Money and Investment Psychology: Why your mind quietly cuts your money returns (TL;DR)

Why this matters for your money

The biggest drag on money returns isn’t fees or stock-picking. It’s your own brain’s shortcuts.

Behavioral biases quietly cost investors 1–2%+ a year - a compounding penalty on their money.

"Over the decade ending Dec 31, 2024, the average fund returned 8.2% annually, but investors realized only 7.0% - a 1.2-point gap driven largely by poor timing." - Source

TL;DR - what you’ll walk away with

The 7 core biases that sabotage money and investment decisions (loss aversion, overconfidence, anchoring, herding/FOMO, recency, confirmation, mental accounting).

Simple guardrails and automation to keep you on course.

A ready-to-use decision playbook, two checklists, and a 30‑minute setup plan.

How Zemyth’s milestone‑based funding, escrow yield, and staking locks act as pre‑built guardrails for better outcomes.

What this guide does better than typical “5 biases” posts

Moves beyond definitions to concrete systems (if‑then rules, exit bands, review cadences) and automation.

Connects money psychology to on‑chain rails that protect both their money and your money.

Who this is for

Angels, DAOs, and retail investors who want fewer unforced errors.

Founders who want investor trust and milestone discipline.

Yield seekers who want dependable base returns while scouting upside.

SEO note

Focused on queries like: money and investment psychology, biases that cut money returns, about your money, protect their money.

Ready to put guardrails around your money and investment decisions? Start with Zemyth today: https://zemyth.app

The 7 core money-and-investment biases that quietly tax your returns

Before we talk charts and tickers, start with the operating system: your brain. These seven biases quietly clip money returns by pushing you to act too early, too late, or for the wrong reasons. Use the tell‑tale signs and 1‑minute fixes to protect their money and your money.

1) Loss aversion + the disposition effect

Losses hurt ~2× more than equal gains; leads to selling winners early and holding losers too long.

"Losses loom larger than gains - the pain of losing outweighs the pleasure of an equivalent gain." - Source

Tell‑tale signs:

You say “I’ll sell when it gets back to my price.”

Quick to take profits; reluctant to cut losers.

Portfolio shows many small wins, a few large drawdowns.

1‑minute fix:

Pre‑commit exit rules: “If thesis breaks or price falls 20% from entry, exit next trading session.”

Use rebalancing bands: trim winners + top up high‑conviction laggards within set bands.

Reframe: “If I had cash today, would I buy this at this price?” If no → sell.

Zemyth guardrail: milestone‑gated unlocks and 48‑hour challenge windows reduce “throw good money after bad.”

2) Overconfidence

Overtrading, concentrated bets, ignoring base rates.

Tell‑tale signs:

Trading frequency spikes after a few wins.

You skip bear cases and dismiss probabilities (“this time is different”).

Position sizes creep beyond your plan.

1‑minute fix:

Cap max position size (e.g., 5%) and daily trade count (e.g., ≤2).

Add a base‑rate box to your checklist: “What does history say for assets like this?”

Keep a decision journal; review quarterly hit rate vs. benchmark.

Zemyth guardrail: escrowed funds and voting thresholds prevent single‑person hero bets from draining capital.

3) Anchoring

Stuck on purchase price/ATH/initial narrative; miss new data.

Tell‑tale signs:

“I’m underwater; I’ll wait to break even.”

You ignore fresh earnings, runway, or regulatory shifts that change fair value.

You quote the ATH as “true value.”

1‑minute fix:

Reset the thesis with today’s data: forward cash flows, unit economics, risk.

Replace “buy price” with “expected value now.”

Schedule a 90‑day thesis refresh for every core holding.

Zemyth guardrail: one‑way state machines and time‑bounded votes force decisions on current facts, not sunk costs.

4) Herding/FOMO

Crowd euphoria and panic; momentum without diligence.

Tell‑tale signs:

You buy because it’s trending on socials; you sell on red days without a thesis update.

You chase after a parabolic move; you reverse on the first -10%.

1‑minute fix:

24‑hour cooling‑off rule for any unsolicited idea.

Require three independent sources + a written bear case before entry.

Starter size only (e.g., 1–2%) with add‑on triggers tied to fundamentals.

Zemyth guardrail: open→funded→milestone unlocks create paced deployment instead of stampede entries.

5) Recency bias

Overweight recent performance; abandon plans after short streaks.

