High‑Risk Funds, Defined: How “High Risk High Profit” Really Works (and When It Doesn’t)

Why this matters now

“High risk high returns” gets thrown around like a slogan. But there’s a world of difference between chasing a hot tip and allocating to a high risk fund with a disciplined process. If you want the upside of investment high risk without blowing up your capital, you need to know what a high risk fund actually is, where it plays, and how the best operators keep risk contained when correlations spike and liquidity vanishes.

"You could lose all the money you invested... and there’s not always a direct relationship between risk and reward." - Source

Zemyth’s stance: yes, pursue high risk high profit - but do it with real risk controls, on‑chain transparency, and capital pathways that don’t leave you stranded between rounds.

What a high‑risk fund actually does

A high risk fund is a vehicle designed to pursue outsized, often asymmetric payoffs by taking concentrated or leveraged exposures where the expected value is positive but the outcome distribution is wide. The difference from simply “speculating on one asset” is process:

Research and edge: Identify repeatable sources of edge - structural (liquidity provision, niche coverage), behavioral (momentum/trend, post‑earnings drift), or informational/process advantages (faster data pipelines, on‑chain analytics, sector expertise).

Risk budgeting: Allocate risk, not just capital. Positions are sized to volatility, correlation, and liquidity. Exposure is constrained by a defined risk budget (e.g., volatility targets, factor limits, leverage caps, concentration rules).

Execution quality: Enter/exit with slippage, funding, and borrow costs in view. Use derivatives for convexity and balance sheet efficiency; stagger entries to reduce path risk; pre‑plan exits for stressed tape.

Risk controls: Hard stops and soft stops, scenario analysis, stress tests, and drawdown controls. Hedging (options, relative value, basis trades) and diversification by strategy/timeframe to avoid single‑point failure.

In other words: a professional high risk fund is engineered. It seeks convex outcomes and protects the downside through position sizing, volatility targeting, and pre‑committed drawdown rules. That’s a world apart from YOLOing into one coin or microcap.

Myths we’ll debunk

Myth: “Higher risk always equals higher return.” Reality: Risk is the price of potential returns, not a guarantee. Regime shifts, correlation spikes (everything sells off together), and liquidity traps can turn “high risk high profit” into “high risk, high loss.”

Myth: “Diversification is dead in crises.” Reality: It’s not dead - just different. Correlations rise in panics, so diversification must include time diversification (entry schedule), strategy diversification (trend vs. carry vs. event), and liquidity buckets, not just more tickers.

Myth: “Leverage is the alpha.” Reality: Leverage magnifies both signal and noise. Funding costs, margin calls, gap risk, and basis risk can destroy returns even if your thesis is right on paper.

Myth: “Hedging kills returns.” Reality: Smart hedging is insurance. Well‑timed tail hedges and dynamic overlays can preserve compounding by reducing deep drawdowns.

Where these funds play

High risk funds hunt where dispersion is high and edges can be defended:

Public markets

Small caps and microcaps: Information gaps and event‑driven catalysts but with liquidity risk and high idiosyncratic volatility.

Emerging markets: Local rates/FX, commodities, and cyclicals with political and currency risk.

Options/volatility: Structured long convexity, selective premium selling, and relative value volatility trades.

Alternatives

Venture capital: Early‑stage equity/tokens with power‑law outcomes and long liquidity horizons.

Private credit: Higher yields with underwriting and recovery risks; seniority and covenants matter.

Crypto: On‑chain momentum, basis/arbitrage, and tokenomics‑driven cycles with 24/7 liquidity and regime whiplash.

Cross‑asset macro

Trend/carry across rates, FX, commodities, and equity indices; crisis alpha, policy shifts, and relative value spreads.

Zemyth’s take: we combine open‑access venture exposure with milestone‑gated tranches (Startup Nest) and a liquid yield base layer (Fund Nest) so contributors can pursue upside while maintaining cash‑flow stability between risk cycles - all with on‑chain reporting.

Reader promise

Across this guide we’ll show how real high risk high returns are attempted in practice - not with hype, but with mechanics:

Position sizing that ties exposure to volatility and conviction (so one loss doesn’t sink the ship).

Volatility targeting so portfolio risk stays intentional across regimes.

Drawdown controls and tranche logic that throttle risk when markets punish liquidity.

If you want high risk high profit, do it like a pro. We’ll break down the playbook next.

The Mechanics Behind High Risk High Returns: Position Sizing, Volatility Targeting, Drawdown Controls

Position sizing 101 for a high risk fund

Position sizing is the steering wheel of a high‑risk fund. You’re not just picking ideas - you’re controlling how hard you press the accelerator on each one.

Fixed‑fractional sizing

Allocate a constant fraction of equity per trade (e.g., 1–2% risk per idea). Simple, scales with account size, but ignores changing volatility.

Volatility‑scaled sizing

Target equalized risk by sizing positions inversely to their volatility. Higher‑vol assets get smaller notional; lower‑vol assets get larger to contribute similar risk. This stabilizes portfolio variance across regimes.

Kelly‑fraction (and fractional‑Kelly)

Size based on estimated edge and odds to maximize long‑run growth. In practice, pros use fractional‑Kelly (e.g., 0.25–0.5 Kelly) to reduce path risk and model error.

Why “risk per idea” beats “dollars per idea”:

A $1M position in a 20% vol asset is far riskier than $1M in a 5% vol asset. Risk‑based sizing equalizes contribution and prevents one wild position from dominating outcomes.

Risk budgets let you add more ideas without ballooning total variance.

Volatility targeting in practice

Vol targeting scales exposure up in calm regimes and down in storms to keep portfolio risk intentional.

Mechanics:

Choose an annualized volatility target (e.g., 10%, 15%, 20%).

Compute current realized or forecast vol; scale portfolio gross exposure by TargetVol / RealizedVol.

Apply caps/floors to avoid over‑gearing in ultra‑low vol or under‑investing in noise.

Why it works:

Drawdowns shrink because you cut size when risk rises.

Upside persists because you maintain exposure in calm periods when Sharpe is often higher.

Implementation nuance:

Use robust vol estimators (EWMA, GARCH, or regime‑aware) and rebalance cadence (daily/weekly) to limit turnover.

Layer constraints: max leverage, sector/factor caps, and liquidity thresholds.

"Volatility-managed equity portfolios deliver higher Sharpe ratios and lower drawdowns than buy-and-hold, with significant utility gains for investors." - Source

Drawdown controls that pros actually use

Hard stops: Pre‑defined exits when price breaches your invalidation level; enforce discipline and protect against thesis drift.

Time‑based exits: If the catalyst window closes or signal decays, flatten regardless of P&L; reduces opportunity cost and sticky losses.

