TL;DR - Put your fund to work with auto‑rebalancing for daily growth and lower drawdowns

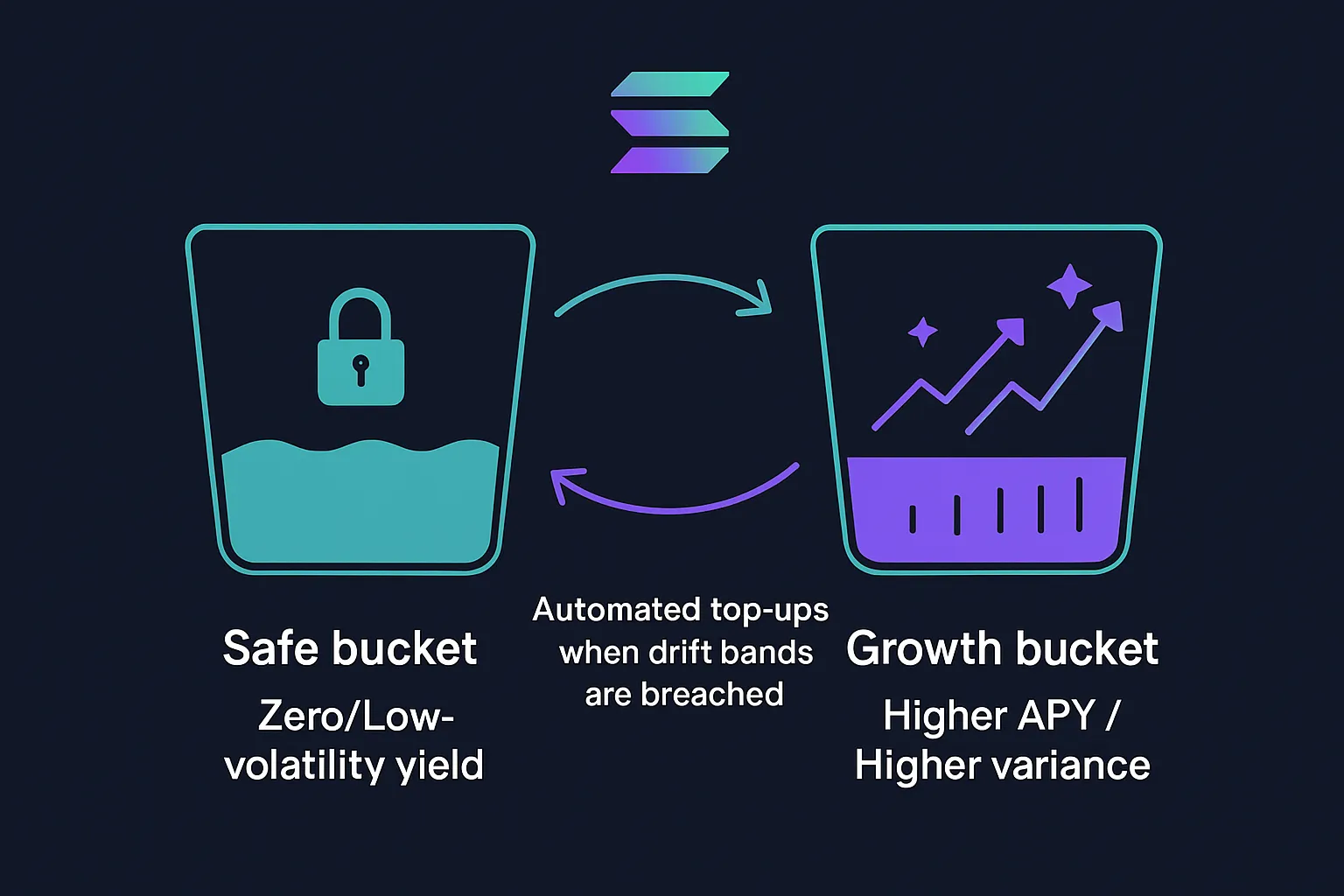

What this guide covers: Why rebalancing matters, exactly how to set rules (thresholds, cadence, buckets), and how Zemyth automates it between a Safe bucket (stability) and a Growth bucket (yield) so your “fund at work” compounds with less drama.

