What Is a Crypto Investment Fund in 2025? The Quick Primer

A crypto investment fund is a professionally managed vehicle that pools capital to buy, trade, lend, or otherwise allocate into digital assets and tokenized real‑world assets on your behalf. Instead of opening multiple exchanges, juggling wallets, guarding private keys, and reacting to 24/7 volatility, you allocate to a manager with a defined mandate, risk controls, and audited operations.

"By June 2025, tokenized real‑world assets reached ~$24B in TVL - nearly fivefold growth in three years, driven by institutional demand for stable yield." - Source

Funds exist to simplify access, diversify risk across strategies, and add professional security so your capital isn’t one misplaced seed phrase away from disappearing.

Why funds exist (simplicity, diversification, managed security)

Pooling capital, professional management, operational safeguards

Pooled capital lets managers run repeatable processes (execution, custody, reporting) at scale - lower slippage, better borrow/lend rates, and negotiated fees with service providers.

Professional managers operate with investment committees, mandates, risk budgets, and counterparty frameworks - turning crypto chaos into a system.

Institutional custody, multi‑sig, and segregated accounts reduce single‑point‑of‑failure risk versus ad‑hoc self‑custody.

How funds remove technical friction vs. self-custody and direct trading

No wrestling with private keys, network fees, bridges, or smart‑contract approvals.

Centralized reporting (NAV, P&L, tax docs) replaces manual spreadsheets and API exports.

Pre‑vetted counterparties and compliance (KYC/AML, audits) reduce operational hazards.

You focus on allocation and outcomes; managers handle execution, security, and monitoring.

The 2025 landscape in one glance

Long-only index/ETF-style products (beta exposure)

Objective: track market beta (e.g., BTC/ETH spot ETFs, broad crypto indices) to capture baseline crypto investment returns with transparent rules and low turnover.

Market-neutral/quant funds (lower beta, alpha-seeking)

Objective: generate uncorrelated returns via arbitrage, basis trades, funding‑rate capture, stat‑arb, and hedged momentum - aiming for smoother volatility and smaller drawdowns.

Yield/RWA funds (tokenized treasuries, private credit)

Objective: prioritize dependable yield through tokenized T‑Bills, money market funds, and on‑chain private credit; attractive for investors who want to invest in a crypto fund without taking full market swings.

Venture/early-stage token + equity funds (high risk, long horizon)

Objective: back founders and protocols pre‑token or at early listings for asymmetric upside; illiquid, manager‑selection‑sensitive, and typically multi‑year horizons.

Where Zemyth fits:

Fund Nest aligns with the yield/RWA layer - an accessible, liquid base for capital parking and daily compounding.

Startup Nest maps to the venture bucket - milestone‑gated rounds on Solana that fund crypto startups with on‑chain proof of execution.

Key benefits and trade-offs vs. DIY crypto

Benefits

Risk frameworks: Position limits, hedging, counterparty checks, and drawdown controls bring discipline impossible to replicate casually.

Custody and security: Institutional‑grade custody, cold storage, and multi‑sig reduce private key and exchange‑failure risk.

Research edge: Full‑time analysts leverage on‑chain data, market microstructure, and venture networks to source and size opportunities.

Reporting and compliance: Standardized statements, NAVs, and tax documentation simplify life - especially across multiple chains and venues.

Operational continuity: 24/7 monitoring, incident response, and disaster recovery protect against “off-hours” events.

Trade-offs

Fees: Management and potentially performance fees reduce net returns; evaluate value‑add against your DIY alternative.

Lockups/liquidity terms: Some mandates need lockups or gates to execute properly - less flexibility than holding coins yourself.

Less control: You outsource trade decisions and custody paths; that’s the point - but it’s not for everyone.

Manager selection risk: Strategy drift, poor execution, or weak risk management can underperform passive beta.

How Zemyth addresses the balance:

Milestone‑gated venture rounds tie capital to delivered proof, reducing hype risk.

Fund Nest offers a liquid yield base so your dry powder compounds between venture tranches.

On‑chain transparency on Solana provides verifiable progress and contributor reputation.

What this guide will help you decide

Whether to invest in a crypto investment fund or build your own Web3 stack (or blend both using Zemyth’s Fund Nest for base yield and Startup Nest for venture upside).

How to compare strategies - beta, market‑neutral, yield/RWA, and venture - so your allocation matches your risk and time horizon.

How to weigh fees, lockups, and manager selection against your desire for control, liquidity, and hands‑on execution.

Where crypto funds fit inside your broader portfolio so you can fund crypto exposure with a structure that supports your goals - without letting volatility dictate your playbook.

Strategy Map: Market‑Neutral, Yield, Long‑Only, Venture, and RWA Funds

A clear strategy map helps you decide how to invest in a crypto investment fund that matches your goals. Here’s how the major buckets differ, what they target, and how to benchmark managers so you can fund crypto exposure with intent - not hope.

Core strategy buckets and how they differ

Long-only (BTC/ETH/majors; beta exposure and tracking error)

Objective: Capture crypto beta through spot, ETFs, and indexed baskets of majors; minimize tracking error versus benchmarks.

Levers: Asset weighting, rebalancing cadence, limited factor tilts (smart beta), staking yield on select assets.

Quant/trend/momentum (systematic; signal-driven)

Objective: Harvest directional or relative-value edges via trend, momentum, mean‑reversion, carry, and microstructure signals.

Levers: Risk targeting, volatility scaling, model ensembles, regime switching, and strict stop frameworks.

Market-neutral (basis/arbitrage, liquidity provision, options delta-hedging)

Objective: Generate uncorrelated returns by hedging market beta and extracting spreads - cash/futures basis, funding, options vol, maker rebates.

Levers: Cross‑venue execution, inventory/risk caps, counterparty diversification, options Greeks management.

Yield/RWA income funds (tokenized treasuries, private credit, real estate)

Objective: Deliver steady income from tokenized T‑Bills and money markets, senior secured private credit, and real estate cash flows.

Levers: Duration and credit selection, tranche mix, liquidity windows, hedging rate and spread risk.

Venture/early-stage (tokens, SAFTs, equity in protocols and infra)

Objective: Back founders and protocols for power‑law outcomes; accept illiquidity and long horizons.

Levers: Deal sourcing, milestone gating, tokenomics design, governance and post‑investment support.

Zemyth in this map:

Fund Nest: Yield/RWA base layer - park capital, earn daily yield, keep liquidity to pounce on deals.

Startup Nest: Venture exposure - milestone‑gated tranches tied to on‑chain proof, not hype.

