TL;DR - Real‑world assets (RWA) on‑chain in 2025: invest in real assets with crypto, safely

"Tokenized real‑world assets reached $33.84B (Oct 14, 2025), with stablecoins pushing the broader tokenized market beyond $240B." - Source

What this guide covers in 3 bullets

RWAs in plain English: how “investment real” works on-chain via a legal wrapper that maps off‑chain ownership, smart contracts that automate rights and cash flows, and custody that secures both tokens and the underlying asset.

Where to find yield now: tokenized Treasuries, real estate, private credit, commodities, and carbon - with step‑by‑step ways to invest with crypto rails.

A practical risk framework (custody risk, liquidity risk, legal enforceability) plus an action plan using Zemyth to manage cash, access yield, and automate rebalancing.

Why RWAs now - and why this matters for your portfolio

Institutions, clearer rules, and better infrastructure make it viable to invest in real assets on-chain - turning “invest in real” into a mainstream path for crypto investments.

RWAs offer 24/7 markets, fractional access, programmable income, and faster settlement - bringing real assets for investment onto rails you already use.

Quick wins you can execute after reading

Establish a base yield with tokenized Treasuries; layer diversified exposure (real estate, private credit) based on liquidity horizons and your income needs.

Apply a custody + liquidity playbook to avoid redemption traps, issuer concentration, and chain risk - so you can invest with crypto without sacrificing safety.

How this guide improves on typical RWA explainers

Beyond definitions: you get concrete asset menus, due‑diligence checklists, custody comparison tables, and a workflow you can run today.

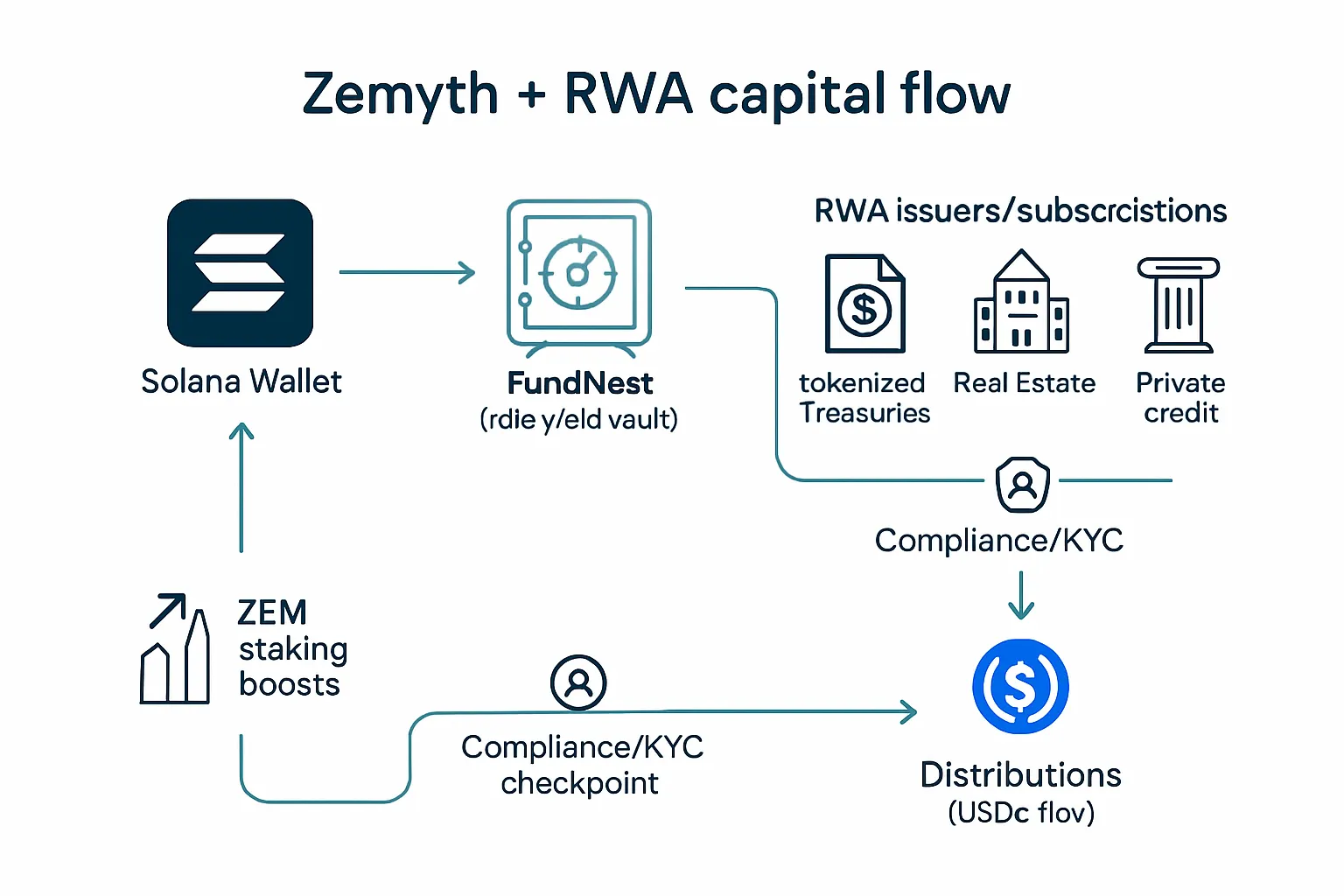

Integrated Zemyth plan: park cash for yield in FundNest, stake ZEM for boosts, and execute disciplined allocations across RWAs with automated rebalancing.