Core idea: A stable investment fund keeps a target split (e.g., 40% Safe / 60% Growth). When markets drift, automation trims winners and tops up laggards without emotion - turning investment work into a calm, rules‑driven system.

Outcomes you want: Smaller drawdowns, protected gains, and steadier daily growth; fewer manual decisions, more compounding.

What you’ll set up: Targets, drift bands (e.g., 5/25 or custom), cash‑flow rules (new deposits/dividends), and exceptions (pause rules, volatility spikes).

Proof this works in the real world:

"98% of plans that designated a QDIA selected target‑date funds as the default investment option." - Source

CTA: Start now with Zemyth’s FundNest auto‑rebalancing on Solana (low fees, transparent flows): https://zemyth.app

Keywords: fund at work; stable investment fund; investment work; daily growth

Why automatic rebalancing beats ad‑hoc tinkering

Markets drift; risk drifts with them. Over time, growth assets can dominate exposure and raise portfolio volatility beyond your comfort zone - until a correction reminds you that “set and forget” wasn’t really a plan.

Automation helps you:

control risk by keeping your target mix intact,

avoid timing temptations,

buy low/sell high systematically,

maintain your desired “daily growth” profile so your fund at work compounds as a stable investment fund rather than a mood swing.

Band vs. calendar (and why hybrid wins)

Bands/thresholds: React only when drift is meaningful (e.g., 5/25 rule). This cuts noise and captures buy‑low/sell‑high moments without constant fiddling.

Calendar: Pick a cadence (quarterly/annual) and reset to target. Simple, predictable, light mental load.

Hybrid: Review on a schedule, but only rebalance when bands are breached. Sanity + precision = less tinkering, more compounding.

"Threshold‑based ‘opportunistic’ rebalancing can deliver significant return improvements over annual calendar rebalancing while controlling portfolio drift." - Source

Design goal with Zemyth

Turn policy on once, let the rails do the investment work. Zemyth’s FundNest keeps your target split between a Safe bucket (stability) and a Growth bucket (yield) and executes band‑ or calendar‑based adjustments automatically. You monitor exceptions (pauses, volatility spikes); the system handles the rest.

The result you care about

Protect gains in bull runs (trim back to target).

Reduce pain in drawdowns (keep ballast topped up).

Keep your fund at work with minimal oversight - steadier daily growth, lower drawdowns, and fewer decisions to second‑guess.

Watch: Bucket Rebalancing 101 - Safe vs Growth and how automation stabilizes daily growth

Design your two‑bucket policy (Safe vs Growth) for a stable investment fund

1) Set targets

Choose a base split aligned to your horizon and risk (e.g., 40% Safe / 60% Growth; 60/40; or 30/70).

Safe bucket example: stablecoin LPs, short‑duration, zero‑ or low‑volatility strategies (e.g., FundNest Zero‑Risk pools).

Growth bucket example: curated LPs with higher APY and moderate volatility (e.g., SOL/USDT LPs, diversified growth vaults).

Goal: keep your fund at work with steadier daily growth while matching comfort with risk.

2) Define drift bands

Classic 5/25 rule per sleeve, or fixed absolute bands (±3–5 percentage points for Safe; ±5–10 percentage points for Growth).

Hybrid approach: evaluate monthly or quarterly; rebalance only if bands are breached to reduce noise and trading.

3) Choose funding sources

Rebalance with cash flows first (new deposits, accrued yield, dividends) to minimize taxes and transaction costs.

Only sell/trim when drift is outside the band and cash flows are insufficient - keep investment work focused on compounding.