Strategy comparison matrix

Strategy | Primary return drivers | Typical gross target returns | Volatility/Drawdown profile | Liquidity & lockups | Typical fee range | Best fit investor profiles |

|---|---|---|---|---|---|---|

Long-only (BTC/ETH/majors) | Market beta, index construction, position sizing, staking on select assets | Benchmark-relative (no fixed target; aim to match/beat BTC/ETH or broad crypto index) | High volatility; 50–80% drawdowns possible across cycles | Daily–weekly for ETFs/indices; monthly for some funds | 0.5–2% mgmt; 0–20% perf | Investors seeking straightforward crypto exposure with minimal complexity |

Quant/trend/momentum (systematic) | Trend, momentum, mean‑reversion, carry; risk targeting | ~15–35% p.a. over a full cycle (program‑dependent) | Medium–High; controlled via risk budgets; 15–30% drawdowns | Monthly redemptions typical; weekly/monthly NAV | 2% mgmt; 20–30% perf | Allocators wanting systematic alpha with rules‑based discipline |

Market‑neutral | Basis/funding, cross‑venue spreads, options vol capture, liquidity provision | ~10–20% p.a. (spread/vol regime dependent) | Low–Medium; tail risk from venue events/pegs; smaller, sharper drawdowns | Monthly with gates; some weekly; T+7–30 redemptions | 1–2% mgmt; 10–20% perf | Income‑oriented investors prioritizing lower beta and smoother P&L |

Yield/RWA income (treasuries, private credit, real estate) | Short‑duration rates, coupons, senior secured credit cash flows, rental income | ~4–6% (treasuries), ~8–12% (private credit); blended ~4–12% | Low volatility; interest‑rate drift and credit tail risk | Daily/weekly for treasuries; monthly/quarterly for credit/RE; lockups common | 0.15–1% mgmt; 0–10% perf/carry varies | Capital parking, conservative income, base layer for active allocators |

Venture/early-stage | Power‑law winners, token unlocks, M&A/IPO exits; value‑add to founders | Fund‑level 3–5x gross MOIC targets; ~20–40% gross IRR on winners | Mark‑to‑model; binary outcomes; high permanent loss risk | 4–10 year lockups; quarterly/annual marks; no routine redemptions | 2–2.5% mgmt; 20–30% carry | Long‑horizon investors seeking asymmetric upside and network access |

Matching strategy to goals and constraints

Target returns vs. volatility and drawdown tolerance

Want smoother crypto investment returns? Market‑neutral and Yield/RWA fit. Comfortable with swings for upside? Quant or Long‑only. Hunting for 10x outcomes? Venture.

Liquidity windows; redemption terms; NAV cadence

Need frequent liquidity and daily marks? Long‑only ETFs or tokenized treasuries. Can accept monthly/quarterly windows? Quant, market‑neutral, private credit. Multi‑year lockups? Venture.

Operational complexity you’re willing to accept

Minimal ops: Long‑only ETFs/indexes and treasury RWAs. Moderate ops: Quant/market‑neutral due to venue, margin, and hedging. High ops: Venture diligence, tokenomics, governance.

Portfolio role

Core beta: Long‑only. Diversifier: Market‑neutral/Quant. Income base: Yield/RWA. Moonshots: Venture. Zemyth’s Fund Nest can be your liquid base; Startup Nest adds milestone‑gated venture upside.

Benchmarks to judge performance

Beta anchors

BTC, ETH, and blended crypto beta indices (market‑cap weighted) for long‑only and directional quant.

Risk‑adjusted measures

Sharpe and Sortino for reward per unit of volatility and downside risk; Information Ratio vs. benchmark for active bets.

Drawdown and hit rate

Max drawdown and recovery time; hit rate and payoff ratio by strategy; correlation to BTC as a sanity check for “neutral” claims.

Strategy‑specific context

Market‑neutral: Excess over risk‑free plus basis/funding spreads; low correlation mandate. Yield/RWA: Net yield vs. comparable T‑bill or credit indices. Venture: DPI/TVPI and pacing versus peer cohort and vintage.

"Median fees for crypto hedge funds in 2024 were 2% management and 20% performance." - Source

Bottom line: pick the bucket that matches your outcome target, drawdown tolerance, and liquidity needs. If you want to invest in a crypto fund without sitting fully idle, use a Yield/RWA layer as your dependable base and layer in selective beta, quant, or venture exposure. Zemyth is built precisely for that stack.

How Crypto Funds Actually Make Money (Return Drivers You Can Validate)

"U.S. spot Bitcoin ETFs amassed over $33B in net inflows in their first year since launch in Jan 2024, a landmark for directional flows." - Source

Directional, neutral, yield, and venture strategies monetize different edges. Here’s how a crypto investment fund typically turns process into P&L - and what proof you should request before you invest in a crypto fund.

Directional: riding crypto investment returns

Capital appreciation in BTC/ETH/majors

Core driver: capturing uptrends across crypto cycles; allocations via spot, ETFs, and indexed baskets of majors.

Flow catalysts: ETF net inflows, macro liquidity (rates, dollar, liquidity cycles), and institutional adoption can amplify moves.

Cycles and regimes

Crypto’s 3–4 year boom‑bust cadence ties to liquidity, innovation cycles, and BTC halving supply dynamics.

Long-only mandates often add staking yield or smart‑beta tilts, but most value comes from the trend itself.

How to validate

Benchmark vs. BTC/ETH and blended beta indices, track tracking error and excess return.

Confirm rebalancing rules, slippage assumptions, and liquidity buffers during stress.

Market-neutral: clipping basis and volatility premia

Cash-and-carry/basis trades

Go long spot, short futures; harvest the futures premium (or discount) net of funding/fees, collateral, and borrow costs.

Funding arbitrage and liquidity provision

Earn positive funding by taking the opposite side of skewed perp markets; collect maker rebates and spreads by providing liquidity across venues.

Options income with delta hedging

Systematic short‑vol or relative‑value options strategies with tight delta controls to monetize implied vs. realized volatility gaps.

Risk controls that matter

Venue and counterparty diversification, borrow/funding caps, stress tests for de‑pegs and exchange outages, and hard stop‑outs on spread compression.

How to validate

Strategy‑level P&L attribution (basis vs. funding vs. options), executed venue list, borrow/funding constraints, and position/risk caps.

Low correlation to BTC is a must; inspect drawdown profile around market shocks.

On-chain yield & RWA income

Staking rewards and restaking

Native staking on PoS assets adds baseline yield; restaking/LSDs can boost returns but add smart contract, liquidity, and correlation risk.

Validate validator performance, slashing history, and custody segregation.

Tokenized treasuries and private credit

Short‑duration T‑Bill tokens deliver rate‑driven income with daily liquidity; private credit funds target higher coupons with underwriting and lockups.

Risk levers: duration, credit selection, tranche seniority, collateral, default procedures, and recovery timelines.