Kill‑switches: Portfolio‑level max peak‑to‑trough (e.g., ‑10%, ‑15%, ‑25%). When tripped, reduce gross/net, widen hedges, or move to cash until recovery rules are met.

Correlation heat maps: Monitor cross‑asset co‑moves; when correlation spikes, trim overlapping risk and add hedges (index puts, long vol, cross‑hedges).

Liquidity rules: Minimum ADV multiples, slippage bounds, and forced de‑risk if spreads widen/market depth deteriorates.

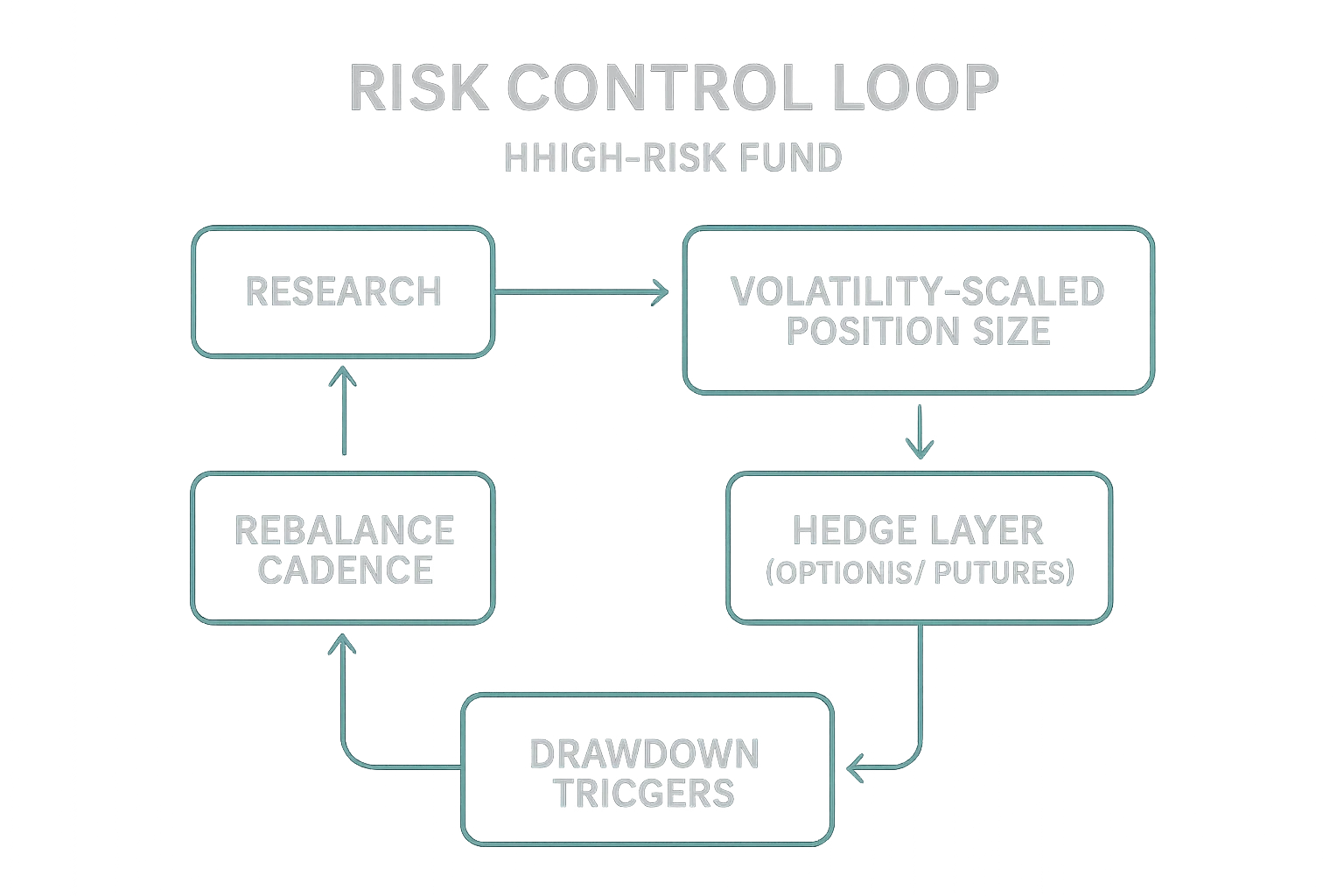

Execution loop

Signal → sizing → hedges → monitoring → rebalance; repeat.

Signal: Entry from momentum, value, carry, catalyst, or on‑chain flows.

Sizing: Volatility‑scaled with risk budget per sleeve and portfolio caps.

Hedges: Options overlays, pair trades, basis/spread hedges to cut tail and basis risk.

Monitoring: Real‑time P&L, factor drift, vol/corr, and liquidity.

Rebalance: Cadence per strategy (daily/weekly) plus event‑driven adjustments.

Risk Budgeting Cheat Sheet

Risk Budget (% of equity) | Max Risk per Position (%) | Volatility Target (annualized) | Max Portfolio Leverage (x) | Max Peak‑to‑Trough Drawdown Rule (%) | Typical Number of Concurrent Positions |

|---|---|---|---|---|---|

Conservative | 5–7% | 0.25–0.75% | 8–10% | 1.2x | 8–12% |

Balanced | 8–12% | 0.5–1.0% | 12–15% | 1.5–2.0x | 12–18% |

Aggressive | 12–18% | 1.0–1.5% | 15–20% | 2.0–3.0x | 18–25% |

Very Aggressive | 18–25% | 1.5–2.5% | 20–30% | 3.0–5.0x | 25–35% |

How to use it:

Pick a portfolio vol target aligned with your capital base and mandate.

Translate total risk budget into per‑position limits to prevent concentration blow‑ups.

Set leverage ceilings and portfolio drawdown kill‑switches that force systematic de‑risking.

What fails without process

Over‑betting: Position size overwhelms the error bars; one gap risks forced liquidation.

Leverage spirals: Rising vol + margin calls + funding costs = involuntary de‑risk at the worst time.

Liquidity mismatches: Daily‑liquidity promises against illiquid exposures end in gated exits or fire‑sale marks.

Zemyth builds mechanics into the venture stack: milestone‑gated tranches to limit downside, a liquid yield base via Fund Nest to smooth cash flow, and on‑chain reporting to keep risk visible - so contributors can pursue high risk high profit without flying blind.

