Introduction: Funding the Next Big Thing (and Why “Picking Winners” Isn’t Enough)

"The top 20 VC firms generate about 95% of the industry's returns - venture capital is fundamentally a game of access." - Source

The new reality for startup investment funds

The best funds don’t just “pick” - they win access, design milestone gates, and build portfolios where outliers pay for everything. That’s the difference between chasing hype and engineering asymmetric upside.

Hot markets compress diligence and magnify outcome volatility. When everyone speeds up, error rates spike - making a rigorous, repeatable evaluation process a competitive advantage.

What this guide covers: how we source deals systematically, run rapid but rigorous diligence, tranche capital against on‑chain milestones, and construct portfolios that compound outcomes - not risks.

Who this is for

Founders raising pre‑seed to Series A who want to prove, then unlock, capital on clear milestones.

Angels, DAOs, and retail contributors seeking transparent, milestone‑gated exposure - without black‑box terms.

Yield‑oriented contributors who want a dependable base while scouting the next big investment.

The Zemyth angle (what’s different here)

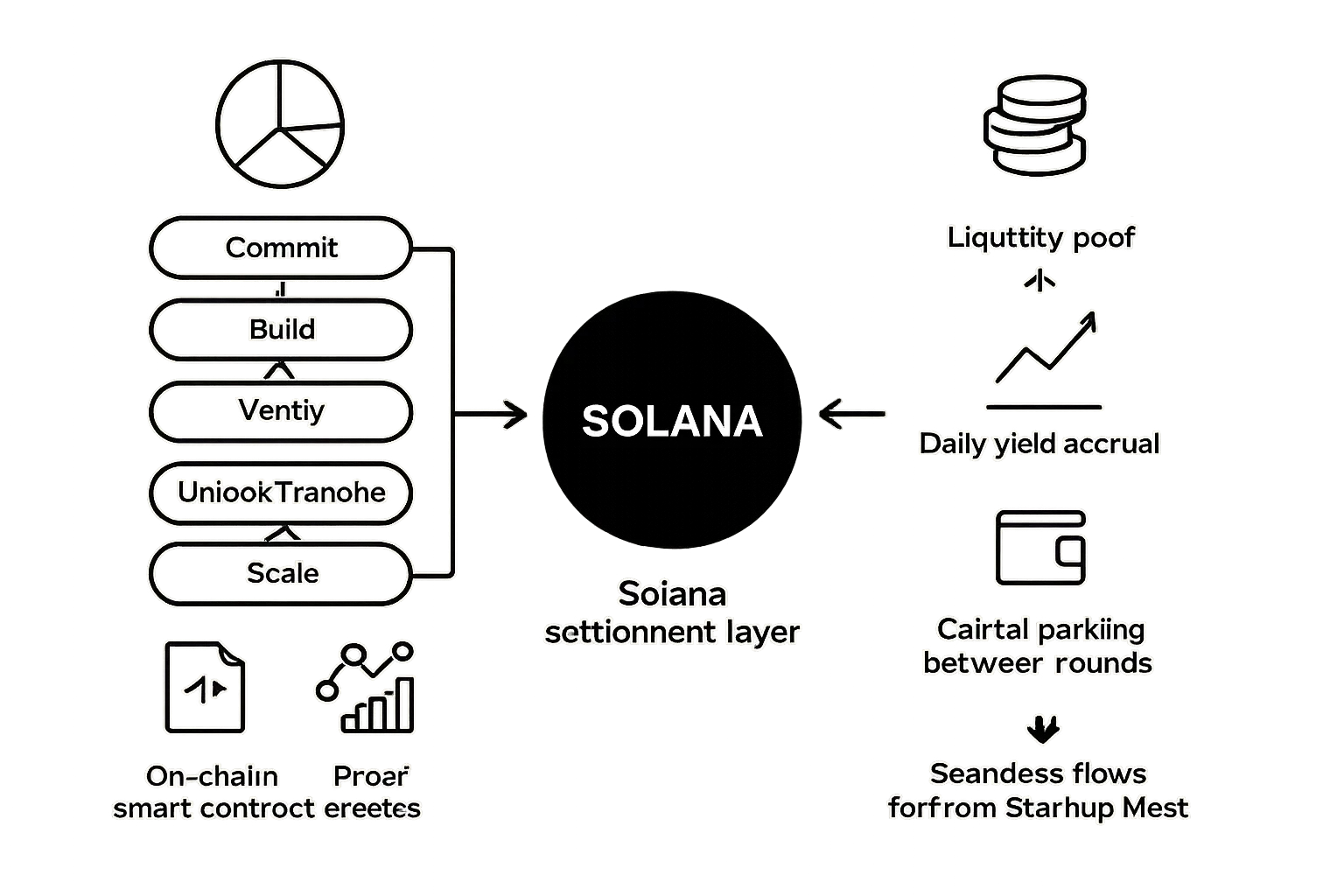

Open‑access venture on Solana: milestone‑gated rounds in Startup Nest, on‑chain proof of progress, a liquid Fund Nest to park capital and earn daily yield, and an affiliate network that drives community‑led deal flow.