How to validate

Compare net yields to off‑chain benchmarks (e.g., 3‑month T‑Bills, private credit indices).

Review default handling playbooks, auditor attestations, legal structure (SPVs, bankruptcy remoteness), and custodian arrangements.

Venture/early-stage returns

Power laws and illiquidity premia

A small set of winners often drives the fund MOIC; the rest may flatline or go to zero - position sizing and pacing matter.

Token unlock schedules and milestone risk

Returns can cluster around unlocks, listings, and product‑market‑fit milestones; anti‑dilution and vesting terms shape realized outcomes.

Post‑investment value‑add

Governance, tokenomics, distribution, and BD support can materially change outcomes versus passive checks.

How to validate

DPI/TVPI, win‑rate and multiple distribution, vintage pacing, realized vs. unrealized bridge, and follow‑on discipline.

Request case studies tying value‑add to measurable inflection points.

What to ask managers for proof

Trade logs and execution venues

Venue list, fill quality, borrow/funding sources, cross‑venue routing, and any auto‑liquidation protections.

Auditor attestations and NAV methodology

Independent audits, pricing sources (spot/oracle hierarchy), hard‑to‑value asset treatment, and frequency of valuations.

P&L attribution and risk reports

Break down returns by strategy sleeve (directional, basis, options, staking, credit). Provide VaR, max DD, and correlation to BTC/ETH.

Slippage, borrow, and capacity constraints

Realistic slippage models, borrow caps, market impact limits, and capacity at target AUM.

Counterparty and custody controls

Custodian names, segregation details, multi‑sig policies, address whitelisting, insurance/assurance reports, and incident response plans.

How Zemyth fits:

Fund Nest: a liquid RWA/yield base so your dry powder compounds while you evaluate opportunities - transparent, on‑chain, with daily accrual.

Startup Nest: milestone‑gated venture rounds that release capital only when founders deliver verifiable proof, aligning upside with execution rather than hype.

When you fund crypto exposure through a manager, insist on receipts: verifiable strategy mechanics, independent oversight, and performance that maps cleanly to the return drivers above.

Fees That Matter in 2025: What You’ll Pay and How It Hits Net Returns

Understanding the fee stack is the difference between impressive gross returns and disappointing net results. Here’s how to decode the pricing mechanics across vehicles - and where Zemyth keeps costs working for you, not against you.

The fee stack decoded

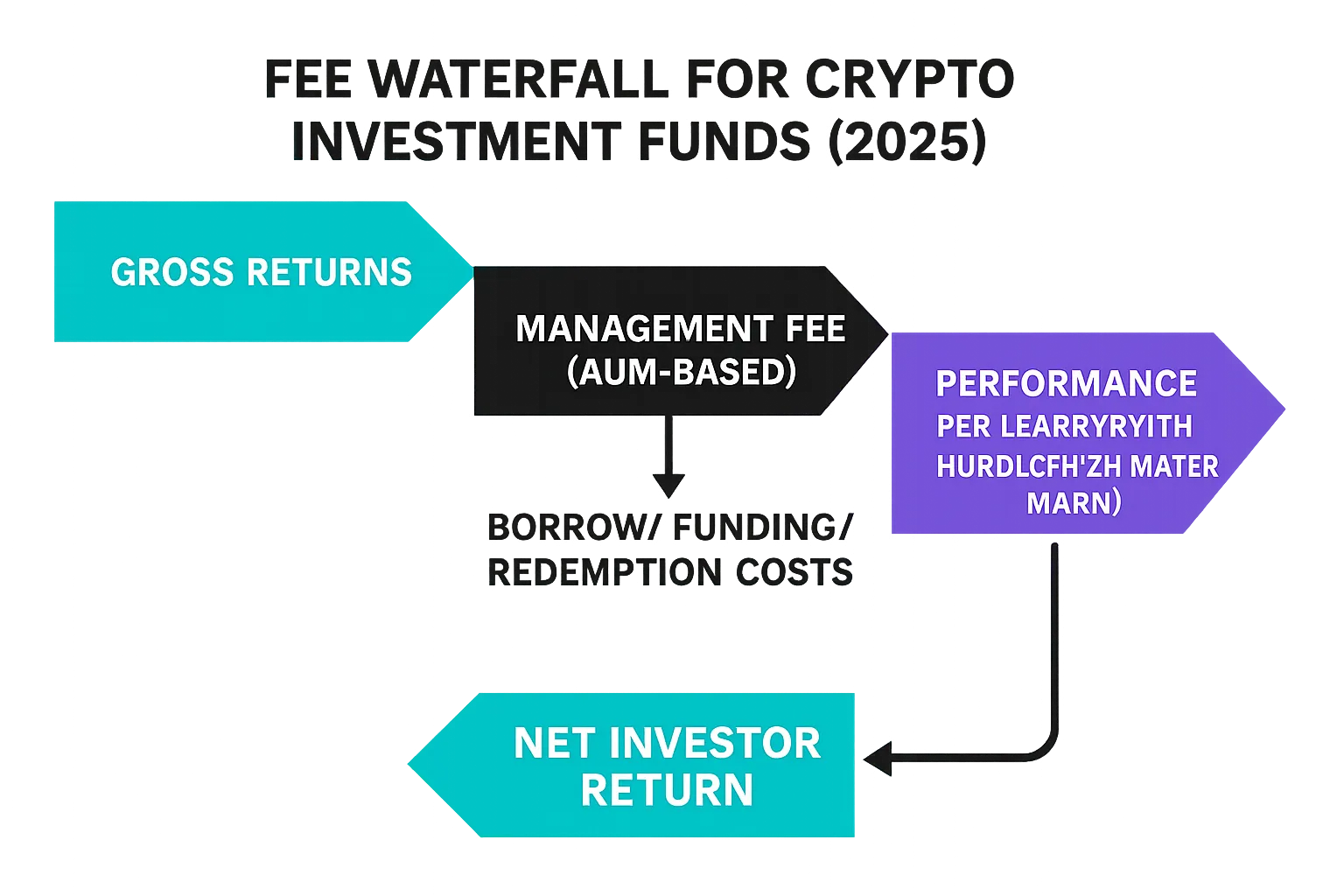

Management (AUM-based), performance (carry), hurdle/high‑water marks

Management fee: Annualized charge on assets under management to operate the strategy.

Performance fee/carry: A share of profits above zero or a hurdle; high‑water mark prevents fees on previously lost value.

Hurdle types: Soft (fees on all gains if hurdle met) vs. hard (fees only on gains above hurdle).

Admin, audit, custody, borrow/funding costs, redemption/early exit fees

Admin and audit: Fund accounting, NAV calc, investor statements, annual financial audits.