Portfolio Construction for High‑Risk Funds: Barbell, Convexity, and Kelly‑Lite

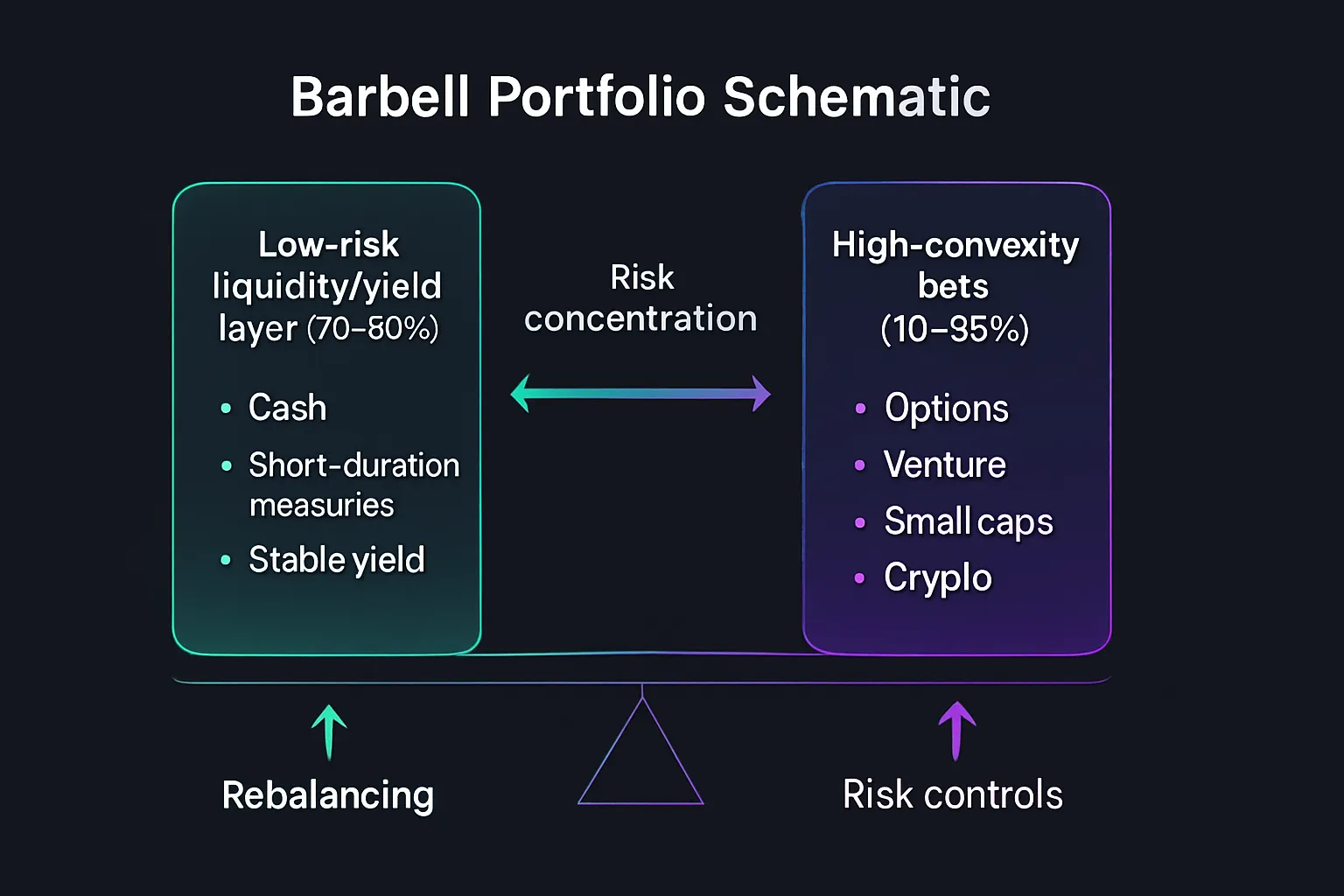

The barbell for high risk high profit

The barbell anchors most capital in low‑volatility, high‑liquidity assets while concentrating risk - not dollars - in a smaller sleeve of convex opportunities. The result: keep powder dry, harvest steady yield, and deploy into asymmetry where the upside justifies the variance.

Core sleeve (70–90%): Cash, short‑duration Treasuries, stable yield strategies, and liquid market‑neutral/low‑beta exposures.

Convex sleeve (10–30%): Options structures, early‑stage venture, small/micro caps, and select crypto protocols.

Risk concentration: Although the convex sleeve is a minority of capital, it can be the majority of risk budget due to higher volatility and optionality.

Convexity and payoff shapes

Convex payoffs are the engine of asymmetric outcomes. You cap the downside and leave the upside open - or at least wider.

Long optionality: Calls, call spreads, protective puts with financed structures; small premium outlay, large right‑tail if thesis hits.

Venture moonshots: Power‑law equity/token outcomes where a few winners offset many zeros.

Linear exposures: Common stock or futures offer 1:1 payoff - use when edge is durable and liquidity strong.

Engineering convexity: Use options around catalysts, pair trades to isolate idiosyncratic right‑tails, and structured exits to protect capital.

Kelly‑lite in the real world

Full Kelly maximizes long‑run growth under perfect knowledge; real funds live with model error, regime shifts, and drawdown constraints.

Fractional Kelly (0.25–0.5×) balances growth and survivability, reducing variance and avoiding catastrophic path dependency.

Apply Kelly‑lite to risk units, not dollars: scale exposure by expected edge and uncertainty, then cap by liquidity and correlation.

Portfolio‑level guardrails: cap sleeve leverage, cap single‑name risk, and adjust fractions when realized performance deviates from forecasts.

Rebalancing rules

Rebalancing keeps the barbell honest and your risk on‑target.

Volatility bands: Only rebalance when vol‑adjusted weights drift beyond thresholds (e.g., ±20%) to control turnover.

Calendar vs. threshold: Weekly/monthly cadence for the core; threshold triggers for the convex sleeve post‑events.

Capital recycling: Systematically cut losers that breach thesis or time stops; pyramid into winners within max risk caps; redeploy free cash from realized gains back to the barbell core.

