TL;DR + What You’ll Achieve in 12 Weeks

TL;DR

A 12-week, step-by-step investment academy that helps you invest your money with confidence - covering wallets, security, risk planning, asset allocation, diversification (including DeFi), due diligence, and exit rules.

You’ll build a personal plan, set up accounts/wallets, automate contributions, define allocation targets, and learn exactly when to rebalance or exit.

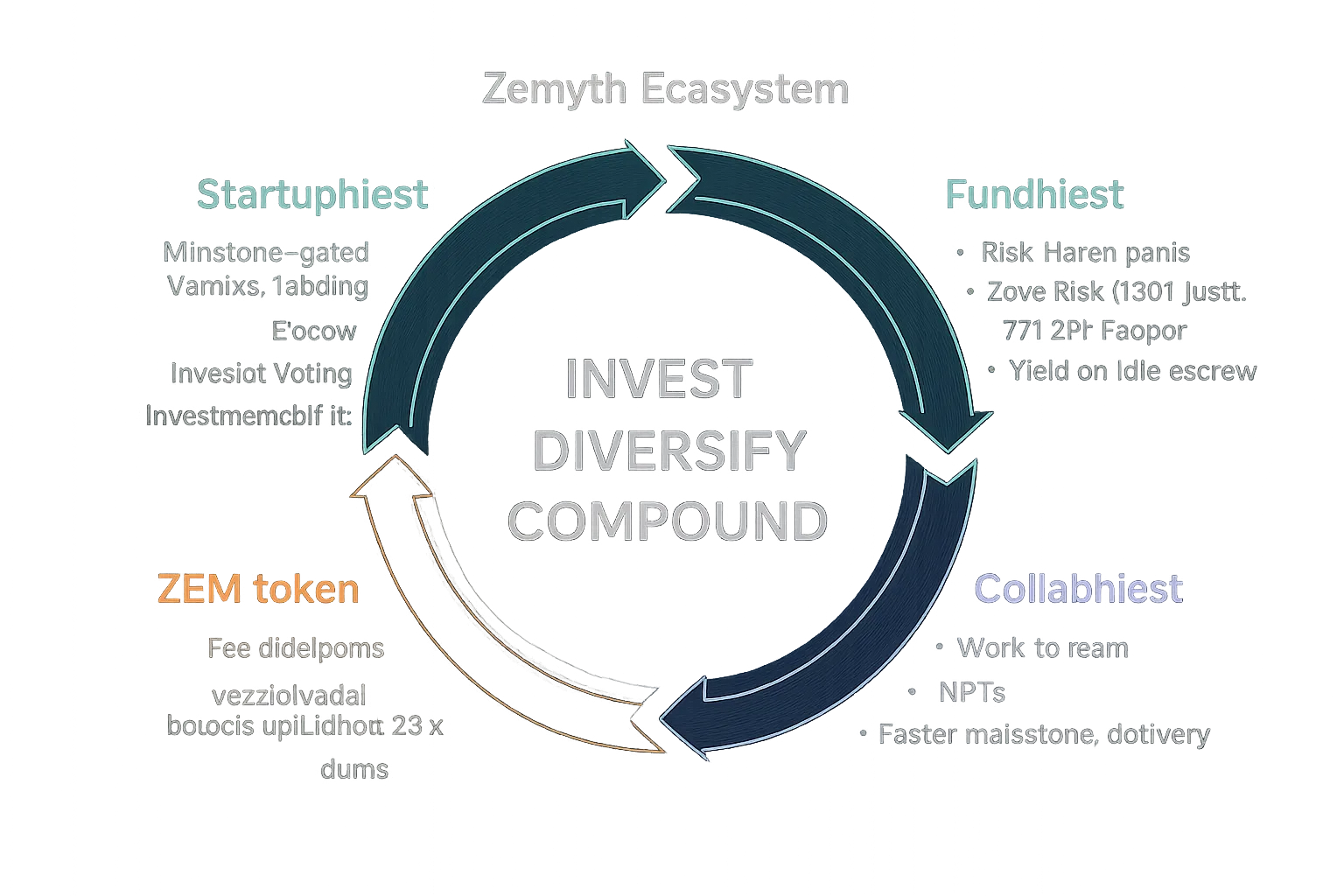

Powered by Zemyth’s ecosystem: FundNest (yield layers), StartupNest (milestone-gated venture deals), and ZEM token utilities for boosts and fees.

