The $1 Question: Can a $1 Investment Grow Into Real Wealth?

Yes - if you use it to start the right habit. A $1 investment won’t retire you. But that tiny, repeatable action - micro‑DCA, automated deposits, and steady compounding - can snowball into meaningful wealth over decades. At Zemyth, we see small, consistent contributions as the on‑ramp: build the habit, then scale into higher‑conviction, milestone‑gated venture opportunities when you’re ready.

Why starting with “almost nothing” works

Micro‑investing removes friction. You don’t wait for “extra money” that never appears - you automate tiny deposits, let compounding do the heavy lifting, and keep your risk calibrated.

The case for micro‑investing and micro‑DCA: Micro‑DCA (micro dollar‑cost averaging) means you contribute bite‑sized amounts on a fixed schedule - $1 a day, $5 a week, or round‑ups from everyday purchases. Because you buy across time, you avoid perfectionism and reduce the impact of bad timing. Automation defeats procrastination and emotional decision‑making.

How compounding turns tiny deposits into meaningful balances: Compounding is earnings on top of prior earnings. The absolute dollars don’t matter early - the cadence does. As your balance grows, each additional dollar of return grows with it. A $1 investment repeated thousands of times, with reinvested gains and prudent fees, compounds into real money.

Practical path with Zemyth:

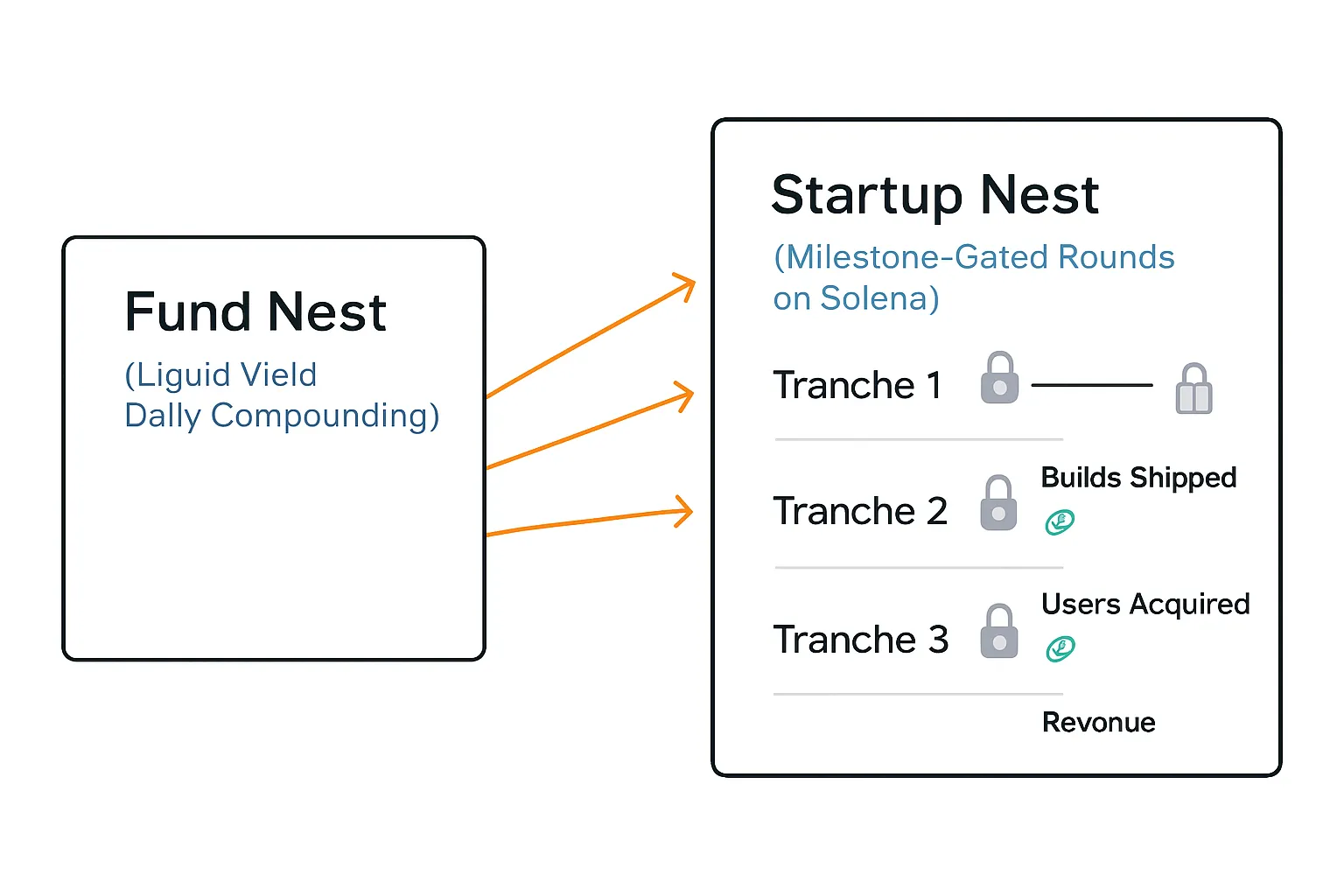

Park small, regular contributions in Fund Nest for liquid, lower‑risk yield that compounds daily - your base to invest money to earn money methodically while you scout deals.

Allocate selectively into Startup Nest rounds tied to on‑chain milestones - capital follows execution, not hype - so you can earn with investment through venture exposure governed by proof.

What this article covers

Where to invest money to earn money safely without hype: building a liquid base layer first, then adding diversified and milestone‑gated exposure.

How to earn with investment via automation and discipline: micro‑DCA, fee control, and compounding routines.

The real limits: fees, risk, and expectations. We’ll be blunt about why chasing “earn daily profit” promises is a trap - and how to build durable returns instead.

Set your benchmark

If you’re going to judge progress, anchor it to long‑run market context. The stock market has delivered solid average returns over many decades, with plenty of rough patches along the way. That’s why “time in the market” beats “timing the market” - especially for small, automated contributions.

"From 1926 through 2024, the S&P 500’s average annual total return was approximately 10.4% (nominal)." - Source

Use that historical range as a planning reference, not a promise. In practice:

Time in the market vs. timing the market: Micro‑DCA keeps you invested through cycles, which historically captures more of the long‑run upside than trying to guess tops and bottoms.

Fees, taxes, and slippage matter: The smaller your deposits, the more every basis point matters. Favor transparent, low‑fee options and automated reinvestment.

How Zemyth frames it:

Fund Nest gives you daily‑compounding liquidity to smooth cash flow between opportunities.

Startup Nest tranches unlock only when founders ship real proof - users, revenue, or builds - so your venture risk is tied to progress, not marketing.

Quick takeaway

A $1 investment is symbolic - but the habit it kickstarts is the engine of real wealth. Start tiny, automate relentlessly, control fees, and let time work. As your balance and confidence grow, layer in higher‑conviction allocations - without ever chasing unrealistic “earn daily profit” claims.

How Micro‑Investing and Micro‑DCA Actually Work

Fractional shares and round‑ups

Buy $1–$10 slices of ETFs/stocks instead of whole shares: Fractional shares let you own a tiny piece of big‑name funds and companies without waiting to “save up.” That means you can invest money to earn money even when your budget is tight.

Automate round‑ups from everyday purchases: Link a card, and each transaction rounds up to the next dollar - those pennies funnel into your portfolio automatically. It’s set‑and‑forget momentum.

Micro‑DCA: small, consistent buys

Weekly or daily micro‑buys reduce timing stress: Micro‑DCA spreads your entries across market conditions. You don’t need to nail the “perfect” day - you just show up on schedule.

Why automation beats willpower: Systems outperform moods. Auto‑deposits and recurring buys make consistency non‑negotiable and remove the decision fatigue that derails most new investors.

Behavioral edge

Friction reduction: Fewer taps and no second‑guessing means you actually contribute.

Choice minimalism: Pre‑select a diversified mix so you don’t chase headlines.

Consistency wins: The habit compounds as much as the money.

Reality check

Diversification ≠ no risk; short‑term volatility still happens. The goal isn’t zero drawdowns - it’s staying invested through them. Manage fees, keep cash for emergencies, and let time do the heavy lifting.