“Funding next” means capital follows execution - not hype. We invest in startups by rewarding shipped product, real users, and revenue with tranche unlocks - so contributors back momentum they can verify, and founders raise faster by proving what matters.

Selection Science: Power Laws, Diligence Speed, and How Funds Actually Decide

"Using cellphone signal data, researchers show VCs perform less due diligence in hotter, more competitive markets - and that reduced diligence is linked to more volatile investment performance." - Source

The power law in venture

What a startup investment fund optimizes for is not average outcomes but fat-tailed upside. A few outliers drive nearly all returns; the rest are noise. If you don’t design for power-law dynamics, you’ll optimize for activity, not performance.

When we say “we invest in startups,” what we really mean is “we underwrite optionality and convexity.” Optionality = many shots on goal with minimal downside per shot. Convexity = when you’re right, you’re really right. Great funds structure deal access, proof, and follow-ons to preserve both.

Why rushing kills returns

Hot rounds, FOMO, and compressed timelines tempt funds to truncate diligence - and the cost is measurable. In practice, faster, competitive markets cut diligence time and widen outcome volatility by roughly 15–34%; at the peak, diligence time fell up to ~85%. You don’t just get more hits - you get more blowups.

What to verify fast (speed with proof):

Market model: Explicit TAM/SAM/SOM with credible bottoms-up assumptions.

Founder–market fit: Evidence the team has earned unique insight/advantage.

Proof momentum: Shipped builds, visible roadmap velocity, and week-over-week progress.

Early unit signals: Activation, retention, CAC-to-LTV shape, gross margins, willingness to pay.

Milestone path: A realistic, trancheable plan that ties capital to measurable unlocks.

What great funds measure in first meetings

Evidence check:

Shipped builds and roadmap velocity (commits, release notes).

Activation and retention snapshots (D1/D7/D30, cohort shape, usage depth).

Revenue signals (paid pilots, LOIs with teeth, ACV/ARPU clarity).

Waitlist/LOI quality (ICP fit, conversion evidence, sales cycle realism).

Risk triage:

Technology risk (R&D unknowns, reliability, security).

Distribution risk (repeatable channels, partnerships, unit economics).

Regulatory risk (licensing, data, jurisdiction, enforceability).

Capital intensity (burn multiple, hardware/inventory, timelines).

Governance (cap table health, vesting, rights, milestone design).

Watch and learn

Power Laws + Milestone-Based Investing: How to move fast without breaking diligence

