TL;DR: Invest in crypto like a pro, not a coin shopper

"As of July 2025, total crypto market cap ≈ $3.4T and Bitcoin ≈ $2.1T." - Source

Problem: Most people “invest” by chasing coins, headlines, and screenshots.

Solution: Treat crypto like a portfolio you operate with rules - allocate by risk, demand milestones and cash‑flow potential, and automate decisions.

5‑step plan:

Define a Core–Explore–Speculate allocation and risk budget.

Park idle cash in low‑risk yield (so your money works while you wait).

Back milestone‑gated projects, not promises.

Write a simple IPS (rules for buys/sells/rebalancing) and stick to it.

Use Zemyth’s ecosystem to do all three in one place.

Best way to invest your money in crypto: stop buying coins impulsively; fund progress, compound yield, and size positions by risk.

CTA: Start your disciplined plan with Zemyth → https://zemyth.app

A good way to invest your money isn’t to “invest coins” at random - it’s to build a rules‑driven system. The best way to invest your money in crypto is to make crypto investments behave like a portfolio, not a dopamine machine. If you’re done with money‑buying hype and want real money investment strategies, run a plan that allocates by risk, pays you while you wait, and only funds execution with on‑chain proof.

What most people do vs. what investors do

Coin‑buying: guess coins, ape into pumps, zero thesis, zero exit rules.

Investing: allocate across risk tiers, demand on‑chain milestones, use position sizing, collect yield, rebalance.

Start your disciplined plan with Zemyth - one platform to fund milestone‑gated projects (StartupNest), park idle cash in low‑risk yield (FundNest), and align incentives with a revenue‑linked token (ZEM). Launch now: https://zemyth.app

Speculation vs. Investing: the four tests

Ownership & Cash Flow Test: What economic right do you actually hold? What pays you while you wait?

Evidence Test: Is there milestone‑based progress or just narratives?

Sizing & Liquidity Test: Can you size the risk and exit without blowing up?

Time Horizon Test: 3–5 years with rebalancing vs. “number go up this week.”

What it means in crypto

Coins without cash flows ≠ bad; it means your edge is in underwriting code quality, user adoption, and incentive design - not vibes.

Milestone‑gated venture deals, real yield sources, and revenue‑linked tokenomics tie crypto to measurable progress. Zemyth stitches this together: StartupNest (milestones), FundNest (yield), and ZEM (revenue‑linked utility).

"If they don’t have this kind of information, they can’t make the calculation. In this case, it’s more like gambling than investing." - Source

Coin‑Buying vs. Investing (10-point reality check)

Criteria | Coin‑Buying | Investing |

|---|---|---|

Ownership right | None or undefined; price exposure only | Defined rights: yield claims, milestone votes, allocations |

Cash flow while you wait | None or emissions-only | LP/trading-fee yield, revenue share, staking boosts |

Thesis | Narratives, influencers, screenshots | Written thesis: adoption driver, unit economics, catalysts |

Milestones | Absent; hope-based | On‑chain, milestone‑gated delivery tied to unlocks |

Position sizing | YOLO/all‑in, random lot sizes | Core–Explore–Speculate with risk budgets |

Liquidity plan | “I’ll sell later” | Pre‑planned exits, laddering, depth/slippage checks |

Time horizon | Hours–weeks | 3–5 years with quarterly/trigger rebalancing |

Due diligence depth | Headline scanning | Code, tokenomics, team, runway, on‑chain data |

Rebalancing rule | None | IPS rules: thresholds, DCA, profit‑taking bands |

Expected edge | Luck and momentum | Process, information, and time arbitrage |

Watch: How to Build a Crypto Investment Plan (DCA, Risk, Rules)

If you want the best way to invest your money in crypto, stop trying to “invest coins” impulsively. Use money investment strategies with clear rules: size by risk, demand milestones, and collect yield while you wait. Zemyth makes this practical in one place: StartupNest to fund progress, FundNest to compound yield, and ZEM to align incentives. Start building like an investor, not a gambler: https://zemyth.app

