Introduction: Why Foundation Investing Beats Chasing Big Investments

When rates fall, the temptation to swing for the fences is real. But the winners aren’t the investors who chase the headline “big investments” - they’re the ones who build a resilient foundation first. Foundation investing means you set up a cash buffer, a stable yield core, and a clear risk budget before you go after outsized returns. That way, every bold move lives inside a plan - not as a gamble that can derail it.

Set the stage: rate cuts, scarcer yield, and the urge to swing big

Context: The Federal Reserve’s recent rate cut restarted a likely cutting cycle. As short rates drift lower, yield becomes scarcer, and cash yields reset down - fast.

Problem: Many investors either stay overweight cash (and watch their purchasing power fade) or leap into “big investments” without a base, turning a smart idea into unnecessary risk.

Solution: Foundation investing - build a resilient core first so future big investments don’t jeopardize your plan. Your cash buys time, your core keeps your fund at work, and your risk budget sets boundaries for upside bets.

"59% of U.S. adults would need credit, loans, or help to cover a $1,000 emergency expense." - Source

What you’ll learn

A 3-layer blueprint: Cash buffer → Yield core → Risk budget.

How to keep your fund at work while preserving resilience as yields drift lower.

A practical, on-chain path using Zemyth to automate parts of the plan: park cash in yield (FundNest), deploy upside via milestone-gated venture (StartupNest), and align incentives with ZEM.

TL;DR: Don’t chase big investments on a shaky base. Build your foundation - cash buffer, yield core, and risk budget - so every bold move compounds your plan instead of threatening it. Zemyth helps you automate the base and channel risk where it belongs.

Ready to put foundation investing on-chain? Get started at https://zemyth.app

TL;DR - The Foundation Investing Blueprint

Build the base before the skyscraper: that’s foundation investing.

3 layers:

Cash buffer: 3–12 months of essential expenses to kill panic selling and bill stress.

Yield core: stable, high-quality yield that compounds regardless of market drama.

Risk budget: a pre-sized pool for big investments (venture, crypto, real estate, etc.).

Core-satellite mindset: 70–90% core, 10–30% satellites (tune by risk tolerance and time horizon).

Rate-cut cycle play: lock in medium-duration quality yield, trim reinvestment risk, and keep dry powder for opportunities.

Implementation path with Zemyth:

Park cash buffer and conservative core in FundNest’s Zero Risk vaults (target APY ranges),

Pre-define risk budget before entering StartupNest milestone-gated ventures,

Use ZEM for boosts, priority, and fee discounts.

CTA: Ready to make your fund at work, not sit idle? Start at zemyth.app.

Start your foundation at https://zemyth.app.

The Core-First Playbook: Cash Buffer → Yield Core → Risk Budget

Why a foundation first

Volatility happens; your core absorbs shocks and funds opportunity.

Big investments are optional; a stable base is not. Foundation investing ensures your investment of money keeps your fund at work without exposing your plan to a single bad bet.

