1) Reality check: “invest and earn daily” vs daily investing that actually works

Set expectations up front

If you searched for a “daily investment app” or an “invest and earn daily app,” you’ve seen the pitch: deposit a little, get paid every day, retire by Friday. That’s marketing. What works in practice is a small, automated routine built on:

Daily contributions you can actually sustain (think $5–$20/day via DCA)

Transparent yield that accrues and compounds over time (not miracle payouts)

Disciplined tracking so you see what’s working and cut what’s not

“Daily” should describe your routine and compounding cadence - not the promise of outsized daily profits. Any “invest money earn daily” scheme pushing guaranteed returns is a red flag. Real finance is boring-compounding, not jackpot-chasing.

"97% of those who persisted in day trading for at least 300 days lost money." - Source

Compounding > gimmicks

DCA does the heavy lifting: Automate a small buy every day. At $10/day, you’ll put $3,650 to work annually. With a modest 5% annual yield while funds idle and compounding daily, consistent DCA plus steady base-layer yield can add thousands to your long-term outcome - without guessing tops and bottoms.

Fee drag kills “daily” dreams: A 1% annual fee can siphon away 20%+ of your potential gains on a 5% yield. Optimize for low friction: low fees, tight spreads, and clear execution.

Behavior > bravado: The edge isn’t a hot tip; it’s doing the boring stuff daily - automated deposits, consistent allocations, periodic rebalancing, and reviewing results against your plan. That routinely beats chasing “daily payouts.”

A quick reality math check:

$10/day for 5 years = $18,250 in contributions

Add a steady 5% base yield compounding daily, and you’re ~5 figures ahead of holding idle cash - without sprinting after risky “earn daily” gimmicks.

What you’ll build in this guide

A 10-minute daily routine that automates:

DCA buys into your core allocation

Stablecoin yield routing for idle capital to compound daily

Simple performance tracking with a weekly review cadence

Tools and criteria to avoid hype and scams:

Transparent fees and on-chain settlement

Verifiable yield sources and risk disclosures

Clear rules for deposits, withdrawals, and slippage

Where Zemyth fits

Fund Nest: a liquid, lower‑risk base layer to park capital between opportunities and compound daily yield on Solana.

Startup Nest: milestone‑gated venture exposure where tranches unlock only when founders deliver verifiable proof (users, revenue, shipped builds). Capital follows execution - not hype.

This is the daily invest app approach that actually works: automate contributions, let transparent yield compound, and stay disciplined.

2) What is a daily investment app (and what it isn’t)

Clear definition

A daily investment app helps you build wealth through habits, not hype. It:

Automates small, regular buys (Dollar-Cost Averaging) so you contribute consistently regardless of price swings.

Sweeps idle cash into transparent yield sources so it compounds instead of sitting idle.

Tracks progress with clear dashboards so you can adjust allocations and behavior over time.

It is not:

A scheme promising fixed “daily returns,” “guaranteed income,” or risk-free payouts.

A black box with opaque custody, no audits, or obstruction when you try to withdraw.

"The promise of a high rate of return, with little or no risk, is a classic warning sign of investment fraud." - Source

Must-have features for beginners

Micro-buys and clarity

$1–$10 daily buys, fractional allocations, and easy scheduling

Clear fees, tight spreads, and transparent yield accrual (not vague “daily APR” claims)

Frictionless pause/resume and instant, penalty-free withdrawals

Bank and stablecoin rails for smooth funding and payouts

Guardrails that build behavior

Goal-based buckets (core, yield, opportunistic)

Nudges that matter: alerts, streaks, auto-escalation for contributions, and weekly check-ins

Simple rebalancing rules and performance snapshots you can actually use

Red flags to avoid

“Guaranteed” high daily APRs, referral pressure, or time-limited deposit boosts that vanish when you try to cash out

Opaque custody with no proof of reserves, no independent audits, or no public withdrawal history

Vague token mechanics, unrealistic yields, or influencers pushing “invest and earn daily app” scripts without risk disclosure

Complex lockups and hidden fees that trap your capital or erode returns

Video primer (watch once, save hours later)

Dollar-Cost Averaging (DCA) beats timing anxiety by making contributions the star of the show. Commit to a fixed daily/weekly amount, route idle cash to transparent yield, and let compounding work - no miracle “daily” payouts required.

