TLDR: A practical, risk-first checklist for investments with high returns

High risk high reward is not a strategy; it’s a discipline. This section gives you a risk-first framework to pursue high reward investments (crypto, DeFi, venture-style bets, small caps) while protecting downside. You’ll learn how to verify teams, audits, tokenomics, and liquidity, then size positions and exits so a single loser can’t sink your portfolio - enabling truly asymmetric, investment high risk high return outcomes.

"All of investing consists of dealing with the future... and the future is something we can't know much about." - Source

What you’ll learn

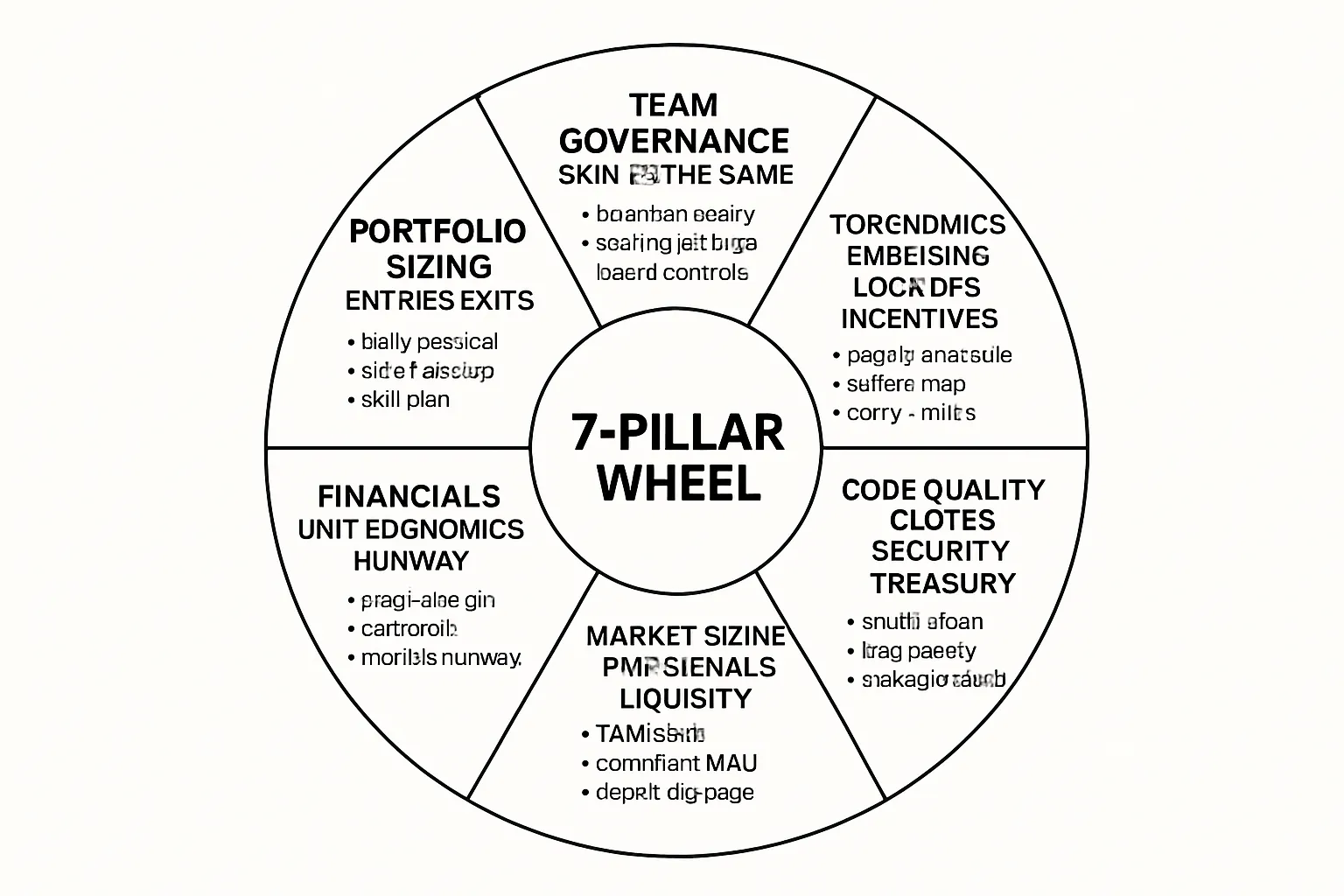

A 7‑pillar due diligence system tailored to high risk, high reward investments (crypto, DeFi, venture-style plays, small caps).

How to score teams, verify tokenomics/lockups, read audits, and pressure-test market liquidity.

Exact rules for position sizing and exits so one loser can’t sink your portfolio.

