Day Investing vs Daily DCA: The quick take

If you’re weighing day investing against a daily DCA plan as your way to invest, here’s the quick take: day investing is an active, short-term, high-variance game; daily DCA is a set‑and‑stick‑to‑it daily strategy that compounds steadily and reduces timing risk. The right pick comes down to your time horizon, skill, and tolerance for volatility.

2‑minute explainer

A fast primer on how day investing compares to daily DCA - and when to use each.

What you’ll learn

The core difference: active day investing (frequent, short‑term trades) vs daily DCA (automated, fixed buys each day)

Who each strategy fits based on time horizon, skill, and risk tolerance

How these approaches impact costs, taxes, and behavior

Where Zemyth can anchor a daily, compounding base layer while you deploy long‑term allocations

TL;DR comparison at a glance

Day Investing: high effort, high variance, potentially higher gross upside but lower consistency; sensitive to fees/taxes; best for skilled, time‑rich traders focused on days/weeks.

Daily DCA: low effort, high consistency, reduces timing risk and decision fatigue; best for investors with months/years horizons who want a steadier way to invest.

Quick note on Zemyth

Use Fund Nest as a daily‑yield, liquid base to park capital between moves.

Use Startup Nest to DCA into milestone‑gated venture rounds that unlock with on‑chain proof of progress.

Feature-by-feature TL;DR comparison

Feature | Day Investing | Daily DCA |

|---|---|---|

Goal | Capture short-term price swings | Accumulate positions at an averaged cost and compound steadily |

Time horizon | Days to weeks | Months to years |

Effort | High: constant monitoring and rapid decisions | Low: automated, schedule-driven buys |

Skill required | Advanced technical and execution skills | Basic: discipline and consistency |

Risk profile | High variance; larger drawdowns likely | Lower variance; smoother equity curve |

Fee sensitivity | High - frequent trades amplify costs | Low - fewer, scheduled purchases |

Tax friction | High - short-term gains often taxed at higher rates | Lower - less frequent taxable events (jurisdiction dependent) |

Best for | Time-rich, skilled traders seeking active edges | Long-horizon investors prioritizing consistency and simplicity |

Biggest risk | Overtrading, whipsaws, behavioral mistakes | Underparticipation in strong early moves if capital isn’t front-loaded |

What exactly are we comparing? Definitions and mechanics

Day Investing (aka active short-term trading)

Objective: exploit intraday/daily price moves; relies on speed, setups, and strict risk controls.

Typical mechanics: scanning, entries/exits, stop-loss/take-profit, journaling, post-trade review.

Capital and tools: low-latency platforms, charts, screeners, order types; discipline is mandatory.

Trade-offs: higher potential gross returns but high variance; very sensitive to costs and slippage.

Daily DCA (automated fixed-amount buys, every day)

Objective: reduce timing risk by averaging entry price over time.

Setup: choose asset(s), fixed daily amount, automation, and rebalancing cadence.

Trade-offs: lower effort and smoother experience; may lag lump-sum in straight up markets.

Scope & assumptions used in this article

Assets: principles apply to equities, crypto majors, and diversified funds.

Fees: impact scales with frequency and venue; we’ll model the frictions conceptually.

Taxes: examples reference common U.S. contexts; always check your local rules.

Evidence from stock markets: timing’s brutal math

Missing the best days crushes returns

Over long horizons, returns are concentrated in a handful of big up days.

Day investing risks being out of the market during those spurts; DCA keeps you steadily exposed.

Implication for strategy choice

For most non-professional traders, consistent exposure via DCA helps avoid the “missed best days” penalty.

Day investing must overcome higher error rates, fees, and taxes to compete net of costs.

"Over the 20 years ending 12/31/2022, missing the 10 best days cut annualized returns from ~9.8% to ~5.6%." - J.P. Morgan, Guide to Retirement (2023)

Evidence from crypto: does DCA still win in higher volatility?

Research snapshot

In crypto’s boom-bust cycles, disciplined DCA often outperforms ad‑hoc dip buying and reduces behavioral mistakes.

Volatility increases timing risk; automated DCA reduces “decision drag.”