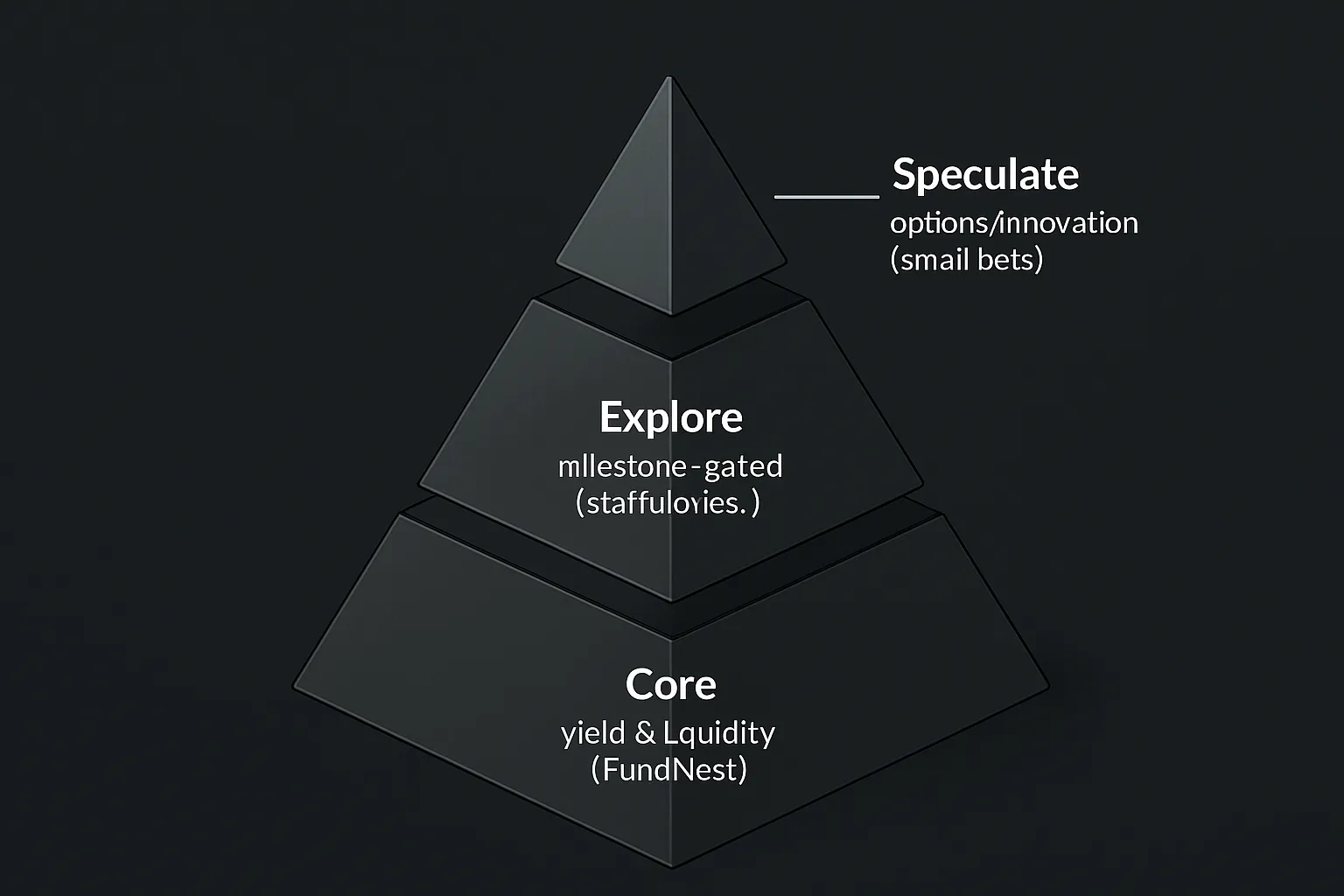

Build a Core–Explore–Speculate allocation (and stop overbetting)

Core (capital preservation + dependable yield): stable/low‑vol strategies; aim for liquidity and 24/7 access.