High‑Risk Portfolio Styles Compared

Approach | Pros | Cons | Suitable Investor Profile | Typical Max Drawdown Range (historical) | Liquidity Needs |

|---|---|---|---|---|---|

Barbell | Preserves dry powder; concentrates risk where convexity is highest; smoother base‑layer returns | Requires discipline to avoid over‑allocating to convex sleeve; potential FOMO in raging risk markets | Investors who value survivability and optionality; funds with liquidity mandates | 10–25% at portfolio level (convex sleeve can see 50–80%) | Core: daily; Convex sleeve: mixed (daily to multi‑year) |

Equal‑Risk | Balanced risk contribution across assets; stable volatility profile | May dilute upside in right‑tail regimes; requires frequent re‑scaling | Systematic allocators, risk‑parity‑style funds | 12–20% depending on target vol | Mostly daily/weekly |

Kelly‑Lite | Targets growth with bounded drawdowns; adapts to changing edge estimates | Needs robust edge and error modeling; complex to govern | Advanced quants, funds with strong research infrastructure | 15–30% depending on Kelly fraction and hedging | Daily to weekly; derivatives access helpful |

Concentrated Long/Short | High active share; potential for outsized alpha from deep conviction | Path‑dependent; manager skill dispersion; large single‑name risk | Skilled stock pickers with strict risk controls | 20–40%+ depending on leverage/short book stress | Daily for publics; short borrow/liquidity critical |

Zemyth enables a practical barbell: park idle capital in the Fund Nest’s liquid yield layer, then deploy into milestone‑gated, high‑convexity startup rounds in the Startup Nest. Risk stays intentional; upside remains uncapped when real proof unlocks the next tranche.

Where High Risk High Profit Actually Shows Up: Power Laws, Hit Rates, and Sell Discipline

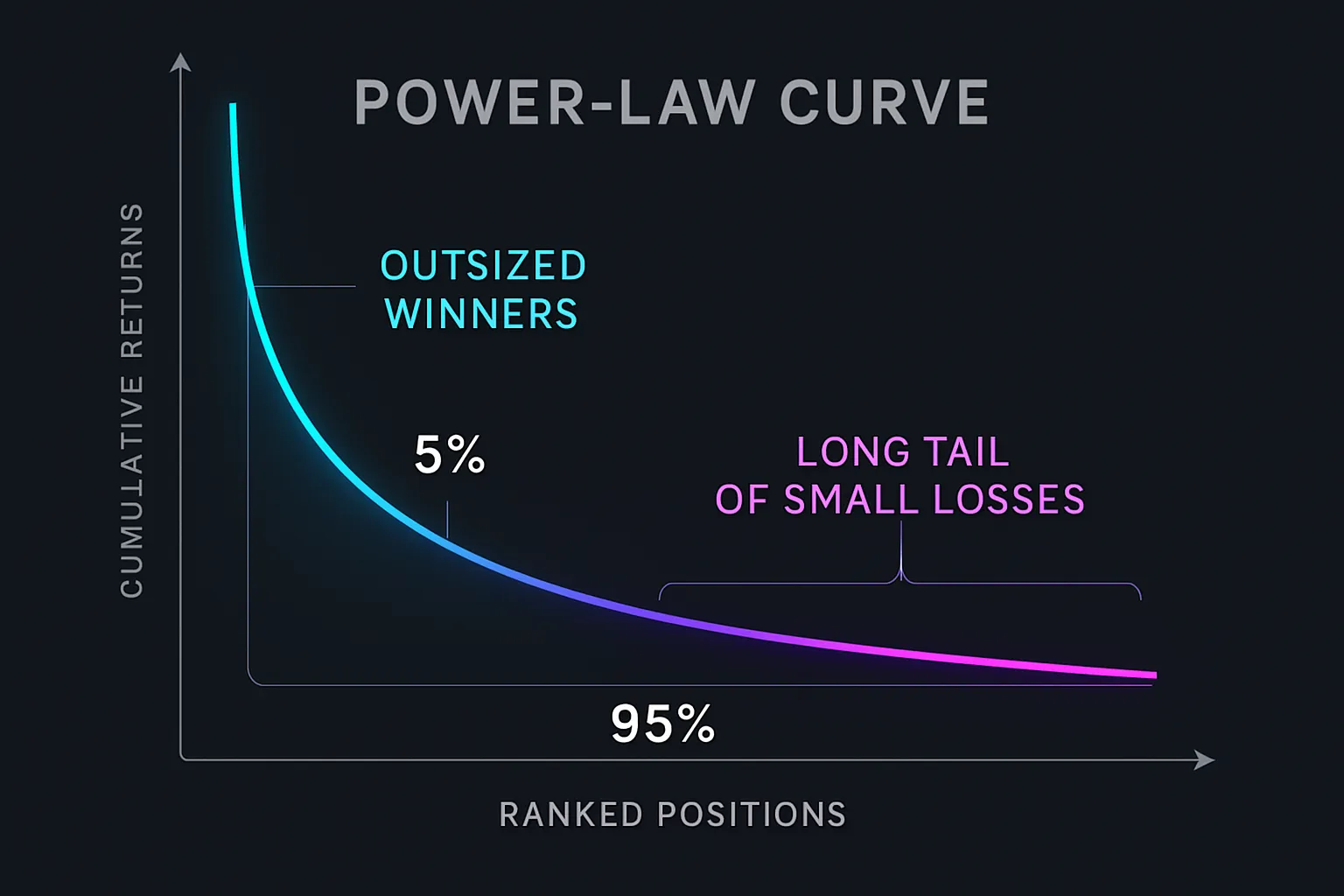

Power‑law reality

In true high risk high returns strategies, a tiny slice of positions deliver the bulk of P&L. The rest are scratches, small wins, controlled losses, or write‑offs. Your job isn’t to be right a lot; it’s to make the few right calls matter - and ensure the many wrong or mediocre ones don’t sink the ship.

"Analyzing 7,000+ companies (1985–2014), roughly 6% of investments generated about 60% of total returns." - Source

Designing for skew

To capture high risk high profit, design the portfolio to harvest right‑tail outcomes while capping the left tail.

Many small shots on goal: Increase independent bets with controlled risk per idea; breadth raises odds of catching outliers.

Strict loss limits: Hard stops/time stops; no averaging down losers. Capital returns faster than returns on capital.

Let winners compound: Trailing stops, profit‑taking ladders that preserve a core, and pyramiding rules that scale with realized strength.

Risk the right way: Allocate risk units (volatility/VAR) not dollars; size smaller in high‑vol assets and larger in low‑vol to keep contribution balanced.

Liquidity realism: Exit plans that work in stress; avoid positions that only fit through the door on sunny days.

Zemyth aligns skew structurally: startup tranches unlock on proof, not promises - so losers stop early while winners earn more capital.

Exit math

Selling is a system, not a vibe. Pre‑commit your exits to avoid round‑trips.

Profit‑taking ladders (example for a convex bet):

Take 20–30% off at 2R (2× risk), 20–30% at 3–4R, let 40–60% trail with a volatility‑adjusted stop.

Time‑based exits:

If the catalyst window closes (e.g., 30–90 days with no follow‑through), reduce or exit regardless of P&L.

Trailing logic:

Use ATR/volatility bands or higher‑low structures for trend trades; widen during regime shifts; tighten after parabolic moves.

