Fund meaning, decoded: simple definition and why it matters

If you’ve ever wondered what “fund” really means, here’s the straight talk: a fund is a simple, powerful way to pool money with others and put it to work toward a clear goal. Understanding fund meaning is the foundation of smarter fund investment choices - because structure, costs, and risk control drive real-world outcomes more than hype.

"Over the 10-year period ending 2023, 78.68% of U.S. large-cap active equity funds underperformed the S&P 500." - Source

This is why design matters - fees, mandates, and the way a fund manages risk and tracks a benchmark can make or break your long-term results.

What is a fund (in plain English)

A fund is a pooled pot of money collected from many investors to pursue a specific objective - growth, income, capital preservation, or a mix.

It’s run to a mandate: rules for what the fund can and can’t buy, how it measures success (its benchmark), and how it controls fund risk (position limits, diversification, liquidity rules).

You buy shares/units of the fund. Your fund returns rise or fall with the value of the underlying holdings and how well the strategy executes.

At Zemyth, we keep this choice clear: Fund Nest for stable, low-volatility daily growth; Startup Nest for high-risk, high-upside exposure. Different mandates, different risk profiles - your path, your call.

Everyday and investing examples

Everyday “funds”:

Emergency fund: your personal cash buffer.

School endowment: invests to fund scholarships and operations.

Insurance reserve: set aside to pay claims and keep the system safe.

Investing “funds”:

Mutual funds and ETFs/index funds: diversified baskets of stocks/bonds that track or beat a benchmark.

Money market funds (aka money funds): target stability and liquidity with short-term debt.

Bond funds and equity funds: focus on fixed income or stocks; some are broad market, others sector or theme-based.

Hedge funds: flexible, often higher-fee strategies using derivatives, leverage, and long/short positions.

Crypto funds: exposure to digital assets or crypto-native strategies.

Fund of funds: invests in other funds to add another layer of diversification (and potentially, fees).

Why funds exist and why you should care

Diversification: one purchase, many securities. This lowers single-asset blowups and smooths the ride.

Access: tap markets and strategies (thousands of bonds, broad global equities, private/crypto exposure) you likely can’t build on your own.

Professional management and clear reporting:

NAV tells you what your slice is worth.

Holdings show what you own.

Fees and risk metrics reveal the true cost and volatility profile.

Bottom line: funds are a core building block. Whether you want stable income or outsized upside, there’s a fund structure for that.

Fast glossary for first-timers (investment foundation)

NAV (Net Asset Value): The per-share value of the fund’s assets minus liabilities. For open-end funds, it’s the price you transact at after markets close.

Benchmark: The yardstick a fund aims to track or beat (e.g., S&P 500 for large-cap U.S. stocks).

Expense ratio: Annual fee charged by the fund as a percentage of assets. Lower costs often mean more of the fund returns stay in your pocket.

Tracking difference: The performance gap between a passive fund and its benchmark. Smaller is better.

Drawdown: The peak-to-trough decline during a period. Shows how much a strategy can drop before it recovers.

Standard deviation: A statistic showing how much returns vary. Higher = more volatile.

Sharpe ratio: Risk-adjusted return metric. Higher means more return per unit of volatility.

Outcome

You now have a clear, practical fund meaning: a professionally managed pool with a defined objective and risk rules.

You understand why funds power long-term wealth: diversification, access, and disciplined reporting.

You’re ready to evaluate fund risk, costs, and fit - and choose the path that matches your goals, whether that’s steady daily growth (Fund Nest) or bold upside (Startup Nest).

How funds work: pooling, managers, and active vs. passive

The mechanics

You buy fund shares; the fund owns the underlying assets. You participate in fund returns through the rise/fall of the fund’s share price and any distributions.

Your share price reflects the total market value of the portfolio (NAV), minus liabilities and fees. For open-end funds, NAV is struck once after markets close; for ETFs, prices trade intraday around NAV.

"A mutual fund is a company that pools money from many investors and invests the money in securities." - Source

Who does what

Portfolio manager(s) and analysts: research markets, select securities, size positions, and manage risk to the mandate.

Custodian and administrator: safeguard assets, settle trades, calculate NAV, and maintain shareholder records.

Auditor and board/trustees: independent oversight on financial statements, valuation, fees, and adherence to the prospectus.

At Zemyth, we keep roles clean and incentives aligned so you can focus on the strategy you choose - stable daily growth (Fund Nest) or high-upside exposure (Startup Nest).

Active vs. passive management

Active: portfolio team picks securities to beat a benchmark. Expect higher fees and a wider dispersion of outcomes - some managers outperform; many don’t, especially after costs.

Passive (index funds/ETFs): track a benchmark at low cost. The key quality metric is tracking difference/error - the gap between fund returns and the index after fees and frictions.

Trading and liquidity basics

Open-end mutual funds: priced once daily at NAV; your order executes after the market close at that day’s NAV.

ETFs: trade intraday on exchanges near NAV. The creation/redemption mechanism (authorized participants delivering/balancing baskets) helps keep ETF prices aligned with underlying value, enhancing liquidity and tax efficiency.

