Choosing Investment Funds in 2025: ETFs, Crypto Indexes, and Nest Funds at a Glance

"In 2024, digital asset investment products saw a record $44.2B of inflows, nearly quadrupling the 2021 high." - Source

TLDR

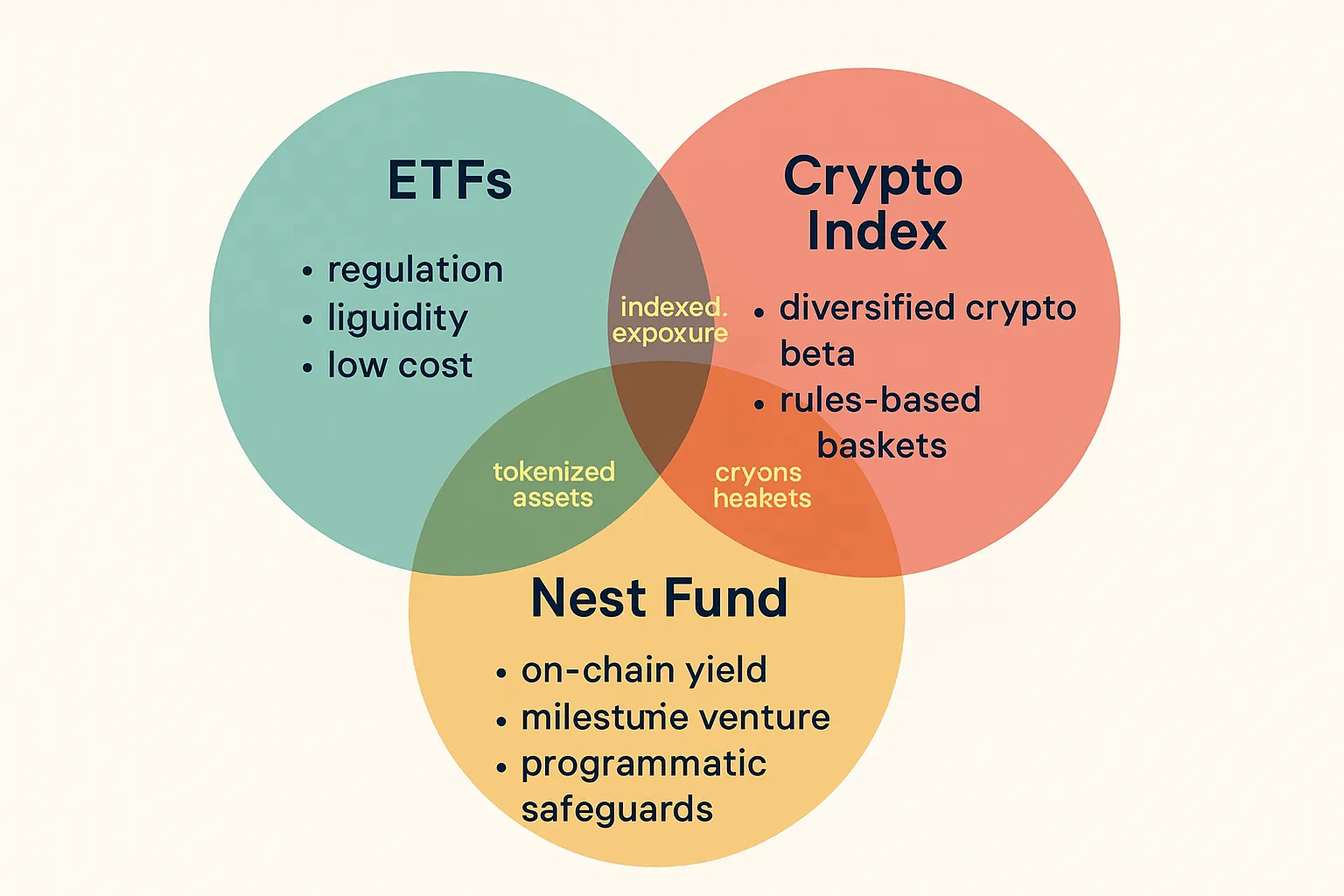

ETFs = regulated, liquid, low-cost market exposure via your brokerage with true ETF day liquidity.

Crypto index products = diversified crypto exposure without picking coins; simple “beta” to the asset class.

Nest funds (Zemyth) = on-chain yield and milestone‑gated venture exposure with programmatic safeguards and transparent flows.

Choosing investment funds in 2025 comes down to risk/volatility tolerance, liquidity needs (ETF day-to-day trading vs. on-chain), and whether you want passive beta (ETFs/indexes) or programmatic upside + yield (nest fund).

What you’ll learn

Clear definitions and differences: ETF vs crypto index vs nest fund (Zemyth).

Fees, liquidity, volatility, and drawdown trade-offs so you can compare apples-to-apples.

Who each option fits, and how to invest through each (brokerage, exchange/ETP, or on-chain with Zemyth).

Who this guide is for

Retail and institutional allocators deciding between ETF/crypto index beta vs. on-chain “nest fund” strategies.

Yield-seeking investors who want dependable base returns plus optional risk-on venture exposure.

Web3-native and traditional investors evaluating how to invest through on-chain rails while keeping risk in check.

How we compare options

Fees (expense ratios, carry/performance fees, on-chain costs)

Liquidity/access (ETF day liquidity vs. exchange hours vs. on-chain settlement)

Volatility/drawdown (beta profiles and historical max drawdowns)

Diversification (market-cap coverage, sector mix, tail assets)

Taxes (brokerage vs. tokenized/ETP vs. on-chain considerations)

Regulation (’40 Act/UCITS-style wrappers, exchange listing, on-chain transparency)

Investor fit (time horizon, risk tolerance, yield needs, custody comfort)

SEO note

Targets: choosing investment funds, nest fund, ETF day liquidity, invest through on-chain.

Ready to put your capital to work with programmatic safeguards and on-chain yield? Explore Zemyth’s nest fund approach and invest through on-chain at https://zemyth.app.