Explore (asymmetric upside with milestones): milestone‑gated venture bets and token allocations with clear unlock logic.

Speculate (tight risk leash): small bets for innovation/optionality; strict sizing and time‑boxed reviews.

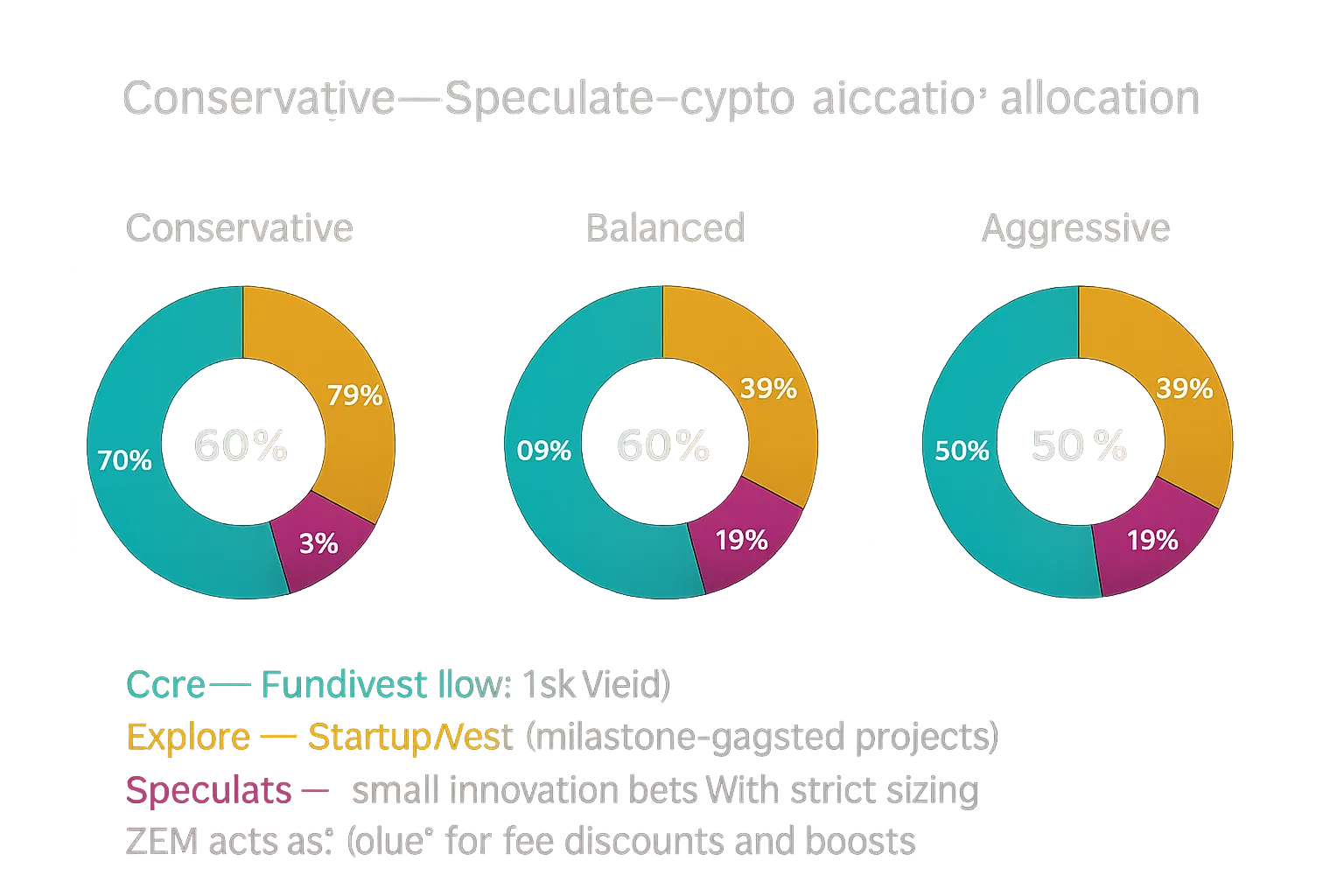

Caption: Three allocation models (teal=Core via FundNest yield, amber=Explore via StartupNest milestones, magenta=Speculate with strict sizing). ZEM is the “Glue”: fee discounts, boosts, and priority access across the stack.

