TL;DR: English Funds Explained - the fastest ways to invest money into markets (UK)

What you’ll learn in minutes

The UK’s main account wrappers to invest through: ISAs (Cash, Stocks & Shares, Lifetime, Innovative Finance) and pensions (SIPPs)

How ETFs work, why they’re popular, and how to buy them inside an ISA/SIPP

Smart cash parking (money market funds, short gilts) and the latest HMRC talk on “cash‑like” funds in ISAs

Crypto exposure options for UK investors and how to keep risk in check

"Global ETF assets totaled about US$14.85 trillion by end‑2024." - Source

Quick definitions (for new investors)

ISA (Individual Savings Account): UK tax wrapper; Stocks & Shares ISAs let you invest money into funds/ETFs/shares with tax‑free growth and income

ETF (Exchange‑Traded Fund): a basket of assets you buy/sell like a share; most track an index at low cost

ETP/ETN (incl. some crypto products): exchange‑traded notes/products that track a single asset or strategy; eligibility in ISAs varies

SIPP: Self‑Invested Personal Pension; tax relief on contributions; long‑term retirement wrapper

Note on cash‑like funds: HMRC has floated tests for “cash‑like” holdings in Stocks & Shares ISAs (e.g., money market funds/very short‑dated bonds). It’s under consultation; check rules before 2027 changes and stay within guidance when you invest through a Stocks & Shares ISA.

SEO intent anchors

English funds and the UK channels you can invest through

Where to invest money in the UK today (wrappers + diversified products)

How to put money into markets in a tax‑smart, low‑cost way

Ready to put your money into markets with smart, diversified building blocks? Explore Zemyth to park cash for yield (FundNest), back milestone‑gated ventures (StartupNest), and boost outcomes with ZEM. Start here: https://zemyth.app

ISAs decoded: the UK tax wrappers you invest through (and how the rules may change)

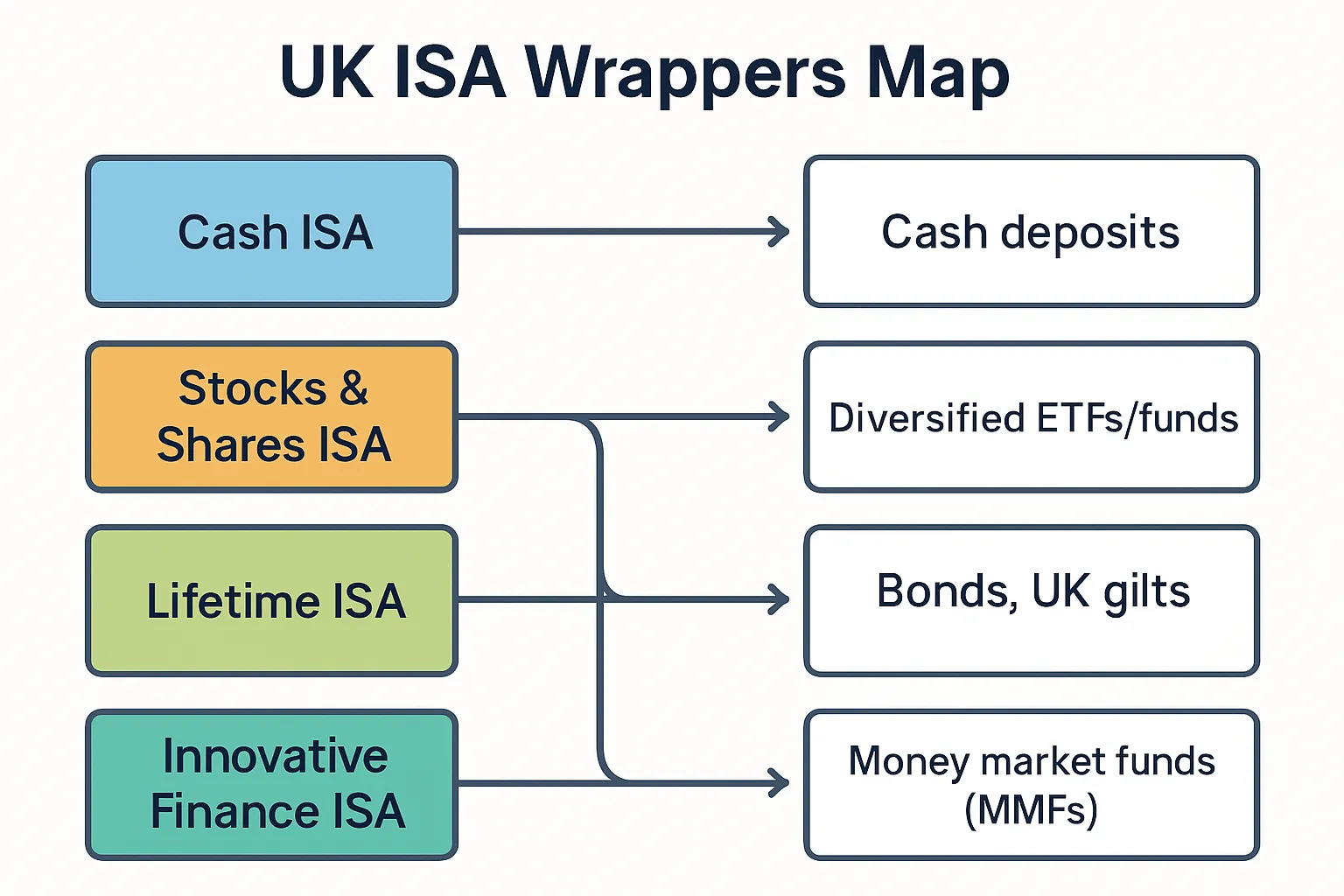

ISA types at a glance

Cash ISA

What it’s for: Short‑term goals, emergency funds, and certainty. Typically easy‑access or fixed‑term savings.

