Intro + TL;DR: Monetary investment vs sweat equity

Monetary investment is cash put to work today; sweat equity is time, skills, and network converted into ownership. Angels typically invest their money in tranches tied to traction. Founders invest twice: first with sweat to create value, then with surgical cash where speed matters. The smartest start up investment strategies combine both - using cash through investment for externally priced needs and sweat for core IP and execution. Want the best of both worlds? Explore milestone-gated raises and work-to-earn on Zemyth: https://zemyth.app

"38% of startups cite 'ran out of cash/failed to raise new capital' as a reason for failure." - Source

What you’ll learn

Clear definitions of monetary investment (cash) vs sweat equity (time/skills) in startup investment.

How angels invest their money vs how founders invest cash and sweat.

Ownership math: dilution, vesting, and how to keep the cap table healthy through investment.

A practical framework for deciding when to favor cash or sweat at each stage.

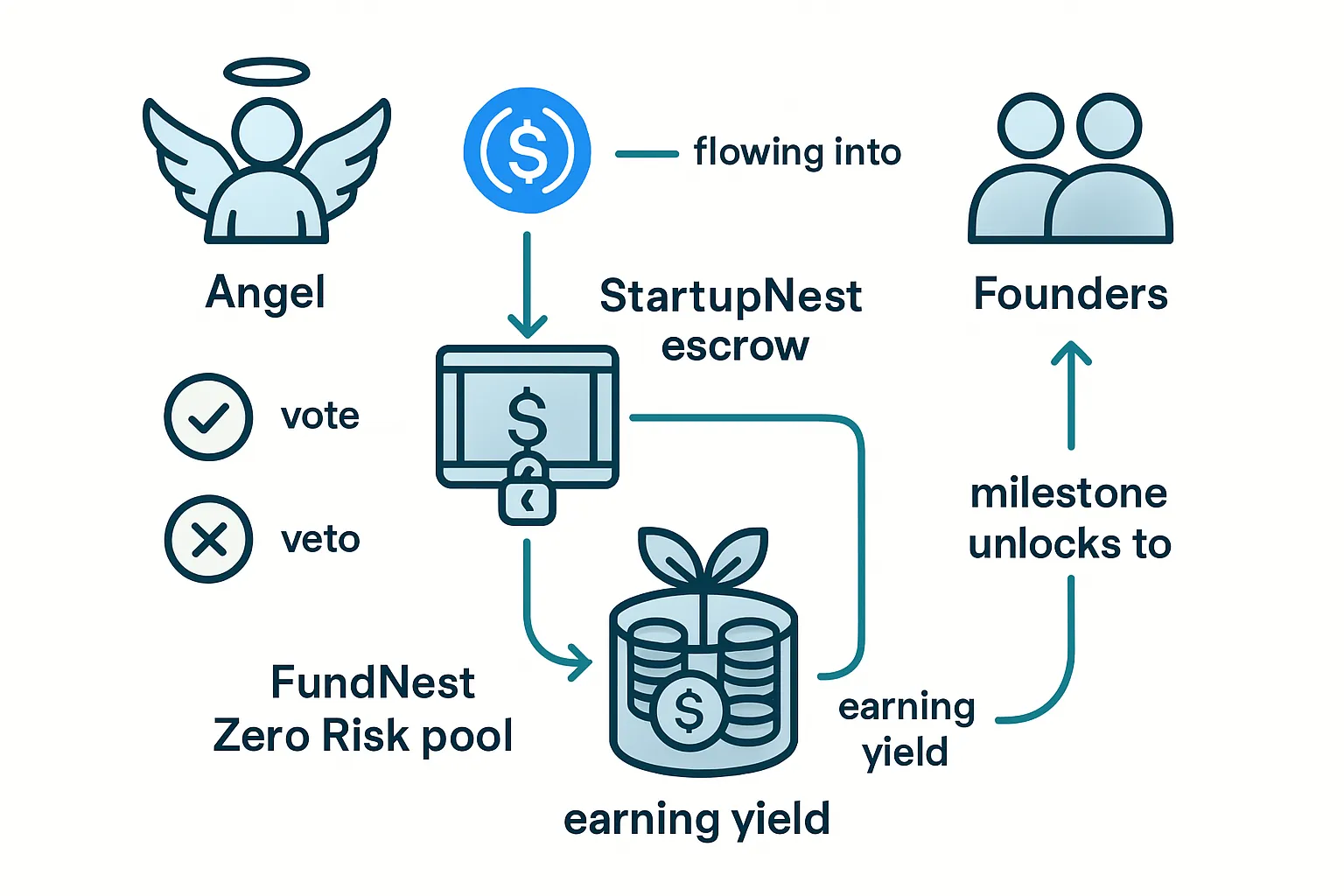

How to combine both on Zemyth (StartupNest + CollabNest + FundNest) to protect capital, reward contributors, and speed milestones.