Example targets (customize to your risk)

Conservative: 70% Core / 25% Explore / 5% Speculate.

Balanced: 60% / 30% / 10%.

Aggressive: 50% / 35% / 15%.

Where Zemyth fits

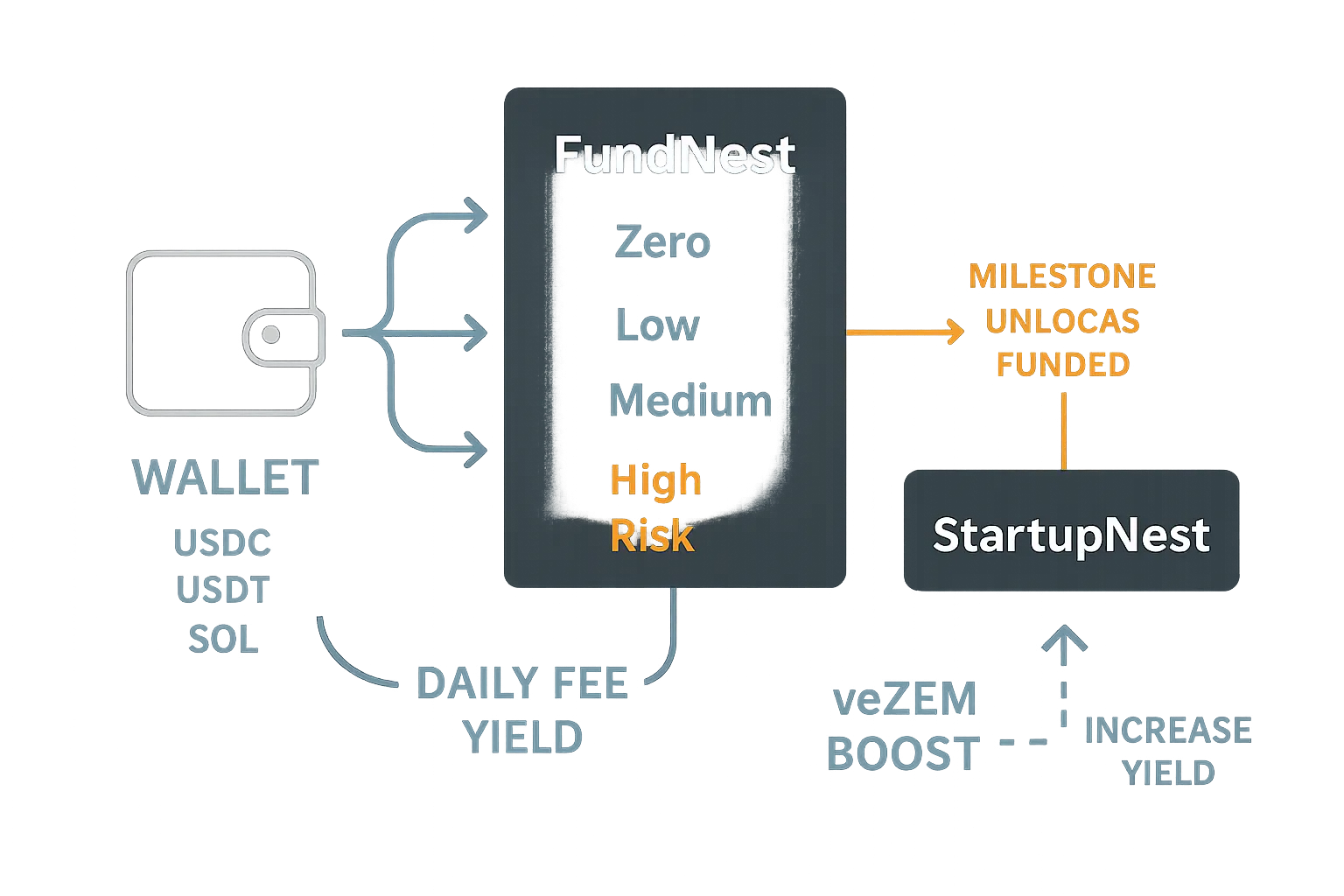

FundNest (Core): tiered pools (e.g., Zero Risk target yield) to earn while you wait.