Custody and security: Institutional custody, cold storage, MPC/multisig operations.

Borrow/funding: Margin, futures funding, borrow fees in market‑neutral/quant books.

Redemption/early exit: Gates, swing pricing, or exit fees to protect remaining investors during withdrawals.

Typical ranges by vehicle type

Vehicle | Mgmt fee | Performance fee/carry | Other common costs | Typical lockup | Notes on investor fit |

|---|---|---|---|---|---|

Hedge/Quant (directional + market‑neutral) | 1–2.5% | 10–30% | Admin/audit 10–30 bps; custody 5–20 bps; borrow/funding variable | Monthly/quarterly with gates | For allocators seeking alpha or low‑beta carry; expect process, risk reports, and capacity limits |

RWA Income Funds (treasuries/private credit) | 0.15–1.0% | 0–10% (varies by product) | Transfer agent, custody 5–20 bps; legal/SPV costs; servicing fees for credit | Daily–quarterly; some lockups | For income stability and capital parking; compare net yield vs. T‑Bill/credit benchmarks |

Venture (tokens/SAFTs/equity) | 2.0–2.5% | 20–30% carry | Admin/audit; legal; SPVs; token listing/ops costs | 4–10 years | For long‑horizon, high‑risk, asymmetric upside seekers; pacing, DPI/TVPI matter |

ETPs/ETFs (beta exposure) | 0.15–0.95% | 0% | Creation/redemption spreads; brokerage commissions | Daily liquidity | For clean, liquid beta; watch tracking error and total expense ratio |

SMAs (separately managed accounts) | 0.5–2.0% | 0–20% | Custody, trading commissions, venue fees | Custom; usually no lockups | For larger tickets needing custom constraints and transparency |

Fee drag in the real world

Gross vs. net return scenarios; compounding impact of 2&20 vs. lower‑fee vehicles

Example: A 15% gross annual return with 2% mgmt and 20% perf on 13% gains nets roughly 8.4% before admin/custody. Over five years, compounding that gap can forfeit double‑digit cumulative returns versus a low‑fee alternative.

Why liquidity terms and operational complexity often correlate with fees

Complex strategies (basis/vol, cross‑venue routing, private credit underwriting) require teams, systems, borrow lines, and audits - fees fund that infrastructure.

Tighter liquidity (lockups/gates) often comes with higher expected alpha or yield and deeper operational work.

Practical checklist to minimize drag

Match fee load to expected edge: Pay up for scarce alpha; keep beta and treasuries cheap.

Verify hurdles and high‑water marks: Ensure you’re not paying carry on recovery of past drawdowns.

Compare all‑in costs: Include admin, custody, borrow/funding, and redemption terms in your net return math.

Align liquidity: Don’t overpay for daily liquidity you won’t use - or underpay when liquidity risk is real.

Where Zemyth focuses:

Fund Nest targets transparent, low‑friction income with daily accrual and clear disclosures, designed as your low‑drag base layer.

Startup Nest aligns carry with real progress using milestone‑gated unlocks - capital follows execution, not hype.

Risk Management, Custody, and Compliance: How Funds Protect (and Sometimes Fail) Capital

Robust crypto funds don’t just chase returns - they engineer resilience. Here’s the playbook top managers use to protect capital across market, counterparty, and operational risks - and what to look for so you can spot weaknesses before they surface.

Core risk buckets

Market risk (beta/drawdowns)

Directional exposure to BTC/ETH/majors; regime shifts and halving cycle shocks. Mitigate with hedges, sizing, and max‑DD limits.

Liquidity risk (gates, side‑pockets)

Stress redemptions, venue outages, or thin book depth can force unfavorable exits. Use liquidity tiering, redemption gates, and side‑pockets for illiquid assets.

Counterparty and borrow risk

Exchange solvency, prime broker rehypothecation, borrow recalls, and funding spikes. Diversify venues, set exposure caps, and enforce collateral standards.

Smart‑contract risk

Protocol exploits, oracle manipulation, and upgrade keys. Require audits, timelocks, bug bounties, and position size limits per protocol.

Operational and key‑person risk

Key loss, process failure, single‑point human dependencies. Use documented runbooks, dual control, and cross‑training; test disaster recovery.