TL;DR

Money de-risks operations now; sweat preserves cash and aligns long-term incentives.

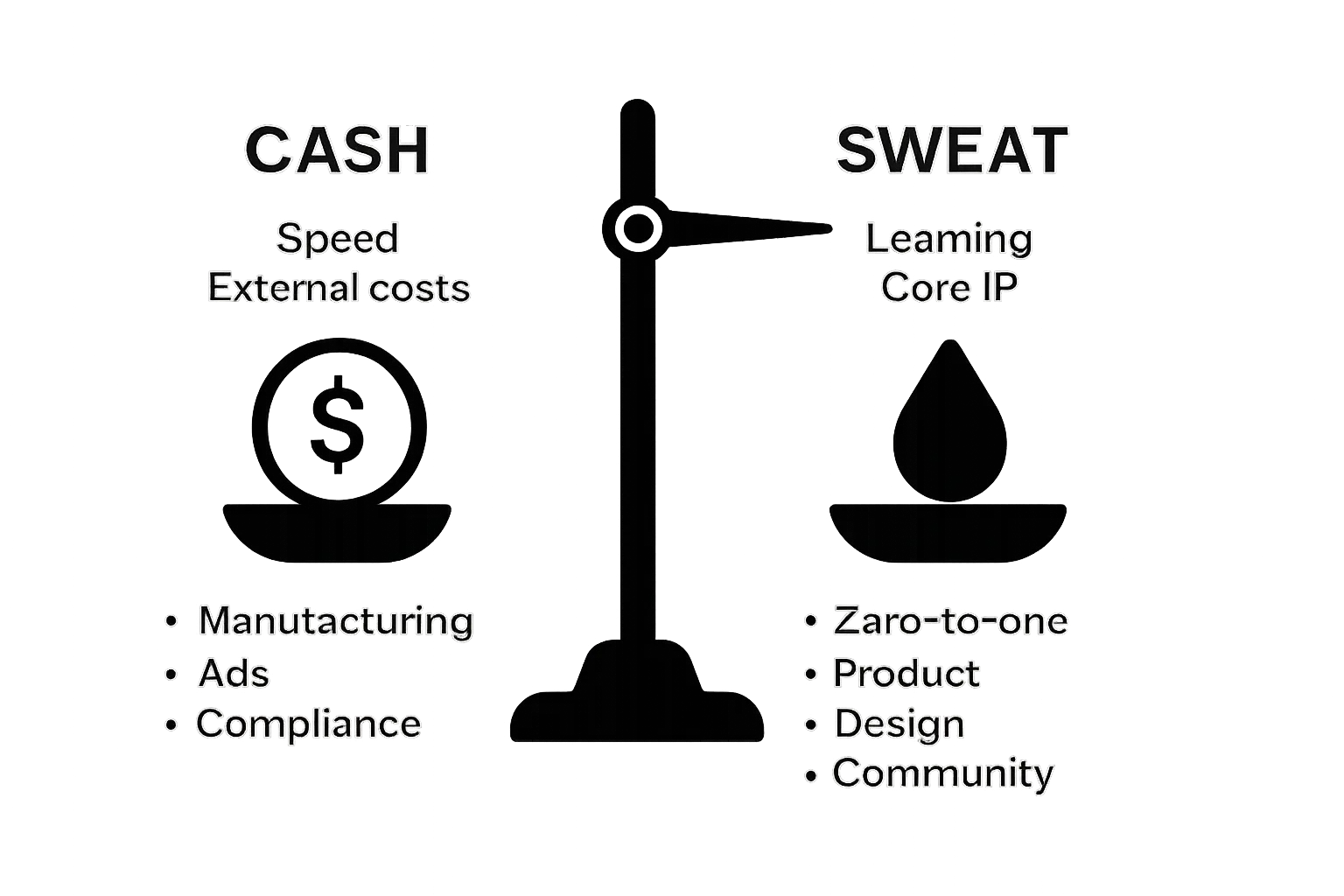

Use cash for speed-critical, externally priced needs (manufacturing, ad spend); use sweat for core-IP, builder roles.