Portfolio‑level guardrails:

If portfolio drawdown breaches the kill‑switch (e.g., −15%), scale gross/net down and pause new risk until recovery criteria are met.

Case pattern examples (illustrative)

Venture moonshot (power‑law sleeve)

Sizing: Small initial ticket across many names (e.g., 0.25–1.0% of fund equity each), milestone‑based follow‑ons.

Risk: Expect high write‑off rate; limit exposure per name; concentrate follow‑on capital into traction‑positive outliers.

Exits: Secondary liquidity, M&A, IPO; distribute tokens/equity on unlock schedules; take staged profits while preserving upside.

Options convexity (long call/call spread around catalysts)

Sizing: Premium at 0.25–0.5% of equity per trade; spreads to reduce decay; diversify expiries.

Risk: Defined downside (premium); avoid illiquid strikes; hedge event gaps where feasible.

Exits: Pre‑set profit ladder (100–300% gains take partials), roll winners forward, auto‑cut at 50–70% premium decay or time stop.

Small‑cap breakout (linear exposure with tight risk)

Sizing: Volatility‑scaled cash equity; cap single‑name risk ≤0.75–1.0% at stop.

Risk: Liquidity filters (ADV multiples), hard stop below structure; avoid averaging down.

Exits: Scale at measured targets (prior high/extension bands), trail remainder; exit fully on failed retests or liquidity deterioration.

With Zemyth, contributors can keep the base of the barbell productive via Fund Nest’s daily liquidity and yield, while the Startup Nest focuses shots on milestone‑gated, high‑convexity rounds - so the portfolio is engineered for power‑law outcomes without undisciplined downside.

Hidden Risks That Blow Up “High Risk High Returns”: Liquidity, Leverage, and Counterparty

Liquidity traps

In stress, liquidity isn’t a feature - it’s a mirage. Prices gap through your stops, books show stale marks, and exit capacity collapses just as you need it most.

Gap risk: Overnight moves or headline shocks skip your levels; only market/IOC orders fill, at painful prices.

Stale marks: Illiquid positions can look fine until a real print hits; then the “paper” P&L vanishes in one mark.

You are the liquidity: If your ticket is a material share of average daily volume, you set the price on the way out.

Leverage math

Leverage doesn’t create edge; it scales your error bars. It multiplies variance, deepens drawdowns, and adds funding and basis risks.

Variance multiplier: Doubling gross with no change in edge doubles volatility and expected drawdown depth.

Financing & margin calls: Stress regimes push up borrow and funding costs; volatility expands haircuts; margin spirals force selling at lows.

Basis risk: Futures, swaps, and proxy hedges can decouple from cash instruments when liquidity fragments - your “hedge” may fail when needed most.

"While leverage can enhance returns in favourable market conditions, it also amplifies losses during downturns, and excessive leverage in funds can heighten volatility and contagion risk." - Source

Counterparty and operational risks

You don’t control the pipe you trade through - or the people on the other side. Build defenses.

Prime broker risk: Concentration with a single PB raises exposure to service outages, collateral disputes, or failure.

Rehypothecation: Your collateral can be re‑used; in a default chain, recovery timing/value is uncertain.

Settlement failures: Post‑trade plumbing breaks in stress; fails and recalls can trigger forced unwinds.

Operational controls: Dual approvals, maker/checker, access segregation, disaster recovery, and independent reconciliations. Audit trails on‑chain where possible.

Practical safeguards

Engineer the downside so the upside can compound.

Tier positions by liquidity: Tier 1 (daily) gets larger sizes; Tier 2 (weekly) smaller; Tier 3 (event/permit) smallest with longer exit horizons.

Stress‑test slippage: Model exits at 3–10× normal spreads and reduced depth; only size positions that survive those assumptions.

Uncorrelated hedges: Index puts, long vol, cross‑asset hedges; budget premium so insurance doesn’t become a drag.

Cash buffers and credit lines: Maintain dry powder for collateral calls and opportunistic adds; pre‑clear facilities before you need them.

Redemption alignment: Match investor liquidity terms to asset liquidity; use gates/side pockets only as last‑resort, and disclose clearly.

Zemyth bakes safeguards into the stack: milestone‑gated unlocks limit capital at risk when proof is weak, Fund Nest offers daily liquidity for cash buffers, and on‑chain settlement on Solana keeps collateral, progress, and counterparties transparent - so contributors can pursue high risk high profit without hidden time bombs.

Due Diligence: How to Evaluate a High‑Risk Fund (Before You Wire a Dollar)

When you back a high risk fund, you’re buying a process. Before chasing high risk high profit headlines, pressure‑test the machinery that’s supposed to turn investment high risk into high risk high returns - without wrecking your capital in the drawdowns.

Strategy and edge

Ask what the fund does to earn returns that the market doesn’t easily give away - and how that edge persists.

Source of alpha

Structural: Liquidity provision, time‑horizon arbitrage, capacity to trade niches others avoid.

Behavioral: Momentum/trend, overreaction/underreaction, event‑driven dislocations.

Informational/process: Faster data, on‑chain analytics, domain expertise, differentiated research network.

Evidence beyond backtests

Live track record vs. simulated; walk‑forward/out‑of‑sample results; parameter stability across regimes.

Attribution: How much P&L is true alpha vs. beta, factor tilts, or rising leverage?

Breadth and significance: Number of independent bets, t‑stats/p‑values where applicable, persistence through varying markets.

Edge decay and capacity

What happens as AUM grows? Slippage and borrow costs at scale? Time‑to‑liquidate under stress?

Crowding risks: How many peers run the same trade? What’s the exit plan if correlations spike?

Key questions:

What’s your hit rate and payoff ratio by strategy sleeve?

How does the strategy perform in high‑volatility shocks vs. low‑vol grind?

Where has the thesis failed historically - and what changed since?

Risk framework

Real high risk funds are built to survive their own variance. You’re looking for documented, enforced limits.

Position and exposure limits

Single‑name risk cap (risk‑at‑stop %), sector/factor limits, country/FX limits.

Gross/net exposure bands; leverage caps (by sleeve and portfolio).

Portfolio risk targets

Volatility target (annualized), VaR/Expected Shortfall thresholds, beta/factor exposure constraints.

Drawdown rules: Max peak‑to‑trough, auto‑de‑risk triggers, and recovery protocols.

Liquidity governance

Liquidity tiers by days‑to‑exit at x% ADV (and stress multipliers).

Slippage models for risk sizing; pre‑trade and post‑trade TCA.

Hedging and correlation control

Index/sector hedges, tail‑risk overlays, cross‑asset hedges; budget for “insurance.”

Correlation heat maps and de‑risk rules when co‑moves rise.

Ask to see:

Written risk policy with numeric thresholds.

