Investment fundraising 101: how investors and startups connect and close rounds

Raising capital isn’t magic. It’s a repeatable system that smart founders run with discipline - especially in tough markets. This section maps the real path from hello to wired cash so investors and startups can move fast, reduce friction, and close confidently.

At Zemyth, we think of investment fundraising as a high-signal conversation: clarity of story, clarity of proof, and clarity of next steps. Whether you’re courting angels, micro-VCs, syndicates, DAOs, or strategic partners, the same core mechanics apply to funding and investment - build trust, demonstrate progress, and make it easy to say yes.

If you’re on the investor side, this helps you screen startups for investment with sharper criteria. If you’re a founder, it’s your operating manual for investment and funding, from first outreach to signed term sheet. Markets shift. A tight process wins. That’s how we funders avoid noise and focus on outcomes.

What you’ll learn

The end-to-end fundraising loop: build signal → meet investors → diligence → negotiate → close → report

Who’s involved: founders, angels, micro-VCs, venture firms, syndicates, DAOs, crowdfunding portals, and strategic investors

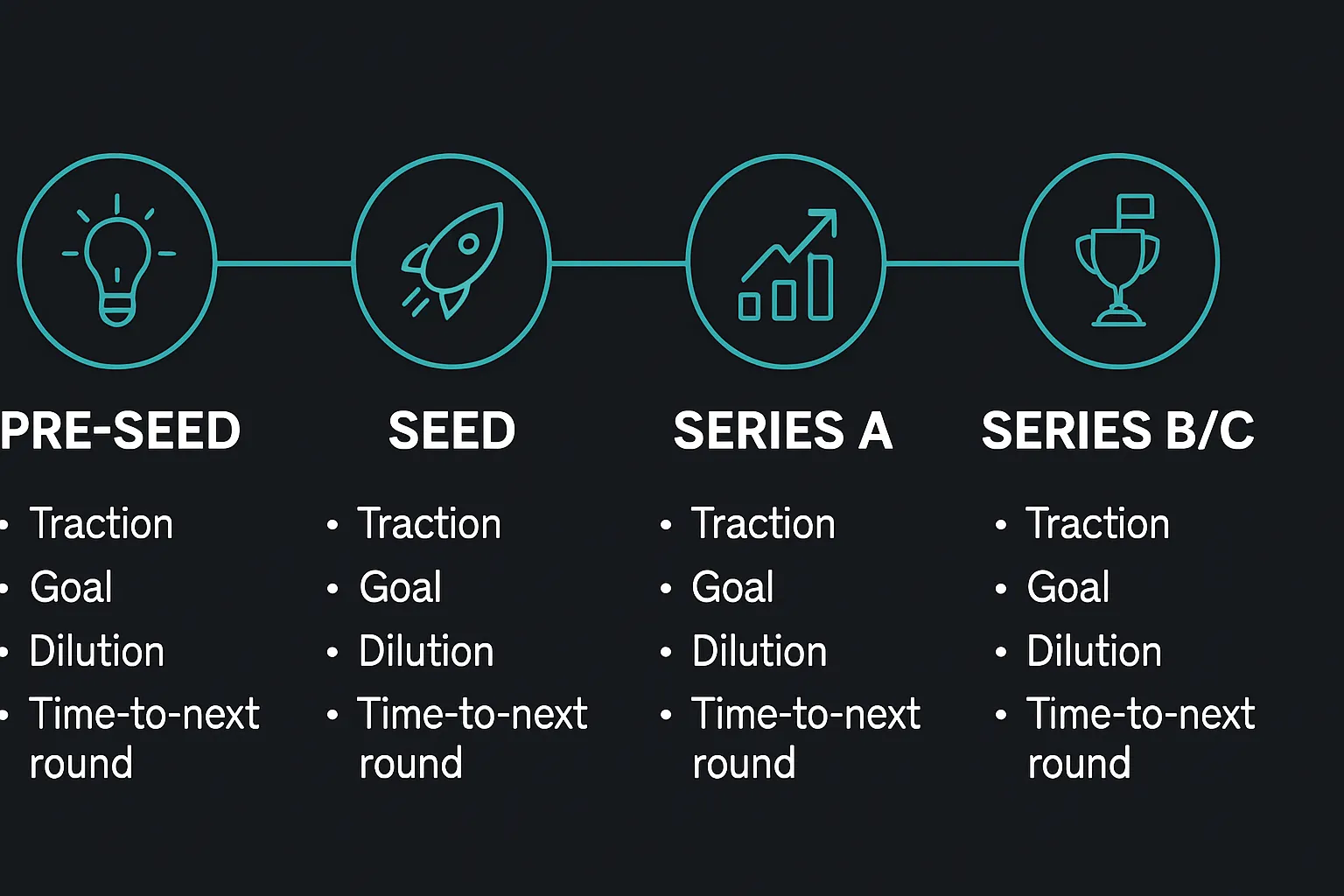

What changes by stage (pre-seed → Series C) and what never changes (clarity, speed, proof)

How to avoid common mistakes (spray-and-pray outreach, weak metrics, messy data rooms)

Why this matters now

Venture markets shift, but disciplined investment fundraising wins in any cycle

Set realistic expectations on timing, dilution, and milestones

"Global venture funding fell 38% year over year to about $285B in 2023." - Source

Zemyth’s take: whether you’re raising or evaluating, this environment rewards founders who operate with precision - clean data rooms, crisp metrics, and fast follow-up - and investors who prioritize signal over hype.