Who this is for

Angels, crypto investors, DAO treasuries, and advanced retail hunting asymmetric upside.

How Zemyth helps (overview)

Milestone-gated investing (StartupNest), curated yield parking (FundNest), and revenue-linked tokenomics (ZEM) provide on-chain guardrails that map 1:1 to this checklist.

CTA

Grab the full checklist and start applying it on live deals: https://zemyth.app

Step 0 – Calibrate risk/return before you open the data room

Before chasing investments with high returns, set your rules. High risk high reward only works when your downside is capped and your upside is unconstrained. Step 0 builds your personal mandate, hurdle rate, sizing, and portfolio-fit - so every investment high risk high return bet earns its place.

Define your mandate

Target annualized return and maximum drawdown.

Example: target 25–40% annualized with a max 15–20% portfolio drawdown; per-position max loss 1–2% of equity.

Risk capacity vs. risk tolerance; what you can lose vs. what you can stomach.

Capacity = objective (income, runway, liquidity). Tolerance = subjective (sleep-at-night factor). Set rules to the lower of the two.

Build your hurdle rate

Cost of capital + risk premia for stage, liquidity, and tech/security risk.

Start with your personal cost of capital (e.g., 8–12%).

Add premia:

Stage (pre-revenue, experimental): +10–20%.

Liquidity (small caps, long unlocks): +5–10%.

Tech/security (smart contracts, bridges): +5–15%.

If a deal’s realistic, risk-adjusted return doesn’t clear your hurdle, pass - even if it looks like a high reward investment.

"In 2023, crypto hacks stole roughly $1.7B - down about 54% from 2022." - Source

Use this base-rate to price a security risk premium into your hurdle rate for DeFi/crypto exposure.

Position sizing guardrails

Kelly-fraction style sizing with caps; pre-commit stop criteria.

Use Fractional Kelly (e.g., 0.25–0.50 Kelly) to avoid overbetting high-volatility edges.

Hard caps: per-position 2–5% of portfolio; per-theme 10–20%; per-custodian/exchange 10%.

Pre-commit risk controls:

Define invalidation levels (thesis, technical, or fundamental).

Stop-loss or time-stop rules (e.g., -25% from entry or 90-day no-progress).

No “averaging down” unless risk/reward improves and position remains within caps.

Expected value and base-rate thinking

Power-law outcomes: many zeros, few mega-winners. Prepare your math and your mindset.

Assume a hit-rate of 10–30% with a small number of 10–50× outcomes driving returns.

Require convexity: cap downside (e.g., -1R) and leave upside open (≥5–10R).

Build theses that can compound if you’re right (network effects, recurring revenue, token sinks).

Integrate with portfolio

Correlation checks, scenario tests, and cash management between entries.

Keep uncorrelated “bets” across sectors, chains, and catalysts to smooth equity curve.

Run scenarios: +/–50% market moves, liquidity dries up, unlock cliffs - ensure portfolio DD stays within mandate.

Park idle cash in low-volatility yield until new entries meet your hurdle; avoid drift into unintended risk.

This calibration step turns “high risk high reward” from a vibe into a repeatable system that filters, sizes, and sequences opportunities - before you ever open the data room.

The 7‑Pillar High-Risk/High-Reward Due Diligence Checklist (overview)

Pillar 1: Team, governance, and skin-in-the-game.

Pillar 2: Tokenomics, emissions, lockups, and incentive design.

Pillar 3: Code quality, audits, security posture, and treasury safeguards.

Pillar 4: Market sizing, product‑market fit signals, and liquidity depth.

Pillar 5: Legal, regulatory, and compliance exposure.

Pillar 6: Financials, unit economics, and runway to sustainable cash flow.

Pillar 7: Portfolio construction, position sizing, entries/exits.

Note: Each pillar includes red flags, verification actions, and a simple score (0–5) to compare deals side by side.

Zemyth mapping (at a glance)

StartupNest → live milestone evidence, voting, and escrowed unlocks.

FundNest → park idle cash in curated pools while waiting for milestones/entries.

ZEM → revenue-linked emissions, fee discounts, and staking boosts.

Pillar 1 – Team, governance, and skin‑in‑the‑game

People risk is the primary driver of outcomes in high risk high reward deals. Before you chase investments with high returns, validate who is actually shipping, who holds the keys, and how incentives bind the team to the same future as you.

What to verify

Founder resumes, prior exits, domain depth, open-source footprint, and shipping velocity.

Track record: previous startups, outcomes (exits/failures), and references you can call.

Domain depth: papers, patents, conference talks, production systems in similar stacks.

OSS and GitHub: contributor graph, meaningful commits in core repos, code review quality.