CTA

Ready to put real assets on‑chain to work? Start here: https://zemyth.app

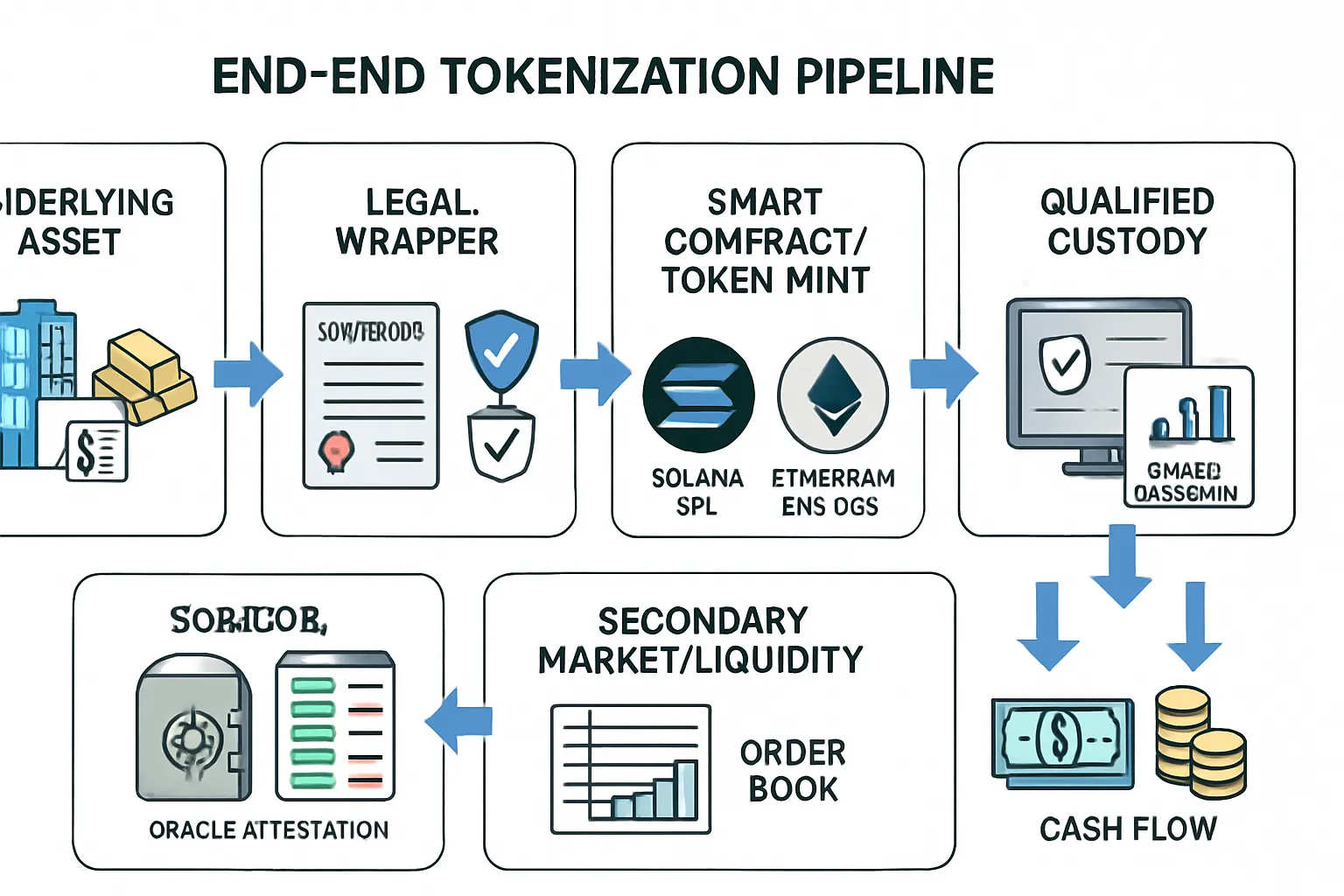

How tokenization works end‑to‑end (legal, smart contracts, custody) - watch this first

"I believe the next generation for markets, the next generation for securities, will be tokenization of securities." - Source

The off‑chain legal wrapper

SPV/trust structures hold the underlying (e.g., T‑bills in a bankruptcy‑remote SPV, real estate held in a property SPV), then issue claims mirrored on‑chain. This keeps legal title and investor rights enforceable in court.

Compliance paths define who can hold/transfer: Reg D/Reg S, KYC/AML, investor accreditation, and jurisdictional rules. Expect transfer restrictions, investor allowlists/deny‑lists, and whitelisting workflows.

Key docs: offering memorandum/subscription agreements, trust deed/SPV charter, custodian agreements, price oracles/attestation SLAs, and redemption terms. If you want to invest with crypto while keeping “investment real,” these documents are your legal backbone.

The on‑chain engine

Smart contracts encode the cap table: mint/burn, transfer rules, and cash‑flow logic (coupons, dividends, fee splits). They automate distributions and enforce transfer restrictions programmatically.

Token standards and rails:

ERC‑20 for fungible RWAs (T‑bill tokens, gold, private credit notes). ERC‑1400/1410 adds partitions/transfer controls for compliant securities.

Solana SPL for high‑throughput RWA rails where speed/fees matter.