Tell‑tale signs:

You extrapolate last month’s returns into next year’s targets.

You abandon diversified allocation after a bad quarter.

1‑minute fix:

Anchor to long‑term lookbacks (5–10 years) and rolling periods.

Rebalance on calendar (e.g., quarterly) or bands (±20% of target weights).

Hide daily P&L; evaluate monthly against your Investment Policy Statement (IPS).

Zemyth guardrail: pre‑set review cadences (14‑day votes, 48‑hour challenges) dampen knee‑jerk shifts.

6) Confirmation bias

Cherry‑picking data that fits your view; echo chambers.

Tell‑tale signs:

Your notes are 90% bull case; you ignore dissenting analysts.

You follow only creators who agree with you.

1‑minute fix:

Red‑team it: write two disconfirming facts needed to delay/exit.

Pre‑mortem: “It’s 12 months later and this lost money - what happened?”

Require one credible opponent source in your memo before funding.

Zemyth guardrail: investor voting and moderator checks force cross‑examination before funds move.

7) Mental accounting

Treating identical dollars differently; silos reduce total return.

Tell‑tale signs:

“House money” gets risked more aggressively; “salary money” sits idle.

You run many small accounts with overlapping bets and hidden concentration.

1‑minute fix:

View everything as one portfolio with target allocation and risk budget.

Consolidate idle cash into a yield sleeve; route all flows through one plan.

Use goal labels but invest from a unified policy; automate transfers.

Zemyth guardrail: FundNest deploys idle escrow into zero‑risk pools to earn base yield, so dollars don’t sit unproductive.

Takeaway: codify your if‑then rules, automate the boring parts, and let on‑chain guardrails handle the rest. This is how you protect money returns - consistently - in real markets.

Turn biases into guardrails you actually use

Friction‑reducing defaults that beat willpower

Auto‑DCA and auto‑rebalance to keep money and investment plans on track without guesswork.

Calendarized reviews (monthly/quarterly) with a one‑page scorecard on allocation, risk, and drift.

Pre‑set exit bands (e.g., thesis break or −20% hard stop; +25% trim) to protect your money returns.

Cooling‑off periods (24–48 hours) for new ideas; no same‑day FOMO buys.

Trade journal prompts: “Why now?”, “What would change my mind?”, “Base rate?”

Checklists and pre‑commitments

One‑page investment memo before capital moves: thesis, risks, base rate, catalysts, exit conditions.

If‑then rules:

If price −20% or thesis breaks → exit next session.

If position > target by 20% band → trim to target.

If new idea passes diligence (3 sources + bear case) → starter size only; add on fundamentals, not hype.