Who it suits: Conservative savers who want FSCS‑protected cash and easy planning.

Stocks & Shares ISA

What it’s for: Long‑term growth using diversified ETFs, index funds, bonds, or shares; a common way to invest money in the UK markets.

Who it suits: Investors with 5+ year horizons who want to put money into diversified assets and keep returns tax‑free.

Lifetime ISA (LISA)

What it’s for: First home (up to £450k) or retirement after age 60, with a 25% government bonus on contributions.

Who it suits: 18–39 year‑olds aiming for a first home or retirement bridge. Contribute up to 50 each tax year and “invest through” cash or stocks.

Innovative Finance ISA (IFISA)

What it’s for: Peer‑to‑peer lending and related products; higher potential yield with higher credit/liquidity risk.

Who it suits: Experienced investors who accept the risks of P2P platforms and want income beyond traditional bonds.

Allowances, withdrawals, and portability

Current allowance: Up to £20,000 per tax year across your adult ISAs (Cash, Stocks & Shares, IFISA, and LISA counts toward this via its £4,000 cap).

Withdrawals: Cash ISAs offer instant access (if easy‑access). Stocks & Shares ISAs can be withdrawn anytime, but investment values fluctuate and settle on T+ days. LISA withdrawals before age 60 and not for a first home usually incur a 25% penalty.

Portability: You can transfer ISAs between providers (and between types, subject to rules) without losing tax status. Use official transfer forms - don’t withdraw to your bank first.

Junior ISA note: Separate allowance for under‑18s; not part of your £20,000 adult cap.

The 80/20 of choosing the right ISA

Short‑term goals (0–3 years): Cash ISA or short‑duration funds (e.g., short gilts, money market funds via a Stocks & Shares ISA). Pros: stability and liquidity. Cons: may lag inflation; cash‑like instruments inside S&S ISAs are under review (see below).

Long‑term growth (5+ years): Stocks & Shares ISA with diversified ETFs/funds. Simple core: global equity ETF + bond ETF. This is a low‑cost way to invest money in markets and stay tax‑efficient.

First‑home/retirement bridge: Lifetime ISA basics

Contribute up to £4,000/yr; 25% government bonus added.

First home: property up to £450,000 after 12 months, or keep for retirement (withdraw penalty‑free at 60).

Watch the 25% early‑withdrawal penalty for non‑qualifying uses.

“Cash‑like” instruments under review (what to watch)

"HMRC has floated tests to determine whether holdings in Stocks & Shares ISAs are ‘cash‑like’ to prevent circumvention of lower Cash ISA limits - raising industry concern that money market funds or very short‑dated bond funds could be restricted." - Source

What it could mean

Money market funds/ETFs and short‑dated bond funds might face eligibility tests in Stocks & Shares ISAs.

Platforms may need to distinguish cash from contributions vs. sale proceeds and apply potential charges on cash interest.

For investors: avoid “gaming” allowances; keep an operational cash buffer but consider deploying excess into diversified funds where appropriate; check provider guidance as HMRC clarifies rules.

Practical approach while awaiting clarity

Maintain a small trading cash buffer; deploy the rest into your chosen diversified ETF/fund mix.

If you use cash‑like instruments (MMFs, short gilts) in a S&S ISA, monitor HMRC updates and your platform’s policy.

Consider multi‑asset funds that internally manage liquidity within a compliant structure.

ISA types and allowances (quick reference)

ISA Type | Typical Use Case | Annual Allowance | Tax Treatment | Access Rules | Notable Caveats |

|---|---|---|---|---|---|

Cash ISA | Short‑term savings, emergency fund | Part of overall £20,000 adult allowance (current rules) | Interest is tax‑free | Easy access or fixed‑term; check withdrawal terms/penalties | Proposed policy changes may reduce Cash ISA allowance for some from April 2027 (under consultation) |

Stocks & Shares ISA | Long‑term growth via ETFs, funds, bonds, shares | Part of overall £20,000 adult allowance (current rules) | Capital gains and dividends/interest tax‑free inside wrapper | Withdraw anytime; value fluctuates; settlement times apply | HMRC considering ‘cash‑like’ tests for holdings (e.g., MMFs/very short bonds) within S&S ISAs |

Lifetime ISA (LISA) | First home (≤£450k) or retirement after 60 | £4,000/yr max (counts toward overall £20,000) + 25% gov’t bonus | Growth and bonus tax‑free; penalty for non‑qualifying withdrawals | Withdraw penalty‑free for first home (after 12 months) or after age 60 | Must open 18–39; contributions until 50; 25% penalty on non‑qualifying withdrawals |

Innovative Finance ISA (IFISA) | P2P lending/related instruments for income | Part of overall £20,000 adult allowance (current rules) | Interest tax‑free | Liquidity depends on platform/loan market | Higher risk (credit/liquidity); platform failures possible; eligibility varies by provider |

Update notes

Figures reflect current UK ISA rules. Government consultations may change specific allowances (e.g., Cash ISA) and define “cash‑like” tests inside S&S ISAs from future tax years - check HMRC updates each April.

Action plan

Decide your goal and time horizon (months vs years).

Pick the ISA type that fits: Cash (short‑term), Stocks & Shares (long‑term), Lifetime (first home/retirement boost), IFISA (experienced income seekers).

Automate contributions (monthly direct debit) to keep money flowing into markets you invest through.

Review annually: rebalance ETFs/funds, top up toward your allowance, and verify any rule changes.