What Each Option Is: Definitions, Mechanics, and Where Returns Come From

"On Jan 10, 2024, the SEC approved the listing and trading of certain spot Bitcoin ETP shares, expanding investor access beyond prior futures-based products." - Source

Traditional ETFs (equity/bond/commodity and Bitcoin/Ether ETFs)

What they track: An index or asset basket (e.g., S&P 500, Treasurys, gold). Crypto-focused ETFs may track spot Bitcoin/Ether or futures contracts.

How shares trade: Intraday on exchanges with market makers providing bids/asks. Authorized Participants perform creation/redemption to keep prices near NAV.

Costs: Ongoing expense ratio (often 0.03%–0.50% for traditional broad-market ETFs; crypto ETFs higher), plus trading spreads and any brokerage commissions.

ETF day-to-day liquidity advantages: Intraday “ETF day liquidity” to enter/exit positions quickly inside a brokerage account, with tight spreads on popular tickers.

Who should use them: Investors prioritizing regulation, simplicity, and deep liquidity for broad market beta or single-asset crypto exposure via a brokerage.

Crypto Index Funds/ETFs

What they track: Market‑cap or rules‑based baskets (Top 10 crypto, DeFi, L2s, infrastructure). Rebalanced on a fixed schedule (e.g., monthly/quarterly).

Mechanics: Diversified exposure across multiple tokens/ETPs to reduce single‑asset idiosyncratic risk. Custody handled by fund providers or underlying ETPs.

Why diversified crypto beta helps: Spreads risk beyond Bitcoin/Ether, capturing sector leadership shifts (e.g., DeFi tokens, L2 ecosystems) while smoothing coin‑specific drawdowns relative to a single-asset approach.

Costs and trade-offs: Expense ratios often higher than traditional ETFs; crypto market volatility remains elevated versus equities/bonds.

Nest Funds (Zemyth)

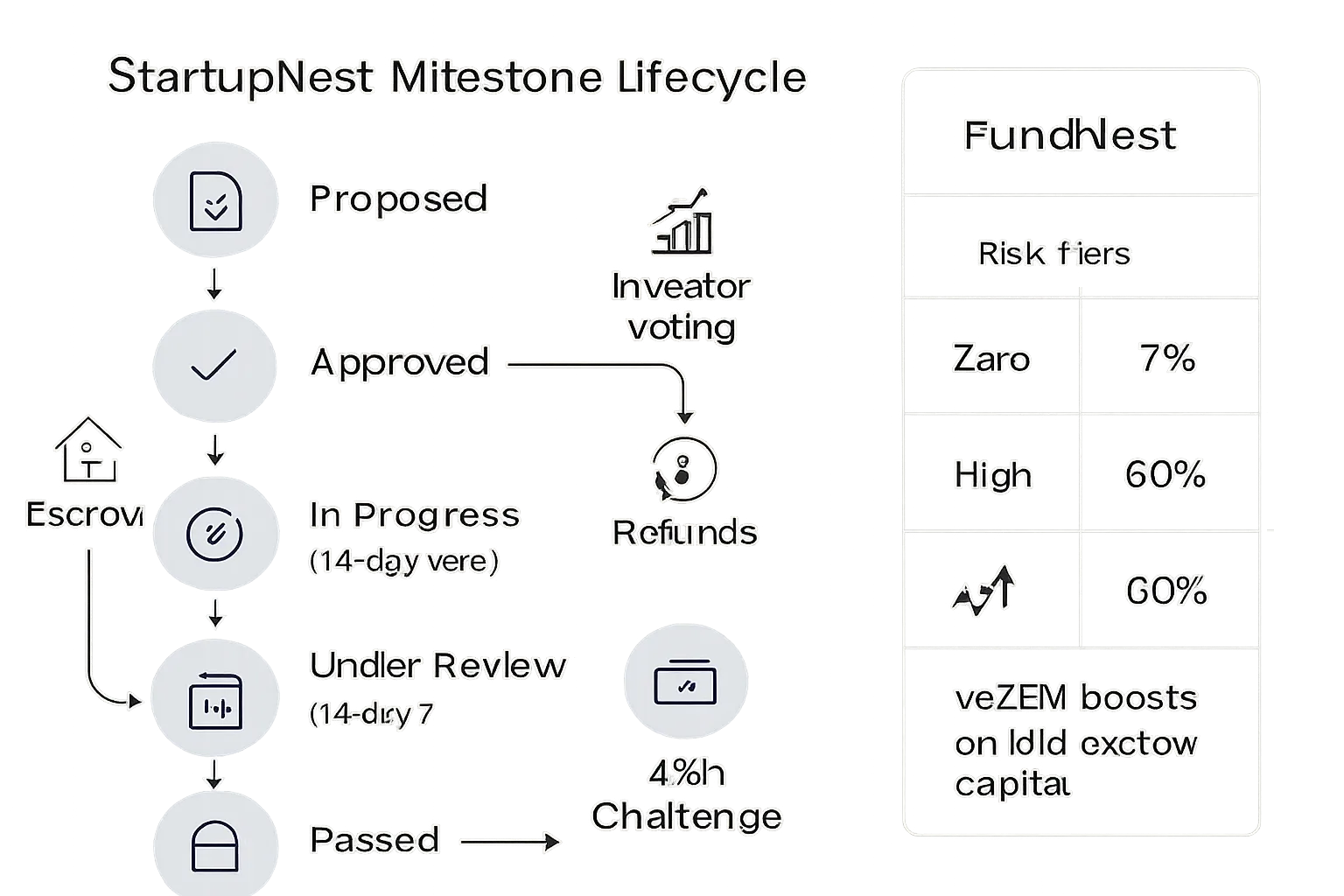

FundNest (on-chain yield): Risk‑tiered liquidity pools targeting 7%–60% APY from DEX trading fees. Zero‑risk stable pools for principal protection; higher tiers for risk‑takers. Withdraw anytime; boosts via ZEM staking.

StartupNest (venture exposure): Milestone‑gated financing where funds unlock only after investor‑approved progress. Investors hold Investment NFTs for voting, token claims at TGE, and potential secondary market liquidity.

Where returns originate:

Yield: DEX trading fees from curated LP positions (FundNest) plus ZEM boosts.