"Dollar-cost averaging does not assure a profit or protect against loss in declining markets." - Source

From $1/Day to Five Figures: The Math You Can Actually Use

What a $1 investment habit looks like over decades

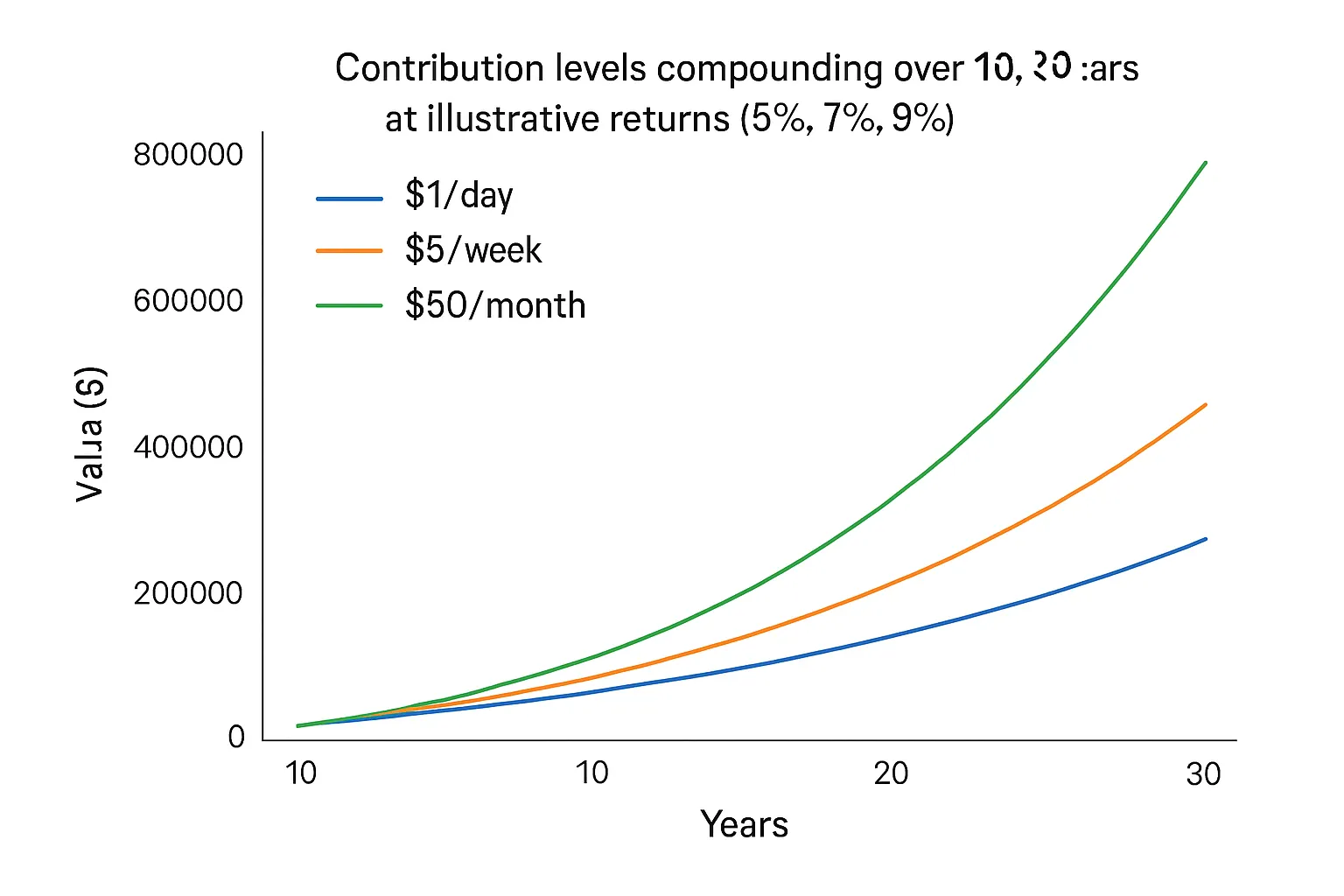

Scenarios at $1/day, $5/week, $50/month

Projections at 5%, 7%, and 9% annualized returns

Below are illustrative projections showing how small, automated contributions can compound into meaningful balances. Assumes reinvestment and steady contribution schedules.