4) Map to objectives

Want smoother daily growth? Favor a heavier Safe bucket + tighter bands (e.g., Safe ±3 pp, Growth ±6 pp).

Chasing higher APY? Tilt larger to Growth + moderate bands, but enforce a firm Safe floor to protect capital.

5) Policy wording (make it explicit)

Example: “Maintain 45% Safe / 55% Growth. Check weekly. Rebalance if Safe < 40% or > 50%. Use new cash and accrued yield first; otherwise trim the overweight sleeve.”

Bucket Policy Blueprint

Target Split | Safe Assets (examples) | Growth Assets (examples) | Drift Bands | Rebalance Source Order (1. new cash, 2. yield, 3. trims) | Notes (e.g., daily growth preference) |

|---|---|---|---|---|---|

60% Safe / 40% Growth | Stablecoin LPs (USDC/USDT), short‑duration stable vaults, zero‑vol strategies | Balanced LPs with moderate APY, diversified growth vaults | Safe ±3 pp; Growth ±6 pp | 1 → 2 → 3 | Prioritize stability and smoother daily growth; suitable for shorter horizons |

50% Safe / 50% Growth | Zero‑/low‑vol stable pools; cash‑like yield strategies | Curated SOL/USDT LPs; diversified higher APY pools | Safe ±4 pp; Growth ±7 pp | 1 → 2 → 3 | Balanced compounding; steady “fund at work” profile |

40% Safe / 60% Growth | Zero‑risk stable LPs; short‑duration reserves | Higher APY LPs; selective growth vaults | Safe ±4 pp; Growth ±8 pp | 1 → 2 → 3 | Growth‑tilt with a strong ballast; moderate daily variance |

30% Safe / 70% Growth | Minimal Safe floor in stable vaults | Higher variance LPs; opportunistic growth strategies | Safe ±5 pp; Growth ±10 pp | 1 → 2 → 3 | Aggressive APY target; expect bumpier daily growth; keep a hard Safe floor |