The three layers explained

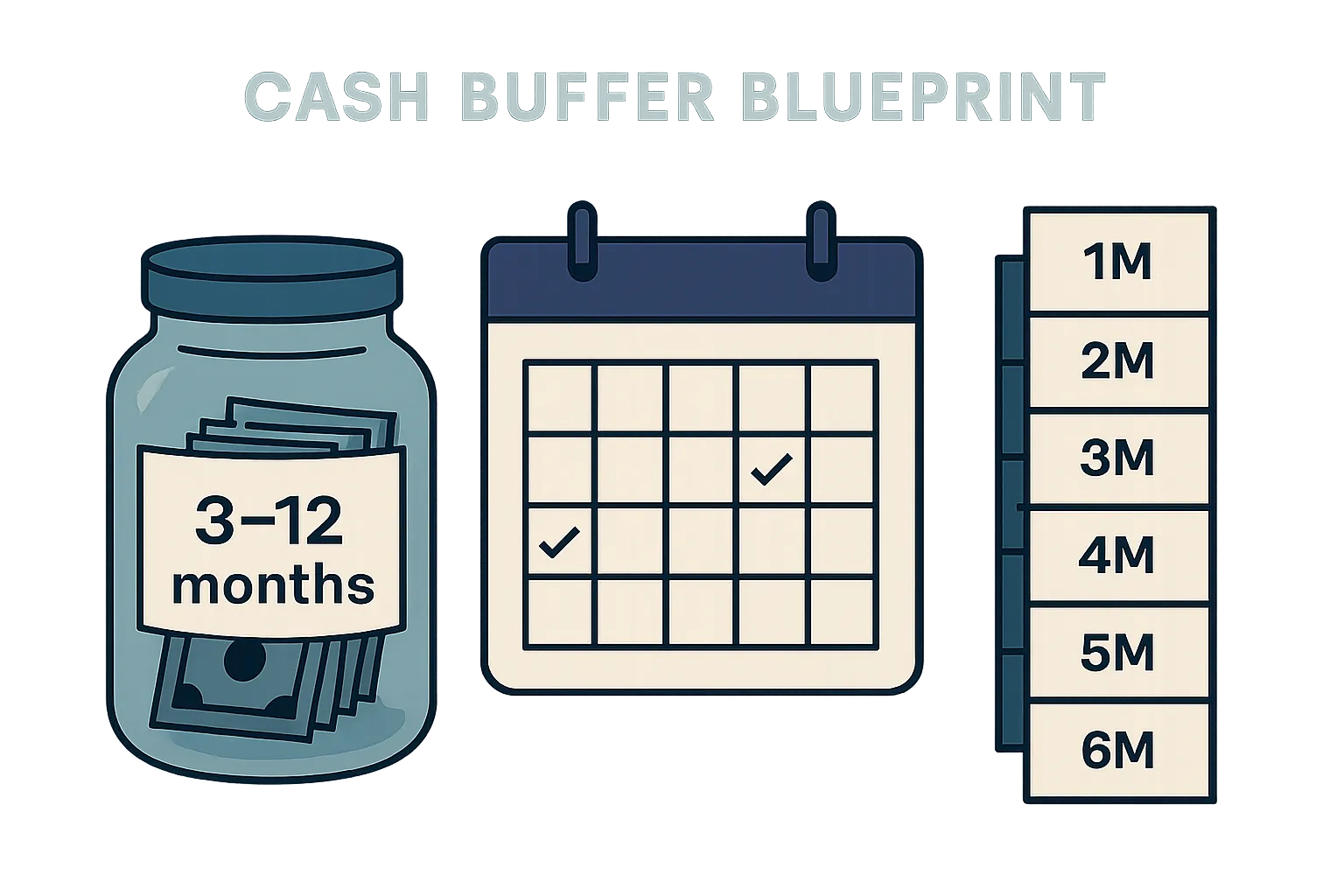

Cash buffer: Hold 3–12 months of essential expenses. Calibrate by income stability, number of dependents, and job cyclicality.