Safeguards you should see

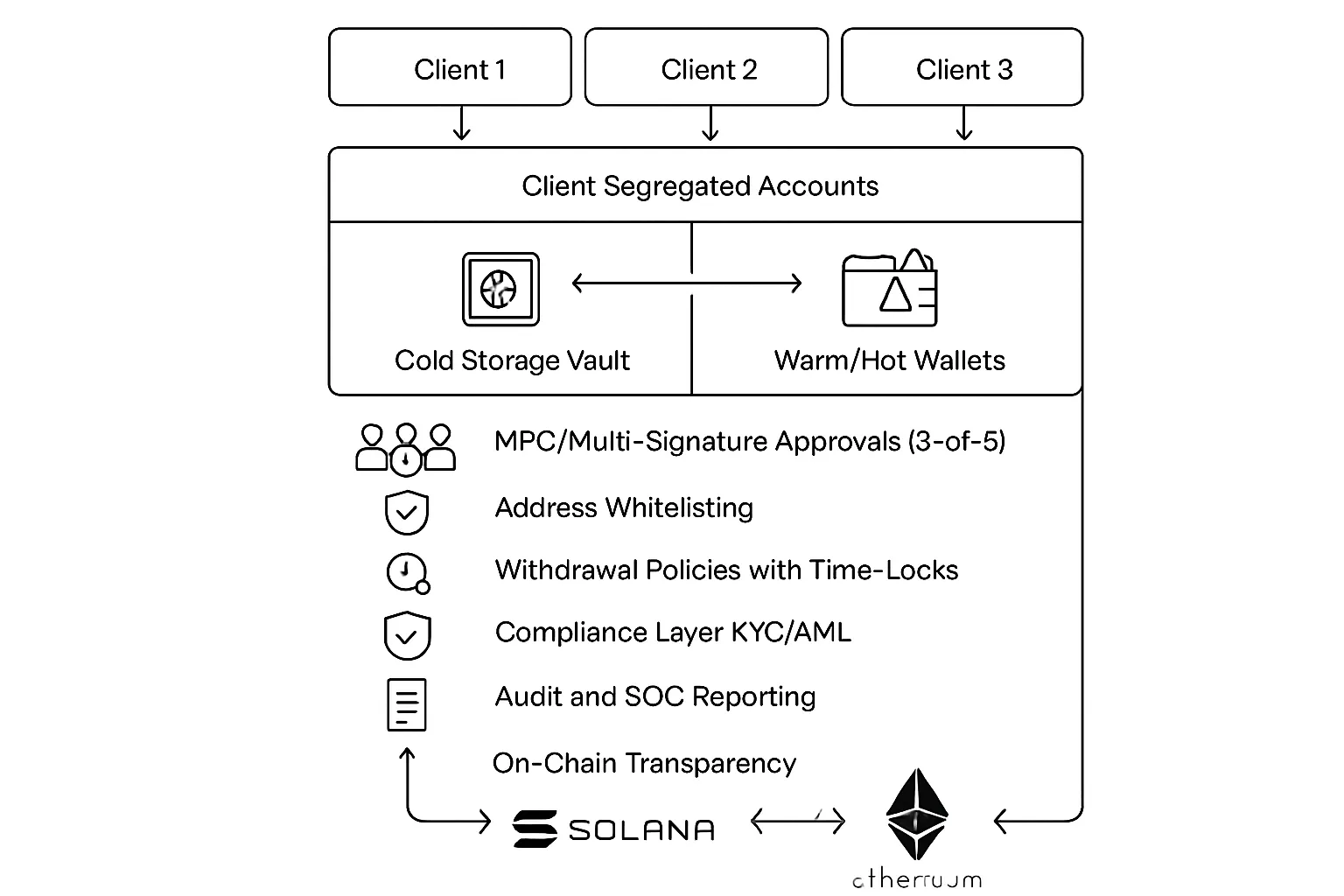

Qualified custodians and wallet security

Multi‑sig/MPC with 3‑of‑5 or better; cold/warm segregation; address whitelists; geographic key dispersion; withdrawal time‑locks; SOC 1/2 reports.

Segregated client accounts with verifiable on‑chain addresses on Solana/Ethereum; daily reconciliations across exchanges, wallets, and custodians.

Proof‑of‑reserves and attestations

Independent attestations with liabilities mapping; on‑chain wallet disclosures; periodic third‑party verification of asset ownership and segregation.

Valuation/NAV policies and reconciliation cadence

Price source hierarchy (primary exchanges, oracles, TWAPs), fair‑value methodologies for thin assets, and exception logs. Daily or weekly NAVs; end‑of‑month independent pricing checks.

Compliance and regulatory alignment

KYC/AML screening, sanctions checks, Travel Rule; alignment with MiCA/SEC/VARA‑style regimes; clear offering docs and investor eligibility controls.

Independent annual audits; board/IC oversight; incident reporting SLAs and post‑mortem disclosures.

Post‑mortems to learn from

Basis trade blow‑ups

Over‑levered cash‑and‑carry with borrow dependency, venue concentration, or funding regime flips. What changed: hard leverage caps, borrow diversification, dynamic haircuts, and pre‑approved unwind playbooks.

Stablecoin depegs and rehypothecation chains

Hidden leverage and circular collateral created false liquidity. What changed: asset‑liability matching, counterparty concentration limits, and look‑through exposure mapping.

Oracle failures and smart‑contract exploits

Manipulated price feeds and permissioned upgrade keys triggered liquidations. What changed: multi‑oracle aggregation, timelock governance, and circuit breakers with position caps.

Exchange/prime failures

Insolvency events froze funds. What changed: asset segregation at qualified custodians, daily position attestations, hot/warm wallet limits, and live withdrawal drills.

How Zemyth implements the standard:

On‑chain transparency: Solana settlement with contributor reputation and verifiable progress for Startup Nest milestones.

Custody discipline: Segregated accounts, multi‑sig policies, and defined withdrawal approvals with audit trails.

Rule‑based capital release: Milestone‑gated venture tranches ensure funds follow proof - builds shipped, users acquired, revenue milestones - reducing misuse risk.

Education‑first ops: Playbooks for contributors and founders so process and controls are understood, not just documented.

Due Diligence Checklist: 25 Questions to Vet Any Crypto Fund + Red Flags

"Carefully review the fees and expenses associated with any investment to understand their effect on your returns." - Source

If you plan to invest in a crypto investment fund, sharpen your selection edge. Use these 25 questions to pressure‑test a manager’s edge, operations, and alignment - then scan the red flags. This is how you protect capital and stack the odds of durable crypto investment returns.

Manager, strategy, and edge

What is your live, independently verified track record net of fees, and since when?

How do returns compare to BTC, ETH, and a blended crypto beta index across bull and bear cycles?

What specific edge (informational, analytical, execution) generates your P&L, and how does it decay with AUM?

What is your capacity at target volatility, and what hard capacity limits are enforced?

What share of P&L comes from directional vs. market‑neutral vs. yield/RWA sleeves (with attribution)?

What were max drawdown and time‑to‑recovery per sleeve over the last 3 years?

What is your slippage and borrow/funding model; can you show real fill‑quality and borrow availability evidence?

What proportion of results is backtest vs. live, and how were out‑of‑sample periods and true costs treated?

Operations and service providers

Who is the qualified custodian, and what are wallet policies (MPC/multi‑sig, cold/warm limits, address whitelists)?

Who is the fund administrator; NAV frequency; pricing source hierarchy; fair‑value methodology for illiquid assets?

Who is the auditor; date and opinion of last audit; any qualifications or scope limitations?

Who is legal counsel; fund domicile; investor rights and side‑letter governance?

What are primary execution venues; exposure limits per counterparty; rehypothecation controls?

Do you publish on‑chain addresses and reconciliations; proof‑of‑reserves/attestations cadence?

What oracles/data vendors do you use, and how do you mitigate oracle manipulation and data outages?

Risk and scenario control

What are target volatility, VaR limits, and stop‑out/deleveraging triggers by strategy?

How are assets bucketed by liquidity; what are redemption gates and side‑pocket criteria?

What is borrow/funding policy; minimum haircuts; margin buffers under stress?

How do you manage stablecoin and basis/depeg risks; show stress test assumptions and results.

What incident‑response playbooks exist; share the last three incidents and the process changes that followed.

How is key‑person risk mitigated - dual control, runbooks, cross‑training, and succession?

Investor alignment

How much GP capital is co‑invested (skin in the game), and in which share class?

Full fee schedule: management, performance/carry, hurdles, high‑water marks, and fee breakpoints at scale.

What transparency cadence do LPs get (positions, risk dashboard, P&L attribution, counterparty summary)?

Liquidity terms: notice period, settlement, gates, early‑redemption fees - who can change them and how?

Red flags

Unverifiable AUM or addresses; no third‑party admin or auditor.

Changing benchmarks post hoc to “explain” underperformance.

Excessive leverage, mismatched collateral, or concentration in a single venue/borrow source.

Unaudited or stale NAVs; vague pricing source hierarchy; mark‑to‑myth.

Opaque custody - no named qualified custodian, no wallet policies, no address whitelisting.

