TL;DR: Fund of funds 101 - quick answer

What a fund of funds is

A pooled vehicle that invests in other funds (mutual funds, ETFs, private equity/VC/real estate funds, hedge funds). In short: investors fund the fund, and the fund invests across multiple managers - your one “fund to invest in.”

When it makes sense

Diversification with one ticket across strategies, sectors, and managers.

Access to closed or high‑minimum managers you couldn’t reach solo.

Professional due diligence, portfolio construction, and monitoring.

Convenience: one statement, one K‑1 (in traditional structures), automated rebalancing in certain retail formats.

"83% of all participants utilized target-date funds." - Source

Watch‑outs

Layered fees and taxes (management + performance fees at multiple levels).

Liquidity terms (lockups, gates, redemption windows, capital calls).

Manager selection and concentration risk beneath the surface.

Correlation during market stress - diversification can compress when you need it most.

Benchmarking illusions and “highest fund returns” marketing; read the fee footnotes.

Is a fund of money right for your portfolio?

Likely yes if you want broad access, curated selection, and less hands‑on management - especially when high-fund minimums or capacity constraints apply.

Likely no if your top priority is the absolute lowest fee, full control over single positions, or DIY manager research.

Middle ground: hold low‑cost core exposure, then use a “fund the fund” sleeve for hard‑to‑access strategies.

What you’ll learn in this guide

Mechanics: how multi‑manager portfolios work and allocate.

Fee math: double‑layer costs, carry, hurdles, and what “all‑in” really means.

Use cases: diversification, access, convenience, and pacing.

Risk checks: liquidity, overlap, due‑diligence depth, and stress‑correlation.

How to build one: traditional and on‑chain approaches, governance, and admin.

How to judge “highest fund returns” claims responsibly.

CTA

Want a transparent, risk‑tiered way to put idle capital to work? See FundNest by Zemyth for yield‑layered liquidity options.

Visit: https://zemyth.app

Explore Zemyth → https://zemyth.app

How a fund of funds works

The basic stack

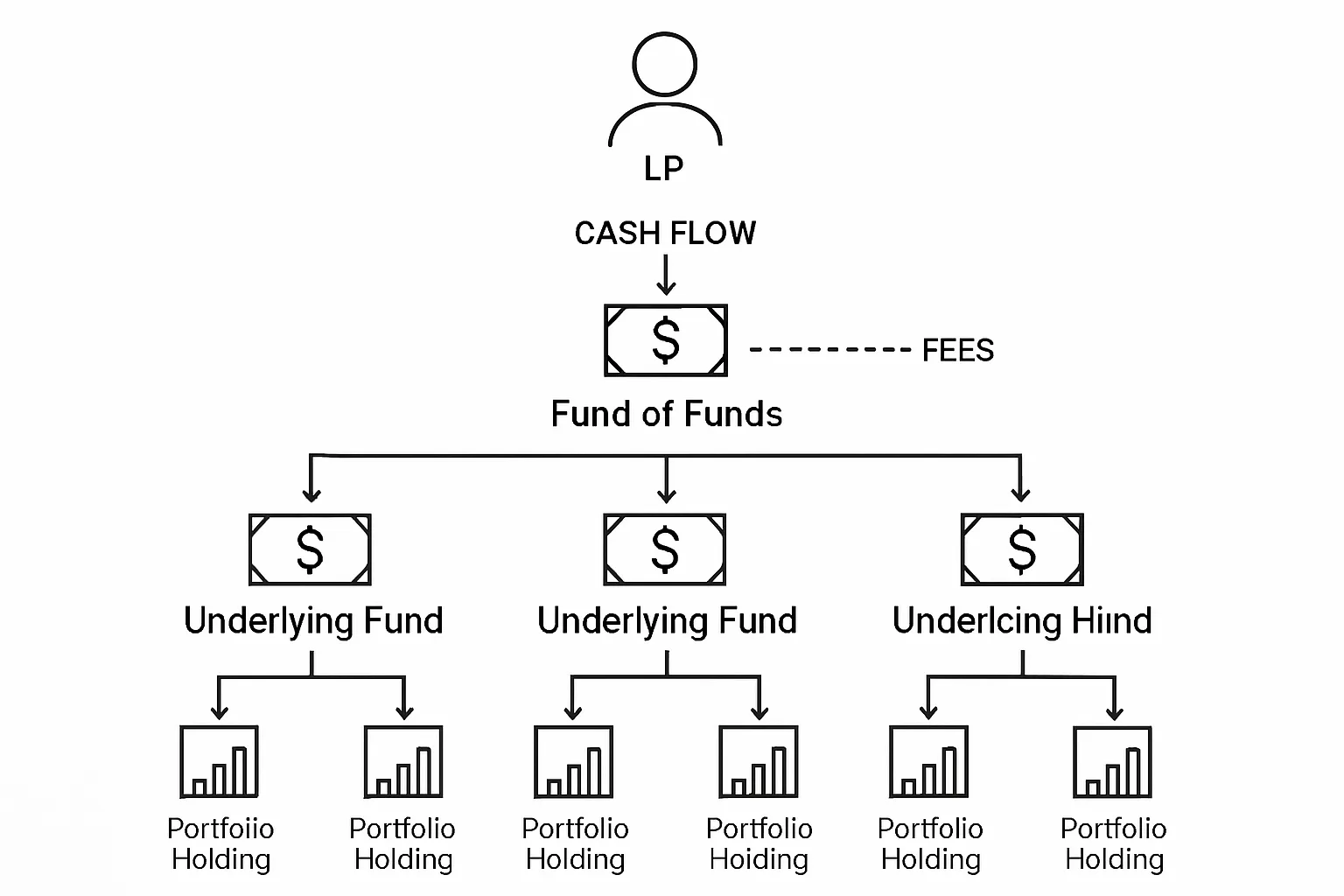

You (LP) → Fund of Funds (FoF) → Underlying funds → Portfolio holdings.