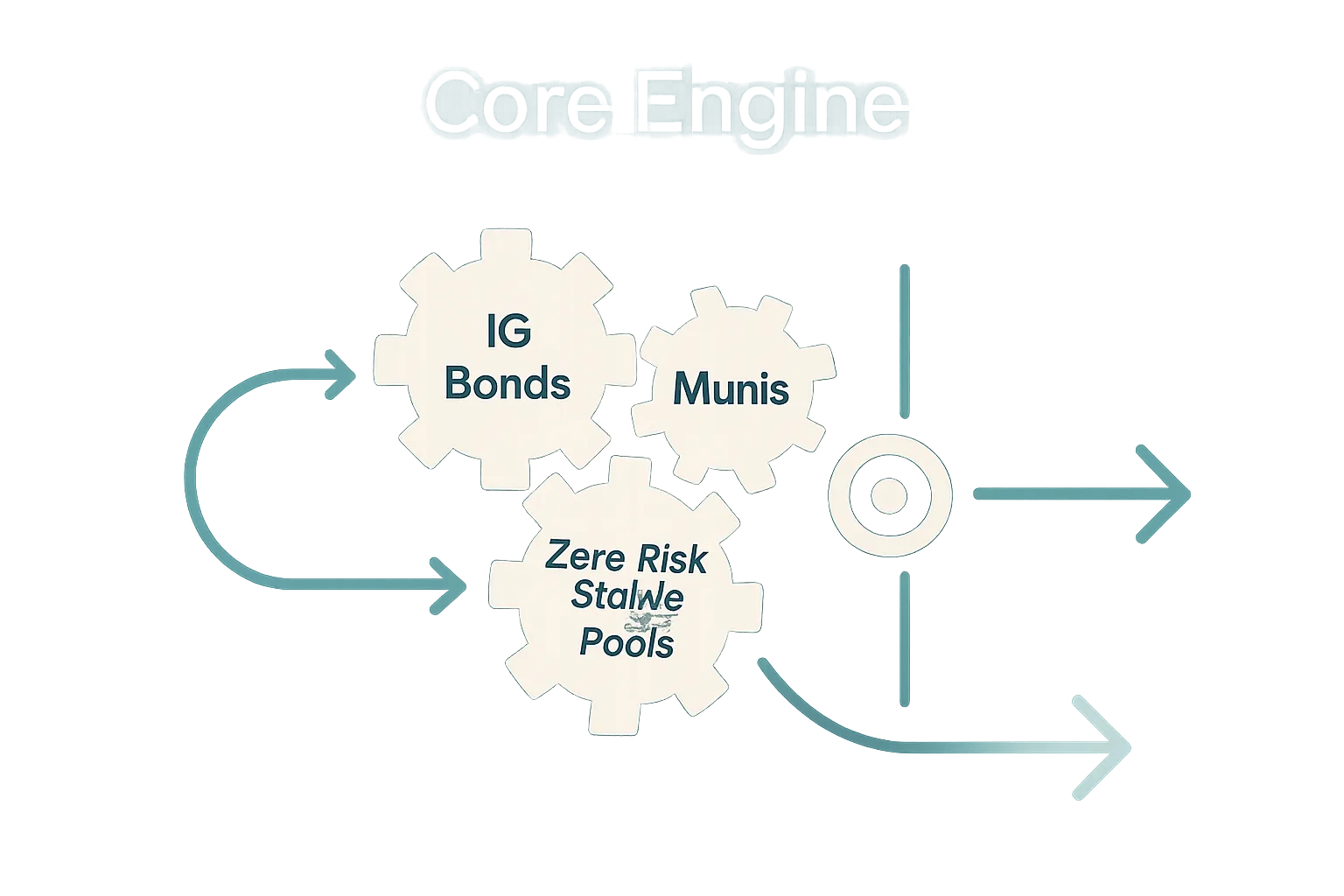

Yield core: Diversified, high-grade income to keep compounding through market drama. Use traditional IG bonds/munis or DeFi zero-risk stable pools to maintain principal and clip steady coupons/fees.

Risk budget: A pre-sized sandbox for big investments (venture, crypto, real estate). Wins compound the plan; a miss can’t nuke it.

Rules of engagement (non-negotiables)

No big bets until cash buffer and core are funded.

Position sizing: 0.5–2.0% per risk asset; max 10% aggregate per theme until proven.

Rebalancing cadence: quarterly or when bands breach (±20% drift of sleeve weights).

Drawdown guardrails: halt new risk allocations if portfolio max drawdown exceeds your preset threshold (e.g., 12–15%); resume only after recovery to plan bands.

3-Layer Foundation Blueprint

Layer | Purpose | Target Size (rule of thumb) | Example Assets | Rebalancing Rule |

|---|---|---|---|---|

Cash Buffer | Eliminate panic selling and bill stress | 3–12 months essential expenses | High-yield savings, T‑bills, stablecoin cash rails | Refill first when < target; no drawdowns for risk |

Yield Core | Stable, high-quality income that compounds | 70–90% of investable portfolio | IG bonds/munis, laddered Treasuries, FundNest Zero Risk vaults | Quarterly or ±20% band around sleeve weights |

Risk Budget | Pre-sized sandbox for big investments | 10–30% of investable portfolio | StartupNest ventures, BTC/ETH, real estate syndicates | Trim to caps; stop new adds beyond guardrails |

Quick start checklist

Know your monthly burn; set a 3–12 month cash buffer target.

