Introduction: Fund of funds vs single-fund investing (who each is for)

What this comparison covers

Fund of funds (FoF): a fund that invests in a portfolio of other funds (e.g., PE/VC/hedge/mutual/ETF), adding manager- and strategy-level diversification.

Single-fund diversified investing: one fund that holds a diversified asset mix (e.g., target-date or target-allocation mutual fund/ETF) you can buy and forget.

Reader promise: By the end, you’ll know which structure fits your investment strategy, risk tolerance, and how hands-on you want to be.

Where Zemyth fits: If you prefer a single-fund-style path over multi-manager FoFs, Zemyth gives you two clear tracks: Fund Nest for stable, USD-denominated daily yield ($1/day per $1,000 invested) and Startup Nest for asymmetric high growth (the bold bet). Simple choices, daily progress - backed by education and an affiliate program to grow your network.

Comparison at a glance

Factor | Fund of Funds (FoF) | Single-Fund Diversified Investing |

|---|---|---|

Diversification depth | Deep, multi-manager diversification across strategies, sectors, geographies, and vintages | Broad, asset-class diversification inside one selected fund (stocks/bonds/cash), often global |

Fee layers | Two layers: FoF fees plus underlying fund fees/carry | One layer: single expense ratio (typically lower) |

Minimums / access | Often high minimums; accreditation/common in private markets | Low minimums; retail-friendly via mutual funds/ETFs |