3) Your 10-minute daily stack: DCA + stable yield + tracking (the blueprint)

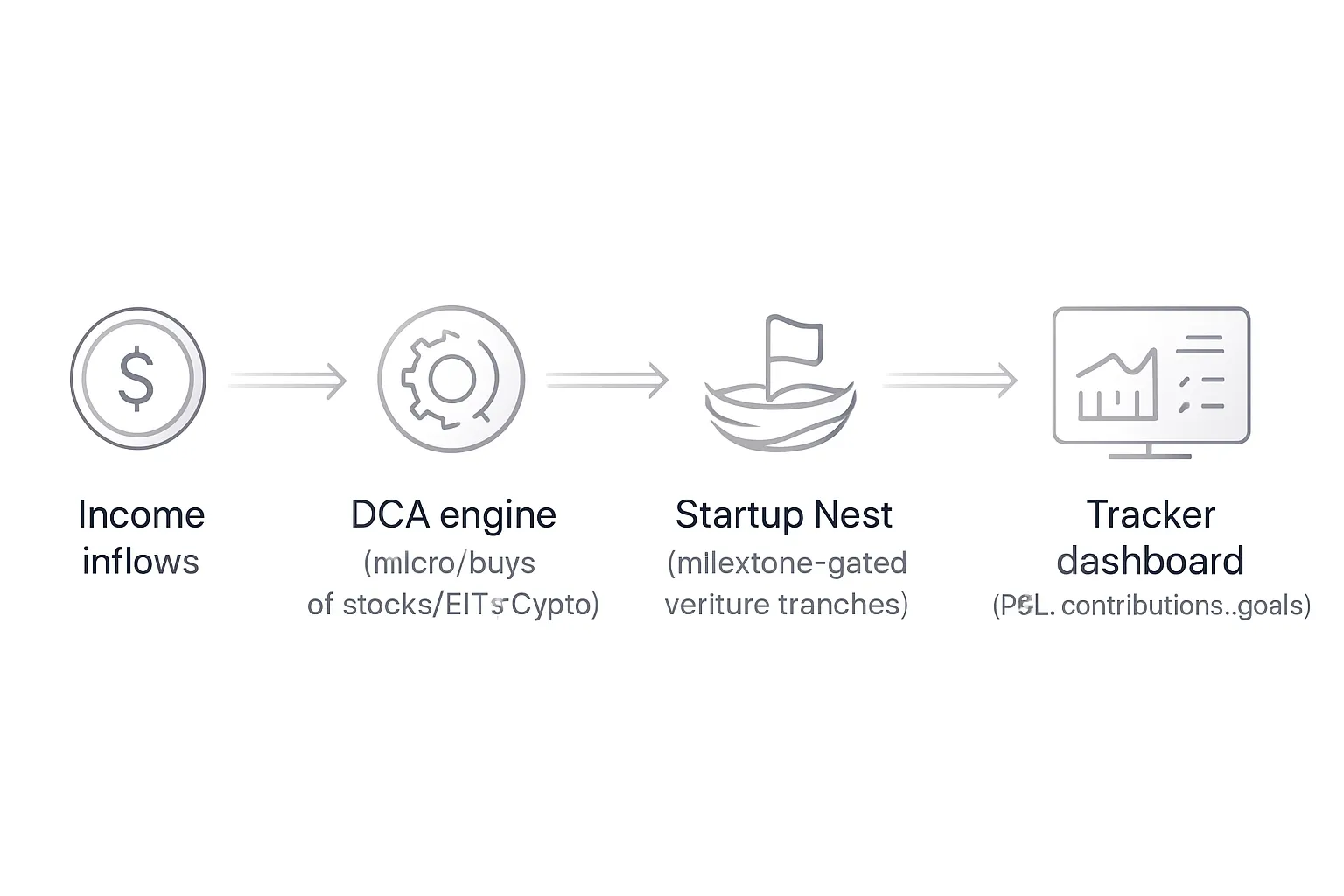

The flow at a glance

Incoming funds → daily DCA buys (stocks/ETFs/crypto) → idle cash auto-swept to transparent yield → weekly review in one dashboard