How Zemyth’s FundNest automates rebalancing on Solana

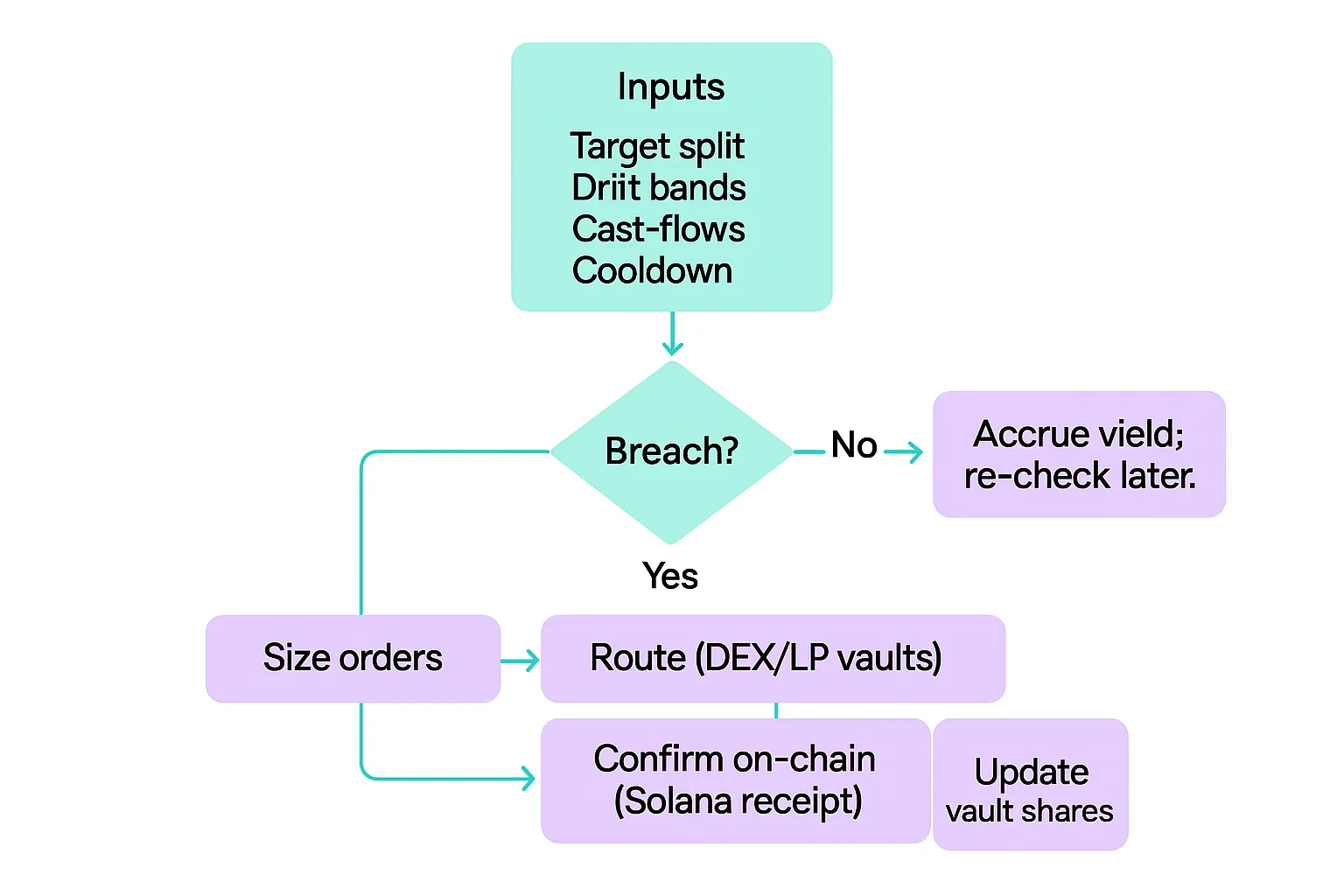

What gets automated

Target allocations per bucket; continuous drift detection; order sizing; execution routing; on‑chain confirmations.

Yield accrual is auto‑routed to the underweight bucket where possible, reducing the need to sell.

Triggers and cadence

Continuous drift checks with human‑readable policies (bands, cooldowns, max turnover/day).

Hybrid logic: evaluate often, act only when breach + cooldown are satisfied to minimize churn.

Cost and transparency

Solana settlement for low fees and high throughput.

On‑chain receipts for every action; vault tokens represent a verifiable share of underlying pools.

Protections

Safety rails: max single‑trade size, slippage guards, and a pause switch during abnormal volatility.

Optional floor control: never let Safe drop below X% (CPPI‑style cushion add‑on).

Results you monitor

Time‑in‑band %, turnover %, realized APY, max drawdown vs. target, and tracking error to policy.

Rebalancing Methods vs. Zemyth Automation

Pros | Best use‑case | Turnover profile | Human time | Notes | |

|---|---|---|---|---|---|

Calendar | Simple, predictable | Hands‑off investors | Moderate, periodic | Low | May miss opportunistic buy‑low/sell‑high moments |

Threshold/Band | Reacts to meaningful drift | Risk control with precision | Variable; event‑driven | Medium | Requires monitoring to catch breaches |

Hybrid | Sanity + precision | Most everyday portfolios | Lower than pure threshold | Low‑medium | Evaluate on cadence; act on breach |

CPPI add‑on | Enforces a safety floor | Capital protection with upside | Variable | Medium | Floor prevents Safe from falling below X% |

Zemyth Auto | On‑chain, policy‑driven execution with receipts | Two‑bucket Safe/Growth on Solana | Optimized; cooldown + routing | Very low | Auto‑routes yield, enforces rails, exposes clear metrics |

Set your rules: thresholds, cadence, cash‑flows, and cooldowns

Thresholds (bands)

Pick absolute or relative bands that match each bucket’s volatility.