Translation: you fund the fund; the FoF selects and allocates across multiple managers; those managers own the actual securities, assets, or deals. It’s a single “fund to invest in” that spreads risk across many strategies.

Cash flow & lifecycle

Commit/subscribe

You subscribe with a lump sum (registered/retail FoFs) or make a capital commitment (private PE/VC FoFs).

Capital calls or funding

Private FoFs call capital over time; retail FoFs invest immediately.

Allocation engine

FoF allocates across sub‑funds (mutual funds/ETFs, hedge funds, private equity/VC/real estate funds), rebalancing as policies dictate.

Fees applied at each layer

FoF management (and possibly performance) fees + underlying funds’ expenses/performance fees → your net return.

Distributions roll up

Underlying funds distribute income/realizations to the FoF; the FoF passes them through (net of fees/expenses) to you.

Exit

You redeem per the FoF’s liquidity terms (daily/monthly/quarterly or at term end for closed‑end/private FoFs).

"Even small differences in fees can have a big impact on your investment portfolio over time." - Source

Roles & documents

Roles

General Partner/Investment Manager (FoF): strategy, manager selection, allocation, risk, reporting.

Underlying managers: run the constituent funds/strategies.

Administrator, auditor, custodian (where applicable), transfer agent, legal counsel, tax advisor.

Core documents

PPM (Private Placement Memorandum), LPA (Limited Partnership Agreement) or prospectus/SAI for registered funds, subscription docs, side letters (custom fee/liquidity terms), DDQs and ODD reports.

Liquidity spectrum

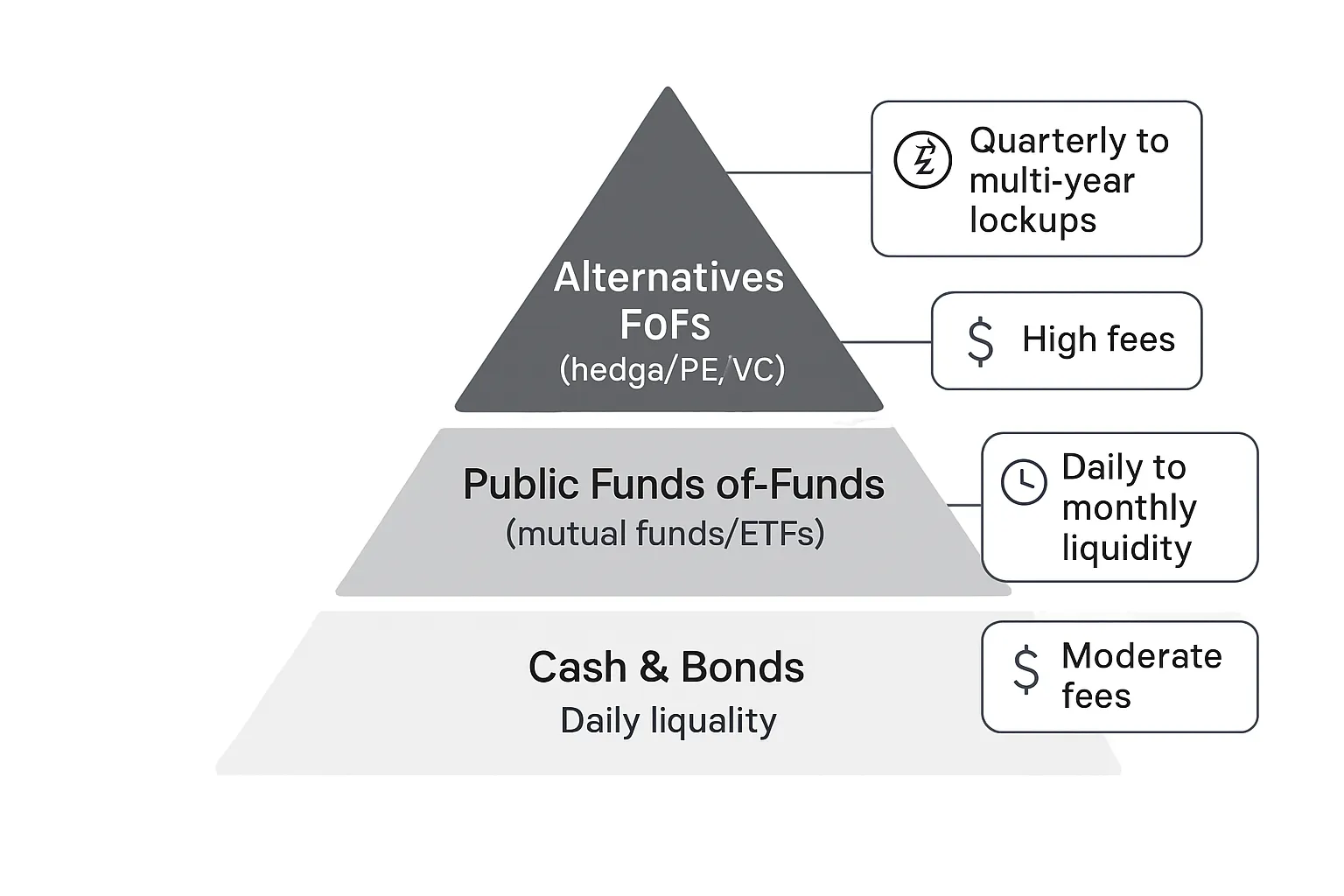

Daily/T+1: mutual fund‑of‑funds and many ETF‑of‑ETFs (retail “all‑in‑one” portfolios).