Top-of-funnel: where investors and startups actually connect

Top-of-funnel is where momentum is made. Smart investment fundraising starts by putting your story in the right rooms, with the right proof, and the right ask - so investors and startups move from intro to diligence without friction. Treat it like a pipeline, not a lottery.

Channels that work

Warm intros (portfolio founders, operator angels, advisors)

High-quality cold outreach (short, specific, proof-first)

Demo days, accelerators, curated events

Platforms and communities (investor databases, founder communities, syndicates)

Public proof: open-source contributions, product launches, thought leadership

"Make it short, i.e. 60 seconds or less to read." - Source

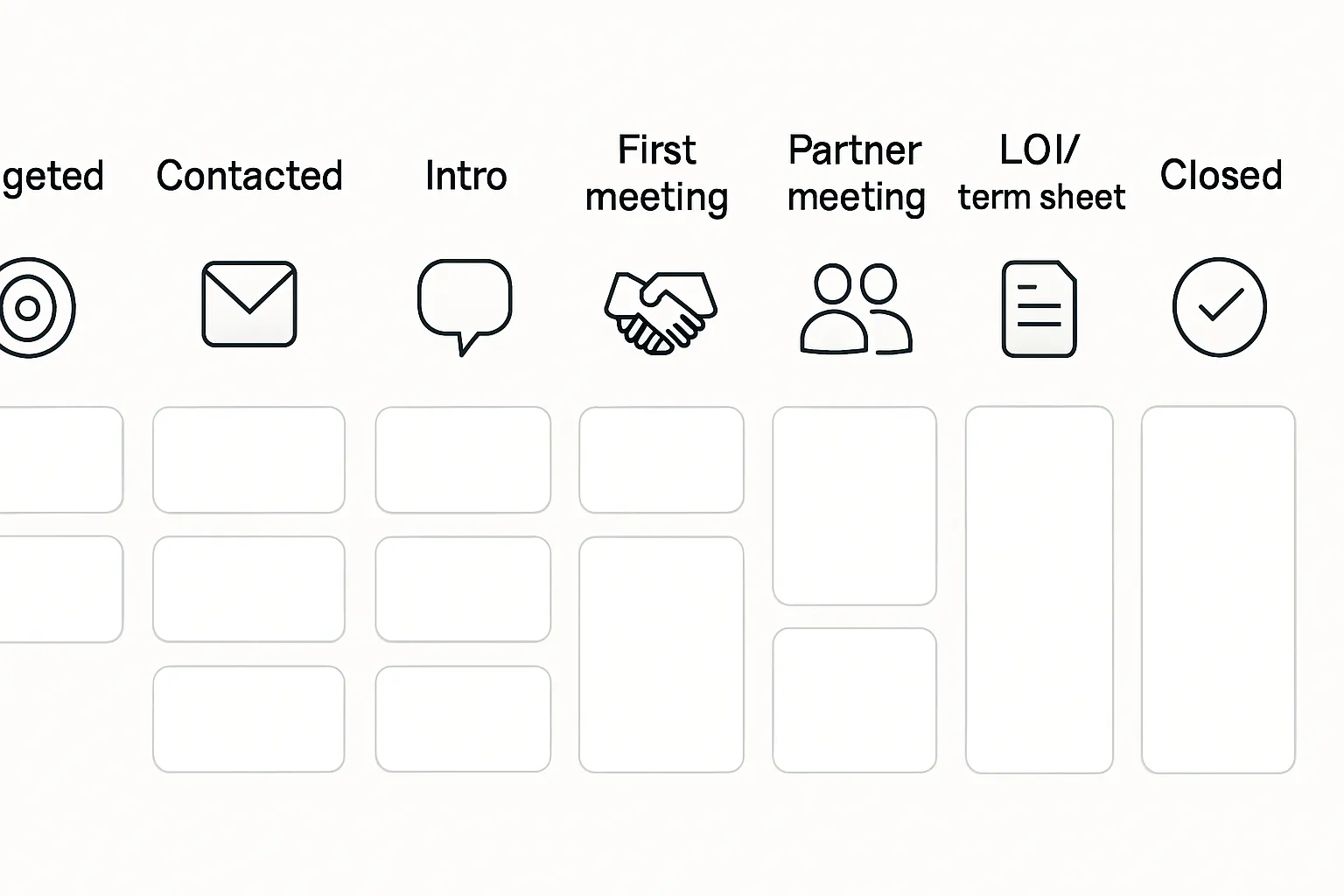

Build an investor pipeline (like sales)

Define ICP: stage, sector, check size, geography, thesis

Target list of 50–150 investors; tag by likelihood and fit

Track touchpoints in a simple CRM; time-box active raise to 4–6 weeks of meetings

Avoid time waste

Don’t chase “tourist capital”; prioritize aligned theses and decision-makers

Batch meetings to create momentum; push for clear next steps

Quick script swaps that convert

From “Can I pick your brain?” → “We’re raising $1.5M on a $8M cap SAFE; 32% MoM revenue growth; would love to share 6-slide deck - interested?”