Select core sleeve(s) mapped to risk tolerance and time horizon (e.g., IG muni ladder plus FundNest Zero Risk).

Write down your risk budget percentage and per-position caps (0.5–2.0%), plus your drawdown stop rules.

Start your foundation at https://zemyth.app.

Step 1 - Activate Excess Cash (Without Getting Burned)

Size the buffer (3–12 months)

3–6 months: dual-income, stable jobs.

6–9 months: single income or variable income.

9–12 months: founders, contractors, early retirees, caregivers.

Park it smarter (minimize reinvestment risk)

Short-duration IG vehicles; laddered T-bills; ultra-short IG funds.

DeFi equivalent: zero-risk stable pools with minimal IL and transparent fees (e.g., FundNest Zero Risk vaults targeting ~7% APY ranges; no leverage).

"In the 12 months after the first Fed rate cut of an easing cycle, 3‑month T‑bill yields fell by an average ~6.11%." - Source

Don’t let cash drift too high

The quiet risk is erosion from inflation and falling short rates after rate cuts. Foundation investing keeps your investment of money productive so your fund at work doesn’t stall.

Practical moves this month

Pick a target dollar buffer; automate transfers until filled.

Ladder maturities 1–6 months or allocate to zero-risk stable pools; calendar roll dates.

Keep emergency access frictionless (same-day liquidity where possible).

Cash Buffer Sizing & Parking Options

Profile Type | Buffer Target | Primary Parking | Liquidity (days) | Reinvestment Risk | Notes |

|---|---|---|---|---|---|

Dual-income, stable jobs | 3–6 months | HY savings + 1–6M T‑bill ladder | 0–1 | Medium | Auto-refill from paycheck; roll ladder monthly |

Single or variable income | 6–9 months | 1–6M T‑bill ladder + ultra‑short IG fund | 0–2 | Low–Medium | Stagger maturities to smooth resets |

Founders/contractors/caregivers | 9–12 months | 50% HY savings, 50% laddered T‑bills or Zero Risk vaults | 0–1 | Low | Preserve runway; keep 1–2 months in instant cash |

DeFi‑savvy, conservative | 6–12 months | FundNest Zero Risk (USDC/USDT) + small instant‑cash sleeve | 0–1 | Low | No leverage; minimal IL; transparent fees |

High‑tax bracket, HNW | 6–12 months | Short‑duration IG/muni MM + T‑bill ladder | 0–2 | Low–Medium | Optimize after‑tax yield; prefer high‑grade exposure |

CTA: Keep your base tight so big investments stay optional, not existential. Start at https://zemyth.app.

Step 2 - Build a Yield Core That Works While You Sleep

Purpose of the core

Provide steady income, ballast, and compounding irrespective of market hype.

Keep your investment of money productive so your fund at work doesn’t depend on timing big investments.

What belongs in the core

Traditional:

Investment-grade (IG) bonds, short-to-intermediate duration.

High-quality municipal bonds (tax-advantaged for eligible investors).

Diversified ultra-short IG for liquidity with less volatility.

DeFi:

Curated, low-volatility liquidity pools such as FundNest Zero Risk vaults (stable/stable).

As risk appetite allows, graduate selectively into Low/Medium tiers with guardrails.

Positioning in a rate-cut cycle

Extend duration modestly from ultra-short into short/intermediate IG as yields start to fall to reduce reinvestment risk.

Prefer quality and broad diversification; avoid unnecessary credit tail-risk and exotic structures.

Reinvest coupons/fees promptly to maintain compounding as rates drift lower.

Make your fund at work (automation)

Auto-compound yields and set a quarterly rebalance to keep sleeve weights aligned.

In taxable accounts, harvest losses when appropriate to improve after-tax returns.