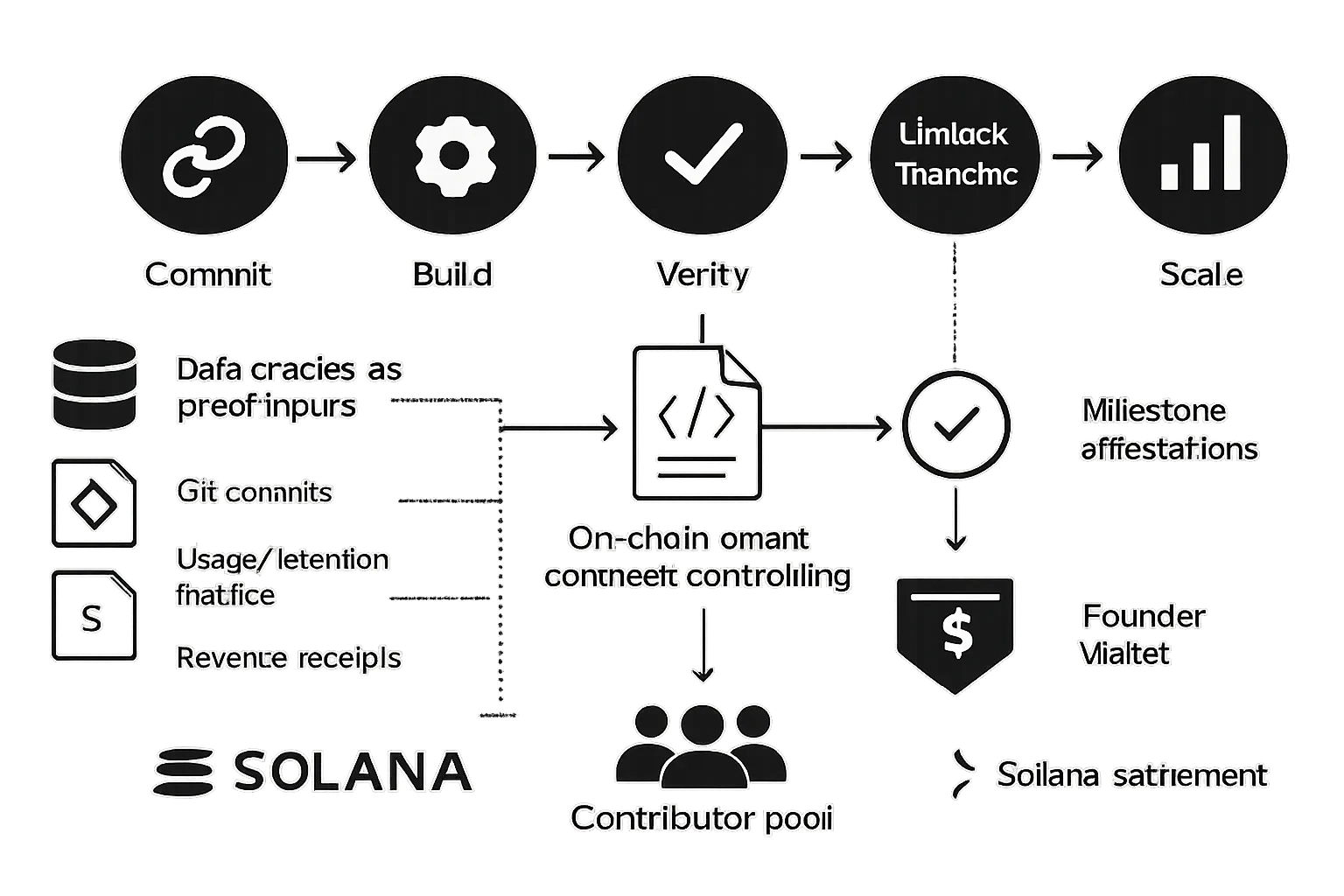

Zemyth makes “speed with proof” practical: we tranche capital on Solana against on-chain milestones so contributors can back verifiable execution. That’s how a startup investment fund can move fast, preserve diligence, and stay positioned for the next big investment without adding avoidable risk.

From Sourcing to Signed Check to Milestone Unlocks: The Modern Fund Playbook

"Super-angels are a new form of fast-moving, lightweight VC fund - pushing traditional VCs to make smaller investments faster." - Source

The end-to-end flow

Sourcing: inbound from founders, affiliate/community referrals, targeted scraping of product launches and repos, and thematic theses that pre-define our ICP and proof standards.

Screening: rapid triage with proof thresholds - shipped builds, activation/retention snapshots, revenue or LOIs with teeth, and a credible milestone plan.

Diligence: focused sprints on founder backgrounds and references, market mechanics and unit model, traction quality and cohort shape, legal/structure and governance hygiene.

Term sheet: milestone definitions with objective verification criteria, tranche sizes and vesting logic, follow-on mechanics, and contributor protections on Solana.