Place the video here for fast context

Watch on YouTube: https://www.youtube.com/embed/A3MmYbH1hbs Why it matters: YC’s Michael Seibel breaks down practical tactics for investor outreach, narrative, and momentum so investors and startups convert top-of-funnel interest into real funding and investment progress for startups for investment (yes, we funders notice signal).

Stages decoded: funding and investment expectations from Pre-Seed to Series C

The fastest way to de-risk your raise is to know exactly what “good” looks like at each stage. Use this to calibrate your investment fundraising narrative, align with investors and startups on expectations, and plan your next milestone with precision.

What investors look for by stage

Pre-Seed: sharp insight, early product, founding team credibility, first proof of demand

Seed: usage/revenue traction, retention and unit economics signals, early GTM repeatability

Series A: product-market fit evidence, scalable channels, revenue quality/cohorts, hiring plan

Series B/C: scale efficiency, category leadership signals, path to profitability, expansion thesis

Round mechanics you can plan

Typical dilution bands by stage (e.g., Seed 15–25%, A 15–25%, later rounds variable)

Runway goal: 12–18 months per raise; raise against milestones, not vanity targets

Crypto/web3 note: if tokens are involved, separate token economics from equity and follow compliance (SAFTs, jurisdiction specifics)

Funding stage vs. what good looks like

Stage | Typical traction proof | Core milestone for next round | Typical round size range | Typical dilution range | Lead investor profile |

|---|---|---|---|---|---|

Pre-Seed | Compelling insight + prototype/MVP; early waitlist/LOIs; 3–10 design partners or first $0–$10k MRR | MVP in market; first active customers; early retention signal; clear ICP and GTM hypothesis | $250k–$2M | 5–15% | Angels/operator angels, pre-seed funds, accelerators, syndicates |

Seed | 10–50k MRR or fast usage growth; 30/60/90-day retention; early LTV/CAC signal; 3–5 repeatable channels | PMF evidence; repeatable GTM; path to $1M+ ARR and high-confidence roadmap | $1M–$5M+ | 15–25% | Seed funds, micro-VCs, sector-focused firms |

Series A | $1M–$3M+ ARR (business-model dependent); healthy cohorts and net retention; CAC payback discipline; hiring velocity | Scale motion proven; senior team in place; channel scalability; roadmap to multi-year growth | $8M–$20M | 15–25% | Leading venture firms (generalist or sector-focused) |

Series B | $5M–$20M ARR; efficient growth (e.g., payback < 18 months); ops maturity; expanding ACVs/markets | Category leadership wedge; internationalization or new product lines; durable unit economics | $20M–$50M | 10–20% | Growth-stage VC, larger multi-stage firms |

Series C | $20M+ ARR and strong margins; profitability line-of-sight; enterprise and channel scale | Market expansion, M&A, IPO-readiness; multi-geo execution | $30M–$100M+ | 5–15% (variable) | Late-stage VC, crossover funds, PE, strategic investors |

Mistakes to skip

Over-raising without milestone clarity, under-raising without buffer, ignoring option pool top-ups

Mixing token and equity economics; keep clean instruments and compliance in crypto/web3

Fuzzy metrics and messy data rooms that slow diligence and kill momentum

This is your scannable checklist to keep investment and funding aligned with today’s market. For investors scanning startups for investment, and for we funders selecting winners, clarity beats noise every time.

