Build Your Personal Investment Strategy: From Timeline to Tactics

You don’t need another list of “hot investments.” You need a written plan that tells your money what to do and when to do it - then runs on autopilot. This playbook aligns your investment methodology with concrete investment tactics and a clear timeline investment map, so you can deploy capital deliberately, measure progress, and adjust without emotion. And because Zemyth is built for execution - milestone-gated venture rounds in the Startup Nest and a liquid, yield-focused Fund Nest - you’ll have practical rails to implement your strategy on-chain with transparency.

What this playbook covers (goal-first, timeline investment, and execution)

Translate goals into a time-stamped plan: define cash needs by month/quarter, then match risk to horizon.

Turn investment methodology (your rules and constraints) into investment tactics (your automations, allocations, and rebalancing triggers).

Build a timeline investment stack: immediate needs, near-term buffers, medium-term growth, and long-term conviction plays.

Automate the boring but critical: contributions, rebalancing, and cash sweeps - so you stick to the plan, not the headlines.

Execute with tools that fit the plan:

Fund Nest for liquid, lower-risk yield and parking capital between rounds.

Startup Nest for milestone-gated venture upside where capital follows execution, not hype.

Why timeline-first beats product-first (sequence-of-returns risk, clarity of cash needs)

A timeline-first strategy designs around when you need money - not around whatever product is trending.

Reduces sequence-of-returns risk: If you’re forced to withdraw after a drawdown, compounding suffers. Mapping withdrawals to safer sleeves ensures you’re not selling risk assets at the worst time.

Clarifies cash needs: Assign exact amounts and dates for obligations (runway, taxes, purchases). Then fund those with low-volatility, high-liquidity vehicles so the rest of the portfolio can compound.

Aligns risk to horizon: 0–12 months = liquidity first. 12–36 months = stability with modest yield. 3–7 years = diversified growth. 7+ years = high-conviction, higher-volatility bets you can hold through cycles.

Turns “strategy” into weekly actions: Automate contributions to Fund Nest, set recurring rebalances, queue venture tranches that only unlock when teams ship verifiable milestones.

"Asset allocation policy accounted for about 90% of the variability in total plan returns over time." - Source

Quick glossary you’ll actually use

Investment methodology: Your operating system - the beliefs, constraints, and rules that govern how you invest. Examples: prefer milestone-gated venture over hype; cap position sizes; target after-tax total return; rebalance when bands breach ±20% of target weights.

Investment tactics: The concrete actions that make your methodology real. Examples: automate dollar-cost averaging into Fund Nest; set quarterly rebalancing and band-based trims; allocate a fixed tranche size to Startup Nest rounds only after on-chain proof-of-progress; set cash sweeps to refill your 6–12 month buffer.

Timeline investment: A plan that maps each goal to a time horizon and risk budget, then assigns the right vehicles. Examples:

0–12 months: cash buffer and Fund Nest yield to smooth cash flows.

1–3 years: low-volatility yield and short-duration exposure for predictable needs.

3–7 years: diversified growth (public beta, thematic ETFs, or diversified crypto majors).

7+ years: higher-variance/venture exposure in Startup Nest with tranche unlocks tied to builds, users, and revenue.

Outcome: a written, reviewable plan you can automate and measure

By the end of this playbook, you’ll have:

A one-page, goal-first strategy that links time horizons to allocations and rules.

A tactical checklist: what to fund weekly/monthly, when to rebalance, and which automations keep you on track.

A measurement loop: dashboards for yield, drawdown tolerance, cash runway, and milestone-based venture exposure - so you adjust with data, not emotion.

On Zemyth, that means your liquidity base compounds daily in Fund Nest while your venture sleeve deploys only when founders deliver verifiable proof. That’s investment and strategy working together - timeline-first, tactic-driven, and built to run.

Turn Your Investment Methodology into a Written IPS You’ll Follow

Your Investment Policy Statement (IPS) is the bridge between investment methodology and day-to-day execution. It distills your beliefs, constraints, and risk budget into rules and automations you can follow in any market - then it tells you exactly when to act and when to do nothing. On Zemyth, that means your plan can pair the Fund Nest for liquid, lower-risk yield and cash buffers with milestone‑gated exposure in the Startup Nest where capital unlocks only on verifiable progress.

