TL;DR: A 10‑minute checklist for any fund app / fundr app / fund earning app

Verify the entity: Confirm legal name, jurisdiction of registration, physical address, and real team bios with LinkedIn, regulatory filings, and domain history. If you can’t verify the company in 5–10 minutes, walk away.

Map the yield: Write down exactly where returns come from (e.g., trading fees, market‑making, lending interest, token emissions) and the risk path to those returns (volatility, counterparty, smart‑contract, liquidity). If you can’t map it, you can’t trust it.

Custody & coverage: Determine who actually holds funds: bank/broker/qualified custodian vs self‑custody contracts. Note protections (SIPC/FDIC/none) and what they do and don’t cover (market losses are never covered).

Security proof: Look for independent smart‑contract audits, SOC 2 Type II for the platform, active bug bounties, public proof‑of‑reserves with third‑party attestation, and a transparent incident post‑mortem history.

Terms & liquidity: Read lockups, withdrawal windows, challenge periods, early‑exit fees, and how queues/backlogs are resolved during stress. No clear timeline = your money stuck.

Fees & revenue model: Demand transparent, capped, aligned fees. Avoid opaque taker spreads, hidden performance fees, and any blanket right to rehypothecate customer assets.

Data & privacy: Know what’s collected (KYC, device, behavioral), who sees it (partners/affiliates), retention limits, and your deletion/portability rights. No data map, no deal.

Transparency & support: Check for a real‑time status page, on‑chain or independently verifiable metrics, and human support with published response‑time SLAs.

Why this matters in 2025

“Investment app earning” promises exploded - and so did scams and unsafe yield. The fastest way to protect yourself is a repeatable checklist you can run before you tap “Deposit.”

This guide helps you vet any fund app, fundr app, fund earning app, investment app earning platform, or so‑called “your money app” in minutes.

"Consumers reported losing over $10 billion to fraud in 2023." - Source

What you’ll learn

An 8‑pillar framework, the biggest red flags, two side‑by‑side comparison tables, and a copy‑ready due‑diligence flow you can reuse for every “fund app” you see.

Prefer a vetted, transparent alternative? Explore Zemyth - https://zemyth.app

The 8 pillars to assess a fund app that promises earnings

Before you tap “Deposit” into any fund app, fundr app, fund earning app, or “your money app,” run this 8‑pillar check. Start here:

Pillar 1 - Identity & licensing: legal entity, regulators, jurisdictions, attestations.

Confirm the legal name, jurisdiction of incorporation, and physical address.

Verify registration or exemptions with relevant regulators (e.g., SEC/FINRA in the U.S., FCA in the U.K.), plus any state/AFS licenses as applicable.

Look for third‑party attestations (SOC 2, ISO 27001) tied to the named entity - not just a brand.

Cross‑check exec/team bios with verifiable work history and governance disclosures.

Pillar 2 - Custody & coverage: bank/broker/qualified custodian vs self‑custody; segregated accounts.

Identify exactly who holds customer funds and where: qualified custodian, bank trust account, broker, or on‑chain self‑custody smart contracts.

Confirm segregation of client assets and whether omnibus accounts are used.

Document coverage: FDIC (cash deposits, per bank limits), SIPC (brokerage securities), or none. Note: coverage never protects market losses.

