TL;DR: Milestone‑Gated Rounds vs. Traditional VC (and why Fund Nest keeps capital productive)

TL;DR

Traditional VC over-rewards pitch theater and under‑prices execution risk. Deals take long to close, progress is opaque, and capital sits idle between raises.

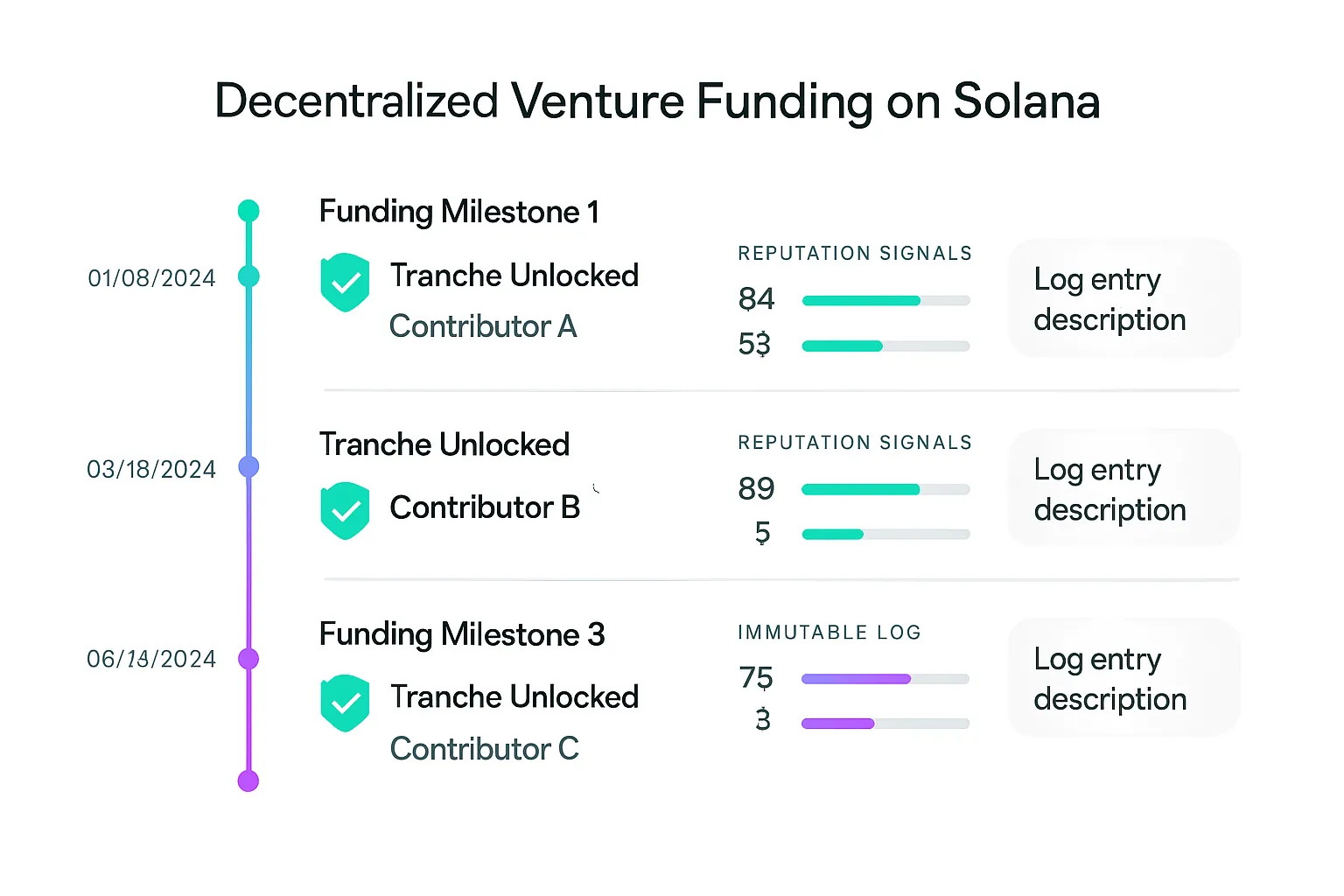

Decentralized venture funding on Solana flips the script: milestones are defined upfront, proof is verified on‑chain, and tranche unlocks keep founders honest while giving contributors line‑of‑sight to progress.

Zemyth’s Fund Nest is the liquidity base layer: contributors earn daily yield while waiting for milestones or scouting deals, so capital is always compounding instead of collecting dust.