StartupNest (Explore): milestone‑based projects with escrowed funds and investor voting.

ZEM (Glue): fee discounts, staking boosts, priority access; a good way to invest your money across the stack.

Build a risk budget you can live with

Expect 50–80% drawdowns in crypto; size so you can sleep and hold the plan.

Position sizing: cap any single idea at X% of portfolio; use add‑only on strength or DCA rules.

Rebalancing bands: ±20% drift triggers trims/adds.

Liquidity: keep an emergency float in Core to avoid forced selling.

"Bitcoin has experienced multiple 70%+ peak‑to‑trough drawdowns across cycles (2011, 2014–15, 2018, 2022)." - Source

Practical math

Pre‑commit a max portfolio drawdown (e.g., 20–30%).

Backsolve per‑position max sizes and stop‑adding rules.

Time horizon: 3–5 years; quarterly reviews; annual deep‑clean.

The 12‑point DD filter (skip 90% of pitches fast)

Problem–solution clarity: specific user, painful problem, measurable win.

Verify: clear ICP (ideal customer profile), quantified benefit (e.g., -40% fees, +25% conversion), and demo evidence.

Pass signal: 1–2 sentences explain who, what, and the measurable win. Fail: buzzwords, no before/after metric.

Traction: on‑chain activity, users, revenue, not just followers.

Verify: contracts with non-zero calls, daily/weekly active users, retention, $ revenue/fees.

Pass: verifiable dashboards (Dune/Nansen), cohort charts. Fail: vanity socials and “coming soon” promises.

Team & shipping cadence: repos, release notes, burn rate.

Verify: Git history, tagged releases, public changelogs, monthly burn runway ≥ 12 months.

Pass: steady commits and shipped features. Fail: big gaps in commits, unclear headcount/comp.

Token–product link: real utility beyond “number go up.”

Verify: token required for fee discounts, staking boosts, access, or claims; not just emissions.

Pass: token confers durable rights/utility. Fail: token only used for “rewards.”

Token supply & emissions: caps, unlocks, revenue‑linked incentives.

Verify: total supply fixed, unlock schedule published, emissions bounded by revenue.

Pass: transparent cliffs/vesting, emissions that flex with platform income. Fail: back‑loaded unlock cliffs dumping on users.

Milestones: objective deliverables tied to funding tranches.

Verify: milestone checklist with dates, acceptance criteria, and artifacts.

Pass: pay on proof; unlocks require on‑chain votes. Fail: lump‑sum funding on narratives.

Escrow & investor rights: refunds, challenge windows, voting.

Verify: funds locked until milestone pass, challenge/veto periods, pivot/abandonment exits.

Pass: codified rights, permissionless triggers. Fail: founder‑custodied multisig without guardrails.

Liquidity design: market‑making, vesting, TGE protections.

Verify: initial liquidity plan, anti‑MEV measures, TGE escrow, 10–30% token retention post‑TGE.

Pass: planned depth, unlock staggering, circuit breakers. Fail: day‑one free‑float chaos.

Governance: upgrade path, quorum, anti‑whale rules.

Verify: thresholds, time‑locks, vote weighting, proposal flow, emergency powers.

Pass: clear governance with checks and balances. Fail: opaque council or single‑key control.

Security posture: audits, bug bounties, incident response.

Verify: auditor names/reports, open bounty with tiers, runbooks for pauses/rollbacks where applicable.

Pass: recent audits, active bounty, staged releases. Fail: “audit scheduled.”