Tools and roles

DCA automation: set micro-buys by day-of-week, pause anytime

Yield router: park unallocated capital for daily compounding

Tracker: P&L, contributions, and goal progress with alerts

Where Zemyth fits

Fund Nest: liquid, lower-risk daily yield to keep capital productive between venture rounds

Startup Nest: milestone-gated tranches for venture exposure when proof is delivered (builds/users/revenue)

Solana settlement + on-chain transparency for verifiable progress and contributor reputation

4) Automate your daily DCA (from $1/day) the right way

Step-by-step setup

Pick your rails: bank → brokerage for ETFs/stocks, or stablecoin (e.g., USDC) → exchange/wallet if you prefer on-chain.

Choose your mix: broad market ETFs (core), blue‑chip crypto (small slice), or both.

Set micro-amounts ($1–$10+) and schedule (daily/weekday). Keep it small enough that it’s effortless.

Turn on round-ups if helpful, but prioritize fixed DCA so deposits don’t depend on spending.

Keep fee drag tiny

Prefer zero‑commission trades, low expense‑ratio funds, and low on‑chain swap fees (target <0.3%).

If fees apply per order, batch small buys (e.g., daily accrual, single buy every 3–5 days). Otherwise keep daily cadence to build the habit.

Watch spreads and slippage - automate during liquid market hours or use limit/recurring orders where available.

Sample templates

Starter (Rs/$ 1–3/day): 100% broad index ETF or stablecoin DCA; quarterly rebalance.

Balanced (Rs/$ 5–10/day): 80% index, 20% sector/thematic; sweep idle cash to transparent yield.

Crypto‑curious (small slice): 90% index, 10% BTC/ETH on a separate rule with strict caps and quarterly rebalance.

Guardrails

Auto‑pause if your emergency fund drops below 3 months’ expenses.

Contribution step‑ups (+1% per month) so you grow without feeling it.

5% drift rule: rebalance when any sleeve moves 5% off target (or quarterly, whichever comes first).

Daily DCA templates by budget

Daily amount | Asset mix | Platform/rail | Fee notes | Auto-pause rules | Rebalance cadence |

|---|---|---|---|---|---|

$1/day | 100% broad market ETF (or 100% USDC until you reach a minimum trade size) | Bank → low‑cost broker (ETFs) or Stablecoin → Solana wallet (USDC) | Target $0 commissions; ETF ER <0.05%; on‑chain swap fee <0.3% | Pause if EF < 3 months or monthly cash flow negative | Quarterly; or 5% drift rule |

$5/day | 80% broad index, 20% sector/thematic; idle cash swept to daily yield | Bank → broker for ETFs; Stablecoin rail (USDC) → yield venue for idle | Blended ER <0.15%; use recurring orders; keep spread <0.05% where possible | Pause if EF < 3 months or debt APR > 15% | Quarterly with sleeve caps |

$10/day | 90% index ETFs, 10% BTC/ETH on a separate DCA rule | Bank → broker (ETFs) + Stablecoin → exchange/DEX for crypto | Keep exchange/DEX fee <0.2–0.3%; avoid high slippage windows | Pause crypto sleeve if allocation >10% or EF < 3 months | Monthly micro‑rebalance and 5% drift rule |

Pro move with a daily investment app: lock in the habit (fixed DCA), route any unallocated cash to a transparent daily yield source, and review once per week. If you’re scouting venture exposure, keep your base compounding while you wait - then deploy from that base when the thesis (and proof) show up.