Daily/weekly risk reports: realized vs. target vol, exposure by factor, liquidity ladder, stress tests (’08/’20/’22 analogs).

Evidence that limits bite (examples where positions were cut because rules required it).

Process and people

Edge is a team sport with a repeatable loop. No process, no persistence.

Investment process

Idea pipeline: Sourcing, hypothesis, pre‑mortems, checklist discipline.

Trade construction: Entry/exit playbooks, options overlays, fractional‑Kelly sizing guardrails.

Post‑mortems: Systematic reviews of winners/losers; parameter drift analysis; model versioning.

Governance and cadence

Investment committee frequency, voting rules, escalation paths for limit breaches.

Monitoring: Real‑time P&L/risks; who is on deck when volatility spikes?

Ops and data lineage

OMS/PMS stack, reconciliations, market data providers, alternative data compliance.

Maker/checker, role segregation, disaster recovery, cyber and key‑man plans.

Team and incentives

Track records by sleeve lead; turnover history; succession.

Compensation tied to risk‑adjusted outcomes (not just gross P&L).

Due‑diligence requests:

Org chart with decision rights, bios with relevant experience, and independent references.

Compliance manuals, best‑execution policy, broker list and evaluation criteria.

External auditor and fund administrator details; SOC1/SOC2 reports where applicable.

Fees, alignment, and terms

If incentives are wrong, the process will drift.

Fee model

Management/performance fees; hurdles; high‑water mark; clawbacks; pass‑through expenses.

Compare net returns to peer benchmarks at similar risk targets.

Liquidity terms

Subscriptions/redemptions, notice periods, gates, side pockets; alignment with underlying asset liquidity.

Transparency cadence: Monthly letters, position/sector/factor snapshots, risk metrics.

Alignment

GP co‑invest (“skin in the game”); lockups for principals; capacity policy; side‑letter MFN protections.

Conflicts disclosure: Cross‑fund trades, affiliate relationships, order allocation.

Documents to review:

LPA/PPM, subscription docs, valuation policy, side‑letter policies, fee examples on hypothetical P&L.

What good looks like

Expect to see professionalism, measurement, and humility under uncertainty.

Core materials

Strategy memo with edge thesis, capacity, and risk map.

Risk handbook with numeric limits and breach protocols.

Monthly/quarterly letters: P&L attribution (alpha/beta/factors), winners/losers analysis, outlook framed by risk, not predictions.

Independent audits, admin reports, and TCA summaries.

KPIs a pro shop reports

Returns: Sharpe, Sortino, MAR, hit rate × payoff ratio, skew/kurtosis.

Risk: Realized vs. target volatility, max DD and recovery time, VaR/ES breaches, correlation to major indices.

Liquidity: Weighted days‑to‑exit by tier, % NAV in Level 2/3 assets, average slippage vs. model.

Process: Limit‑breach incidents and remediation, model change logs, capacity utilization.

Concentration/power law: % of P&L from top 5/10 positions, position‑level risk contributions.

Red flags:

Backtest glamour with no live control evidence; moving goalposts when performance sours.

Vague risk language (no numbers), unmanaged leverage, or reliance on gates to mask liquidity gaps.

“Trust me” opacity on positions, service providers, or valuation.

Green flags:

Clear, falsifiable hypotheses; tight feedback loops; willingness to cut size when rules say so.

Transparent reporting that makes it easy to see where returns came from and what risks were taken to get them.

How Zemyth helps you run this playbook:

On‑chain transparency: Milestones, tranche unlocks, and contributor reputation recorded on Solana.

Alignment by design: Capital follows execution, not hype; poor performers starve early, potential outliers earn follow‑on.

Liquidity base layer: Park idle capital in Fund Nest’s daily yield so your barbell has a reliable core while you evaluate high‑convexity rounds.

Education and tools: Academy playbooks and affiliate network to improve sourcing and due diligence outcomes.

Bottom line: Treat every high risk fund like a system to audit. If the system is robust, high risk high profit becomes a disciplined pursuit - not a coin flip.

