lockup tolerance; quarterly reviews.

Balanced: 10% total venture bucket; 1% per project; mix Zero/Low Risk pools; 3–6 month lockup tolerance; quarterly reviews.

Aggressive: 15% total venture bucket; 2% per project; add Medium Risk pools selectively; 6–9 month lockup tolerance; monthly reviews around milestones.

Position-sizing cheat sheet

Risk profile | Per-project cap | Total venture bucket | Preferred pools | Lockup tolerance | Review cadence |

|---|---|---|---|---|---|

Conservative | 0.5% | 5% | Zero Risk (stable LPs) | 1–3 months | Quarterly |

Balanced | 1% | 10% | Zero + Low Risk | 3–6 months | Quarterly |

Aggressive | 2% | 15% | Low + Medium Risk | 6–9 months | Monthly |

CTA: Start staking startup tokens on Zemyth and apply this framework → https://zemyth.app

Step-by-step: How to stake startup tokens on Zemyth (beginner flow)

1) Connect your Solana wallet

Use Phantom or Solflare; confirm the Solana network and keep a small SOL balance for fees.

Security tip: verify the official domain (zemyth.app) and double‑check transaction prompts before signing.

2) Pick a StartupNest project and tier

Review tier minimums, token ratio per dollar, vote multiplier, and max lots available.

Cross‑check the project’s roadmap, team, and TGE expectations before allocating.

3) Understand milestones and voting

Read acceptance criteria for each milestone; note 14‑day voting windows and the 48‑hour challenge period after “Pass.”

Add key dates to your calendar so you never miss a vote or exit window.

4) Stake and (optionally) boost with ZEM

Confirm your stake to mint an Investment NFT that encodes your allocation and voting rights.

Boost options:

NFT + ZEM staking for enhanced token distributions (subject to lock terms).

veZEM for FundNest yield amplification on escrowed capital.

5) Monitor progress and act when needed

Vote on milestone reviews; watch for pivot proposals and exit windows.

Track FundNest escrow yield while milestones are in progress and rebalance if your allocation caps are exceeded.

6) Claim tokens at/after TGE

After founders deposit tokens, claim once per Investment NFT.

Plan liquidity and tax events: consider phased selling, long‑term holding, or staking strategies post‑TGE.

CTA: Start staking startup tokens on Zemyth → https://zemyth.app

Due diligence checklist - reduce downside before you stake

Founder and roadmap validation

Verify founder identity (socials, prior exits, public commits) and advisor credibility.

Assess roadmap realism: milestones with objective acceptance criteria, dates, and measurable outputs.

Look for builder-market fit: demo, waitlist, or early users validating the problem.

Tokenomics sanity test

Supply and unlocks: total supply, cliffs/vests, and circulating supply at TGE.

Utility and sinks: fee discounts, staking boosts, burns, or required collateral.

TGE commitments: founders’ token deposit amount and 10% post‑TGE escrow to align incentives.

Market and liquidity plan

Go‑to‑market: target users, channels, and partnerships with near‑term traction.

Listing expectations and market makers: realistic venues and initial depth plans.

Post‑TGE liquidity management: avoid hyper‑dilution; allocate incentives where they compound value.

Security and ops

Audit status and bug bounty presence; transparency around findings and fixes.

Permissionless safety triggers (abandonment, refund, TGE checks) and moderator workflow.

Test coverage, on‑chain telemetry, and incident response playbooks.

Governance and community health

Voter participation: % of weight engaged in recent milestone votes and on‑time submissions.

Communication cadence: changelogs, milestone evidence, and AMA frequency.

Transparency: dashboards for funds in escrow, unlock history, and token claims.

CTA: Put this checklist to work and stake smarter on Zemyth → https://zemyth.app

Taxes, accounting, and tracking basics (not tax advice)

Staking startup positions can create multiple taxable events. Rules differ by country - use this checklist to stay organized and talk with a qualified professional.

Typical events to consider

Reward accruals while funds sit in escrow pools (if considered income in your jurisdiction).

Token claims at TGE (often taxed at the fair market value at receipt).

Realized P/L when you sell claimed tokens or trade Investment NFTs.

Refunds/exit events (adjust basis; may create gains/losses depending on timing and valuation).

Fee deductions (network fees, platform fees) where permitted.

Record-keeping

Timestamped records for: stake, tier selection, NFT mint, votes, milestone results, unlocks, claims, refunds/exits.

Transaction hashes, wallet addresses, project IDs, Investment NFT IDs, pool/escrow references.

Fair market value (in your home currency) at each income event (e.g., claim time), plus associated fees.

Notes for lockup/vesting terms and any ZEM boost locks relevant to timing.

Cost basis and timing

Investment NFT: record purchase cost (including fees); track holding period start date.

Token claims at TGE: log fair market value at receipt (commonly income basis) and start new holding period for subsequent sales.