Alpha: Token distributions from StartupNest TGEs; priority access/boosts for ZEM holders.

Programmatic safeguards: Escrow, voting, challenge windows, and on‑chain state machines that enforce one‑way fund flows and refund rights in edge cases.

Pros/Cons at a glance

Traditional ETFs (passive beta)

Pros: Regulated, highly liquid, low fees, tax‑efficient wrappers.

Cons: Market beta only; no on‑chain yield; crypto ETFs can carry higher ERs.

Crypto Index Funds/ETFs (curated crypto exposure)

Pros: Diversified crypto beta without picking coins; rules‑based rebalancing.

Cons: Higher volatility; higher fees than broad equity ETFs; exchange-hour liquidity.

Nest Funds (Zemyth) (programmatic yield + venture)

Pros: On‑chain yield from LP fees, milestone‑gated venture upside, transparent escrow, investor voting rights, and optional boosts with ZEM.

Cons: Requires wallet/custody comfort; crypto-native volatility; on-chain ops vs. traditional brokerage.

When to favor each

Favor Traditional ETFs when: You need ETF day liquidity, low fees, and regulated exposure via a brokerage (core equity/bond beta, spot Bitcoin/Ether wrappers).

Favor Crypto Index Funds/ETFs when: You want diversified crypto beta across sectors and market caps without managing wallets or tokens.

Favor Nest Funds (Zemyth) when: You want programmatic on‑chain yield plus milestone‑gated venture upside with investor protections and transparent flows.

Quick comparison matrix

Vehicle | What it tracks | Where you buy (invest through) | Typical fees | Liquidity | Volatility | Diversification | Best for |

|---|---|---|---|---|---|---|---|

Traditional ETFs | Equity/bond/commodity indexes; spot/futures-based BTC/ETH | Brokerage account on stock exchanges | ~0.03%–0.50% (broad market), crypto ETFs higher | Intraday “ETF day liquidity” | Low–Medium (traditional), High (crypto) | Broad market or single-asset | Regulated, low-cost beta via brokerage |

Crypto Index Funds/ETFs | Market-cap or rules-based crypto baskets (Top 10, DeFi, L2s) | Brokerage (listed ETPs) or exchange platforms | ~0.5%–2.5% | Exchange trading hours (varies by venue) | High | Multi-coin exposure across sectors | One-ticket diversified crypto beta |

Nest Funds (Zemyth) | FundNest LP pools + StartupNest milestone venture | On‑chain via Zemyth app (wallet) | Protocol fees; LP costs; optional ZEM boosts | On‑chain settlement | Medium–High (depends on pool/tier and venture mix) | Yield sources + venture diversification | Yield seekers and venture upside with on‑chain safeguards |

Ready to turn on-chain yield and milestone‑gated upside into a strategy you control? Invest through Zemyth at https://zemyth.app.

Fees, Liquidity, and Access: How You Invest Through Each Vehicle

Expense ratios and hidden costs

ETFs (traditional and crypto):

Expense ratios: ultra‑low for broad equity/bond beta (often ~0.03%–0.20%); sector/smart‑beta 0.20%–0.60%; spot Bitcoin/Ether ETFs higher.

Hidden/implicit costs: bid/ask spreads, potential premiums/discounts vs. NAV on thin products, brokerage commissions where applicable, and market impact on large orders.

Crypto index products (index funds/ETPs):

Expense ratios: typically ~0.50%–2.50% depending on wrapper, custody, and index licensing.

Hidden/implicit costs: rebalancing turnover costs, spreads on underlying constituents or ETPs, and any issuer/platform fees.

Nest fund (Zemyth):

Protocol-level fees: FundNest 2% AUM + 20% performance fee (target APY varies by risk tier); early exit fee 2% in FundNest.

StartupNest fees: 8% success fee on funds raised, 1% milestone unlock fee, 50 USDC per Investment NFT mint, 2.5% secondary-market fee.

On‑chain costs: network (gas) fees, plus any slippage when entering/exiting LP positions.

Liquidity and ETF day-to-day trading

ETFs:

Intraday ETF day liquidity with market makers; tight spreads on high‑AUM tickers.

Creation/redemption helps anchor price to NAV; thin products can still trade at small premiums/discounts.

Crypto index products:

Exchange‑listed ETPs trade during market hours with spreads tied to underlying crypto markets; after‑hours liquidity may be limited.

Tokenized index products trade 24/7 on crypto venues but can have wider spreads/slippage during volatility.

Nest funds (Zemyth):

FundNest: withdraw anytime from curated pools; slippage depends on pool depth and timing; early exit fee may apply.

StartupNest: liquidity is programmatic - funds unlock per milestone; investors can exit during pivot/abandonment windows; Investment NFTs enable secondary trading.

Minimums, account types, and custody models

ETFs:

Minimums: one share (many brokers offer fractional).

Accounts: brokerages, IRAs/retirement accounts.

Custody: broker/custodian; no wallet required.

Crypto index products:

Minimums: one share/unit for ETPs; tokenized indexes may allow very small on‑chain minimums.

Accounts: brokerages for ETPs; exchanges or self‑custody wallets for tokenized products.

Custody: issuer/custodian for ETPs; self‑custody or exchange custody for tokens.

Nest funds (Zemyth):

Minimums: flexible on‑chain deposits; gas fees apply.

Accounts: supported Solana wallets (e.g., Phantom); invest through on‑chain.

Custody: self‑custody of assets/NFTs; transparent escrow smart contracts.

Access path: where you invest through in 2025

ETFs: major brokerages (Schwab, Fidelity, Robinhood, etc.); retirement accounts eligible.

Crypto index ETPs: brokerages where listed; tokenized index products via crypto exchanges or DeFi apps.

Nest funds (Zemyth): on‑chain via the Zemyth app with a supported wallet.