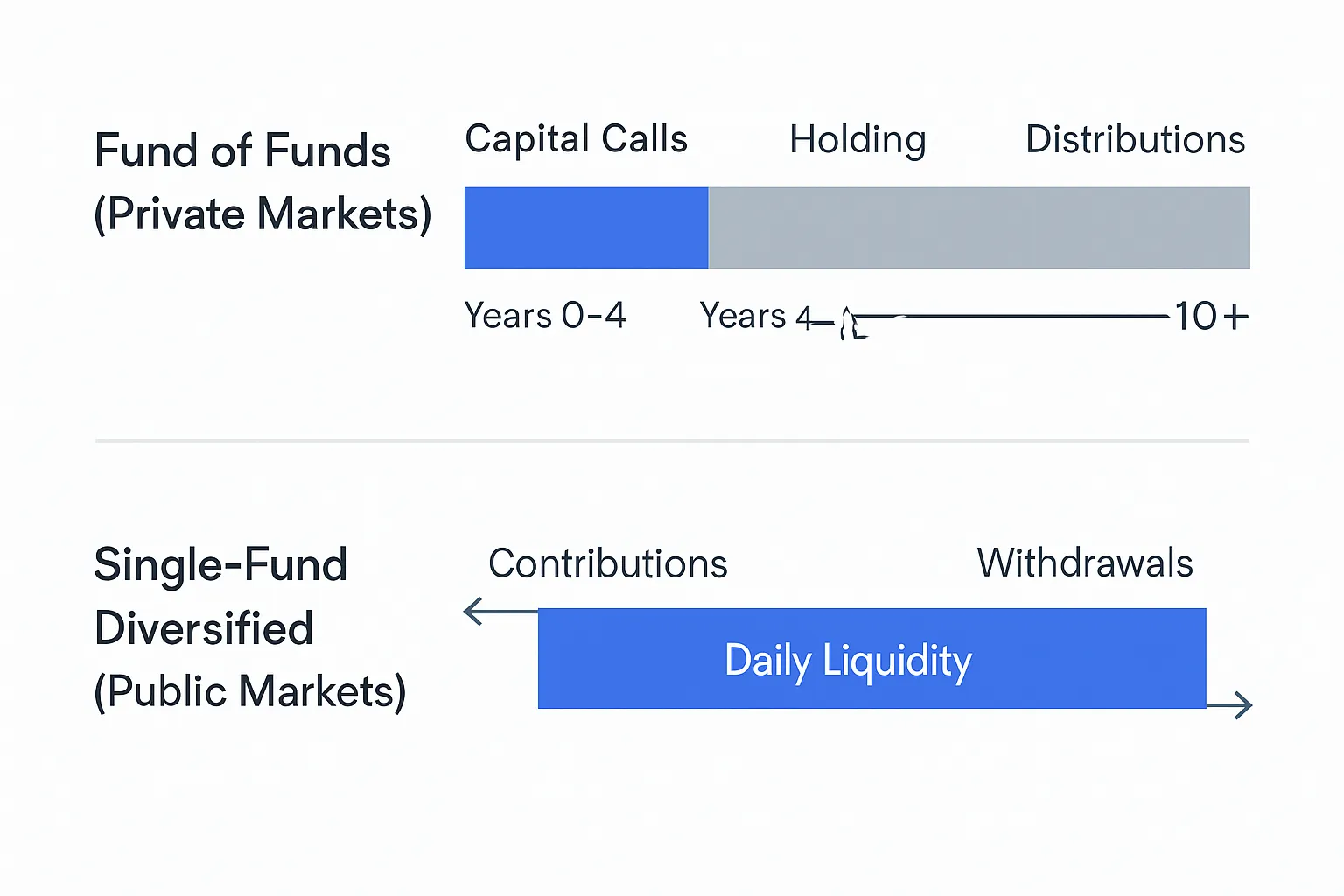

Liquidity | Typically illiquid, with capital calls and long lockups | Generally liquid (daily for mutual funds/ETFs); target-date/target-allocation funds trade normally |

Transparency | Limited look-through; quarterly reporting and manager letters | High transparency; holdings and allocations published regularly |

Time to implement | Longer (subscriptions, due diligence, capital schedules) | Fast - buy once and you’re allocated in minutes |

Monitoring burden | Moderate to high; vintage pacing, re-ups, capital calls, manager reviews | Low; auto-rebalanced to target date or target allocation |

Typical users | Institutions, family offices, HNW investors seeking manager access | Everyday investors seeking simplicity, low cost, and a “set-and-stay” fund investment strategy |

When each wins | When you want elite manager access, co-investments, and layered diversification | When you want clarity, lower cost, and easy alignment with your investment strategy and time horizon |

Quick video explainer

How each model works (structures, cash flows, timelines)

Fund of funds mechanics

Structure: Limited Partners (LPs) commit capital to a FoF. The FoF General Partner (GP) selects and diligences underlying funds, issues capital calls over several years, and passes back distributions as those funds exit positions.

Diversification levers: Manager selection, strategy mix (buyout/growth/VC/hedge/real assets), geographies, and vintage years to smooth market-cycle risk.

Where FoFs show up: PE/VC FoFs, hedge FoFs, real asset FoFs; can be fettered (single family of managers) or unfettered (open architecture).

Pros: Broader access, professional due diligence, vintage diversification. Cons: Fee stacking, limited look-through, pacing and J-curve risk.

Single-fund diversified portfolio mechanics

Structure: One fund holds a diversified mix across public markets (global stocks/bonds/cash) or follows a glide path (target-date) or a fixed mix (target-allocation).

Rebalancing and glide paths: Target-date funds auto-shift from growth to defense over time; target-allocation funds keep a fixed risk profile via periodic rebalancing.

Pros: Simplicity, typically lower cost, easy to rebalance and automate. Cons: Less manager diversification, fewer niche or closed opportunities.

Cash-flow and timeline differences

FoFs: Commitments funded via capital calls; multi-year investment and harvest periods (often 10–15 years in PE/VC); early J-curve and lumpy distributions.

Single-fund: Investable immediately with daily liquidity for mutual fund/ETF wrappers; straightforward recurring contributions and withdrawals.

Where Zemyth maps conceptually

Fund Nest ≈ a single-fund, outcome-based path focused on stable daily yield in USD.

Startup Nest ≈ a focused, high-upside track offering asymmetric potential - closer to direct exposure than FoF breadth.