Examples:

Absolute: Safe ±3 percentage points; Growth ±7 percentage points.

Relative (5/25 rule): Rebalance if an allocation drifts more than 5 pp in absolute terms or 25% relative to its target.

Tip: Use tighter bands for the Safe sleeve to lock in a smoother daily growth profile; wider for Growth to avoid over‑trading.

Cadence

Evaluate daily or weekly; execute only on breach to cap turnover and fees.

Hybrid approach: frequent checks + action only when band breach + cooldown are both satisfied.

For most “fund at work” policies, weekly checks with event‑driven execution are sufficient.

Cash‑flow priority

New deposits

Accrued yield/dividends

Internal trims/sells

Goal: keep a stable investment fund tax‑efficient - avoid taxable sales and spreads where possible; let incoming cash do the investment work first.

Cooldowns

Minimum 48–72 hours between rebalances to reduce whipsaw in choppy markets.

Optional: dynamic cooldowns - lengthen when realized volatility spikes; shorten when markets are calm.

Slippage & size limits

Set per‑trade slippage caps (e.g., 0.30%) and per‑day turnover caps (e.g., 5–10% of a sleeve).

Add a max single‑trade size (e.g., 1–2% of sleeve) to stay market‑friendly and protect daily growth consistency.

Exception tags

Pause automation during protocol events, platform upgrades, oracle anomalies, or extreme volatility (VIX/vol proxies).

Examples: “Protocol‑Maintenance,” “Depeg‑Watch,” “Vol‑Spike,” “Liquidity‑Thin.”

When an exception is active: accrue yield to underweight sleeve, log breach timestamps, and resume once cleared.

Example policy (explicit and testable)

Target: 45% Safe / 55% Growth

Bands: Safe ±3 pp; Growth ±7 pp (5/25 override on any sleeve)

Cadence: Check daily 00:00 UTC; execute only on breach + 72h cooldown met

Cash‑flows: Route new deposits and accrued yield to underweight first; sell only if deficit persists

Limits: Max slippage 0.30%; max per‑day turnover 7% per sleeve; max single trade 2% per sleeve

Exceptions: Auto‑pause on “Vol‑Spike” (proxy > threshold), “Maintenance,” or “Oracle‑Divergence > 0.25%”; resume and reconcile on clear

This ruleset keeps your fund at work with clear thresholds and a disciplined cadence, letting cash‑flows do the heavy lifting while cooldowns and limits protect against churn - so your investment work compounds into steadier daily growth.

Taxes, costs, and on‑chain efficiency

Location matters

Favor doing taxable‑sensitive sells inside tax‑advantaged accounts when possible (IRAs, pension wrappers). In DeFi, track realized P/L per jurisdiction and wallet to keep your stable investment fund fully compliant.

Minimize turnover

Let cash flows and yield do most of the heavy lifting; only sell when allocations drift out of band. This keeps your fund at work while preserving daily growth and minimizing taxable events.

Fees

On Solana, network fees are negligible; the bigger costs are slippage and performance fees. Control them with tighter bands on the Safe sleeve, size caps, cooldowns, and liquidity‑aware routing.

"Solana’s base fee is 5,000 lamports (0.000005 SOL) per signature - typically a fraction of a cent." - Source

Record‑keeping

Maintain an exportable ledger of every rebalance: transaction hashes, timestamps, cost basis, source of funds (new cash, yield, trims), and before/after weights. This makes audits, tax filing, and strategy reviews straightforward.

International note

Jurisdictions treat token swaps and yield differently. If uncertain, consult a tax professional to map wallet activity to local reporting requirements.

Zemyth angle

On‑chain receipts and vault tokens provide a clean, verifiable trail - far clearer than opaque brokerage statements. FundNest surfaces cost basis, realized P/L, and rebalance events so your investment work stays transparent and defensible.