5) Earn daily, safely: route idle cash to transparent yield

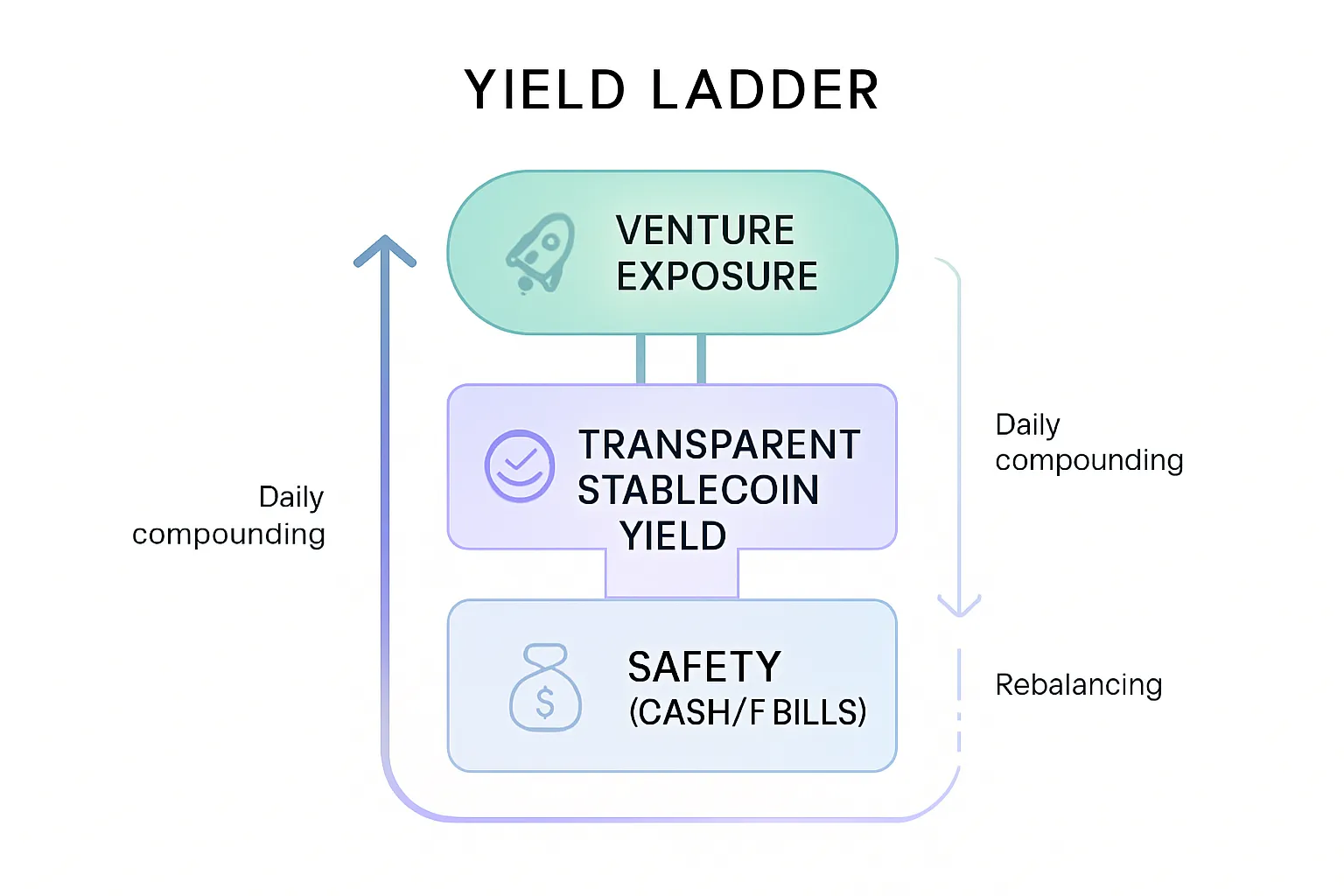

The role of a base-layer yield

Keep capital productive between buys and bigger opportunities

Daily accrual with full visibility beats chasing fixed daily payouts

Options (from traditional to on-chain)