Monthly/quarterly with notice and potential gates: hedge fund FoFs.

Multi‑year lockups with capital calls and distributions: private equity/VC/real estate FoFs (capital returned via exits over a fund’s life).

Tax and reporting basics

Registered FoFs (’40 Act mutual funds/ETFs): 1099 reporting; look‑through AFFE disclosure; typically daily NAV and standardized performance reporting.

Private FoFs (partnerships): K‑1s (including “K‑1 chains” from underlying partnerships), possible multi‑state filings; timing can run late in the season; consider estimated payments and extensions.

Hedging and derivatives may introduce special tax lots/straddles - confirm with your CPA.

Jargon decoder

AFFE (Acquired Fund Fees & Expenses): the embedded fees of underlying funds shown in a registered FoF’s expense ratio.

Hurdle: the minimum return a manager must exceed before taking performance fees.

High‑water mark: performance fees only accrue on gains above the prior peak NAV.

Vintage year dispersion: outcome differences across private FoFs based on the year capital is deployed (market entry timing matters).

Look‑through exposure: analyzing sector/strategy/issuer overlap across underlying funds to understand real concentration.

“Highest fund returns” claims: marketing that highlights best‑case or vintage‑specific results - always evaluate net, all‑in returns vs. appropriate benchmarks.

When a fund of funds makes sense (and when it doesn’t)

Best‑fit scenarios

One‑ticket diversification across managers, strategies, and geographies.

Access to closed or high‑minimum managers you can’t reach solo.

Professional monitoring, rebalancing, and operational due diligence.

Smoother capital deployment pacing vs. hunting for single deals.

Situations to avoid

If you demand ultralow fees and won’t tolerate layered costs.

If you want granular control over every single position and timing.

If you need immediate, penalty‑free liquidity (many FoFs use gates, notice periods, or multi‑year locks).

If your allocation is too small to justify added complexity.

Who it’s for

HENRYs and affluent retail who value curation and time savings.

Time‑poor professionals who want a “fund to invest in” that does the heavy lifting.

Family offices seeking manager breadth without building a full in‑house team.

Workplace plan participants defaulting to all‑in‑one portfolios (e.g., target‑date funds).

SEO angle

How to choose a fund to invest in when faced with many FoFs:

Match objective (growth, income, alt access) → then match liquidity (daily vs. quarterly vs. multi‑year).

Compare all‑in fees (AFFE included) and look‑through exposure to avoid hidden overlap.

Verify manager roster, governance, auditor/admin, and redemption mechanics.

What “fund the fund” commitments mean:

In private FoFs, you commit capital and respond to capital calls over years; expect a J‑curve and staged distributions.

Warning signs behind “highest fund returns” claims:

Are returns net of all fees and carried interest?

Is performance cherry‑picked by vintage, leverage, or survivorship?

Is benchmark selection fair and comparable?

Investor profile → Best structure

Profile | Goals | Liquidity Need | Suitable Structure | Why |

|---|---|---|---|---|

New investor or plan participant | Autopilot, age‑appropriate mix | Daily | Target‑date fund‑of‑funds | One‑ticket diversification with glidepath; simple, low‑touch. |

HENRY/time‑poor professional | Broad exposure with oversight | Daily/Monthly | Discretionary multi‑asset FoF (registered) | Professional allocation and monitoring; minimizes decision fatigue. |

Accredited seeking alternatives | Access to PE/VC/hedge funds | Multi‑year lock | PE/VC FoF (closed‑end LP) or hedge FoF | Aggregates commitments, opens doors to closed/high‑min managers. |

Yield‑first income seeker | Consistent cash flow, risk‑tiering | Daily/Monthly | Income‑focused multi‑asset FoF or ETF‑of‑ETFs | Diversifies yield sources; manages duration/credit mix. |

DIY allocator | Low cost, full control | Daily | ETF‑of‑ETFs core portfolio | Keeps fees minimal; transparent, easy to rebalance yourself. |

Family office | Manager breadth + governance | Monthly/Quarterly | Customized FoF with SMA sleeves | Centralized oversight; tailored mandates and risk controls. |

Tax‑sensitive high earner | Maximize after‑tax income | Daily/Monthly | Municipal bond FoF or muni ETF‑of‑ETFs | Seeks tax‑advantaged yield with diversified muni exposure. |

Short‑term cash manager | Capital preservation + liquidity | Daily | Ultra‑short bond ETF‑of‑ETFs or cash FoF | Seeks modest yield with tight duration and T+1 access. |

On‑chain DeFi native | Programmatic yield with tiers | On‑demand (protocol terms) | Risk‑tiered “pool‑of‑pools” (e.g., Zemyth FundNest) | Transparent tiers, curated liquidity strategies, composable access. |

Pro tip: If you’re deciding whether a “fund of money” suits you, stack‑rank priorities - access, convenience, and curation vs. fee minimization and control. If access and time savings dominate, a “fund the fund” approach can be the right trade. If fees and precision matter most, build your own ETF‑of‑ETFs core and keep FoFs for true hard‑to‑reach strategies.