Lock equity behind vesting and milestone proofs to keep everyone honest.

Angels: invest their money in clear tranches tied to progress; founders: invest sweat first, cash surgically, and protect future raises with an option pool.

Zemyth lets you do both: milestone-gated funding (StartupNest), work-to-earn (CollabNest), and yield on idle escrow (FundNest).

Cash vs sweat: definitions, incentives, and where each shines

Definitions that matter for the cap table

Monetary investment: founders/angels contribute cash; priced via pre/post-money valuation; returns through equity or tokens.

Sweat equity: contributors trade time, skills, or network for ownership; typically issued as restricted stock, options, or token allocations.

Incentive design

Cash accelerates timelines and buys external resources; investors expect risk-adjusted returns.

Sweat aligns day-to-day delivery with upside; vesting and milestone proofs prevent unearned windfalls.

Where cash wins

Externally priced inputs: paid marketing, tooling, compliance, manufacturing, cloud at scale.

Where sweat wins

Zero-to-one product, design, GTM experiments, community, and ops where learning velocity beats dollars spent.

Practical overlap

Most great rounds mix both: cash covers hard costs; sweat de-risks milestones so every dollar invested works harder. This is how angels invest their money through investment startups: fund the must-pay line items while founders invest sweat to validate and stretch the runway in a start up investment.

Caption: YC’s guidance: equal-but-vested splits often work because the real work is ahead. Make exceptions when there’s clear cash/sweat asymmetry (e.g., one founder invests significant capital, or commits full-time vs. part-time) - but still vest everything.

"Equity should be split equally because all the work is ahead of you." - Source

Ownership math 101: from garage to VC - and where sweat fits

Assumptions

Two co-founders start 50/50, 4-year vest, 1-year cliff; 20% option pool reserved pre-funding.

Family & Friends (F&F) $15k, Angel $200k on $1.0M pre, VC $2.0M on $4.0M pre (illustrative only).

One key contributor earns sweat equity tied to shipped milestones (allocated from the option pool as milestones are accepted).

Walkthrough

Pre-seed (garage): align on roles, set equal-but-vested splits (50/50, 4-year vest, 1-year cliff); document IP assignment.

Post-incorporation: reserve a 20% option pool before outside funding to hire and reward contributors without scrambling later.

F&F: small check with clean docs (SAFE or common at a fixed slice); keep the pool intact and vesting standard.

Angel: negotiate pre-money; ensure the pool is sized pre-round so you don’t get surprised by an investor-mandated pool expansion.

VC: expect larger dilution; arrive with traction and milestone proofs to justify valuation and protect founder ownership.

Sweat contributor: equity unlocks only when milestone acceptance criteria are verifiable (e.g., on-chain proofs or signed acceptance). Allocate grants from the pool; vest on delivery.

Cap-table progression (illustrative)

Stage | Total Shares (normalized) | Founder A | Founder B | Sweat Contributor | Option Pool | F&F | Angel | VC |

|---|---|---|---|---|---|---|---|---|

Garage (pre-incorporation intent) | 100% | 50.00% | 50.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

Post-incorporation (pool reserved) | 100% | 40.00% | 40.00% | 0.00% | 20.00% | 0.00% | 0.00% | 0.00% |

Post-F&F | 100% | 38.00% | 38.00% | 0.00% | 19.00% | 5.00% | 0.00% | 0.00% |

Post-Angel ($1.0M pre/$200k) | 100% | 31.67% | 31.67% | 0.00% | 15.83% | 4.17% | 16.67% | 0.00% |

Post-VC ($4.0M pre/$2.0M) | 100% | 21.11% | 21.11% | 3.00% | 7.56% | 2.78% | 11.11% | 33.33% |

Footnotes:

Percentages rounded; minor rounding error possible.

F&F modeled as 5% for $15k; actual terms vary. Angel = 16.67% on $1.0M pre/$200k. VC = 33.33% on $4.0M pre/$2.0M.

Option pool created pre–outside funding (20%); no top-ups modeled. Sweat contributor receives 3.00% from the pool upon milestone acceptance at the Post-VC stage.