Fee & Liquidity scorecard

Vehicle | Typical expense ratio range | Trading/withdrawal costs | Intraday liquidity | Settlement speed | Minimums |

|---|---|---|---|---|---|

Traditional ETFs | ~0.03%–0.60% (higher for niche/crypto) | Bid/ask spreads; possible brokerage commissions | Yes, exchange hours | T+1 at brokerages | One share (fractional at many brokers) |

Crypto Index Funds/ETFs | ~0.50%–2.50% | Spreads; index turnover costs; platform/issuer fees | Yes (ETPs during market hours); 24/7 for tokenized variants | T+1 for ETPs; near‑instant on‑chain for tokens | One share/unit for ETPs; small on‑chain for tokens |

Nest Funds (Zemyth) | Protocol fees (e.g., 2% AUM + 20% perf in FundNest) | On‑chain gas; LP slippage; 2% early exit (FundNest) | On‑chain withdrawal windows; generally anytime for FundNest | Near‑instant on Solana finality | Flexible on‑chain deposit sizes |

Choosing investment funds in 2025 comes down to the trade‑offs you prefer: ultra‑low‑fee brokerage access and ETF day liquidity, diversified crypto beta via index products, or on‑chain programmatic yield and milestone‑gated venture exposure through a nest fund. Ready to invest through on‑chain with safeguards and yield? Start at https://zemyth.app.

Risk and Return: Volatility, Drawdowns, and Diversification Benefits

"Bitcoin’s annualized volatility was ~65% with a maximum drawdown of ~73% (Jan 2020–Sep 2025)." - Source

Volatility and maximum drawdown realities

Single-asset crypto vs. diversified baskets:

A single coin (e.g., BTC) concentrates risk in one narrative and one liquidity pool, so realized volatility and maximum drawdowns skew higher.

Diversified crypto indexes distribute exposure across sectors (L1s/L2s, DeFi, infrastructure). When leadership rotates, basket-level swings are typically lower than any one coin’s, even though crypto beta remains elevated versus equities.

Traditional ETFs (equity/bond) vs. crypto:

Broad equity/bond ETFs usually sit at the low end of volatility and drawdowns relative to crypto instruments. They provide smoother core beta but less convex upside.

Nest funds (Zemyth):

FundNest: risk-tiered pools let you target a volatility/return band - from low-variance stablecoin LP fees to higher-variance volatile pairs. Stable pools typically exhibit minimal price volatility and limited impermanent loss, while higher tiers accept more variance for higher target APYs.

StartupNest: milestone-gated venture tranches reduce capital-at-risk at any moment; funds unlock only after on-chain approvals. Token upside at TGE can be significant, but per-project exposure is time-gated and escrow-protected between milestones.

Diversification math for crypto baskets

Construction that dampens tails:

Market-cap weighting captures the “winners” as they grow, but can over-concentrate in BTC/ETH. Caps (e.g., 10–25%) limit dominance and curb single-asset tail risk.

Rules-based inclusion screens (liquidity, security history, free float) cut long-tail illiquid assets that amplify drawdowns.

Rebalancing cadence (monthly/quarterly) realizes mean reversion and leadership rotation, preventing persistent overweights in past winners.

Result: A diversified crypto index often shows lower volatility than any single constituent, while maintaining exposure to secular growth. It’s still high beta - just less boom/bust than a one-coin bet.

Scenario analysis

Bull market

Traditional ETFs: Core equity ETFs grind higher; commodity/thematic ETFs vary by macro regime.

Crypto Index Funds/ETFs: Outperformance is common as alt segments (DeFi, L2s) rotate into leadership; rebalancing locks in breadth.

Nest Funds (Zemyth): FundNest LP fees can rise with volume/volatility; higher-risk pools may see outsized fees. StartupNest sees faster milestone completions and more TGEs, unlocking venture upside and token distributions.

Sideways/chop

Traditional ETFs: Range-bound with modest dispersion; factor tilts matter.

Crypto Index Funds/ETFs: Choppy beta with whipsaw risk; diversification helps versus single-coin bets but remains volatile.

Nest Funds (Zemyth): FundNest stable pools continue fee accrual regardless of price trend; higher tiers may see muted but steady fees. StartupNest continues milestone gating - capital is not blindly deployed, limiting downside drift.

Bear market

Traditional ETFs: Drawdowns are generally smaller vs. crypto; flight-to-quality favors broad market, Treasurys, and cash-like ETFs.

Crypto Index Funds/ETFs: Deep drawdowns are typical; baskets cushion some single-asset tails but remain high beta.

Nest Funds (Zemyth): FundNest stable pools aim to preserve principal while generating fees (subject to market volumes). StartupNest’s escrow limits loss on unearned milestones; investors retain exit windows during pivots/abandonment, and challenge periods add a final veto before fund releases.

Portfolio role

Core vs. satellites

Core beta: Traditional ETFs (equity/bond) as the foundation for most allocators seeking lower volatility and ETF day liquidity.

Crypto beta sleeve: Crypto index funds/ETFs to capture diversified crypto upside without single-asset concentration risk.

Yield/venture sleeve: Nest funds (Zemyth) for on-chain yield (FundNest) and programmatic venture exposure (StartupNest) with escrow and milestone safeguards.

Suggested guardrails (illustrative, not advice)

Core ETFs (equity/bond): majority of public-market allocation for stability and tax-efficient wrappers.

Crypto Index beta: measured exposure sized to risk tolerance; favor capped, rules-based baskets with disciplined rebalancing.

Nest fund (Zemyth): split by risk tier - stable FundNest pools for dependable base yield; smaller venture sleeve in StartupNest for milestone-gated upside. Reinvest yields or harvest during high-volatility spikes.

Access and execution

Prefer deep-liquidity ETFs for day-to-day flexibility and tight spreads.

Use diversified crypto indexes for rotation capture across sectors.

Invest through on-chain with Zemyth when you want programmatic yield, escrowed venture unlocks, and transparent state machines governing risk.

Want on-chain yield plus milestone‑gated venture upside with investor protections? Invest through Zemyth at https://zemyth.app.

Investor Fit: Which Option Matches Your Goals and Timeline?

TLDR

Capital preservation + ETF day liquidity → Traditional ETFs as your core.

Balanced growth with diversified crypto beta → Add a crypto index sleeve.

Yield + asymmetric venture upside → Add a nest fund sleeve via Zemyth (FundNest + StartupNest) and invest through on-chain.