Plan & Horizon | Total Contributed | Projected Value @5% | Projected Value @7% | Projected Value @9% | Fee Drag Placeholder |

|---|---|---|---|---|---|

$1/day for 10 years | $3,650 | $4,740 | $5,290 | $5,920 | 0.25%/yr ≈ -3% FV |

$1/day for 20 years | $7,300 | $12,540 | $15,940 | $20,480 | 0.25%/yr ≈ -5% FV |

$1/day for 30 years | $10,950 | $25,420 | $37,380 | $56,290 | 0.25%/yr ≈ -7% FV |

$5/week for 10 years | $2,600 | $3,370 | $3,770 | $4,220 | 0.25%/yr ≈ -3% FV |

$5/week for 20 years | $5,200 | $8,940 | $11,350 | $14,600 | 0.25%/yr ≈ -5% FV |

$5/week for 30 years | $7,800 | $18,100 | $26,620 | $40,100 | 0.25%/yr ≈ -7% FV |

$50/month for 10 years | $6,000 | $7,780 | $8,670 | $9,730 | 0.25%/yr ≈ -3% FV |

$50/month for 20 years | $12,000 | $20,620 | $26,190 | $33,660 | 0.25%/yr ≈ -5% FV |

$50/month for 30 years | $18,000 | $41,780 | $61,430 | $92,530 | 0.25%/yr ≈ -7% FV |

Small inputs, big arc: time does the heavy lifting.

Time > rate

Starting earlier beats chasing an extra 1–2%. Ten extra years of consistent micro‑DCA often outruns trying to “find” a higher return.

That’s why automation matters: a $1 investment repeated relentlessly can help you invest money to earn money with less stress and more staying power.

Assumptions, not promises

These are projections, not guarantees. Markets vary, and short‑term volatility is normal.

Fees and taxes reduce outcomes; controlling costs boosts how much you ultimately earn with investment.

Keep cash reserves for near‑term needs; don’t chase “earn daily profit” claims - focus on consistency and risk‑aware growth.

"Vanguard’s research finds lump‑sum investing outperforms dollar‑cost averaging roughly two‑thirds of the time across markets, but DCA can reduce regret and behavioral risk for many investors." - Source