Designs range from permissioned (allowlists, role‑based controls) to permissionless (open transferability), often with hybrid “compliant by design” patterns.

Integration points: oracles for NAV/pricing, T+0 settlement hooks, and payout modules for programmable income - bringing real assets for investment onto crypto rails.

Custody and control

Qualified custodians vs self‑custody:

Qualified custodians hold the underlying (e.g., T‑bills, property titles, gold); they provide audits, insurance, and SOC reports.

Token custody can be self‑custody (your wallet) or institutional custody (MPC, segregated accounts). Trade‑off: self‑custody = control; institutional custody = operational safety and recovery tooling.

Proof‑of‑reserves/oracle attestations: periodic attestations (auditor or oracle) verify that on‑chain supply equals the off‑chain assets. Look for signed reports and chain‑posted hashes.

Redemptions: who can trigger, and how they settle:

On‑chain stablecoin redemptions (USDC/SOL) vs fiat wires to bank accounts.

Some products enforce redemption minimums, windows, or fees - plan liquidity so your crypto investments don’t get stuck in redemption traps.

Cash flows and lifecycle

Primary issuance → secondary trading → income distribution → redemption/buyback:

Primary: subscribe on an allowlisted sale; tokens minted to your wallet.

Secondary: trade on approved DEX/OTC venues with rule‑aware transfer checks.

Income: coupons/dividends stream to token holders per record date (USDC on‑chain).

Redemption/buyback: burn tokens for NAV‑based payout or exit via buyback windows.

Where settlement risk hides:

Bank rails: fiat legs, cutoff times, and banking holidays.

Custodial bottlenecks: centralized signers, batch processing, limited windows.

Allowlists: KYC status changes can freeze transfers - keep docs current to avoid forced illiquidity when you want to invest in real assets.

What success looks like

Legally enforceable claims, mapped cleanly from the SPV/trust to the token.

Predictable redemptions with clear SLAs, posted fees, and no surprise gates.

Deep enough liquidity (issuance size, market‑maker commitments, active venues) to size positions and exit without heavy slippage.

Independent audits plus public on‑chain attestations (supply, holdings, income).

Transparent on‑chain data: cap table, distribution history, oracle updates - so you can treat RWAs as disciplined, programmable building blocks in your portfolio.

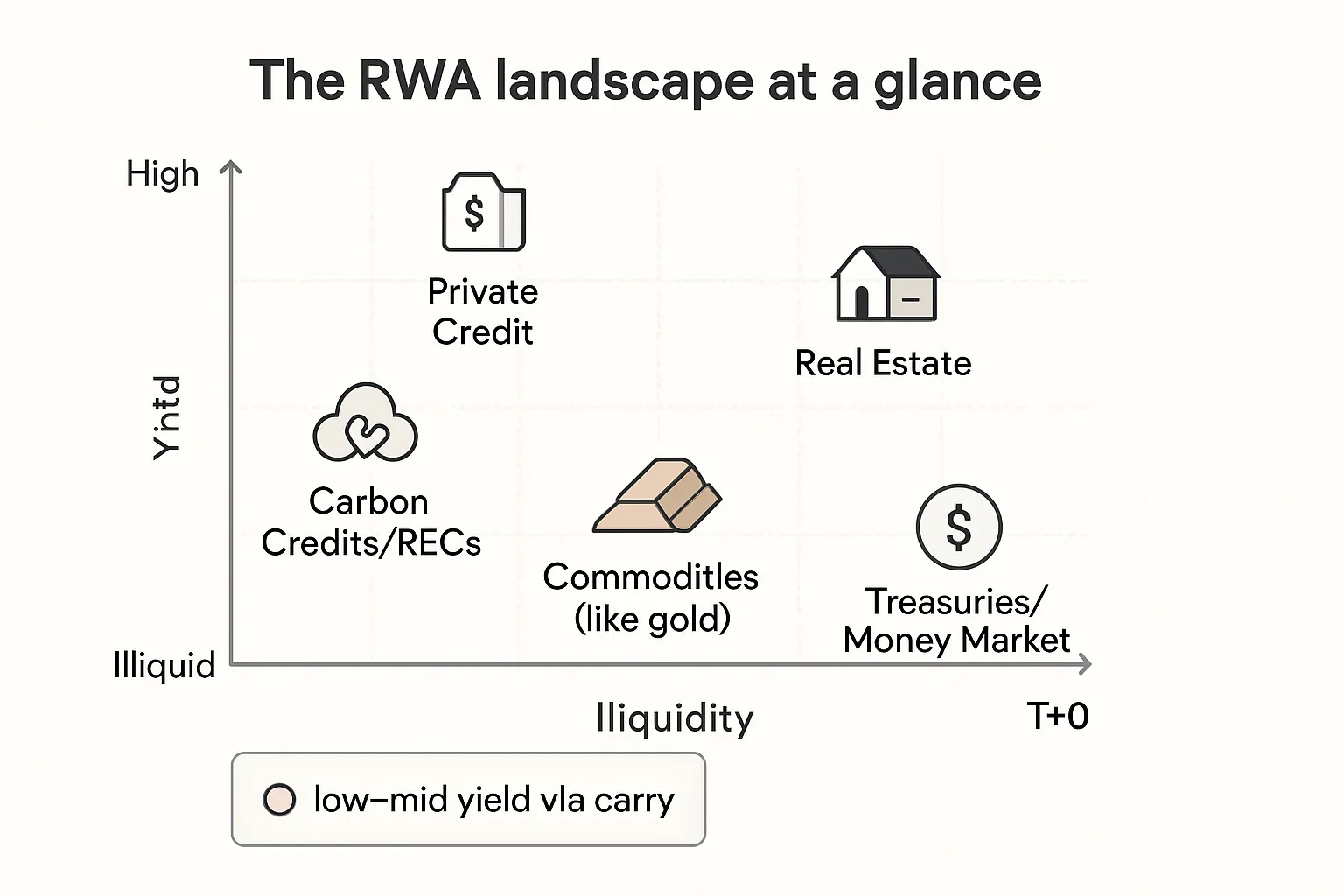

What you can invest in today: tokenized Treasuries, real estate, private credit, commodities, and carbon