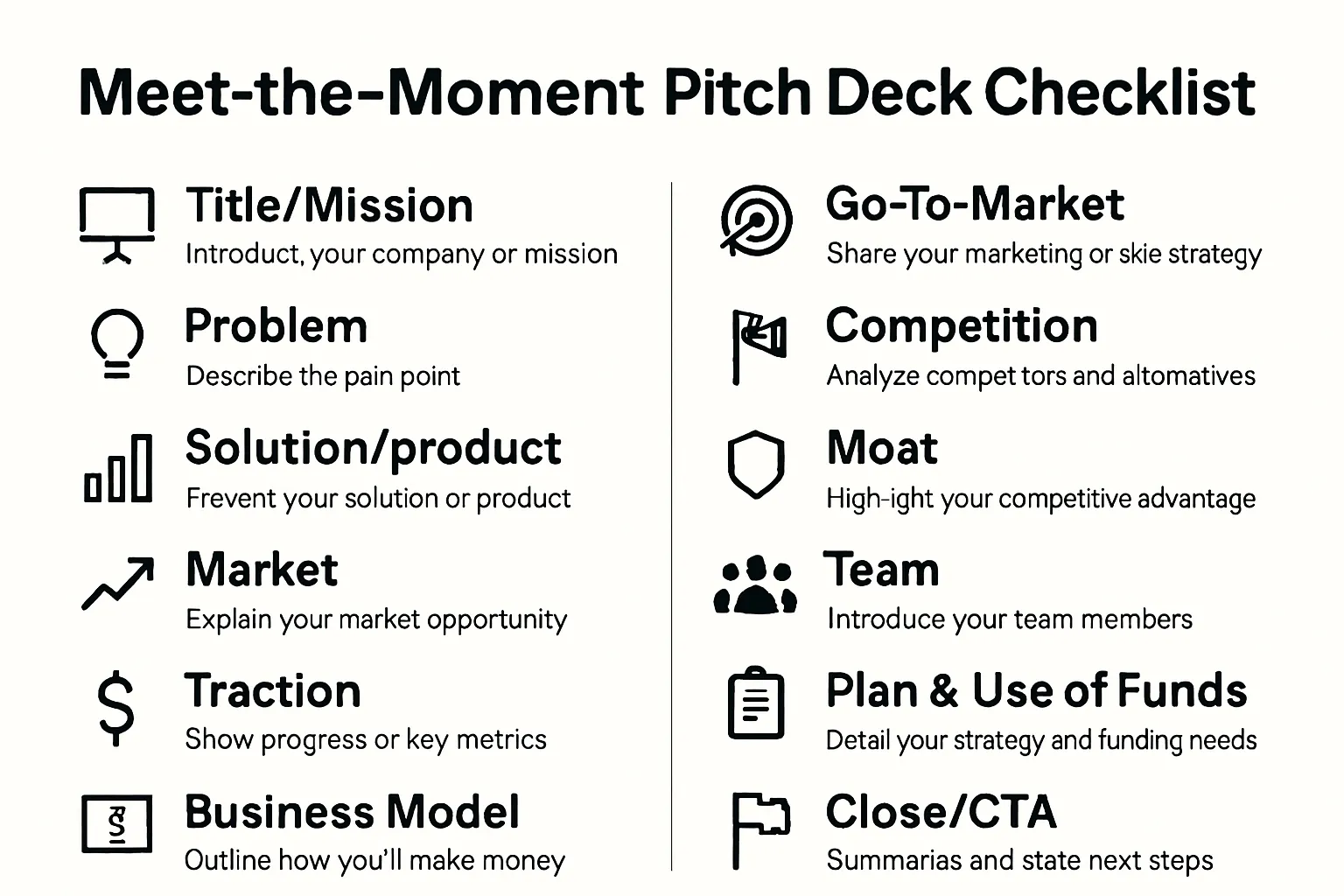

Prep to win: narrative, metrics, and a tidy data room

The best rounds are won before the first meeting. Your narrative, metrics, and data room do the heavy lifting so investors can confidently champion you to their partners. Keep it crisp, provable, and repeatable.

Craft a narrative investors repeat to their partners

Problem → unique insight → solution → market size → differentiation → business model → traction → roadmap → use of funds

In crypto: articulate token’s role (if any), user value, and compliance posture

Show the right metrics

Retention (logo, revenue), cohort curves, payback period, CAC/LTV, sales velocity

Product proof: activation rate, weekly active users, contributor/community health

Pitch deck blueprint (10–12 slides)

Title/mission, problem, solution/product, market, traction, business model, GTM, competition, moat, team, plan & use of funds, close/CTA

Data room essentials

Corporate docs, cap table, financials + forecasts, key contracts, metrics definitions, security/privacy docs, compliance notes (especially for tokens)

Find the right "we funders": angels, VCs, DAOs, and platforms

Fundraising works when you match your story to the right backers - by stage, sector, and speed. Build a target list with intent, qualify fast, and focus energy where conviction can compound.

Build your target list without guessing

Map investor theses to your stage/sector/geography/check size

Use signals: who funded similar startups for investment? Who leads, who follows?

Advanced sourcing tactics

Portfolio founder referrals and operator angels

Curated syndicates and thematic communities (including web3 DAOs)

Thought-leadership breadcrumbs (public roadmaps, open-source, founder letters)

Qualify fast

3-question fit test: thesis match, decision speed, value-add beyond capital

Red flags: vague process, moving goalposts, misaligned control terms

Who brings what value

Investor type | Typical check size | Speed to yes/no | Where they add the most value | Common pitfalls |

|---|---|---|---|---|

Angels (operator/entrepreneur) | $10k–$250k | Fast (days to weeks) | Hands-on advice, early customer intros, credibility | Limited follow-on capacity; value varies by engagement |

Micro-VCs (pre-seed/seed) | $100k–$1.5M | Moderate (2–6 weeks) | Lead discipline, early GTM help, fundraising prep | Smaller reserves; may stretch on ownership/control asks |

Institutional VCs (Series A–C) | $2M–$25M+ | Slower (4–12+ weeks) | Scaling playbooks, hiring execs, follow-on capacity | Process-heavy, partner dynamics, signaling risk if they pass |

Strategics (corporates) | $1M–$20M+ | Variable (6–16+ weeks) | Distribution, partnerships, credibility in enterprise | Commercial entanglements, ROFRs, slower decision cycles |

Syndicates (angel-led) | $50k–$500k | Fast (days to weeks) | Access to operator networks, flexible participation | Herding logistics, opaque diligence quality |

DAOs (web3 communities) | $25k–$1M | Variable (on-chain governance cycles) | Community liquidity, protocol alignment, evangelism | Voting delays, governance complexity, token/equity mix |

Crowdfunding platforms | $50k–$5M | Moderate (campaign-driven) | Brand awareness, user-investor flywheel | Heavy marketing lift, disclosure overhead |

Prioritize your outreach by fit and speed to reduce cycle time and increase the probability of a clean, momentum-rich raise.