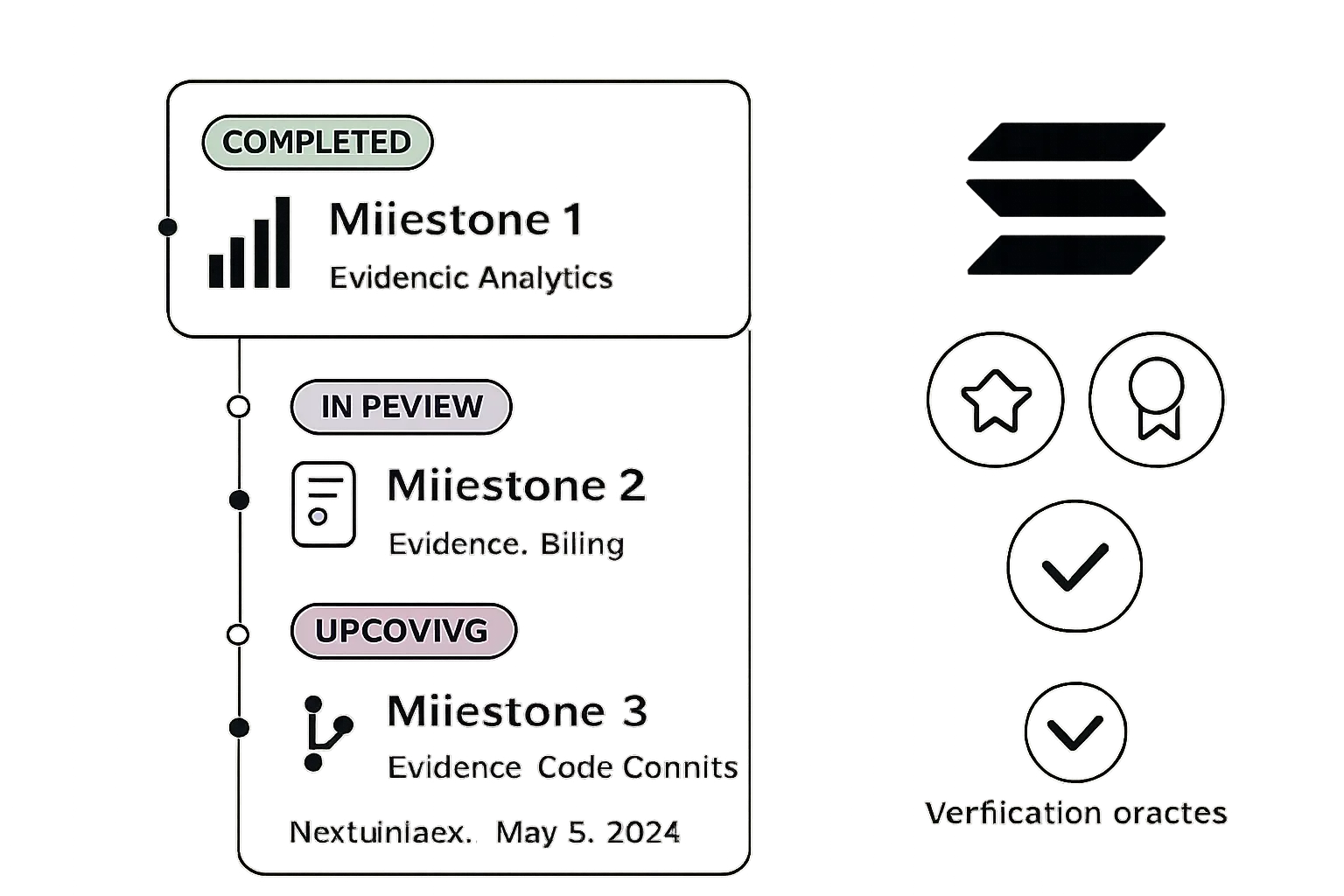

Post-investment: weekly operating cadence, on-chain milestone attestations, oracle-verified proofs (usage, revenue, deploys), controlled unlocks, and compounding outcomes via learning loops.

Why milestone-based tranching wins

Cuts capital risk by tying cash to evidence - builds shipped, users acquired, revenue milestones hit - so capital follows execution, not hype.

Improves founder/investor alignment: clear goals, faster feedback, and a tighter speed-to-learning cycle. Founders raise continuously by proving; contributors re-allocate to momentum transparently.

On-chain transparency

Solana-native settlement: tranches, attestations, and contributor distributions executed by smart contracts.

Verifiable proofs: data oracles ingest product metrics, commit history, and revenue receipts to validate milestones.

Reputation by design: contributor and founder reputations accrue on-chain; governance, cap table logic, and unlock conditions are visible and auditable.

Access Is Alpha: Winning Deal Flow Without a Tier‑1 Badge

The old playbook: brand and closed networks

Tier‑1 loops compound. Sequoia and a16z don’t just write checks - their brand, capital, and operator networks create a self‑reinforcing access flywheel: founders signal up, top partners get first look, outcomes reinforce brand, and the cycle tightens. For emerging funds, competing head‑to‑head on brand alone is a losing game.