Tokenized Treasuries and money market funds

On‑chain wrappers for short‑duration government paper (T‑bills, 2–6 month duration) deliver base yield with high credit quality.

Typical use: park your liquidity bucket, ladder maturities, keep stable dry powder for crypto investments while earning daily yield.

Notes: most products are permissioned with KYC and defined redemption windows; distributions typically in USDC.

Real estate (fractional equity and income streams)

Residential/commercial fractions via SPVs with rental income distributed on‑chain; equity upside tied to property performance.

Differentiators: liquidity profile (secondary market depth, redemption terms) and the legal enforceability of your claim stack.

Watch for: appraisal methodology, sponsor quality, fees, and transfer restrictions.

Private credit (on‑chain lending to real businesses)

Asset‑backed credit pools (inventory, equipment), invoice financing, and revenue‑based financing accessible via tokenized notes.

Higher yields come with underwriting risk, borrower concentration, and potential gating during stress.

Key checks: collateral controls, seniority/waterfall, default/collection process, independent servicer oversight.

Commodities (e.g., gold) and tokenized reserves

Physically backed gold with vault attestations and periodic audits; on‑chain settlement and ease of transfer.

Often zero “yield” (pure price exposure), but efficient for hedging, diversification, and fast collateral mobility.

Important: redemption fees, bar sizes, vault jurisdictions, and attestations cadence.

Carbon and sustainability markets

Tokenized carbon credits and renewable energy certificates (RECs); choose between compliance market instruments and voluntary credits.

Verification stack matters: registry linkage, methodology, permanence, and double‑counting protections.

Liquidity and pricing vary; policy/regulatory changes can move markets quickly.

Where to start if you invest with crypto

Build a base layer with tokenized T‑bills for reliable yield, then layer real estate and private credit based on your liquidity horizon and risk tolerance.

Keep “investment real” by prioritizing products with clear legal wrappers, predictable redemptions, and transparent on‑chain data - so you can invest in real assets with crypto without sacrificing safety.

RWA investor menu - yields, liquidity, KYC, key risks

Asset class | Typical target yield (range) | Liquidity profile (T+0/T+1/T+X) | KYC requirement (Y/N; permissioned/permissionless) | Redemption mechanics | Primary risks | Example issuers/projects (descriptive, non‑promotional) |

|---|---|---|---|---|---|---|

Tokenized Treasuries / Money Market | ~4–6% (rate dependent) | T+0–T+2 (product‑specific) | Y; permissioned | Burn/mint with USDC or fiat wire; windows and minimums apply | Rate cuts, issuer concentration, bank/custodian risk, allowlist changes | Regulated SPVs issuing tokenized T‑bills; permissioned tokenized MMFs with daily USDC distributions |

Real Estate (fractional equity/income) | ~3–10% net income + potential appreciation | T+7–T+30; secondary market dependent | Y; permissioned | Periodic redemptions or secondary sales via allowlisted venues | Legal enforceability, valuation/appraisal risk, vacancy, fee drag, illiquidity | Property SPV tokens (residential/commercial), rental income distributions on‑chain |

Private Credit (asset‑backed/invoice) | ~8–18% (underwriting‑dependent) | T+7–T+90; potential lockups | Y; permissioned | Rolling windows; pro‑rata liquidity; possible gates under stress | Borrower default, collateral recovery, concentration risk, servicer quality | On‑chain invoice financing pools; senior secured working‑capital credit notes |

Commodities (Gold) | 0% yield (price exposure) | T+0–T+1 | Mixed; some permissionless, some permissioned | Physical redemption (fees/thresholds) or cash equivalent | Vault/custody risk, audit frequency, basis vs spot, redemption fees | LBMA‑vaulted gold tokens with attestation and serial‑number tracking |

Carbon Credits / RECs | Price exposure (variable); 0–10% in structured strategies | T+0–T+2 (venue‑dependent) | Compliance: Y; Voluntary: mixed | Retirement/burn for offsets; redemption into certificates/claims | Verification integrity, policy/regulatory risk, liquidity fragmentation | Verified carbon credit tokens (registry‑linked), renewable energy certificate tokens |

Zemyth angle: If you want real assets for investment on crypto rails, use Treasuries as your base yield, then add targeted exposure to real estate and private credit for income, and gold/carbon for diversification. Through Zemyth’s FundNest, you can park stablecoins for daily yield, then reallocate into curated RWA strategies - keeping custody, liquidity, and legal enforceability front and center so you can confidently invest with crypto and still keep it “invest in real.”