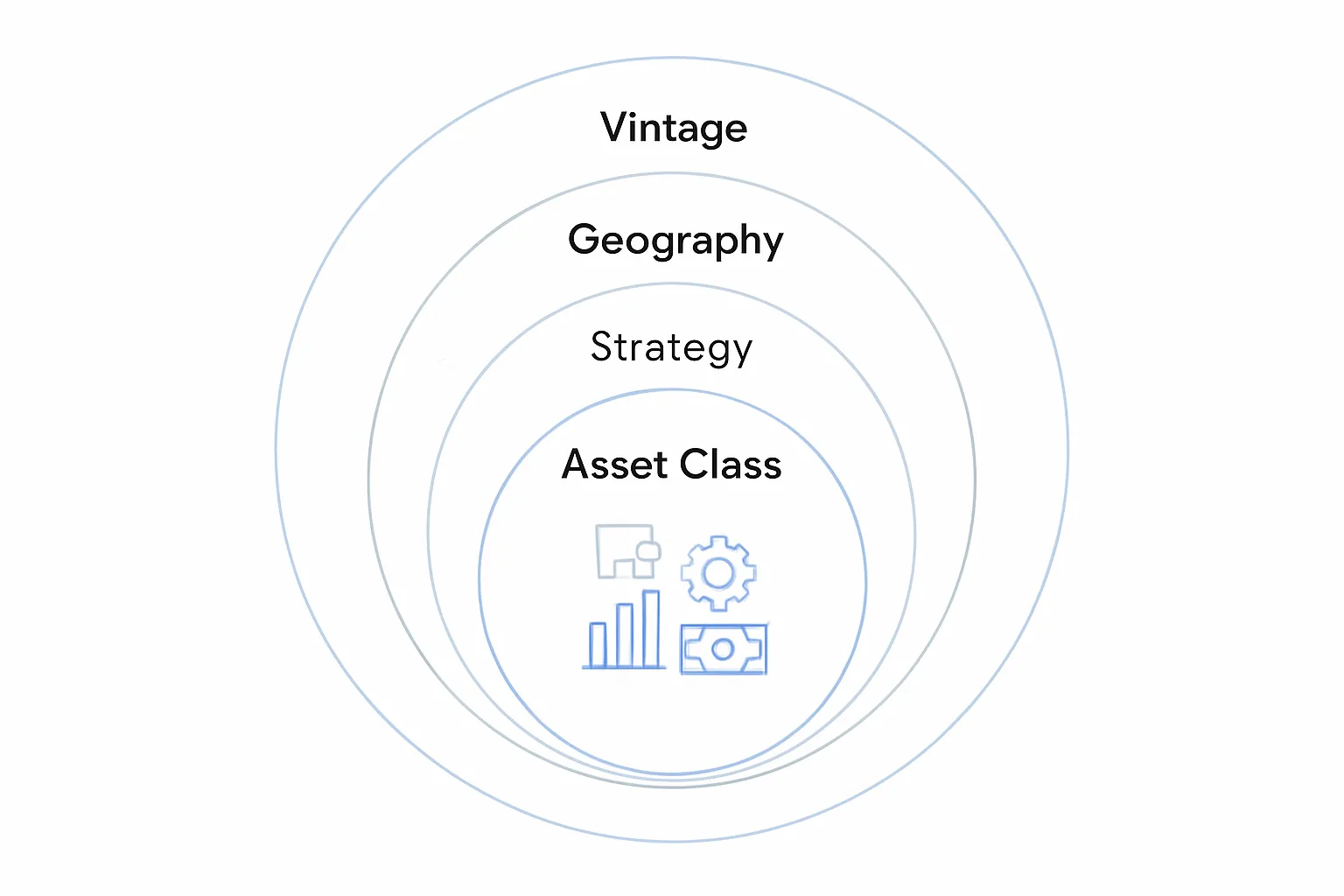

Diversification: depth vs simplicity

What diversification means at each layer

Asset class diversification: spreading across stocks, bonds, and cash (and sometimes real assets).

Manager diversification: different teams, styles, and decision processes.

Strategy diversification: buyout, growth, venture, long/short, macro, index, etc.

Geography diversification: exposure across regions and currencies.

Vintage diversification: staggering allocations across fundraising years.

FoFs excel at manager, strategy, and vintage diversification. Single-fund diversified products excel at asset-class diversification with broad, global exposure built into one wrapper.

Avoiding overdiversification

Diminishing returns are real: beyond a point, adding more funds can dilute outcomes and push you toward average results - especially in very broad FoFs.

Smart concentration keeps a meaningful position in high-conviction ideas while still managing risk.

Practical implications for your investment strategy

If your selected fund objective is broad market exposure with minimal upkeep, a single-fund diversified vehicle typically wins.

If your investment strategy seeks specialist managers, niche strategies, and vintage staggering, a FoF can be the better fit.