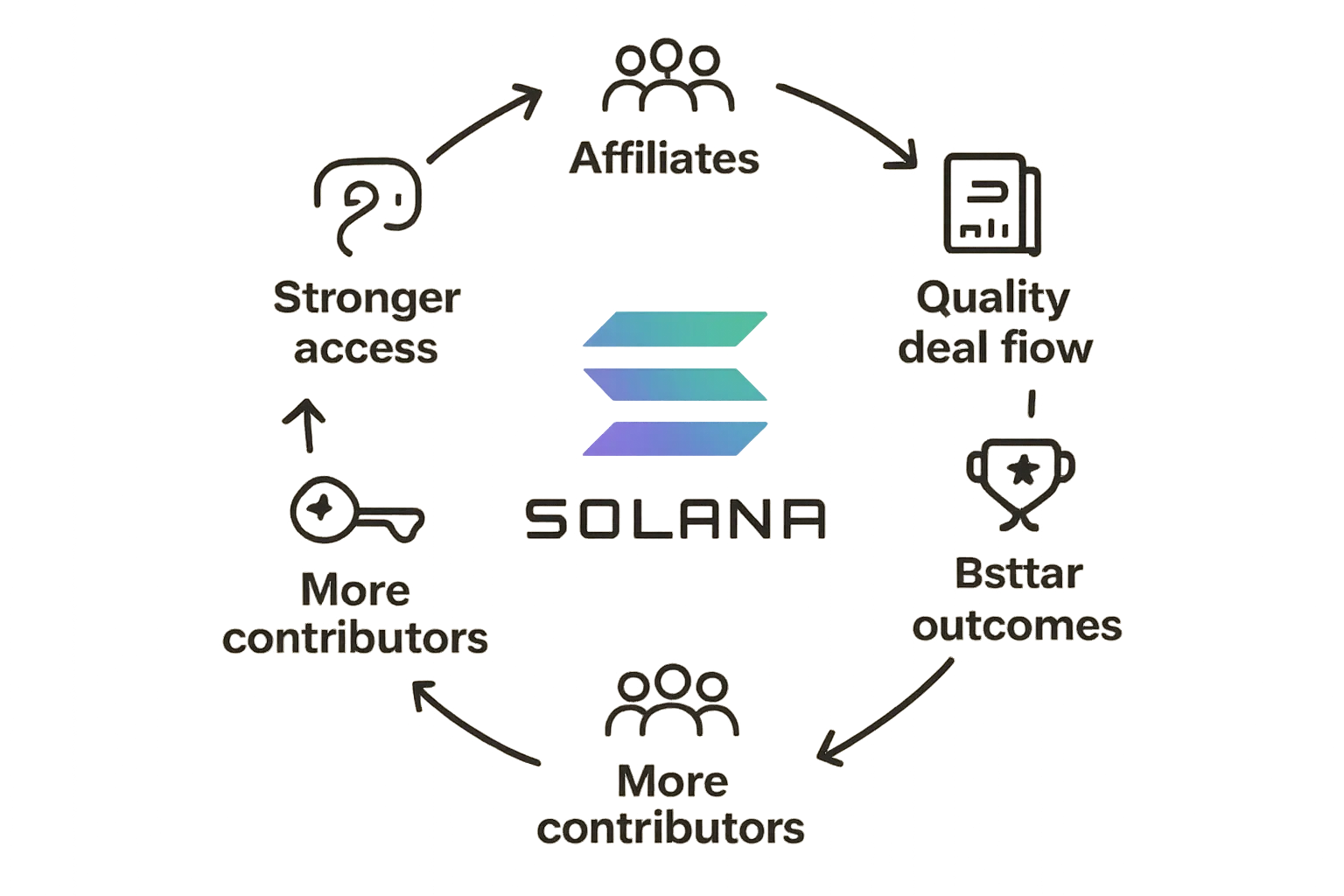

The new playbook: community-led access

Affiliate networks that reward credible sourcing: invite creators, operators, and community leaders to surface founders; reward them transparently when deals perform. You turn many trusted scouts into a scalable, merit‑based pipeline.

Founder magnetism via transparent, fair milestone design and fast settlement: when founders see clear rules, clean terms, and rapid on‑chain unlocks, they choose you - not for a logo, but for speed, clarity, and aligned incentives.

How decentralized platforms change access

Open rules and visible progress reduce signaling risk. Everyone sees the same milestones, proofs, and unlocks - no backstage whispers, no opaque preferences. Contributors evaluate the same evidence funds do.

“Funding next” means creating surfaces for talent to find you - and stay when you execute. Zemyth’s Solana rails, milestone‑gated rounds, and affiliate‑driven sourcing turn access from a closed club into an open, compounding flywheel.

Designing Milestones That Actually De‑Risk the Next Tranche

What makes a milestone investable

Observable, falsifiable, and time‑boxed: the startup investment fund and founders agree on what will be proven, how it’s measured, and by when. No ambiguity, no moving goalposts.

Directly tied to value creation (not vanity): milestones must improve survival odds or unlock the next growth channel - product readiness, activation/retention, efficient revenue, or compliant market access. That’s how we invest in startups and keep “funding next” tethered to execution.

Proof that travels well

Tech: feature complete against a published spec; load tests meeting target throughput/latency/error budgets across realistic concurrency; security scans and reliability SLOs established.

Users: activation rate, D7/D30 retention, depth of usage (sessions, weekly active to monthly active), plus cohort curves that flatten at healthy levels; B2B expansion and time‑to‑value.