Key takeaway

Structure and mandate decide how fund risk and fund returns show up in your results. Know what you own (active vs. passive, open-end vs. ETF), how it’s priced (NAV vs. intraday market), and what you pay (expense ratio, spreads) before you invest.

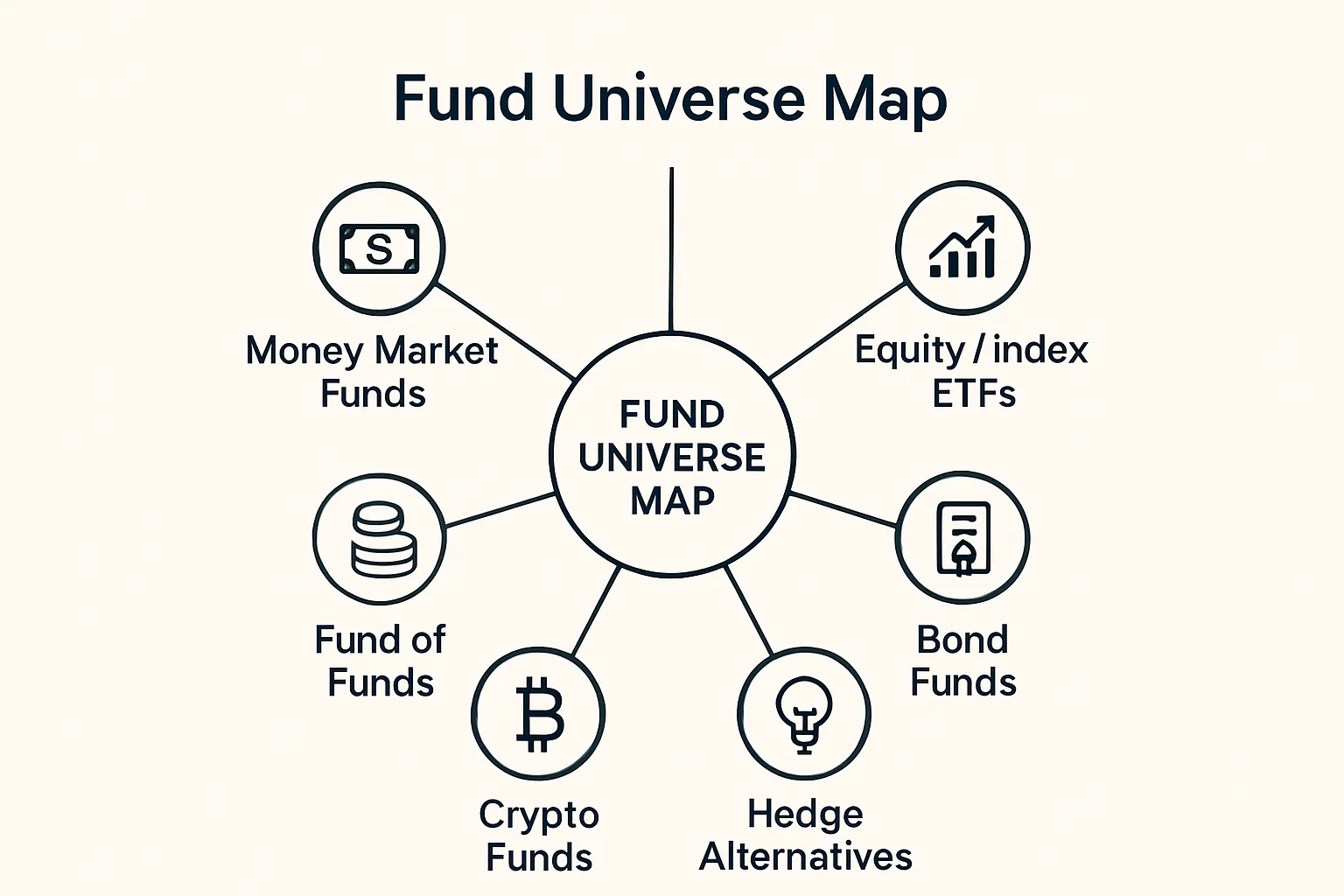

Types of funds: money funds, equity/index/ETF, bond, hedge/alternatives, crypto funds, and fund of funds

"Global ETF/ETP assets reached $10.99 trillion in November 2023." - Source

Money market funds (money funds)

Objective: capital preservation + current income, using short-term, high-quality instruments (Treasury bills, commercial paper, repos).

Typical use: cash management, “parking” funds, low-volatility core for liquidity needs.

What to watch: yield vs. safety, portfolio credit quality, weighted average maturity/ life (WAM/WAL), and expense ratio.

Equity funds and index funds/ETFs

Objective: long-term growth via stocks; can be broad market (e.g., S&P 500), factor/style (value, growth, small-cap), sector, or thematic.

Passive index funds/ETFs: track a benchmark at low cost; key metric is tracking difference/error after fees and frictions.

Active equity funds: aim to beat a benchmark through security selection and risk tilts; fees and manager skill (and consistency) are critical.