Shipping velocity: release cadence, changelogs, incidents closed vs. opened, roadmap delivered vs. promised.

Governance: board/advisors, voting rights, milestone discipline, incident transparency.

Board/advisors: relevant operators with time in seat; documented meeting cadence and minutes.

Voting rights: clearly defined decision framework (what’s on-chain vs. off-chain, who can veto).

Milestone discipline: specific definitions of “done,” time bounds, and retrospective summaries.

Transparency: public post‑mortems within 72 hours of material incidents; comms channels staffed.

Skin in the game: founder vesting/lockups, founder token/stock % at risk, personal capital.

Vesting terms: 3–4 year vest with 1‑year cliff; no early unlocks without investor vote.

Lockups: team tokens subject to linear vest; clawbacks if milestones fail or TGE conditions aren’t met.

Personal capital: meaningful founder cash at risk or foregone salary tied to delivery milestones.

Practical verification actions:

Speak to 3–5 independent references (ex‑colleagues, customers, investors).

Read the last 90 days of release notes and incident reports; match commits to claims.

Confirm multi‑sig signers, custody setup, and rotation policies for keys and access.

Obtain vesting/lockup schedules and verify on-chain or in signed legal agreements.

Simple score (0–5):

0–1: Anonymous or unverifiable team; no governance; no vesting. Pass.

2–3: Partial track record; basic governance; vesting but weak lockups. High caution.

4: Strong operators; clear board and voting; robust vesting/lockups and disclosure. Consider.

5: Tier‑1 builders with shipped history; transparent, enforced governance; maximum alignment. Green light.

Red flags

Anonymous core team with no verifiable track record where custody/treasury is involved.

Over‑promising roadmaps and under‑delivery patterns; vanished comms during setbacks.

Concentrated key control (single-signer treasuries), no incident post‑mortems, or pay‑to‑play “advisors” without real involvement.

Early unlocks or side letters that let insiders dump ahead of retail.

How Zemyth helps

Milestone voting and on‑chain unlocks force delivery before cash moves; Investment NFTs encode voting rights, token claims, and exit/refund rights.

Time‑bounded votes (14 days), 48h challenge windows, and 7‑day hold requirements curb flash attacks and enforce accountability.

Pivot approvals trigger exit windows; 90‑day inactivity can mark projects Abandoned with proportionate refunds - real skin‑in‑the‑game for founders.