Unit economics: who pays whom and why; path to cash flows.

Verify: revenue model, take rates, acquisition cost vs. LTV, fee flows on‑chain.

Pass: positive gross margins and a plausible CAC/LTV path. Fail: “we’ll monetize later.”

Exit paths: TGE, buybacks, revenue share, secondary markets.

Verify: claim mechanics, buyback triggers, secondary trading rules, vesting exit options.

Pass: multiple, predictable exit avenues. Fail: no clarity beyond token listing.

Use this filter to separate gambling from crypto investments. If a project fails any 3–4 of these, move on. This is the best way to invest your money in crypto without overexposing yourself: you skip low‑quality pitches fast and reserve capital for provable progress. It beats money buying based on hype and is a good way to invest your money with discipline.

How Zemyth shortens DD

StartupNest: milestone‑gated funding with escrow, 14‑day voting, 48‑hour challenge windows, pivot/abandonment exits, and TGE safeguards built into the deal. You fund progress, not promises.

FundNest: park idle escrow in risk‑tiered pools (e.g., Zero Risk) to earn yield while you wait, so your capital compounds between unlocks.

CollabNest: work‑to‑earn cNFTs align talent delivery to milestones; investors see verifiable contribution trails, improving pass/fail confidence.

ZEM (Glue): revenue‑linked incentives, fee discounts, staking boosts, and priority access make your plan cheaper and more effective across the stack.

Stop trying to “invest coins” on vibes. Apply this 12‑point filter, allocate by Core–Explore–Speculate, and let Zemyth compress your due diligence while protecting downside and compounding upside.

Earn while you wait (without chasing degen APYs)

Core idea: deposit USDC/USDT/SOL → curated pools → daily fee yield; withdraw anytime.

Zero Risk pool: stablecoin pairs, no leverage, minimal IL - ideal parking between milestone unlocks.

Optional boosts: lock ZEM for veZEM to amplify yields and priority access.

Why this matters for disciplined investors

Reduces FOMO: your unallocated cash still compounds.

Funds milestones without constantly adding fresh cash.

Improves total return vs. idle stablecoins.

Your one‑page IPS (print it, sign it, follow it)

Define your crypto investments in writing so you act on rules, not emotion. This is the best way to invest your money with discipline and avoid random “invest coins” instincts or money buying on hype.

Objective: Capital growth with a max portfolio drawdown of X% (e.g., 25%), while optimizing after-tax returns and tax‑aware rebalancing.

Allocation: Core/Explore/Speculate split with ±20% drift bands. Core = FundNest (yield/liquidity). Explore = StartupNest (milestone‑gated). Speculate = small, time‑boxed options on innovation.

Buy rules: Fixed DCA cadence (weekly/biweekly), only add on strength or on milestone proofs. Use checklists for code, tokenomics, and adoption signals.

Sell/trim rules: Valuation bands, milestone failures, or thesis breaches trigger trims/exits. Take partial profits per pre‑set ladders.

Position caps: Max X% per idea, Y% per theme; Speculate capped at Z% total and a small per‑position max.

Liquidity & safety: Maintain an emergency Core float, custody with a hardened OPSEC plan (multisig/cold storage), and avoid leverage.

Review cadence: Monthly quick check (drift, risks), quarterly rebalance to targets, annual deep review of thesis, tokenomics, and IPS.

IPS trigger → action matrix

IPS Trigger | Action |

|---|---|

Explore > target by 20% | Trim back to target; move excess to Core (FundNest Zero Risk) to keep yield compounding. |

Milestone fails vote (StartupNest) | Reduce position by 50% at the next liquidity window; exercise any refund/exit rights; revisit thesis. |

Speculate position +100% | De‑risk: take profits equal to original cost; reclassify remainder to Explore if thesis strengthened. |

Portfolio drawdown > 20% | Pause new Speculate buys; rebuild Core via DCA; review risk budget and tighten caps. |

Allocation drift beyond bands (±20%) | Rebalance back to target weights; prioritize trimming winners, not adding to laggards without fresh evidence. |