Personas and priorities

Capital preservation + liquidity (ETF core)

Priorities: stability, low fees, tight bid/ask spreads, tax-efficient wrappers.

Fit: broad equity/bond ETFs as your primary exposure; optional spot BTC/ETH ETF at small weights.

Why: regulated access, intraday liquidity, predictable tracking to benchmarks.

Guardrails: avoid excessive niche/thematic tilt; use ETF day liquidity to rebalance on schedule, not emotion.

Balanced growth with diversified crypto beta (crypto index)

Priorities: upside participation across L1s/L2s/DeFi without single-coin risk.

Fit: a rules-based, capped crypto index product; rebalanced monthly/quarterly to capture leadership rotation.

Why: diversified beta smooths coin-specific drawdowns while preserving participation in sector upcycles.

Guardrails: cap single-asset exposure; prefer transparent index rules and liquidity.

Yield + asymmetric venture upside (nest fund via Zemyth)

Priorities: dependable on-chain yield with optional venture convexity.

Fit: FundNest for tiered LP yields (zero→high risk), StartupNest for milestone‑gated venture exposure via Investment NFTs.

Why: escrowed milestones, challenge windows, and voting rights create programmatic safeguards while fees from LP activity generate daily yield.

Guardrails: size StartupNest exposure prudently; diversify across projects; use stable FundNest tiers for base yield and step up risk selectively.

Suggested allocation example ranges (educational, not advice)

Conservative

70–90%: Traditional ETFs (core equity/bond beta; intraday liquidity; ultra‑low fees)

5–15%: Crypto Index Funds/ETFs (capped, rules‑based diversified crypto beta)

5–15%: Nest Funds (Zemyth)

90% of this sleeve: FundNest Zero/Low‑Risk pools for base yield

10% of this sleeve: StartupNest small, milestone‑gated positions

Balanced

50–70%: Traditional ETFs (broad market core, use ETF day liquidity to keep drift in check)

15–25%: Crypto Index Funds/ETFs (Top 10/sector baskets; monthly/quarterly rebalancing)

15–25%: Nest Funds (Zemyth)

~60% of this sleeve: FundNest Zero/Low/Medium‑Risk pools

~40% of this sleeve: StartupNest diversified across 3–5 projects

Growth‑oriented

30–50%: Traditional ETFs (anchor for liquidity and tax efficiency)

25–35%: Crypto Index Funds/ETFs (broader crypto beta, capped to avoid concentration)

20–30%: Nest Funds (Zemyth)

~40% of this sleeve: FundNest Medium/High‑Risk pools (sized to tolerance)

~60% of this sleeve: StartupNest across multiple milestones/sectors

Notes:

Treat ranges as starting points; calibrate to your risk tolerance, time horizon, and liquidity needs.

Use contribution caps per project and per risk tier to avoid over-concentration.

Reinvest FundNest yield or sweep to stable tiers during high volatility.

Time horizons and rebalancing cadence

Horizons

ETFs (core): multi‑year; compounding from low costs adds up.

Crypto index sleeve: full-cycle exposure (3–5+ years) to capture rotations across sectors.

Nest fund sleeve: FundNest for ongoing yield across cycles; StartupNest for milestone‑gated distributions and TGEs over 12–36 months.

Cadence and rules you can stick to

Rebalance quarterly or semi‑annually using tolerance bands (e.g., ±5% around targets).

Automate DCA for crypto index exposure to dampen timing risk.

For Nest funds:

Set policy rules: max 5–10% per single project; only add on milestone progress.

Keep a base allocation to Zero/Low‑Risk FundNest; adjust higher‑risk tiers during periods of sustained volume and healthy fee generation.

Use on‑chain reporting to review escrow status, voting outcomes, and unlock history before increasing exposure.

Want on‑chain yield plus milestone‑gated venture upside with programmatic safeguards you can actually audit? Invest through Zemyth at https://zemyth.app.

Inside a Nest Fund: How Zemyth’s FundNest and StartupNest Work

"FundNest’s Zero Risk stablecoin pools aim for ~7% APY; StartupNest releases escrowed funds per milestone after investor votes and a 48-hour challenge window." - Source

FundNest - yield tiers and where returns come from

Zero→High risk vaults: curated pools from stablecoin LP (Zero Risk target ~7% APY) up to high‑volatility pairs targeting higher APYs (up to ~60%) with greater variance.

No leverage in Zero Risk tier: minimizes liquidation risk and impermanent loss; ideal for principal‑preservation or escrow capital.

veZEM boosts: lock ZEM as veZEM to amplify APYs (up to ~2.5× boost on select tiers), stacking base yield with token utility.

Yield source: trading fees from DEX activity; carefully curated venues, risk screens, and automated rebalancing.

StartupNest - milestone‑gated venture exposure

Escrow first: investor capital locks in program escrow; funds move forward only on milestone success.

Investor voting: 14‑day voting windows; >50% of cast votes needed to pass a milestone.

Challenge windows: after a milestone is Passed, a 48‑hour challenge/veto period gives investors a final check before funds unlock to founders.

Refund paths: investor exit during pivots; refunds in abandonment or TGE‑failure scenarios; all rights encoded in Investment NFTs.

Investment NFTs: on‑chain positions with voting weight, token claim rights at TGE, and transferability for secondary market liquidity.

Why Nest vs. ETF/Index

Programmatic safeguards: one‑way state machines, time‑bounded windows, and permissionless checks enforce disciplined capital flows.

On‑chain transparency: escrow balances, votes, and state transitions are verifiable on Solana.

Capital efficiency: idle escrow can earn yield in FundNest Zero Risk pools until milestones unlock, improving IRR vs. idle cash.

How Zemyth fits into a diversified 2025 portfolio

Use Zemyth as your yield/venture sleeve:

Park a base in FundNest Zero/Low Risk pools for dependable daily fee yield.

Allocate selectively to StartupNest for milestone‑gated upside with NFT-based rights.

Combine with ETF/index cores:

Keep broad ETF beta in brokerage accounts for liquidity and tax efficiency.

Add a diversified crypto index sleeve for sector rotation.

Layer Zemyth on‑chain for programmatic yield and transparent venture exposure.