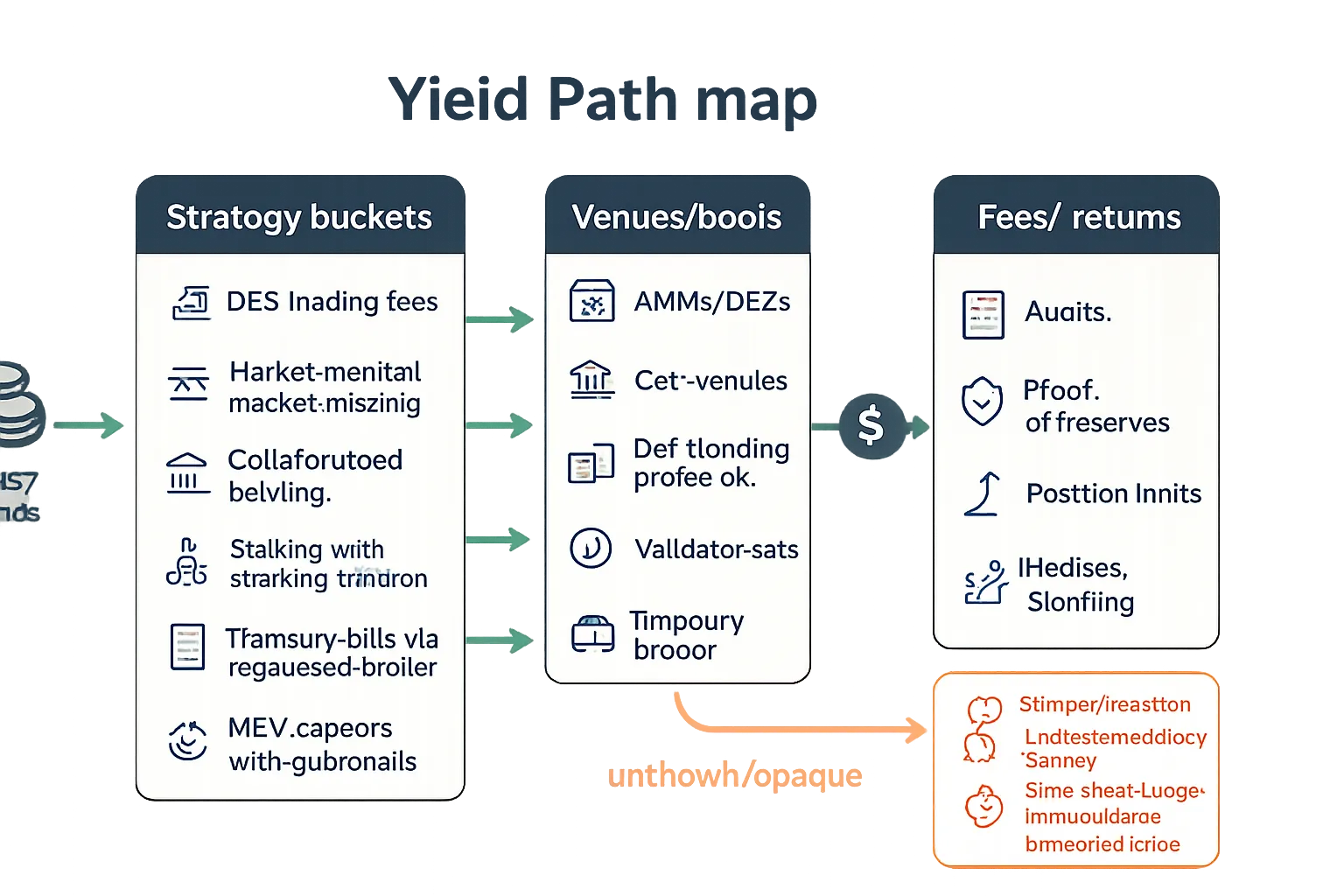

Pillar 3 - Yield source clarity: trading fees, lending spreads, staking, MEV, market making, or… vague?

Write down the stated sources (e.g., DEX trading fees, market‑making rebates, securities lending, staking rewards, MEV capture, arbitrage).

Map the risk path for each source (volatility, counterparty, smart‑contract, liquidity, regulatory).

If the “investment app earning” story is emissions‑only or undisclosed, treat it as a red flag.

Pillar 4 - Security & audits: SOC 2, smart‑contract audits, proof‑of‑reserves, bug bounty, pen‑tests.

Require recent SOC 2 Type II (platform) and independent smart‑contract audits (if on‑chain).

Look for an ongoing bug bounty with disclosed scope and payouts.

Check for third‑party proof‑of‑reserves or attested asset‑liability reporting with methodology.

Read incident post‑mortems and security status updates; absence of history ≠ absence of risk.

Pillar 5 - Terms & liquidity: withdrawal timing, lockups, queues, challenge windows, force‑majeure.

Note lockups, notice periods, challenge windows, and early‑exit fees.

Ask how withdrawals are queued during stress, what “gates” may apply, and who can pause withdrawals.

Review force‑majeure and rehypothecation clauses - do they let the platform use your assets?

Pillar 6 - Fees & alignment: management/performance fees, spread, performance watermark, boosts.

Itemize all fees: management, performance/incentive, spread/taker fees, withdrawal/early‑exit, network fees.

Look for a high‑water mark on performance fees and explicit caps to avoid misalignment.

Ensure any “boosts” or token incentives come from transparent, revenue‑linked models - not dilution that masks risk.

Pillar 7 - Data & privacy: what’s collected; retention; sharing with third parties.

Catalog data collected (KYC, device, behavioral, financial).

Check retention periods, encryption in transit/at rest, and breach notification timelines.

Identify third‑party sharing (affiliates, advertisers, data brokers) and opt‑out/deletion/portability rights.

Pillar 8 - Transparency & support: status page, incident history, response SLAs, escrow proofs.