"The investment policy statement is the cornerstone of the investment process, translating objectives and constraints into a long‑term plan." - Source

Define goals by time horizon (near-term, mid-term, long-term) and funding targets

Goal-first means time-first. Assign each goal a horizon, amount, and service level (how certain the money must be available).

Near-term (0–12 months): Non-negotiable expenses, taxes, emergency runway, short-term purchases.

Funding target: 6–12 months of spending. Instruments: high-liquidity, low-volatility yield. On Zemyth: park in Fund Nest for daily yield and cash-flow smoothing.

Mid-term (1–3 years): Known lumpy costs (tuition, relocation, seed capital for a project).

Funding target: 100% of expected spend with modest growth. Keep volatility contained to avoid sequence risk.

Long-term (3–7 years): Growth with periodic rebalancing to manage drawdowns.

Funding target: Expected spend plus a growth premium; accept cyclical volatility with guardrails.

Very long-term (7+ years): Higher-volatility, higher-upside allocations.

Funding target: Use a risk budget for venture-style allocations. On Zemyth: Startup Nest rounds with milestone-based tranches tied to builds, users, and revenue.

Risk budget and drawdown limits that fit your mindset (behavior-first design)

Your IPS should protect you from your worst enemy: bailing at the bottom. Set explicit, behavior-aware limits.

Portfolio-level risk budget:

Max peak-to-trough drawdown you can tolerate without changing the plan (e.g., 18%).

Volatility target range (e.g., keep annualized vol within 8%–12%).

Sleeve-level limits:

Near-term sleeve: target <5% drawdown. If exceeded, top up from Fund Nest yield or new contributions.

Mid-term sleeve: target <10% drawdown; rebalance if >10% or band breach.

Long-term sleeve: accept higher variance; rebalance on ±20% bands vs. target weights.

Venture sleeve: position sizing caps (e.g., any single deal ≤2% of total portfolio; total venture ≤15%).

Behavior triggers:

Pre-commitment: “I will not sell risk assets due to headlines. I only act on IPS triggers.”

Cooling-off rule: 72-hour delay before any discretionary deviation; document rationale.

Translate objectives into investment tactics you can automate (DCA, auto-rebalance, cash buffers)

Turn investment strategy into repeatable investment tactics:

Dollar-Cost Averaging (DCA):

Automate weekly or monthly contributions into Fund Nest and long-term sleeves. Auto-allocate by percent to keep discipline and cadence.

Auto-rebalance:

Quarterly scheduled rebalance plus band-based intraperiod rebalances when sleeves drift ±20% from target.

Tax-aware sequencing: rebalance in tax-advantaged accounts first; in taxable, use new cash and distributions to steer back toward targets before selling.

Cash buffers:

Maintain 6–12 months of expenses in the near-term sleeve. Sweep excess Fund Nest yield to refill the buffer automatically after withdrawals.

Venture execution rules (Startup Nest):

Deploy only via milestone-gated tranches; no full upfront allocations.

Require on-chain or verifiable proof-of-progress for each unlock (builds shipped, user growth, revenue).

Enforce deal caps and pacing (e.g., no more than one new deal per month).

Liquidity choreography:

Sequence withdrawals from near-term and mid-term sleeves first to avoid selling long-term risk after a drawdown.

Guardrails and escape hatches (what triggers changes; what never does)

Guardrails keep you in bounds. Escape hatches define when the playbook itself should change.

What triggers changes:

Life events: income ±25% change, major purchase added/removed, new dependents.

Risk tolerance shift: documented inability to hold through an IPS-defined drawdown.

Horizon shift: a goal’s date moves by ≥12 months.

Structural regime change in your income or liquidity needs.

What never triggers changes:

Headlines, market noise, FUD/greed cycles, or a single-month drawdown.

Individual asset narratives without changes to fundamentals or your goals.

Exceptional overrides (documented only):

If portfolio drawdown exceeds your max risk budget by 25% (e.g., 18% limit hit 22.5% actual), initiate a predefined de-risking ladder over 3 tranches rather than one-shot selling.