Build your on‑chain yield and milestone‑gated upside with Zemyth. Invest through https://zemyth.app.

Regulation, Taxes, and Security in 2025: What Actually Matters

Regulatory posture

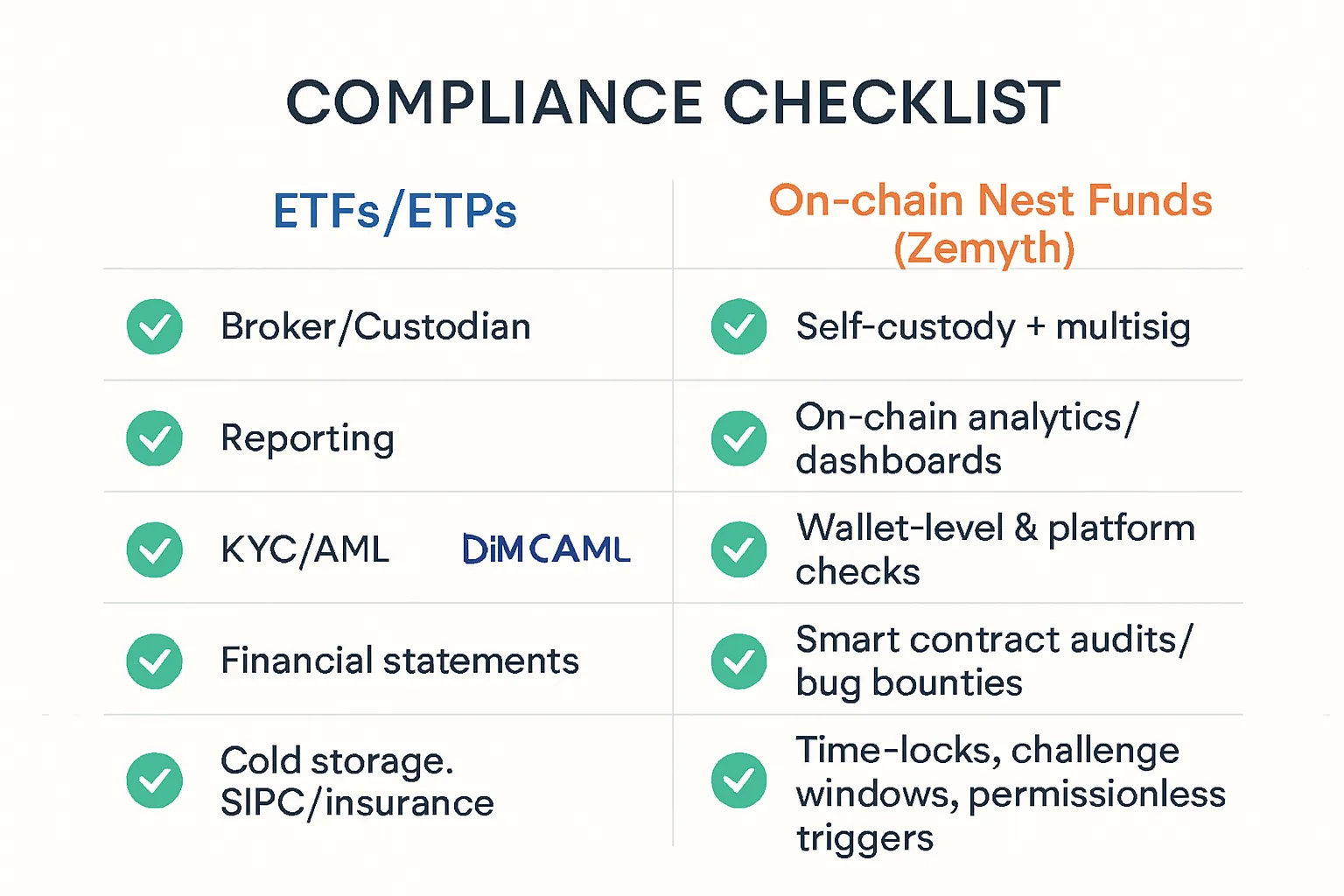

ETFs/ETPs (securities law oversight)

U.S.: SEC oversight of registered investment companies and exchange listings; futures-based products also intersect with CFTC rules. Prospectus/SAI, daily NAV, creation/redemption via Authorized Participants (APs), market surveillance at listing venues.

EU/UK: UCITS/UCITS-like wrappers (where eligible) and exchange listing rules (ESMA/FCA). Crypto ETPs often structured as exchange-traded products with dedicated crypto custodians and listing prospectuses.

Implication for investors: standardized disclosures, exchange oversight, market-maker support, and established remediation paths.

On‑chain products (jurisdiction varies)

Protocols and tokenized strategies can be treated differently across the U.S., EU, and APAC. Platform-level KYC/AML may apply; some jurisdictions require VASP registration or equivalent.

Smart-contract transparency and on-chain attestations often substitute for traditional reporting, but you must assess legal status locally before allocating.

Tax basics (jurisdiction‑dependent, educational only)

ETFs/ETPs

U.S. investors typically receive Form 1099s. Equity/bond ETFs can be tax‑efficient due to in‑kind redemptions; commodity/crypto ETPs may differ by structure (trust vs. ’40 Act fund).

Distributions may be qualified dividends, ordinary income, or capital gains. Gains/losses realized on sale of shares; cost basis reported by broker.

Futures-based ETFs (where applicable) can have different tax treatment (e.g., 60/40 blended Sec. 1256 in the U.S. - product specific).

On‑chain yield/tokens

Yield from LP fees, staking, or token rewards is generally taxable upon receipt as ordinary income; later disposals typically trigger capital gains/losses.

Gas fees may adjust cost basis; NFT dispositions and token airdrops can be taxable events.

Always consult a qualified tax advisor; rules vary by country and product wrapper.

Custody and security checklists

ETFs/ETPs: broker/custodian standards

Segregated client assets; exchange listing and transfer agent workflows.

Crypto ETPs: institutional cold storage, MPC/custodian insurance arrangements, SOC1/2 reports, disaster recovery and key ceremony procedures.

Investor action items: use reputable brokers, verify listing venue, review issuer’s custodian, and check prospectus risk disclosures.