Treasury-backed money markets and laddered T-bills (traditional brokers)

Reputable stablecoin yield with transparent backing and auditability

Zemyth Fund Nest: liquid, lower-risk yield with daily compounding to smooth cash flow between Startup Nest rounds

Risk ladder and allocation

Safety-first bucket for short-term cash; growth bucket for DCA; optional venture bucket for milestone-gated rounds

Transparency matters

On-chain settlement on Solana, verifiable proof-of-progress, withdrawal history

Avoid protocols without disclosure, audits, or clear redemption mechanics

6) Track, review, and nudge: the behavior system that compounds

A minimal routine that sticks

Daily (≤10 minutes): confirm DCA executed; check Fund Nest accrual; log a one-line note on any deviations

Weekly: review contributions vs target; top up if you missed a day; scan alerts for fees/slippage

Monthly/quarterly: rebalance back to ranges; update allocation and risk caps as goals evolve

A disciplined daily investment app routine turns consistency into returns. Keep it lightweight so you’ll actually do it, every day.

Useful signals, not noise

Contribution streaks that reinforce habit; missed‑buy alerts that prompt catch‑ups

30‑day yield accrual summary so “daily” refers to compounding, not gimmicks

Guardrail alerts for fee spikes, slippage, or drift outside your target mix

Journaling and decisions

Write the “why” before every allocation change; if you can’t articulate it in one sentence, don’t do it

Capture screenshots of plans (targets, rules, rebalance bands), not price charts

If emotions are high, delay by 24 hours and re‑read your plan

Your compounding routine

Actions | Tools | Time budget | Outcome | |

|---|---|---|---|---|

Daily | Verify DCA ran; check Fund Nest daily accrual; one-line journal entry | Recurring orders; yield dashboard; notes | 5–10 min | Habit locked in; idle cash compounding; decisions recorded |

Weekly | Compare contributions vs target; top up misses; scan alerts (fees, slippage, drift) | Contribution tracker; alert center | 10–15 min | On-target funding; reduced leakages; timely course corrections |

Monthly/Quarterly | Rebalance to bands; update allocations/risk caps; review performance vs plan | Rebalancer; allocation editor; P&L and yield reports | 20–30 min | Portfolio aligned to goals; risk contained; plan refreshed |

Pro tip: If you’re tempted by an “invest and earn daily app,” translate the pitch into signals and rules. If it can’t show transparent accruals, low fees, easy withdrawals, and clear progress tracking, it doesn’t support compounding - skip it.