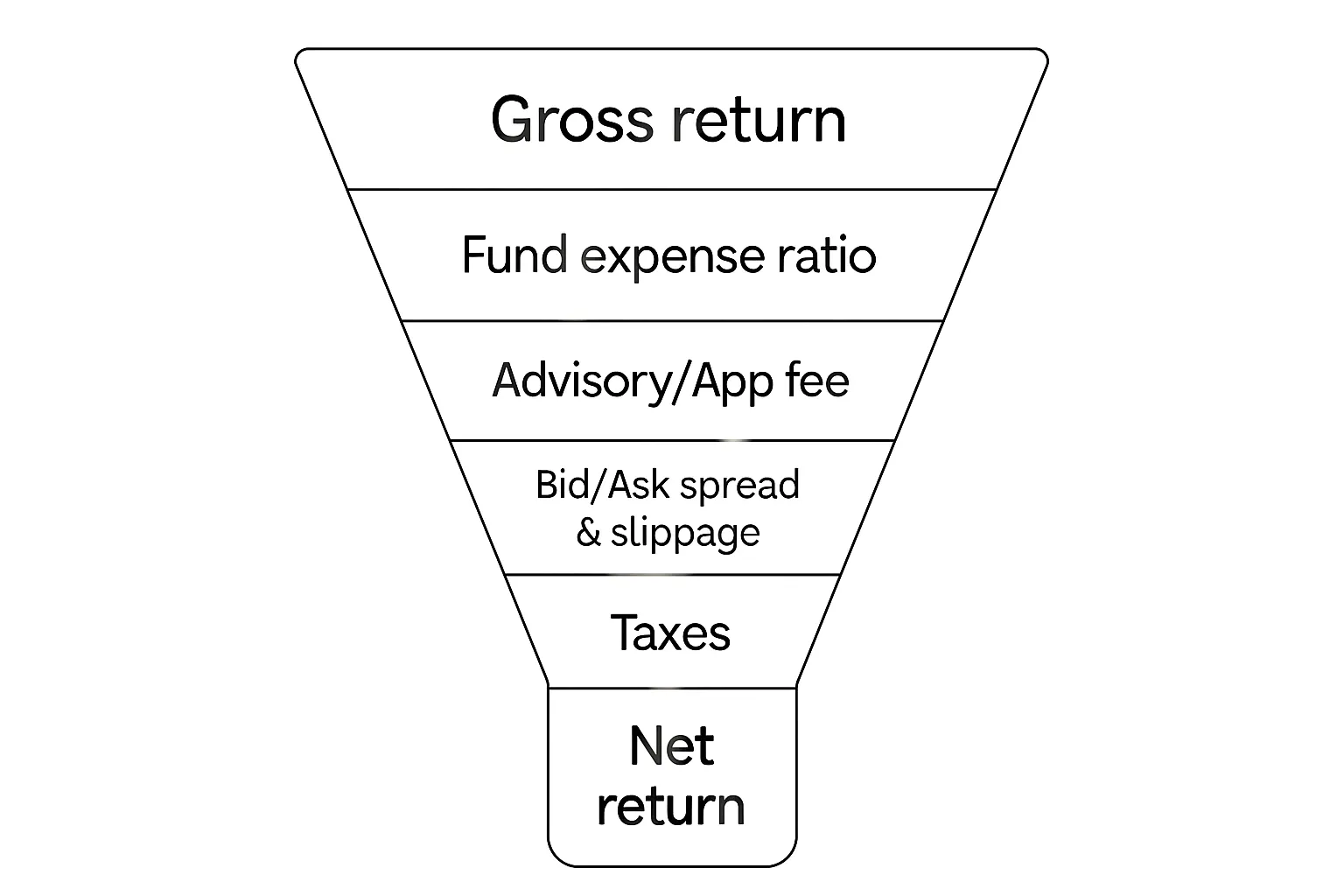

Fees: The Silent Return Killer (How to Keep More of Your Gains)

Flat fees vs percentage fees

Why $1–$5 monthly app fees can crush tiny balances: On a $50 account, a $3/month fee is $36 a year - 72% of your balance in Year 1. That’s a non‑starter. Flat fees only make sense once your balance is high enough that the dollar amount is a tiny fraction of assets.

When a 0.25%–0.40% annual fee is more efficient: Percentage fees scale with you. On $200, 0.25% is just $0.50 per year; on $5,000 it’s $12.50. For micro‑investors, low percentage‑based pricing usually preserves more of your return.

Expense ratios and spreads

ETF expense ratios and how they differ from advisory/app fees: The expense ratio is the ongoing cost built into a fund’s price (for management, operations). Advisory/app fees are separate platform charges. You want both low.

Hidden friction: bid/ask spreads and transfer fees: Thinly traded funds can widen spreads, quietly taxing every buy/sell. Brokerage transfer, wire, or crypto bridge fees add up. Minimize churn and choose liquid, low‑spread instruments.

Taxes and accounts

Taxable vs tax‑advantaged wrappers (IRAs, 401(k)s) to minimize drag: If you’re eligible, routing recurring contributions into tax‑advantaged accounts can materially improve long‑run outcomes. In taxable accounts, favor tax‑efficient funds and avoid unnecessary realized gains.

Balance | Flat $1/mo | Flat $3/mo | Flat $5/mo | 0.25%/yr | 0.50%/yr | Cheaper Option at This Balance |

|---|---|---|---|---|---|---|

$50 | $12 | $36 | $60 | $0.13 | $0.25 | Percentage fees |

$100 | $12 | $36 | $60 | $0.25 | $0.50 | Percentage fees |

$250 | $12 | $36 | $60 | $0.63 | $1.25 | Percentage fees |

$500 | $12 | $36 | $60 | $1.25 | $2.50 | Percentage fees |

$1,000 | $12 | $36 | $60 | $2.50 | $5.00 | Percentage fees (vs $1/$3); tie vs $5 at 0.50% |

$2,500 | $12 | $36 | $60 | $6.25 | $12.50 | 0.25% beats all; 0.50% ≈ $1/mo |

$5,000 | $12 | $36 | $60 | $12.50 | $25.00 | Break‑even: $1/mo ≈ 0.25% |

Practical moves to keep more:

Prefer platforms with percentage fees under ~0.25%–0.40%.

Choose broad, low‑cost ETFs with tight spreads.

Automate contributions into tax‑advantaged accounts when possible.

Avoid unnecessary transfers and frequent trading that trigger spread and tax drag.

Zemyth angle:

Fund Nest offers daily compounding with transparent costs - ideal for parking cash between Startup Nest rounds.

Startup Nest releases capital in tranches when founders hit on‑chain milestones, so you’re not paying for inertia - your money moves with real progress.