By Week 12, you’ll have a written Investment Playbook, a live portfolio (even if you start small), and rules you can follow in under an hour per month.

"Over the decade ending December 31, 2022, the average U.S. investor underperformed their funds by about 1.7% annually due to timing mistakes." - Source

Who this investment academy is for

Beginners and intermediate investors who want a structured, practical path in 12 weeks.

Founders, angels, DAOs, creators, and yield‑oriented investors who want a dependable base via FundNest while scouting StartupNest.

What you need to start

A browser, a mobile wallet (for Solana), a regulated brokerage or exchange, and 1–2 hours per week.

Optional: stablecoins (USDC/USDT) for DeFi yield experiments and ZEM to unlock boosts.

What makes this academy investment plan different

Milestone‑gated venture exposure with safety rails (escrows, voting, challenge windows).

Yield-on-idle capital via FundNest while you learn - your money doesn’t sit still.

A single connected stack (Zemyth) to learn, practice, and deploy - all in one place.

SEO note (included naturally in copy)

Phrases we’ll weave throughout: investment academy, academy investment, invest your money, your money.

Ready to start? Build your 12-week plan and launch your live portfolio with Zemyth today: https://zemyth.app

Your 12‑Week Investment Academy Roadmap at a Glance

Watch this first (3 minutes)

The one-page overview of how the 12 weeks fit together - what to do, when, and why.

Chapters

0:00 Week 1 - Setup, goals, accounts

0:15 Week 2 - Wallets, 2FA, hardware security

0:30 Week 3 - Risk plan (capacity vs. tolerance)

0:45 Week 4 - Core/satellite asset allocation

1:00 Week 5 - Due diligence checklists

1:15 Week 6 - Automation: DCA + rules

1:30 Week 7 - TradFi + DeFi diversification

1:40 Week 8 - FundNest yield and ZEM boosts

1:55 Week 9 - StartupNest venture position

2:10 Week 10 - Exit rules and challenge windows

2:25 Week 11 - Rebalancing cadence and metrics

2:40 Week 12 - Capstone Investment Playbook

Roadmap highlights

Weeks 1–3: Accounts, wallets, security hardening, and personal risk plan.

Weeks 4–6: Asset allocation, due diligence, and automation (DCA + rules).

Weeks 7–9: Diversification across TradFi + DeFi; FundNest yield; StartupNest ventures.

Weeks 10–12: Exit rules, rebalancing cadence, performance metrics, capstone Playbook.

Key outcomes

Clarity on risk capacity vs. risk tolerance, allocation targets, and contribution schedule.

Practical exposure: a zero‑risk yield pool, one diversified ETF core, and one milestone‑gated venture position (size‑appropriate).

"Diversification is the only free lunch in investing." - Source

12‑Week Curriculum Overview

Week | Focus | What You’ll Do | Tools You’ll Use (Zemyth modules where relevant) |

|---|---|---|---|

1 | Foundations & Accounts | Define goals, baseline net worth, open brokerage/exchange, set up Solana wallet. | Browser + brokerage/exchange; Phantom/Solflare wallet; Zemyth Academy templates. |

2 | Security Hardening | Enable 2FA, secure seed phrases, test hardware wallet flow, set access policies. | Password manager, authenticator, Ledger/Trezor; Wallet best‑practice checklist. |

3 | Personal Risk Plan | Quantify risk capacity vs. tolerance; set emergency fund; position sizing rules. | Risk calculator; Investment Playbook draft; Zemyth risk templates. |

4 | Asset Allocation | Build core/satellite model; pick diversified ETF core; set target weights. | Brokerage ETF screener; allocation worksheet; Zemyth Playbook. |

5 | Due Diligence | Apply checklists to ETFs/tokens; assess fees, liquidity, mandate drift, on‑chain risk. | DD checklist; on‑chain explorers; StartupNest project pages (read‑only). |

6 | Automation (DCA + Rules) | Set recurring buys; define buy/sell guardrails; pre‑commit rebalancing bands. | Broker/exchange automation; rules template; alerts. |