Zemyth angle

Prefer a single, clear path? Use Fund Nest for steady, USD-denominated daily outcomes. Use Startup Nest for asymmetric upside. Then, if needed, add other exposures around that core.

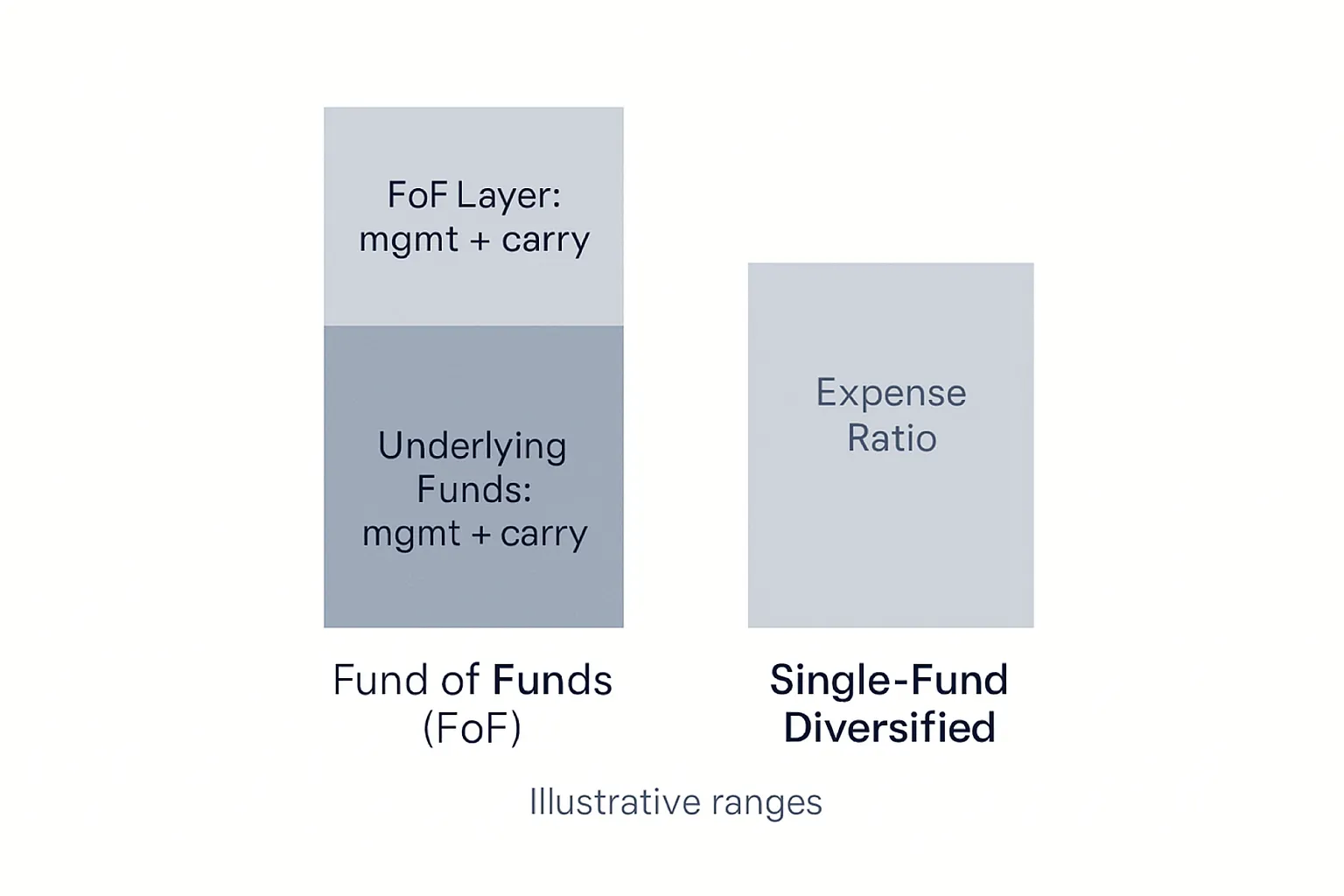

Fees and your net returns (what you actually keep)

Understanding fee layers

Fund of fund strategy fees stack: you pay the FoF layer (management + performance/carry) on top of the underlying funds’ fees. That means two levels of costs before returns reach you.