On‑chain nest funds (self‑custody best practices)

Wallet hygiene: hardware wallets, multi‑sig or social recovery where possible, offline seed backups, allowlisted addresses, phishing and dApp permission audits.

Protocol diligence: independent audits, bug bounties, timelocked upgrades, emergency pause with limitations, oracle resilience, circuit breakers on abnormal flows.

Investor action items: test small transactions first, monitor on-chain positions in explorers, and set notification alerts for contract state changes.

Operational risk controls to demand

ETFs/ETPs

Daily holdings transparency (where applicable), clear NAV methodology, multiple APs for robust creation/redemption, exchange surveillance sharing agreements, and audited financials.

On‑chain nest funds (as implemented by Zemyth)

Auditability: all escrow balances, votes, and state transitions recorded on-chain (Solana).

Time‑locks & challenge windows: 48h veto period after a milestone passes before funds unlock to founders.

Voting & governance: 14‑day milestone voting; >50% of cast votes required to pass; 7‑day hold requirement prevents flash attacks.

Auto‑approve fallbacks: moderator timeouts to prevent stalling; reduces single‑point-of-failure risk.

Permissionless triggers: anyone can trigger inactivity checks, TGE deadlines, and refund states (Abandoned, TGEFailed), ensuring timely resolution without gatekeepers.

One‑way state machines: terminal states are immutable; funds only move forward upon success criteria, or back to investors during defined safety windows.

Capital efficiency: idle escrow can be deployed into FundNest Zero‑Risk pools to earn yield without leverage, then pulled back automatically for milestone unlocks.

Bottom line: pick the regulatory and security model that matches how you want to invest through in 2025. If you want regulated wrappers and ETF day liquidity, brokerage‑held ETFs/ETPs fit. If you want programmatic safeguards, verifiable on‑chain governance, and capital efficiency while you earn, Zemyth’s nest fund architecture was built for that. Ready to see it in action? Start at https://zemyth.app.

Decision Framework: A Simple 3‑Step Way to Choose

Step 1 - Prioritize outcomes

Decide what you want your money to do first. Everything else follows.

Liquidity first (ETF core)

You value intraday ETF day liquidity, tight spreads, and regulated wrappers.

You need the ability to raise cash quickly without moving markets.

Outcome: core allocation to broad equity/bond ETFs; optional small spot BTC/ETH ETF sleeve.

Diversified crypto beta (crypto index)

You want exposure to the crypto asset class without picking coins.

You prefer rules‑based baskets (Top 10, DeFi, L2s) with rebalancing and caps.

Outcome: add a capped, market‑cap/rules‑based crypto index sleeve.

Yield + venture upside (nest fund via Zemyth)

You want on‑chain yield today (FundNest) plus milestone‑gated venture convexity (StartupNest).

You value programmatic safeguards (escrow, votes, challenge windows) and transparent state machines.

Outcome: allocate to FundNest (by risk tier) and selectively to StartupNest projects.

Quick self‑check:

Need cash access any day? Favor ETFs.

Want crypto exposure without single‑asset risk? Favor crypto index.

Want programmatic yield plus venture shots with safeguards? Add a nest fund sleeve.

Step 2 - Set guardrails

Write rules you can live with in stormy markets.

Risk/drawdown

Max portfolio drawdown tolerance (e.g., −15%, −25%, −40%).

Position caps:

Single ETF: ≤10–20% of portfolio (varies by core vs. satellite).

Single crypto index: ≤10–15%.

Single StartupNest project: ≤1–3%.

FundNest high‑risk tiers: ≤5–10% total.

Fees

Expense ratio caps (e.g., ≤0.20% for core ETFs; ≤1.5% for crypto ETPs).

On‑chain costs: set a gas and slippage limit for deposits/withdrawals.

Protocol fees: accept only if net yield/alpha meets your hurdle rate.

Taxes and accounts

Where will you hold each sleeve? (Brokerage/IRA vs. on‑chain wallet).

Distribution policy:

ETFs: reinvest dividends.

FundNest: auto‑compound or sweep to stable tier.

StartupNest: define a harvest plan at TGE (e.g., laddered exits).

Custody preferences

Brokerage custody for ETFs/ETPs.

Self‑custody best practices for on‑chain (hardware wallet, allowlist, permission review).

Maintain a 3–6 month liquidity buffer outside on‑chain allocations.

Rebalancing rules you’ll follow

Cadence: quarterly or semi‑annual.

Tolerance bands: rebalance when weights drift ±5% from target.

DCA schedule for crypto index sleeve to reduce timing risk.

For StartupNest: only add on milestone progress; never average down into failing governance.

Step 3 - Build your mix

Use a simple core/satellite structure with clear rebalancing triggers.

Core (stability + liquidity)

40–80% Traditional ETFs (broad equity/bond, low fees, intraday liquidity).

Optional 0–5% spot BTC/ETH ETF inside the core if policy allows.

Satellite 1 (diversified crypto beta)

10–30% Crypto Index Funds/ETFs (capped, rules‑based baskets; monthly/quarterly rebalance).

Prefer transparent methodologies and deep secondary liquidity.

Satellite 2 (yield + venture via Zemyth)

10–30% Nest Funds (on‑chain):

FundNest: 50–80% of this sleeve across Zero/Low/Medium/High tiers per your risk profile.

StartupNest: 20–50% of this sleeve diversified over 3–8 milestone‑gated projects.

Sample implementation recipes (educational, not advice):

Conservative

70% Core ETFs

15% Crypto Index

15% Nest Funds (80% FundNest Zero/Low; 20% StartupNest small positions)

Balanced

60% Core ETFs

20% Crypto Index

20% Nest Funds (60% FundNest Zero/Low/Medium; 40% StartupNest across 3–5 projects)

Growth

45% Core ETFs

25% Crypto Index

30% Nest Funds (40% FundNest Medium/High; 60% StartupNest diversified)

Operational checklist

Rebalance quarterly with ±5% bands; harvest winners, top up laggards.

Automate DCA into crypto index on a fixed day each month.

FundNest: set a base allocation to Zero/Low Risk; scale higher tiers only when fee volumes and pool depth are healthy.