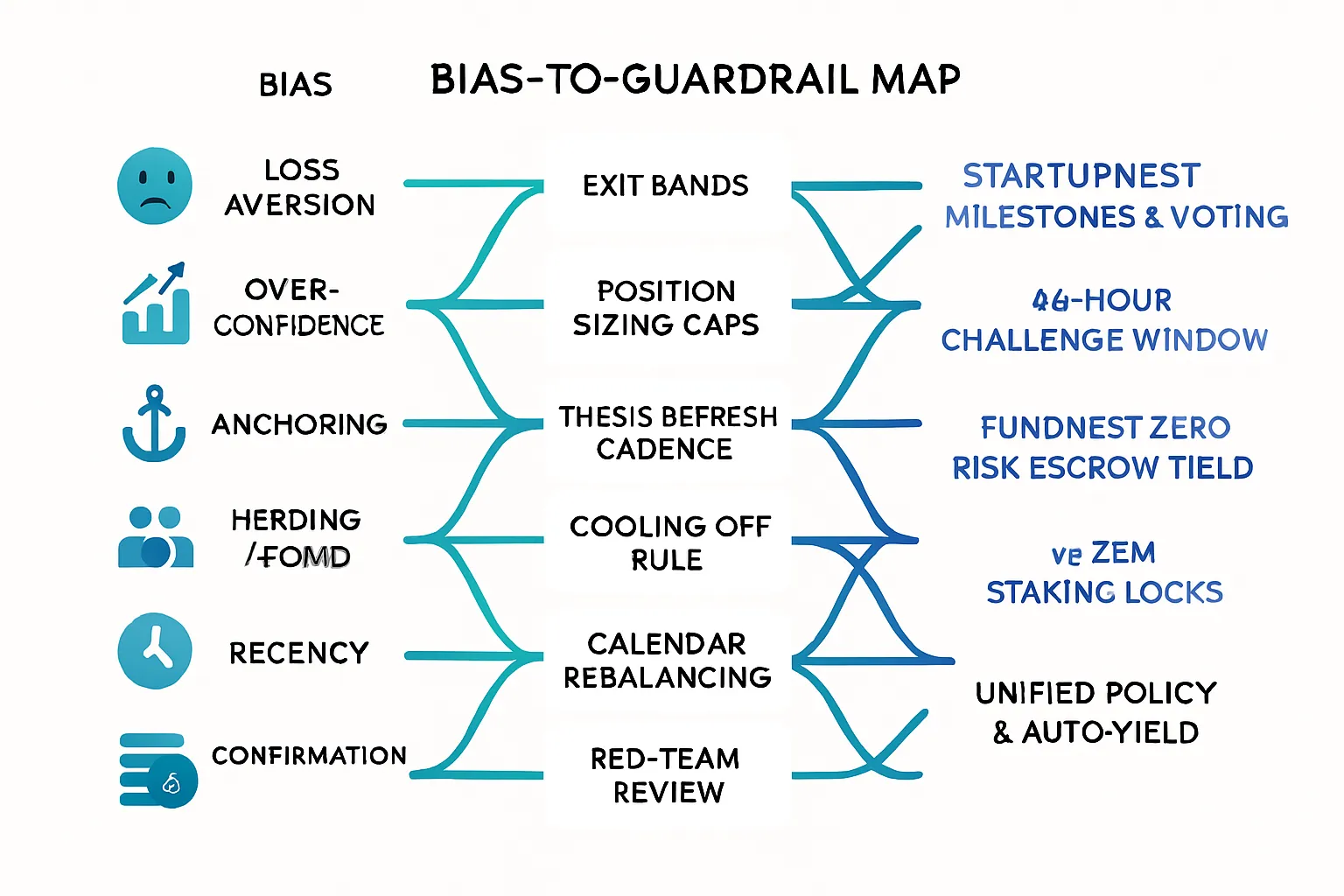

Mapping bias → guardrail → Zemyth feature

Loss aversion → exit bands & milestone unlocks.

FOMO → diligence checklist before allocation; StartupNest gating.

Recency → time‑boxed votes/reviews; no mid‑cycle changes.

Overconfidence → team review, size caps; veZEM lockups.

Anchoring → 90‑day thesis refresh; sequential milestones enforce “current facts.”

Confirmation → red‑team memo; investor voting + moderator checks.

Mental accounting → unified policy; FundNest Zero Risk for idle capital.

Bias → Cost → Guardrail → Zemyth Rail

Bias | Typical Cost to Money Returns | Guardrail/System | Zemyth Feature(s) | What to Set Up in 10 Minutes |

|---|---|---|---|---|

Loss aversion (disposition) | Selling winners early; riding losers into large drawdowns; 1–2%+ annual “behavior gap” | Hard exit bands; trailing stops; scheduled rebalancing; thesis-based exits | StartupNest milestone unlocks; 48‑hour challenge window; shutdown vote + refunds | Define exit bands in broker; add “thesis break” checklist; enable rebal alerts; learn challenge/vote flow |

Overconfidence | Overtrading, oversized bets, ignoring base rates → volatility and blow‑ups | Max position size caps; trade count limits; decision journal with base‑rate box | Investor voting weight checks; milestone gating; veZEM lockups encourage long‑term horizons | Set 5% cap per position; limit to 1–2 trades/day; duplicate journal template |

Anchoring | Clinging to entry price/ATH; ignoring new data; missed reallocations | 90‑day thesis refresh; valuation triggers; “buy it today?” test | Time‑bounded votes; one‑way state machines; sequential milestones | Calendar a quarterly thesis review; add valuation trigger to memo |

Herding/FOMO | Buying tops, panic selling bottoms; momentum without diligence | 24–48h cooling‑off rule; 3‑source diligence + written bear case; starter sizing | Moderator approval; StartupNest gating; pivot exit windows | Turn on cooling‑off in your rules; add “3 sources + bear case” checklist; starter size = 1–2% |

Recency bias | Chasing hot streaks; abandoning allocation after short slumps | Auto‑rebalance (calendar or ±20% bands); long‑lookback dashboards (5–10y) | 14‑day voting windows; fixed review cadences; no mid‑cycle changes | Enable auto‑rebalance; add long‑term return widget to your dashboard |