The real cost: fee stacking, taxes, and return drag

Typical fee layers

FoF fees: management (e.g., 0.5%–1.0%+), sometimes performance (e.g., 5%–10% carry in private FoFs).

Underlying fund fees: mutual funds/ETFs (0.02%–0.50%+), hedge funds (1%–2% + 10%–20% performance), PE/VC/real estate (typically “2 and 20”).

Platform/admin costs: custody, audit, administration, legal, and trading costs. In a “fund the fund” setup, expect fees to stack at both layers.

Registered vs private formats

Registered retail FoFs (e.g., target‑date funds, ETF‑of‑ETFs) often disclose AFFE and deliver low all‑in expense ratios due to institutional share classes and internal fee netting.

Private FoFs (hedge/PE/VC) frequently exceed 2% management plus multi‑layer performance fees (“double carry”), with additional operating/admin costs. High fund complexity can be worth it for access, but you must model “all‑in” drag.

Taxes & turnover

Registered FoFs: 1099 reporting; distributions and capital gains can be triggered by underlying turnover - mind year‑end distributions.

Private FoFs: K‑1s with “K‑1 chains,” potential multi‑state filings, and later delivery timelines; look‑through to underlying realization schedules and capital calls.

Tax alpha levers: loss harvesting (registered accounts), holding‑period management, and vehicle selection (ETF‑of‑ETFs often more tax‑efficient than mutual fund FoFs).

Why the math matters

Compounding magnifies small fee differences into large ending‑wealth gaps.

Always model 10–20+ years “net of fees” vs. a low‑cost benchmark before choosing a fund to invest in - even when the pitch highlights “highest fund returns.”

For a “fund of money” sleeve, keep core beta cheap and reserve fee‑heavy FoFs for strategies you can’t otherwise access.

"For example, did you know that over 20 years, a 1.00% annual fee reduces the value of a $100,000 portfolio by nearly $30,000 as compared to a 0.25% annual fee?" - Source

Example fee stack by vehicle

Vehicle | Mgmt Fee | AFFE/Underlying | Perf Fee | Typical All‑in | Liquidity | Notes |

|---|---|---|---|---|---|---|

Target‑date FoF (retail) | ~0.00%–0.15% | ~0.05%–0.15% | None | ~0.08%–0.25% | Daily | Uses institutional share classes; AFFE disclosed; automatic glidepath. |

ETF‑of‑ETFs | ~0.05%–0.20% | ~0.02%–0.15% | None | ~0.10%–0.25% | Daily | Tax‑efficient wrappers; low turnover; transparent holdings. |

Hedge FoF | ~0.5%–1.0% | Underlying 1%–2% + 10%–20% | FoF 0%–10% (varies) | 2%–4%+ (ex‑carry); higher net with carry | Monthly/Quarterly (gates/notice) | Double layer of fees; diligence and access are the value. |

PE FoF | ~0.5%–1.5% | Underlying ~2% + 20% carry | FoF 5%–10% carry (varies) | 2%+ mgmt plus double carry | Multi‑year lockups; distributions | Vintage timing drives outcomes; capital calls and J‑curve behavior. |

Pro tip: If fees are your top constraint, keep your core beta in low‑cost vehicles, and only “fund the fund” where manager access is truly scarce or operational alpha outweighs the drag.

Diversification realities and risk controls

What diversification you actually get

Dimensions that matter: manager, strategy, geography, sector, and (for private markets) vintage year. A well‑built “fund to invest in” spreads risk across all of these.

Hidden correlation in stress: strategies that look uncorrelated in calm markets can sync up in selloffs (crowding, de‑risking, liquidity spirals). Expect correlations to rise when beta bites.

Look‑through reality: two different managers can own the same names or factor tilts. Always check exposure overlap, factor bets (value/growth, duration, credit beta), and liquidity buckets.

Liquidity tiering: daily‑liquid retail FoFs vs. monthly hedge FoFs vs. multi‑year PE/VC FoFs. Your “fund of money” allocation should match time horizon and cash‑flow needs.

Key risks

Overlap risk: duplicated holdings/tilts reduce true diversification and may amplify drawdowns.

Capacity constraints: “high fund” capacity gets saturated; alpha decays as AUM grows.

Style drift: managers chase what’s working; your mandate quietly changes under the hood.

J‑curve (PE/VC): early negative returns as fees/costs hit before exits; pacing is essential.

Liquidity mismatch: offering more liquidity than underlying assets (gates, suspensions).

Valuation lag: stale marks in private strategies can mask real‑time risk.

Fee stack drag: layered fees erode the compounding you’re chasing - verify all‑in costs.

Due diligence checklist

Team & track record: who drives the process; persistence across regimes; key‑person risks.

Sourcing edge: access to closed/high‑minimum managers; co‑invest capability; pipeline repeatability.

Risk systems: position limits, factor monitoring, stress tests, liquidity ladders, scenario analysis.