7 | Diversify: TradFi + DeFi | Fund a small DeFi pilot; understand stablecoin mechanics and risks. | FundNest Zero Risk pool (USDT/USDC); wallet confirmations. |

8 | Yield Layers & Boosts | Optimize yield; explore ZEM utilities for fee discounts and boosts. | FundNest yield dashboard; ZEM staking/veZEM boosts. |

9 | Venture Exposure | Take a size‑appropriate position in a milestone‑gated StartupNest deal. | StartupNest (Investment NFT mint); project docs; voting overview. |

10 | Exit Rules | Document exits: rebalancing, thesis‑break, challenge windows; protect downside. | Exit rulebook; Zemyth challenge‑window guide; alerts. |

11 | Rebalance & Measure | Set cadence; track performance, drawdowns, Sharpe‑like heuristics. | Portfolio tracker; broker reports; Zemyth metrics template. |

12 | Capstone Playbook | Finalize written Investment Playbook; simulate 12 months; schedule monthly review. | Zemyth integrated stack (StartupNest + FundNest + ZEM); Playbook PDF. |

This investment academy gives you a structured academy investment path to invest your money with confidence - your money works while you learn via FundNest, and you add measured venture exposure via StartupNest.

Ready to deploy this 12‑week plan? Start now at https://zemyth.app

Weeks 1–3 - Set the Foundation: Wallets, Security, and Your Risk Plan

Week 1: Accounts and Wallets

Open brokerage/exchange accounts; set up a Solana wallet (Phantom/Solflare) for DeFi.

KYC, backup phrases, device hygiene; connect test networks and learn to sign safely.

Pro tips

Use a dedicated browser profile for finance, isolate extensions, and disable auto‑fill on exchanges and wallets.

Record your seed phrase offline (paper/steel). Never store seeds or private keys in cloud notes or screenshots.

Week 2: Security Hardening

MFA, passkeys, hardware wallets; phishing red flags and allow‑list practices.

Transaction previews, spend limits, and vaulting larger sums.

Pro tips

Prefer authenticator apps or hardware security keys over SMS codes.

Turn on transaction simulation/preview and human‑readable decoding before confirming on-chain actions.

Week 3: Personal Risk Plan

Map time horizon, liquidity needs, and drawdown tolerance.

Translate risk to allocation bands (core vs. satellite); define sizing rules for ventures.

Pro tips

Write your max portfolio drawdown (e.g., “I can tolerate ‑20% without selling”) and size satellites accordingly.

Cap any single venture position (e.g., 0.5–2% of portfolio) and require milestone‑gated checks before adding.

Deliverables by end of Week 3

Security checklist complete; seed backups stored; wallet test transaction done.

One‑pager: Investment policy statement (IPS) with max loss, risk tiers, and position sizes.

Your foundation sets the tone for the entire investment academy. Invest your money with confidence by securing your stack first - your money, your rules. Get started with Zemyth’s connected stack at https://zemyth.app

Weeks 4–6 - Asset Allocation, Due Diligence, and Automation

Week 4: Asset Allocation That Fits You

Core/satellite structure (e.g., global equity + bonds as core; DeFi/ventures as satellites).

Choosing low‑cost, broad ETFs; understanding base currency vs. exposure currency.

How to think about it

Start with a global equity ETF plus high‑quality bonds as your “sleep‑at‑night” core; satellites are where you learn, explore DeFi yield (FundNest), or size‑appropriate venture positions (StartupNest).

Prioritize total cost of ownership: TER, spreads, tracking difference. Compare hedged vs. unhedged share classes relative to your base currency.