Single-fund diversified ETFs/mutual funds typically charge one expense ratio - often far lower if index-based - so more of your performance stays in your account.

Break-even intuition

For a FoF to beat a single-fund diversified approach, its manager selection must add enough alpha to clear the entire fee stack. Otherwise, net-of-fee returns can lag.

Cost drag compounds. A seemingly “small” 1%–2% annual difference can translate into tens of thousands over long horizons - so build your fund investment strategy around net, not gross.

"Index funds’ average expense ratio was 0.09% vs 0.56% for active funds (as of Dec 31, 2024)." - Source

Typical ranges and examples (illustrative, vary by fund type)

Structure | Fee layers | Typical management fees | Performance fees | Notes |

|---|---|---|---|---|

Fund of Funds (PE/VC) | Two layers: FoF + underlying | FoF: ~0.5–1.0% + Underlying: ~1.5–2.5% | FoF: ~5–10% carry + Underlying: ~15–25% carry | Strong access and selection alpha required to overcome stacked costs |

Hedge FoF | Two layers: FoF + underlying | FoF: ~0.5–1.0% + Underlying varies (often 1–2%) | FoF: incentive possible + Underlying: performance fees common | May enhance strategy/manager diversification at higher total cost |

Single-fund diversified index ETF/target-date | Single layer | ~0.05–0.40% expense ratio | None | Index versions are typically cheapest; active versions higher |

Single-fund diversified active | Single layer | ~0.40–1.00%+ expense ratio | Sometimes performance fees (rare in mutual funds) | Pays for active security selection within one selected fund |

Actionable takeaways

Model scenarios net-of-fees and ask for look-through fee disclosures - especially with FoFs.

If you’re fee-sensitive or want a low-maintenance core, single-fund diversified is usually superior on cost and simplicity.

If access to specialist managers, co-invests, or vintage staggering is central to your investment strategy, FoFs may justify the higher costs.

Zemyth angle

If you want transparent, outcome-framed costs without multi-layer stacks, Zemyth’s single-track choices keep it simple: Fund Nest for steady daily outcomes, Startup Nest for asymmetric upside. Use one as your core, then layer other exposures if they strengthen your investment strategy.

Access, minimums, and liquidity

Access and minimums

Fund of funds (private markets): Often require institutional or high-net-worth minimums. Some platforms can reduce thresholds, but access is still curated and diligence-heavy.

Single-fund diversified mutual funds/ETFs: Generally low minimums with straightforward brokerage access, ideal for setting up automated contributions.

Liquidity

FoFs in private markets: Expect long lockups and staged distributions over years; liquidity is limited and timing is uncertain. Secondary markets can provide optionality, subject to discounts.

Single-fund diversified public funds: Typically daily liquidity; target-date and target-allocation funds are usually redeemable like standard mutual funds/ETFs.

Secondary markets trend (for context)

"Secondary funds raised $35 billion in Q1 2024, up 6% from $33 billion in Q1 2023." - Source

Implementation tip

Need flexible liquidity or frequent rebalancing? Prefer single-fund diversified vehicles.

Comfortable locking capital 7–12+ years to access specialist private strategies? A FoF can fit.

Zemyth angle

Zemyth focuses on a USD-denominated, accessible, day-to-day experience - appealing if liquidity and clarity matter to you. Choose Fund Nest for predictable daily yield or Startup Nest for bold upside, then add other exposures if they support your investment strategy.

Risk, volatility, and performance expectations

Risk profiles by structure

Fund of funds (FoFs): By spreading capital across multiple managers, strategies, and vintages, FoFs reduce single-manager blowup risk. But they still inherit the underlying strategy’s risk profile - buyout cyclicality, VC write-downs, hedge macro shocks, etc. Dispersion narrows (less chance of top-decile or bottom-decile outcomes), yet it doesn’t disappear. In short: smoother, but still exposed to the core risk drivers of the chosen fund of fund strategy.

Single-fund diversified: Market beta dominates. Your path is set largely by the equity/bond mix (or the glide path if it’s a target-date fund). With a selected fund that holds global stocks and bonds, you’re accepting transparent, mark-to-market volatility in exchange for liquidity and simplicity.