Thesis breach (utility/emissions misaligned) | Stop adding; set a 30‑day clock for evidence recovery; exit if unresolved. |

Tokenomics red flag (emissions > revenue, surprise unlocks) | Cut exposure by 25–50% immediately; re‑enter only after documented fixes. |

Liquidity crunch (need cash) | Use Core emergency float first; never sell Explore/Speculate at fire‑sale unless IPS drawdown cap is threatened. |

Quarterly review due | Recompute targets, harvest gains within tax constraints, roll DCA schedule; document changes. |

Annual deep review | Reset assumptions, refresh DD, rotate underperformers; re‑sign IPS for the next 12 months. |

ZEM tier threshold reached (fee discounts/boosts) | Evaluate ROI of next ZEM tier; if net positive, accumulate via DCA and lock veZEM to boost yields. |

Emotional trade urge (FOMO/FUD) | Enforce a 24‑hour cooling‑off period; action only after checklist re‑pass and IPS alignment. |

Print this one‑pager, sign it, and keep it visible. The good way to invest your money in crypto is to follow your written money investment strategies - allocate by risk, fund milestones, and compound yield - then let Zemyth do the heavy lifting across FundNest (Core), StartupNest (Explore), and ZEM (fee discounts, boosts, priority). Launch your rules‑based plan: https://zemyth.app