Require a live status page with uptime and incident logs.

Prefer on‑chain or independently verifiable metrics (TVL, reserves, utilization).

Verify human support with published SLAs and escalation paths.

For escrowed funds, seek deterministic proofs (on‑chain addresses, custodial attestations).

"Mobile investing apps may use game-like features that influence investors to trade more often or take on more risk." - Source

Red flags to watch for (fast-pass list)

“Guaranteed” double‑digit APY; no clear yield path; no independent audit; no named custodian; withdrawal delays, pauses, or gating with no clear policy.

How to document your review

Keep dated screenshots/URLs, save PDFs of terms/privacy/audit reports, and paste support/chat/email replies into your due‑diligence log so you can compare claims vs. contracts over time.

Follow the Money: Legit Yield vs. Ponzinomics

Where the “earnings” come from in a fund earning app

Legitimate sources:

Trading fees from AMMs/DEXs

Market‑neutral market making

Collateralized lending spreads

Staking rewards with slashing insurance

Treasury bills/notes via a regulated broker

MEV capture with guardrails

Risky/opaque sources:

Rehypothecated user collateral

Undercollateralized lending

Unsourced “arbitrage”

Cross‑chain bridges without audits

Unverified “bots”

How to interrogate yield claims

Ask for pool/exchange names, strategies, position limits, and risk controls; demand look‑through transparency. If a fund app, fundr app, or “your money app” can’t show you where the capital sits and how it moves, you’re the yield.

Decision rule

If you can’t succinctly explain the yield path and its risks in 30 seconds, don’t deposit.

Yield source vs. risk vs. what to ask

Source | Typical APY range | Core risk(s) | Evidence to request | Immediate red flags |

|---|---|---|---|---|

AMM/DEX trading fees (stable pairs) | ~2%–12%+ depending on volume/volatility | Smart‑contract risk, temporary IL, venue risk | Pool addresses, audited contracts, fee/APR history, protocol name/version | No pool names; “proprietary DEX” with no audit |

Market‑neutral market making | ~5%–20% | Model error, inventory/latency, exchange counterparty | Venue list, inventory caps, hedging policy, daily PnL attestations | “AI bot prints money” claims; no drawdown history |

Collateralized lending spreads | ~3%–12% | Counterparty default, oracle/liquidation failure | LTVs, collateral whitelist, liquidation engine audits, reserve ratios | “Low/no collateral” lending; secret borrower list |

Staking with slashing insurance | ~4%–12% (chain‑dependent) | Slashing/downtime, validator performance | Validator IDs, slashing insurance terms, uptime history, custody of stake | Yields far above protocol rate; no validator disclosure |

Treasuries via regulated broker | Prevailing T‑bill yields (low single‑digits to mid, rate‑dependent) | Duration/interest‑rate, custodian failure (operational) | Broker/custodian name, account type (segregated), CUSIPs, statements | “Synthetic T‑bills” off balance sheet; no broker listed |

MEV capture with guardrails | ~5%–15% (highly variable) | Algo/market changes, fairness/ethics risk | Strategy policy, caps, audits, independent monitoring | Opaque MEV that exploits users; no rules/limits |

Rehypothecated user collateral | “Promised” high APY, unstable | Full loss via cascades, liquidity mismatch | None (avoid); if present: strict rehypothecation limits | Unlimited rehypothecation; buried consent in T&Cs |

Undercollateralized lending | Often double‑digit promises | Borrower default, zero recovery | Credit policy, borrower disclosures, loss reserves | “Whitelist only” with no data; no reserves |

Unsourced “arbitrage” | Varies; often exaggerated | Strategy doesn’t exist; execution risk | Trade logs with timestamps/venues, auditor attestation | “Proprietary arb” with no specifics or proof |

Cross‑chain bridges (unaudited) | Varies | Bridge hacks, key compromise | Bridge audits, bug bounty, TVL/incident history | In‑house bridge, no audits, admin key concentration |

Unverified “bots” | Varies | Black‑box, survivorship bias | Code reviews, third‑party audit, long‑horizon PnL | Screenshots only; no independent verification |

This is how you separate a legitimate investment app earning model from Ponzinomics. If a fund app can’t name venues, show addresses, or disclose controls, the “yield” is likely your principal.