Run the process: outreach, updates, and momentum mechanics

The fastest rounds aren’t accidents - they’re engineered. Treat investment fundraising like a product launch with clear timelines, tight communication, and visible progress. Momentum is the message investors and startups both respond to.

Week-by-week plan (example)

Week 1–2: finalize materials, soft-circled investors, calendar block

Lock your narrative, 6–8 slide lite deck, and one-pager; rehearse 15-minute pitch.

Warm up 10–20 soft circles (angels, operator VCs) to pre-qualify interest.

Block 3–4 afternoons/week for first meetings; prepare a clean data room.

Week 3–6: compressed first meetings; weekly update to all active investors

Batch 6–10 first meetings/week to create temporal momentum.

Send one concise weekly update to all active investors: highlights, metrics, asks, next steps.

Convert strong maybes into partner meetings quickly; clarify process and timing.

Week 7–8: term sheet negotiation and reference checks; parallel diligence

Run references in parallel with term-sheet discussions; keep a shared Q&A log.

Time-box diligence requests; share a metrics glossary to avoid definitional drift.

If multiple offers, align on valuation, dilution, governance, and speed to close.

Outreach cadences and templates

5–7 sentence cold email with traction-first subject line

Subject options:

“32% MoM, $86k ARR, raising $1.5M SAFE ($8M cap) - intro?”

“Open-source X for Y - 18k MAU, 4 wk payback, seed round open”

Body (keep to 5–7 sentences):

1: One-line what/why (problem + unique insight).

2: Proof (growth, retention, revenue, notable design partners).

3: Team credibility (1–2 relevant wins).

4: The ask (round size, instrument, valuation/cap, use of funds).

5: Why them (thesis fit in one line).

6: CTA with 2–3 time windows for a 20-min intro.

One-pager and 6–8 slide lite deck for quick scans

One-pager: mission, problem/solution, 3 proof bullets, market, business model, round details, contact.

Lite deck (6–8 slides): Title, Problem, Solution/Product, Proof/Traction, Market, GTM, Team, Round & Ask.

Keep the flywheel spinning

Time-box diligence requests; share a metrics glossary

Commit to 72-hour turnaround on standard items; push non-critical items post-term sheet.

Metrics glossary examples: how you compute MAU, activation, CAC, CAC payback, LTV, net/revenue retention, cohort windows.

Handle maybes: re-engage after new milestones

Park maybes; re-approach only with new proof (e.g., +30% MRR, new enterprise logo, audit passed).

Use monthly “progress proof” updates to keep the door warm without chasing.

Manage over-subscription and allocation fairly

Prioritize lead + highest conviction value-add; communicate allocation constraints early.

Offer pro-rata guidance and clear deadlines; don’t drag negotiations past your decision date.

Crypto/browser-native nuance

Communicate security posture, audits, and compliance; separate token and equity discussions

Share audit reports, bug bounty details, custody/key management, KYC/AML posture by jurisdiction.

If tokens: outline utility vs. governance, emissions/vesting, and any SAFT terms separately from equity.

Maintain a token cap table and an equity cap table; clarity reduces legal friction and speeds funding and investment decisions.

Zemyth tip: operate like a deal athlete. Responsive, precise, and predictable beats loud every time - for we funders and for startups for investment looking to convert interest into investment and funding with minimum drag.