Fees & netting: management/carry at both layers, offsets, hurdle/high‑water mark, expense caps, clawbacks.

Governance: independent board/IC, conflict policies, MFN/side‑letter parity, related‑party checks.

Audits & service providers: Big‑4/credible auditor, independent admin, custodian, reputable counsel.

Transparency & reporting SLAs: look‑through holdings/exposures, AFFE disclosure, capital‑call forecasts, quarterly letters, audited financials on time.

Documents: PPM/LPA, ADV (if applicable), ODD/DDQ, valuation policy, liquidity and gating terms.

Marketing sanity check: be skeptical of “highest fund returns” claims - insist on net, all‑in results versus fair benchmarks.

Practical guardrails

Position sizing rules: cap any single FoF at X% of portfolio; cap any single underlying manager exposure (look‑through) at Y%.

Pacing plan: for PE/VC, ladder commitments by vintage/sector; maintain dry powder to meet capital calls without forced selling.

Rebalancing policy: set tolerance bands (e.g., ±20% of target weight) with scheduled quarterly reviews; use cash flows to minimize turnover and taxes.

Stop‑adding criteria: pause allocations if net fees exceed target, drawdown correlation > threshold, style drift is detected, or reporting SLAs slip.

Liquidity ladder: bucket by daily/monthly/quarterly/locked; pair long‑lock FoFs with liquid sleeves for redemptions and opportunistic buys.

Cash management: park idle capital in a low‑risk sleeve while you “fund the fund” (e.g., tiered liquidity pools like Zemyth’s FundNest) to reduce cash drag.

Fund of funds vs alternatives

Co‑GP and co‑investments

Pros: lower fee drag (often reduced/zero carry), greater control and visibility, potential for enhanced upside if you help create value.

Cons: tough access (invite‑only), meaningful workload and governance obligations, higher concentration risk, lumpy deal flow.

When to prefer over a “fund to invest in”: you’ve got access, expertise, and the appetite to underwrite single‑deal risk rather than funding the fund.

ETF‑of‑ETFs / target‑date funds

Pros: extreme simplicity, daily liquidity, low all‑in cost with AFFE netting; autopilot rebalancing and glidepaths for retirement timelines.

Cons: limited alternatives exposure, little customization, market‑beta heavy.

Ideal “fund of money” for hands‑off investors who want one ticket, clear liquidity, and low fees.

SMAs / model portfolios

Pros: tax control (loss harvesting, asset location), customization of mandates, manager replacement without capital gains (for SMAs holding individual securities).

Cons: higher minimums, requires oversight and an advisor/OCIO process, can be less turnkey than a single “fund the fund” solution.

Direct‑fund selection

Pros: fee savings (no FoF layer), precise tilts, bespoke pacing.

Cons: diligence burden, operational overhead, counterparty/selection risk, potential overlap and style drift; can chase “highest fund returns” and miss all‑in costs.

Use when you want control and can underwrite managers - and accept the admin lift.

Structure showdown

Structure | Fees | Access | Liquidity | Control | Admin Complexity | Typical Minimums |

|---|---|---|---|---|---|---|

Fund of Funds (FoF) | Layered: FoF 0.5%–1.0% mgmt; may add 5%–10% carry; underlying fees/carry apply | Broad manager roster; can open doors to closed/high‑min managers | Daily (retail FoFs) to monthly/quarterly; PE/VC FoFs are multi‑year lockups | Low–Medium (policy‑driven allocation) | Low (registered) to Medium/High (private LP with K‑1s) | Retail FoF: ~$1k–$5k; Private FoF: ~$250k–$5M |

Co‑investments / Co‑GP | Reduced fees; often no management fee and minimal/zero carry on co‑invests; GP economics if Co‑GP | Hard access; relationship‑driven, limited capacity | Illiquid until exit; deal‑by‑deal timelines | High (deal‑level underwriting and governance) | High (documents, monitoring, capital calls) | Typically $250k–$5M+ per deal |

ETF‑of‑ETFs / Target‑date | Low: ~0.08%–0.25% all‑in with AFFE | Broad public‑market exposure; limited alts | Daily | Low (rules‑based rebalancing) | Very Low (1099, one ticker) | As low as $100–$1,000 (ETF: 1 share) |

SMA / Model Portfolio | Advisory ~0.25%–1.0% plus underlying ETF costs; no FoF layer | Flexible; customize exposures, add niche sleeves | Daily (public markets) | Medium–High (mandates, tax, overlays) | Medium–High (rebalancing, tax lots, IPS) | ~$250k–$1M+ typical |

Direct Funds (DIY selection) | Underlying fund fees only; no FoF layer | Depends on relationships; retail funds easy, hedge/PE/VC hard | Varies: daily for mutual funds/ETFs; term for private funds | High (you pick and size each manager) | Medium–High (subscriptions, DDQs, K‑1s) | Retail: low; Hedge/PE/VC: $100k–$5M |

Bottom line: If you want a single “fund to invest in” that handles manager selection, pacing, and monitoring, a FoF is purpose‑built. If fee minimization and control are paramount, build a low‑cost ETF‑of‑ETFs core, then selectively add co‑invests or direct managers where you have genuine edge and access.

How to evaluate “highest fund returns” claims

"Past performance does not guarantee future results." - Source

Net vs gross (and what’s included)

Demand net-of-all-fees, net-of-carry, and cash-drag–inclusive returns at the “fund to invest in” level, not just underlying managers.