All founder and contributor equity subject to 4-year vest with 1-year cliff; unvested shares subject to repurchase at cost.

Security types simplified (e.g., preferred vs common) for clarity; in practice, investors typically hold preferred.

Takeaway

Dilution is healthy when valuation and velocity compound faster than ownership shrinks. Monetary investment buys the externally priced speed you need; sweat equity de-risks milestones so every dollar invested works harder. Lock both behind vesting and milestone proofs so sweat becomes accretive, not risky, as you progress from start up investment in the garage to institutional rounds where angels and VCs invest their money through investment startups.

Pricing sweat fairly: a repeatable conversion formula (+ examples)

The formula

Define Market Salary Equivalent (MSE) per role.

Compute Cash Deferred (CD) = MSE × % unpaid × months.

Apply Risk Multiplier (RM) = 1.0–2.5 (stage, scope, scarcity).

Add IP/Outcome Bonus (IOB) for shipped outcomes (0–30% of CD×RM).

Equity % ≈ (CD×RM + IOB) / Pre‑Money Valuation (pre-round) - then subject to vesting and milestone acceptance.

Example scenarios

Senior engineer

Inputs: $12k/month MSE × 6 months × 100% unpaid; RM 1.8; IOB 0%; pre‑money $3M

CD = $12,000 × 1.0 × 6 = $72,000

Implied $ Value = CD × RM + IOB = $72,000 × 1.8 + $0 = $129,600

Indicative Equity ≈ $129,600 / $3,000,000 = 4.32% (then vest + milestone-based unlocks)

Fractional CMO

Inputs: $8k/month MSE × 4 months × 50% unpaid; RM 1.3; IOB 20% after qualified pipeline target; pre‑money $3M

CD = $8,000 × 0.5 × 4 = $16,000

Implied $ Value = ($16,000 × 1.3) + 20% = $20,800 + $4,160 = $24,960

Indicative Equity ≈ $24,960 / $3,000,000 = 0.83% (vest + milestone acceptance)

Sweat-to-Equity Quick Calculator

Role archetype | MSE/month | % Unpaid | Months | RM | IOB % | Implied $ Value | Pre‑money $2M | Pre‑money $3M | Pre‑money $5M |

|---|---|---|---|---|---|---|---|---|---|

Founding Engineer | $12,000 | 100% | 6 | 1.8 | 0% | $129,600 | 6.48% | 4.32% | 2.59% |

Founding Designer | $9,000 | 100% | 6 | 1.6 | 10% | $95,040 | 4.75% | 3.17% | 1.90% |

Fractional CMO | $8,000 | 50% | 4 | 1.3 | 20% | $24,960 | 1.25% | 0.83% | 0.50% |

BizDev Lead | $7,000 | 70% | 5 | 1.2 | 15% | $33,810 | 1.69% | 1.13% | 0.68% |

Notes:

Implied $ Value = (MSE × % Unpaid × Months × RM) + IOB% of that product. Percentages are illustrative and rounded.

All equity is subject to standard vesting (e.g., 4 years, 1‑year cliff) and objective milestone acceptance.

Keep rounds financeable by granting from a defined sweat/option pool; avoid ad‑hoc grants that bloat the cap table.

Guardrails

Cap total sweat pool (e.g., 10–15% of fully diluted).

Tie unlocks to objective milestones; no milestone, no equity.

Re‑price RM down as risk falls between rounds (e.g., after PMF or revenue).

Result

This conversion makes sweat a transparent, right‑sized slice of ownership while keeping the round fundable. Use monetary investment for externally priced speed; allocate sweat for core IP and learning loops - then codify both on Zemyth: milestone‑gated cash (StartupNest) and contribution‑based equity (CollabNest), with idle escrow earning yield (FundNest) so every dollar they invest works harder through investment in startups.