Watch: ETFs & ISAs Explained (UK) in 10 Minutes

Want a streamlined way to route money into diversified products and keep yield working? Explore Zemyth’s ecosystem (StartupNest, FundNest, ZEM) and start compounding intelligently: https://zemyth.app

ETFs explained: what they are, how they work, and how to buy them (better than picking single stocks)

The ETF in one sentence

A low‑cost basket of assets that trades like a share

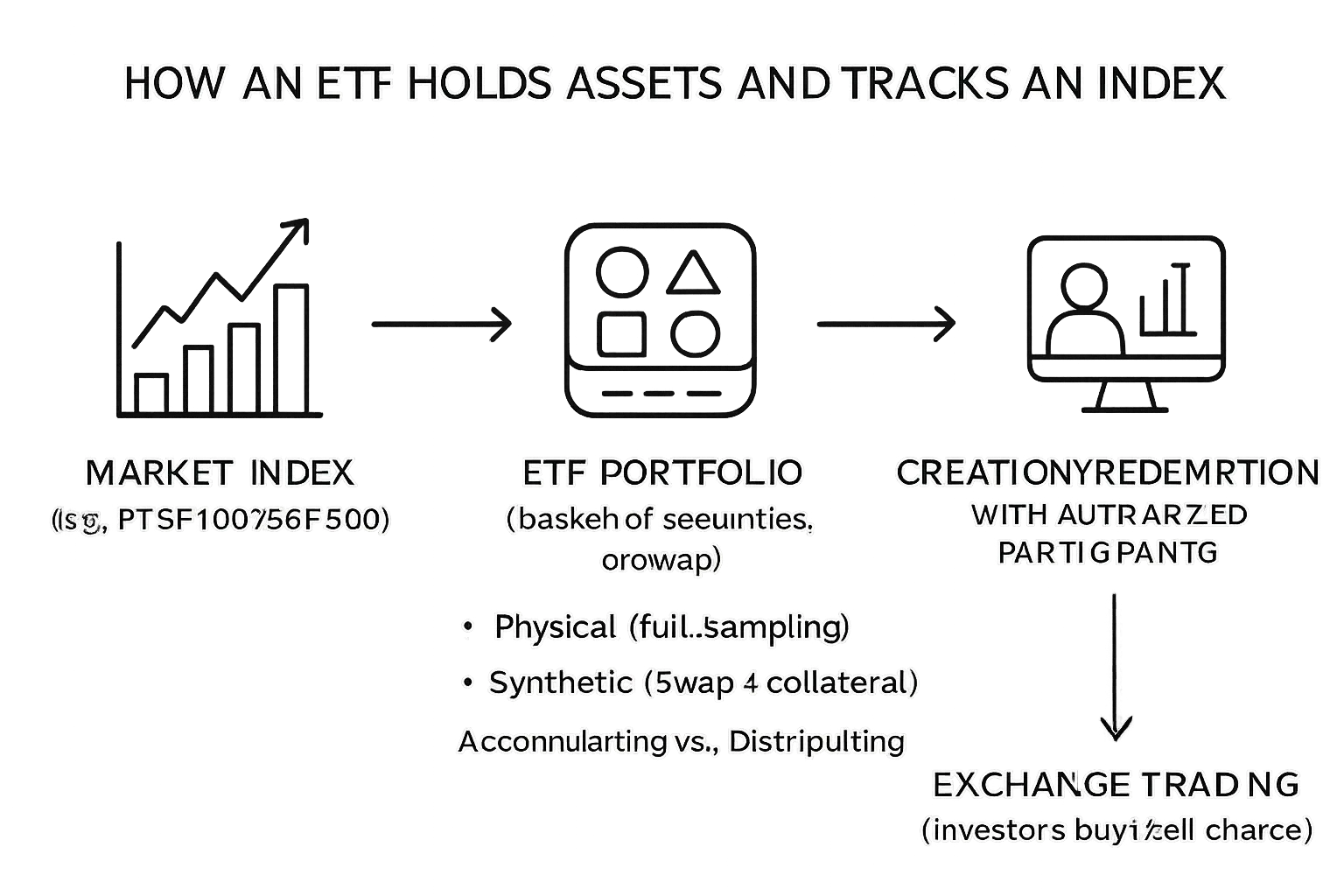

Replication methods and why they matter

Physical replication

Full replication: the ETF buys every security in the index, in index weights.

Sampling: the ETF buys a representative subset when the index is too large or illiquid to replicate fully.

Synthetic (swap‑based) replication

The ETF enters a swap with a counterparty (typically a bank) to deliver the index return, often holding collateral to mitigate counterparty risk.

Why it matters: replication affects tracking difference, costs, and specific risks (e.g., counterparty risk in synthetic ETFs). UCITS rules cap counterparty exposure and set collateral standards.

Accumulating vs. Distributing ETFs

Accumulating (Acc): Dividends/interest are automatically reinvested, aiding compounding without manual reinvestment.

Distributing (Dist): Cash income is paid out to your account - useful for income targets or rebalancing manually.

Tax angle: In an ISA or SIPP, ongoing income and gains are sheltered. Outside wrappers, distributions may be taxable.

Costs to watch

OCF/TER: Ongoing fund charge - what the ETF provider takes annually.

Bid‑ask spread: The difference between buy/sell prices on exchange; tighter is cheaper.

Tracking difference: Actual ETF return vs. index after fees, taxes, and frictions.

FX conversion: Buying a USD‑traded ETF from GBP may incur currency conversion costs.

Platform/dealing fees: Broker charges for holding and trading.

Buy mechanics

Ticker and exchange: Identify the exact ticker and listing (e.g., London Stock Exchange GBP line).

Trading hours: Liquidity is best when home and underlying markets overlap.

Order types: Market orders fill instantly at the best available price; limit orders set your max/min price.

Fractional dealing: Some platforms allow buying fractional ETF shares.

Settlement: Trades typically settle T+2; dividends follow ETF distribution schedules.

Quality checks before you buy

Size/liquidity: Larger AUM and higher daily volume generally mean tighter spreads.

Replication: Physical full vs. sampling vs. synthetic - understand pros/cons for your index.

Domicile/regime: UCITS ETFs have robust diversification, liquidity, and counterparty rules.

Index methodology: Know what’s inside - market‑cap vs. equal‑weight, inclusion rules, rebalancing.