Confirm whether results include:

Acquired Fund Fees & Expenses (AFFE) for registered FoFs.

Admin, audit, custody, finance costs.

Subscription/redemption fees, and any “fund the fund” platform costs.

Ask for net IRR, net TVPI/DPI (private funds) and time-weighted net returns (public FoFs), plus since-inception and by calendar year.

Apples-to-apples

Match vintage year, strategy, leverage, and liquidity. A 2017 PE FoF is not directly comparable to a 2021 VC FoF.

Use appropriate benchmarks:

Public FoFs: category indices plus a blended policy benchmark that mirrors the FoF’s target mix.

Private FoFs: peer quartiles by vintage; public-market equivalent (PME) for context.

Inspect dispersion: “highest fund returns” may mask wide underperformers inside the “fund of money.”

Risk-adjusted context

Sharpe/Sortino ratios and maximum drawdown alongside CAGR.

Hit ratio and payoff ratio for hedge FoFs; loss rates and MOIC dispersion for PE/VC FoFs.

Capital at risk and liquidity profile: gates, notice periods, and lockups change the real risk/return trade.

Stress and factor lenses: beta, rates duration, credit beta, style tilts (value/growth), and correlations during shocks.

Biases to watch

Backfill and survivorship: databases that only include managers after good years inflate “high fund” claims.

Smoothed marks: private funds with infrequent pricing can understate volatility; ask for write-down cadence and valuation policy.

Cherry-picked periods: insist on full since-inception histories and standardized time frames (1/3/5/10 years).

Model vs. live: simulated track records demand live-AUM context, tradeability, and implementation slippage.

Red flags

Capacity claims that ignore liquidity/alpha decay; if assets scale, can the edge persist?

Inconsistent audits, frequent valuation policy changes, or late financials/K‑1s.

One-line 3‑year wonders with no attribution, exposure, or risk reporting.

“Top decile” marketing without net-of-fee evidence, peer set definitions, and independent data sources.

Quick reality check for investors:

If a “fund to invest in” advertises the “highest fund returns,” verify net, all-in results after stacked fees and taxes, confirm comparable vintage/strategy, and test drawdowns vs. your own tolerance. If you can’t reconcile the numbers with risk and liquidity, pass.