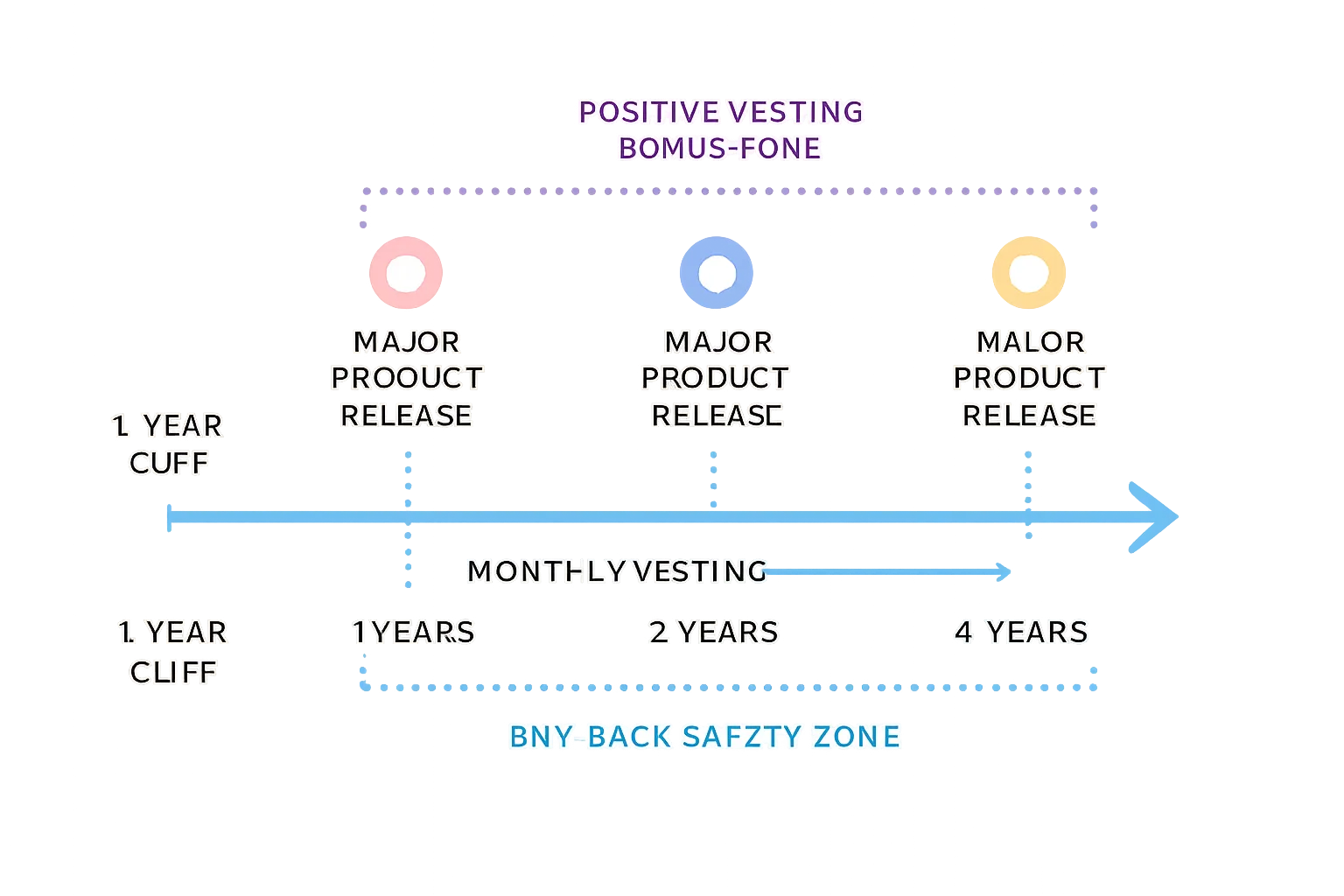

Vesting, cliffs, and dynamic rebalancing that keeps things fair

Must-haves

Standard founder vesting: 4 years, 1-year cliff, monthly thereafter.

Positive vesting: exceed targets → consider extra grants/bonuses.

Negative vesting/buy-backs: if performance drops or someone departs early, enable low-cost repurchase of unvested or even some vested shares (subject to local law).

Dynamic adjustments

Pivot or scope changes → re-point milestones and update sweat allocations prospectively.

Performance frameworks → use objective KR/OKRs to avoid emotional equity fights.

Tax tip (jurisdiction-specific)

Where applicable (e.g., U.S.), consider 83(b) elections for early restricted stock to avoid adverse tax later; consult counsel.

Zemyth angle

StartupNest enforces milestone proofs before funds unlock; CollabNest issues Contribution NFTs that vest with verified work - reducing equity regret.

Pitfalls and protections: legal, tax, valuation, and option pools

Common traps

No vesting or cliffs → early departures lock up cap tables.