Pillar 2 – Tokenomics, emissions, lockups, and incentive design

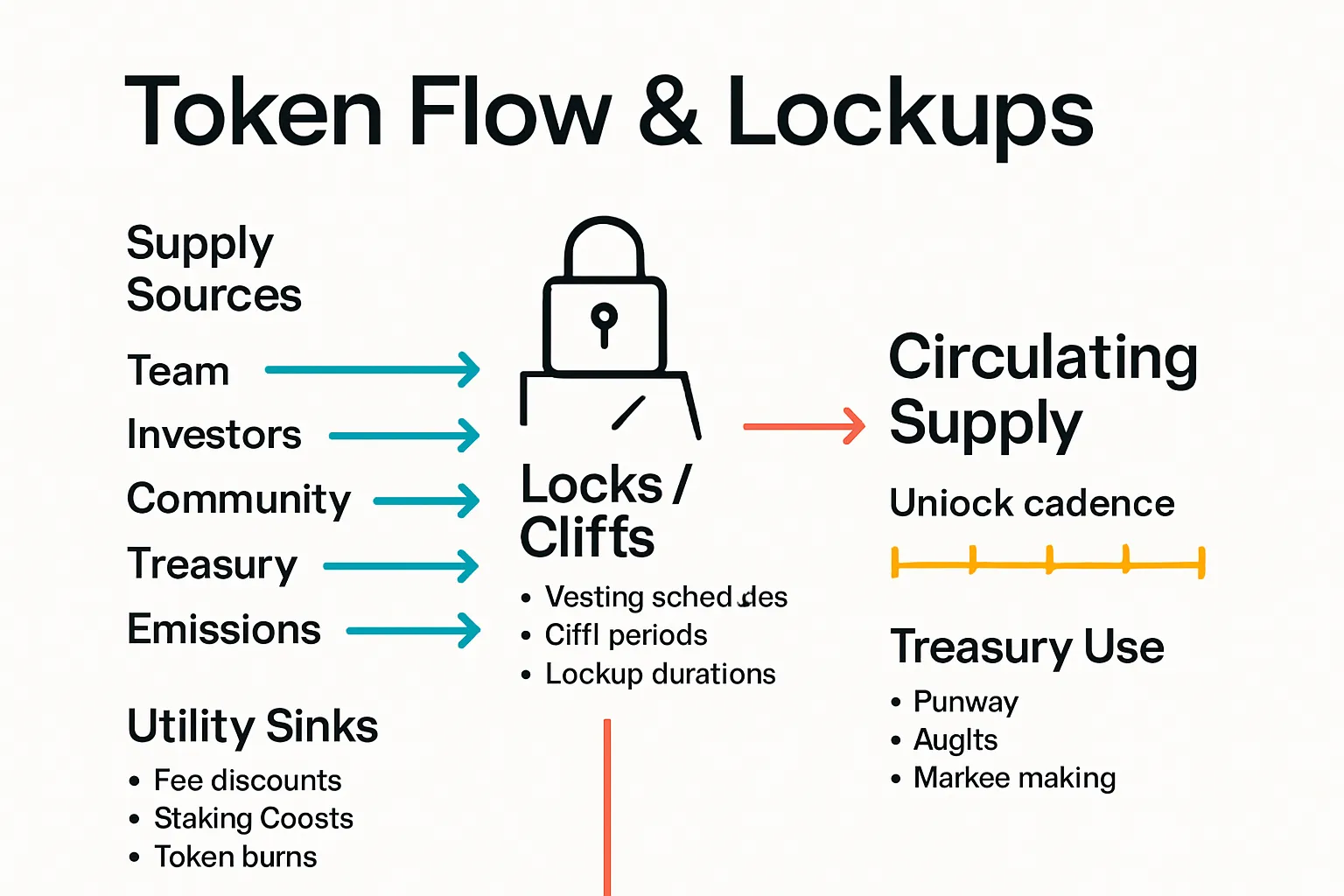

Token design is the gravity of a high risk high reward project. If supply leaks faster than demand grows, price sinks. If utility creates persistent buy pressure and lockups pace supply, you can achieve investments with high returns without reflexive blowups.

What to verify

Supply schedule: hard cap, vesting cliffs, unlock cadence, and emission math tied to revenue.

Utility with real sinks: fee discounts, staking boosts, gating, and burns.

Holder alignment: team/investor lockups, distribution fairness, treasury runway.

Red flags

Front‑loaded unlocks, reflexive emissions, or unlimited inflation not tied to platform revenue.

Utility that only rewards speculation rather than usage.

How Zemyth helps

ZEM emissions capped by revenue/token price; burns on protocol usage; fee discounts and yield boosts create real sinks.

Scoring notes

Assign 0–5 for vesting discipline, 0–5 for revenue link, 0–5 for real utility sinks; average into Tokenomics Score.

Tokenomics due diligence scorecard

Factor | What “Good” Looks Like | Red Flags | Quick Test |

|---|---|---|---|

Emissions vs. revenue | Emissions hard-capped by platform revenue/value; adaptive throttle | Unlimited or reflexive emissions decoupled from usage | Ask: “Show formula tying monthly emissions to revenue/token price.” |

Unlock schedule | 3–4 yr vest, 6–12 mo cliffs; linear/uniform unlocks | Front‑loaded unlocks; insider unlocks before PMF/TGE | Plot monthly unlock % vs. expected demand growth. Does supply outrun demand? |

Utility sinks | Fee discounts, staking boosts, burns tied to activity | “Governance only” or speculation-only utility | List sinks → quantify annual demand in tokens vs. annual emissions. |

Treasury runway | 18–24 mo runway with budget transparency | <9 mo runway; opaque spend; reliance on token sales | Request 24‑month cash plan; stress test at -70% token price. |

Holder concentration | Distributed holders; multisig treasury; vesting enforced on-chain | >40% in top 10 wallets; unvested team tokens liquid | Pull top 10 holders; verify locks/vesting contracts on-chain. |

Market-maker terms | Transparent, low-leakage MM with KPI triggers | Aggressive token borrow/sell pressure from MM | Review MM contract: borrow APR, inventory caps, reporting cadence. |