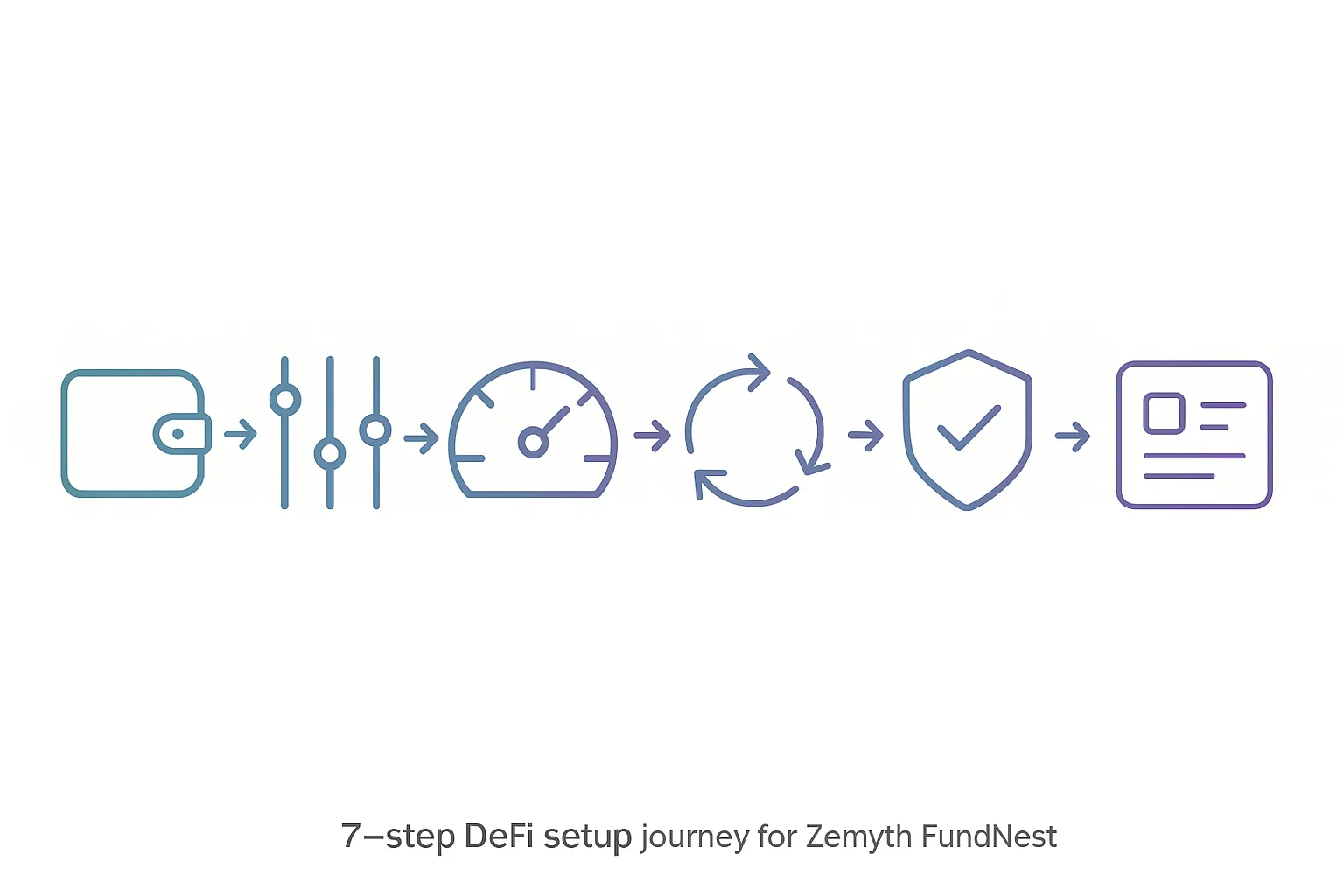

Step‑by‑step: Turn on “fund at work” with Zemyth

Connect wallet

Use Phantom or Solflare. Confirm Solana network and permissions before proceeding.