Under-sized option pool → hard to hire; investors will push to resize pre-money (hurts founders).

Mispriced sweat → later investors balk; disputes escalate.

Tax missteps → unexpected liabilities for equity recipients.

Protections

Founder service agreements + IP assignment.

Option pool set before priced rounds (often 10–20%).

Clear milestone definitions for sweat unlocks.

Use SAFEs/convertibles thoughtfully; model dilution under multiple valuation caps.

"An 83(b) election must be filed no later than 30 days after the date the property is transferred." - Source

Note: Local-jurisdiction rules vary; non-U.S. readers should consult local tax counsel.

Audit readiness

Keep a clean, real-time cap table; document all grants, vesting schedules, board consents, and milestone approvals.

Zemyth support

On-chain state machines for milestones, time-bounded votes, and permissionless triggers reduce ambiguity and protect all parties across monetary investment and sweat equity - making it easier for angels to invest their money through investment in startups, and for founders to allocate sweat fairly without derailing future rounds.

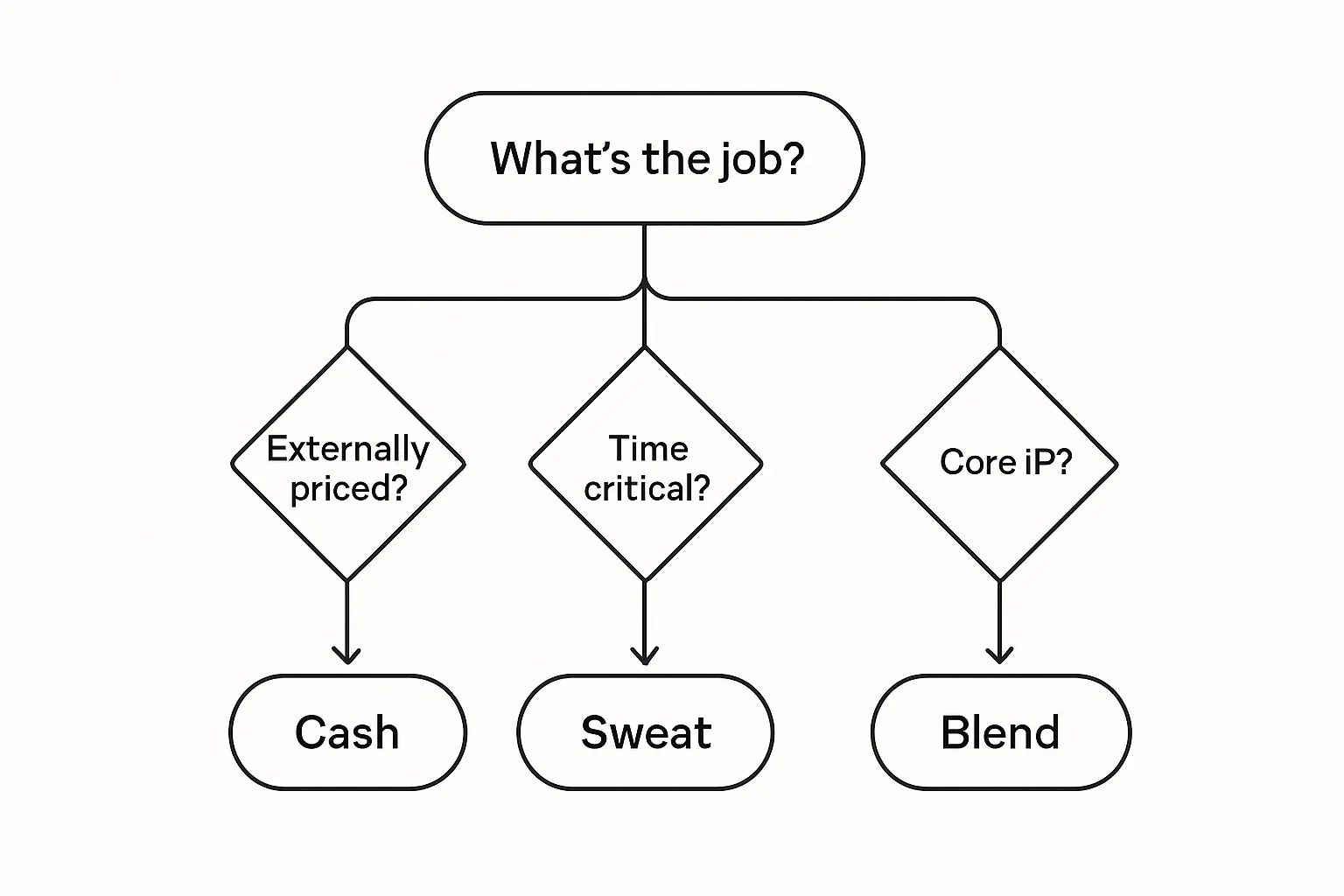

When to favor cash vs sweat: a simple decision framework

Ask these questions

Is the work externally priced with little learning value? Favor cash.

Is the work core IP or hypothesis-driven? Favor sweat.

Will delay cost more than dilution? Favor cash.

Is runway < 6 months and revenue < 3 months away? Blend: short-term cash + tightly scoped sweat milestones.

Stage-by-stage heuristics

Idea/Pre-seed: max sweat, minimal cash; pay only hard vendors; reserve option pool.

Angel/Seed: mix; cash for growth motion; sweat for product velocity.

Series A: cash-heavy; sweat for specialized high-upside roles with clear KPIs.

Economic test

Compare implied equity cost of sweat vs the cash alternative at current pre-money. Choose the cheaper route that doesn’t slow learning.

Zemyth fit

Lock cash in StartupNest escrow and earn yield via FundNest while you ship sweat-based milestones on CollabNest.

Angels: how to invest your money without crushing founder ownership

Angel checklist

Tie capital to milestone unlocks (weeks, not months) with objective acceptance criteria.

Right-size the option pool pre-money; avoid surprise founder dilution.

Choose instruments (SAFE/convertible vs equity) based on speed and clarity; model conversion scenarios.

Add value beyond the wire: customer intros, hiring, and governance support.

Zemyth playbook

StartupNest: invest their money into NFT positions with voting rights; funds unlock per milestone; emergency protections (veto, shutdown votes, refunds).