Revenue: MRR/ARR with net revenue retention signals, payback period, and gross margin guardrails appropriate to the model; early churn roots addressed with playbooks.

Distribution: CAC/LTV guardrails by channel, repeatable channel‑fit, sales cycle time, and conversion funnels that show learning velocity (not just spend).

Governance and verification

Who attests? Founder/operator attestations plus designated reviewers (lead contributors or milestone committee) with clear conflict‑of‑interest rules.

What data sources? Product analytics, billing data, CRM, version control and CI/CD logs, cloud metrics, and third‑party attestations (e.g., SOC 2, HIPAA, PCI, regulatory licenses).

What if proof is contested? Define a cooling‑off and re‑measurement window, escalation path (to an on‑chain committee/multisig), and a tie‑breaker via independent auditor or data oracle. The goal is speed with integrity - keep the path to unlock or revise explicit.

Milestone Design Cheatsheet

Milestone type | Evidence required | Acceptance threshold | Verification method (on‑chain attestations, third‑party audits, data oracles) | Typical tranche % |

|---|---|---|---|---|

Product | Feature-complete build vs. spec; passing test suite; load/stress test reports; uptime/error budgets; security scans | Core feature parity; p95 latency ≤ target; error rate ≤ 0.5%; uptime ≥ 99.5% over 30 days | On‑chain attestation referencing CI/CD logs and load-test artifacts via data oracle; optional third‑party pen‑test report hash | 15–25% for pre‑PMF readiness; higher if product risk dominates |

Users | Activation and retention cohorts; usage depth; WAU/MAU; NPS/qual insights by ICP | Activation ≥ 30% (consumer) / ≥ 60% (B2B seats); D30 retention ≥ 15% (consumer) / logo retention ≥ 90% (B2B) | Analytics oracle pulls cohort tables; founder + reviewer attest on definitions; on‑chain hash of cohort exports | 15–20% tied to clear user love; unlocks follow-on for growth |

Revenue | MRR/ARR from billing; gross margin; NRR/GRR; payback period; booked vs. collected | MRR ≥ $25k with ≥ 65% gross margin; payback ≤ 12 months (B2B) / ≤ 9 months (consumer); NRR ≥ 110% (if applicable) | Billing data oracle (Stripe/processor) with on‑chain proofs; accountant attestation for margin | 20–30% when revenue quality reduces model risk |

Distribution | CAC/LTV by channel; conversion funnel; sales cycle; partner contracts/LOIs with teeth | LTV:CAC ≥ 3:1; CAC payback ≤ 12 months (B2B) / ≤ 9 months (consumer); ≥ 2 repeatable channels | CRM + ads platform data via oracle; signed partner LOIs anchored on wallet IDs; on‑chain attestation | 10–20% tied to channel repeatability and unit discipline |

Regulatory | Formal approvals (e.g., SOC 2 Type I/II, HIPAA BAA, PCI-DSS, licenses); compliance audit trails | Achieve required certifications or licenses for target market; remediation plan closed | Third‑party audit certificates hashed on‑chain; regulator database links; compliance oracle | 10–15% when market entry hinges on compliance |

Design milestones that make the next big investment obvious: each tranche should remove a core uncertainty and compound learnings. This is how “funding next” works at speed - capital follows verifiable execution, founders keep momentum, and contributors see the same proof on‑chain.

Fast, Not Loose: A Diligence Sprint You Can Do in 10 Days

Day-by-day sprint outline

Day 1–2: Founder references and competitive map

Founder references: backchannel 3–5 operators/investors; verify execution history, integrity, speed-to-learning.

Competitive map: identify incumbents and fast followers; chart wedge, moat, switching costs. Document differentiation that compounds.

Decision gate: investable founder/market story or stop.

Day 3–4: Market model sanity check (TAM/SAM/SOM realism) and exit math

Build bottoms-up SAM by ICP and pricing; triangulate with usage or demand proxies.

Exit math: model dilution, ownership, and path to a 10–20x return; ensure category supports ≥$500M–$1B outcomes.

Decision gate: realistic path to power-law potential; if not, re-scope thesis or pass.

Day 5–6: Traction quality (activation, retention, payback) and tech review

Traction quality: cohort tables (D1/D7/D30), WAU/MAU, NRR/GRR (if B2B), CAC payback; confirm definitions and event hygiene.

Tech review: shipped builds vs. roadmap; reliability (p95 latency, error budgets), security posture, scalability bottlenecks.

Decision gate: proof of love (users) or proof of money (revenue) plus a credible engine to scale.