Bond funds (fixed income)

Objective: income + stability; risk/return driven by duration (interest-rate sensitivity) and credit quality (Treasury vs. investment grade vs. high yield/emerging markets).

Flavors: core aggregate, short/ultra-short, investment grade corporate, municipals, high yield, EM debt, multisector.

What to watch: duration, credit exposure, yield-to-maturity vs. fee, and liquidity of underlying bonds.

Hedge funds and alternative strategies

Objective: absolute return, hedging, or specialized exposures (long/short equity, macro, relative value, event-driven, managed futures).

Audience: typically sophisticated or accredited investors; higher and performance-based fees, use of leverage/derivatives, lockups/gates.

Role: diversify equity/bond risk, seek uncorrelated returns, dampen drawdowns - or target niche opportunities.

Crypto funds (and digital-asset index/staking strategies)

Objective: capture crypto beta (e.g., BTC/ETH) or earn yield via on-chain mechanisms (staking, liquidity provision) or basis trades.

Unique risks: smart contract risk, custody, regulatory shifts, exchange/issuer concentration, protocol upgrades, market structure.

Access spectrum: spot ETFs/ETNs, index baskets, actively managed crypto funds, yield/staking strategies.

Fund of funds (FoFs)

Objective: one-ticket diversification across multiple underlying funds or managers (mutual/hedge/PE/VC/crypto); access and curation at the cost of an extra fee layer.

Pros: manager diversification, due diligence, simplified reporting.

Cons: fee-on-fee structure, potential overlap, slower liquidity.

Fund types at a glance

Fund type | What it invests in | Primary goal | Liquidity (T+?) | Typical fee range | Typical risk level | Who it’s for |

|---|---|---|---|---|---|---|

Money market funds | T-bills, repos, high-grade commercial paper | Capital preservation + liquidity | T+0–T+1 (orders at NAV) | 0.05%–0.30% | Very low | Cash management, emergency buffers |

Equity index funds/ETFs | Broad market or factor/sector stock indexes | Low-cost long-term growth | Intraday trading; settle T+1 | 0.02%–0.15% | Medium to high (equity beta) | Core market exposure, fee-sensitive investors |

Active equity funds | Stock selection vs. a benchmark | Outperformance (alpha) | T+1 (mutual funds at NAV) | 0.60%–1.50%+ | Medium to high | Hands-off investors seeking potential alpha |

Bond funds (IG/core) | Treasuries, agencies, IG corporates, MBS | Income + stability | T+1–T+2 | 0.05%–0.50% | Low to medium (duration risk) | Income-focused and balanced portfolios |

Bond funds (HY/EM) | High yield corporates, EM sovereign/corporate | Higher income with more credit risk | T+1–T+2 | 0.40%–1.00% | Medium to high (credit risk) | Yield seekers comfortable with drawdowns |

Hedge/alternatives | Long/short, macro, relative value, event, managed futures | Absolute return/diversification | Quarterly/annual; gates may apply | 1%–2% + 10%–20% perf | Strategy-dependent; often moderate drawdowns vs. equities | Sophisticated allocators seeking uncorrelated returns |

Crypto funds | BTC/ETH, diversified digital assets, staking/yield | Crypto beta or yield | Daily/intraday for ETFs; T+1 for funds | 0.50%–2.00% (+ custody/spread) | High/very high | Crypto-curious with high risk tolerance |

Fund of funds (FoFs) | Portfolios of underlying funds/managers | Diversification + access | Monthly to quarterly; varies | 0.50%–1.00% + underlying fees | Mixed - depends on underlying funds | One-ticket diversification, institutional-style access |

How to pick among types

Start with your goal: income vs. growth vs. preservation.

Time horizon and liquidity: money funds for near-term cash; equity/bond index funds for multi-year compounding; alts for patient, diversified allocations.

Risk tolerance: match volatility and drawdown history to your comfort level.

Fee sensitivity: prefer index ETFs for cost efficiency; pay up only when a manager’s edge and process are clear.

Platform fit: at Zemyth, choose Fund Nest for stable daily growth (cash-like consistency) or Startup Nest for bold, high-upside exposure - build your mix to fit your path.

Where fund returns come from (and what can drag them down)

The return engines

Interest (bond and money funds): coupons and money fund 7-day yields drive most of the return in fixed income and cash-like strategies.

Dividends (equity funds): cash distributions from companies add a steady contribution to total return.

Capital gains: price appreciation of holdings over time and realized gains distributions.

Alpha vs. beta: manager skill attempting to add excess return (alpha) on top of broad market exposure (beta).

For crypto funds: asset price beta (e.g., BTC/ETH), potential yield from staking/lending where applicable, plus basis/arb in some products.

Frictions and drags

Expense ratio and performance fees (if any) reduce investor take-home returns.

Trading costs and taxes: higher turnover can increase spreads, market impact, and distributions you may owe tax on.

Tracking difference for index funds; slippage/liquidity costs in alternatives/crypto; funding costs for derivatives.

Practical read-through

Distributions vs. NAV moves: when a fund pays a distribution, NAV typically drops by the same amount on the ex-date - total return (price + distributions) is what matters.