Securities lending: Can reduce costs but introduces counterparty/operational risk; check collateral policies and revenue‑sharing.

Common mistakes to avoid

Overlapping ETFs: Multiple broad funds can duplicate holdings; build a core first, then satellite.

Ignoring total cost of ownership: OCF + spread + tracking difference + platform fees.

Chasing themes: Without a core, high‑beta or niche themes can dominate risk and whipsaw returns.

Wrong trading line: Mixing up USD vs. GBP lines or non‑UCITS products not eligible for your wrapper.

ETF replication and income policies

Replication Type (Physical Full, Physical Sampling, Synthetic Swap) | Pros | Cons | Typical Use | Notes on Risk |

|---|---|---|---|---|

Physical Full | Very close index tracking; transparent holdings | Harder for very large/illiquid indices; potentially higher trading costs | Large, liquid indices (e.g., FTSE 100, S&P 500) | Market risk only; operational trading costs can impact tracking |

Physical Sampling | Lower costs vs. full; efficient for broad/illiquid universes | Slightly higher tracking error; less transparency than full | Very broad or less liquid indices (EM, small caps) | Sampling risk; still no counterparty swap risk |

Synthetic Swap | Precise tracking for hard‑to‑access markets; potential tax efficiencies | Counterparty risk; complexity; collateral quality matters | Commodities, niche or constrained markets | UCITS caps exposure; collateral and daily mark‑to‑market mitigate risk |

Income Policy (Acc vs. Dist) | Who it suits | Pros | Cons |

|---|---|---|---|

Accumulating (Acc) | Long‑term compounding inside ISA/SIPP | Auto‑reinvests income; no manual cash drag | No cash payouts for income needs |

Distributing (Dist) | Income seekers; drawdown portfolios | Regular cash flow; helps fund spending | Potential reinvestment drag if not needed immediately |

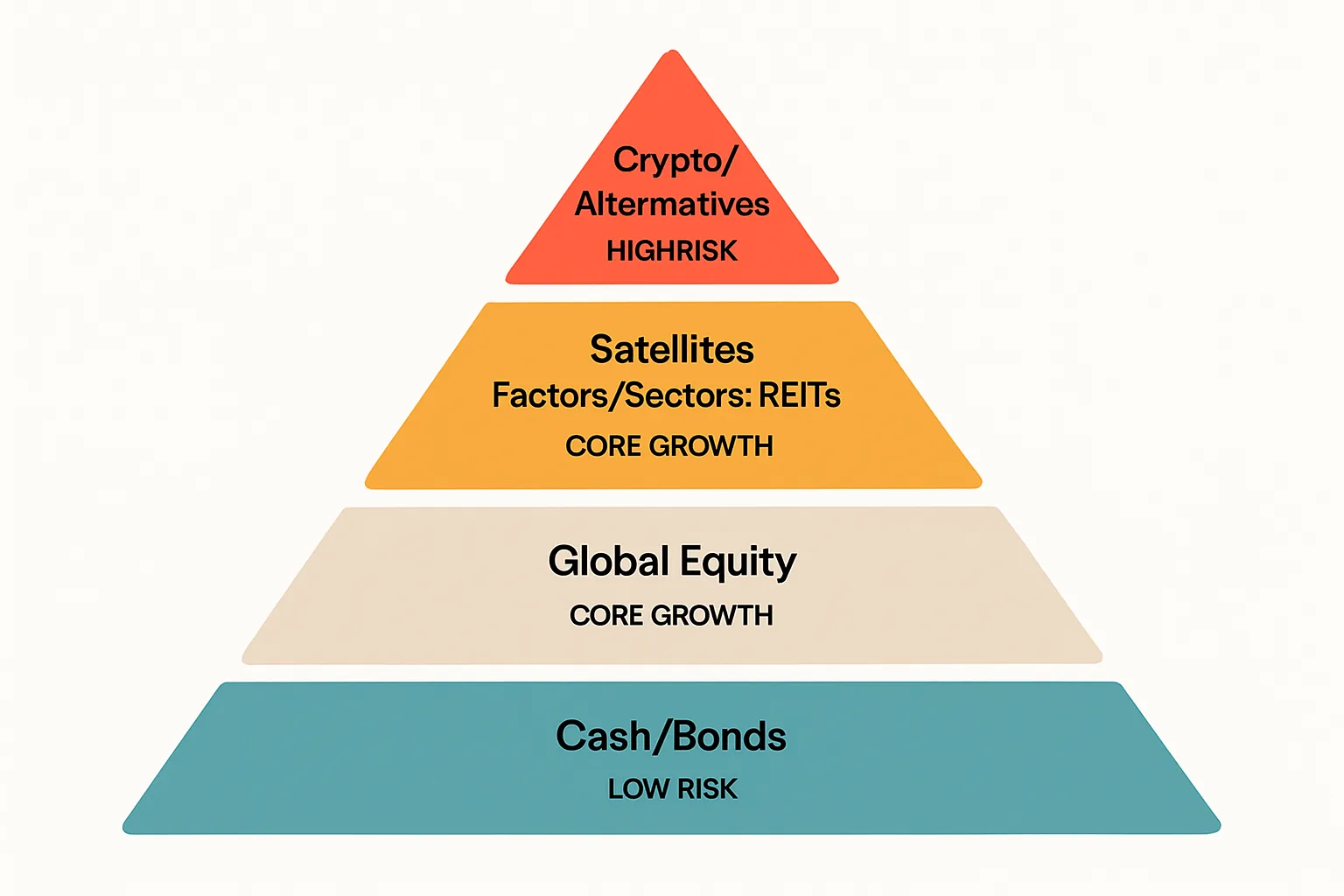

Build a diversified ‘core and satellite’ portfolio to invest money into with confidence

Core building blocks

Global equity ETF: One broad fund covering developed and emerging markets (market‑cap weighted) to anchor growth.