If a venture tranche fails milestone verification, skip unlock; do not “average down” outside the tranche plan.

Deliverable: a one-page IPS you can revisit quarterly

Build a concise IPS you’ll actually read and follow. Suggested sections:

Purpose and philosophy: Your investment methodology and beliefs.

Goals by timeline: Table of goals with date, amount, and certainty.

Target allocation: Sleeve weights (near-, mid-, long-term, venture) and acceptable bands.

Risk budget: Max drawdown, volatility target, position limits.

Tactics and automations: DCA schedule, rebalance rules, cash buffer policy, Fund Nest sweeps.

Venture rules: Tranche sizing, milestone criteria, pacing, and caps via Startup Nest.

Guardrails and governance: What triggers plan updates, review cadence, and documentation process.

Metrics to monitor quarterly: Cash runway months, sleeve drift, yield rate, realized vs. planned contributions, milestone unlocks.

Revisit quarterly, but act only on IPS-defined triggers. That’s how timeline investment, investment methodology, and investment tactics become a single, durable investment and strategy you can execute with confidence on Zemyth.

Map Your Timeline to Risk Buckets and Investment Tactics

Your timeline investment map turns abstract goals into sleeves with clear risk budgets and investment tactics you can automate. Build from liquidity outward: protect near-term cash needs first, then stack growth engines and high-upside venture where time is your ally. Zemyth’s Fund Nest and Startup Nest make the pipeline practical - liquidity and daily yield between deployments, and milestone‑gated venture rounds where capital follows execution.

Bucket 1: 0–18 months (capital preservation and liquidity)

Tools: High-liquidity cash, short-duration Treasuries; Fund Nest as a liquid, lower‑risk yield layer.

Tactics: Auto-sweeps from paycheck/inflows, monthly withdrawals automation, maintain 6–12 months of expenses; refill buffer with Fund Nest yield before adding risk.

Bucket 2: 18–60 months (steady growth with guardrails)

Tools: Investment‑grade bonds, short/intermediate-duration ladders, balanced ETFs; Fund Nest for parking between deployments.

Tactics: Glidepath rebalancing (gradually derisk as spend date nears), 5% drift rules, tax‑aware trims in advantaged accounts first.

Bucket 3: 5–10+ years (growth engine)

Tools: Global equities across market caps/regions, factor tilts (quality, value, momentum), real assets/inflation hedges.

Tactics: Quarterly rebalancing, disciplined DCA into equities, band‑based reallocations at ±20% of target weights.

Venture Sleeve (long horizon, high dispersion)

Tools: Milestone‑gated venture via Zemyth Startup Nest on Solana with on‑chain proof (builds, users, revenue).

Tactics: Tranche‑by‑tranche funding upon verified milestones; pacing rules; position sizing caps (e.g., 1–3% per deal; total venture ≤10–20% depending on your IPS risk budget).