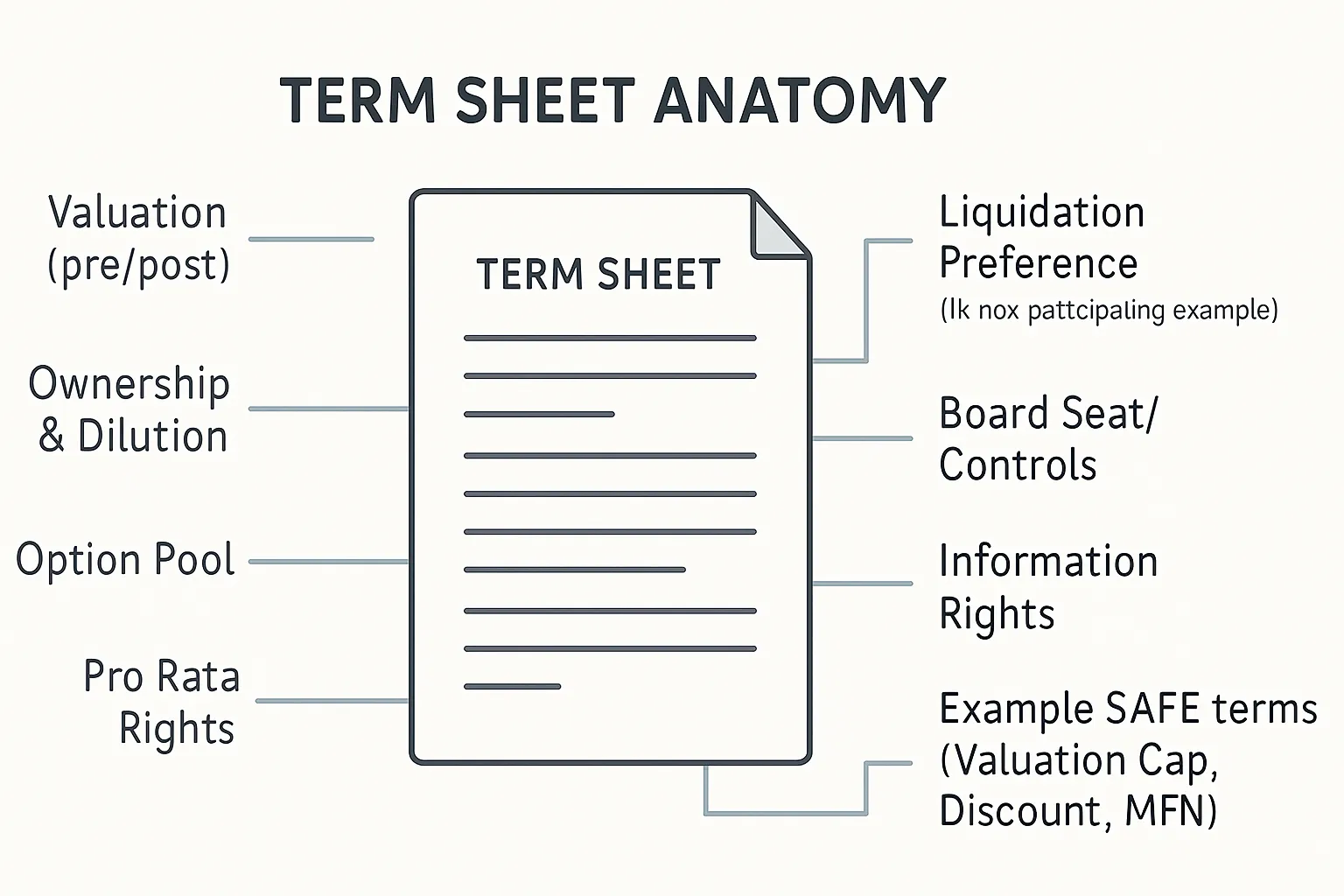

Diligence to done: negotiate funding and investment terms the smart way

Your goal at this stage is simple: reduce uncertainty, align incentives, and move from intent to wired cash with minimal friction. Investors and startups both win when diligence is crisp, terms are clear, and the close is clean.

Diligence checklist

Product and traction proof (live product, activation/retention, cohorts)

Financials and unit economics (MRR/ARR, gross margin, CAC, LTV, payback)

Legal/compliance (corporate docs, IP assignment, privacy/security posture)

Security (audits, pen tests, data handling), especially for crypto/web3

Customer references (champions, churned accounts, pipeline validation)

Term sheet anatomy (equity and SAFE)

Valuation and amount raised: pre-money, post-money, ownership, dilution math

Option pool: pre- or post-money expansion; hiring plan alignment

Pro rata rights: investor participation in future rounds; super pro rata exceptions

Liquidation preferences: e.g., 1x non-participating standard; watch for participating/multiples

Board and controls: board seats/observers, voting thresholds, protective provisions

Information rights: cadence and detail of financials/metrics reporting

SAFE terms: valuation cap, discount, MFN; clarity on conversion mechanics

Priced equity terms: preferred stock rights, anti-dilution, pay-to-play, drag/tag

Token-related structures (if applicable)

SAFT basics: clear token purpose, distribution schedule, and regulatory posture

Token allocation policy: team/community/investor splits, emissions, lockups/vesting

Disclosures: risks, utility vs. governance, jurisdiction-specific compliance

Negotiation tactics

Optimize for the right lead, not just the highest headline valuation

Align on milestones and follow-on support early (reserves, pro rata intentions)

Stack-rank terms: non-negotiables (governance, economics) vs. tradable (timing, rights)

Keep competitive tension ethical and time-bound; communicate deadlines clearly

Use redlines sparingly; solve for clarity, speed, and long-term partnership

Closing cleanly

Final docs: signatures, consents, side letters, option pool updates, board approvals

Wire checklist: closing funds flow, banking details, cap table updates (and token cap table, if applicable)

Announce with a customer-first narrative: why this funding and investment accelerates user value

Post-close: establish reporting cadence and KPI dashboard to keep investors and startups aligned

"After signing a term sheet, the legal negotiations and deal closing stage can last six to eight weeks." - Source

Operate with discipline and transparency. In investment and funding, speed comes from readiness - clean data, clear terms, and a shared plan to hit milestones after the round closes.

After you close: operating cadence and investor relations

Closing is the starting gun. The next 90 days determine whether your funding and investment turns into momentum or drift. Here’s the operating cadence that keeps investors and startups aligned, compounding proof, and ready for the next raise.

30/60/90-day priorities

First 30 days

Hiring against roadmap: close offers for the 2–4 roles that unlock the plan (engineering, GTM, ops).

Onboarding and enablement: day-1 access, 30-day success plans, weekly manager check-ins.

Budget discipline: lock quarterly budget, owner per line item, and burn guardrails; sunset low-ROI vendors.

Governance: finalize board calendar, reporting cadence, and cap table/option grants.

Data hygiene: single metric glossary and dashboards; freeze definitions for retention, CAC, LTV, and cohorts.

Days 31–60

Execution rhythm: weekly ops review (KPIs, experiments, blockers), biweekly product roadmap sync.

Customer proof: ship 1–2 “needle-mover” features; publish 2–3 referenceable wins or case studies.

GTM engine: instrument funnel, tighten ICP, launch 1–2 repeatable channels; set SLA for lead follow-up.