“Too smooth” returns for the mandate (e.g., long‑only with tiny drawdowns).

Capacity hand‑waving: no clear limits, no plan for diminishing edge with AUM growth.

Build vs. buy: where Zemyth fits

If you want venture upside with on‑chain accountability: Zemyth Startup Nest uses milestone‑gated, tranche‑based unlocks so capital follows proof (builds shipped, users, revenue), not hype.

If you want lower‑risk, liquid yield while you scout deals: Zemyth Fund Nest offers a dependable base layer - daily yield, clear disclosures, and practical liquidity.

Combine both for a results‑driven barbell: park capital in Fund Nest for stability, deploy into Startup Nest for curated, milestone‑verified venture exposure - so you can fund crypto opportunities with discipline rather than guesswork.

Portfolio Fit: How Much to Invest in a Crypto Fund and Sample Allocations

Picking how much to invest in a crypto fund is about role clarity: what outcome do you want - income, diversification, or moonshot upside - and what volatility can you actually live with? Use these rules and sample mixes to structure exposure that’s intentional, repeatable, and easy to rebalance.

Allocation rules of thumb

3–10% of total portfolio to crypto depending on risk tolerance

3–5% for conservative allocators seeking diversification and selective yield.

5–7% for balanced investors comfortable with cyclicality.

8–10% for experienced, higher‑tolerance allocators with strong rebalancing discipline.

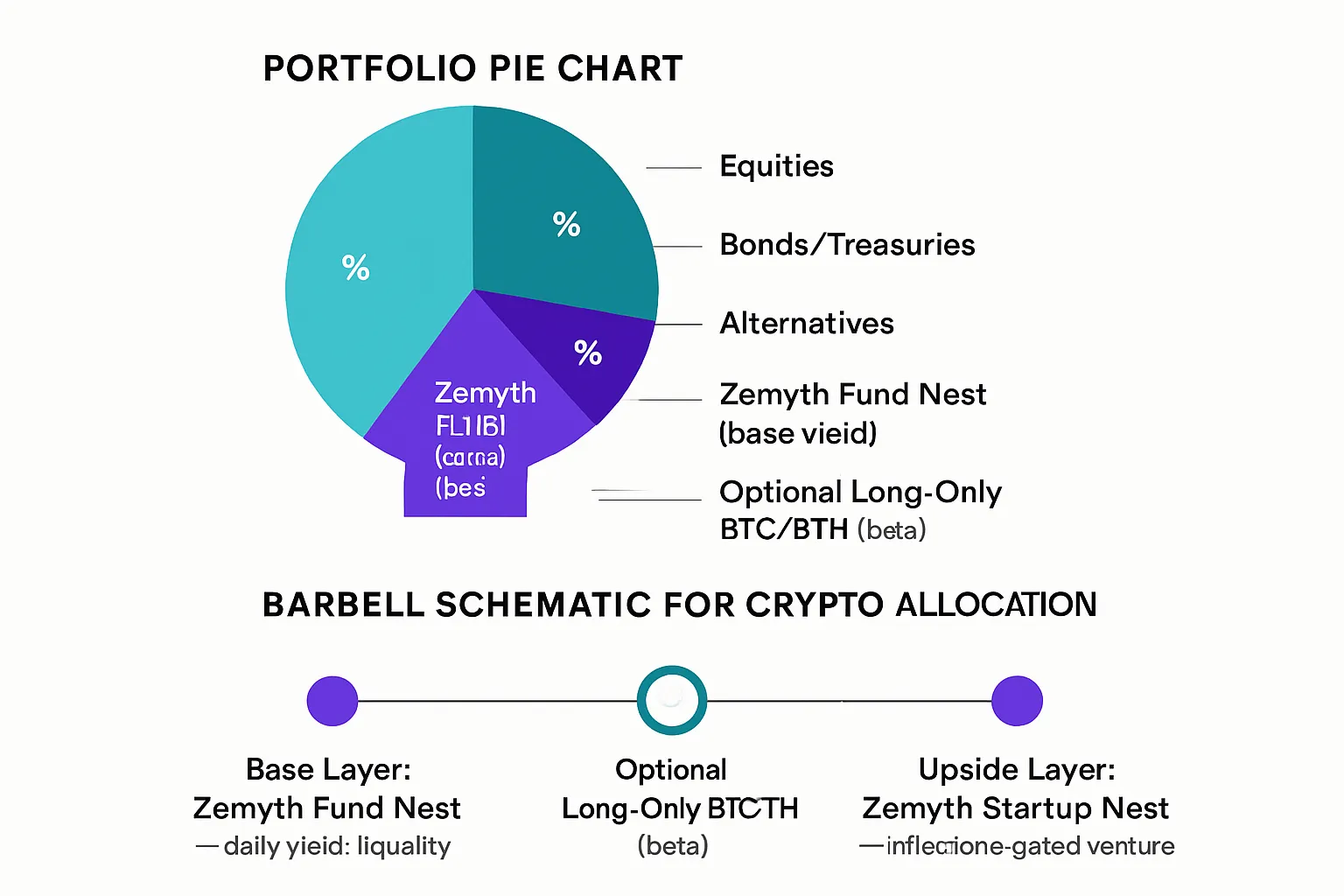

Barbell vs. core‑satellite approaches; rebalancing discipline

Barbell: Anchor in stable yield (RWA/treasuries) and take measured venture or directional bets on the other side.

Core‑satellite: Core beta via BTC/ETH funds or ETFs; satellites in market‑neutral and RWA for smoother P&L, and a small venture sleeve.

Rebalance rules: Set threshold bands (e.g., ±20% of target weight) or quarterly cadence to systematically trim winners and add to laggards.

Model mixes (illustrative; not financial advice)

Conservative income

70% treasuries/bonds

20% equities

5% RWA income fund

5% long‑only BTC/ETH

Rationale: Preserve capital, modest inflation‑plus yield; small crypto sleeve focused on stability.

Balanced

55% equities

25% bonds

10% crypto fund (blend of market‑neutral + RWA)

10% alternatives

Rationale: Diversified growth with a smoother crypto return path via neutral + income blend.

Venture‑tilted (experienced allocators)

10–15% crypto funds split across market‑neutral, RWA yields, and venture vehicles

Rationale: Barbell upside with risk‑controlled base; demands tolerance for multi‑year illiquidity and drawdowns.

Zemyth‑powered barbell

Base layer: Zemyth Fund Nest for daily yield and cash‑flow stability

Park capital between rounds, maintain liquidity, and let idle funds compound.

Upside layer: Zemyth Startup Nest for milestone‑gated venture exposure

Tranches unlock only when founders deliver on‑chain proof - capital follows execution.