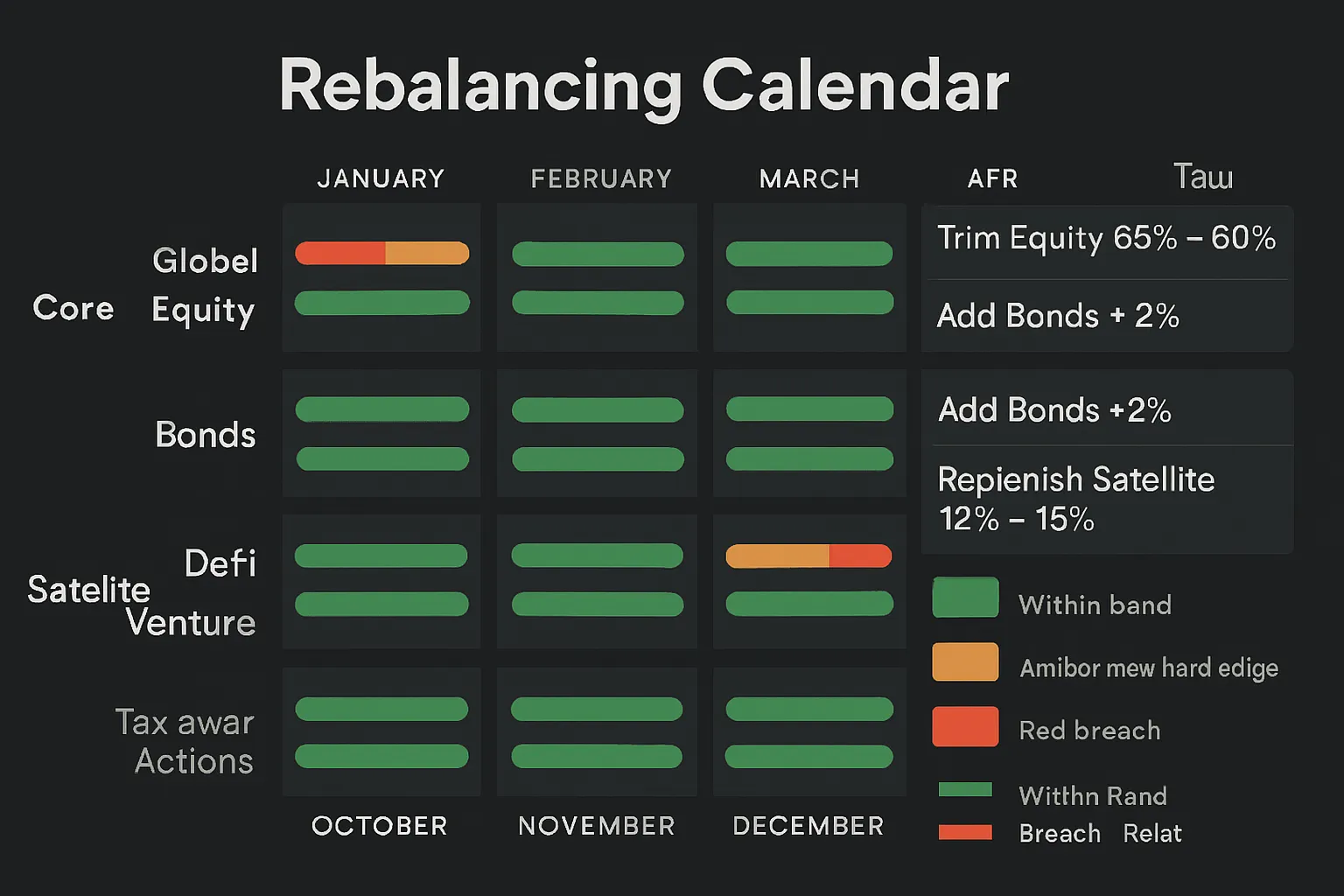

Define target weights with bands (e.g., Global Equity 60% ±5%, Bonds 25% ±3%, Satellites 15% ±3%) so rebalancing is rules‑based.

"Over the 15 years ending Dec. 31, 2023, 93.03% of U.S. large‑cap active funds underperformed the S&P 500." - Source

Why it matters

This investment academy favors low‑cost, diversified cores because the data is clear. Build the base to invest your money with confidence; then use satellites to express views - without risking your money on guesswork.

Week 5: Due Diligence, But Practical

Fund factsheets, fees, tracking error, turnover, and liquidity.

For ventures: milestone design, escrow rules, team signals, token distribution, and unlocks.

Your rapid DD checklist

ETFs/funds: mandate fit, index methodology, TER vs. peers, tracking difference vs. benchmark, replication method (physical vs. synthetic), AUM/volume, spreads, domicile/tax.