Day 7: Legal/structure and cap table hygiene

Review corporate docs, equity grants/vesting, SAFEs/notes terms, pro rata/ROFR, IP assignment, data/privacy posture.

Cap table: founder ownership after pro forma, option pool sizing, debt/convertible pressure points.

Decision gate: no hidden landmines; fixable before term sheet.

Day 8: Risk memo and milestone draft

Write a one-pager: thesis, risks (tech, distribution, regulatory, capital intensity, governance), and mitigations.

Draft milestone plan: 2–4 tranches with objective acceptance criteria (activation/retention, MRR, CAC/LTV, compliance).

Decision gate: risk-adjusted path where each tranche de-risks the next.

Day 9: Term sheet alignment and tranche plan

Align on valuation, tranche sizes, milestone definitions, re-measurement windows, and proof sources (analytics, billing, audits).

Confirm contributor protections and founder flexibility (clear use of proceeds, escalation path if proof contested).

Decision gate: handshake on “capital follows execution” and timelines.

Day 10: Investment committee and commit

Present: evidence snapshots, risk memo, tranche logic, ownership and exit math.

IC vote; if greenlit, sign and set Day 0 operating cadence and data access rails.

Outcome: from sourcing to signed check with milestone-gated clarity - ready to “funding next.”

What to never skip

Independent customer calls: at least 3–5 conversations; validate problem intensity, willingness to pay, and alternatives.

Cap table review: founder control, vesting, debt/convertible overhang, option pool; ensure room to recruit.

Milestone acceptance criteria: observable, falsifiable, time-boxed; specify metrics, systems of record, and who attests.

How on‑chain proof compresses the cycle

Shared data rails reduce re‑work and subjective debates: analytics, billing, and release artifacts can stream to on-chain attestations on Solana.

Evidence parity for all contributors: the startup investment fund, angels, DAOs, and retail contributors evaluate the same proofs.

Faster closes, cleaner follow-ons: with milestone gates defined up front, we invest in startups quickly while keeping diligence tight - making each tranche the next big investment only when the proof is real.

Portfolio Construction: Cohort Size, Check Sizes, and Follow‑On Logic

"With 1,000 investments, the probability of at least tripling the initial investment reaches 93% - diversification is a fact in early‑stage venture." - Source

Build a portfolio that finds outliers

The math is unforgiving: a startup investment fund must be designed for fat‑tailed outcomes. A 20–40 position core is table stakes to surface outliers; breadth finds the spike, not precision alone.

Follow‑on reserves amplify winners. The point of “we invest in startups” isn’t to be right more often - it’s to be disproportionately right when the data proves a breakout. Keep dry powder to press conviction.

Allocation model for startup investment funds

Initial vs. reserves: most managers run 60/40 or 70/30 (initial checks/reserves). Earlier stages and tranching discipline support a higher reserve ratio; later‑stage focus can run lighter.

Stage mix and velocity:

Pre‑seed/seed lead: fewer, larger ownership targets; slower cadence, more work per deal.

Co‑invest cadence: more positions at smaller checks; rely on milestone‑based signals and shared diligence to keep speed with proof.

Zemyth angle: milestone‑gated rounds and on‑chain proofs reduce reserve waste - capital follows execution, not hope.

Dilution math and outcome targets

Underwrite 30x–50x potential at entry. Back‑solve ownership, dilution, and exit ranges to ensure a single winner can carry the fund.

Sanity‑check market capture, margins, and pricing power. If the exit requires implausible share or margin, adjust ownership or pass.

Risk management

Sector and stage caps: avoid over‑concentration; set guardrails by theme and maturity.

Correlated bet controls: cap exposure to macro‑sensitive clusters (e.g., fintech lending, consumer ad‑dependent).

Kill‑switch triggers: stop following when milestone gates aren’t met, burn multiples deteriorate, or governance red flags appear.

On‑chain transparency (Zemyth): Solana‑settled tranches and visible milestone proofs keep discipline consistent across the cohort.