Confirmation bias | Ignoring red flags; lopsided research; fragile theses | Red‑team step; pre‑mortem; require a credible contrarian source | Community voting + moderator checks; transparent on‑chain evidence | Add “contrarian source” field; write a 3‑minute pre‑mortem for each idea |

Mental accounting | Idle cash drag; hidden concentration across silos | Unified IPS; single portfolio view; auto‑yield for idle dollars | FundNest Zero Risk escrow yield; unified rails for capital parking | Route idle USDC/USDT to Zero Risk; tag all holdings under one policy |

When to override (rarely) and how to document it

Define “override‑eligible” cases (e.g., regulatory shock, fraud discovery, existential thesis break).

Log exceptions with time, reason, data, decision, and outcome after 30/90 days.

Cap overrides (e.g., max 2 per quarter) to protect their money and your money from impulse.

TL;DR: Don’t fight biases with willpower. Install defaults, checklists, and on‑chain rails so your money and investment strategy stays disciplined - automatically.

Ready to lock in better habits and steadier money returns? Get started with Zemyth: https://zemyth.app

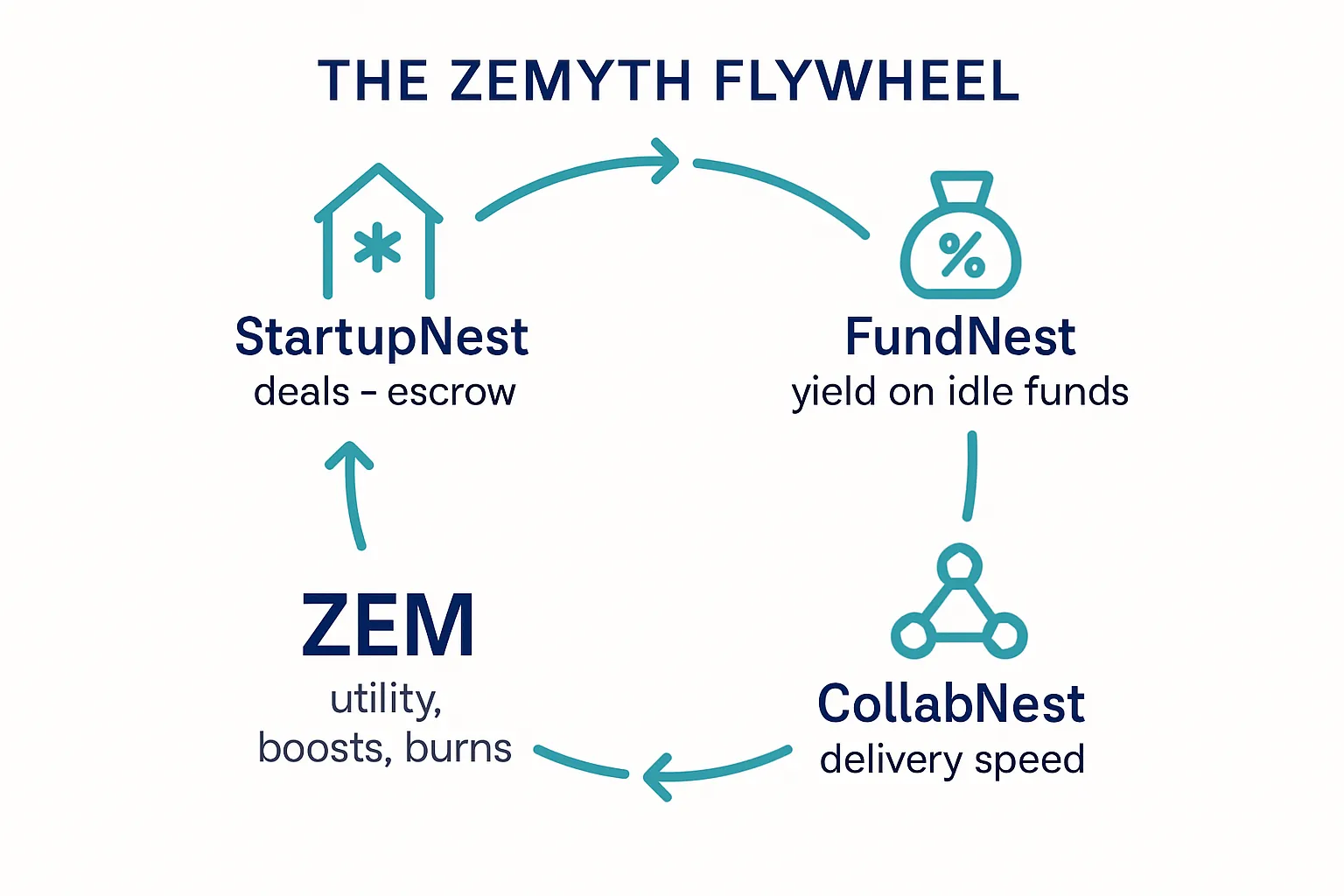

Automation and smart nudges: stacking the odds with Zemyth

Automate the base plan

Auto‑DCA to core holdings; default rebalancing so your allocation stays aligned without guesswork.

Park idle cash in yield via FundNest Zero Risk to cut cash drag and keep money working between milestones.

Time windows that tame impulses

StartupNest milestone votes run in 14‑day windows with 48‑hour challenge periods and inactivity rules that protect capital from drift.

Voting hold requirements curb flash/FOMO attacks by ensuring only committed positions can vote.

Commitment devices that align behavior

veZEM lockups and NFT staking reinforce long‑term thinking with yield boosts and status benefits for sticking to the plan.

Smart nudges, not noise

Calendarized prompts for quarterly reviews, rebalancing checks, and thesis refreshes - not dopamine‑drip price pings.

"Participants in 'Save More Tomorrow' raised average savings rates from 3.5% to 13.6% over 40 months through automatic escalation and commitment devices." - Source

15‑minute implementation