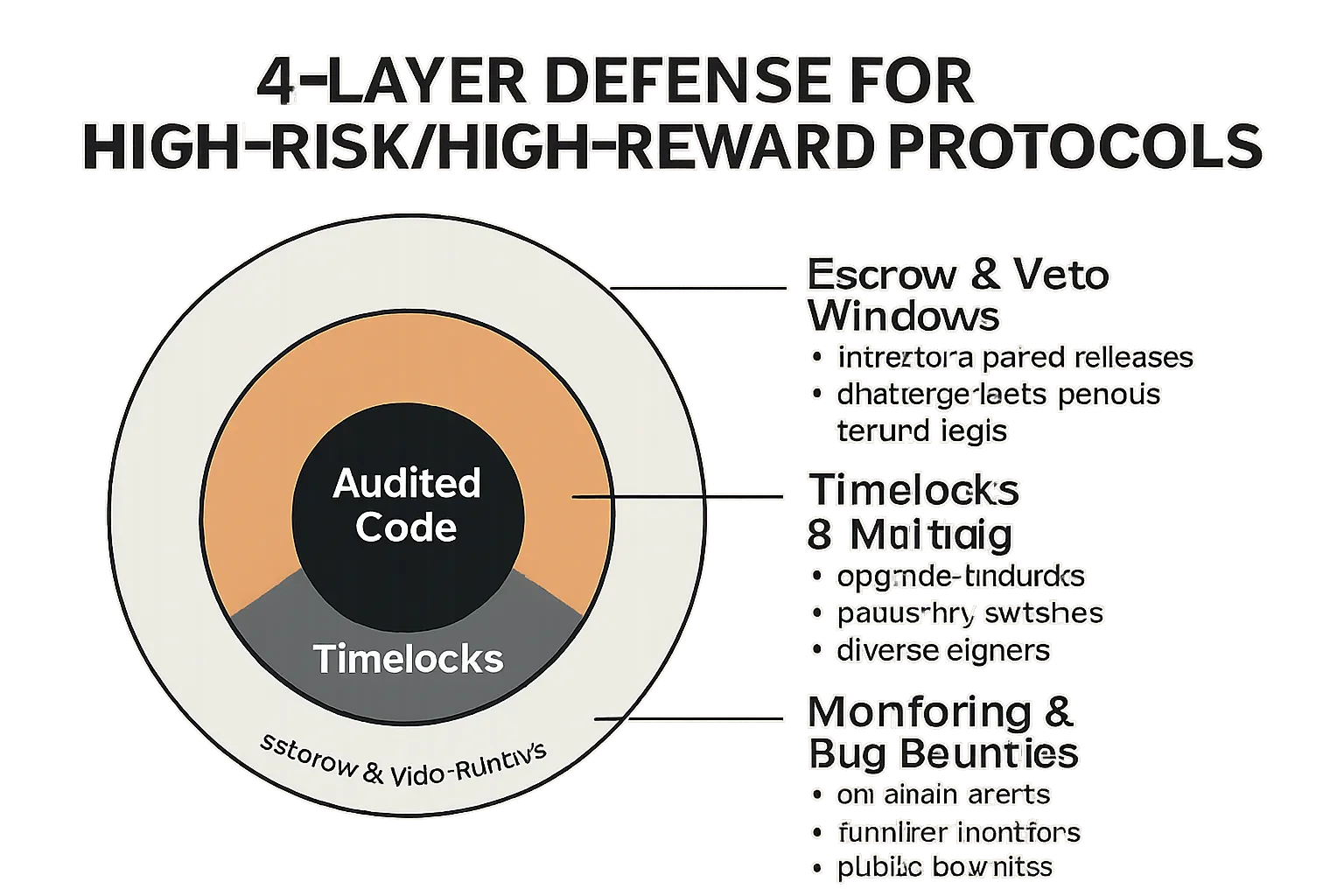

Pillar 3 – Code, audits, security posture, and treasury protection

Security is the non-negotiable for high risk high reward deals. Your expected value collapses if a single exploit drains treasury or a rushed upgrade bricks contracts. Treat security like compounding insurance on investments with high returns.

What to verify

Audit pedigree (firm reputation, findings severity, remediation proof), ongoing monitoring, bug bounties.

At least one top-tier audit, plus follow-up fix verification; public reports with severity breakdowns.

Continuous monitoring (on-chain alerts, anomaly detection) and active bug bounty with payouts.

Code quality: test coverage, modularity, upgradeability, pause/kill switches, and timelocks.

90%+ unit/integration coverage; gas/edge-case tests; reproducible builds.

Controlled upgrade paths (timelocks, proxy patterns) and emergency pause/kill switches.

Treasury ops: multisig signers, proof-of-reserves, segregation of duties, incident runbooks.

3–5+ diverse signers, rotation policy, separate hot/cold paths, and routine sign-off reviews.

Public proof-of-reserves with chain analytics; incident comms and remediation SLAs.

Practical verification actions:

Read the last audit PDF and compare “critical/high” findings to fix commits.

Confirm timelock parameters and upgrade proxy owners on-chain.

Inspect multisig signer distribution and test a small withdrawal path end-to-end.

Review bounty programs (scope, max payout, historical submissions).

Red flags

“Audited” claims without public reports; unremediated criticals; no bounties; single-signer treasuries.

Upgrades without timelocks, opaque proxy ownership, or no emergency pause.

Lack of monitoring or incident post‑mortems; no proof-of-reserves.