"A single $40B deal turned what would’ve been a 36% QoQ funding drop into $80B+ total; deal counts continued to decline as investors got more selective." - Source

Side‑by‑Side: Decentralized Milestone Funding vs. Traditional VC

Dimension | Milestone‑Gated (Zemyth) | Traditional VC |

|---|---|---|

Access | Open, retail venture access via decentralized venture funding on Solana; contributor reputation surfaces credible leads and aligns behavior. | Gated by warm intros, partner bandwidth, and geography; retail is largely excluded from startup fundraising. |

Speed to Capital | Tranche unlocks as milestones are verified on‑chain; capital lands in days, not months. | Long diligence cycles and committee politics; months between term sheet and close. |

Proof Standard | On‑chain proof of execution (builds shipped, users acquired, revenue milestones) before each release of funds. | Slide decks, selective metrics, and trust‑me narratives until the next board update. |

Transparency | Real‑time, on‑chain progress and contributor reputation; clear rules, clear state. | Opaque reporting cadence; information asymmetry between insiders and everyone else. |

Capital Efficiency | Capital follows execution; unused funds park in Fund Nest earning daily yield between milestones so nothing sits idle. | Large, upfront checks; cash sits on balance sheets and in reserves waiting for the next round. |

Risk Controls | Milestone‑gated rounds, pause/stop mechanics, and tranche sizing reduce downside; contributors choose exposure per milestone. | Binary round risk; surprises surface late (down rounds, bridge dependence, runway shocks). |

How Milestone‑Gated Venture Works: On‑Chain Proof, Tranche Unlocks, and Contributor Reputation

Zemyth turns startup fundraising into a disciplined, verifiable loop. Milestone‑gated rounds on Solana align capital with execution, using on‑chain proof and tranche unlocks to keep founders focused and contributors protected - all while Fund Nest provides daily yield so idle capital stays productive.