Build your own fund of funds: step‑by‑step

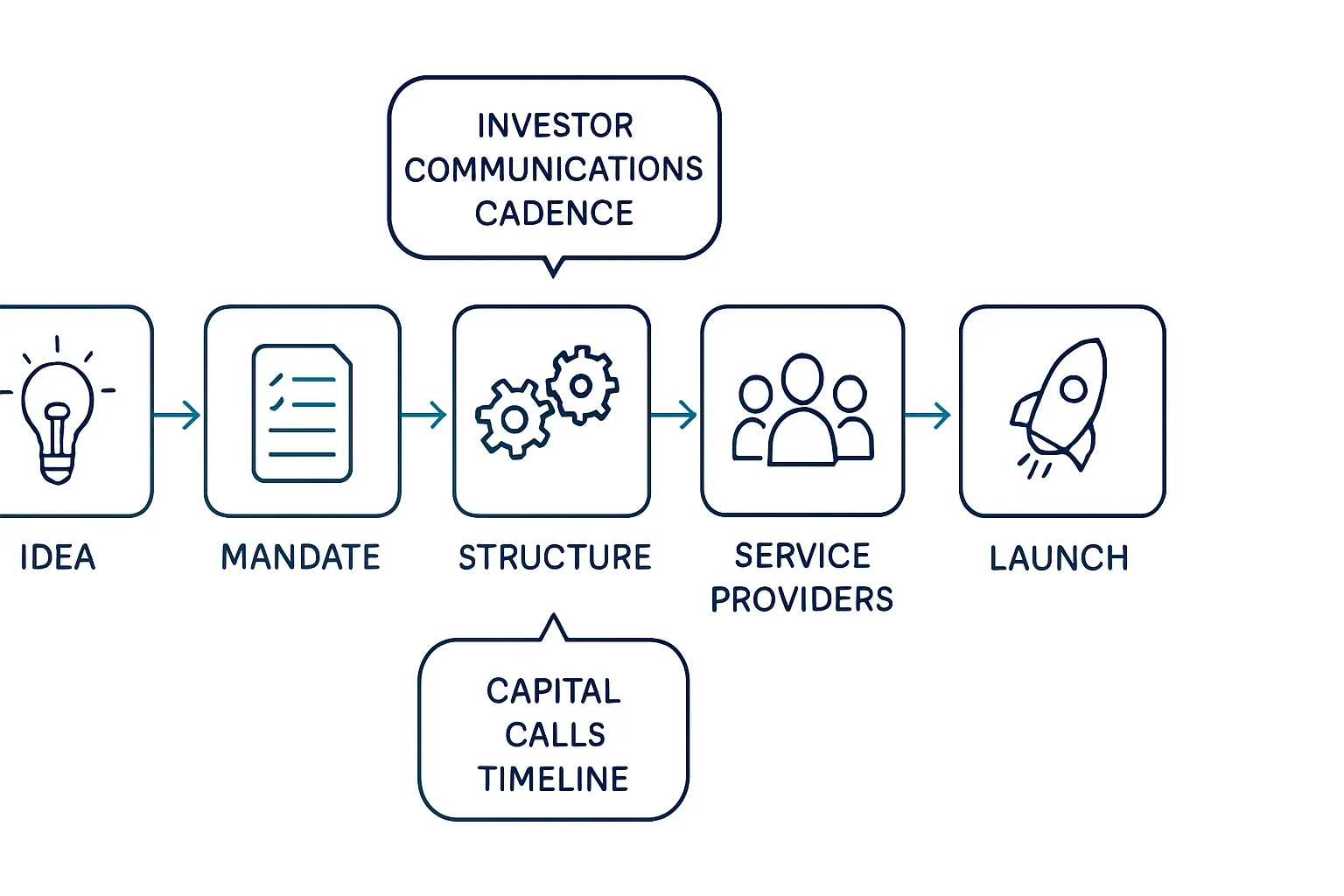

Design the mandate

Objective: growth, income, or balanced; define target returns and acceptable drawdown.

Eligible strategies: mutual funds/ETFs, hedge funds, PE/VC/real estate funds; specify geographic/sector limits and max leverage.

Risk limits: manager/strategy caps, factor tilts, max correlation targets, and look‑through exposure thresholds.

Liquidity terms: daily/monthly/quarterly or closed‑end; align with underlying assets.

Pacing plan: how you’ll fund the fund - commitment schedule, rebalancing cadence, and cash management to reduce drag.

Reporting cadence: quarterly letters, exposure reports, and audited annuals; set SLAs for timeliness and transparency.

Structure & compliance

Wrappers:

Retail: ’40 Act mutual fund or ETF; UCITS in the EU - lowest friction for broad distribution.

Private: Reg D 506(b)/(c) LP/LLC, or AIF structures - suitable for accredited/qualified purchasers.

Filings: Form D, Blue Sky/state notices, AIFMD (if applicable), and ongoing compliance calendar.

Service providers: independent administrator, auditor, custodian/prime, legal counsel, tax advisor; document segregation of duties and escalation paths.

Fee policy

Align with value delivered:

Lower base fee + performance fee only over a hurdle with a high‑water mark (avoid charging for beta).

Retail approach: all‑in expense caps with AFFE transparency.

Offsets/netting: rebate any placement, monitoring, or sub‑advisor fees; prevent double‑dip “fund the fund” economics.

Share classes: define breakpoints, founder class, and lockup‑based fee discounts.

Ops stack

Investor lifecycle: subscription docs, e‑sign, KYC/AML, suitability checks, side‑letter workflow.

Money movement: bank/custody setup, approved signers, capital call tooling, and disbursement controls.

Data/NAV: admin-led NAV production, pricing sources, valuation policy, and audit trail; quarterly closes and annual audit calendar.

Portal & comms: investor portal for statements/K‑1s/1099s, secure messaging, and FAQs; publish a reporting schedule.

Risk & compliance: exposure look‑through, factor and liquidity dashboards, breach alerts, and incident playbooks.

Launch checklist

Seed capital secured (align economics with early backers).

Pipeline of target managers with term sheets/allocations and a diversification map.

Side‑letter and MFN policy documented; no preferential terms that harm the base class.

IR playbook: who you target (retail vs accredited), RIA channels, and education content that sets expectations on fees/liquidity.

Risk dashboard live: concentration, correlation, drawdown scenarios, cash ladder.

Day‑1 admin readiness: NAV timetable, audit engagement letter, tax calendar, and communication SLAs.

Pro tip: While you’re building, park idle capital in a transparent, risk‑tiered yield sleeve (e.g., Zemyth FundNest) so your “fund of money” isn’t sitting at 0% awaiting allocations. Explore Zemyth → https://zemyth.app