Sample Early‑Stage Portfolio Model

Stage | Target # deals | Avg check | Ownership target | Reserve ratio | Decision triggers |

|---|---|---|---|---|---|

Pre‑seed | 20–25 positions across 18–24 months to build breadth | $75k–$150k per initial check; trancheable on proofs | 2–4% on entry (co‑lead) or 1–2% (co‑invest) with pro rata rights | 30–40% of fund reserved to press early traction | Advance if activation ≥ target, D30 retention clears threshold, core feature set shipped; pause on weak cohorts or unclear ICP |

Seed | 10–15 positions; slower cadence, deeper diligence | $250k–$500k per initial check; milestone‑based tranches | 4–8% if leading; 2–4% if co‑investing, secure super‑pro rata where possible | 40–50% of fund reserves across seed/Series A | Advance if CAC payback ≤ 12 months (B2B) / ≤ 9 months (consumer), gross margin guardrails met, repeatable channel fit proven |

Follow‑on | 10–20 follow‑ons into top 20–30% of cohort | $500k–$1.5M per follow‑on, contingent on verified proof | Maintain or grow pro rata in top decile; avoid median | Deploy 60–70% of reserves into top performers; keep 30–40% for late breakers | Double‑down on NRR ≥ 110%, revenue velocity, burn multiple ≤ 1.5, governance clean; stop following on missed milestones or deteriorating unit economics |

Breadth finds the outliers; reserves let you ride them. With milestone‑based tranching and on‑chain proofs, “funding next” becomes a disciplined loop - discover, verify, and concentrate into the next big investment when the evidence compels it.

What “Funding Next” Looks Like on Zemyth

The Startup Nest (venture upside)

Tokenized, milestone‑gated rounds on Solana designed for speed with proof.

Tranche unlocks tied to real evidence: shipped builds, activation/retention thresholds, revenue milestones, or regulatory events - all verifiable on‑chain.

Contributor reputation and transparent progress: every attestation, unlock, and outcome is visible - so capital flows to execution, not noise.

The Fund Nest (liquidity layer)

Park capital between rounds and earn daily yield to smooth cash flow.

A practical base layer for contributors who want upside without sitting idle - a liquid core that can move into Startup Nest tranches the moment proof clears.

Why it matters

Capital follows execution, not hype: milestone‑gated tranches create discipline without slowing momentum.

Open access venture with clear rules, steps, and on‑chain verification: the same playbook for founders, angels, DAOs, and retail contributors - transparent, fair, and fast.

How to Assess Your Next Big Investment (on Zemyth or Anywhere)

A 12‑step checklist

Founder‑market fit proof: earned insight, past domain wins, unfair access.

Market model sanity (TAM→SOM with exit math): bottoms‑up by ICP and pricing; path to ≥$500M–$1B outcomes.

Traction quality (activation, retention, payback): cohort shape and CAC payback discipline.

Distribution wedge and CAC paths: repeatable channels and predictable conversion.

Gross margin and unit economics runway: margin guardrails and burn multiple.

Tech risk and build velocity: shipped builds, reliability, and security posture.

Regulatory surface area: licenses, data/privacy, compliance roadmap.

Cap table and ownership math: founder control, option pool, pro rata rights.

Milestone design (clarity and verification): observable, falsifiable, time‑boxed.

Tranche sizing vs. runway: capital tied to learning cycles, not calendar time.

Follow‑on plan and reserves logic: when to double‑down and when to pause.

Kill‑switch conditions: explicit triggers to stop following or revise plan.

Red flags that masquerade as green lights

Vanity metrics and synthetic demand (paid trials, inflated waitlists).

Uncontrolled channel CAC or shifting attribution.

Stacked SAFEs with conflicting terms; uncapped liabilities or IP gaps.

Fuzzy milestones without acceptance criteria or systems of record.

How on‑chain verification changes the game

Shared facts reduce signaling risk and speed consensus. When milestones, evidence sources, and unlock logic are visible on Solana, everyone - funds, angels, DAOs, and retail contributors - evaluates the same proof. That’s how you consistently spot and fund the next big investment with conviction.

Conclusion: Ready to Fund the Next Big Thing? Make Capital Follow Proof with Zemyth

Why this works

Power laws reward access and discipline. The best startup investment fund design isn’t about guessing right more often - it’s about earning access, underwriting convexity, and concentrating when the proof appears.

Milestone‑based tranching turns speed into smart speed. Move fast, but gate every tranche to observable execution: shipped builds, activated users, efficient revenue, or regulatory unlocks.

Portfolio breadth plus follow‑ons catch outliers. A prepared reserve strategy lets you double down on the few that matter - the ones that become your next big investment.

Your next move

Founders: define 2–4 milestones that unlock unfair momentum - then apply to the Startup Nest to raise tokenized, milestone‑gated capital on Solana.

Contributors: park idle funds in the Fund Nest to earn daily yield, then back milestone‑gated rounds with transparent, on‑chain proof. Capital compounds while you scout - and moves the moment evidence clears.

Affiliates: bring credible founders and earn for curating “funding next.” Turn your community and expertise into a real access flywheel.

Visit Zemyth: https://zemyth.app - Open access venture on Solana, built for builders and contributors who want results, not hype.