DeFi yield (FundNest): pool type (e.g., USDT/USDC zero‑risk), smart‑contract provenance, IL profile, fees, withdrawal terms, and any boosts (ZEM/veZEM).

Venture (StartupNest): milestones (clear, verifiable), escrow and voting mechanics, founder track record, token distribution/FDV, vesting/lockups, TGE plan, runway and reporting cadence.

Signal filters

If a fund drifts from its stated mandate or a venture repeatedly fails milestones, reduce or exit; satellites must earn their keep.

Week 6: Automation and Rules

Set DCA schedule; auto‑sweep to stablecoins; threshold rebalancing triggers.

Alerts for position limits, valuation bands, or milestone votes.

Build your system

DCA: Schedule weekly or bi‑weekly buys into your core; auto‑sweep idle cash to stablecoins and, if appropriate, deploy to FundNest’s Zero Risk pool.

Threshold rebalancing: When a sleeve breaches its band (e.g., ±5%), rebalance back to target. Use limit orders or periodic windows to control slippage.

Guardrails and alerts: Set position‑size caps, valuation band alerts for satellites, and StartupNest milestone vote reminders so you never miss a decision point.

Pre‑commit rules: Define your “add,” “hold,” and “exit” criteria now - so emotions don’t decide later.

Deliverables by end of Week 6

A written allocation with target bands; a DCA automation live; a due diligence checklist template you’ll reuse.

Ready to systemize your academy investment and put your money on autopilot? Get the tools to execute at https://zemyth.app

Weeks 7–9 - Diversify and Compound: FundNest Yield + StartupNest Ventures

Week 7: Safe Base Yield (Zero‑Risk Pool)

Park part of your emergency buffer or idle funds in FundNest Zero‑Risk pool (USDT/USDC) for ~7% APY target from trading fees; understand IL and no‑leverage mechanics.

Treat this as your dependable base during the academy investment journey - your money keeps working while you learn.

Checklist

Deposit equal USDT/USDC, confirm LP receipt, review withdrawal terms.

Note that impermanent loss is minimal in stable‑to‑stable pools; no leverage means no liquidation risk.

Week 8: Milestone‑Gated Venture (StartupNest)

Learn how escrow, voting, and challenge windows protect capital; how Investment NFTs encode your rights; how to size positions within your satellite band.

Focus on milestones: clear deliverables, 14‑day voting, 48‑hour challenge windows, and sequential unlocks.

Checklist

Review 2–3 StartupNest projects; read milestone definitions, team proof, token distribution and TGE plan.

Take a starter position sized to plan (or add to a watchlist if signals aren’t strong yet).

Week 9: Boosts and Compounding (ZEM)

Fee discounts, staking boosts, and vote‑to‑earn; how veZEM boosts FundNest yields and improves deal access on StartupNest.

Lock ZEM for veZEM to amplify base yield and get priority access to hot deals.

Checklist

Map your ZEM tier to your expected activity (FundNest deposits, StartupNest participation).

Turn on milestone vote reminders; claim vote‑to‑earn within monthly caps.

Deliverables by end of Week 9

One live yield position sized to plan; one venture position (or watchlist) with milestones reviewed; ZEM plan for boosts aligned to your commitment level.

Make diversification do the heavy lifting: anchor yield with FundNest, express upside with StartupNest, and compound with ZEM utilities. Start building your positions at https://zemyth.app

Weeks 10–12 - Exit Rules, Rebalancing, and Your Capstone Playbook

Week 10: Exit and Risk‑Off Rules

Pre‑commit sell rules:

Valuation/weight bands: trim when a sleeve breaches its upper band (e.g., Core Equity 60% target, +5% band; trim above 65%). Add when it breaches lower band.

Thesis breaks: exit if an ETF/fund drifts from mandate, a token changes economics/security, or a strategy underdelivers vs. its stated objective for 2+ quarters.

Time‑based stops: sunset a satellite if catalysts stall beyond your timeline.

StartupNest risk‑off specifics:

Milestone failures and inactivity: after 3 failed milestone votes, voluntary exit window opens; at 90 days of inactivity, project can be marked Abandoned with refunds. A shutdown vote passes at 66%.