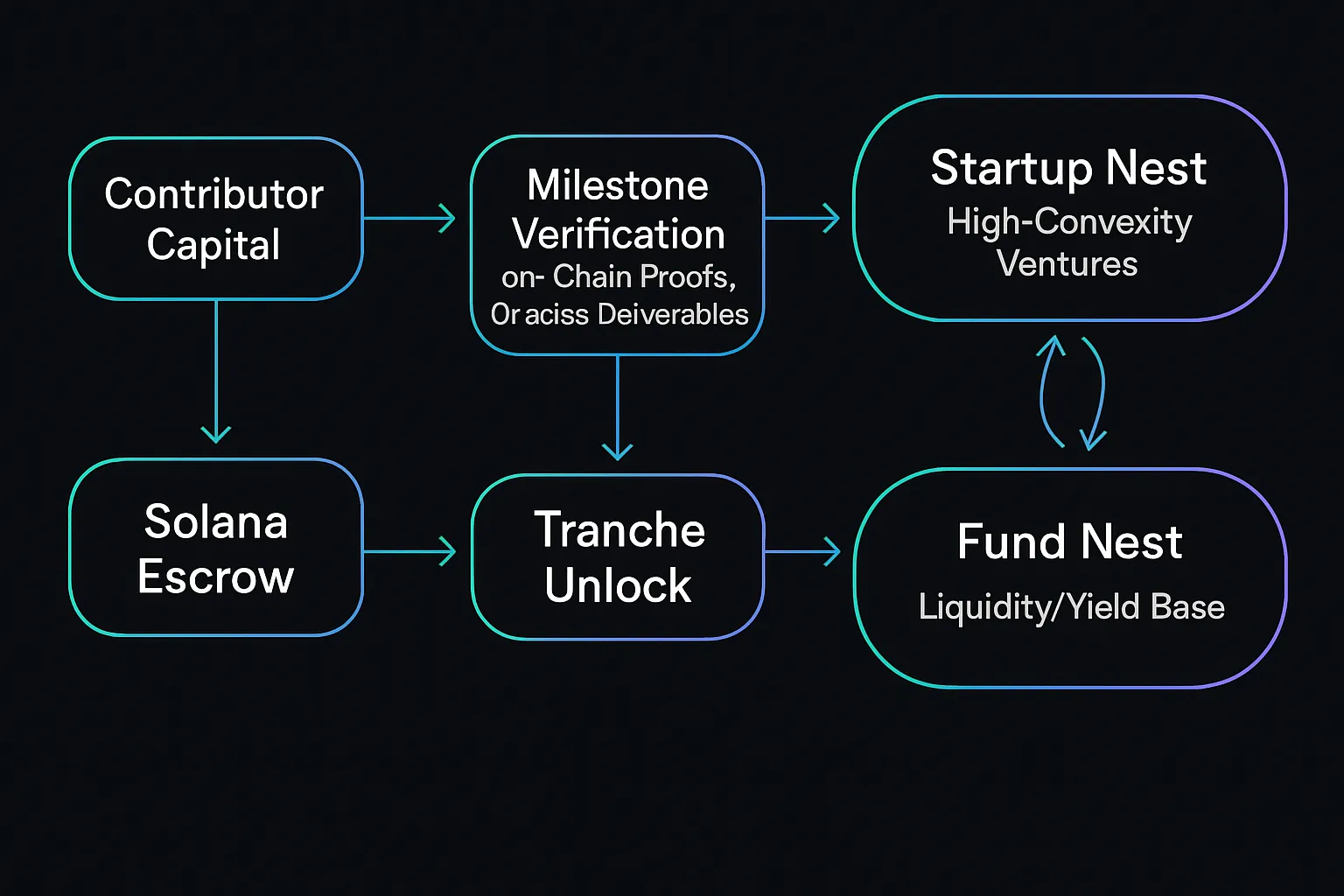

On‑Chain High‑Risk Funds Done Right: Zemyth’s Milestone‑Gated Ventures + Fund Nest Liquidity Layer

Why on‑chain matters for investment high risk

When stakes are high, transparency isn’t a “nice to have.” On‑chain execution gives you real‑time visibility, auditable progress, and programmatic rules that limit narrative drift. If capital is going to chase high risk high returns, let it do so with verifiable milestones and clear conditions - so performance, not persuasion, moves the money.

Startup Nest (high‑risk, high‑convexity)

Zemyth’s Startup Nest is built for asymmetric upside without blind trust.

Milestone‑gated tranches: Capital sits in escrow and unlocks only when proof arrives - builds shipped, users acquired, revenue milestones hit.

Execution‑tied release: Founders know exactly what earns the next tranche; contributors see the same rules.

Power‑law capture, downside capped: Many small tickets, follow‑ons only for traction‑positive teams; underperformers stop early.

Fund Nest (base‑layer stability)

Idle capital shouldn’t sit idle.

Liquid, lower‑risk yield: Park funds in the Fund Nest to smooth cash flow between rounds.

Daily compounding on Solana: Transparent settlement and predictable accruals.

Flexible participation: Scale in and out without derailing the venture sleeve.

The combined stack

This is the barbell - engineered for on‑chain venture.

Fund Nest as ballast: A dependable liquidity/yield base that stabilizes contributor cash flows.

Startup Nest as convex shots: Milestone‑gated venture rounds for true upside.

Community engine: Affiliates surface vetted founders; Academy upgrades both sides with practical playbooks.

Risk clarity: On‑chain proofs, open reporting, and tranche logic ensure risk is intentional and visible.

What contributors and founders see

On‑chain settlement and clear milestone contracts - no fine‑print surprises.

Contributor reputation, transparent voting/approvals, and standardized KPIs.

A single, verifiable source of truth for progress, unlocks, and performance across the entire venture stack.

Step‑by‑Step Playbook: Allocate to High‑Risk Funds Without Blowing Up

High risk high profit is earned with discipline, not bravado. Use this step‑by‑step playbook to deploy into a high risk fund or run your own high risk high returns sleeve without courting a blow‑up.

Before you allocate

Define the outer walls first. Investment high risk only works when losses are capped by design.

Set your risk budget

Max allocation to high‑risk sleeve: 5–20% of net worth, sized to your income stability and liquidity needs.

Annual loss limit: e.g., −5% to −10% of net worth or −50% of the high‑risk sleeve, whichever hits first.

Max peak‑to‑trough drawdown for the sleeve: pre‑commit a kill‑switch (e.g., −25%) that forces de‑risking.

Fix your time horizon

Venture/illiquid bets: 5–10 years. Public/crypto convexity: 6–24 months per trade; strategy horizon 3–5 years.

Write it down

One‑page investment policy: goals, constraints, risk budget, liquidity needs, execution rules, and what will cause you to stop.

Run “if/then” scenarios

If volatility doubles, then reduce gross by 30–50%.

If sleeve hits −10% in a month, then pause new risk and review drivers before resuming.

Build your barbell

Protect the base; concentrate risk where convexity lives.

Base liquidity/yield (ballast)

Park 70–90% of sleeve capital in liquid, low‑volatility yield (e.g., short‑duration, stable yield strategies). This smooths cash flow and keeps dry powder ready.

High‑risk sleeve (convex shots)

Allocate 10–30% across convex payoffs: options structures, milestone‑gated venture, selective small/micro caps, disciplined crypto strategies.

Ring‑fence and pre‑commit

Separate accounts/wallets for base vs. risk sleeve to prevent drift.

Rebalancing rules: calendar (monthly/quarterly) plus thresholds (±20% drift) to top up the base from outsized wins.

Map risk to controls

Choose a volatility target (e.g., 12–20% annualized) and max leverage. Document position caps and liquidity tiers by days‑to‑exit.

How Zemyth fits: use Fund Nest as the base liquidity layer, then deploy into Startup Nest’s milestone‑gated, high‑convexity rounds. Tranches align capital with execution, keeping risk intentional.

Entering positions

Entries matter as much as picks. Scale with volatility and diversify entry paths.

Staggered entries

Tranche into positions (e.g., thirds) across time or price bands to reduce timing risk and slippage.

Volatility‑scaled sizing

Size by risk, not dollars. Higher‑vol assets get smaller notionals so each position contributes similar risk to the sleeve.

Use fractional‑Kelly (0.25–0.5×) for ideas with measurable edge; cap by liquidity and correlation.

Protective hedges

For public/crypto: index puts, collars, or long volatility overlays budgeted at 1–3% of sleeve per year.

For venture: milestone‑based follow‑ons only; refuse to average down without new proof.

Liquidity filters

Respect ADV multiples and on‑chain depth. If you are the liquidity, size down or skip.

Monitoring and actions

Have a standing weekly dashboard and rules that bite.

Weekly dashboard

Exposure: gross/net, by sector/factor/chain; beta and factor tilts.

Risk: realized vs. target vol; VaR/ES; current drawdown vs. max.

Correlation and crowding: heat map across positions/strategies; peer overlap where visible.

Liquidity: days‑to‑exit by tier at stress slippage (e.g., 3–10× spreads); borrow/funding costs.

P&L attribution: alpha vs. beta/factors; top 5 contributors; concentration of P&L.

Action rules

If realized vol > 1.5× target → scale gross down 20–40% until back in band.