Investment‑grade bond/gilt exposure: GBP hedged global bonds or UK gilts to dampen volatility and provide ballast.

Cash buffer: 3–6 months of essentials outside markets; inside your portfolio, hold a small operational cash slice for rebalancing and fees.

Satellites (measured bets)

Factors: Value, quality, and small‑cap tilts that historically diversify drivers of return.

Sectors/themes: Healthcare, tech, clean energy - keep sizing modest and time‑horizons long.

Commodities/REITs: Inflation‑sensitive diversifiers; consider broad commodity or REIT exposure.

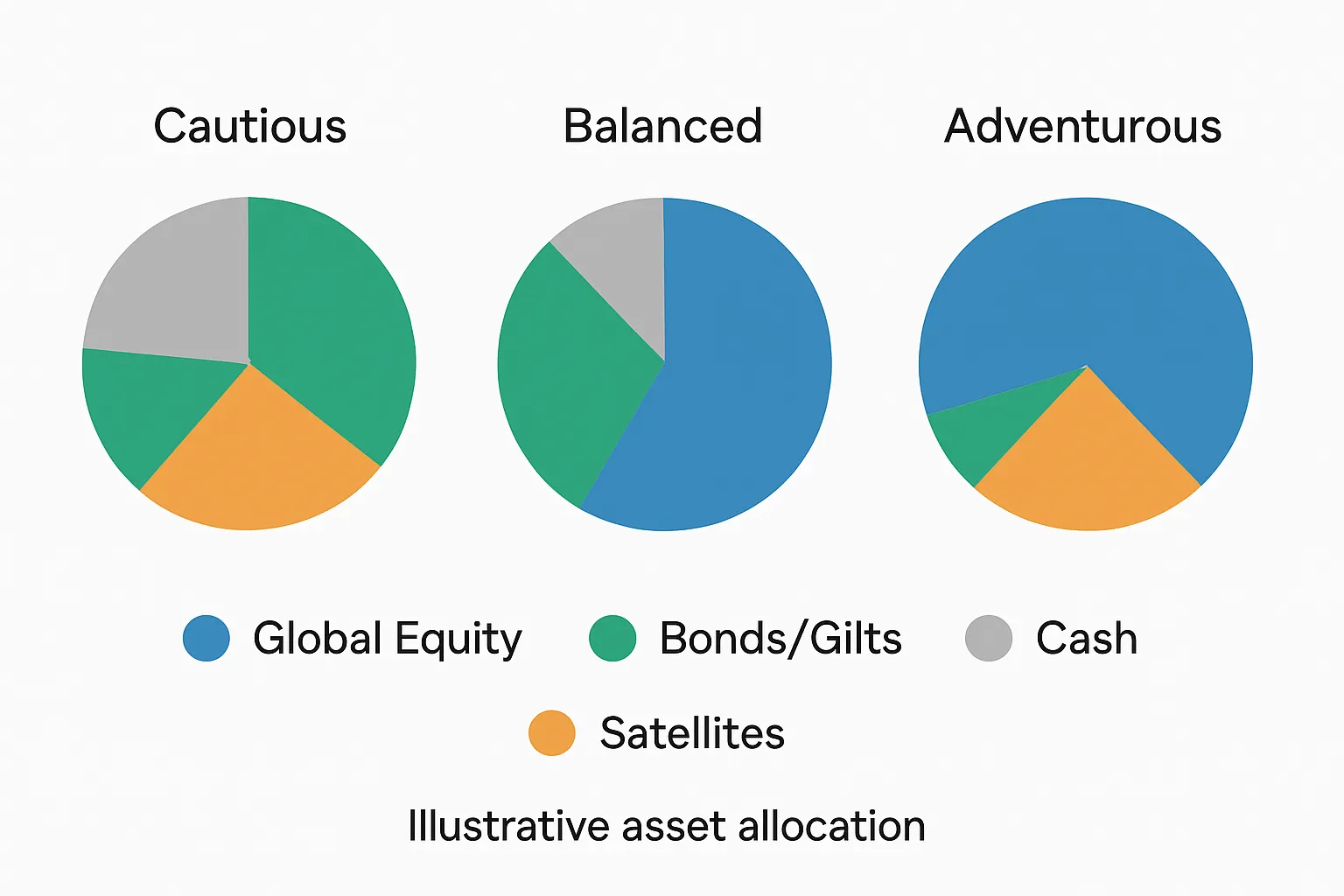

Model allocations by risk level (illustrative, not advice)

Cautious

25–35% Global equity

55–65% Bonds/gilts

5–10% Cash

Satellites: up to 10–15% within the equity slice (e.g., quality factor, REITs)

Balanced

50–60% Global equity

30–40% Bonds/gilts

5–10% Cash

Satellites: up to 20% of total portfolio (e.g., value/small blend, commodities)

Adventurous

75–85% Global equity

10–20% Bonds/gilts

0–5% Cash

Satellites: up to 25–30% of total (e.g., sector tilts, EM small caps) while keeping a broad core

Rebalancing and maintenance

Set bands: Rebalance when an asset drifts ±5 percentage points from target (or semi‑annually).

Harvest gains/losses: Trim winners, top up laggards; in taxable accounts, use allowance‑aware tactics.

Keep costs down: Prefer low OCF ETFs, avoid over‑trading, and use limit orders to control spreads.

One‑fund options

Multi‑asset index funds or risk‑targeted ETFs: Single‑ticket solutions that blend global equities and bonds, auto‑rebalance, and often come with low OCFs - ideal when you want to invest through a simple, set‑and‑review approach.

Want a smarter base plus curated yield? Use Zemyth’s FundNest for tiered yield pools and pair your long‑term core with StartupNest venture exposure - then boost with ZEM. Start here: https://zemyth.app

Crypto and digital assets (UK): sensible ways to put a small slice of money into high‑risk growth

The UK context

Regulation: The FCA requires prominent risk warnings; most crypto assets are unregulated and not FSCS‑protected.