Connect wallet, choose risk tier, set allocations, enable reminders.

Route idle USDC/USDT to FundNest Zero Risk for base yield.

Define exit bands and review cadence once; let automation handle the rest.

Stake ZEM/veZEM for boosts and long‑term alignment across StartupNest and FundNest.

Protect their money and your money with smart defaults that compound discipline. Start now at https://zemyth.app

The decision playbook: one-pagers, if–then rules, and exit bands

Turn money and investment psychology into a repeatable system. This playbook removes guesswork, reduces bias, and protects their money and your money with clear rules you’ll actually follow.

7-step flow from idea to executed position

Hypothesis + base rates

Define the core thesis in one sentence. Add a base-rate snapshot: “Historically, assets like this deliver X–Y% annualized with Z% drawdowns.”

Sources: long-run indices, factor studies, comparable cohorts.

Valuation range + catalysts

Set a conservative–base–bull valuation range and time horizon.

List 3–5 catalysts (product/milestone, regulation, adoption, margin inflection).

Sizing rules + max loss

Convert conviction and risk into size: target weight, max position cap (e.g., 5%), risk-per-trade (e.g., 0.5% of portfolio).

Define maximum loss per idea before auto‑exit.

Entry ladder + DCA plan

Predefine entry tranches (e.g., 40/30/30) and DCA triggers (price/fundamental/technical).

No same-day impulse full-size buys.

Exit bands (profit and protection)

Protection: hard stop (e.g., −15% from entry or thesis break); trailing stop variant as price rises.

Profit: trim bands (e.g., +25% trim 20%; +50% trim to target weight; at +75%, raise stop to breakeven+).

Kill‑switch conditions

Non‑negotiables that force immediate exit or pause (e.g., fraud, governance failure, liquidity collapse, roadmap miss).

Post‑mortem date

Schedule a 30/90‑day review to score thesis vs. reality; capture lessons to improve money returns.

Templates you’ll reuse

One‑page investment memo: what (asset), why (edge), base rates, valuation range, risks, catalysts, alt hypothesis, exit rules.

Red‑team checklist: “What would prove me wrong?” “What am I ignoring?” “Why might consensus be right?”

Quarterly review script: keep/trim/exit with if–then rules; re-rate conviction; rebalance to policy.