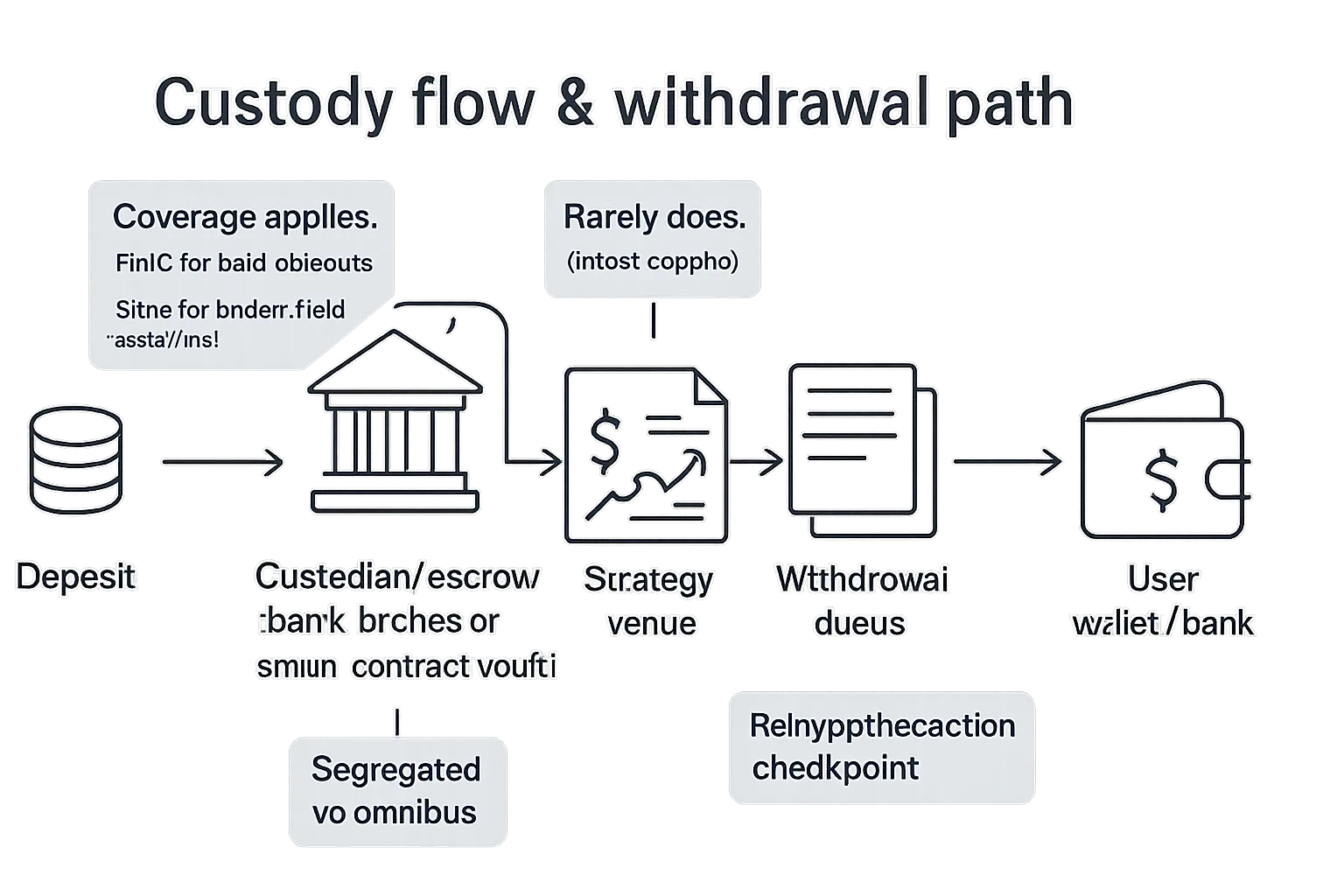

Custody, Wallets, and Coverage: Who Actually Holds Your Funds?

Know where your money lives

Bank/broker custody (FDIC/SIPC context) vs. on‑chain self‑custody vs. omnibus exchange wallets.

Segregated accounts vs. pooled/omnibus; rehypothecation policies; withdrawal rails.

Coverage primers

FDIC (bank deposits), SIPC (securities at brokers), private insurance (limited, exclusions), none (most crypto unless explicitly insured).

"SIPC protects customers of member broker‑dealers up to $500,000 per customer, including a $250,000 limit for cash." - Source

Crypto specifics

Hot vs cold wallets; multi‑sig; hardware security modules; withdrawal allowlists; challenge windows.