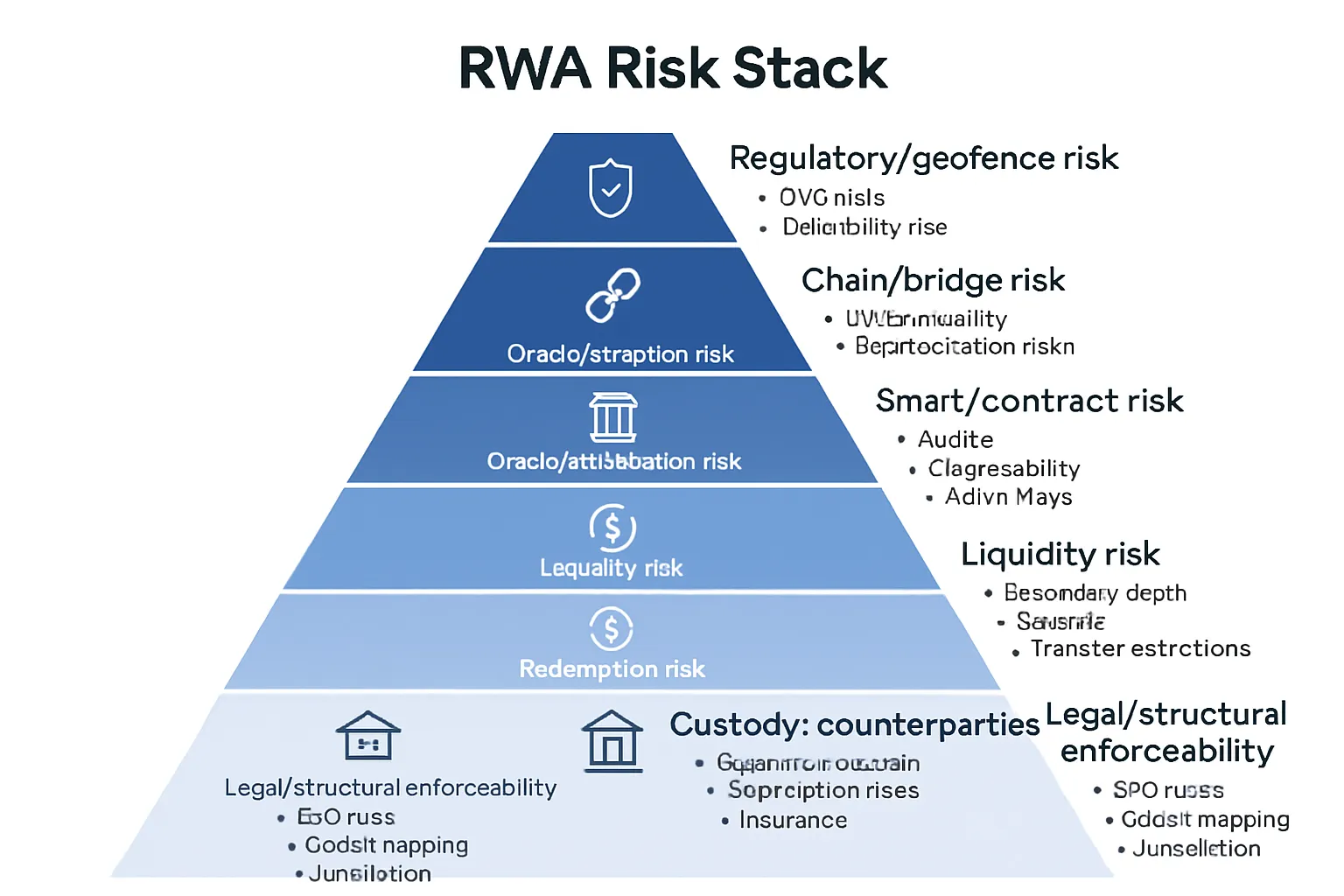

Risk framework: custody, liquidity, and legal enforceability for real investment on‑chain

The 8 risks that actually matter

Legal/structural enforceability - Do tokens map to enforceable claims? Review SPV/trust docs, jurisdiction, bankruptcy‑remoteness, and investor rights in defaults.

Custody and counterparty risk - Who holds title? Are assets fully segregated? Check custodian qualifications, insurance, audits, and rehypothecation policies.

Redemption risk - Lockups, gates, who can redeem, at what NAV, with what fees? Understand windows, minimums, slippage, and settlement rails (USDC vs fiat).

Liquidity risk - Secondary depth, spreads, transfer restrictions, allowlist changes. Model exit costs and “what if” scenarios under stress.

Smart contract risk - Audits, upgradability, admin keys, pause switches, bug bounties. Prefer time‑locked upgrades and multi‑sig controls.

Oracle/attestation risk - Price feed sources, proof‑of‑reserves cadence, and independence. Verify signatures and chain‑posted hashes.

Chain/bridge risk - L1/L2 security assumptions, bridge design, and permissioned asset handling across chains. Avoid opaque custodial bridges.

Regulatory/geofence risk - Jurisdiction, KYC/AML, tax reporting, sanctions lists, and reporting obligations. Track rule changes that can affect transferability.

Due‑diligence checklist before you click “buy”

Legal mapping: SPV/trust agreements, offering docs, investor rights, and jurisdiction fit.

Custody verification: qualified custodian, segregation statements, SOC/audit reports, insurance coverage.

Redemption mechanics: windows, NAV policy, fees, minimums, who can redeem, and expected settlement time.

Liquidity tests: secondary venue depth, spreads, transfer rules, and allowlist dependencies.