Security and compliance: start audits or gap assessments (SOC 2, privacy), update DPA policies.

Vendor cleanup: renegotiate, consolidate, or cancel tools that don’t directly support the plan.

Days 61–90

Milestone readout: show trendlines (growth, retention, gross margin, payback); document what’s working.

Team leveling: fill remaining critical roles; adjust org design; calibrate OKRs for next quarter.

Next-raise prep: identify milestones needed for seed/A/B; back-cast timelines and owners.

Cash planning: scenario plans (base/goal/defensive), credit options checklist, and debt readiness (if relevant).

Communication that compounds

Monthly investor updates (one page, same template every month)

Highlights: 3–5 wins tied to the plan (customers, product, hiring).

KPIs: revenue/usage, retention/cohorts, CAC/LTV, payback, burn/runway; one chart per KPI.

Product: shipped, adoption, next 30 days.

Pipeline: top deals, stage, risks; requested intros.

Hiring: open roles, key starts, open backfills.

Asks: 3 specific, easy-to-forward bullets (talent, customers, partners).

Board rhythm and materials

Quarterly board meeting with pre-read (48–72 hours prior): narrative memo, KPI pack, financials, product roadmap, hiring plan, risks/mitigations, decisions needed.

Record decisions and owners in a single tracker; follow up within 72 hours.

Extend runway early

Forecast monthly

Re-forecast each month; track burn multiple and cash-out date; publish “no-surprise” runway timeline to the board.

Scenario planning: base/goal/defensive; tie hiring gates to leading indicators (activation, ACV, sales cycle).

Credit options (use thoughtfully)

Venture debt, RBF, or working capital lines tied to covenant-safe metrics and conservative draw schedules.

In crypto/web3, separate treasury management from operating cash; document custody, risk, and liquidity policies.

Bridges and extensions

Pre-emptive bridge if you can pull forward proof; milestone-based extension if you need 3–6 months to lock PMF or channel scale.

Keep instruments clean (e.g., uncapped notes with MFN are harder; be explicit on cap/discount and pro rata).

Create a win factory

Align OKRs to raise-milestones

Examples: Seed → “consistent 30/60/90-day retention,” Series A → “$1–3M ARR with <12–18 mo payback,” Series B → “efficient growth with category wedge.”

Keep experiment logs

Weekly experiment reviews with hypothesis → result → decision; kill or double down fast.

Celebrate proof, not hype

Institutionalize “proof posts”: customer stories, before/after ROI, cohort strength, security milestones, meaningful partnerships.

Browser-native/crypto nuance

Reporting

Share on-chain metrics (DAU/MAU, TVL, liquidity, fee/reward flows, contract usage) alongside company KPIs.

Separate token vs. equity updates; keep a token cap table and emissions schedule visible.

Compliance and security

Publish audit results, bug bounty data, and governance decisions; maintain jurisdiction-specific notes (KYC/AML, disclosures).

Practical templates you can copy

Monthly update subject line: “March Update - $112k MRR (+14% MoM), 54% 60-day retention, SOC 2 audit started, 2 hires closed - Asks inside”

Investor update sections: Highlights | Metrics | Product | GTM/Pipeline | Hiring | Asks | Risks/Mitigations | Next 30 Days

KPI glossary starters: Activation (first value action within X days), Net revenue retention (cohort-based, monthly), CAC (fully loaded), LTV (gross margin basis), Payback (CAC/GM-months)

After a round, the best investors and startups operate like one team. Clear cadence, consistent metrics, and disciplined spend turn investment and funding into durable growth - so when it’s time to raise again, your story is already proven.