Custody & coverage checklist

Custody model | Custodian name | Account type | Segregation | Coverage type & limit | Insurance exclusions | Withdrawal rails | Verification link |

|---|---|---|---|---|---|---|---|

Bank custody (cash) | Demand/deposit | Segregated client sub‑accounts | FDIC up to legal limits (per depositor, per bank) | Investment losses, investments held at non‑banks | ACH, wire, RTP | ||

Broker custody (securities) | Cash + margin/brokerage | Segregated customer accounts | SIPC up to $500k (incl. $250k cash) | Market losses, promises of performance | ACH, wire, ACAT | ||

Qualified custodian (alts) | Custody/escrow | Segregated | Private insurance (varies) | Crypto smart‑contract loss, force majeure | Wire, custodian transfer | ||

On‑chain self‑custody | Smart‑contract vault | Programmatic segregation | None by default | Protocol exploits, key loss | On‑chain transfer/bridge | ||

Exchange omnibus wallet | Pooled omnibus | Commingled | Often none/private (limited) | Exchange insolvency, rehypothecation | Exchange withdrawal |

Your action list

Name of custodian, account title, coverage limits, incident history, and how to independently verify each.

Security, Audits, and Code Reality Checks

Verify before you trust

SOC 2 Type II vs. smart‑contract audits vs. pen‑tests

SOC 2 Type II: verifies a company’s security, availability, and process controls over time (organization and data handling).

Smart‑contract audits: review on‑chain code logic, invariants, and upgrade paths (the actual program holding funds).

Pen‑tests: ethical hacking against apps, APIs, infra, and auth to map the attack surface in real conditions.

Proof‑of‑Reserves & Proof‑of‑Liabilities

Only accept PoR paired with PoL (and methodology). Assets without matching liabilities proof can mask insolvency.

Ask for independent attestation, point‑in‑time hash/merkle proofs, and solvency deltas over time.

Bug bounty size and scope

Clear scope, mainnet eligibility, payout tiers, and past paid reports are signals the platform expects to find (and fix) issues.

Incident history and post‑mortems

Look for public write‑ups, timestamped mitigations, and follow‑up fixes. No history ≠ no incidents; it may mean no transparency.

Emergency pause/kill‑switch governance

Understand who can pause contracts, what multisig/DAO thresholds exist, and the playbook for unpausing. Centralized kill‑switches without checks are high risk.

"Scammers often promise to help you get rich - with little or no risk... there’s no such thing as high guaranteed investment returns, and every investment involves risk." - Source

How to self‑verify

Check the paper trail

Read audit repos: verify report hashes, commit SHAs, and dates match current deployed contracts and app versions.

Auditor reputation and scope: Was it a top‑tier firm? Did scope include proxy/upgrade logic, oracles, and governance modules?

Findings resolution: Look for “Fixed”/“Mitigated” status with links to patches and re‑audit confirmations.

Validate reserves and liabilities

Confirm proof‑of‑reserves AND proof‑of‑liabilities with independent attestation, methodology, and user‑verifiable merkle proofs.

Monitor solvency changes over time, not just a one‑off snapshot.

Stress the money flows (safely)

Start with a tiny deposit; execute a real withdrawal. Note timing, fees, any challenge windows, and queue behavior.

Test multiple rails (on‑chain, ACH, wire) and verify the exact custodian/contract address holding your funds.

Inspect the attack surface

Review pen‑test summaries for API auth, rate‑limit, role/permission checks, and secrets handling.

Confirm active bug bounty (scope, payouts, response SLAs) and recent paid disclosures.

Governance and emergency controls

Identify who can pause/upgrade contracts and what quorum is required.

Ensure published runbooks for incident response, with status‑page updates and user notification SLAs.

If a fund app, fundr app, or “investment app earning” platform can’t show recent audits, paired PoR/PoL, a live bug bounty, and a real withdrawal test - don’t trust it with your money.