Use tax-advantaged wrappers where eligible (IRAs, HSAs, 401(k)s) for interest-heavy sleeves.

Zemyth boosts (optional, advanced)

Lock ZEM (veZEM) to amplify FundNest yields across Zero Risk and future tiers.

Hold ZEM for fee discounts and priority access, letting your core earn more without changing risk.

Keep core allocations rule-based; use boosts as enhancers, not excuses to overreach.

TL;DR: Your yield core is the engine - quality income, modest duration, automated compounding. Let it work while you sleep so you can take smarter, sized shots elsewhere.

Start your foundation at https://zemyth.app.

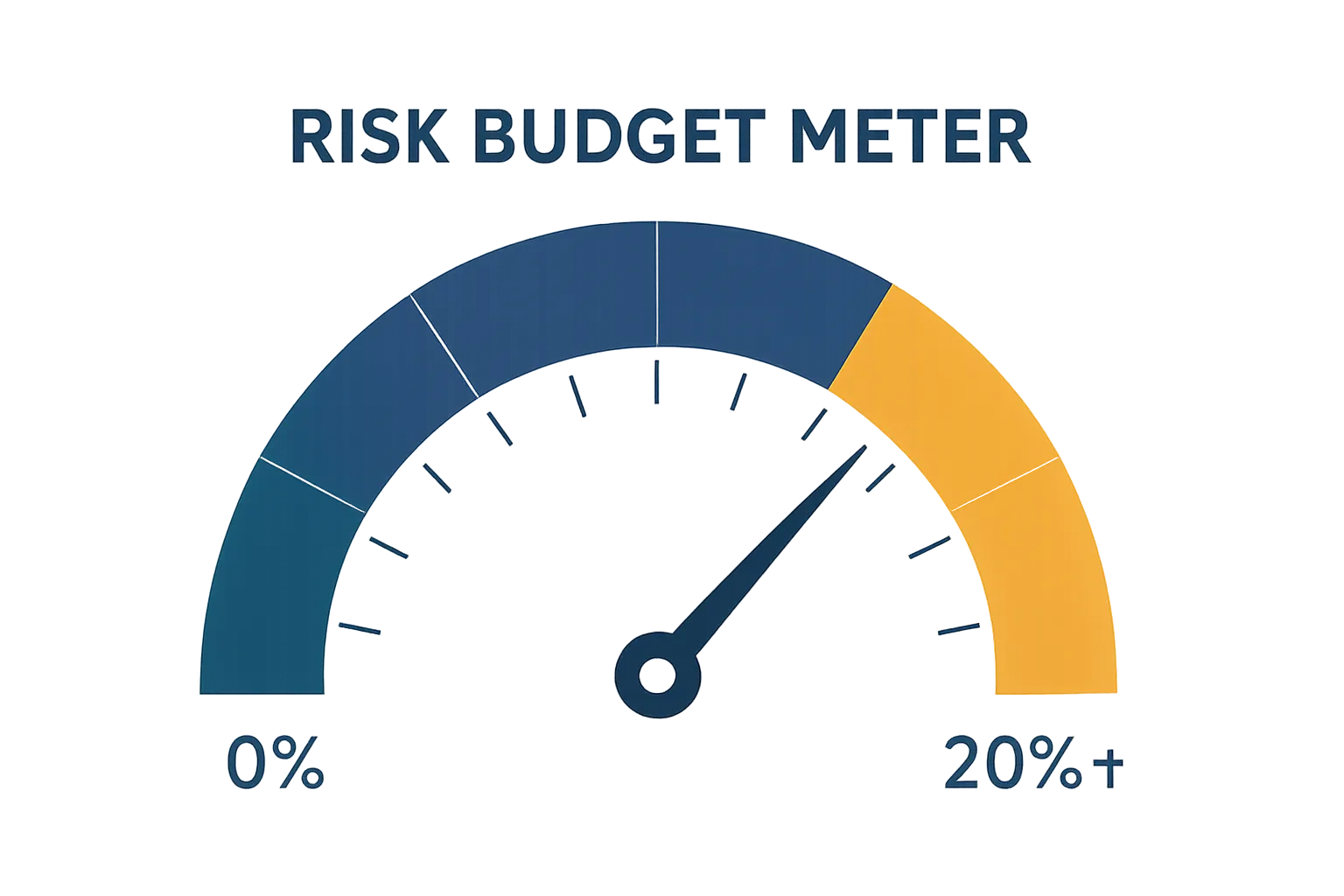

Step 3 - Define Your Risk Budget Before Big Investments

Why a risk budget

Big investments can pay off - but only when pre-sized so one miss won’t wreck your plan.

A risk budget turns excitement into rules: how much total, how much per position, and when you’re done adding.

Sizing rules (examples to tailor)

Total risk sleeve: 10–30% of portfolio (age, income stability, goals).

Per-position: 0.5–2.0%; max theme: 10% until de-risked by realized gains.

Stops and thesis rules:

Define a stop-loss (price-based) or invalidation (fundamental/on-chain) before entry.

Time-box reviews (e.g., 90 days): if catalysts slip twice, trim or exit.

Workflows that prevent blow-ups

Pre-trade checklist: thesis, catalysts, size, entry/exit levels, time limit, risk/reward.

Post-trade journal: what changed, scenario outcomes, hold/trim/exit decision.

Applying this to Zemyth

Use StartupNest’s milestone-gated projects: escrow + investor voting limit downside paths and improve capital discipline.

Stake Investment NFTs with ZEM to boost upside - without upsizing beyond your risk budget.

Keep risk sleeve separate from core; rebalance back to targets quarterly or at bands.

Start your foundation at https://zemyth.app.

Rate Cuts, Scarcer Yield: How to Reposition the Core (Foundation Investing in Practice)

What falling rates mean for the core

Pros: As rates fall, high-quality bonds with duration can see price gains - your core can pick up total return.