How this complements or substitutes a traditional crypto investment fund

Complements: Use Fund Nest as a low‑drag core and add external managers for market‑neutral or quant edges.

Substitutes: If you want venture access with accountability and transparency, Startup Nest provides a rules‑based path without relying on opaque fund marks.

Optional long‑only sleeve: Add a small BTC/ETH allocation for pure beta if it fits your risk budget.

Implementation tip: Decide your total crypto budget first (e.g., 6% of portfolio), then split 60–70% to the Fund Nest base layer, 20–30% to Startup Nest venture, and 10–20% to long‑only or external neutral funds. Rebalance quarterly and increase the base layer after large rallies to lock in gains.

Taxes, Reporting, and Liquidity: Practical Realities by Region

Taxes and reporting can turn great gross crypto investment returns into mediocre net outcomes if you don’t plan ahead. Here’s a practical map to help you decide whether to invest in a crypto fund or build your own stack - then stay compliant while preserving liquidity.

Tax buckets to understand

Interest vs. capital gains vs. staking income

Interest: Tokenized treasuries, money market RWAs, and private credit typically generate ordinary interest income. Expect it to be taxed at your marginal rate.

Capital gains: Selling ETF/ETP shares, tokens, or fund interests generally creates capital gains/losses. Long-term gains often receive preferential rates; short-term gains do not.

Staking/restaking yield: Often treated as ordinary income when received at fair market value; subsequent sale triggers capital gains/losses. Restaking/LRTs can add complexity (timing, valuation, smart contract risk).

Holding periods

Track acquisition dates for long- vs. short-term treatment. Rolling, automated purchases (DCA) create multiple lots - accurate lot tracking improves tax outcomes.

PFIC/ETF nuances (US-centric but instructive)

Offshore crypto funds structured as foreign corporations may be PFICs for US taxpayers, triggering Form 8621 and election choices (QEF/mark-to-market). These decisions can materially change taxes and admin burden.

Spot Bitcoin ETFs/ETPs typically produce capital gains/losses on sale; many do not distribute income. Check issuer tax treatment and your broker’s reporting.

Reporting and tools

Statements and tax forms

Funds/LPs: Expect K‑1s (US partnerships), or local equivalents outside the US. Offshore funds may issue investor statements but not US tax forms - your CPA will need detail.

ETFs/ETPs: Typically report via 1099‑B (US) for proceeds and cost basis; interest/dividends via 1099‑INT/DIV if applicable.

RWA income: Interest breakdowns, withholdings, and NAV statements from the platform or transfer agent/administrator.

On‑chain proofs and attestations

Ask for wallet addresses, proof‑of‑reserves, and custody attestations. These don’t replace tax reporting but help reconcile positions and verify segregation of assets.

Portfolio trackers and accounting

Use reliable trackers that import from exchanges, wallets, and fund portals. Ensure they support cost‑basis methods (FIFO/LIFO/HIFO), multiple chains, and lot-level tax lots.

For active traders, ensure tools can export 8949/Schedule D (US) equivalents and attach fee/interest/airdrop classifications correctly.

Redemption mechanics and liquidity traps

Gates and notice periods

Hedge/quant/market‑neutral funds commonly use monthly/quarterly liquidity with notice (e.g., 30–90 days) and may impose gates to prevent forced liquidations during stress.

Side‑pockets

Illiquid or hard‑to‑value positions (private credit, venture tokens, distressed assets) are often moved to side‑pockets, separating them from routine NAV. Expect longer realization timelines.

Secondary markets for tokenized funds

Some RWA and fund tokens offer secondary trading on DEX/ATS venues. Depth can be thin - assume NAV-based creations/redemptions drive real liquidity. Slippage and spreads are part of the exit cost.

Settlement timing and NAV cadence

Redemptions may settle T+7 to T+30 (or quarterly for certain credit/venture sleeves). Match your cash-flow needs to the fund’s cadence before you allocate.

Regional notes (high level; verify locally)

United States

Tax treatment: Crypto is generally property. Capital gains on sale; staking and interest treated as ordinary income. Wash-sale rules have been debated - assume scrutiny and track lots carefully.

Vehicles: Onshore LPs (K‑1) vs. offshore funds (PFIC concerns). ETFs/ETPs simplify reporting but don’t eliminate capital gains.

Eligibility: Accredited/qualified investor rules apply to many private funds. Expect KYC/AML and suitability checks.

Forms to know: 1099‑B/INT/DIV, K‑1, 8949/Schedule D; potential foreign reporting (FBAR/8938) for offshore accounts.

European Union

MiCA sets licensing/oversight for crypto-asset service providers, improving investor protections and disclosures. Taxation remains national - treatment varies across member states.

Expect CASP (MiCA) venue requirements, standardized whitepapers for certain assets, and clearer custody/reporting obligations. Clarify whether your fund is marketed under MiCA-compliant frameworks.

Singapore

Regulatory clarity and high bar for licensing; IRAS generally treats routine trading as business income, while long-term investment gains are often not taxed - facts and circumstances matter.

Funds and platforms operate under strict AML/CFT oversight; expect strong KYC and source-of-funds checks.

Hong Kong

SFC frameworks allow licensed virtual asset trading platforms and tokenized products. Profits tax may apply if activity constitutes a trade; long-term investments may be outside scope - get local advice.

United Arab Emirates (ADGM/DIFC/Dubai VARA)

Progressive regimes for digital assets with clear licensing and custodial standards. Personal tax can be favorable, but corporate tax may apply for businesses; treatment depends on residence and entity structure.

Always consult tax/legal advisors

Jurisdiction determines outcomes: fund domicile, investor residency, and platform licensing all drive your tax and reporting reality. Get written advice before large allocations to any crypto investment fund.

How Zemyth keeps it practical

Reporting you can use: On‑chain transparency on Solana plus regular statements and performance breakdowns built for your tax pro.

Liquidity by design: Fund Nest offers a liquid, lower‑risk base to park capital between rounds, smoothing cash flow without forcing risk.

Accountability where it matters: Startup Nest releases tranches only when founders hit on‑chain milestones - clean evidence for governance and audit trails.

Bottom line: Build your allocation around the taxes you’ll actually owe, the reports you can actually file, and the liquidity you can actually access. When you fund crypto exposure through managers or RWAs, plan the exit and the tax lot before you enter.

Step‑by‑Step: How to Invest in a Crypto Fund in 7 Moves

Make your allocation process boring - in a good way. Follow this clean, repeatable playbook to turn due diligence into decisions and decisions into disciplined execution.