Volatility: Double‑digit daily moves are common; plan for sharp drawdowns and long recoveries.

Portfolio role: If used at all, crypto is a satellite allocation in a broader plan - not a core holding.

Routes to exposure

Exchange‑traded crypto ETPs/ETNs

Some UK platforms allow professional access to crypto ETNs; retail access and ISA/SIPP eligibility vary - check broker and wrapper rules carefully.

Direct spot purchases

Use reputable, UK‑compliant platforms with strong KYC/AML; prioritise secure custody (hardware wallets, multi‑sig), and enable 2FA.

Yield via DeFi (advanced)

Potential returns from lending/liquidity, but risks include smart‑contract exploits, oracle/counterparty failure, and governance attacks. Treat as experimental.

Position sizing & risk controls

Keep it small: Many investors cap total crypto exposure at <1–5% of portfolio value.

Rebalance: Set rules (e.g., quarterly) to trim after big rallies or top up within a strict ceiling.

Taxes: UK CGT applies to disposals; staking/yield may be taxable as income - keep records and seek tax guidance.

Where Zemyth fits in the landscape (overview, details later)

FundNest: Tiered liquidity pools targeting yield on-chain, designed for transparent, curated deployment and risk tiers.

StartupNest: Milestone‑gated, tokenised venture exposure where investment NFTs and voting provide discipline and transparency.

ZEM token: Utility and boosts across the ecosystem, aligning incentives for sophisticated users.

Plain‑English disclaimer

Crypto and digital assets are highly volatile, complex, and may be unsuitable for most investors. You can lose all invested capital. Regulatory treatment can change quickly. Only invest what you can afford to lose and ensure allocations fit your risk tolerance, time horizon, and the broader plan.

Ready to explore structured, research‑first on‑chain opportunities? Start with Zemyth: https://zemyth.app

Platforms and fees: where to open accounts and invest through (UK)

Picking your platform(s)

Account type first: Decide whether you’ll invest through a Stocks & Shares ISA (tax‑free growth/income), a SIPP (tax relief for retirement), or a General Investment Account (GIA) for overflow. For most UK investors, the ISA is the default “first stop” for putting money into markets.

FCA authorization checkpoint: Only open with FCA‑authorised firms. Search the Financial Services Register to confirm authorisation and permissions before you invest money in any platform.

Eligibility and instruments: If you plan to buy UCITS ETFs (UK/EU compliant) you’re fine on most UK brokers. US‑domiciled ETFs are usually not available to UK retail due to disclosure rules. If your plan includes bonds, MMFs, or REITs, verify instrument availability in advance.

Fee menu to compare

Platform fee: Percentage (e.g., 0.15–0.45% on assets) vs. flat (£/month). Percentage fees are often cheaper for small balances; flat fees can win as your portfolio scales. Calculate total cost at your current and target portfolio sizes.

Fund/ETF OCF (ongoing charge): The cost baked into the product (typically 0.05–0.30% for broad index ETFs; higher for niche themes/active).

Dealing commission: Some platforms are £0 on funds but charge for ETF trades; others are low fixed per trade or offer free regular investment.

FX conversion: If you buy non‑GBP lines, expect FX markup per trade or per cash conversion. Consider GBP‑traded lines where possible.

Other frictions: Withdrawal/transfer fees, in‑specie transfer charges, live pricing add‑ons, and custody fees on specific assets. Add these to your “all‑in” cost comparison.

Tip: Your real Total Cost of Ownership (TCO) = Platform fee + OCF + dealing + FX + spreads/slippage. Compare TCO, not just headline fees.

Nice‑to‑have features

Autoinvest/regular savings: Automate monthly ETF/fund purchases to keep money flowing into markets and reduce timing risk.

Fractional shares/ETFs: Handy for smaller contributions and precise rebalancing when unit prices are high.

In‑app research/screeners: Basic fund facts, KIDs/KIIDs, factor and sustainability data, and model portfolio tools.

UX and service: Reliable mobile app, quick deposits/withdrawals, ISA/SIPP transfer support, and responsive customer service.

Funding and routing money into markets

Pay yourself first: Set a standing order/direct debit the day after payday into your ISA/SIPP/GIA.

Monthly vs. lump sums: Monthly smooths volatility; lump sums reduce cash drag if you’re comfortable with market timing risk. Many split the difference (e.g., 3–6 tranches).

Avoid idle cash drag: Use regular investment features to deploy cash promptly. If you must hold cash before investing, know your platform’s interest policy and any constraints on “cash‑like” holdings inside a Stocks & Shares ISA.

When to consider multiple accounts

Cost arbitrage: Keep your long‑term ISA on a low‑cost percentage platform when small, then move to a flat‑fee platform as balances grow; keep a separate low‑cost trading app for occasional satellite positions.

Segmentation by purpose: One ISA for a long‑term, diversified core; a separate GIA for speculative trades you can switch off mentally. A SIPP with a broader fund universe if you need specialist bond or factor ETFs.

Admin clarity: Separate accounts make it easier to track strategies, rebalance, and audit fees.

TL;DR: Choose an FCA‑authorised platform that fits your wrapper (ISA/SIPP/GIA), compare the all‑in cost at your balance today and tomorrow, automate contributions, and minimise idle cash. Build a low‑cost core you can invest through, then add satellites deliberately.

Ready to turn fees saved into compounding? Pair your brokered ISA/SIPP core with Zemyth’s on‑chain yield and venture exposure for a diversified, research‑first edge: https://zemyth.app

Taxes beyond ISAs: CGT, dividends, and pensions (SIPPs) made simple

TL;DR: Outside ISAs, plan for CGT and dividend taxes; inside SIPPs, use tax relief to compound faster. Keep records, pace disposals across tax years, and mind the 30‑day share‑matching rules.