“High yield” ≠ “low risk”: bigger yields often come with more duration/credit or strategy risk. Know the trade-off.

Past performance ≠ future results: design (mandate, costs, liquidity) and fund risk control shape the path of returns.

Return sources by fund type

Fund type | Primary return sources | Secondary sources | Biggest drags | Typical time horizon |

|---|---|---|---|---|

Money fund | Short-term interest income (7-day yield) from T-bills, repos, and high-quality paper | Small repo spreads; fee waivers in certain markets | Expense ratio; rare credit/liquidity stress; yield resets lower if policy rates fall | Days to months (cash parking/liquidity) |

Bond fund | Coupons (income) + rate/curve dynamics (roll-down) + price gains when yields fall | Spread tightening; sector/issuer selection | Duration losses when rates rise; credit downgrades/defaults; fees; trading costs | 2–5+ years (longer for higher-risk credit) |

Equity index fund | Market beta (earnings/dividends/multiples) + dividend income | Securities lending revenue (where applicable) | Expense ratio; tracking difference; index reconstitution costs | 5–10+ years (compounding focus) |

Active equity fund | Stock selection alpha + equity beta + dividends | Factor tilts; tactical positioning | Higher expense ratio; turnover/taxes; style drift; capacity constraints | 5–10+ years (manager-dependent) |

Crypto fund | Asset price beta (BTC/ETH and baskets) + staking/lending yield (if used) | Basis/arb, airdrops/token rewards | High volatility and drawdowns; custody and platform fees; slippage; regulatory shocks | Multi-year cycles (3–10+), high risk |

Fund of funds | Blended returns from underlying funds (equity/bond/alt/crypto) | Manager selection alpha; rebalancing and pacing | Extra fee layer; liquidity constraints; strategy overlap | 5–10+ years (depends on mix/liquidity) |

At Zemyth, we design for clarity around fund returns and fund risk. Fund Nest targets stable, low-volatility daily growth - think disciplined, cash-first consistency. Startup Nest embraces high-beta, venture-style upside. Choose the fund investment path that aligns with your time horizon, liquidity needs, and fee sensitivity.