Investment Decision Checklist (1‑pager)

Step | Prompt (short, actionable) | Your Answers |

|---|---|---|

1) Hypothesis + base rates | State the thesis in one sentence. Add 10-year base rates (returns, drawdowns) for similar assets. | [Type here] |

2) Valuation range + catalysts | Define conservative/base/bull targets with horizon; list 3–5 catalysts you require. | [Type here] |

3) Sizing rules + max loss | Target weight, max cap (e.g., 5%), risk per trade (e.g., 0.5%), portfolio max drawdown. | [Type here] |

4) Entry ladder + DCA plan | Tranche plan (e.g., 40/30/30) and DCA triggers (price/fundamental/time-based). | [Type here] |

5) Exit bands (profit & protection) | Protection stop (e.g., −15% or thesis break), trailing stop logic, profit trim bands and %s. | [Type here] |

6) Kill‑switch conditions | Binary events that force exit/pause (fraud, governance failure, liquidity, milestone miss). | [Type here] |

7) Post‑mortem date | Calendar the 30/90‑day review, metrics you’ll check, and decision (keep/trim/exit). | [Type here] |

Copy‑paste if–then rules you can use today

If price falls 15% from average entry OR thesis variable X breaks → exit next session, record reason.

If position weight > target by 20% band → trim back to target; redeploy per policy.

If catalyst A fails by deadline → freeze adds; reassess valuation range; reduce size by 50%.

If price is +25% vs. entry → trim 20%; raise stop to −5% from current; at +50% → trim to target weight.

If three independent sources do not corroborate key claim → no entry (cooling‑off 24–48h).

If two consecutive quarterly misses vs. thesis KPIs → move to hold/exit list for next rebalance.

How this stacks with Zemyth guardrails (quick pointers)

StartupNest milestones and 14‑day votes map to your catalyst and review cadence; 48‑hour challenges protect capital during unlocks.

FundNest Zero Risk parks idle cash to cut cash drag while you DCA and wait for milestones.

veZEM locks and NFT staking act as commitment devices that align behavior with long‑term plans.

TL;DR: Decisions beat predictions. Ship one clean page, pre‑commit your if–then rules, and let exit bands enforce discipline so your money and investment plan stays consistent.

Ready to turn this playbook into action and protect their money and your money? Start with Zemyth: https://zemyth.app

Case studies: from bias tax to basis points back

Case 1 - Herding/FOMO vs milestone gating

Situation: A hype token prints new ATHs; social feeds scream “don’t miss it.” Without guardrails, investors buy high, then panic-sell on the first −25%.

Guardrail: StartupNest tranche discipline - capital releases only after milestones pass investor votes; 48‑hour challenge window before funds move.

Outcome: Avoids top‑tick entries; deploys only after verifiable proof. Basis points saved can be redeployed into vetted deals with clearer risk/return.

Case 2 - Anchoring to IPO price vs fresh valuation

Situation: Investor anchored to an IPO buy at $30 “waits to break even” while fundamentals deteriorate.

Guardrail: Re‑underwrite on current data (cash flow, runway, competitive position). If thesis breaks, exit; rotate into higher‑EV ideas.

Outcome: Frees trapped capital; improves expected value by prioritizing where each new dollar compounds best.

Case 3 - Overconfidence day‑trading vs base yield + optionality

Situation: Churn, slippage, and fees erode returns in a high‑frequency sprint after a lucky streak.

Guardrail: Park core cash in FundNest Zero Risk for base APY; size a small “explore” sleeve for selective bets with if–then adds/exits.

Outcome: A dependable base plus staged upside; fewer unforced drawdowns from overtrading.

Case 4 - Confirmation loop vs dissent checklist

Situation: Research folder is 90% bullish takes; red flags ignored.

Guardrail: Dissent checklist - require one credible contrarian, write a 3‑minute pre‑mortem, and specify data that would change size or exit.

Outcome: Theses become antifragile; position sizes reflect real, not imagined, conviction.