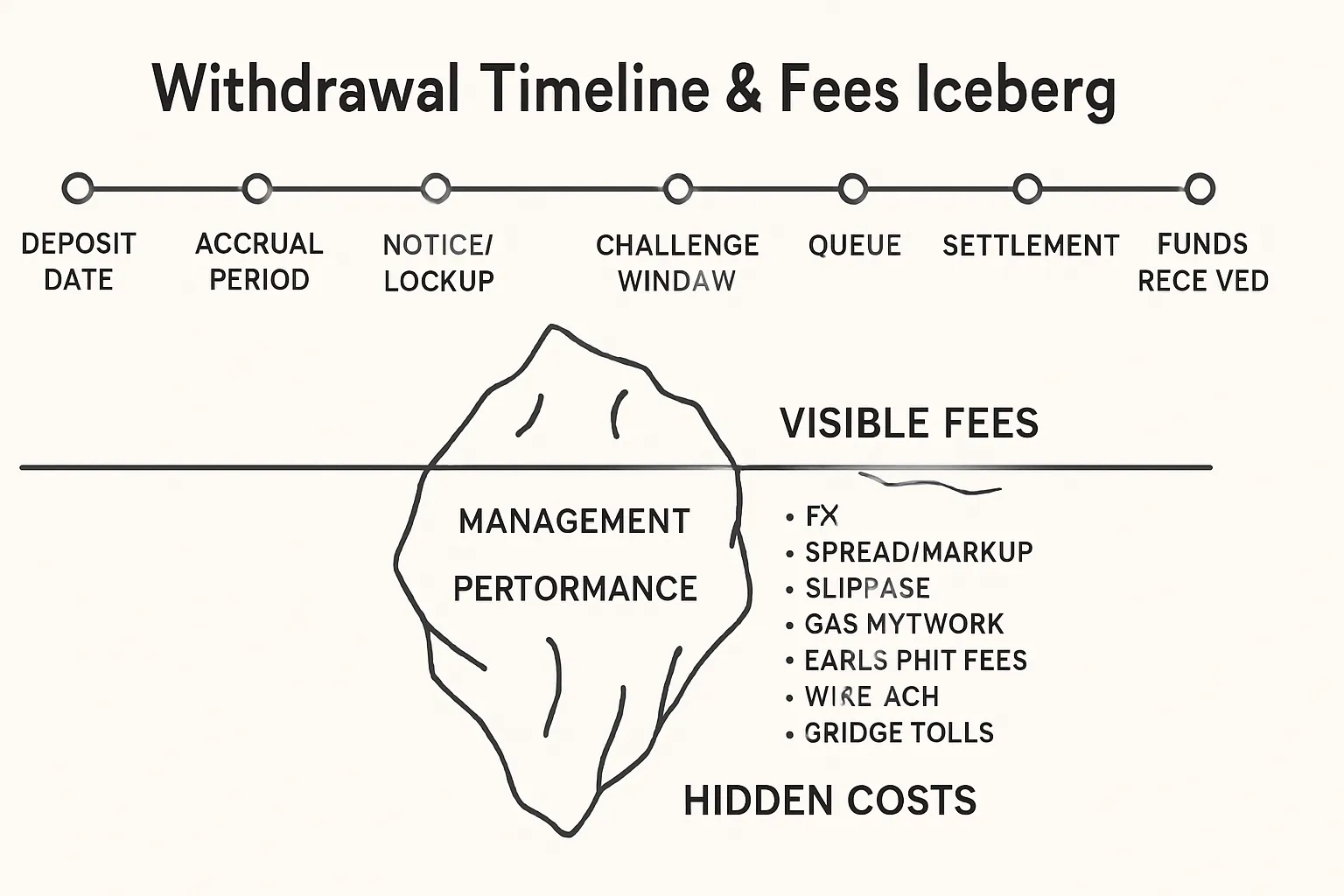

Terms That Trap: APY Math, Lockups, Withdrawal Timing, and Fees

Read the fine print like a pro

APY vs APR: APR is the sticker rate; APY includes compounding. The higher the compounding frequency, the bigger the gap. Always ask for the APY and compounding schedule.

Compounding frequency: Daily/weekly/monthly compounding changes realized returns, especially with short holding periods and reinvested rewards.

Performance fees: Check if fees are charged on gross or net PnL, whether there’s a high‑water mark, and how losses/reset periods work.

Withdrawal/early‑exit fees: Some “anytime” apps still charge exit fees or haircut your rewards if you withdraw before a set window.

Spread/markup: Hidden costs often hide in FX, taker spread, and “convenience” markups around bridges/swaps.

Liquidity promises vs. reality

Lockups: Fixed periods where withdrawals are disabled - common in venture, staking, or high‑volatility strategies.

Notice periods: Some funds require 3–30 day advance notice before processing withdrawals.

Challenge windows: On‑chain systems may include dispute windows to protect against fraud, delaying your payout.

Withdrawal queues during stress: When many investors exit at once, queues form, gates trigger, or pro‑rata redemptions apply. Ask for the exact queuing policy and historical worst‑case timing.

Practical tests

Start with a tiny deposit → earn for 1–2 cycles → withdraw fully → measure timing, fees, slippage, and support responsiveness.

Compare quoted APY vs. realized return after all costs. If realized returns consistently trail quotes with no clear fee breakdown, that’s a red flag.

Document everything: timestamps, fee line items, transaction hashes, and chat transcripts. If support can’t explain deductions, reconsider depositing more.