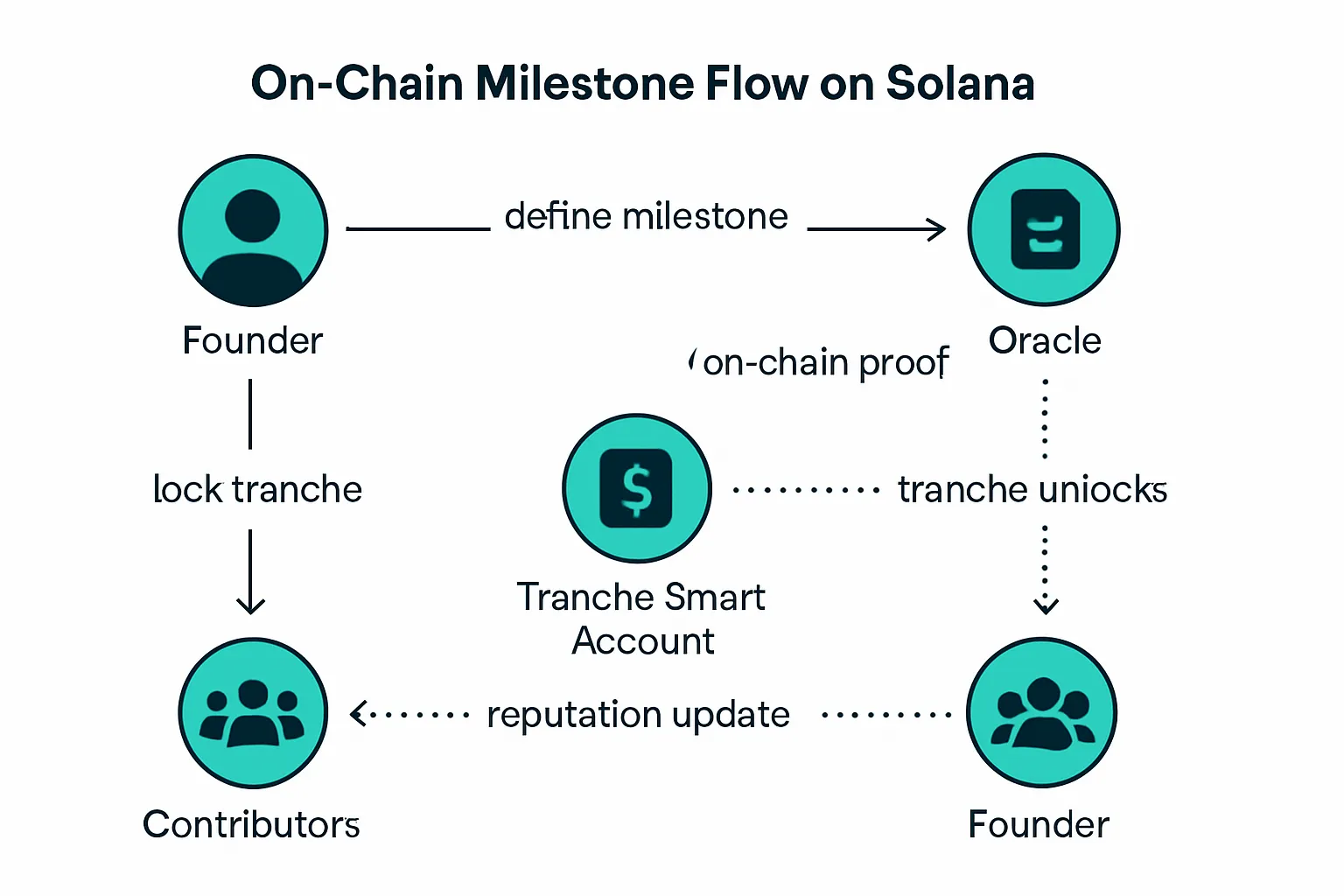

The core loop: Define → Verify → Unlock

Define: Tranches map to objective milestones - build shipped, users acquired, revenue milestones - each with explicit acceptance criteria and data sources (e.g., Git commits, RPC metrics, signed revenue attestations).

Verify: Proof is submitted and verified on‑chain via oracles and attestations. No proof, no unlock.

Unlock: When criteria pass, the Tranche Smart Account releases funds automatically; contributors see the state change in real time.

Rinse and repeat: Each milestone is a checkpoint, not a vibe check - keeping startup fundraising tight, transparent, and execution‑led.

On‑chain proof on Solana

Programmatic oracles: Usage telemetry, revenue attestations, code‑commit proofs, and signed data feeds provide verifiable progress for milestone‑gated rounds.

Low‑cost settlement: Solana’s speed and fees enable frequent proofs and granular tranche unlocks without overhead.

Real‑time state: On‑chain proof updates the round’s scorecard instantly; contributors monitor progress without waiting for board decks.

Contributor reputation and transparent scorecards

Reputation by outcomes: Founders and contributors earn on‑chain reputation from verified milestones - performance, not pitch theater.

Public histories: Every milestone, proof, and unlock builds a transparent track record that compresses diligence cycles and improves retail venture access.

Incentive alignment: Contributors who consistently surface strong deals and vote accurately on proofs earn status and follow‑on allocation priority.

Why this beats pitch‑driven rounds

Lower agency risk: Funds are released only when milestones are met; capital follows execution instead of hype.

Capital efficiency: Tranches match the build cadence. Between milestones, unused funds can sit in Fund Nest earning daily yield - capital never idles.

Faster feedback loops: Clear, on‑chain proof standards and tranche unlocks keep teams shipping and contributors engaged.

Better market access: Decentralized venture funding opens startup fundraising beyond the old gatekeepers while preserving discipline via on‑chain verification and contributor reputation.

"Milestone financing conditions future funding on achieving specific milestones and can mitigate agency problems compared to open‑ended round financing." - Source