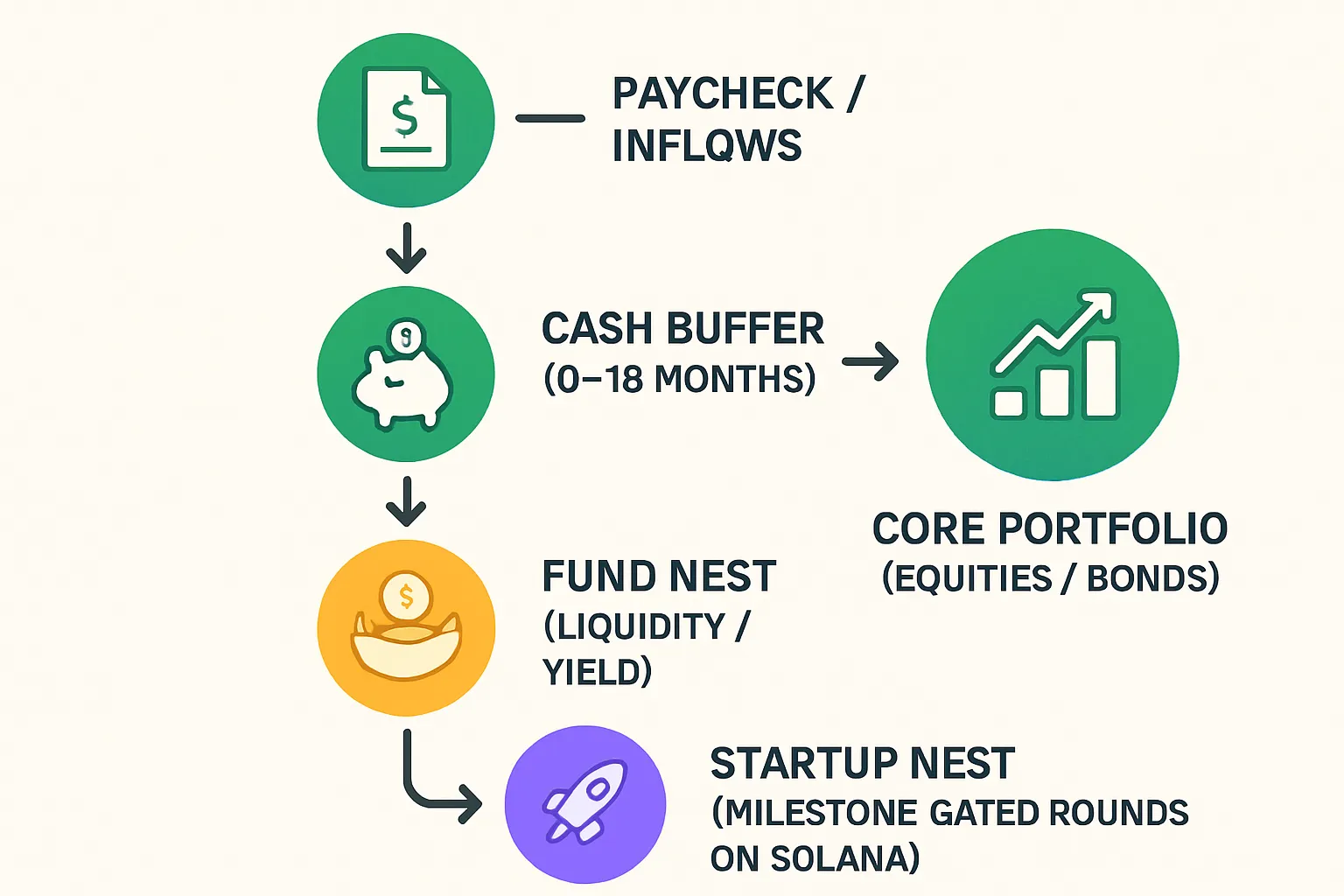

Put it together: one funding pipeline from income → cash buffer → Fund Nest → core portfolio → Startup Nest

Income auto‑routes to the Cash Buffer (0–18m) first.

Excess sweeps to Fund Nest for daily yield and staging.

Scheduled releases fund the core portfolio (bonds/equities) based on your IPS targets.

Selectively route a predefined slice to Startup Nest deals, unlocking tranches only when proof is delivered.

Timeline → Risk Buckets → Tactics Matrix

Time Horizon | Goal Examples | Risk Budget (max drawdown) | Primary Vehicles | Investment Tactics (automations) | Zemyth Layer (Fund Nest/Startup Nest role) |

|---|---|---|---|---|---|

0–18 months | Taxes, emergency runway, near-term purchases | ≤5% | High-liquidity cash, short-duration Treasuries; Fund Nest | Paycheck auto-sweeps, monthly withdrawal automation, yield sweeps to refill buffer | Fund Nest for liquidity and daily yield; no venture |

18–60 months | Tuition, relocation, down payment | ≤10% | Investment-grade bonds, short/intermediate ladders, balanced ETFs; Fund Nest for staging | Glidepath derisking, 5% drift rules, quarterly light rebalance | Fund Nest to park between deployments; no Startup Nest until >60m |

5–10 years | Growth for future lifestyle/work optionality | 15–25% (per IPS) | Global equities, factor tilts, real assets | DCA into equities, quarterly rebalancing, band-based trims at ±20% | Fund Nest as overflow/liquidity sleeve; venture optional but capped |

10+ years (Venture) | High-upside innovation exposure | Deal cap 1–3% each; total venture ≤10–20% | Startup Nest milestone‑gated rounds on Solana | Tranche unlocks on on‑chain proof, paced deal flow, strict caps | Startup Nest executes venture; Fund Nest holds undeployed/dry powder |

This is investment and strategy done right: match time horizons to risk buckets, enforce your risk budget, and let investment tactics and automations execute the plan. Fund Nest smooths cash flow and compounds idle capital; Startup Nest unlocks venture upside only when founders deliver evidence - so your portfolio stays aligned with your written methodology.