CGT and dividend basics (outside wrappers)

Capital Gains Tax (CGT)

Annual exempt amount: A small tax‑free CGT allowance applies each tax year (reduced in recent years). Plan disposals to make use of it.

Rates: For most shares/funds, gains above the allowance are taxed at your marginal CGT rate (basic‑rate band typically lower than higher/additional). Residential property can attract different rates.

Reporting triggers: You generally must report if gains exceed the annual allowance, you have CGT to pay, or your total proceeds exceed 4× the allowance in a tax year.

Pairing with a spouse/civil partner: Transfers between spouses/civil partners are typically “no gain/no loss,” letting you use two CGT allowances and optimise tax bands.

Dividends

Dividend allowance: A small tax‑free dividend allowance applies each year (cut several times recently).

Rates: Dividends above the allowance are taxed at dividend rates for your band (basic/higher/additional), which differ from income tax rates.

Practical tip: Prefer accumulating funds/ETFs inside ISAs/SIPPs for simplicity; outside wrappers, track distributions and withholdings.

SIPP fast‑track

Why SIPPs help you invest through the tax system

Up‑front relief: Personal contributions typically receive 20% relief at source; higher/additional‑rate relief may be claimable via Self Assessment.

Annual allowance: Subject to an annual cap and your UK relevant earnings; unused room may be carried forward up to three prior tax years if eligible.

Special cases: Money Purchase Annual Allowance (MPAA) can restrict future contributions after flexible access; high earners may face a tapered allowance.

Access rules

Normal minimum pension age is 55 (rising to 57 from April 2028). Withdrawals are subject to income tax beyond any tax‑free lump sum, and complex new lump‑sum limits apply after the lifetime allowance’s removal - check current HMRC guidance.

Consolidation & fee hygiene

Consider transferring old workplace/personal pensions into a single SIPP if it reduces total fees and improves fund choice.

Check exit fees, guaranteed annuity rates, protected tax‑free cash, with‑profits bonuses, and any Defined Benefit safeguards before moving.

Smart habits

Bed & ISA / Bed & SIPP

Sell a holding in a taxable account, then repurchase inside your ISA/SIPP to shelter future growth/dividends. This helps you put money into markets tax‑efficiently.

UK share‑matching caution: The 30‑day rule can affect loss claims if you repurchase the same security within 30 days (including a repurchase by you in an ISA/SIPP). If harvesting a capital loss, consider a 30‑day gap or buy a similar - but not identical - ETF to maintain exposure.

Plan across tax years

Stage disposals to use multiple years’ CGT/dividend allowances and to manage your income bands.

Use both partners’ allowances and bands where appropriate.

Keep good records

Track trade dates, quantities, prices, fees, FX rates (for overseas securities/ETFs), and all distributions. Accurate data makes CGT/dividend reporting cleaner and supports better decisions.

Always current

Tax rules change. Allowances, rates, and pension rules can be updated at each Budget. Tailor to your circumstances and seek professional advice if you’re unsure - especially before large disposals, pension crystallisation, or DB transfers.

Make your tax wrappers work harder, then amplify your plan with curated on‑chain yield and milestone‑gated venture exposure. Start with Zemyth: https://zemyth.app

Step‑by‑step: buy your first ETF in a Stocks & Shares ISA

TL;DR: Define your goal, pick a broad UCITS ETF, fund your ISA, place a limit order, then automate monthly buys and simple rebalancing. Keep total costs low, avoid overlapping funds, and stick to your plan.

1) Define the job for your money

Time horizon: 5+ years is the sweet spot for equity ETFs; shorter can use a larger bond/cash mix.

Risk level: Decide your equity/bond split (e.g., 60/40, 80/20). Higher equity = higher expected returns and deeper drawdowns.

Target allocation: Write it down. Example core: 70% global equity ETF, 25% investment‑grade bonds/gilts, 5% cash buffer. This keeps your “invest money in” plan clear before you put money into markets.

2) Pick the index, then the ETF

Choose the index first: Broad, diversified benchmarks (e.g., MSCI ACWI, FTSE All‑World, global aggregate bonds) are great “English funds” style core exposure for UK investors.

Compare ETFs tracking that index:

OCF (ongoing charge): Lower is better all else equal.

Size/liquidity: Higher AUM and trading volume generally means tighter spreads.

Replication: Physical full vs. sampling vs. synthetic - prefer physical for mainstream equity exposure; synthetic can suit niche markets.

Domicile (UCITS): Choose UCITS (typically Ireland/Luxembourg) for UK ISA/SIPP eligibility and investor protections.

Tracking difference: Check how closely the ETF matches its index after fees and frictions.

Share class: Accumulating (reinvests income) vs. Distributing (pays cash). Inside an ISA, Acc can simplify compounding; Dist can help if you want income.

Trading line: Prefer GBP listings on the London Stock Exchange to avoid unnecessary FX.

3) Place the trade

Fund your ISA: Bank transfer or direct debit to your platform’s Stocks & Shares ISA.

Find the ETF by ticker: Confirm it’s the UCITS, GBP‑traded line you intend to buy.

Order type: Use a limit order during market hours for tighter control and to avoid wide spreads (especially at the open/close).

Review costs: Platform fee, dealing commission, ETF OCF, and any FX (if applicable). Confirm before placing.

Confirm settlement: Most ETFs settle T+2; you’ll see the position in your ISA once executed.

4) Automate and maintain

Autoinvest: Set monthly contributions and regular ETF buys to reduce timing risk and keep money flowing into markets you invest through.

Rebalance: Add a calendar reminder (e.g., semi‑annual). If weights drift beyond ±5 percentage points, trim winners/top up laggards.

Dividends: For distributing ETFs, choose whether to reinvest automatically; for accumulating, the fund handles it.

Keep records: Note tickers, dates, prices, and fees for clear tracking and better decisions.