StartupNest: size per project ≤2% of portfolio; increase only after Passed milestones; monitor votes and 48h challenge outcomes.

Document your exit rules (price bands, milestone events, TGE distributions) and stick to them.

Bottom line: pick the primary outcome you need, set risk and process guardrails, then assemble a core/satellite mix you can maintain through full cycles. When you’re ready to add programmatic yield and milestone‑gated upside to your plan, invest through Zemyth on‑chain at https://zemyth.app.

Implementation Playbooks: From First Dollar to Ongoing Rebalance

Brokerage route (ETFs)

Open/fund your account

Choose a low‑cost broker with fractional shares, dividend reinvestment (DRIP), and tax‑lot selection (FIFO/Specific ID).

Fund via ACH/wire; enable margin only if policy permits (not required for ETFs).

Build your core list

Core equity/bond ETFs (e.g., total market, S&P 500, aggregate bonds).

Optional satellite tilts (dividends, small‑cap, international, sector themes).

If adding crypto exposure via ETFs, define a small, capped sleeve.

Order types and cost control

Use limit orders during high‑liquidity hours; avoid the open/close to reduce spread and volatility.

For larger tickets, break into tranches; consider time‑weighted (TWAP) execution.

Turn on DRIP; minimize turnover; harvest tax losses within wash‑sale rules.

Rebalancing and drift rules

Rebalance quarterly/semis using tolerance bands (e.g., ±5% from target).

Automate alerts for drift, distribution dates, and corporate actions.

Crypto index route

Choose custody and wrapper

Brokerage ETPs (regulated, exchange‑hours liquidity, 1099 reporting).

Tokenized index baskets (24/7 markets; requires wallet and self‑custody).

Validate index methodology

Selection: market‑cap/rules‑based, free‑float/liquidity screens, security exclusions.

Caps: single‑asset caps (e.g., 10–25%) to limit concentration.

Rebalance cadence: monthly/quarterly; check turnover and estimated costs.

Execution and tracking

ETPs: monitor premium/discount vs. NAV, creation/redemption health, spreads.

Tokenized: mind slippage, venue depth, and custody risks; stage entries.

Tracking error: compare fund performance vs. benchmark; investigate persistent deviations.

Ongoing maintenance

Schedule contributions via DCA to reduce timing risk.

Review methodology updates and constituent changes each rebalance cycle.

Nest fund route (Zemyth)

Connect and fund

Install a supported Solana wallet (e.g., Phantom/Solflare); secure seed offline.

Visit the Zemyth app and connect your wallet; fund with USDT/USDC/SOL.

Pick your FundNest tier

Zero Risk: stablecoin LP pools targeting ~7% APY, no leverage - principal‑preservation base.

Low/Medium/High Risk: higher target APYs from volatile pairs; accept more variance.

Cost controls: set max slippage; batch deposits during optimal liquidity.

Boost APY with ZEM

Lock ZEM as veZEM (1–4 years) to boost FundNest yields (up to ~2.5× on eligible tiers).

Track lock expiry and incremental boost effects; ladder locks for flexibility.

Add StartupNest (venture sleeve)

Browse projects: review milestones, funding percentages, TGE terms, and timelines.

Investment NFTs: each position mints an NFT with voting weight and token claim rights; NFTs are transferable for secondary liquidity.

Governance: vote during 14‑day windows; monitor Passed states and the 48‑hour challenge period before unlocks.

Risk rails: cap any single project at ≤1–3% of portfolio; only scale after successful milestones.

Distributions: at TGE, claim tokens via NFT; define a harvest plan (ladder exits, hold with ZEM+NFT staking boosts where applicable).

Ongoing management

Reinvest FundNest yield or sweep to Zero/Low Risk tiers during high volatility.

Set alerts for milestone votes, challenge windows, and pivot/exit windows.

Review escrow states and protocol audit logs before increasing exposure.

Automation, monitoring, and review

Calendarized reviews

Monthly: contributions, yield receipts, ETF/ETP drift check.

Quarterly: full rebalance against targets; verify fee drag and tracking error.

Semi‑annual: re‑underwrite index methodologies; reassess Nest fund risk tiers and project slate.

Alerts and dashboards

ETFs/ETPs: alerts for large premium/discount, spread widening, and AUM/creation halts.

Crypto index: index changes, rebalance dates, methodology updates.

Nest fund (Zemyth): on‑chain alerts for vote openings, Passed statuses, 48h challenges, and refund/exit windows.

Risk checks

Max drawdown guardrail for the whole portfolio; throttle deposits if breached.

Position caps: single ETF/index/NFT limits; per‑tier caps for FundNest.

Counterparty/protocol health: audit status, bug bounty activity, and venue liquidity.

From your first dollar to a disciplined, on‑chain yield + venture sleeve, Zemyth makes it straightforward to invest through on‑chain with programmatic safeguards. Ready to add it to your plan? Get started at https://zemyth.app.

Conclusion and Next Step: Build Your 2025 Portfolio with Zemyth

Recap

ETFs: regulated, liquid core beta with ETF day liquidity via your brokerage.

Crypto index: diversified crypto exposure without coin‑picking, rules‑based baskets and rebalancing.

Nest fund (Zemyth): on‑chain yield + milestone‑gated venture with programmatic safeguards, escrow, and transparent governance.

Actionable close

Start with a core/satellite mix that matches your liquidity, drawdown tolerance, and tax constraints.

Use ETFs for the core - low fees, tight spreads, and simple rebalancing.

Add a crypto index sleeve for diversified crypto beta without single‑asset risk.

Use Zemyth’s FundNest for dependable base yield (tiered pools, veZEM boosts) and StartupNest for milestone‑gated venture exposure with Investment NFTs, escrow, voting, and 48‑hour challenge windows.

Rebalance quarterly or semi‑annually with tolerance bands, automate DCA where possible, and document guardrails you’ll follow in volatile markets.

CTA

Start with Zemyth: Earn base yield with FundNest and access milestone‑gated venture via StartupNest → https://zemyth.app

Try Zemyth now and see live vaults and projects: https://zemyth.app

Reminder: This is educational content, not financial advice.