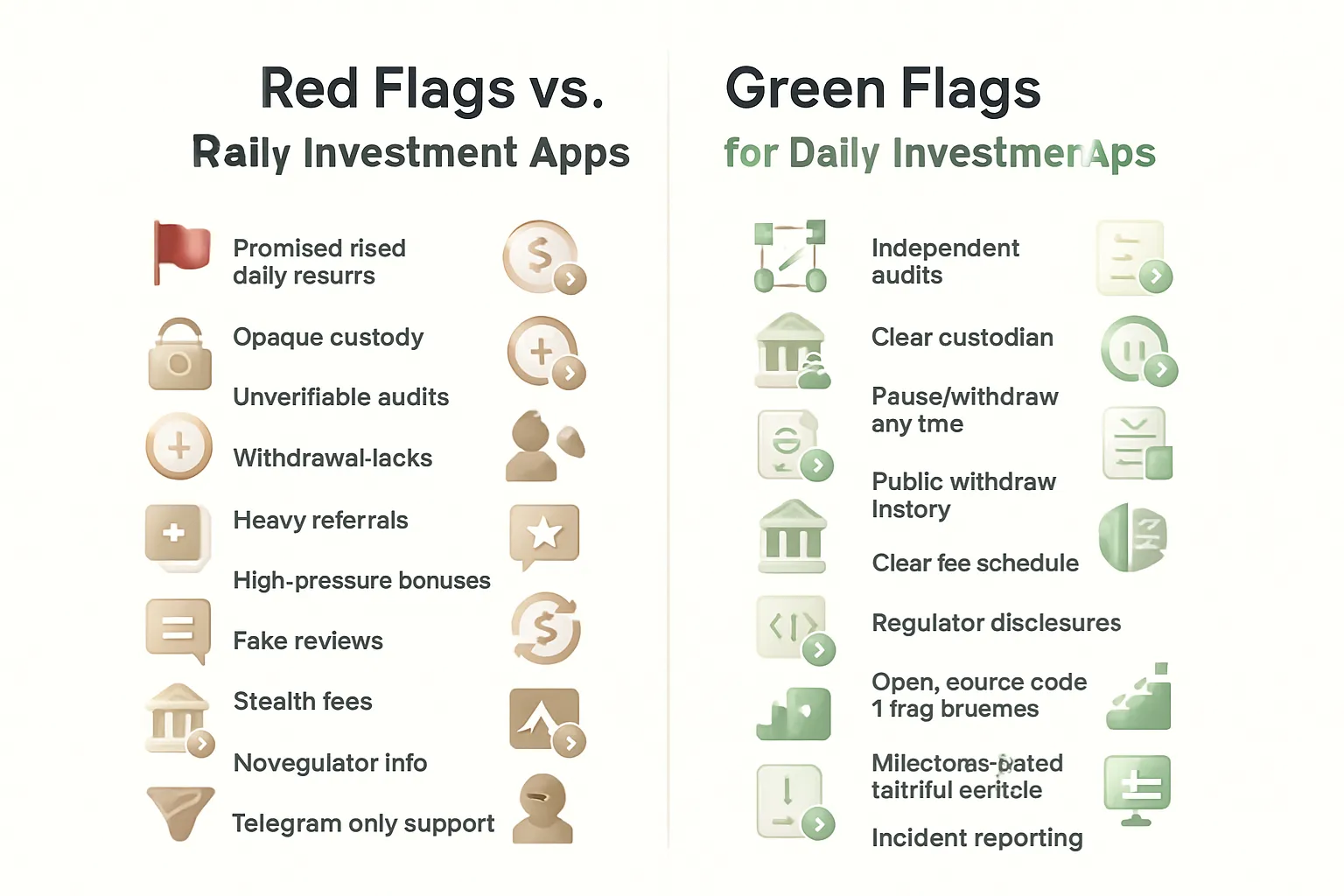

7) Scam filter: 12 red flags of “invest money earn daily” apps

Instant red flags

Promised fixed daily returns

No custodian clarity or on-chain proof; unverifiable audits

Withdrawal friction or “membership” locks before redemption

Referral-heavy economics; pressure to recruit vs invest

Guaranteed profits, time-limited boosts, or ROI calculators with no risk

Anonymous team, Telegram-only support, fake reviews

Closed-source code with no bug bounties

Stealth fees and confusing token mechanics

No regulator disclosures or guidance

No public withdrawal history

Price manipulation via internal market only

Aggressive “act now” countdowns

Due-diligence checklist

Who holds assets? Which custodian or smart contract? Can you verify on-chain?

Where is yield generated? Lend/borrow, market making, treasuries - show sources and risk

Independent audits, code reviews, proof-of-reserves, or regulator guidance

Real users, real withdrawals, and public dashboards with historical data

Clear service-level terms for deposits, lockups, and redemptions

Green flags you want

Clear fees, pause/withdraw anytime, transparent disclosures

On-chain settlement with verifiable reserves and progress

Independent audits and ongoing monitoring; open-source or reviewable code

Public withdrawal history and incident reporting

Verifiable yield sources with risk bands and limits

Milestone-gated capital release (e.g., Startup Nest tranches tied to shipped proof)