Refunds/partial unlocks: adjust basis proportionally; document methodology and stay consistent.

Local rules vary on income vs. capital treatment, constructive receipt, and timing - confirm with a tax professional.

Tools and workflows

Export on-chain history from your wallet and blockchain explorers; keep a clean CSV per wallet.

Integrate with portfolio/tax trackers; tag events (stake, claim, refund) for accurate categorization.

Calendar lockups, voting windows, challenge periods, and expected TGEs to anticipate income and liquidity.

Reconcile monthly: match positions, cost basis, and realized P/L; archive proofs (screenshots, hashes).

Professional guidance

Regulations change quickly. Consult a qualified tax professional in your jurisdiction to confirm treatment, elections, and reporting formats.

Keep conservative reserves for potential tax liabilities, especially around TGE and large unlocks.

CTA: Track milestones, claims, and exits as you stake startup tokens on Zemyth → https://zemyth.app

FAQ - staking startup tokens for yield

What makes startup-token staking different from PoS staking?

Startup-token staking on Zemyth is venture-style: you back real projects via milestone-gated tranches and earn two layers of return - base escrow yield and project token distributions at TGE - plus optional ZEM boosts. PoS staking secures networks for a steady, single-source yield; Zemyth adds upside tied to startup execution, without AMM impermanent loss.

Can I exit early if a project pivots or stalls?

Yes. Pivot proposals open a 7-day exit window to withdraw your proportional share of remaining escrow. If a milestone is inactive for 90 days, the project can be marked Abandoned, triggering a 14-day refund window. You can also sell your Investment NFT on the secondary market at any time.

How are returns affected if milestones are delayed?

Your base yield from FundNest continues while funds remain in escrow, but token distributions are pushed back until milestones pass and TGE occurs. If delays stack, watch for challenge, exit, or refund windows and rebalance position sizes to your allocation caps.

What happens if TGE fails or is late?

Founders must deposit tokens at/after TGE; 10% stays in escrow for 30 days to discourage immediate rugs. If tokens aren’t deposited by the deadline, the project transitions to TGEFailed and final milestone amounts are refunded pro‑rata to investors.

How do ZEM boosts work with Investment NFTs?

Two ways:

NFT + ZEM staking: lock ZEM with your Investment NFT for enhanced token distributions (e.g., 1.5× boost with a 12‑month lock).

veZEM: lock ZEM to boost FundNest yield on escrowed capital (up to 2.5×) and gain fee discounts/priority access.

Where does the base yield come from while funds are in escrow?

From FundNest’s risk-tiered liquidity pools. “Zero Risk” pools use stablecoin pairs to earn trading fees with minimal volatility and no leverage - ideal for capital that must remain secure until milestones unlock.

How do I evaluate tiers (token ratio, voting power)?

Check:

Minimum per tier and token ratio per $ (more tokens per dollar in higher tiers).

Vote multiplier (higher tiers = more voting weight).

Max lots available (scarcity can drive demand). Pick tiers that align with your position sizing and governance influence goals.

What are realistic APY expectations for beginners?

Plan for a conservative base from escrow (steady, low-volatility yield) and treat token distributions as variable upside tied to milestone execution and market conditions. Avoid projecting single “headline APY”; blend scenarios across multiple projects and set allocation caps.

Is there a secondary market for Investment NFTs?

Yes. Investment NFTs are transferable; voting, claim, and refund rights move with the NFT. This provides pre‑TGE liquidity and lets you rotate between projects.

How do I secure my wallet and reduce operational risks?

Use a hardware wallet for cold storage; keep only small working balances hot.

Bookmark the official domain (zemyth.app) and verify every transaction prompt.

Keep a small SOL buffer for fees; test with small amounts before scaling.

Rotate/limit approvals; never sign blind messages.

Store seed phrases offline; enable device PINs and 2FA where applicable.

CTA: Ready to stake startup tokens with milestone‑gated safety? Start at https://zemyth.app

Ready to earn from your investment? Start on Zemyth

Why Zemyth now

Milestone-gated capital: funds unlock only when proof is delivered, aligning incentives and protecting downside.

FundNest escrow yield: put idle tranches to work in curated, risk-tiered pools (e.g., Zero Risk stables) for steady base returns.

ZEM-driven boosts: amplify base yield and token distributions, get fee discounts, and priority access to the best deals.

Net effect: a practical on-ramp to venture-style upside where you can stake startup tokens, earn & invest, and target investment growth without day trading.

Your next steps

Create/connect wallet → choose a vetted project → pick a tier → stake and monitor milestones → claim at TGE.

Final note

Start small, diversify across projects and tiers, and use the due diligence checklist - then compound what works.

CTA

Get started in minutes: https://zemyth.app

CTA: Earn from your investments with milestone-gated startup staking → https://zemyth.app