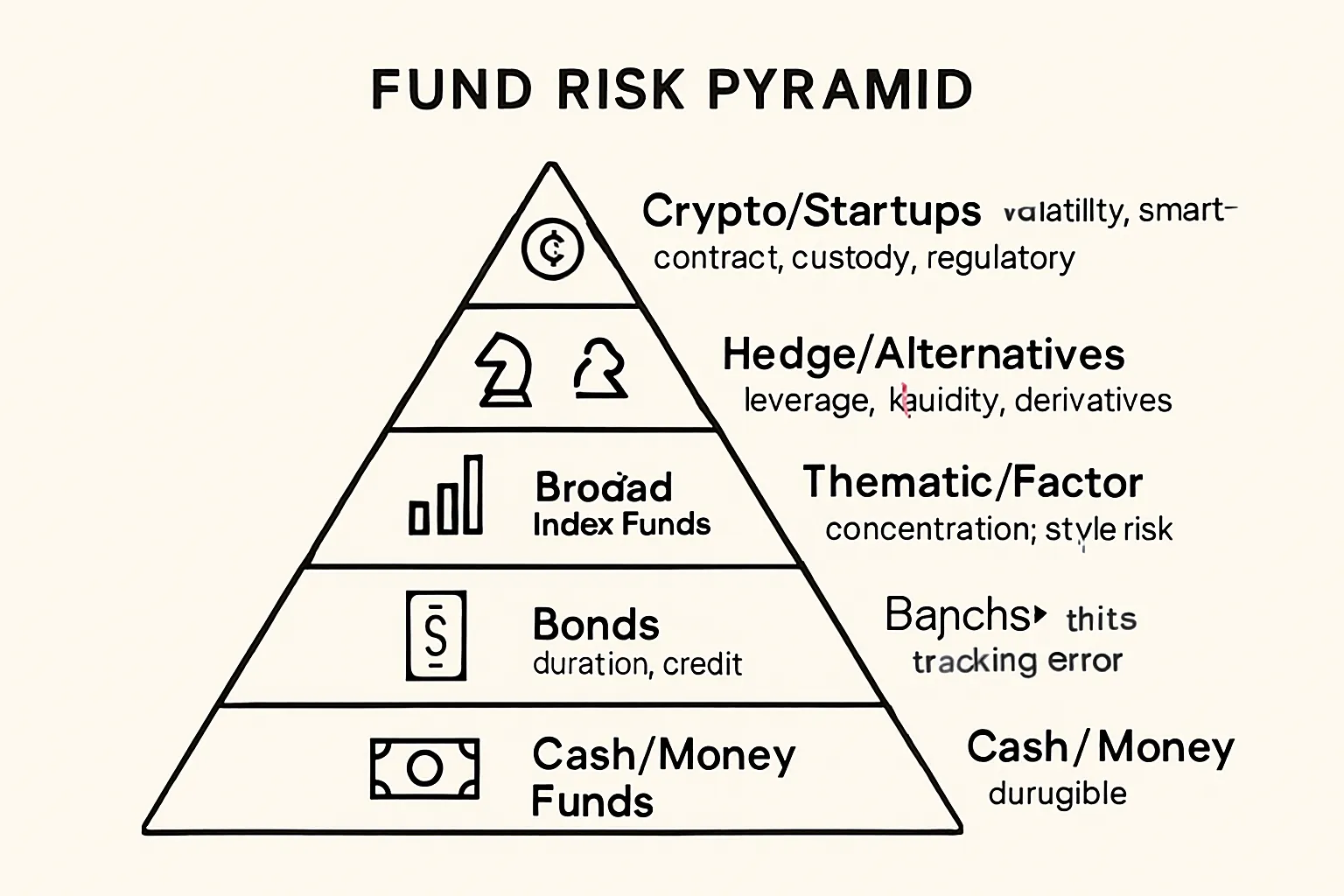

Fund risk, decoded: market, credit, duration, liquidity, tracking error, and on-chain specifics

Core risk buckets

Market/systematic risk: Broad equity and crypto beta - when markets move, diversified portfolios move with them.

Rate (duration) risk: Bond prices fall when interest rates rise; longer duration amplifies moves.

Credit/default risk: Issuer fails to pay coupons/principal; spread widening can also hit prices.

Counterparty risk: Exposure to brokers, custodians, lending venues, or derivatives counterparties.

Liquidity and gap risk: In thin markets or stressed periods, prices can gap; closed-end funds may trade at premiums/discounts; small caps, alts, and some crypto tokens can be hard to exit quickly.

Structure-specific risks

Tracking error: Index funds/ETFs can deviate from benchmarks due to fees, trading frictions, or replication methods.

Leverage/derivatives usage: Magnifies gains and losses; adds margin and funding risks.

Crypto-specific: Smart-contract bugs/exploits, custody/key management failures, exchange or stablecoin risk, and fast-changing regulation.

How to read risk in documents

Core stats:

Standard deviation: volatility measure - how widely returns vary around the average.

Max drawdown: largest peak-to-trough loss - your “worst-case so far.”

Beta: sensitivity to a benchmark (e.g., equity beta ~1 means market-like moves).

VaR (if provided): modeled loss at a confidence level over a time horizon.

Stress tests: hypothetical shocks (rate spikes, equity crashes, liquidity freezes).

Scenario thinking:

What breaks this fund? Concentration, leverage, liquidity, counterparty, or tech/custody?

What happens in a 20% market drop? Estimate potential drawdown using beta, duration, and historical stress.

For crypto and alts: consider exchange outages, on-chain exploits, de-pegs, and regulator actions.

Actionable takeaway: Align the fund’s risk profile and structure (open-end vs. ETF, active vs. index, on-chain mechanics) with your time horizon, liquidity needs, and loss tolerance.

Structures and costs 101: open-end vs. closed-end, NAV, fees, loads, and performance fees

Open-end vs. closed-end

Open-end (mutual funds/most ETFs):

Continuous share creation/redemption.

Mutual funds transact at end-of-day NAV; orders execute after market close.

ETFs trade intraday at market prices that typically hover near NAV thanks to creation/redemption by authorized participants (APs).

Replication approach matters: full replication vs. sampling vs. optimized futures; each affects tracking, liquidity, and cost.

Closed-end funds (CEFs):

Fixed number of shares after IPO; trade on exchanges.

Market price can trade at a discount or premium to NAV - discounts can persist.

Many CEFs use leverage to boost income, which amplifies both fund returns and fund risk.

Distribution policies (managed payouts) can include return of capital; read the breakdown.

The true cost of ownership

Ongoing fund fees:

Expense ratio: annualized operating costs taken from assets; lowers fund returns by the stated percentage.

12b-1 fees (where applicable): marketing/distribution fees embedded in the expense ratio for some mutual funds.

Transaction-related costs:

Loads (front-end or back-end/deferred sales charges) on certain share classes.

Trading spreads and market impact (ETFs/CEFs): wider in volatile or less liquid markets.

Brokerage commissions (where applicable), redemption or short-term trading fees for some mutual funds.

Taxes and turnover:

Capital gains distributions in mutual funds can create tax drag even if you didn’t sell; ETFs are generally more tax-efficient but not tax-free.

Higher turnover can increase realized gains, spreads, and slippage.

Performance fees and incentive structures:

Hedge/alt/crypto funds may charge a management fee plus a performance fee (e.g., “2 and 20”).

Hurdle rates: fees accrue only above a specified return level.

High-water marks: managers earn performance fees only on new highs.

Crystallization period: how often performance fees are calculated/paid (monthly/quarterly/annually).

Fulcrum fees (some active funds/’40 Act): fees adjust up/down with benchmark-relative performance.

Hidden-ish frictions to note:

Tracking difference (index funds/ETFs) from fees, cash drag, sampling, and reconstitution costs.

Securities lending revenue: can partially offset costs; check who keeps the revenue (fund vs. manager).