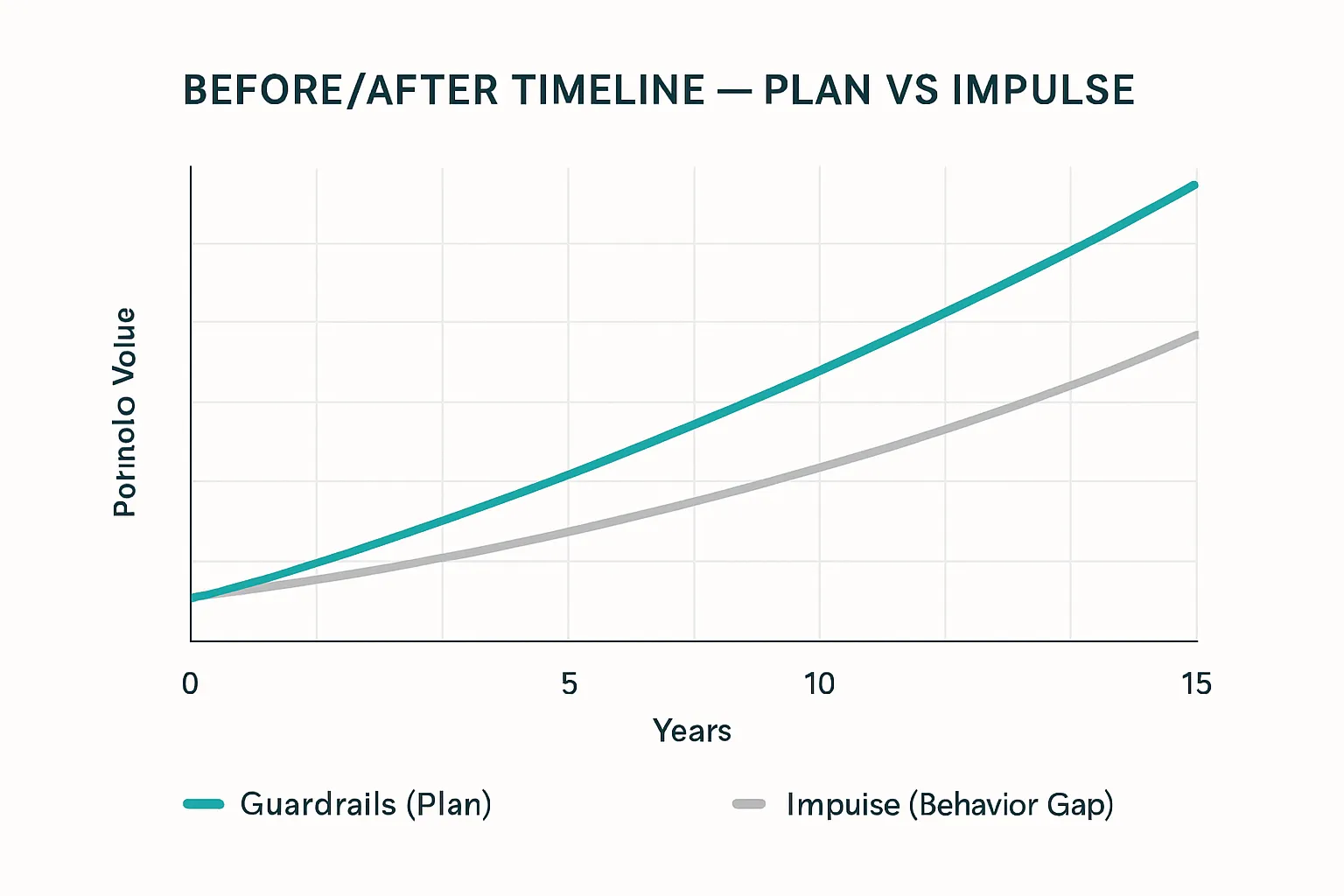

Before/after math

Behavior gap removed:

Impulse portfolio: 6.5% annualized for 15 years on $50,000 → ~$128,000.

Guardrailed plan: 8.0% annualized for 15 years on $50,000 → ~$158,000.

Difference: ~$30,000+ - pure discipline dividend.

Scale it up:

On $250,000, the same 1.5% delta over 15 years is ~$150,000+ of reclaimed value.

Compounding lesson:

A small bias tax repeated becomes a big number. Convert biases into rules, and those basis points flow back to you.

CTA: Put milestone discipline and base yield to work for your portfolio today - start at https://zemyth.app

For founders, angels, and DAOs: protecting their money and your money

Why milestone‑gated capital protects both sides

Escrow + unlocks only on verifiable proof, with investor voting per milestone.

48‑hour veto windows catch late‑breaking risks before funds move.

Immutable terminal states (Completed, Failed, Abandoned, TGEFailed) stop rollbacks and clarify outcomes.

Liquidity and accountability via Investment NFTs

Voting rights (weight by tier), token claim rights at TGE, and refund/withdrawal rights in pivots or failure cases.

Secondary trading enables price discovery and exits without harming the project.

Transparent, auditable state machines track project progress end‑to‑end.

Speed without chaos: CollabNest cNFTs

Work‑to‑earn turns key tasks into Contribution NFTs - contributors earn tokens for shipped milestones.

Multi‑party verification and arbitration reduce disputes; staking by arbitrators aligns incentives.

Faster delivery → faster unlocks → fewer carrying costs for capital.