Real‑World Signals: Reviews, KYC/AML, Status Pages, and Support

External clues that predict your experience

App ratings that actually matter

Track App Store/Google Play trends by version, not just the overall score. A recent dip after an update often signals bugs, login failures, or withdrawal issues.

Read the “Most recent” and “Critical” reviews. Search for “withdrawal,” “locked,” “KYC,” and “fees” inside reviews of any fund app, fundr app, or fund earning app.

Check third‑party trust pages and complaint boards to see recurring themes.

Uptime, status, and incident transparency

Look for a public status page with real‑time components (API, wallet, deposits/withdrawals) and a legible incident history with timestamps and remediation steps.

Compare incident logs against social posts, release notes, and user reports for consistency.

KYC/AML standards and geo policies

Confirm the KYC provider, what data is collected, and review their privacy policy. Sanctions screening and PEP checks should be explicit.

Suspicious geo‑blocking patterns (e.g., silently disabling key regions with strict regulation) are a red flag. Transparent policy pages beat vague “service unavailable” popups.

Support channels and SLAs

Expect multiple live channels: chat + email + ticketing, with published SLAs (first response/resolve times) and escalation paths for stuck withdrawals or KYC holds.

Test support pre‑deposit: ask two tough questions (custody details and withdrawal queues). Note speed, clarity, and whether they provide verifiable links.

Community health (how they behave in public)

Documentation should be complete, current, and versioned. Roadmaps and changelogs should show regular, non‑cosmetic progress.

Watch how the team handles tough questions in forums/AMA/X/Discord: Do they answer with specifics (custodian names, contract addresses, SLAs) or dodge with marketing?

For any “investment app earning” pitch, insist on look‑through transparency to pools/venues and verifiable performance methodology.

Quick scan tactics

Use search with recency filters:

“[brand] withdrawal delay,” “[brand] hacked,” “[brand] rug pull,” “[brand] KYC locked,” “[brand] status page.”

Check regulator and enforcement databases:

SEC/FINRA/FTC (U.S.), state securities regulators, FCA Warning List (U.K.), ESMA/NCA portals (EU), MAS/ASIC, etc.

Cross‑reference disclosures:

Match the legal entity on the website to the one in terms/privacy, status page, and app store listing.

Compare support answers to docs/terms; inconsistency is a red flag.

Do a zero‑risk “ops test”:

Open a support ticket and see if you receive a specific, link‑rich reply within the posted SLA. If they miss their own SLA before you’re a customer, expect worse after you deposit.

Monitor release quality:

Read mobile/website release notes. Frequent “hotfixes” for core flows (login, deposits, withdrawals) signal instability in a “your money app.”