How Zemyth helps

Milestone‑gated unlocks + challenge windows ensure funds move only after verifiable delivery.

Permissionless state changes for inactivity/abandonment and TGE failure reduce hostage risk.

Escrow logic and proportional refunds protect capital, with voting and veto mechanics as final safeguards.

Pillar 4 – Market sizing, PMF signals, and liquidity depth

Even the best teams and code can’t save a product that nobody needs - or a token you can’t get in or out of at size. Before you aim for investments with high returns, prove there’s a real market, persistent product‑market fit, and sufficient liquidity to execute your strategy in high risk high reward assets.

What to verify

Market: top‑down TAM vs. bottom‑up SAM/SOM; catalysts; regulatory trend lines.

Top‑down: credible TAM with defensible assumptions (substitution, pricing power).

Bottom‑up: users × ARPU or transactions × take rate; sensitivity to adoption curves.

Catalysts: roadmap unlocks, partnerships, L2/L3 launches, regulatory green lights.

Regulation: clear jurisdictional stance; foreseeable changes that could expand or cap demand.

PMF signals: cohort retention, organic growth, waitlists, revenue concentration.

Retention: 30/60/90‑day user or logo retention; net revenue retention (NRR) >100% is ideal.

Organic pull: search trends, referral rate, unpaid signups, backlog/waitlist quality.

Concentration: top‑5 customers <30% of revenue; diversified geographies/segments.

Willingness to pay: stable or rising gross margin; churn reasons tied to solved gaps.

Liquidity: order book depth, slippage at size, unlock/vesting overhang, market-maker agreements.

Depth: estimate slippage for your intended position (e.g., <$10k: <0.5%, <$100k: <1–2%).

Overhang: map 6–12 months of unlocks vs. average daily volume (ADV); prefer unlocks <20–30× ADV/month.

MM terms: transparent inventory caps, no predatory token borrow; clear reporting cadence.

"'No market need' was cited as a reason in 42% of startup failures." - Source

Use this base rate to demand PMF evidence before large entries in any investment high risk high return bet.

Red flags

Thin liquidity that can’t absorb your position; vanity metrics without retention; growth paid entirely by incentives.

Unlock schedules that exceed foreseeable demand; opaque or extractive market‑maker agreements.

Regulatory headwinds that directly cap adoption in your target market.

How Zemyth helps

CollabNest accelerates execution and delivery, bringing PMF signals (retention, milestones hit) forward in time.

FundNest lets you park capital in curated yield while waiting for catalysts or improved liquidity - staying patient without sitting idle.

Pillar 5 & 6 – Legal, compliance, and financials/unit economics

Regulatory clarity and real unit economics separate durable investments with high returns from stories that implode at first stress. In high risk high reward environments, validate the structure that keeps you onside with regulators and the math that keeps the lights on.

Legal and regulatory

Entity, jurisdiction, and token classification risk; disclosures; KYC/AML where relevant.

Entity/jurisdiction: confirm place of incorporation, ultimate beneficial owners (UBOs), tax nexus, reporting obligations.

Token classification: documented legal memo on utility vs. security; compliance plan if distribution touches restricted markets.

Disclosures: clear risk factors, token supply/unlock tables, fee policies, and change‑management processes.

KYC/AML: where relevant, Travel Rule adherence, sanctions screening, and PEP checks for counterparties; vendor evidence (policies, audits).

Licensing: MSB/VASP status where applicable; payment/market licenses if custody, exchange, or yield is provided.

Data/privacy: GDPR/CCPA posture; breach notification procedures; DPA with processors.

IP ownership, open-source licenses, and 3rd‑party dependencies.

Ownership: assignment agreements for founders/contractors; trademark and domain control.

OSS licenses: compatibility with commercial use; no copyleft contamination in core proprietary code where not intended.

Dependencies: oracle/bridge/RPC providers, cloud contracts, security monitoring vendors; SLAs and redundancy plans.

Contracts: clear rights to use data, models, and third‑party APIs; termination and step‑in provisions.

Practical verification actions:

Obtain external counsel letter on token classification and distribution plan per jurisdiction.

Review KYC/AML policy versions and recent audit or regulator correspondence.

Run a software bill of materials (SBOM) to map licenses; confirm IP assignments for all contributors.

Map critical vendors and failover playbooks; test a simulated vendor outage.

Financials and unit economics

Cash runway, burn multiple, gross margin durability, CAC payback, LTV/CAC sanity.

Runway: months of cash at current and stress‑case burn (target 18–24 months).

Burn multiple: Net Burn / Net New ARR (early stage: ≤1.5–2.0 is strong; >3 is weak).