Smart contract review: audit links, admin controls, upgrade path, bug bounties, pause policies.

Oracle/attestations: feed independence, update frequency, proof‑of‑reserves method, on‑chain hashes.

Chain/bridge posture: security assumptions, bridge audits, custody model for wrapped/permissioned assets.

Compliance hygiene: KYC/AML status, residency/geofence checks, tax forms, and reporting setup.

Capital at risk drill: size positions to withstand gates and delays; maintain a cash buffer for obligations.

Final step: run a small redemption test before committing size; monitor allowlist/terms changes continuously.

Choosing platforms and custody models to invest in real assets safely

Platform selection criteria (fast checklist)

Jurisdiction and regulator: Where is the SPV/fund domiciled? Who regulates it? Confirm qualified custodian, asset segregation, insurance, and audit cadence (SOC/ISAE, financial statements).

Fees and disclosures: Management/performance/redemption fees, spread, mint/burn, custody. Transparent NAV methodology, valuation sources, pricing frequency, and investor reporting.

Transferability and settlement: On/off allowlists, secondary market venues, transfer restrictions, and settlement options (USDC/SOL vs fiat wires). Documented redemption windows, gates, and minimums.

Custody models you’ll encounter

Self‑custodied permissionless RWAs (e.g., some gold tokens): you hold the keys; redemptions vary by issuer. High autonomy, but legal and redemption paths can be uneven.

Permissioned on‑chain funds (allowlisted wallets): qualified custody of the underlying; stronger compliance and clearer redemptions; controlled liquidity and transfer rules.

Off‑chain transfer‑agent models (token mirrors registrar): token reflects an off‑chain shareholder register. Strong legal clarity; slower operations and fewer DeFi integrations.

CeFi wrappers (IOUs): centralized platforms issue claims. Simple UX and often deep liquidity - at the cost of higher counterparty and rehypothecation risk.

Custody models vs control and liquidity

Model | Who holds underlying? | Investor control | KYC required | Redemption path & timeline | Typical fees | Key pros | Key cons |

|---|---|---|---|---|---|---|---|

Self‑custodied, permissionless token (e.g., some gold) | Vault/custodian appointed by issuer; you self‑custody the token | High over tokens; none over underlying | Often N (varies by issuer) | On‑chain transfers T+0; physical/cash redemption may require KYC; T+1–T+14 typical | Mint/burn, spread, redemption fees | 24/7 mobility, broad composability, fast collateralization | Legal enforceability varies, redemption friction, allowlists can appear later, oracle/attestation risk |

Permissioned on‑chain fund (allowlisted wallets) | Qualified custodian (segregated); fund/SPV holds title | Medium: transfers within allowlist | Y (permissioned) | Defined windows; T+0–T+2 for stablecoin cash‑outs; clear NAV terms | Mgmt 0–50 bps+/yr; mint/burn; redemption fee (0–50 bps) | Strong compliance, predictable redemptions, audited NAV, clearer investor rights | KYC friction, transfer limits, potential gates under stress |

Off‑chain transfer‑agent mirror | Transfer agent/registrar holds official register; token mirrors it | Medium‑Low: off‑chain register is final | Y | Off‑chain instructions; T+1–T+5 typical | Transfer‑agent/admin fees; spreads | Legal clarity, corporate actions aligned, strong records | Slower ops, limited DeFi utility, operational bottlenecks |

CeFi wrapper (IOU) | Centralized platform (exchange/lender) | Low: platform controls redemption/halts | Usually Y | Platform ticket/wire/stablecoin; T+0–T+2 (subject to pauses) | Trading/withdrawal fees; spread | Simple access, often deep liquidity | Counterparty/rehypothecation risk, freeze risk, opaque reserves |

How to match model to your strategy

Short‑term liquidity: Use permissioned T‑bill wrappers with documented windows and NAV policy; settle in USDC to keep your crypto investments nimble.

Long‑term income: Allocate to real estate/private credit with robust legal docs, independent audits, and clear waterfall/redemption terms; accept longer notice periods for higher yield.

Tactical hedging/diversification: Use permissionless commodity tokens (e.g., gold) for fast collateral and 24/7 mobility - verify vault attestations and redemption procedures.

Operational simplicity vs sovereignty: If you must “invest with crypto” and keep control, prefer self‑custody within permissioned products. If simplicity is paramount, a CeFi wrapper is easy - size it small due to counterparty risk.

Zemyth workflow: Park stablecoins in FundNest for daily base yield, then scale into curated permissioned RWA strategies. Keep an emergency buffer in T‑bill wrappers for predictable redemptions, and layer income (real estate/private credit) as your “investment real” core.

Tokenized Treasuries playbook: build your base yield, then stack crypto investments

Why every RWA portfolio starts with Treasuries

Base yield with high credit quality: short‑duration U.S. T‑bills are the cleanest “risk‑off” anchor for any on‑chain RWA strategy.

Clear redemption terms: documented windows, NAV methodology, and settlement in USDC or fiat make cash management predictable.

Emergency liquidity: a T‑bill core lets you meet obligations without forced selling of higher‑beta positions.

Practical tactics

Duration laddering:

Split across 4–13 week T‑bill buckets to smooth reinvestment risk and keep rolling liquidity.

Rotate maturities weekly so you always have a portion nearing redemption.

Weekly DCA:

Automate buys into your preferred tokenized T‑bill wrapper each week to average yields and spreads.