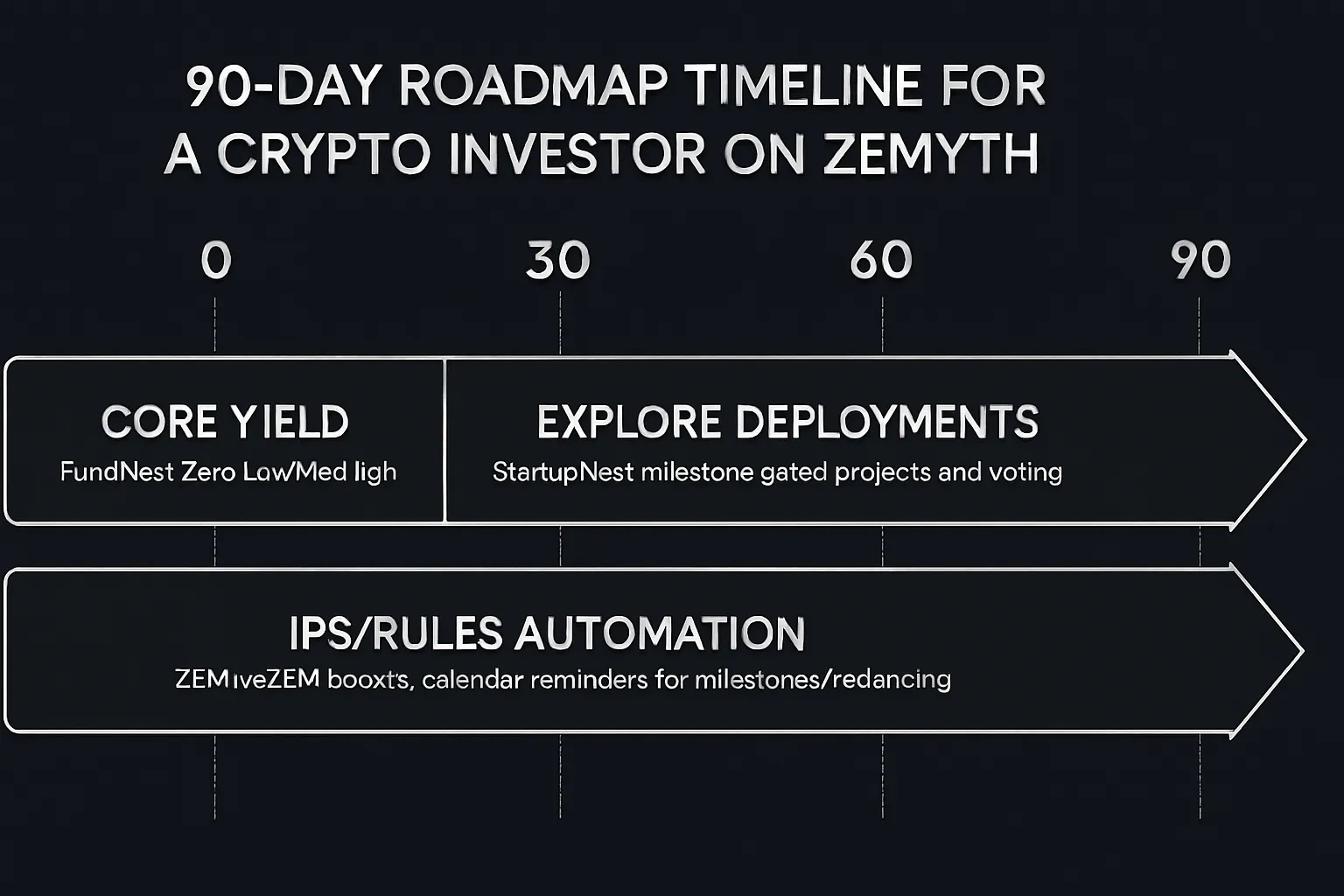

0–30 days: Set the foundation

Connect wallet; define risk budget and allocation.

Park Core in FundNest Zero Risk; set DCA for ZEM if boosts fit your plan.

Shortlist 3–5 StartupNest deals; read milestones and escrow rules.

31–60 days: Deploy Explore capital

Take small positions across 2–3 milestone‑gated projects.

Stake Investment NFT + ZEM for boosts if eligible; track voting windows.

Rebalance back to targets using yield and new cash.

61–90 days: Optimize and automate

Write your IPS and share it with an accountability buddy.

Set calendar for milestone votes, challenge windows, and TGE claims.

Review performance vs. plan; adjust only if rules say so.

The traps that drain portfolios

FOMO/pump chasing → solved by Core yield and IPS buy windows. FundNest pays you daily fees on idle cash so you stop “money buying” on impulse and only add per rules.

Overconcentration → capped position sizes and Explore diversification. Core–Explore–Speculate sizing prevents a single idea from nuking your crypto investments.

Narrative blindness → milestone votes and escrowed unlocks. StartupNest ties funding to on‑chain milestones, not vibes.

Idle cash decay → FundNest earnings between unlocks. Your unallocated cash compounds, improving total return vs. sitting in stablecoins.

Fee drag & chaos → ZEM discounts and integrated operations. Lower friction = more net yield; fewer tabs, fewer mistakes.

Reality check

Crypto investments are not backed by traditional assets or cash flows by default; your edge is process and structure. The best way to invest your money is to formalize money investment strategies (allocation, milestones, rebalancing) and execute inside one workflow.

"Stocks are backed by a company's assets and cash flow, while many cryptocurrencies lack backing by tangible assets." - Source

Zemyth helps you invest coins with discipline: park Core in FundNest, fund milestone‑gated Explore positions on StartupNest, and use ZEM to cut fees and boost yield - so you avoid the traps and stick to a good way to invest your money, consistently.

Final word

Investing beats coin‑buying when you run a system: allocate by risk, demand milestones, earn while you wait, and follow written rules. That’s the best way to invest your money in crypto - turn impulse “money buying” into repeatable money investment strategies that survive drawdowns and compound over time.

Zemyth gives you the single pane of glass for disciplined crypto investments:

StartupNest: milestone‑gated deals with escrow and investor voting - fund progress, not promises.

FundNest: tiered yield so idle cash earns daily fees while you wait for unlocks - no leverage required.

ZEM: discounts, boosts, and priority access that reduce friction and amplify returns.

CollabNest: work‑to‑earn that helps founders ship faster and align talent with outcomes.

Stop trying to “invest coins” on vibes. The good way to invest your money is to structure your plan and execute it the same way every time - Zemyth handles the plumbing so you can focus on signal.

CTA: Build your plan and start today → https://zemyth.app