Gross margin: durability through cycles; identify cost drivers (infra, liquidity mining, rev‑share).

CAC payback: aim <12 months for software/services; shorter for volatile cycles.

LTV/CAC: conservative LTV assumptions (cohort‑based, churn‑adjusted); require LTV/CAC >3 with clean cohorts.

Revenue quality: recurring vs. one‑off; exposure to token price; % from incentives vs. organic.

Sensitivity analysis for downside: FX, fee compression, liquidity shocks.

FX: model 10–20% currency moves on opex and revenues.

Fee compression: simulate 25–50% take‑rate reduction and market volume drawdowns.

Liquidity shocks: 50–80% TVL/volume drop; confirm solvency and covenant headroom.

Counterparty: default of a key MM/custodian/oracle; quantify impact on working capital.

Quick tests:

Tie revenue recognition to usage events; reconcile to on‑chain data or system logs.

Bridge P&L to cash flow; explain variance (working capital, token liabilities).

Build a driver tree (users → conversion → ARPU → margin) and run ±20% scenarios.

Red flags

Opaque corporate structure, unaddressed securities risk, or contingent liabilities.

Forecasts without driver trees; no stress tests; CAC math built on promotional spikes.

Revenue predominantly from incentives/wash volume; inability to reconcile books to on‑chain activity.

Vendor lock‑in without redundancy; no SLA/escrow for critical services or IP.

How Zemyth helps

On‑chain transparency of project states and escrowed unlocks provides verifiable delivery gates and refund logic.

Fee and revenue lines across StartupNest/FundNest anchor ZEM’s revenue‑linked emission discipline and burn mechanics - reducing reflexive token inflation.

Multisig/DAO upgrade paths, voting windows, and permissionless state transitions reduce key‑person and governance risk - supporting safer execution of investment high risk high return strategies.