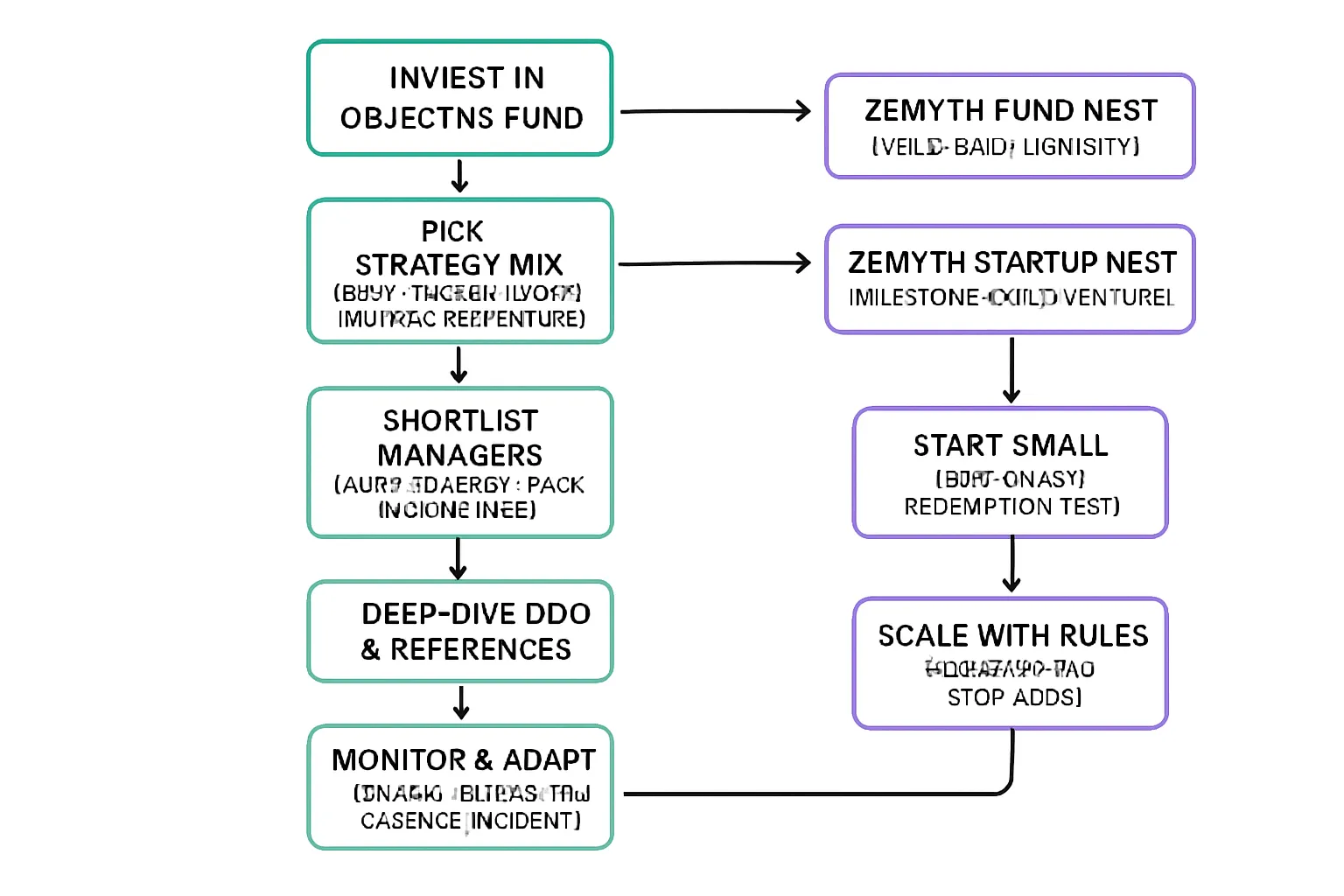

The 7‑step playbook

Define objectives and risk limits (target crypto allocation and loss tolerance)

Clarify outcome targets: income, diversification, or asymmetric upside.

Set a hard crypto budget (e.g., 5–8% of portfolio) and a max drawdown you will tolerate before pausing adds.

Pick a strategy mix (directional vs. market‑neutral vs. RWA/venture)

Map roles: beta for core exposure, neutral for smoother returns, RWA for yield, venture for long‑horizon upside.

Decide liquidity needs now - not after markets move.

Shortlist managers (filters: audits, custody, track record, fees)

Require independent admin + auditor, named qualified custodian, and verifiable addresses/PoR.

Screen for live track record, drawdown history, and clear fee stack (hurdles, HWM).

Deep‑dive DDQ + references (verify returns, service providers, docs)

Request P&L attribution, risk reports, incident post‑mortems, and NAV methodology.

Speak with existing LPs and validate service providers directly.

Start small; test reporting and redemption (pilot ticket)

One billing cycle to vet statements, analytics, and the redemption workflow.

Confirm settlement timing, slippage, and any gates or side‑pocket rules.

Scale with rules (rebalance schedule, stop‑adds after drawdowns)

Pre‑commit add/trim bands; institute cooling‑off periods after large DDs.

Cap position sizes by liquidity tier and counterparty exposure.

Monitor and adapt (KPIs: Sharpe, max DD, NAV frequency, incident logs)

Track risk‑adjusted metrics and correlation to BTC/ETH for drift.

Require quarterly reviews: capacity, staffing, new counterparties, security changes.

Where Zemyth can streamline the plan

Park capital in Fund Nest while diligencing funds; deploy to Startup Nest with milestone‑gated tranches as your venture sleeve.

Use on‑chain transparency on Solana for verifiable progress, clean settlement, and contributor reputation - so capital follows execution, not hype.

Conclusion: Build a Smarter Venture + Yield Stack with Zemyth

The bottom line

Crypto investment funds can deliver exposure across beta, alpha, and real‑world yield - if you pick the right strategy, validate the operation, and respect liquidity and fee drag. Whether you invest in a crypto fund for long‑only beta, market‑neutral spreads, or RWA income, your net outcome hinges on structure, custody, and costs. Treat allocation as a system, not a hunch, and your crypto investment returns become repeatable rather than lucky.

Why start with Zemyth now

Fund Nest: a practical liquidity layer with daily yield so idle capital compounds between rounds - your dependable base before you fund crypto risk.

Startup Nest: milestone‑gated venture exposure where capital follows execution, not hype - tranche unlocks tied to shipped builds, users, and revenue.

On‑chain transparency on Solana: verifiable progress, contributor reputation, and clean settlement.

Community‑led deal flow via affiliates and education via Zemyth Academy - so you don’t just allocate, you level up.

Call to action

Build your barbell: dependable yield + curated venture upside. Use Fund Nest for stability and cash‑flow, and layer Startup Nest for asymmetric outcomes.

Explore live opportunities and contributor onboarding at https://zemyth.app.