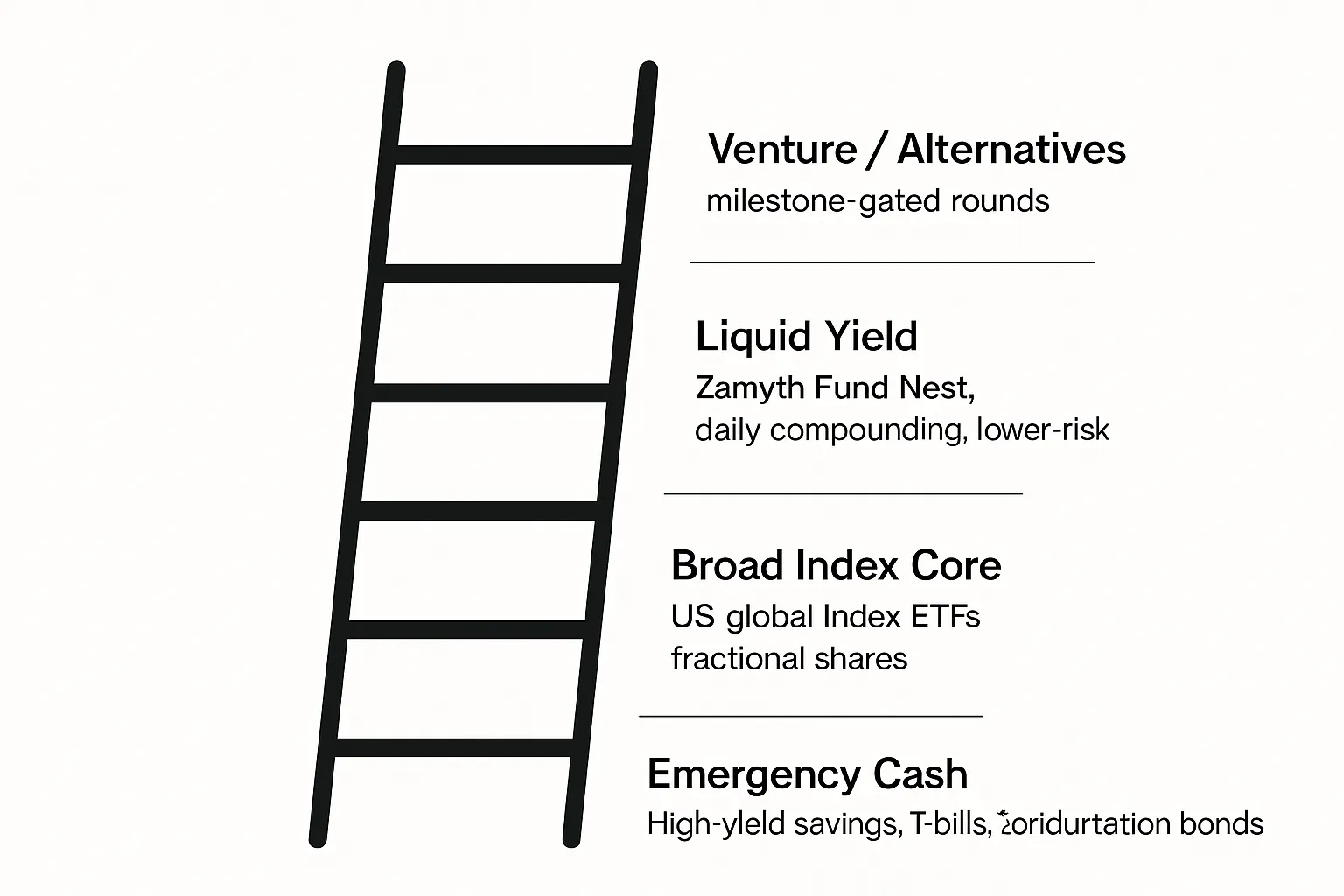

Where to Invest Money to Earn Money Safely (Layered Strategy)

Layer 1: Cash safety net

High‑yield savings, T‑bills, and short‑duration bond funds for 3–6 months of expenses: This is your shock absorber. Keep it boring, liquid, and dependable so market volatility never becomes a bill‑paying problem.

Layer 2: Core compounding

Broad‑market index ETFs (US/global) + fractional buys for steady accumulation: Automate micro‑DCA into diversified, low‑cost index funds. This is your long‑term engine to earn with investment - simple, scalable, and tax‑aware.