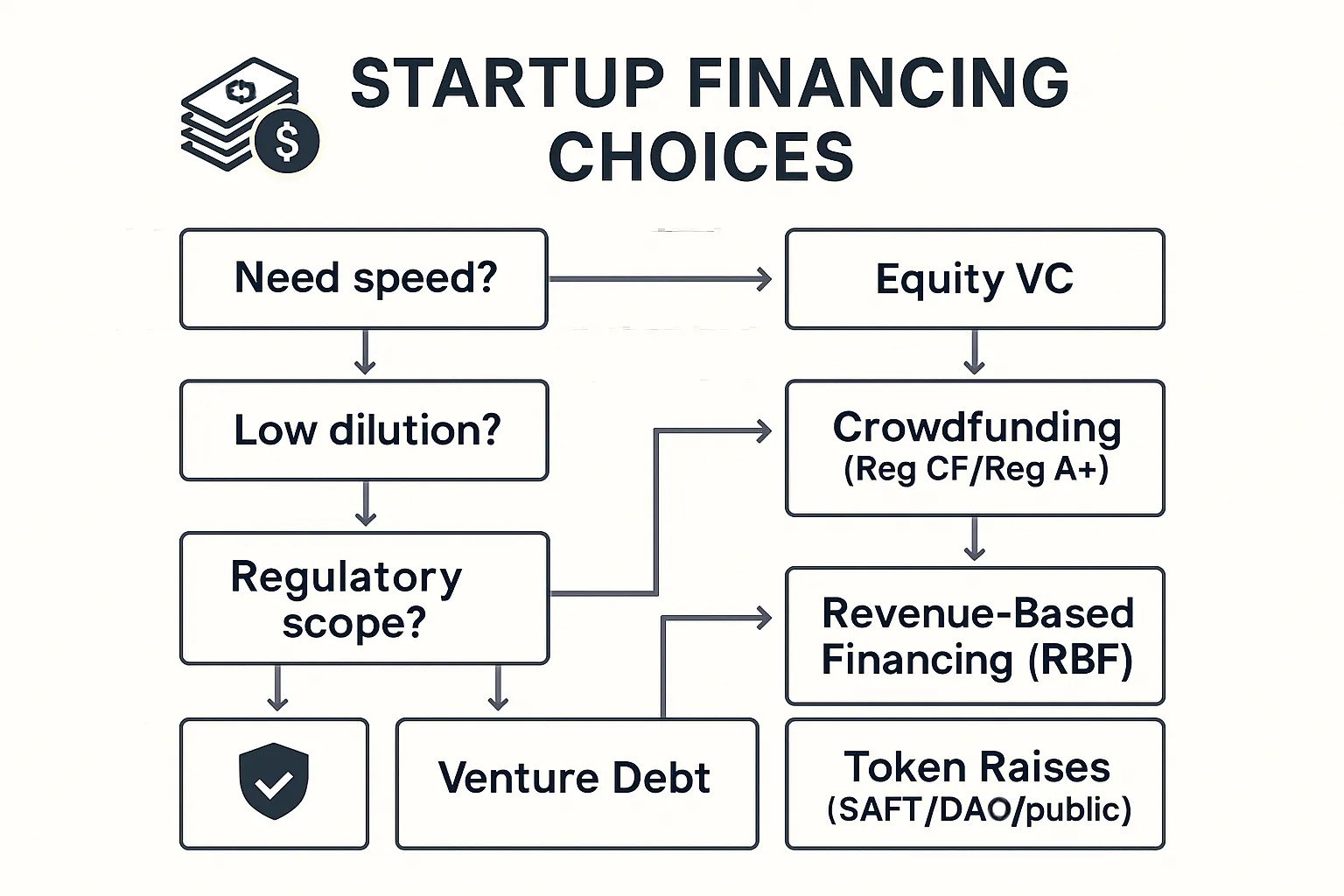

Alternative paths: crowdfunding, venture debt, RBF, grants, and token raises

Not every raise is a VC round. If your goal is speed, non-dilution, or community alignment, there are smarter routes to investment and funding. Here’s how investors and startups can navigate alternatives without noise.

Non-dilutive and retail-accessible options

Revenue-based financing (RBF), venture debt, grants, ecosystem funds

Crowdfunding (Reg CF/Reg A+): widen your backer base and market test demand

"Under SEC Regulation Crowdfunding (Reg CF), eligible companies can raise up to $5 million within a 12-month period." - Source

Community and crypto-native raises

DAOs for aligned backers and governance signals

SAFTs for compliant token pre-sales; public token launches only with jurisdiction-aware legal review

Consider community allocations to reward early users and contributors

How to choose your path

Decision drivers: capital need, speed, dilution tolerance, compliance, retail/community strategy

Fit matrix

Equity VC: category-defining ambition, long runway, willingness to trade dilution for speed and scale

Crowdfunding: strong narrative and consumer appeal; convert customers into owners

Venture debt: predictable revenue and strong gross margins; extend runway with minimal dilution

RBF: recurring revenue with clean unit economics; pay as you grow

Grants/ecosystem funds: deep tech, research, or protocol-aligned work; non-dilutive but slower

Token raises: network effects, protocol/community alignment; compliance-first with clear token purpose

Retail participation and education

Everyday investors want predictable outcomes and transparent risk framing - clear terms, clear timelines, and consistent reporting beat hype.

Translate metrics into plain English (burn, runway, retention, payback) and share progress in a rhythm investors can trust.

Bottom line: alternative capital is a feature, not a fallback. Match the instrument to your milestone map, keep compliance tight, and run the same disciplined playbook investors and startups expect in any funding and investment cycle.

Start raising with intention - and put Zemyth to work

Raising capital isn’t luck - it’s discipline. Apply the playbook above to keep your investment fundraising focused on fit, proof, and speed. While you execute, Zemyth helps you stay sharp, keep cash productive, and build a community that compounds.

Your next move

Apply this playbook: focus on fit, proof, and speed to yes/no

Choose your capital path and timeline; stage your milestones

Keep a tight investor pipeline and weekly updates so investors and startups stay aligned on outcomes

Treat every touchpoint as momentum-building in your funding and investment process

Why Zemyth helps you stay sharp between rounds

Fund Nest: stable, low-risk, USD-denominated returns framed simply as $1/day per $1,000 invested - a steady, predictable complement to volatile startup cycles

Startup Nest: high-upside exposure for bold, risk-tolerant investors (e.g., $1K could 100x - or go to $0). Clear, no-nonsense risk framing

Academy: level up your investor IQ with practical education so your investment and funding decisions get sharper each month

Affiliate program: earn by growing your network while you build; turn your community into real distribution

A clean, motivational experience that supports disciplined investment fundraising - exactly what we funders respect

Call to action

Build your daily results habit and sharpen your edge while you fundraise. Visit https://zemyth.app to get started today.