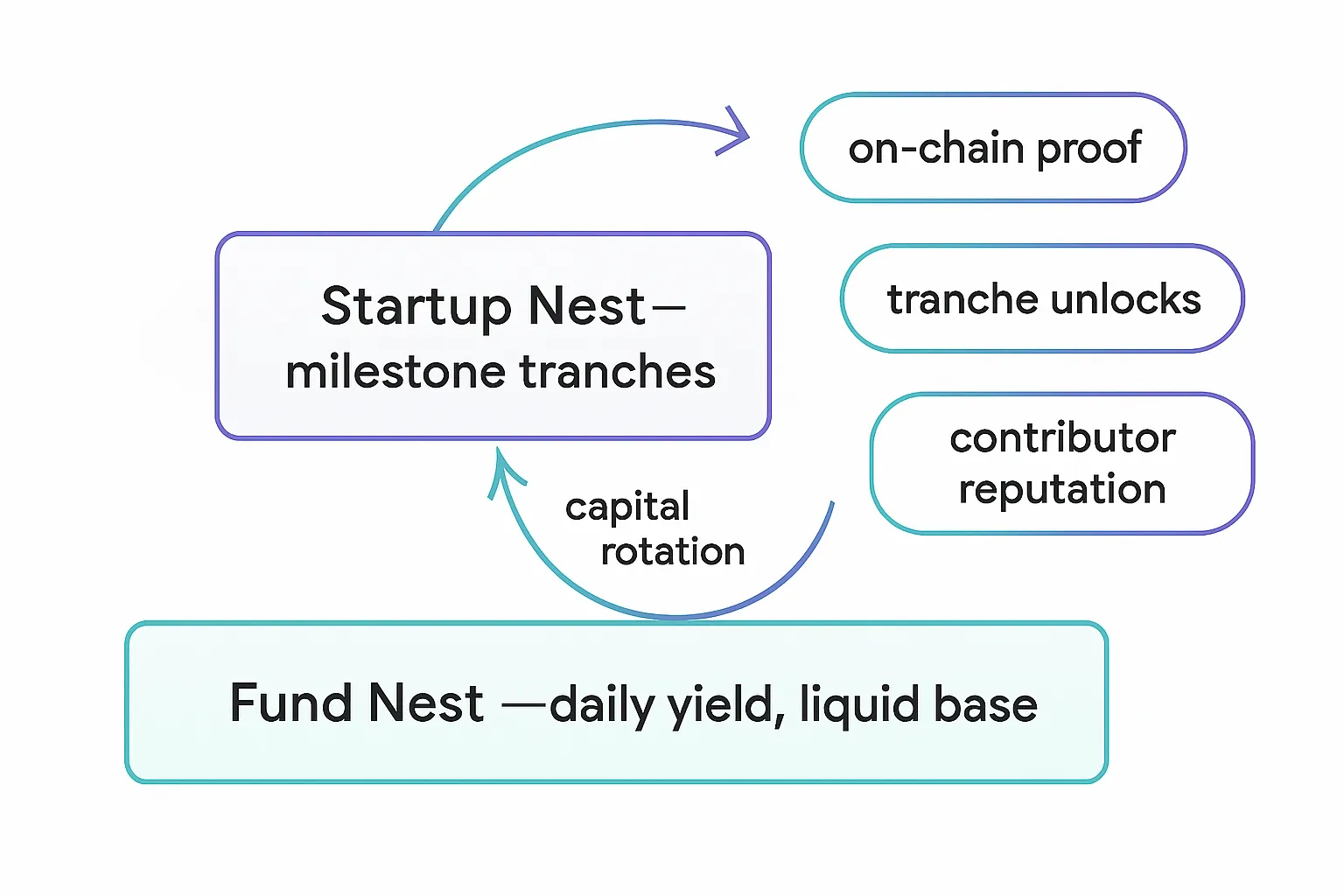

Fund Nest: The Liquidity Base Layer Delivering Daily Yield Between Milestones

Park capital, earn daily yield, stay liquid

Put idle cash to work: Contributors allocate to Fund Nest while scouting Startup Nest or waiting for the next tranche unlock. Capital compounds with daily yield instead of sitting still.

Move when ready: Rapid liquidity means you can rotate into milestone‑gated rounds on Solana the moment on‑chain proof clears, then rotate back between milestones - no dead zones in your portfolio.

Smooth cash flow: Daily compounding creates a dependable base layer across a decentralized venture funding strategy, reducing timing risk across startup fundraising cycles.

"In 2024, the 3-month Treasury bill yield averaged 5.44%, marking a multi-decade high." - Source

Capital productivity math: Compounding during wait times

Idle cash has a cost. Milestone windows often run 2–8 weeks; at a ~5% APY equivalent, daily compounding adds up:

Example (quick math): $10,000 parked for 6 weeks at ~5% APY with daily compounding ≈ $57–$60 earned. At 8 weeks, ≈ $75–$80.

Portfolio reality: $50,000 parked between tranches

2 weeks ≈ $96

4 weeks ≈ $192

8 weeks ≈ $384 That’s incremental fuel for the next tranche without adding risk. Compared to $0 on idle balances, Fund Nest closes the “wait gap” so contributors keep compounding while founders execute.

How Fund Nest interfaces with Startup Nest

Single‑wallet UX: Route capital from Fund Nest (base layer) to Startup Nest (milestone tranches) and back with one flow - no off‑platform juggling.

Execution‑aligned: Tranche unlocks move capital as on‑chain proof lands; between milestones, the base layer keeps earning daily yield.

Incentives that compound: Contributor reputation grows with disciplined allocation and accurate participation in milestone‑gated rounds; founders stay focused on hitting proof standards, not pitch theatrics.

Keywords that matter: Fund Nest enables retail venture access with smart capital rotation, on‑chain proof, and tranche unlocks on Solana - delivering productivity and discipline across your decentralized venture funding stack.

On Solana: Fast, Low‑Cost Settlement and Radical Transparency for Decentralized Venture Funding

Tranche smart accounts and milestone oracles

Escrow by design: Each milestone is mapped to a tranche smart account on Solana. Funds are escrowed at the account level, with parameters that define unlock conditions.

Proof, not promises: Oracle attestations - usage telemetry, revenue proofs, signed Git commits, and verified integrations - trigger automatic unlocks when conditions are met.

Deterministic automation: No committee delays; successful attestations emit on‑chain events and release funds atomically, with contributor visibility in real time.

Treasury segmentation and auditability

Segmented vaults: Every round and milestone has a separate vault, isolating balances and reducing cross‑contagion risk.

Immutable logs: Milestone definitions, oracle submissions, and unlock decisions are written to-chain, creating an auditable trail for contributors and founders.