Layer 3: Liquid yield between opportunities

Parking idle cash in lower‑risk, liquid yield products; daily compounding vs “earn daily profit” hype: You want transparent, low‑friction yield - not promises. The aim is to smooth cash flow, not chase gimmicks.

Zemyth Fund Nest: a transparent, liquid base layer to smooth cash flow between rounds (on Solana): Park contributions while you evaluate deals. Fund Nest compounds daily and keeps capital nimble so you can move when milestones hit.

Layer 4: Venture/alternatives (small sleeve)

Calibrate small, high‑risk allocations only after layers 1–3 are in place: Use a disciplined sleeve for Startup Nest or other alternatives. With Zemyth’s milestone‑gated rounds, capital unlocks only when founders deliver on‑chain proof - so risk is tied to progress, not hype.

A 30‑Day Micro‑Investing Plan to Earn With Investment (Without Overthinking)

Week 1: Foundations

Pick one platform and one core ETF; enable round‑ups; set $5–$10/week auto‑buy

Day 1: Choose your primary platform. Keep it simple - one login, one portfolio.

Day 2: Pick one broad‑market core ETF (US total market or global). No dabbling yet.

Day 3: Enable round‑ups on your spending card to turn spare change into buys.

Day 4: Set a recurring micro‑DCA: $5–$10/week (or $1/day). Automation > intention.

Day 5: Link bank; confirm ACH timelines and minimums.

Day 6: Turn on dividend reinvestment (DRIP) so earnings auto‑compound.

Day 7: Quick fee check: confirm advisory fee ≤0.25%–0.40%, ETF expense ratio ≤0.10%–0.15%.

Pro tip: A $1 investment habit signals consistency to yourself. Scale later, but automate now.

Week 2: Build buffers

Fund emergency cash; route idle funds to a liquid yield layer while keeping access

Day 8: Set your emergency target: 3–6 months of essential expenses.

Day 9: Open a high‑yield savings account (or T‑bill ladder/short‑duration bond fund).

Day 10: Automate transfers every payday into emergency cash (even $10–$25 helps).

Day 11: Separate “must‑pay” bills from “nice‑to‑have” spending to prevent cash raids.

Day 12: For idle capital beyond your emergency target, use a liquid yield layer to smooth cash flow.

Day 13: If you’re operating in Web3, park idle funds in Zemyth’s Fund Nest for daily compounding and fast liquidity between opportunities on Solana.

Day 14: Reconfirm you’re not risking money needed in the next 3–6 months.

Goal: Keep your safety net boring and dependable, so market dips never become bill‑pay emergencies.

Week 3: Automate and forget

Calendar a monthly 10‑minute check‑in; bump auto‑contributions by $1–$5 if feasible

Day 15: Add a monthly 10‑minute calendar block: contributions, fees, drift.

Day 16: Increase your auto‑buy by $1–$5/week if cash flow allows.

Day 17: Turn on recurring fractional buys for your core ETF (weekly cadence).

Day 18: Consolidate stray accounts to reduce fees and decision fatigue.

Day 19: Create a “no‑scroll” rule - no daily price checking; weekly glance only.

Day 20: If you’re evaluating venture exposure, shortlist milestones you’d require to invest.

Day 21: In Zemyth, follow Startup Nest projects and star only those with clear, on‑chain proof milestones; keep allocations small.

Systems beat willpower. Your plan should run while you live your life.

Week 4: Review and refine

Verify fees; keep allocations simple; avoid app‑hopping

Day 22: Audit fees again: platform, ETF expense ratio, spreads; replace anything pricey.

Day 23: Keep allocation simple: one core ETF plus cash/yield layer; no more than one satellite.

Day 24: Revisit your emergency buffer progress; adjust auto‑saves if off‑track.

Day 25: Write your personal rules: contribution amount, rebalance cadence, max venture sleeve.

Day 26: Document your “investment triggers”: what proof unlocks a venture tranche.

Day 27: If using Zemyth, set tranche alerts so capital moves only when milestones are met.

Day 28: Bump contributions by another $1–$5 if comfortable.

Day 29: Plan next month’s deposits into Fund Nest (base layer) and core ETF (growth).

Day 30: Debrief: What worked? What felt heavy? Strip friction and keep compounding.

Guardrails

Don’t invest money you need in under 6 months.