Safety rails: each milestone unlock includes a 48‑hour challenge window (investors can veto with 30% aggregate vote weight).

Action playbook: “Reduce to target” on band breaches; “Zero or Watchlist” on thesis breaks; “Use exit window” on repeated milestone stress; “Hold” when signals remain intact.

Week 11: Rebalancing and Performance Tracking

Rebalancing:

Threshold vs. calendar: use threshold rebalancing for satellites (faster‑moving), calendar (monthly/quarterly) for core; combine both if helpful.

Tax‑aware moves: harvest losses where eligible, defer short‑term gains, use specific‑lot selection, and net fees/withholding. In DeFi, account for yield as ordinary income where applicable.

Performance metrics to track monthly:

Portfolio return (time‑weighted), money‑weighted return, and alpha vs. your reference mix.

Max drawdown and volatility (simple stdev proxy is fine).

Hit rate (wins/total), average win/loss, up/down capture vs. benchmark.

Yield attribution: FundNest fees/yield vs. capital gains, ZEM boosts/discounts, and vote‑to‑earn.

Liquidity and slippage costs on each rebalance cycle.

Dashboards and alerts:

Bands and position‑size caps, StartupNest milestone vote reminders, monthly DCA confirmation, and “thesis review” prompts every quarter.

Week 12: Capstone - Your Personal Investment Playbook

Build a 2–3 page living document you can run in under 60 minutes per month:

IPS: objectives, risk capacity vs. tolerance, max acceptable drawdown, and cash buffer policy.

Allocation map: target weights with bands for core (global equity, bonds) and satellites (FundNest yield, StartupNest ventures).

Position sizing grid: max position by tier (e.g., single venture 0.5–2%); entry/scale rules.

DCA plan: frequency, sources of cash, auto‑sweeps to stablecoins, and deploy rules to FundNest Zero‑Risk.

Venture checklist: milestones, escrow/voting, token distribution, unlocks, TGE plan.

Exit rules: valuation/weight bands, thesis breaks, StartupNest challenge/exit windows, and shutdown vote criteria.

Rebalance cadence: threshold triggers, calendar dates, tax‑aware instructions, and who/what approves changes.

Operationalize it:

Set calendar reminders, finalize alerts, and store the Playbook with version history.

Run a “paper” 12‑month simulation to pressure‑test your rules before full size.

Deliverables by end of Week 12

Finalized 2–3 page Playbook (IPS, allocation bands, sizing grid, DCA, venture DD, exits, rebalance cadence).

Dashboards/alerts live (bands, milestone votes, DCA confirmations).

A monthly routine that takes under 60 minutes to execute.

Lock in your rules and make them do the heavy lifting. Then let your money compound. Launch your Playbook with Zemyth’s connected stack: https://zemyth.app

Tools, Checklists, and Templates Library (Downloadables)

What you’ll get

Security checklist, wallet setup guide, investment policy statement (IPS) template.

Due diligence scorecard for ETFs and StartupNest projects.

Allocation and rebalancing calculator; DCA schedule worksheet; milestone vote cheat‑sheet.

How to use them in the academy

Each week references the exact tool to use, with pre‑filled examples so you can copy, tweak, and deploy in minutes. The goal: a practical investment academy toolkit that helps you invest your money with fewer decisions and cleaner execution.

Pro tip

Store everything in a single folder or Notion/Obsidian vault, and version after every rebalance so your money strategy is always audit‑ready.

Risk Tier × Investor Profile Matrix

Profile | Core Allocation Bands | Satellite Allocation Bands (DeFi/Ventures) | Example Zemyth Modules to Use (FundNest pool tier, StartupNest position sizing) |

|---|---|---|---|

Conservative | 80–90% core (Global Equity 45–55%, Bonds 30–40%, Cash 5–10%) | 10–20% satellites (DeFi 8–15%, Ventures 1–5%) | FundNest Zero Risk (USDT/USDC ~7% APY target); optional small Low Risk sleeve; StartupNest 0.5–1% per project (0–2 active); light ZEM for fee discounts. |