Contributor‑level trails: Individual allocations, votes, and reputation updates are recorded as on‑chain state - clear histories, fewer surprises.

Affiliate‑driven deal flow and open access venture

Community scouts win: Affiliates who surface credible founders earn rewards as those deals progress through milestone‑gated rounds.

Rules‑based discovery: Standardized milestone templates and oracle menus establish shared expectations and reduce noise.

Open access, disciplined outcomes: Retail venture access expands without sacrificing rigor - capital moves when proofs land, not when decks impress.

Founders’ Checklist: Designing Milestones That Unlock Tranches

Choose milestone types

Build shipped (MVP, v1.0 GA, protocol upgrade)

Users acquired (e.g., 5k MAU, 1k DAO members, cohort retention ≥ X%)

Revenue milestones (MRR/GMV with verifiable sources)

Risk‑kill items (security audit, regulatory greenlights)

Write verifiable acceptance criteria and data sources

Define exact metrics, time windows, and data oracles (analytics endpoints, on‑chain events, signed revenue attestations).

Prefer on‑chain proof (Solana program events, wallet interactions) over screenshots; use signed partner/customer attestations.

Tie each criterion to an automated verifier whenever possible (oracle feeds, telemetry pipelines, audit report hashes).

Set tranche sizes, buffers, and timelines

Start with a 20–30% initial tranche to de‑risk team, scope, and execution rhythm.

Tie subsequent tranches to escalating proof (shipping velocity → user traction → revenue durability).

Add buffer milestones for known unknowns (infra dependencies, audits); pre‑define remediation paths for misses (scope trim, timeline slip guardrails).

Example milestone ladders by stage

Stage | Milestone Type | Acceptance Criteria | Data Source/Oracle | Tranche % | Target Timeline |

|---|---|---|---|---|---|

Pre‑seed | Build shipped (MVP) | Smart contract/program deployed to Solana devnet/mainnet‑beta; CI tests ≥ 95% pass; tagged release v0.1 | Solana RPC events, CI attestations (signed), release tag hash on‑chain | 20–30% | 4–8 weeks |

Pre‑seed | Users acquired (early traction) | ≥ 500 unique wallets or 300 beta users completing core action in 14‑day window | On‑chain interaction analytics, signed telemetry oracle | 10–15% | 2–4 weeks |

Pre‑seed | Risk‑kill (security) | External audit completed; all High/Critical issues resolved and re‑tested | Audit report hash anchored on‑chain; auditor signature | 15–20% | 3–6 weeks |

Seed | Build shipped (v1.0 GA) | v1.0 mainnet; uptime ≥ 99.5% over 30 days; latency SLA met | Uptime oracle, Solana logs, monitoring attestations | 15–20% | 4–6 weeks |

Seed | Users acquired (traction) | ≥ 5k MAU or 1k DAO members; 30‑day cohort retention ≥ 25% | Analytics endpoint signatures, on‑chain membership/usage | 10–15% | 4–8 weeks |

Seed | Revenue milestone | ≥ $25k MRR or $250k GMV run‑rate for 2 consecutive months | Signed revenue attestations; stablecoin inflow addresses | 15–20% | 6–10 weeks |

Series A | Growth efficiency | ≥ 50k MAU or 10k paying users; CAC/LTV ratio ≥ 1:3 | Analytics oracle, payment processor attestations | 10–15% | 6–12 weeks |

Series A | Revenue durability | ≥ $100k–$250k MRR; net revenue retention ≥ 100%; churn ≤ 4% monthly | Billing logs (signed), bank/stablecoin attestation | 15–20% | 8–12 weeks |

Series A | Strategic integrations | 2–3 enterprise integrations live; monthly active integrations ≥ 2 | Partner‑signed attestations; on‑chain usage events | 10–15% | 8–12 weeks |

Tips to align with contributors and accelerate closes:

Keep each milestone atomic, binary, and testable; avoid fuzzy definitions.

Cap any single tranche at a minority of round size to maintain control and optionality.

Publish milestone templates and acceptance oracles upfront to compress diligence.

Use on‑chain proof for all unlocks; if off‑chain is unavoidable, pair with signed attestations and hash commits.