Financing costs for derivatives and leverage; borrow costs for shorts; swap/futures roll costs.

Cash drag from large inflows/outflows or high cash balances.

What to watch

Index products: tracking difference vs. the benchmark, replication method, expected tracking error, and index methodology changes.

Active funds: expense ratio vs. documented edge (process, people, philosophy), turnover, tax profile, capacity constraints, style drift.

Liquidity and trading: average daily volume, spreads, premium/discount behavior (ETFs/CEFs), and creation/redemption robustness in stress.

Distributions: timing, composition (income vs. capital gains vs. return of capital), and tax implications for your account type.

Leverage/derivatives: gross and net exposure, counterparty terms, collateral management, and stress testing.

For alternatives and crypto: lockups/gates, custody model, on-chain risks, and regulatory posture.

Reader outcome

You’ll know exactly where every basis point of friction lives - expense ratio, loads, spreads, taxes, leverage costs, and tracking difference - so you can judge whether the structure and mandate justify the price you pay.

Pro move: write a one-line thesis before you buy - “I’m paying X bps for Y exposure and Z edge.” If you can’t fill in Y and Z clearly, keep looking. With Zemyth, that clarity is built in: Fund Nest for low-volatility daily growth, Startup Nest for high-upside exposure - costs and mandates stated up front.

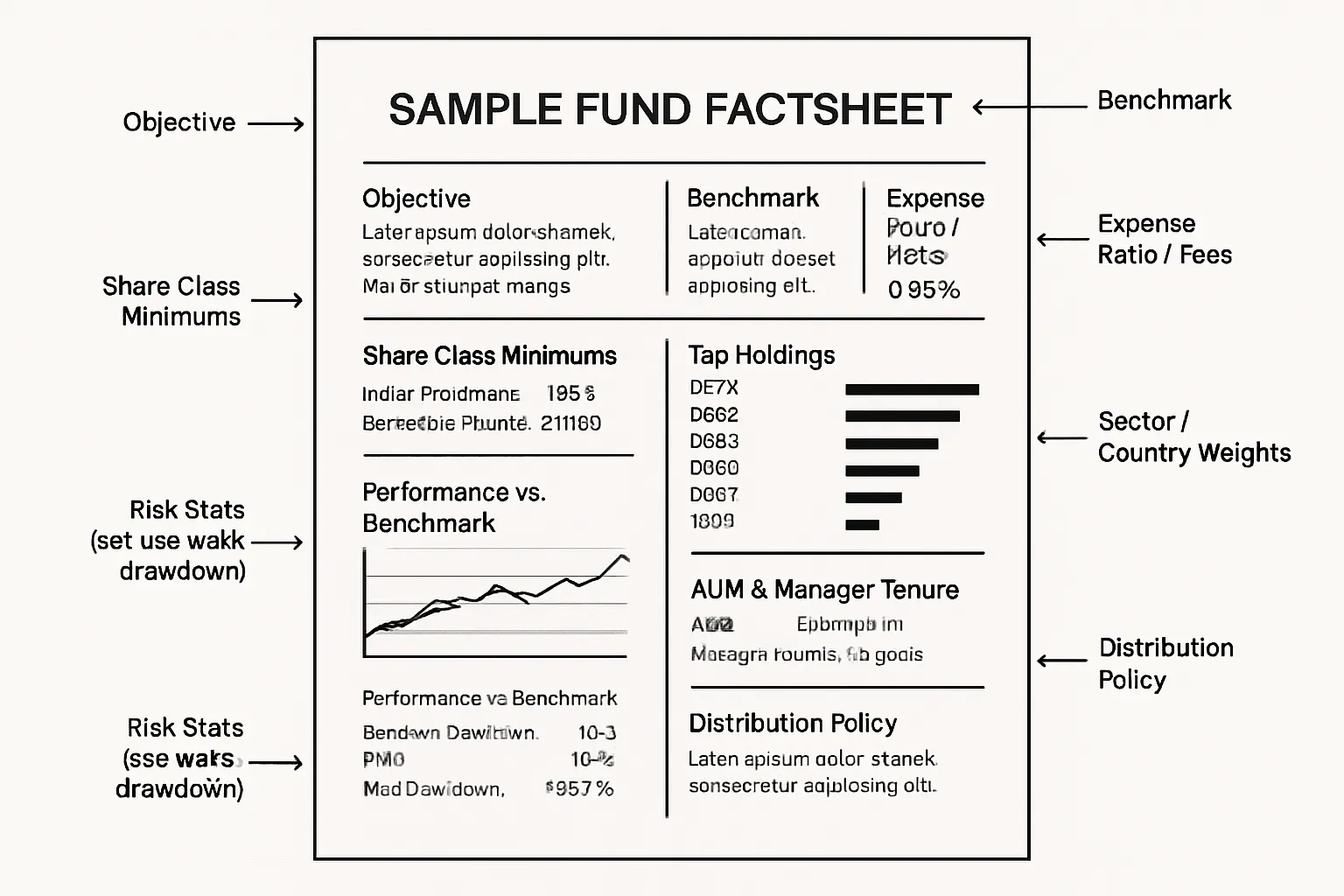

How to read a fund factsheet like a pro (before you invest)

The 10-second scan

Objective: What the fund is trying to do (growth, income, capital preservation) and the strategy it uses.