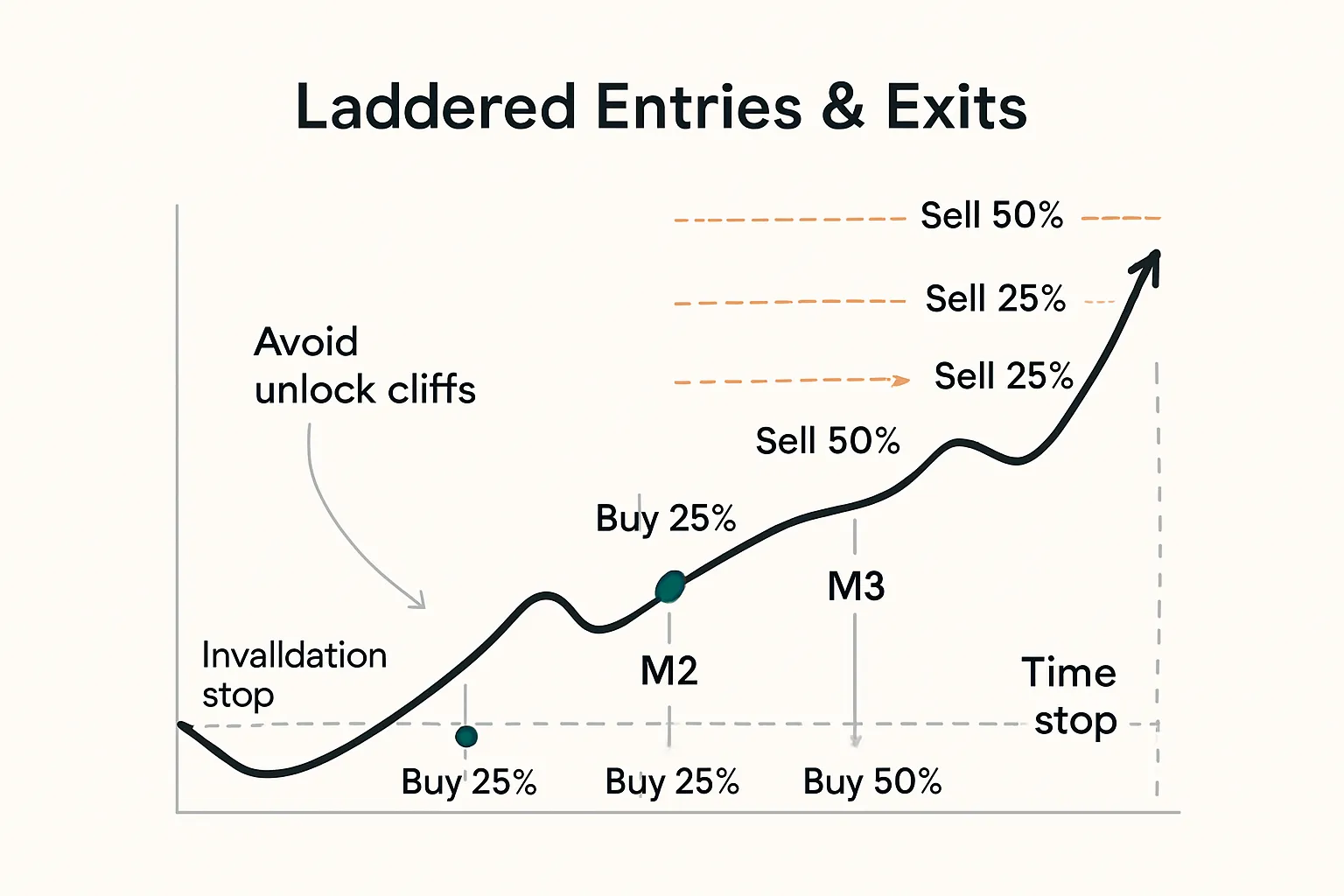

Pillar 7 – Portfolio construction, position sizing, entries/exits

Build a portfolio that survives the downside and captures the upside. In high risk high reward markets, sizing and sequencing matter as much as selection for achieving investments with high returns.

Position sizing

Tie size to conviction × risk bucket with hard caps; use tranches and proof‑based adds after milestones.

Start small, prove the thesis, then scale.

Keep per‑position caps (e.g., Speculative ≤2%, High ≤4%, Medium ≤6%) and per‑theme caps (≤15–20%).

Entry/exit rules

DCA into liquidity; avoid unlock cliffs; pre-define invalidation and time stops; partial profit‑taking.

DCA across days/weeks to minimize slippage.

Map unlock calendars; avoid entries ahead of heavy supply.

Define invalidation (thesis breaks, key milestone fails) and a time stop (e.g., 90 days no progress).

Take profits in bands to derisk while staying in the trend.

Risk aggregation

Correlation checks across sector, chain, custody, and regulatory regimes.

Spread exposure across catalysts and counterparties; cap exchange/custody exposure.

Track realized and implied correlations; reduce if portfolio drawdown exceeds mandate.

How Zemyth helps

Use StartupNest milestone votes as objective add/reduce triggers; keep dry powder in FundNest low‑risk pools to earn while you wait.

ZEM boosts can enhance FundNest yield, helping offset cash drag during staged entries.

Position sizing matrix by risk bucket

Risk Tier (Speculative, High, Medium) | Conviction Score (0–5) | Max Initial Position (% of portfolio) | Add Conditions | Exit/Invalidate Triggers |

|---|---|---|---|---|

Speculative | 0–1 | 0.25–0.5% | None; wait for verifiable milestones | -15–20% price stop, 60–90d no‑progress, failed audit/critical bug |

Speculative | 2–3 | 0.5–1.0% | After M1 passed + audit remediations | Thesis invalidation, unlock overhang >30× ADV, governance failure |

Speculative | 4–5 | 1.0–2.0% | After M1 + M2 passed, on‑chain PMF signals | Breach of treasury policy, signers reduced, loss of key partner |

High | 0–1 | 0.5–1.0% | None; require PMF signal first | -15% stop, 90d no‑progress, regulatory action impacting model |

High | 2–3 | 1.0–2.5% | Add on M1/M2 passes, liquidity depth >50× position | Time stop, unlocks >20× ADV/month, MM terms turn extractive |

High | 4–5 | 2.5–4.0% | Add on revenue KPI beat + security monitoring live | Treasury draw >30% without board vote, adverse tokenomics change |

Medium | 0–1 | 1.0–2.0% | Wait for retention >90‑day target | -10–12% stop, margin compression >500 bps, churn spike |

Medium | 2–3 | 2.0–4.0% | Add on NRR >110% and CAC payback <12m | Macro/liquidity shock breaches DD limits, fee compression 50% |

Medium | 4–5 | 4.0–6.0% | Add on cash‑flow break‑even or clear path in 2–4q | Governance regression, loss of license, data breach without remedy |

Conclusion – Turn due diligence into an edge (and put it on-chain with Zemyth)

High returns come from discipline: verify the team, align incentives, demand security, validate PMF, respect the law, model the cash, and size positions ruthlessly. That’s how you turn high risk high reward ideas into investments with high returns without blowing up.

Zemyth operationalizes this playbook: milestone‑gated capital (StartupNest), yield on parked cash (FundNest), and revenue‑linked tokenomics (ZEM) that reward real usage - giving you on‑chain guardrails for any investment high risk high return strategy.

Next step: Put this checklist to work on real deals today.

CTA: Explore live projects, park idle capital, and lock in your process at https://zemyth.app