Reduce agency risk, increase trust

Clear rules, time bounds, permissionless checks (inactivity, TGE deadlines) minimize surprises.

Data‑driven cadence: 14‑day votes, 48‑hour challenges, 90‑day inactivity safeguards.

Alignment levers: veZEM boosts, fee discounts, burns - real usage drives value.

Want milestone discipline, yield on parked funds, and aligned talent - all on one rail? Start building on Zemyth: https://zemyth.app

Myths, FAQs, and quick answers about your money psychology

Common myths - busted

“I can’t automate because markets change daily.”

Automation handles the boring base (DCA, rebalancing, exit bands) so you can focus on true changes. You can still override with evidence, not impulse.

“Biases don’t matter if I’m smart.”

Money and investment psychology taxes smart people too. The behavior gap compounds whether you know it’s there or not.

“Checklists kill creativity.”

Checklists kill unforced errors. Creativity belongs in research; execution should be systematic to protect their money and your money.

"Vanguard’s Advisor’s Alpha estimates behavioral coaching can add up to about 2% in additional net returns annually." - Source

FAQs

Are these traps worse for traders or long‑term investors?

Different traps, same damage. Traders face overconfidence, FOMO, and recency daily; long‑term investors suffer anchoring, confirmation, and mental accounting. Guardrails (if–then rules, auto‑rebalance, thesis refreshes) reduce both.

How do I know if a rule is too rigid?

If it blocks action when the thesis or risk has clearly changed, it’s too rigid. Add a defined “override” clause: who approves, what data qualifies, and a post‑mortem within 30/90 days.

How often should I review exits and bands?

Quarterly is plenty for most; sooner only if the thesis variables change. Use ±20% rebalancing bands and a pre‑committed stop (e.g., −15% or thesis break).

What if my thesis changes mid‑cycle?

Update the memo, log the change, and adjust size per plan (reduce or exit). In StartupNest, use milestone votes and 48‑hour challenges to formalize pivots instead of ad‑hoc shifts.

How do Zemyth rails fit a traditional portfolio?

Think of Zemyth as guardrails:

FundNest Zero Risk = your cash sleeve earning base yield instead of sitting idle.

StartupNest = milestone‑gated exposure to venture‑like upside with escrow protection.

ZEM/veZEM = commitment devices and boosts that reward long‑term alignment.

Want discipline baked into your money and investment routine? Start with Zemyth guardrails now: https://zemyth.app

30-minute action plan: set your bias‑proof system today

In 30 minutes

Pick your base allocation and max drawdown.

Example: 60% core beta, 30% stable/yield, 10% explore; max portfolio drawdown 12–15%.

Write it into a one‑line Investment Policy: “I rebalance to 60/30/10 and keep losses within 15%.”

Turn on auto‑DCA and quarterly rebalancing.

Automate monthly contributions to core holdings; set calendar or ±20% bands for rebalancing.

Define exit bands (profit protects, loss guards) for top positions.

Loss guards: exit on thesis break or −15% from average entry.

Profit protects: trim 20% at +25%; raise stops as price advances.

Create a 1‑page memo template and paste the red‑team checklist.

Sections: what, why, base rates, valuation range, catalysts, risks, exit rules, “what proves me wrong?”

Schedule two review dates (mid‑year, year‑end) on your calendar.

Agenda: keep/trim/exit logic, allocation drift, thesis refresh. Protect their money and your money by sticking to the plan.

Add the on‑chain guardrails

Open Zemyth, explore StartupNest deals, and understand milestones.

Milestone‑gated releases, voting windows, and challenge periods enforce discipline beyond willpower.

Park idle funds in FundNest Zero Risk for base APY.

Cut cash drag; keep capital productive between unlocks or while you DCA.

Consider veZEM lockups to align long‑term incentives.

Boost yields, get fee discounts, and use lockups as a commitment device for better money returns.

Link-out CTA

Start now: https://zemyth.app

Conclusion: Control your psychology. Compound your money returns with Zemyth

Your edge isn’t secret information - it’s fewer unforced errors.

Replace willpower with rules, checklists, and automation.

Put your plan on rails: milestone‑gated capital, escrow yield, and aligned incentives.

Next steps: visit https://zemyth.app, connect your wallet, explore StartupNest, deposit to FundNest Zero Risk, and set your first review date.

Final CTA: Start protecting their money and your money today with Zemyth’s bias‑proof rails.