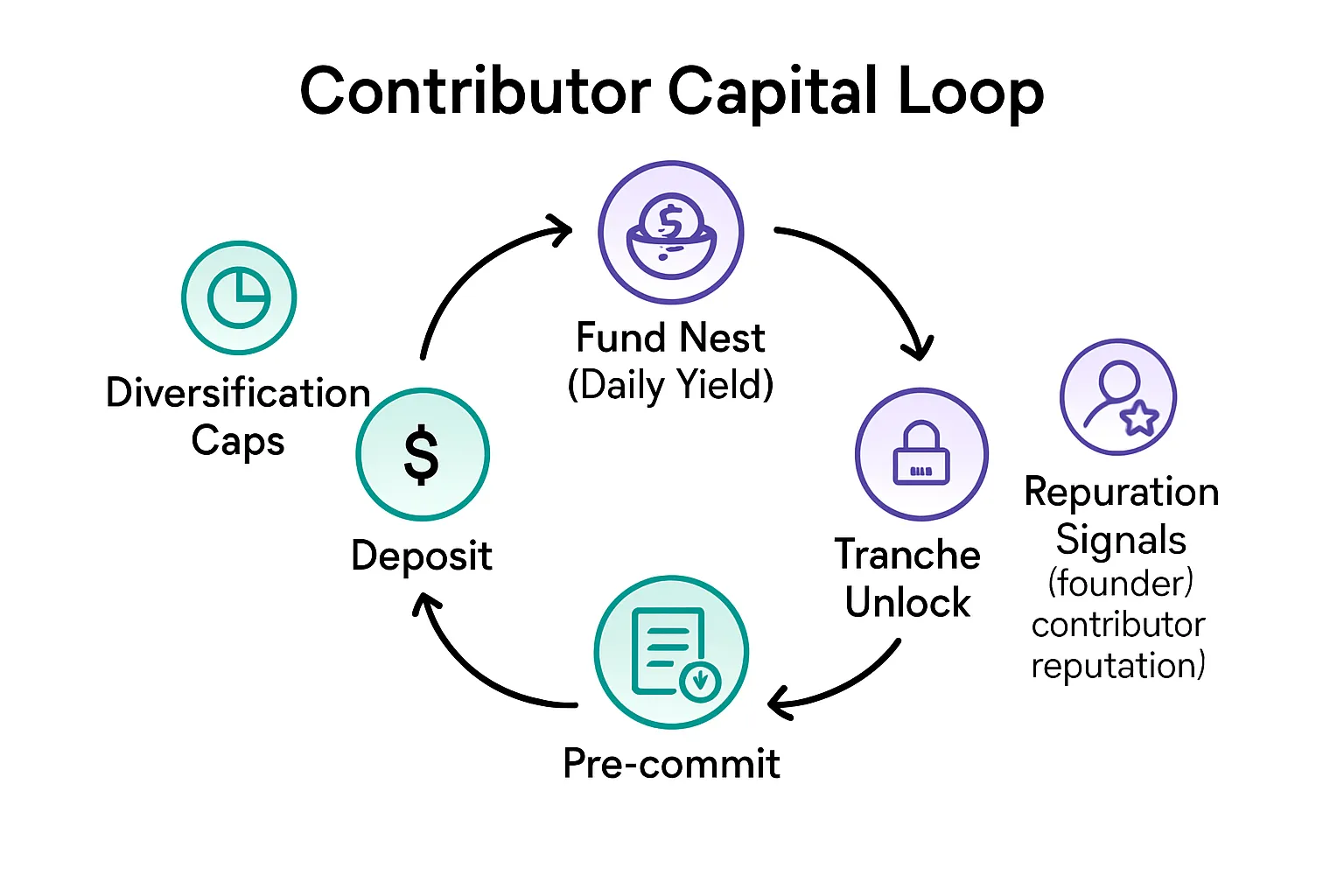

Contributors’ Playbook: Parking Capital in Fund Nest While You Scout Startup Nest

Allocation rhythm: Commit → Park → Unlock → Recycle

Commit: Identify credible founders and milestones; set intent sizes based on tranche timing and on‑chain proof standards.

Park: Keep funds in Fund Nest to earn daily yield until a milestone is imminent.

Unlock: Rotate into the tranche once oracle attestations clear; monitor milestone logs in real time.

Recycle: When the milestone completes or the next window opens, rotate unused or returned capital back to Fund Nest - keep the flywheel spinning.

Risk controls: Diversification, caps, and reputation signals

Per‑project caps: Limit exposure (e.g., ≤ 10–15% of venture sleeve per project) so a single miss doesn’t dent the portfolio.

Stage diversification: Split across Pre‑seed/Seed/Series A milestones to smooth unlock cadence and risk levels.

Reputation weighting: Allocate more to founders and contributors with strong on‑chain reputation and consistent verification histories; underweight unproven participants until they build a track record.

Tranche sizing discipline: Favor smaller initial tranches and escalate only when proof shows velocity and durability.

Example 90‑day plan to keep idle cash near zero

Weeks 1–2 (Scout + Pre‑commit): Screen 10–15 projects; pre‑commit small tickets to 3–5 with near‑term milestones; keep 100% of deployable cash in Fund Nest.

Weeks 3–4 (First Unlocks): Two milestones clear; rotate 20–30% of sleeve from Fund Nest into tranches; leave the rest compounding.