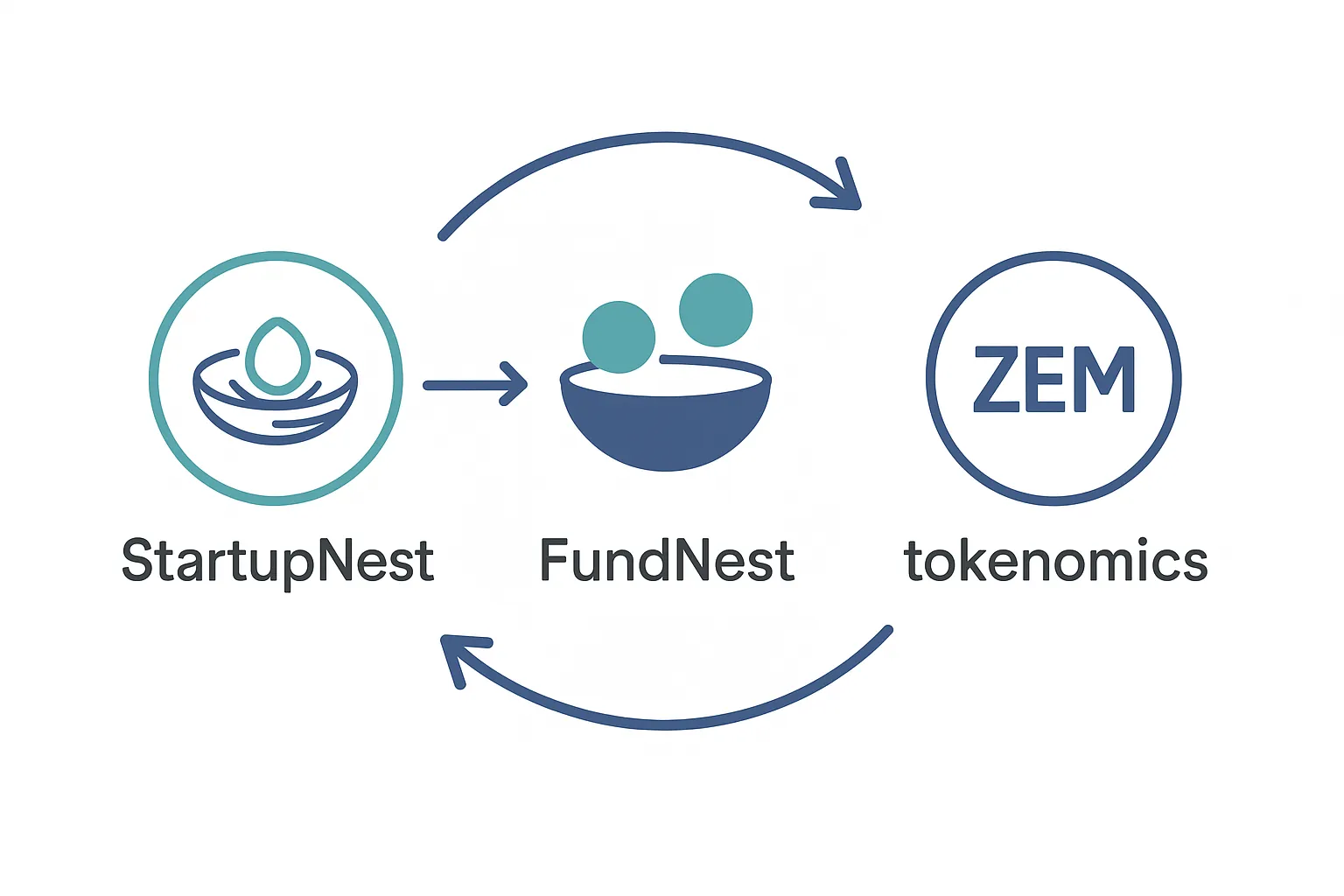

Where DeFi meets fund‑of‑funds: Zemyth’s FundNest as a yield layer

The idea

Park idle capital in curated, risk‑tiered liquidity pools on Solana - think of FundNest as a transparent, on‑chain “fund‑of‑liquidity.”

While your capital waits between capital calls (your “fund the fund” pacing), it earns daily‑accruing yield instead of sitting at 0%. This is the practical “fund of money” layer your portfolio was missing.

How it maps to FoF needs

Cash management between capital calls: allocate treasury or LP commitments into Zero→High risk tiers based on your mandate.

Daily accrual and on‑demand visibility: look‑through transparency to underlying pools and positions, with on‑chain proofs.

Tiered choices:

Zero Risk (live): stablecoin pairs (USDT/USDC), built to minimize IL and prioritize capital stability.

Low/Medium/High Risk: step up the curve for higher target APYs as your tolerance allows.

Operational fit: keep a dependable base yield while you diligence managers, smooth deployment, and reduce cash drag.

Fees and alignment

Clear fee policy: AUM and performance fees are explicit; no hidden layers.

Optional ZEM boosts: lock ZEM to amplify FundNest yields (up to 2.5× boost on supported tiers).

Revenue‑linked emissions: ZEM incentives are tied to real platform revenue to avoid over‑incentivization and dilution - aligning growth with usage rather than hype.

Who it helps

Angels and DAOs crafting pacing plans for “fund to invest in” programs.

Founders managing runway and escrow between milestone unlocks in StartupNest.

LPs who want a dependable base yield while scouting “high fund” opportunities without sacrificing transparency.

Try it

Start conservative: allocate to the Zero‑Risk stablecoin pair to get comfortable with mechanics and daily accrual.

Scale by tier: ladder allocations across Low/Medium/High tiers as your policy and risk budget allow.

Integrate with your FoF: treat FundNest as the cash sleeve in your multi‑manager stack - reduce drag, keep optionality, and maintain look‑through control.

See live tiers and docs → https://zemyth.app

Conclusion: Is a fund of funds right for you?

Quick recap

Fund-of-funds (FoFs) trade higher fees and some control for access, diversification, and professional oversight. They’re a practical “fund to invest in” for investors who want curation over DIY.

Decision checklist

Do you need one-ticket diversification and institutional access you can’t get alone?

Are you okay with layered fees if net results and time savings justify it?

What liquidity do you require - daily, monthly, or multi-year lockups?

Can you evaluate managers yourself, or will your FoF credibly “fund the fund” with real due diligence?

Are you filtering out marketing noise like “highest fund returns” and focusing on net-of-fee outcomes?

Action plan

If yes: shortlist the right fund to invest in (retail or private), verify net-of-all-fees performance vs. proper benchmarks, and start small with clear rebalancing rules.

If not: build a low-cost ETF-of-ETFs core or select direct funds where you have conviction; add a FoF sleeve later for truly hard-to-access strategies.

Try Zemyth

Put idle cash to work while you evaluate managers. Zemyth’s FundNest offers transparent, risk‑tiered yield with on‑chain reporting and optional ZEM boosts - an efficient “fund of money” layer between capital calls.

Start here: https://zemyth.app

Ready to get your capital compounding? Explore Zemyth’s FundNest now → https://zemyth.app