Auto‑reinvest distributions:

Elect to receive income in USDC and auto‑reinvest on a schedule; keeps your base compounding.

Liquidity segmentation:

Operating cash (T+0/T+1): the chunk you may need this week - use wrappers with same‑day or next‑day exits.

Strategic cash (T+7): funds you might deploy within 1–4 weeks - accept a short notice period for better terms.

Long‑term bets: don’t park here; deploy to targeted RWAs (private credit, real estate) once base yield is handled.

Operational guardrails:

Verify KYC status and allowlist settings before sizing up.

Know cut‑off times for subscriptions/redemptions; schedule around holidays and bank rail delays.

Keep a small “test lot” to run periodic redemption dry‑runs.

Blend with DeFi prudently

Use conservative pools only:

Park idle stablecoins in battle‑tested, low‑volatility pools while awaiting RWA subscription windows.

Favor audited, high‑liquidity venues with transparent fee mechanics and no leverage.

Avoid leverage on top of permissioned RWAs:

If liquidation paths are controlled by an issuer or require off‑chain steps, avoid using these tokens as collateral.

If you must borrow, keep LTV ultra‑low and ensure all legs (borrow, unwind, redemption) are under your control.

Rebalance with discipline:

Set fixed rules (e.g., maintain 40–60% in tokenized Treasuries; clip gains from higher‑beta strategies back to base).

Hard stops on position sizing if redemption windows widen or allowlist terms change.

Zemyth tie‑in

While you queue for RWA allocations, park idle capital in FundNest’s zero‑risk tier to earn daily base yield on stablecoins.

When subscriptions open, roll a portion from FundNest into your chosen tokenized T‑bill wrappers to lock in your base.

Stake ZEM to boost FundNest yields and prioritize access to future RWA allocations - then automate periodic rebalancing back to your target split.

Playbook in 7 steps you can run today:

Define your base yield target and emergency liquidity size.

Choose a permissioned T‑bill wrapper with same‑day or T+1 exits for your “operating cash.”

Ladder the rest across 4–13 week buckets with weekly DCA.

Turn on auto‑reinvest of USDC distributions.

Park overflow in conservative DeFi pools while you await subscriptions.

Add satellite allocations (private credit, real estate) in measured tranches.

Rebalance monthly: top back up your Treasury core, trim risk when spreads widen.

Ready to operationalize this playbook with crypto rails? Start here: https://zemyth.app

Step‑by‑step: invest in real assets with crypto using Zemyth rails

1) Set your objectives and constraints

Define your income target (e.g., base yield vs growth), liquidity needs (T+0/T+7), risk tolerance, and any jurisdictional/geofence limits.

Translate this into an allocation template: base (tokenized Treasuries), income (real estate/private credit), diversifiers (commodities/carbon).

2) Prepare your wallet and KYC

Create and secure a Solana wallet (hardware or MPC preferred). Back up seed/recovery, enable passphrases and spending limits.

Complete KYC with permissioned RWA issuers you plan to use; verify allowlist status before wiring size.

3) Cash management while you wait

Deposit USDC/USDT into FundNest’s zero‑risk pools to earn daily yield on idle cash while you complete onboarding or await subscription windows.

Set alerts for cut‑off times and redemption windows so your cash is available when needed.

4) Acquire your first RWA positions

Start with tokenized Treasuries to establish base yield and emergency liquidity.

Add small, staggered allocations to real estate or private credit after reviewing legal docs, audits, redemption mechanics, and fees.

5) Automate compounding and boosts

Stake ZEM for fee discounts, yield boosts in FundNest, and priority access to deals where applicable.

Enable auto‑reinvest of USDC distributions in products that support it; otherwise, schedule manual rollovers weekly.

6) Monitor risks and test exits

Track allowlist/KYC status, issuer updates, oracle/attestation cadence, and any changes to redemption terms.

Run a small redemption test each quarter to validate timelines and settlement rails; keep a T+0/T+1 liquidity slice ready.

7) Rebalance quarterly

Trim positions back to targets; rotate between RWA buckets as yields and terms evolve.

Document changes and rationale using an OpenSpec‑style log; this keeps execution disciplined and auditable.

Pro tip

Maintain a written investment policy statement (IPS) that defines risk limits, liquidity buffers, and rebalance rules. Stick to it during volatility.

Compliance, taxes, and reporting for RWA crypto investments

Know your jurisdiction

Securities classification and who can invest:

Many RWAs are offered as securities (exempt or registered). Know whether you qualify as accredited vs retail and any residency/geofence limits.

Common paths include private placements with allowlisted wallets and transfer restrictions; expect KYC/AML at onboarding and on transfers.

Geofencing and sanctions:

Issuers typically screen against sanctions lists and restrict certain countries. Keep your KYC profile current to avoid unexpected freezes.

Cross‑border implications:

Withholding taxes, treaty benefits, and local reporting can apply when you receive interest/dividends from foreign issuers or funds.

If you invest with crypto across borders, confirm how stablecoin‑settled income is reported in your home jurisdiction.

Record‑keeping and tax basics

Track lot‑level data:

Cost basis, acquisition date/time, wallet used, gas/fees, and FX rate to your reporting currency.

Record all income distributions (interest/coupons, dividends, rental income), reinvestments, redemptions, and buybacks.

Categorize flows correctly:

Interest/coupon = ordinary income; distributions from real estate/private credit may be dividend/interest/other depending on the wrapper; token sales/redemptions typically create capital gains or losses.