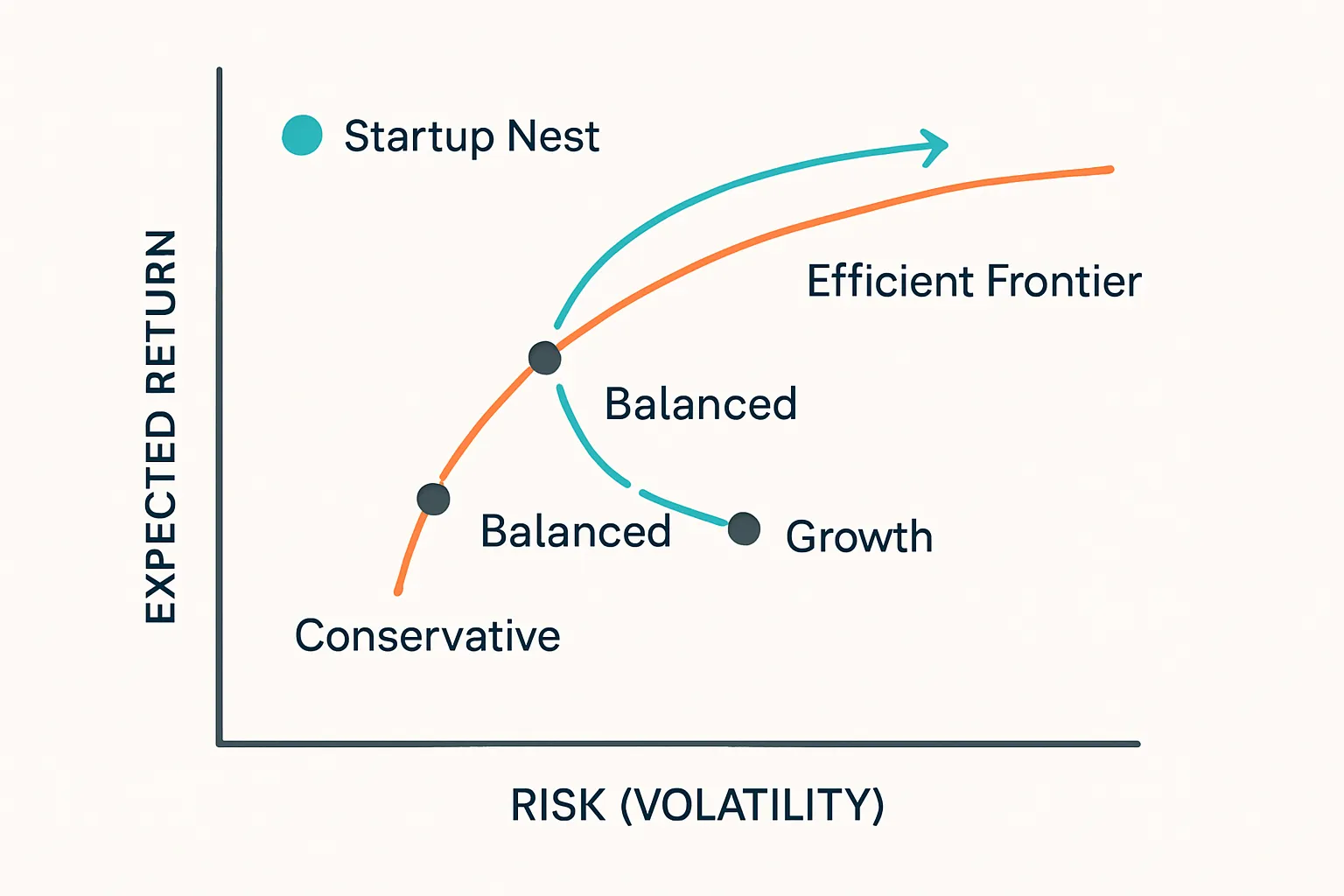

Asset Allocation That Fits Your Strategy: From Efficient Frontier to Guardrails

Efficient allocation turns your investment methodology into measurable risk and return. Start with a core–satellite framework, layer in a disciplined rebalancing policy, and - with eyes wide open around risk - consider a measured venture sleeve where tranches unlock only on proof. Zemyth’s Fund Nest anchors liquidity and yield between deployments; Startup Nest delivers milestone‑gated venture exposure you can size and pace.

Core–satellite design with a venture sleeve

Core: Global stock/bond mix sized to your IPS risk budget. Think broad beta (global equities) plus ballast (high-quality bonds).

Satellite: Factor tilts (value, quality), real assets/inflation hedges, and a measured venture sleeve via Zemyth Startup Nest.

Sizing: Cap any single satellite sleeve to avoid crowding. Venture position caps (1–3% per deal) and total venture exposure within your IPS risk budget.

Rebalancing policy you’ll actually use (thresholds vs. calendar; tax-aware sells)

Primary: Threshold-based bands keep risk aligned as markets move.

Bands: ±5% around target weights for conservative/balanced; ±10% for growth sleeves.

Sequence: Use new contributions/dividends first, then tax-advantaged accounts, then selective taxable sales.

Secondary: Calendar check (quarterly) to catch drift that never breaches bands.

Exceptions: No rebalancing out of deeply dislocated assets during forced-selling windows unless the IPS override triggers are met.

Advanced: volatility targeting or risk parity considerations (optional for pros)

Vol targeting: Adjust risk asset weights to keep portfolio volatility within a target range (e.g., 8%–12% annualized). Scale exposures down when realized vol spikes.

Risk parity: Allocate so each sleeve contributes comparable risk, not just capital. Requires robust risk estimates and disciplined rebalancing.