Cons: Cash-like instruments reset lower; reinvestment risk rises as coupons and money market yields slip.

Tactics to consider

Barbell positioning

Liquidity sleeve: keep an ultra-short/laddered segment for near-term needs and rebalancing ammo.

Intermediate IG sleeve: add measured duration (e.g., 3–7 years) for carry + potential price tailwind.

Munis for tax-equivalent yield

Favor high-quality, intermediate muni exposure if you’re in a higher tax bracket; keep an eye on duration and supply dynamics.

Rebalance into strength

Trim winners back to target weights after rallies; redeploy into underweights instead of reaching for yield in low-quality credit late cycle.

Credit discipline

Maintain broad diversification; avoid thin, complex structures and high-yield drift just to “replace” lost cash yield.

DeFi corollary (FundNest tiers)

Keep cash-like exposure in Zero Risk stable/stable pools for low volatility and transparent fees.

Graduate selectively into Low/Medium tiers only as risk tolerance allows; size within your risk budget.

Use veZEM boosts to enhance APY rather than adding credit risk - optimize the core without compromising quality.

Guardrails

Preserve the cash buffer; never backfill it with risk assets.

Write bands (e.g., ±20% of sleeve weights) and rebalance mechanically, not emotionally.

Define a maximum portfolio drawdown threshold that pauses new risk allocations until you’re back within plan.

TL;DR: In a rate-cut cycle, let foundation investing do the work - barbell liquidity and intermediate quality, leverage munis where tax-advantaged, and keep DeFi exposure in Zero Risk unless your plan justifies more. Rebalance with rules, not vibes.

Start your foundation at https://zemyth.app.

How to Put Your Foundation to Work on Zemyth (Practical Walkthrough)

1) On-ramp and safety basics

Connect a Solana wallet (Phantom or Solflare). On-ramp USDC/USDT via reputable bridges/exchanges.

Enable 2FA on exchange accounts; prefer a hardware wallet for larger balances; keep recovery phrases offline.

2) Fund the layers

Cash buffer: Allocate to FundNest Zero Risk vaults for stable, low-volatility yield with same-day/next-day access.