FundNest: while capital sits in escrow, route to Zero Risk pools to earn yield; share upside with founders/investors.

ZEM: lock for fee discounts and priority access to quality deals.

Outcome

Higher capital efficiency, lower fraud risk, better alignment with builders - without over-dilution at seed.

Founders: stack sweat equity with smart, surgical cash

Blueprint

Use sweat for core build; cash for scale levers (ads, compliance, manufacturing slots).

Sweat drives zero-to-one learning and preserves runway; deploy monetary investment where time-to-market is the edge.

Hire via CollabNest: contributors earn cNFTs tied to specific milestones; no salary burn until value is delivered.

Define objective acceptance criteria; pay in ownership only after shipped outcomes are verified.

Negotiate with angels on StartupNest for tranche-based unlocks that match your roadmap.

Milestone-gated releases protect both sides and help angels invest their money without over-diluting you.

Keep an updated hiring and option pool plan; communicate runway and dilution transparently.

Size your pool pre-round (10–20% typical) and model dilution across SAFE caps and priced rounds.

ZEM utility for founders

Fee discounts across Zemyth products; stake ZEM to boost FundNest yields and tap vote-to-earn.

Park escrow in Zero Risk pools so idle cash compounds while you ship sweat-based milestones.

Hold ZEM for priority access and lower fees on investment startups where they invest through investment.

Result

Faster shipping, cleaner cap table, reduced raise amounts, stronger founder ownership going into Series A.

Blend sweat for core IP and surgical cash for externally priced inputs - then run it all on Zemyth for milestone-gated accountability and capital efficiency. Explore: https://zemyth.app

Conclusion: Put money and sweat to work on Zemyth (CTA)

Cash and sweat aren’t rivals - they’re complementary levers. Use cash when speed and external pricing dominate; use sweat when learning and core IP matter most. Back it all with vesting, milestones, and clean documentation.

Angels, invest their money with milestone gates so every dollar compounds through investment; founders, translate sweat into ownership only when value is shipped.

Zemyth brings it together: raise in tranches on StartupNest, turn work into equity on CollabNest, and earn yield on idle escrow via FundNest - all aligned by ZEM tokenomics.

Take the next step now:

Explore deals or launch your raise on Zemyth: https://zemyth.app

Ship milestones faster with work-to-earn contributors; protect every tranche with on-chain votes and safety windows.

Make every dollar and every hour count.