Prefer a vetted, transparent alternative? Explore Zemyth - https://zemyth.app

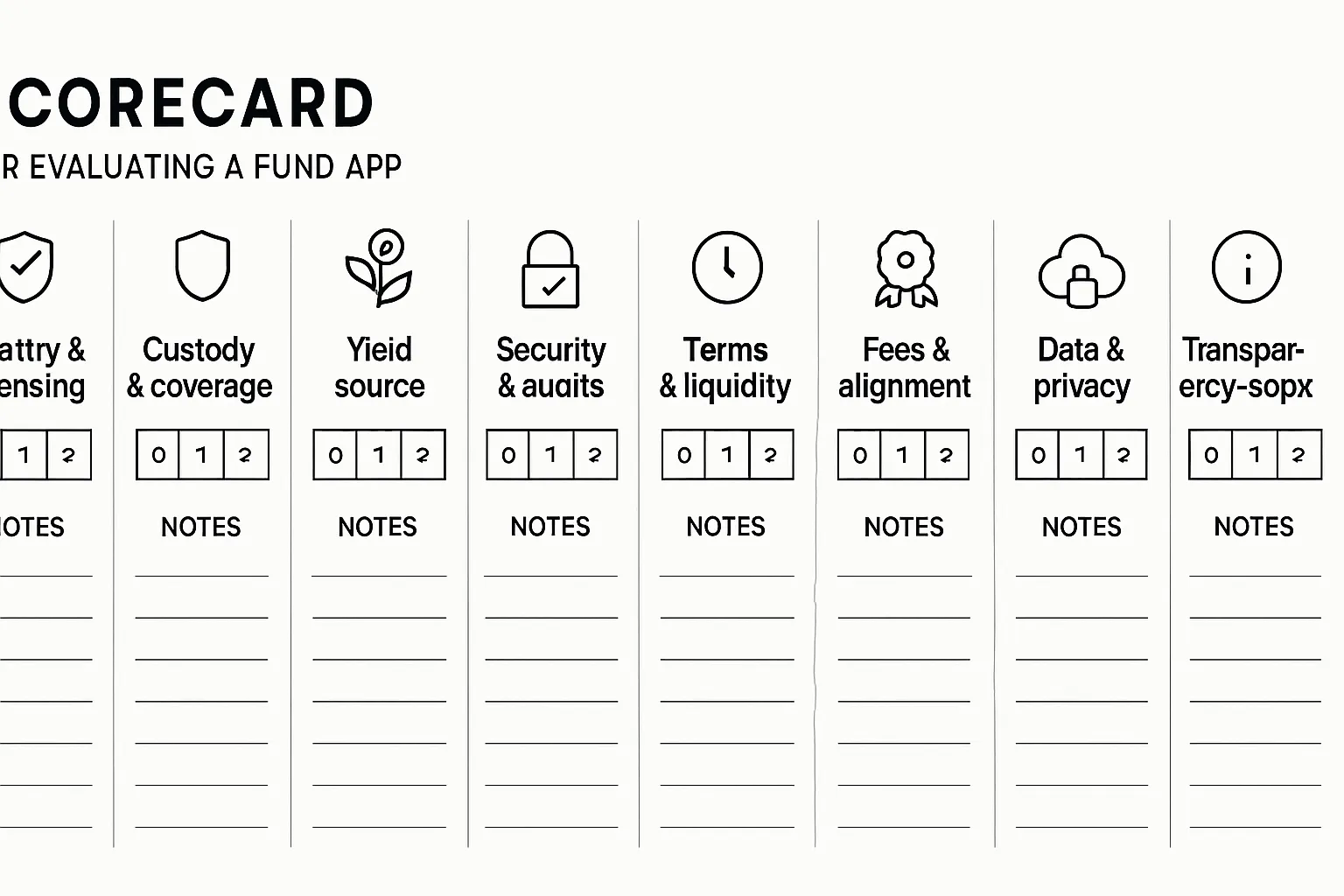

Apply the Checklist: Scoring Zemyth vs a Typical "Your Money" Fund App

Scoring rubric (0–2 per pillar; 16 max)

0 = absent/opaque, 1 = partial, 2 = complete/verifiable.

Zemyth (transparency highlights)

Identity & licensing: public docs, team, and on‑chain design.

Custody & coverage: milestone‑based escrow on Solana; clear state machines; permissionless triggers.

Yield source: FundNest pools (zero→high risk) with target APYs sourced from trading fees; clear tiering.

Security: extensive test suites; audits; anti‑flash attack design; voting holds & challenge windows.

Terms & liquidity: milestone unlocks, exit windows on pivots, abandonment refunds, TGE safeguards.

Fees & alignment: revenue‑linked token emissions; burns; fee discounts for ZEM holders.

Data & privacy: transparent docs; open specs.

Transparency & support: master docs, specs, status via OpenSpec and staged rollouts.

Typical opaque fund app (what we’d expect to see)

Vague strategy, omnibus custody, queue delays, “guaranteed APY,” no audits, no status page.

Action

Use this rubric before depositing anywhere. Favor transparent, verifiable designs over vibes.

Prefer a vetted, transparent alternative? Explore Zemyth - https://zemyth.app

The bottom line

Don’t let slick UI or a too‑good APY sell you risk you don’t understand. If a fund app, fundr app, fund earning app, or “investment app earning” platform can’t show its yield path, custodian, and audits, it’s not “your money app” - it’s their risk on your balance.

Use the 8‑pillar checklist, the two tables, and the withdrawal test on any app that touches your funds. If you can’t explain the yield and the exit path in 30 seconds, don’t deposit.

Why Zemyth

Milestone‑gated funding and transparent escrow on Solana mean capital only moves forward when on‑chain proof and votes say so.

Curated yield via FundNest (zero→high risk tiers) sources returns from trading fees with clear targeting and risk controls.

Revenue‑linked tokenomics and ZEM utility align incentives: caps on emissions, real fee backing, and deflationary burns.

Open specs, status transparency, security controls (anti‑flash attacks, voting holds, challenge windows), and permissionless triggers make Zemyth a strong default for builders and yield‑seekers.

Next steps

Run the checklist on your current apps: identity, custody, yield, security, terms, fees, data, transparency.

Start small, test withdrawals, and only scale after passing every pillar and your practical withdrawal test.

When you’re ready for a vetted alternative, get started with Zemyth.

Primary CTA: Start with Zemyth - https://zemyth.app