Balanced | 60–75% core (Global Equity 40–50%, Bonds 15–25%, Cash ~5%) | 25–40% satellites (DeFi 15–25%, Ventures 5–10%) | FundNest blend: Zero Risk + Low Risk (e.g., 70/30); StartupNest ~1% per project (2–4 active); moderate ZEM/veZEM boosts for yield and access. |

Growth | 50–60% core (Global Equity 45–55%, Bonds 0–10%, Cash 0–5%) | 40–50% satellites (DeFi 20–30%, Ventures 10–20%) | FundNest focus on Low/Medium Risk; consider a small High Risk sleeve once seasoned; StartupNest 1–2% per project (3–6 active); higher ZEM lock for maximum boosts and priority access. |

These templates turn academy investment theory into action - clear bands, rules, and checklists that let your money compound without guesswork. Download your library and deploy it inside the Zemyth stack: https://zemyth.app

Mistakes to Avoid and Fast Answers (FAQs)

"The stock market is a device for transferring money from the impatient to the patient." - Source

Common mistakes we’ll help you avoid

Over‑concentration; chasing heat; skipping security basics; moving without rules.

Neglecting exit criteria; ignoring fees and taxes; not documenting your plan.

FAQs

How small can I start?

Start with whatever you can automate consistently. Even $25–$100/week builds habits and positions over time.

How do I pick my first ETF?

Choose a low‑cost, broad, global equity ETF as the core; confirm TER, tracking difference, and liquidity. Keep it simple.

What if I miss a week?

Don’t chase. Resume your DCA schedule and review your Playbook at the next calendar checkpoint.

How to size a venture bet?

Treat ventures as satellites: 0.5–2% per project, capped by a total satellite band. Add only after milestones pass.

How do voting and escrow protect me on StartupNest?

Funds unlock per milestone after investor voting; 48‑hour challenge windows and inactivity timeouts protect capital; refunds are proportional when safety windows trigger.

How do I use ZEM for boosts?

Hold ZEM for fee discounts; lock veZEM to boost FundNest yields up to 2.5× and improve early access to StartupNest deals; enable vote‑to‑earn for active milestone participation.

Troubleshooting

What to do if a project stalls

Check milestone state. If inactivity >90 days, project can be marked Abandoned, opening refund windows. Consider exiting during pivot/exit windows.

How refunds and safety windows work

During pivots or after multiple failed milestones, voluntary exit windows open; refunds are proportional to escrowed funds remaining.

When to wait vs. redeploy

If your thesis is intact and bands aren’t breached, wait. If a sleeve breaches bands or a thesis breaks, rebalance or exit per your Playbook.

Keep your investing academy simple and systematic - rules first, execution second. When you’re ready, put your plan to work with Zemyth: https://zemyth.app