Pick your risk tier for each bucket

Safe: Zero‑risk stablecoin pools with steady APY.

Growth: Curated LPs with higher APY and vetted liquidity depth.

Set targets and drift bands

Example: 45% Safe (±3 pp); 55% Growth (±7 pp).

Add a “floor” safeguard so Safe never drops below 40% (CPPI‑style cushion).

Choose cash‑flow rules

Route yield and new deposits to the underweight sleeve.

Only sell when out of band and after the cooldown period has elapsed.

Configure execution guards

Set max slippage (e.g., 0.30%), max daily turnover (e.g., 7% per sleeve), and per‑trade caps (e.g., 2% of sleeve).

Review and confirm automation

Preview order logic; accept the on‑chain policy hash; start the monitoring dashboard.

Monitor and iterate

Check monthly: time‑in‑band %, realized APY, and tracking error to policy.

Adjust targets/bands as your horizon or risk appetite changes.

Start now: https://zemyth.app

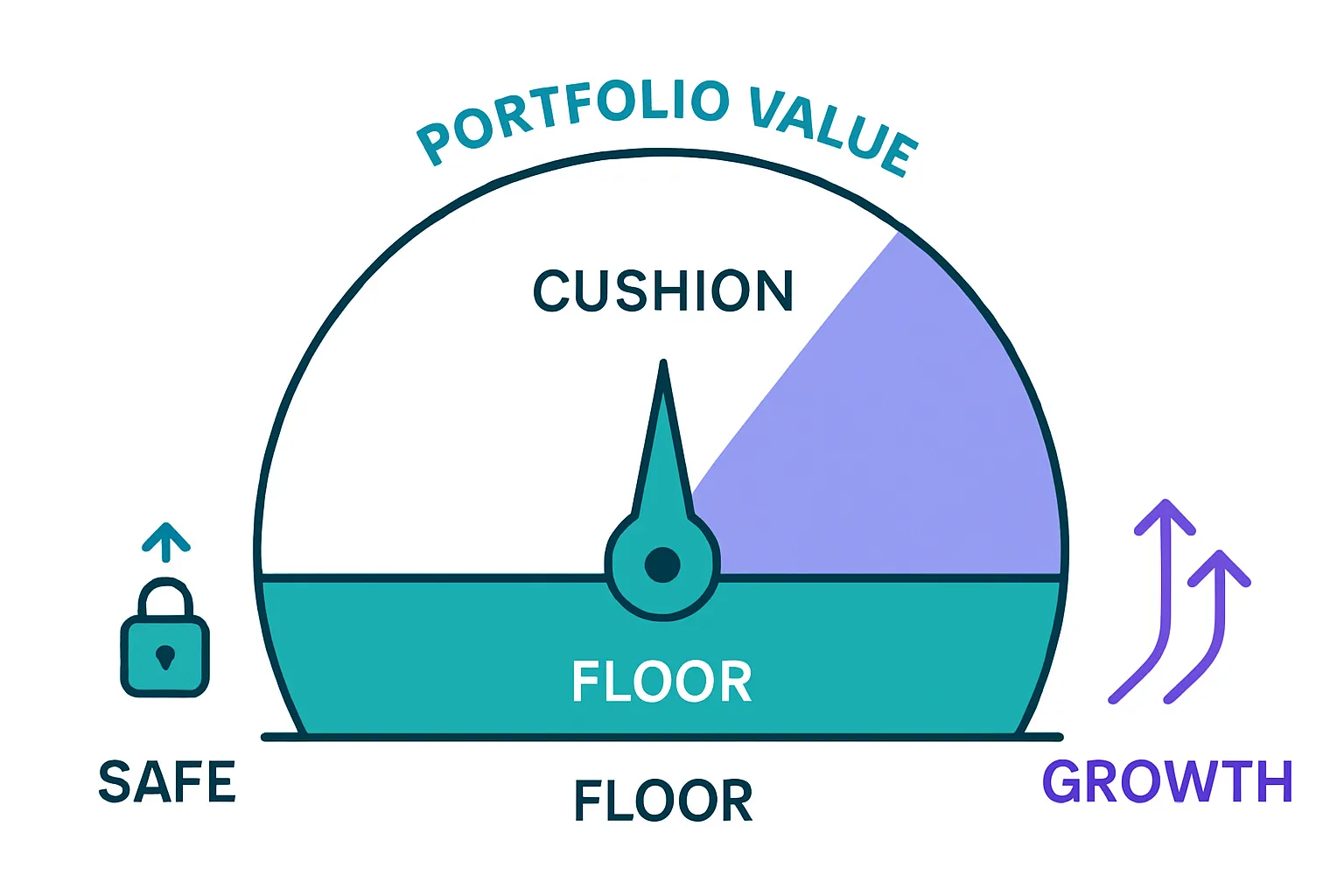

Advanced: Add a CPPI‑style floor for extra stability

Why add CPPI

Protect principal by enforcing a minimum Safe allocation or portfolio floor while still capturing upside as the cushion (portfolio − floor) grows.

Keeps the fund at work with disciplined guardrails that support steadier daily growth and lower drawdowns.

How to configure

Set the floor: e.g., Safe ≥ 40% at all times or a hard dollar floor.

Define cushion‑based scaling: Growth exposure = Multiplier × (Portfolio − Floor), bounded by max Growth allocation.

Emergency behavior: If floor is hit, auto‑lock to Safe until the cushion is rebuilt.

Trade‑offs

May lag V‑shaped recoveries if exposure was reduced near the trough.

Can increase turnover in high‑volatility regimes due to frequent cushion changes.

Combine with bands

Use CPPI as a guardrail that prevents breaching the Safe minimum.

Use drift bands (5/25 or absolute pp) for day‑to‑day allocation adjustments within the allowed range.

When to consider

Shorter horizons with capital‑preservation mandates.

Investors who value principal protection and psychological comfort.