5) Avoid common mistakes

Over‑trading: A broad ETF + periodic rebalancing usually beats frequent tinkering.

ETF overlap: Two global equity ETFs often hold the same stocks - more tickers ≠ more diversification.

Ignoring total cost: OCF + spreads + platform/dealing fees + FX is your real “all‑in” cost.

Chasing themes without a core: Build the core first; keep satellites small and deliberate.

Wrong product line: Don’t accidentally buy non‑UCITS or the USD line if you intended GBP.

Market orders at thin times: Use limits during normal hours to avoid price slippage.

Idle cash drag: Deploy funds promptly or set regular investment so contributions don’t sit earning little.

Ready to turn an ISA into a long‑term compounding machine and add curated on‑chain yield or tokenised venture exposure on top? Explore Zemyth’s ecosystem and invest through a smarter, research‑first workflow: https://zemyth.app

Parking cash without falling foul of rules: money market funds, short gilts, and the new ‘cash‑like’ scrutiny

Why park cash in funds at all?

Earn yield while you wait: Money market funds (MMFs) and ultra‑short bond funds can offer competitive yields compared with many bank accounts, with same‑day or T+1/T+2 access on most platforms.

Smoother transitions: If you plan to invest money into equities or longer‑duration bonds in stages, a fund can be a holding pen that reduces idle cash drag.

Pros vs bank cash

Pros: Institutional scale, diversified holdings, daily pricing, automated reinvestment; inside an ISA/SIPP, distributions are tax‑sheltered.

Cons: Not FSCS‑protected; yields fluctuate; mark‑to‑market NAV can dip; platform trading and settlement apply.

Instruments to know

Money market funds/ETFs

What they hold: Very short‑dated, high‑quality instruments (T‑bills, gilts/bills, top‑tier commercial paper, repo).

What to check: Credit quality, weighted average maturity (WAM), liquidity buckets, OCF, historic stability. Government/treasury MMFs generally sit at the conservative end.

Ultra‑short bond funds

Aim: Keep duration and interest‑rate sensitivity low while adding a bit of credit spread. More yield potential than pure government MMFs, but with slightly higher volatility.

0–1 year gilts (and short gilt funds)

Government‑only interest‑rate exposure with minimal duration. Price can still move with rate expectations, but credit risk is extremely low.

The evolving ISA landscape

“Cash‑like” scrutiny: HMRC has consulted on tests for ‘cash‑like’ holdings inside Stocks & Shares ISAs to prevent using them as de‑facto cash accounts. Industry feedback highlights the risk that MMFs or ultra‑short/short‑dated bond funds could face restrictions or extra operational complexity.

Practical tips until rules are finalised

Keep an operational cash buffer small; don’t park large sums indefinitely in a S&S ISA just to earn interest.

If using MMFs/short gilts within a S&S ISA, monitor your platform’s updates and HMRC announcements ahead of any April rule changes.

Consider whether a Cash ISA is the more appropriate home for short‑term money you do not plan to invest through markets.

Pragmatic rules of thumb

Write a one‑line “intent note” in your IPS: “This cash is for staged entry over 3 months into [target ETF/fund].”

Set a time limit: Use schedules (e.g., monthly tranches) so parking doesn’t turn into an accidental long‑term position.

Size for purpose: Operational cash inside a portfolio is usually a few percent - enough for rebalancing and fees, not a long‑term stash.

Compare net yields: MMF/ultra‑short OCFs matter; your take‑home is gross yield minus costs.

Liquidity check: Know settlement (often T+1/T+2) and cut‑off times to avoid surprises when you rotate into target assets.

Alternatives if access changes

Cash ISA for short‑term goals: If HMRC narrows what counts as eligible inside a S&S ISA, keep near‑term funds in a Cash ISA and invest the rest through your S&S ISA as intended.

Short gilt funds (if eligible): Where MMFs face constraints, very short‑duration gilts can be a nearby substitute with transparent government exposure.

Stagger entries: Use pound‑cost averaging from bank/Cash ISA into your S&S ISA core (global equity and bond ETFs), reducing timing risk.

High‑quality notice/term accounts: For money you won’t need for a few months, notice or fixed‑term savings can complement your investment plan outside market wrappers.

Bottom line: Parking cash can be smart if it’s temporary, intentional, and compliant. Keep documentation of why the cash is there, deploy on a schedule, and stay tuned to HMRC/platform guidance. When you’re ready to put money into markets, move decisively into your core allocations.

Looking for a disciplined way to park and then deploy capital - with curated on‑chain yield and milestone‑gated venture exposure? Explore Zemyth’s FundNest and StartupNest: https://zemyth.app

Conclusion: put your money to work - and explore Zemyth for on‑chain yield and venture exposure

Quick recap

Use the right wrapper (ISA/SIPP) → build a low‑cost ETF core → add satellites carefully → park cash sensibly → review annually

Keep total cost of ownership low (platform + OCF + spreads + FX) and automate contributions so your money keeps flowing into markets

Document your plan, rebalance on a schedule, and avoid overlapping funds or theme-chasing without a core

Why Zemyth

A DeFi ecosystem designed to sit alongside your ISA/SIPP core:

FundNest: tiered liquidity pools to optimise idle capital and daily yield, so your “waiting room” cash works

StartupNest: milestone‑gated, on‑chain venture allocations via Investment NFTs with voting and token claims

ZEM tokenomics: revenue‑linked incentives, fee discounts, staking boosts, and priority access

Built for sophisticated, research‑driven investors who want curated, transparent on‑chain exposure paired with traditional ETF portfolios

CTA

Start small, stay diversified, and keep costs low. Then explore on‑chain opportunities the smart way.

Visit https://zemyth.app - Explore Zemyth’s FundNest and StartupNest to complement your core ETF portfolio with curated on‑chain yield and venture exposure.

Final note

Nothing here is investment or tax advice. Rules change, and personal circumstances differ. Consider regulated advice if unsure.