Time horizon and sequence risk

FoFs (private): Expect a J-curve - early fees and write-downs, later realizations as exits occur. Returns are back-ended and lumpy, with timing risk tied to deal exits and distributions. This suits long horizons but can frustrate near-term cash needs.

Single-fund diversified: You’ll see real-time gains and losses. The key risk is sequence-of-returns - poor markets right before or during withdrawals can dent outcomes. Glide path funds mitigate this by shifting from growth to defense as your time horizon shortens.

Setting expectations for your investment strategy

Frame outcomes up front: What level of drawdown can you tolerate without abandoning your plan? How predictable do you need cash flows to be? If your investment strategy prioritizes liquidity and clarity, a single-fund diversified approach offers transparent volatility and easy rebalancing. If your fund investment strategy targets specialist managers and long-term private market premia, a FoF can fit - provided your time horizon and pacing plan are aligned.

Zemyth angle

Prefer predictability? Fund Nest’s $1/day per $1,000 invested framing aligns with low-volatility goals and cash-flow clarity.

Comfortable with high risk for high potential? Startup Nest aligns with asymmetric return seekers willing to accept wider performance dispersion.

Use one as your core, then layer exposures that match your investment strategy.

Due diligence, transparency, and control

Workload and information rights

Fund of funds (FoFs): Most of the heavy due diligence happens at the FoF level - sourcing, manager evaluation, reference checks, and vintage pacing. Investors rely on the FoF’s process and reporting. Look-through to underlying holdings can be limited and lagged.

Single-fund diversified: Public funds typically publish factsheets, holdings, and rebalancing policies. You get clear rules and frequent reporting with less workload.

Regulatory considerations (public funds)

"SEC Rule 12d1-4 (2020) permits registered fund-of-funds structures beyond Section 12(d)(1) limits while imposing controls to prevent undue influence, regulate voting (e.g., mirror voting), and enhance disclosures via Form N-CEN." - Source

Practical checklists

FoF: Assess the GP’s sourcing edge, track record across cycles, fee netting and carry mechanics, clawbacks, secondary capabilities, reporting cadence and quality, and alignment of interests.

Single-fund: Verify expense ratio, glide path or fixed allocation, rebalancing methodology, tax efficiency, and tracking error versus the benchmark.

Zemyth angle

We keep the path clear and guided. Zemyth’s education-first approach and two-track design reduce due diligence burden - so you can choose predictable daily growth (Fund Nest) or asymmetric potential (Startup Nest) with confidence.

Implementation paths and real-world examples (for inspiration, not endorsements)

Single-fund diversified example

A target-allocation fund family (e.g., a global 60/40 approach) offers low-cost index exposure with automatic rebalancing. What to inspect: expense ratio, breadth of underlying indexes, and the rebalancing policy that keeps your asset mix on target.

Fund of funds example

A global private markets FoF platform can offer primaries, secondaries, and co-investments across managers, geographies, and vintages. What to inspect: total fee stack and net-of-fee modeling, access to top-tier managers, pacing model and secondary capacity, and reporting cadence.