Yield core: Add Low/Medium tier exposure judiciously (per your policy statement); enable auto-compound and track APY.

Risk budget: Pre-set a % allocation (e.g., 10–30%) and per-position caps (0.5–2.0%); document your guardrails.

3) Explore milestone-gated venture (optional risk sleeve)

Review StartupNest projects: read milestones, escrow terms, timelines, disclosures, and tokenomics.

Size positions within your risk budget; mint Investment NFTs and consider ZEM staking boosts prudently.

Vote on milestones; use the escrow and governance process to manage downside paths.

4) Automate and review

Set a quarterly rebalance reminder; rebalance back to target sleeves and bands mechanically.

Track drawdowns and risk budget utilization; pause new risk adds if you breach your max drawdown rule.

Use ZEM for fee discounts, priority access to deals, and FundNest yield boosts (veZEM) instead of reaching for lower-quality yield.

Example foundation

$100k portfolio (illustrative):

$30k Cash Buffer: FundNest Zero Risk (stable/stable; same-day access).

$55k Yield Core: short/intermediate IG exposure plus Zero/Low Risk vaults (auto-compound on).

$15k Risk Budget: StartupNest positions (diversified across 3–6 projects) and other satellites sized 0.5–2.0% each.

Adjust ranges to your risk tolerance, tax profile, and time horizon.

"Across multiple periods, portfolios with a passive core and active satellites delivered higher risk-adjusted returns (higher Sharpe and Sortino ratios) than other combinations." - Source

Start your foundation at https://zemyth.app.

Pitfalls to Avoid and Quick FAQs

Common mistakes

Skipping the cash buffer, then panic-selling during volatility.

Overconcentrating big investments (position size creep beyond 2% per position or 10% per theme).

Reaching for yield with low-quality credit late in the cycle.

No rebalancing cadence; letting winners/losers distort the plan.

Ignoring taxes and account location (misplacing interest-heavy assets in taxable accounts).

Treating the risk sleeve like the core; foundation investing means the core stays boring and reliable.

Letting cash drift too high after rate cuts - your investment of money should keep your fund at work.

FAQs

How big should my core be?

70–90% for most investors, tuned by time horizon, income stability, and risk tolerance.

How often should I rebalance?

Quarterly or when bands breach (e.g., ±20% of sleeve weights), whichever comes first.

Can I use leverage?

Foundation-first says avoid portfolio-level leverage. If you must, limit it to the risk sleeve, size conservatively, and define hard stops.

What if I still have high-interest debt?

Kill that first. Then build the foundation (cash buffer → yield core → risk budget).

Is FundNest “risk-free”?

No investment is risk-free. Zero Risk aims minimal volatility and no leverage, but still has smart-contract and market risks; size accordingly.

How big should my risk budget be?

Typically 10–30% of portfolio. Per-position caps of 0.5–2.0%, with a max of ~10% per theme until de-risked by realized gains.

What’s the right mix in a rate-cut cycle?

Keep liquidity in ultra-short, add measured intermediate IG for duration tailwind, and avoid low-quality reach. In DeFi, stay in Zero Risk unless your policy supports stepping into Low/Medium tiers.

How do I prevent “big investment” blow-ups?

Use a pre-trade checklist (thesis, catalysts, size, exit, time limit) and a post-trade journal. Follow rules, not vibes.

Start your foundation at https://zemyth.app.

Conclusion: Build Your Foundation Today with Zemyth

Bring it home

Foundation investing is how you keep compounding through any cycle - cash buffer for calm, yield core for steady growth, risk budget for disciplined upside.

Don’t chase big investments without a base. Make your fund at work every day, then scale into higher-opportunity bets. Your investment of money should always serve the plan, not threaten it.

Next step

Put the blueprint to work now: allocate your three layers, automate rebalancing, and size your risk - before the next big swing.

CTA

Start your foundation with Zemyth: milestone-gated venture, curated yield vaults, and revenue-linked tokenomics that reward disciplined investors.

Build today at https://zemyth.app

Ready to build your foundation and compound on autopilot? Start now at https://zemyth.app