Weeks 5–6 (Rebalance): Evaluate progress; recycle any unallocated or returned funds back to Fund Nest; refresh pipeline with 3 new candidates.

Weeks 7–8 (Second Wave): Allocate into 1–2 more tranches; enforce per‑project caps and maintain stage diversification.

Weeks 9–10 (Monitor + Harvest): Track on‑chain proof and contributor reputation updates; exit or roll based on milestone outcomes; keep residual balances compounding.

Weeks 11–12 (Review): Post‑mortem performance vs. plan; adjust caps and reputation weights; queue the next cycle with Fund Nest as the base layer.

Risk Controls and Governance: Guardrails That Keep Execution Disciplined

Pre‑defined kill‑switches and no‑go criteria

Integrity and safety first: If critical issues surface (security breach, legal exposure, falsified metrics), tranche unlocks halt automatically.

Automated outcomes: Funds revert to contributors or roll forward to a buffer milestone per preset rules; no ad‑hoc politics.

Binary red lines: Misreporting, audit failures, or oracle tampering trigger permanent no‑go status until remediated with verified fixes.

Multisig approvals and oracle verification

Two‑layer verification: Multisig approvals govern any change to milestone definitions or acceptance criteria; execution data must still pass oracle checks.

Independent attestations: Third‑party oracle providers and auditor signatures reduce single‑source bias.

Event transparency: All overrides, re‑scopes, and attestations emit on‑chain events, creating a visible audit trail.

Handling delays and down‑round equivalents

Partial credit logic: If a milestone is 70–90% complete and verifiable, a proportional tranche unlock can occur with a haircut; the remainder moves to the next checkpoint.

Re‑scoping with consent: Teams can tighten scope, reset acceptance windows, or split milestones, gated by contributor vote and multisig.

Tranche haircuts as transparent re‑pricing: When outcomes slip materially, a haircut mirrors traditional down‑round protections - preserving contributor downside while keeping projects solvent.

"In venture capital, a 'down round' - where a company's pre-money valuation decreases - can significantly dilute existing investors' ownership. To mitigate this, staging investments over multiple rounds allows companies to capitalize on higher valuations as they achieve milestones, thereby protecting early investors' stakes." - Source

Walk‑Through: A Seed‑to‑Series A Milestone‑Gated Raise with Zemyth

A practical, founder‑ready timeline showing how decentralized venture funding on Solana turns hype into execution: define objective milestones, publish on‑chain proof standards, raise in tranches via Startup Nest, and keep all uncalled capital compounding in Fund Nest with daily yield.

Week 0–2: Define milestones and tranche schedule

Draft the plan:

Milestone 1 (Build shipped): MVP on Solana mainnet‑beta with CI >95%, basic telemetry, tagged release v0.1.

Milestone 2 (Users acquired): 5k MAU or 1k DAO members; 30‑day cohort retention ≥ 25%.

Milestone 3 (Revenue): ≥ $25k MRR for 2 consecutive months, verified by signed revenue attestations and stablecoin inflow addresses.

Risk‑kill: External security audit; all High/Critical findings resolved and re‑tested.

Tranche schedule (example): 25% → 35% → 40% tied to the three milestones; risk‑kill acts as a pause/stop gate at any time.

Acceptance criteria and data sources:

On‑chain proof first: Solana program logs, wallet interactions, and event signatures.

Oracles: usage telemetry, revenue attestations, audit report hashes, partner‑signed integrations.

Publish on‑chain:

Milestone definitions, acceptance criteria, oracle menus, and tranche percentages are recorded to immutable logs.

Multisig controls for future changes; contributor vote required for re‑scopes.

Weeks 3–8: Raise initial tranche via Startup Nest; contributors park rest in Fund Nest

Open the round:

Transparent, milestone‑gated terms attract retail venture access alongside angels/DAOs.

Affiliate network amplifies credible founder signals; contributor reputation helps price risk.

Close fast:

Initial 25% tranche fills first; funds escrow in Tranche Smart Accounts.

Uncalled commitments sit in Fund Nest earning daily yield until unlock windows, minimizing idle cash drag.

Execute:

Ship MVP, finalize audit, instrument telemetry; keep milestone logs current so tranche unlocks can fire immediately when proof lands.

Weeks 9–20: Ship proof, unlock Tranche 2; update reputation

Verify and unlock:

Oracles attest to MAU/DAO growth and retention; unlock triggers atomically on‑chain.

Contributors see real‑time state: “Verified” badges, tranche release events, updated runway.

Reputation updates:

Founder reputation increases with on‑time, verifiable delivery.

Contributor reputation adjusts based on accurate participation and verification votes - tightening future allocation priority.