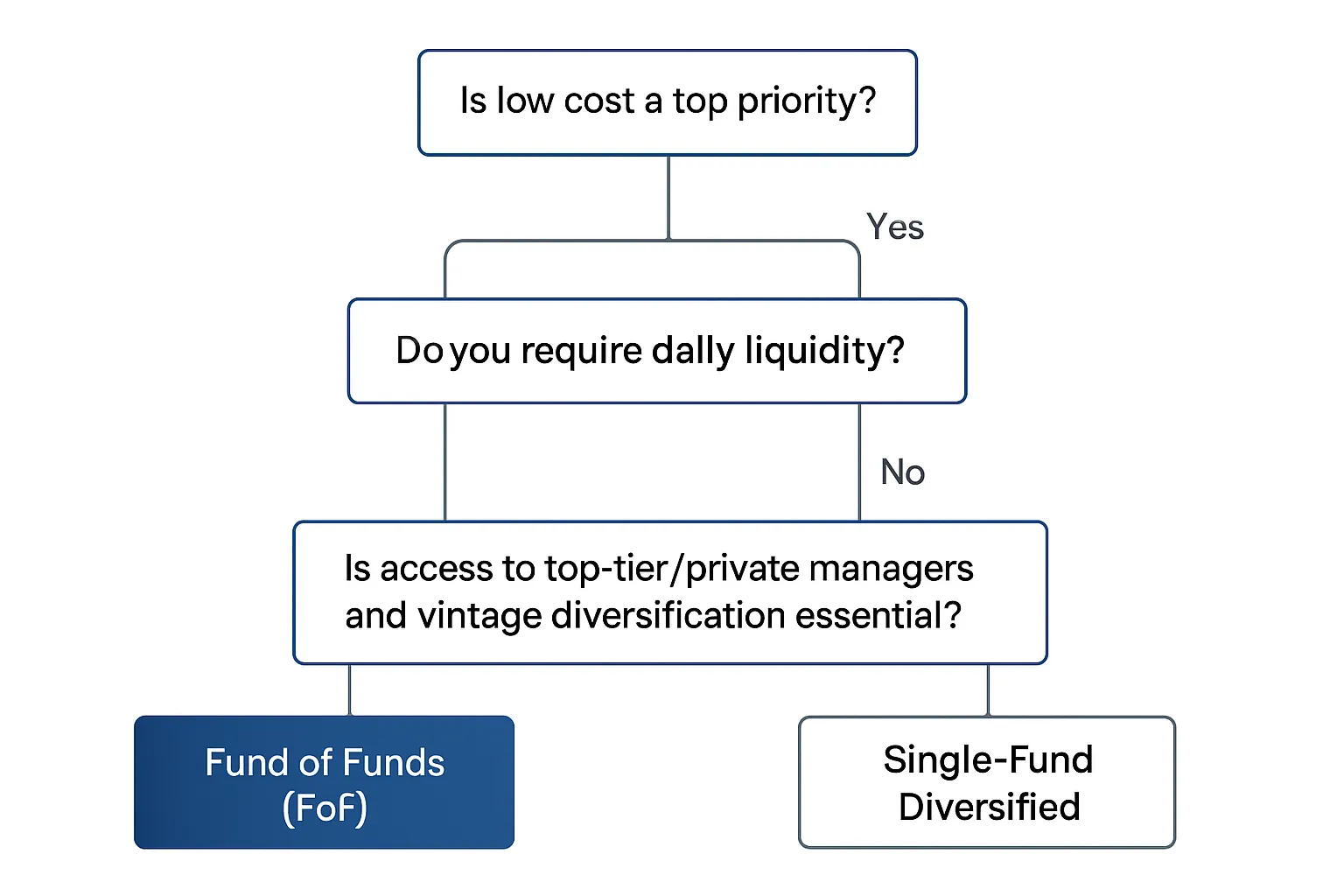

Which should you choose? A simple decision framework + final verdict

Decision checklist

If your priorities are low fees, simplicity, daily liquidity, and minimal maintenance → a single-fund diversified product likely fits your investment strategy.

If your priorities are access to specialist managers, vintage diversification, and you’re willing to accept higher fees and illiquidity → a fund of funds likely fits your fund investment strategy.

Persona-based guidance

Beginner or time-poor investor: Single-fund diversified.

Fee-sensitive, tax-aware investor: Single-fund diversified (index-based).

Access-seeking allocator to private strategies: Fund of funds.

Barbell builder (core + satellite): Use a single-fund core; add FoF or niche satellites if needed.

How Zemyth fits (strategic but fair)

Want predictable daily results? Zemyth’s Fund Nest mirrors the simplicity of single-fund diversified with an outcome-based promise: $1/day per $1,000 invested.

Want high-upside, high-risk exposure? Zemyth’s Startup Nest offers a focused, asymmetric bet - use it to complement or as an alternative to broad FoF diversification depending on your risk appetite.

Prefer to earn while you learn? Zemyth’s Academy and Affiliate program add education and earning pathways around your chosen track.

Final verdict

For most retail investors seeking clarity, low friction, and steady progress, a single-fund diversified approach is the default winner.

Choose a FoF when manager-selection alpha, access to closed funds, and vintage diversification are core to your thesis - and you accept higher fees and lockups.

If you’re deciding today and want an action-ready path: start with a simple single-fund-like core (Zemyth’s Fund Nest for daily yield or a low-cost target-allocation fund), then layer targeted, higher-risk opportunities (Zemyth’s Startup Nest or a FoF allocation) as your knowledge, capital, and time horizon expand.