"Multi-cycle analysis shows DCA frequently outperforms discretionary dip-buying in crypto while reducing drawdowns from mistimed entries." - Galaxy Digital Research (2007–2024 lookback)

What this means for your plan

If your horizon is months/years, daily DCA is a pragmatic default; keep any tactical bets small and rules‑based.

Tooling example

Platforms with automated recurring buys make execution simple.

Costs, fees, and slippage: small frictions, big drags

Fee sensitivity by strategy

Day investing: many tickets magnify trading commissions/spreads; even 10–30 bps per round trip can erode edge.

Daily DCA: many small buys; choose low‑fee venues or batch daily into one order; watch spread on illiquid assets.

Slippage and liquidity

Fast markets widen spreads; day investors pay with worse fills.

DCA works best on liquid assets (majors, broad funds); avoid thin markets for daily automation.

Cost control checklist

Use fee tiers, avoid market orders in thin books, reduce overtrading, and periodically review effective spread.

Cost & friction matrix

Category | Day Investing | Daily DCA |

|---|---|---|

Commissions/fees | 10–30 bps per round trip (more with taker fees) | 0–20 bps per buy (can be lower with fee tiers) |

Spreads/slippage | 5–50 bps typical in fast or thin markets; spikes during news | 1–10 bps on liquid majors/broad funds; higher on illiquid assets |

Order count/month | 100–500+ (multiple entries/exits per day) | ~30 (one automated order per day) |

Effective annual drag at sample fee levels | Example: 0.25% round‑trip cost with 10× monthly turnover ≈ ~30% of equity/year in friction before alpha | Example: 0.10% per buy × 365 ≈ ~0.4–1.0%/year depending on venue, batching, and asset liquidity |

Operational complexity | High: routing, order types, monitoring, post‑trade review | Low: set automation, periodic rebalance check |

Tip: If day investing is your chosen way to invest, measure your “effective spread” (fill vs mid) and total cost per trade. If your daily strategy is DCA, batch buys once per day and stick to the most liquid pairs to minimize friction.