Redemptions at NAV can still trigger gain/loss vs your basis; capture fees and slippage.

Export on‑chain activity:

Use issuer dashboards, block explorers, and CSV exports; reconcile to statements from transfer agents/custodians.

Maintain a master ledger by wallet and entity; document the valuation source for each entry (oracle price, NAV report, or stablecoin face value).

Work with a tax professional:

Prefer a practitioner familiar with digital assets, tokenized securities, and cross‑border rules; align on accounting methods (FIFO/LIFO/Specific ID) and documentation standards.

Operational hygiene

Segregate by purpose and entity:

Use separate wallets for operating cash vs long‑term allocations; separate entities (e.g., company vs personal) to simplify audits and reporting.

Strengthen key management:

Hardware wallets or MPC with role‑based approvals; written policies for key storage, transaction thresholds, and incident response.

Maintain a compliance file:

KYC approvals, offering docs, subscription agreements, SPV/trust deeds, custodian attestations, audits, proof‑of‑reserves links, and redemption policies - all versioned and date‑stamped.

Calendars and controls:

Track cut‑offs (subscription/redemption windows), tax deadlines, audit/attestation cadence, and allowlist renewals. Run periodic “exit drills” with small redemptions to validate timelines and reporting.

Three portfolio blueprints that work in 2025 (examples, not advice)

These allocation templates show how to invest in real assets with crypto rails while controlling risk. Treat them as starting points and size positions to your own liquidity, compliance, and jurisdiction.

1) Conservative income (liquidity first)

Allocation

70–80% tokenized Treasuries (T‑bill wrappers, T+0/T+1 exits)

10–20% permissioned money market RWAs (daily/weekly redemptions)

10% stable, battle‑tested DeFi pools (no leverage)

Rationale

Goal: predictable income, minimal drawdowns, instant‑to‑near‑instant liquidity for obligations.

What to verify: NAV policy, redemption windows/fees, qualified custodian, proof‑of‑reserves cadence.

Execution tips

Ladder T‑bill maturities (4–13 weeks) and auto‑reinvest distributions.

Hold a T+0/T+1 “operating cash” sleeve for emergencies.

Run quarterly exit drills (small redemptions) to validate timelines.

Where Zemyth fits

Park idle cash in FundNest zero‑risk tier between subscriptions; stake ZEM to boost base yield on stablecoins.

2) Balanced barbell (income + growth)

Allocation

50–60% tokenized Treasuries (liquidity core)

20–30% private credit (senior, asset‑backed, permissioned)

10–20% real estate (income‑producing SPVs)

Small tactical crypto investments (strict size limits)

Rationale

Goal: boost yield while keeping a strong liquidity core; mix of “investment real” income with selective upside.

What to verify: legal enforceability (SPV/trust), collateral controls, default waterfall, appraisal/valuation methods.

Execution tips

Stagger allocations in tranches; avoid concentration in a single issuer.

Cap single‑issuer exposure (e.g., ≤10%) and borrower concentration in private credit.

Recycle distributions back to Treasuries unless thesis unchanged.

Where Zemyth fits

Use FundNest to earn daily yield while staged tranches settle; record decisions with OpenSpec discipline.

3) Opportunistic (experienced investors only)

Allocation

30–40% tokenized Treasuries (risk anchor)

20–30% private credit (diversified pools, clear servicing)

20–30% real estate (diversified sectors/regions)

Selective commodity or carbon exposure (hedge/diversifier)

Rationale

Goal: higher total return with careful sizing and strict risk controls; you still “invest with crypto” but keep an anchor in high‑quality paper.

What to verify: liquidity gates, allowlist rules, redemption SLAs, oracle/attestation independence, chain/bridge assumptions.

Execution tips

Hard stop on leverage over permissioned RWAs unless liquidation paths are fully under your control.

Maintain a T+0/T+1 cash slice for opportunistic buys and exits.

Use pre‑set drawdown and spread triggers to rebalance defensively.

Rebalancing cadence

Quarterly with tolerance bands (e.g., ±5% per sleeve).

Harvest and redeploy:

Sweep distributions (USDC) into FundNest, then DCA back to target sleeves.

Signals to rotate

Widening redemption windows/fees → raise Treasury core.

Improving secondary depth/NAV discounts narrowing → re‑add income sleeves.

Records

Keep an IPS (investment policy statement) with target ranges, position caps, and exit rules; log decisions and rationale.

Reminder: These are examples, not investment advice. Your constraints (jurisdiction, KYC status, tax, liquidity schedule) come first. If your goal is “investment real” with crypto, start with Treasuries as the base, then layer income and diversifiers methodically.

Ready to operationalize these blueprints on crypto rails? Start here: https://zemyth.app

Conclusion - start compounding real assets on‑chain with Zemyth

The bottom line

RWAs let you invest in real assets with crypto rails: faster settlement, fractional access, and programmable income. This is “investment real” you can actually operate - 24/7, transparent, and auditable.

Use the risk framework here, start with a tokenized‑Treasury base, and layer selective exposures (private credit, real estate, commodities/carbon) based on liquidity needs and risk tolerance.

Zemyth gives you the operating system to execute: park idle cash in FundNest, unlock fee savings and boosts with ZEM, and run a disciplined, auditable process so you can invest with crypto without sacrificing safety.

CTA

Don’t wait for “perfect clarity.” Start small, test redemptions, and scale what works. Get started now: https://zemyth.app