Don’t chase “earn daily profit” claims - seek transparent, liquid yield and verifiable proof of progress.

Keep fees low; percentage‑based pricing typically beats flat fees at small balances.

One core ETF, one platform, one yield layer. Fewer decisions, fewer mistakes.

Small venture/alternative sleeve only after Layers 1–3 are solid; use milestone‑gated rounds (e.g., Zemyth’s Startup Nest) so capital follows execution.

Outcome: A repeatable system to invest money to earn money safely. Start with a $1 investment habit, automate, control fees, and let time do the compounding.

Avoid the Hype: What ‘Earn Daily Profit’ Really Means

Red flags to ignore

“Guaranteed” daily returns, opaque strategies, no proof of reserves or execution

Unregistered platforms or promoters, pressure to act fast, referral bounties that look like pyramid incentives

Vague performance claims without third‑party verification or on‑chain proof

What’s legit

Daily compounding of variable yields and transparent reporting ≠ guaranteed profits

Real platforms show position‑level data, risks, fees, and liquidity windows; they do not promise fixed daily returns

In DeFi and Web3, look for on‑chain transparency, audited contracts, and verifiable reserves

Due diligence checklist

Fees: Advisory/platform fees, fund expense ratios, and any performance or withdrawal fees

Liquidity: How fast can you exit? Are there lockups, gates, or penalties?

Counterparties: Who holds assets? What’s the credit, smart‑contract, or custody risk?

Risk disclosures: Clear, specific, scenario‑based - not hand‑wavy boilerplate

Verifiable performance: Audited statements, on‑chain metrics, or third‑party analytics

"Promises of high returns with little or no risk are a classic warning sign of fraud." - Source

From Micro to Macro: Scaling Contributions and Adding Venture Upside

Increase the base

Convert $1/day to $2/day, then $5/day as income grows; automate each raise: Tie increases to life events - annual raises, debt payoffs, or tax refunds. Set calendar nudges to boost contributions by $1–$5 at a time so the habit scales without friction.

Add a measured venture sleeve

Keep core index exposure dominant; earmark a small, defined percent for venture bets: Think in ranges (for example, 2%–10% depending on risk tolerance and experience). Rebalance back to target annually so enthusiasm doesn’t quietly bloat risk.

Web3‑native venture with proof

Zemyth Startup Nest: milestone‑gated, tokenized rounds on Solana; tranches unlock only with on‑chain proof (builds, users, revenue): Capital follows execution. Founders unlock the next tranche when they ship what they promised - verifiably.

On‑chain transparency and contributor reputation as a filter against hype: Every step is visible on Solana; contributor history and founder progress create a reputation graph that favors builders over marketers.

Skill up

Use Zemyth Academy playbooks; leverage affiliate rewards to source better deal flow: Learn to evaluate teams, milestones, and tokenomics; earn by surfacing credible founders to the network.

Conclusion: Start Small Today - Let Zemyth Do the Heavy Lifting

The move now

Set a $1–$5/week auto‑buy and route idle cash to a transparent, liquid yield layer. Start with a simple $1 investment habit, let automation run, and add dollars as your income grows. You’re not trying to time markets - you’re building a system to invest money to earn money safely and consistently.

Why Zemyth

Fund Nest: daily‑compounding liquidity to stabilize cash flow between opportunities. Park capital, keep it liquid, and let it work while you wait for conviction.

Startup Nest: milestone‑gated venture access with on‑chain proof and clear rules. Tranches unlock only when founders ship real progress - builds, users, revenue - so capital follows execution, not hype.

Transparency, education, and open access - venture exposure without the guesswork. On‑chain settlement, contributor reputation, and Academy playbooks help you earn with investment using repeatable, verifiable steps.

Quick start

Visit zemyth.app and create a wallet‑connected profile.

Park a small test amount in Fund Nest to establish your liquid, low‑friction base.

Keep your $1–$5/week auto‑buy running in your core market exposure.

Explore Startup Nest rounds and star deals with crisp, on‑chain milestones.

Scale allocations gradually as your base grows - never chase “earn daily profit” promises.

Final word

Wealth comes from repetition, not heroics - start today, adjust quarterly, and let compounding and proof‑based capital allocation work for you. Build the habit with a $1 investment, keep fees and frictions low, and use Zemyth’s Fund Nest and Startup Nest to turn consistency into momentum.