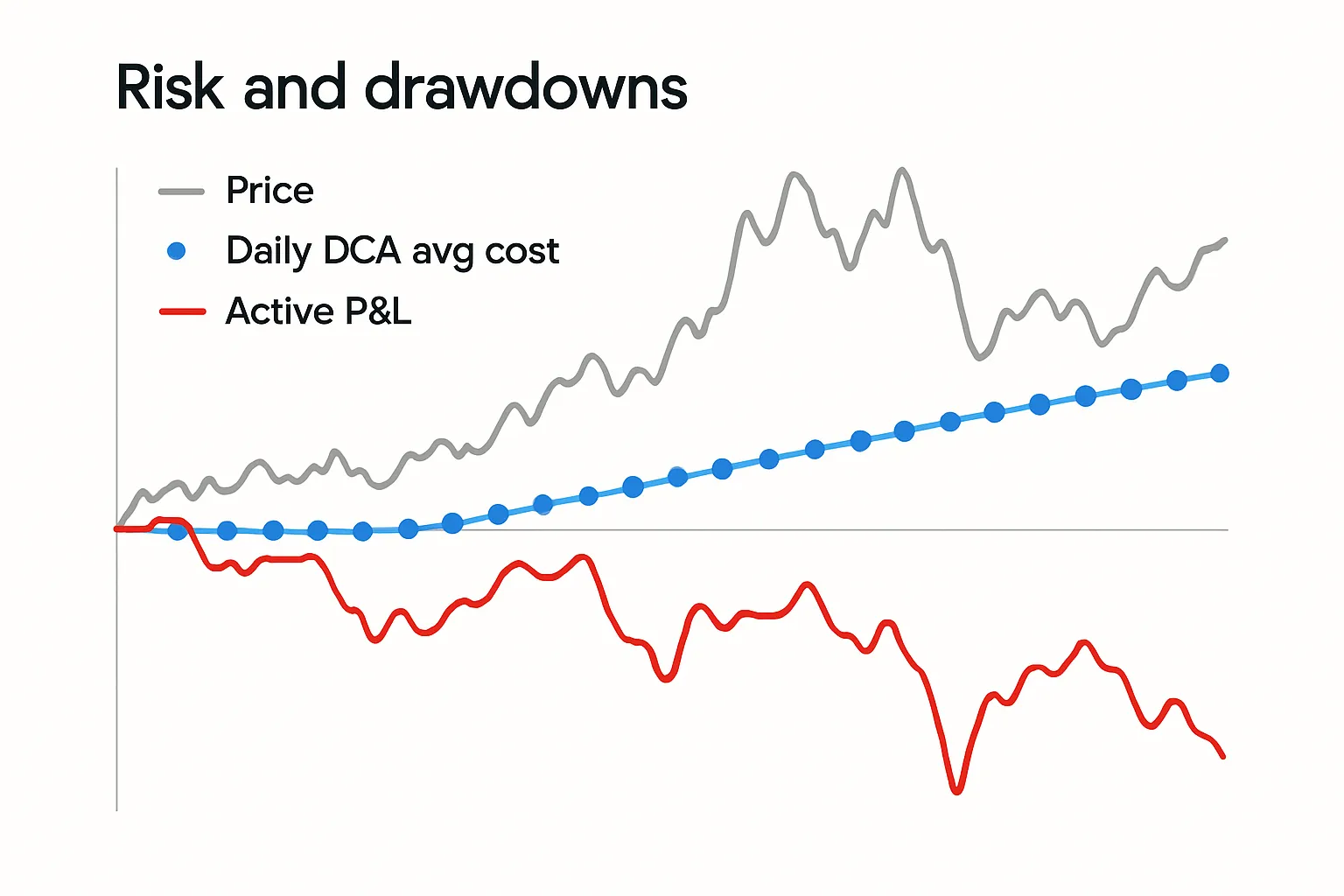

Risk and drawdowns: variance vs smoothing

Day investing risk profile

High variance P&L; risk of large single‑day losses; need strict stop‑loss and position sizing.

“Risk of ruin” rises with leverage and a low hit rate.

Daily DCA risk profile

Smooths entry price and reduces timing risk; still participates in market drawdowns.

Opportunity cost vs lump sum during strong, steady uptrends.

Practical guardrails

Cap leverage (if any), pre‑define max daily loss, and set allocation bands.

For DCA: pre‑commit amount, review quarterly, rebalance annually.

Time, behavior, and execution reality

Time commitment

Day investing: screens, scans, entries, exits, journaling; hours per day.

Daily DCA: minutes per month once automated.

Behavioral traps

Overtrading, FOMO/FOLO, revenge trading, anchoring to entry prices.

DCA reduces decision fatigue; one rule handles dozens of market days.

Platform features to value

For active trading: fast execution, conditional orders, robust charting, real‑time data.

For DCA: automated recurring buys, low fees, portfolio analytics, alerts.