Benchmark: The yardstick for success - what it tracks or aims to beat.

Expense ratio: Your ongoing cost; lower is better all else equal.

Share class minimums: Minimum investment and any eligibility quirks.

The deeper read

Core anatomy:

Top holdings/sector/country weights: Concentration and exposures that drive returns and risks.

Risk stats: Standard deviation, beta, max drawdown, Sharpe, and any stress-test/VaR disclosures.

Performance vs. benchmark: 1/3/5/10-year and since inception; check both absolute and risk-adjusted metrics.

AUM and manager tenure: Scale and stewardship history.

Product-specific checkpoints:

Money funds: 7-day yield, WAM (weighted average maturity), WAL/WALA (where applicable), credit quality, liquidity buckets.

Index ETFs: Tracking difference vs. index, replication (physical vs. synthetic), securities lending policy and who keeps the revenue.

Crypto funds: Custody model (cold/warm, multisig), methodology (spot vs. futures), premium/discount behavior, liquidity windows and creation/redemption mechanics.

Tax lens:

Distribution history and composition (income vs. cap gains vs. ROC).

Turnover and realized gains profile; ETF tax efficiency isn’t automatic - verify.

Final checks

Liquidity: Average daily volume, bid-ask spreads (ETFs/CEFs), creation/redemption activity, and market depth.

Policy details: Distribution policy cadence (monthly/quarterly), reinvestment options, and dividend dates.

Fit and thesis: Write one line - “I’m paying X bps for Y exposure and Z edge.” If you can’t fill in Y and Z, keep researching.

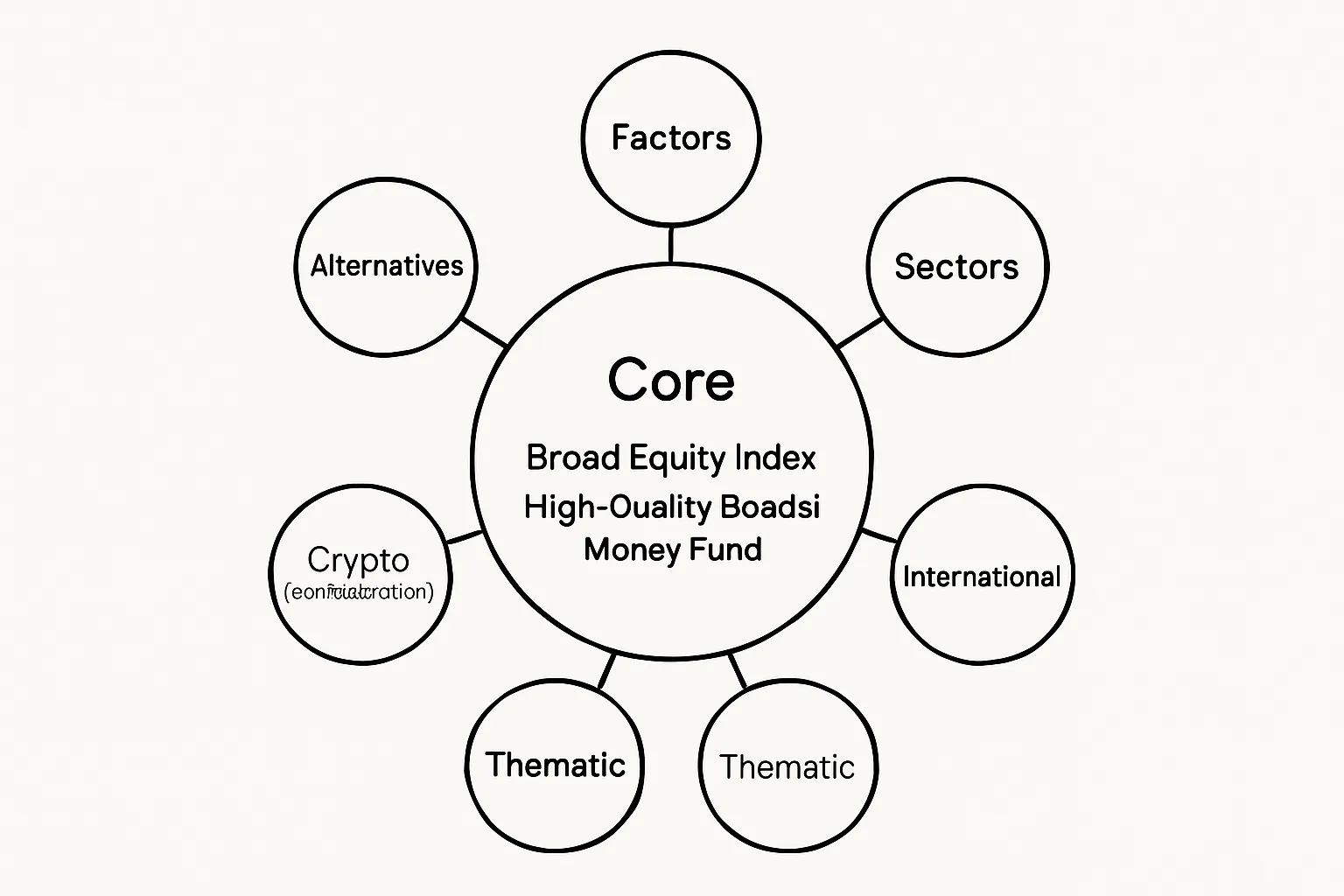

Build your investment foundation with funds (core–satellite made simple)

Start with the core (the investment foundation)

Anchor with a broad index equity ETF for growth plus a high-quality bond fund or money market fund for stability and liquidity.