Case Studies and Success Paths

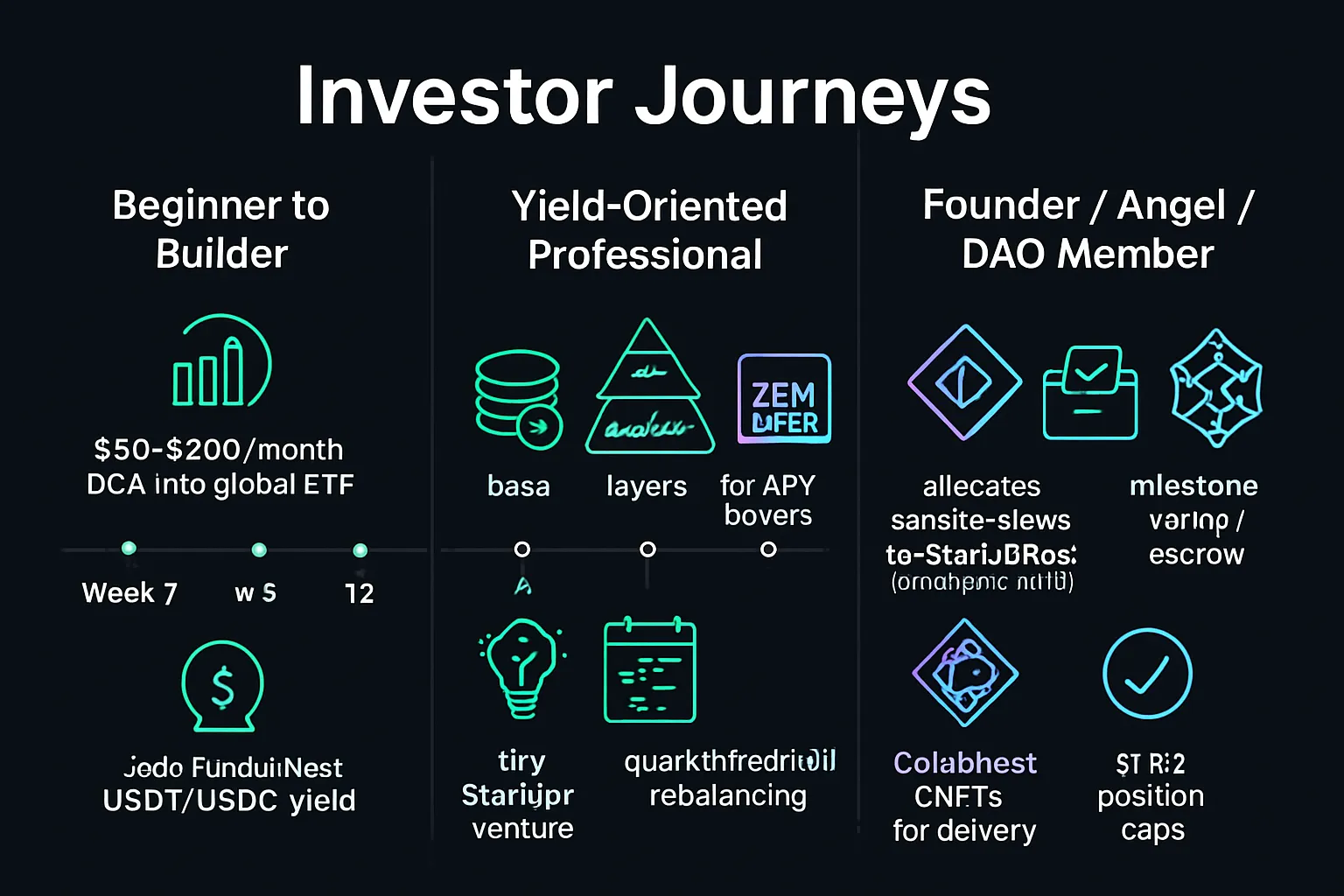

Beginner to Builder (8–12 weeks)

Starts with $50–$200/month DCA into a global core ETF; adds a small Zero‑Risk yield position; documents exit rules; considers a tiny venture position after Week 9.

Outcome by Week 12: a live portfolio, IPS written, DCA running, and one size‑appropriate venture or watchlist - confidence to invest your money with simple rules.

Yield‑Oriented Professional

Builds a dependable base in FundNest Zero‑Risk; layers Low/Medium Risk when comfortable; uses veZEM to boost APY; sets rebalancing to quarterly threshold.

Outcome by Week 12: automated deposits, boosted yields via ZEM, and a clean rebalance cadence that keeps your money compounding without daily screen time.

Founder/Angel/DAO Member

Allocates a satellite sleeve to StartupNest with strict position caps; leverages milestone votes; uses CollabNest to accelerate delivery and earn cNFTs.

Outcome by Week 12: curated venture exposure with escrow protection, active voting rights through Investment NFTs, and contribution‑driven upside via cNFTs.

What they all share

A written playbook, automation, and pre‑commit rules that make decisions easy under stress.

Choose your path, lock your rules, and execute with the Zemyth stack: https://zemyth.app

Conclusion - Start Investing With Confidence on Zemyth

In one sentence

The fastest path to invest your money with confidence is a 12‑week plan you can actually follow - secure, diversified, automated, and rule‑based.

Why Zemyth

Milestone‑gated venture rounds via StartupNest (escrow, voting, challenge windows).

Dependable base yield through FundNest’s risk‑tiered pools (put your money to work every day).

ZEM utilities to reduce fees, boost yields (veZEM), and improve access to hot deals.

On‑chain transparency, community‑aligned incentives, and an integrated investment academy that makes execution simple.

Call to action

Join the free curriculum, start Week 1 today, and download your templates. Your money should be working for you - starting now.

Start now at https://zemyth.app