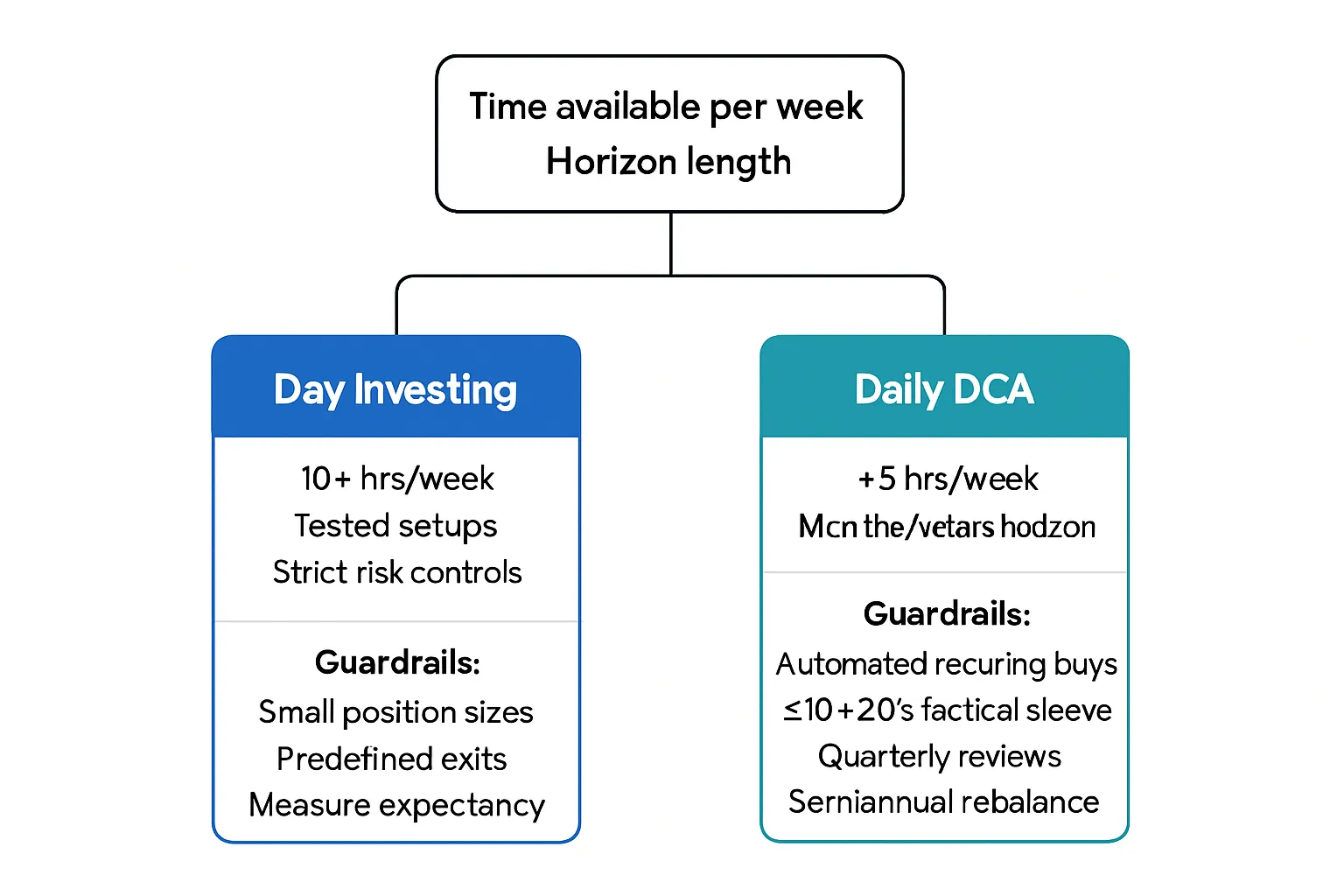

Choose by timeline: 30/90/365-day playbooks

0–30 days (short-term)

Prefer day investing only if you have tested setups, tight risk controls, and time.

Keep position sizes small; pre‑define exit rules; measure expectancy.

30–90 days (medium-term)

Favor daily or weekly DCA to average in; set a review date (not a reaction rule) every 30–60 days.

Keep any tactical trade sleeve ≤10–20% of capital with strict stop rules.

6–24+ months (long-term)

Daily DCA as default; rebalance semiannually; benchmark against a diversified index or crypto majors basket.

Consider diversifying into non‑correlated exposures for resilience.

Where Zemyth fits: a daily-yield base plus milestone-gated upside

Fund Nest: the base layer

Park capital between rounds with liquid, daily-compounding yield to smooth cash flow.

Reduces the urge to force trades just to stay “active.”

Startup Nest: DCA into venture with proof‑based unlocks

Contribute in smaller, repeated tranches as founders hit verifiable milestones on Solana.

Capital follows execution, not hype - aligns with DCA’s discipline.

A practical combo

Allocate a core to Fund Nest for daily yield; schedule recurring contributions into selected milestone rounds.

Review quarterly; rebalance between yield and venture sleeves.

Final verdict: which strategy should you choose?

If you’re optimizing for consistency and low stress

Choose Daily DCA. Automate it, review quarterly, and let time do the heavy lifting.

This daily strategy lowers timing risk, cuts decision fatigue, and gives you a steadier way to invest across market cycles.

If you’re skilled, disciplined, and time-rich

A small day-investing sleeve can work - only with tested rules and tight risk controls.

Track expectancy, cap daily loss, and avoid overtrading. If you can’t measure it, don’t scale it.

A balanced, modern stack

Use a daily-yield base (Zemyth Fund Nest) to keep capital productive between moves.

DCA into milestone‑gated venture rounds (Zemyth Startup Nest) to align capital with on‑chain proof of execution.

Keep tactics small; keep discipline big. Automate the core, review quarterly, and rebalance between yield and venture for a durable plan.