Keep costs low and diversification high - your core does most of the compounding heavy lifting.

Add satellites for targeted goals

Precision tilts: factors (value, quality, small-cap), sectors (tech, healthcare), international/emerging markets, or thematic ideas (AI, clean energy).

Opportunistic sleeves: small crypto beta allocation for risk-tolerant investors, or professionally managed alternatives to diversify.

Size satellites modestly to avoid overpowering the core.

Rules of thumb

Align allocations to your time horizon and drawdown comfort.

Dollar-cost average to smooth entry points.

Rebalance on a set cadence (e.g., quarterly/annually) or thresholds (e.g., 5% bands) to maintain your risk budget and avoid drift.

Example blueprints (illustrative, not advice)

Conservative: 60%–80% bonds/money funds core, 20%–40% equity, minimal or no satellites.

Balanced: ~60% core split across equity/bonds, up to 10% satellites (international, factors, or small crypto).

Aggressive: 70%–90% equity core, 10%–20% higher-growth satellites (thematic, small-cap, international), optional 1%–5% crypto; expect higher volatility.

Outcome

A portfolio you can actually stick with through cycles - clear core for stability and compounding, deliberate satellites for targeted upside. At Zemyth, that translates to Fund Nest as the dependable core and Startup Nest as a focused satellite for bold upside.

Decision flow: choosing your next fund with a clear checklist

Quick decision tree

Goal: income, growth, capital preservation, or diversification?

Time horizon: months (cash/money fund), 2–5 years (bond/core), 5–10+ years (equity/ETF/crypto satellites).

Liquidity need: daily (open-end, ETFs) vs. periodic (some alts/FoFs).

Risk tolerance: acceptable drawdown/volatility (market, credit, duration, on-chain).

Fee ceiling: max expense ratio/performance fee you’re willing to pay for expected alpha/beta.

Tax constraints: account type, distributions, turnover, ETF tax efficiency.

Shortlist: money market fund, bond fund, broad equity index ETF, active equity fund, hedge/alt, crypto fund, or fund of funds - map to your investment foundation.

The pre-buy checklist

Objective fit: the mandate and benchmark align with your goal.

Costs: expense ratio, loads, and trading spreads are justified by the exposure/edge.

Liquidity: average volume, spreads (for ETFs), and redemption terms meet your needs.

Risk metrics: standard deviation, beta, max drawdown, and (if shown) VaR/stress tests are acceptable.

Benchmark: appropriate and consistently used; clear performance measurement.

Process and people: manager tenure, philosophy, and capacity constraints understood.

Structure specifics:

Index ETFs: tracking difference/error, replication method, securities lending policy.

Money/bond funds: 7-day yield, duration, credit quality, WAM/WAL.

Crypto funds: custody model, on-chain risks (smart contracts), premium/discount behavior, regulatory posture.

When to switch (or not)

Switch if: persistent process drift, structural tracking error, unjustified fee hikes, or mandate changes that break your thesis.

Don’t switch just for: short-term underperformance within expected risk bands or normal style cycles - judge over a full market cycle.

Tie-in to Zemyth education

Level up before you allocate: follow our Academy explainer sequence on fund risk, NAV and fees, and core–satellite portfolio design.

Clear next steps on Zemyth:

Fund Nest: low-volatility daily growth as your core.

Startup Nest: high-upside satellite for risk-tolerant investors.

Conclusion: pick your path with Zemyth and get moving

Bring it together

Funds are the clearest path to diversified, rules-based investing. When you understand fund meaning, how fund returns are generated, and which fund risk you’re accepting, you’re building a real investment foundation - one you can stick with through cycles.

Why Zemyth fits

Two transparent tracks so you’re never guessing your intent:

Fund Nest: stable, low-risk daily growth with a simple value frame - $1/day for every $1,000 invested - so you see predictable progress without micromanaging markets.

Startup Nest: high-risk, high-upside exposure to the next breakout startup - outcomes can range from 0 to 100x. Small stakes, big possibilities.

USD-denominated, education-first experience, plus our Academy to sharpen your decisions and an Affiliate program to earn as you grow your network.

Call to action (bold, but grounded)

Stop panic-buying and hype-chasing. Start with structure.

Open Zemyth, choose your path (stable vs. high growth), and put your plan to work today. Your future self will thank you for making a clear, intentional fund investment - built on rules, not impulses.