Real identities, multi-channel support, and a documented risk framework

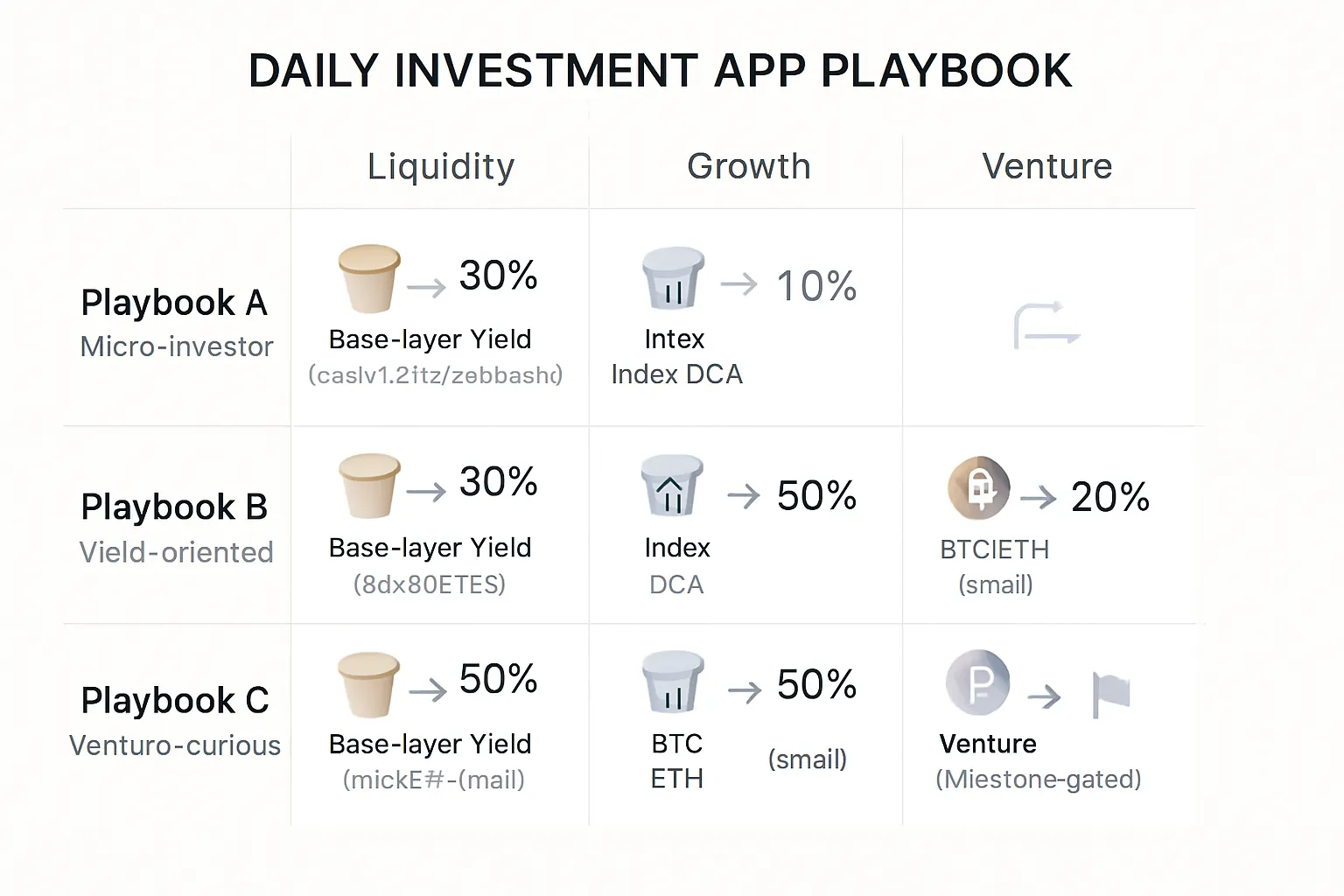

8) Use‑case playbooks: micro‑investing, yield parking, venture exposure

Playbook A: Micro‑investor on a tight budget

$1–$3/day DCA into a broad index ETF; add round‑ups for a small boost

Auto‑sweep idle cash to base‑layer yield so every dollar compounds

Guardrails: keep an emergency fund (3–6 months), rebalance quarterly, don’t chase sectors