If portfolio drawdown > kill‑switch (e.g., −15%/−25%) → cut risk to base, maintain hedges, pause new risk; resume only after recovery criteria.

If correlation spikes > 0.7 across core bets → reduce overlapping exposures; add hedges.

If liquidity deteriorates (depth/spreads worsen materially) → down‑tier sizes; prioritize exits in weakest names.

Post‑mortems and iteration

Recycling capital is as important as allocating it.

Review losers fast

Classify: thesis wrong vs. timing vs. execution. Record what would have invalidated sooner.

Update checklists to catch similar patterns earlier (liquidity traps, crowded narratives, weak catalysts).

Let winners breathe

Use profit ladders and trailing logic to avoid round‑trips while banking gains; redeploy proceeds to the base, then to the highest‑conviction edges.

Measure what matters

Hit rate × payoff ratio, Sharpe/Sortino, MAR (CAGR/DD), time‑to‑recover drawdowns, slippage vs. model, % of P&L from top 5/10 positions.

Capacity and costs

Track impact costs and borrow/funding; reduce sizes or close strategies that decay at scale.

Upgrade the universe

Cull the bottom quartile of managers/strategies each quarter; add new edges only with live pilot capital and pre‑defined success criteria.

Zemyth accelerates this playbook: keep capital productive in Fund Nest’s liquid yield layer, channel risk into Startup Nest’s milestone‑gated rounds, and use on‑chain transparency to monitor progress in real time - so your high risk fund sleeve stays disciplined, compounding, and survivable.

Advanced FAQ: High‑Risk Funds, High‑Risk High Returns, and Practical Nuance

What’s the difference between a high risk fund and simply buying volatile assets?

A high risk fund isn’t a roulette wheel - it’s a risk‑engineered process. Simply buying volatile assets is exposure; a high risk fund is exposure plus a ruleset.

Process vs. punts: Research edge, risk budgeting, volatility‑scaled position sizing, and drawdown controls versus “I like this chart/coin.”

Portfolio construction: Diversified sources of convexity (options, event‑driven, cross‑asset macro, venture) with correlation and liquidity limits.

Execution: Pre‑planned entries/exits, hedges, scenario tests, and kill‑switches. Pros don’t hope their way out - they size and hedge their way out.

Reporting and discipline: Live risk dashboards, post‑mortems, and adherence to numeric limits.

Bottom line: High risk high profit comes from engineering asymmetry while containing the left tail - not from owning the noisiest ticker.

How much of a portfolio should sit in high‑risk strategies?

It depends on income stability, liquidity needs, and stomach for drawdowns - but ranges exist.

Retail and family offices: 5–20% of net worth in a ring‑fenced high‑risk sleeve, with a base‑layer liquidity/yield core and strict drawdown caps.

Professionals with robust risk tooling: 10–30% if the base (business income, core bonds/cash, Fund Nest‑style liquidity) absorbs shocks.

Rules of thumb:

If a 25–35% drawdown in the high‑risk sleeve triggers behavior mistakes (panic selling), you’re over‑allocated.

Align liquidity: don’t promise monthly liquidity against multi‑year venture or illiquid small caps.

Zemyth approach: keep the barbell honest - Fund Nest as ballast; Startup Nest as convex shots. It’s practical exposure to high risk high returns without reckless sizing.

Can diversification reduce blow‑up risk in high‑risk sleeves?

Yes - if you diversify the right things.

Diversify by driver, not label: Trend vs. carry vs. event; public vs. private; linear vs. convex; on‑chain vs. off‑chain factors.

Time diversification: Stagger entries and rebalance on volatility/thresholds so you don’t load all risk into one tape.

Liquidity buckets: Mix daily, weekly, and venture horizons with explicit size caps per bucket.

Hedging and overlays: Long vol, index puts, cross‑asset hedges; budget a fixed “insurance” spend across regimes.

Diversification won’t save you from undisciplined leverage, poor liquidity management, or correlation spikes - but combined with position sizing and vol targeting, it materially lowers blow‑up odds.

Is Kelly Criterion realistic for funds?

Kelly is a compass, not a steering wheel.

Full Kelly assumes perfect edge estimates and no constraints - unrealistic in live markets.

Fractional‑Kelly (0.25–0.5×) is how pros translate estimated edge into size while reducing path risk and model error.

Practical guardrails: cap single‑name risk at stop, cap sleeve leverage, and clip sizes when realized results deviate from expectations.

Use Kelly on risk units (vol/VAR), not raw dollars, and always override with liquidity and correlation limits.

Net: Kelly‑lite helps you grow faster without courting ruin. Combine with volatility targeting to keep portfolio risk stable through regimes.

How do on‑chain milestone unlocks change risk?

They move venture risk from “trust me” to “prove it.”

Programmatic capital release: Funds are unlocked only when on‑chain proofs (deliverables, user metrics, revenue) validate progress - reducing capital at risk in non‑performers.

Transparency: Real‑time, tamper‑resistant records for contributors and founders; less room for narrative drift or stale updates.

Better skew: Many small initial shots, with follow‑ons gated by proof. Losers starve early; winners earn more capital - power‑law friendly.

Liquidity base: With a yield layer (Fund Nest), contributors can maintain cash‑flow stability while waiting for milestones - no idle drag.

This is why Zemyth exists: Startup Nest ties unlocks to execution, Fund Nest keeps liquidity productive, and the whole stack runs transparently on Solana - so investment high risk becomes a disciplined, auditable path to high risk high profit.

Conclusion: Use Zemyth to Pursue High‑Risk High Profit With Real Controls

Why Zemyth now

High risk high returns aren’t about louder bets - they’re about better controls. Zemyth brings the mechanics of a professional high risk fund on‑chain so contributors can pursue investment high risk with real guardrails.

Milestone‑gated rounds: Capital unlocks only when founders deliver proof - builds shipped, users acquired, revenue milestones met - so execution, not hype, drives allocation.

Fund Nest liquidity layer: Park idle capital in a liquid, lower‑risk yield base that compounds daily on Solana, smoothing cash flow while you scout the next asymmetric shot.

On‑chain transparency: Auditable settlement, contributor reputation, and programmatic rules reduce information gaps and keep risk intentional and visible.

What to do next

Explore live rounds: Review Startup Nest opportunities with clear milestones and tranche logic.

Put idle cash to work: Use Fund Nest for daily yield and instant liquidity between rounds.

Grow deal flow: Join the Affiliate network to surface credible founders and earn rewards for community‑led sourcing.

Level up your edge: Dive into Academy playbooks on due diligence, portfolio construction, and on‑chain operations.

Call to action

Ready to pursue high risk high profit with on‑chain transparency and practical safeguards - without flying blind? Start now at https://zemyth.app.