Iterate:

Prep revenue systems (billing, KYC/AML if required), align data feeds for MRR/GMV attestation, and pre‑announce next unlock window.

Month 6+: Bridge to A; Fund Nest smooths runway between unlocks

Bridge planning:

With revenue traction verified, pre‑seed and seed milestones de‑risk Series A.

Contributors keep unallocated capital in Fund Nest for daily yield while diligence and legal wrap up.

Execution discipline:

Any timing gaps between unlocks and the Series A close are funded by operating cash flow plus Fund Nest‑parked reserves - no idle treasury periods.

Expected outcomes and what could go wrong

On‑time scenario:

All milestones met within windows; tranche unlocks fire as scheduled; founder and contributor reputation rise; Series A prices off verified traction.

Delayed scenario:

Milestone slips 2–4 weeks; invoke buffer milestone or split scope; contributors vote on revised acceptance window; Fund Nest keeps capital productive while waiting.

Partial completion:

70–90% of criteria met; proportional unlock with a haircut; remaining proof rolls to the next checkpoint with tighter acceptance metrics.

Miss or critical incident:

Kill‑switch triggers on audit failures, misreporting, or oracle tampering; unlocks halt; automated refunds/rollovers execute; remediation plan requires re‑verification and contributor consent.

What this delivers:

Tranche unlocks tied to on‑chain proof keep startup fundraising honest.

Fund Nest’s daily yield turns wait time into compounding time.

Contributor reputation and immutable logs compress diligence and expand access - bringing disciplined, milestone‑gated rounds on Solana to a broader set of backers.

FAQs and Objections: Speed, Compliance, Tokenization Risk

Is milestone‑gated slower than a traditional round?

Faster after setup: The first setup (milestone templates, oracle selection) takes some lift, but follow‑on tranches unlock quickly once on‑chain proof is verified.

Less back‑and‑forth: Clear acceptance criteria compress diligence and reduce legal churn. On Solana, settlement is near‑instant and low‑cost.

Better cadence: Milestone‑gated rounds turn fundraising into an execution rhythm - Define → Verify → Unlock - rather than a months‑long pitch tour.

How do tokenized rounds align with cap tables?

Legal wrappers, clean mapping: Tokenized claims map 1:1 to equity/economic rights via standardized docs (e.g., tokenized SAFE/SPV units) and issuer‑of‑record registries.

Pro‑rata and transfer controls: Smart contracts enforce transfer restrictions, lockups, and pro‑rata rights; off‑chain registries mirror on‑chain state for legal completeness.

Governance clarity: Voting and information rights are encoded in the wrapper; updates require multisig approvals and transparent on‑chain events to keep startup fundraising compliant and auditable.

What about regulatory compliance and KYC/AML?

Compliant by default: KYC/AML onboarding, sanctions screening, and geofencing are built into access controls for decentralized venture funding participants.

Audit‑ready trails: Contributor‑level logs, oracle attestations, and tranche unlock events create traceable audit records.

Transfer policies: Whitelists/blacklists, jurisdiction filters, and ongoing monitoring keep tokenized participation aligned with evolving regulations.

What happens if a milestone is partially met?

Pre‑defined outcomes: Partial unlock rules and tranche haircuts apply when 70–90% of acceptance criteria are verified; anything below thresholds triggers re‑milestoning.

Contributor votes for edge cases: Exceptions require transparent proposals, contributor voting, and multisig approvals.

Kill‑switch protection: Integrity risks (e.g., misreporting, security incidents) halt unlocks; funds refund or roll forward per the preset rules.

Additional considerations

Oracle and data integrity: Multiple independent oracles, quorum thresholds, and on‑chain reputation reduce manipulation risk and strengthen on‑chain proof.

Liquidity between milestones: Capital parked in Fund Nest earns daily yield and remains liquid for rapid rotation - minimizing idle time while waiting for tranche unlocks.

Access and inclusion: Clear rules and on‑chain transparency expand retail venture access without sacrificing discipline - contributor reputation and milestone‑gated rounds keep incentives aligned on Solana.

Conclusion: Keep Capital Productive and Execution Honest with Zemyth

Stop funding hype. Start funding proof.

Milestone‑gated rounds align capital with outcomes: clear milestones, on‑chain proof, and tranche unlocks that reward execution - not theater.

Fund Nest turns waiting time into daily yield: contributors park capital, stay liquid, and rotate into Startup Nest when milestones are imminent.

Radical transparency on Solana: contributor reputation, immutable milestone logs, and real‑time state make decentralized venture funding practical, fair, and fast.

Next steps

Founders: apply to raise on Startup Nest with milestone‑gated rounds and on‑chain verification.

Contributors: start earning daily yield in Fund Nest while you scout deals and pre‑commit to upcoming tranches.