Playbook B: Yield‑oriented contributor

Park capital in Fund Nest for daily accrual and liquidity

Set a weekly DCA from accrued yield into a core index or a capped BTC/ETH sleeve

Guardrails: maintain withdrawal‑ready liquidity, keep fees low, cap crypto exposure

Playbook C: Venture‑curious but disciplined

Keep the majority in base‑layer yield + index DCA

Allocate a small, capped slice to Startup Nest rounds with milestone‑gated tranches on Solana

Review proof‑of‑progress (users/revenue/builds) before each tranche unlock

Guardrails: strict position caps, staged deployment, exit rules on missed milestones

Portfolio hygiene across playbooks

Caps per asset and sleeve; rebalance bands with a 5% drift rule

Maintain emergency fund before increasing risk

Document your plan; adjust gradually, not reactively

9) Your first 24 hours: a practical walkthrough

Hour 0–1: Set the rails

Create accounts/wallets for your daily investment app and enable 2FA (TOTP/hardware key preferred).

Connect funding rails:

Bank → brokerage for stocks/ETFs

Stablecoin (e.g., USDC) → exchange/wallet for on-chain allocation and yield

Define your daily amount ($1–$10+) and target allocation (e.g., 90% index DCA, 10% BTC/ETH).

Add withdrawal address whitelists and session/device alerts for security.

Hour 1–2: Automate the engine

Schedule daily DCA buys (weekday or every day) for your core allocation.

Turn on contribution streak/missed-buy alerts so habit stays intact.

Enable auto-sweep to base-layer yield for idle cash:

Traditional: money market/T‑bill sweep at your broker

On-chain: transparent stablecoin yield

Zemyth Fund Nest (where eligible): daily accrual to keep capital productive between Startup Nest rounds

Hour 2–4: Guardrails and tracking

Set max position caps (e.g., single asset ≤5–10%, crypto sleeve ≤10–15%).

Define rebalance bands (5% drift rule or quarterly cadence).

Enable fee/slippage alerts and low-liquidity warnings to keep costs tight.

Create a one-line daily journal template:

“Day X: $Y contributed (auto), allocations unchanged, notes: [reason/observation].”

End of day: Check once, then live your life

Confirm the first DCA executed at the expected time/price.

Verify yield accrual has started on idle cash (Fund Nest/treasury ladder/stablecoin yield).

Capture Day 1 note: “Contribution made, no changes.”

Week 1 preview

Review total contributions vs plan and top up if you missed a day; if comfortable, step up +1%.

Shortlist one Startup Nest opportunity to research:

Check milestone plan (builds/users/revenue), prior unlocks, and on-chain proof before any tranche.

Keep cadence daily, but reviews weekly - let automation do the work, not emotion.

This is the no-hype way to “invest and earn daily”: automate $1–$10 buys, route idle cash to transparent yield, track once per day, and review weekly.

10) Conclusion: start small, start daily - start with Zemyth

Why this works

Small automated buys + transparent daily yield + simple tracking = compounding that actually shows up in your balance. A true daily investment app is about a repeatable routine, not jackpot promises.

Proof-over-promise guardrails help you avoid the typical “invest and earn daily app” hype. You automate deposits, park idle cash in transparent yield, and review on a set cadence - no drama.

Why Zemyth

Fund Nest: liquid, lower‑risk daily yield to keep capital compounding between moves. It’s the base layer that turns “daily” into steady accrual - not risky “invest money earn daily” schemes.

Startup Nest: milestone‑gated venture rounds so capital follows execution, not hype. Tranches unlock only when founders ship proof - users, revenue, builds.

On‑chain transparency on Solana + contributor reputation + education via Academy. You get verifiable progress, clear rules, and playbooks that help you operate like a pro.

Call to action

Set your first daily rule and base‑layer yield now. It takes minutes: automate $1–$10/day, route idle cash to transparent yield, and schedule a weekly review.

Visit zemyth.app to launch your daily stack today.