Endowments/treasuries seeking strict downside controls without abandoning growth.

FAQs: Practical nitty‑gritty

How tight should my bands be?

Match band width to each sleeve’s volatility and liquidity; narrower for stable buckets, wider for volatile sleeves.

Will automation overtrade?

Cooldowns and minimum order sizes prevent churn; hybrid logic only fires on meaningful drift.

What happens in extreme volatility?

Pause switch + CPPI floor + size limits = controlled response, not panic.

Can I fund multiple goals?

Yes - spin up separate policies per goal; each with its own Safe/Growth design.

How do I measure success?

Compare realized drawdowns, tracking error, and time‑in‑band % vs. your policy and objective APY.

Is this market timing?

No - rules react to drift, not predictions. The aim is stability and discipline.

What about diversification?

Safe and Growth can each include diversified components (e.g., multiple pools) to avoid concentration risk.

"Annual or threshold‑based rebalancing both keep portfolio risk near target - the key is choosing a rule you’ll consistently follow." - Source

Conclusion - Make your fund work for you with Zemyth (Start now)

You’ve defined targets, bands, cash‑flow priorities, and safeguards. Now let automation execute with precision so your stable investment fund compounds with fewer surprises - and without the ad‑hoc tinkering that derails discipline.

With Zemyth’s FundNest you get on‑chain transparency, low‑fee Solana execution, curated pools by risk tier, and policy‑driven rebalancing that turns investment work into steady daily growth.

Action steps today:

Pick your Safe/Growth split and drift bands.

Enable hybrid rebalancing with sensible cooldowns.

Add a CPPI floor if you want an extra stability layer.

CTA: Put your fund at work now - launch your auto‑rebalancing policy at https://zemyth.app

TL;DR recap: Auto‑rebalancing protects gains, reduces drawdowns, and keeps daily growth on track. Set it once; let Zemyth do the heavy lifting.