Liquidity overlay: Maintain Fund Nest dry powder to meet collateral or rebalance needs without selling at unfavorable times.

How Zemyth fits allocation math: Fund Nest as a liquid “cash‑plus” anchor between venture tranches

Fund Nest: Daily compounding yield, T+liquidity feel, and a parking lane between venture deployments - smooths cash flow, funds rebalances, and refills buffers.

Startup Nest: Milestone‑gated tranches tied to on‑chain proof; you size total venture within your IPS, cap per-deal exposure, and pace commitments to avoid concentration.

Sample Allocations by Risk Profile (Conservative, Balanced, Growth) with Zemyth layers

Risk Profile | Cash Buffer | Bonds | Global Equities | Real Assets | Fund Nest (% of total) | Venture via Startup Nest (% of total) | Rebalance Rule |

|---|---|---|---|---|---|---|---|

Conservative | 6–12% | 45–55% | 25–35% | 0–5% | 5–10% | 0–5% | Threshold bands ±5%; quarterly check |

Balanced | 6–12% | 30–40% | 40–55% | 5–10% | 5–10% | 5–10% | Threshold bands ±5%; quarterly check |

Growth | 6–12% | 15–25% | 55–70% | 5–10% | 3–8% | 10–20% | Threshold bands ±10%; quarterly check |

Guardrails to keep: Maximum peak-to-trough drawdown aligned to your IPS; per-deal venture cap 1–3%; aggregate venture cap per profile; maintain liquidity via Fund Nest for rebalances and runway. When markets wobble, you won’t - your plan already knows what to do.

Behavior and Automation: Make Good Decisions Once, Then Systematize

The best investors don’t outguess the market - they out-execute their plan. Lock in rules when you’re calm, then let automation run the playbook. Zemyth makes this practical: Fund Nest handles liquidity and yield, while Startup Nest enforces milestone‑gated venture deployment so you never chase hype.

"A hypothetical investor who missed just the 5 best days from 1988–2023 ended with ~37% less than a fully invested peer." - Source

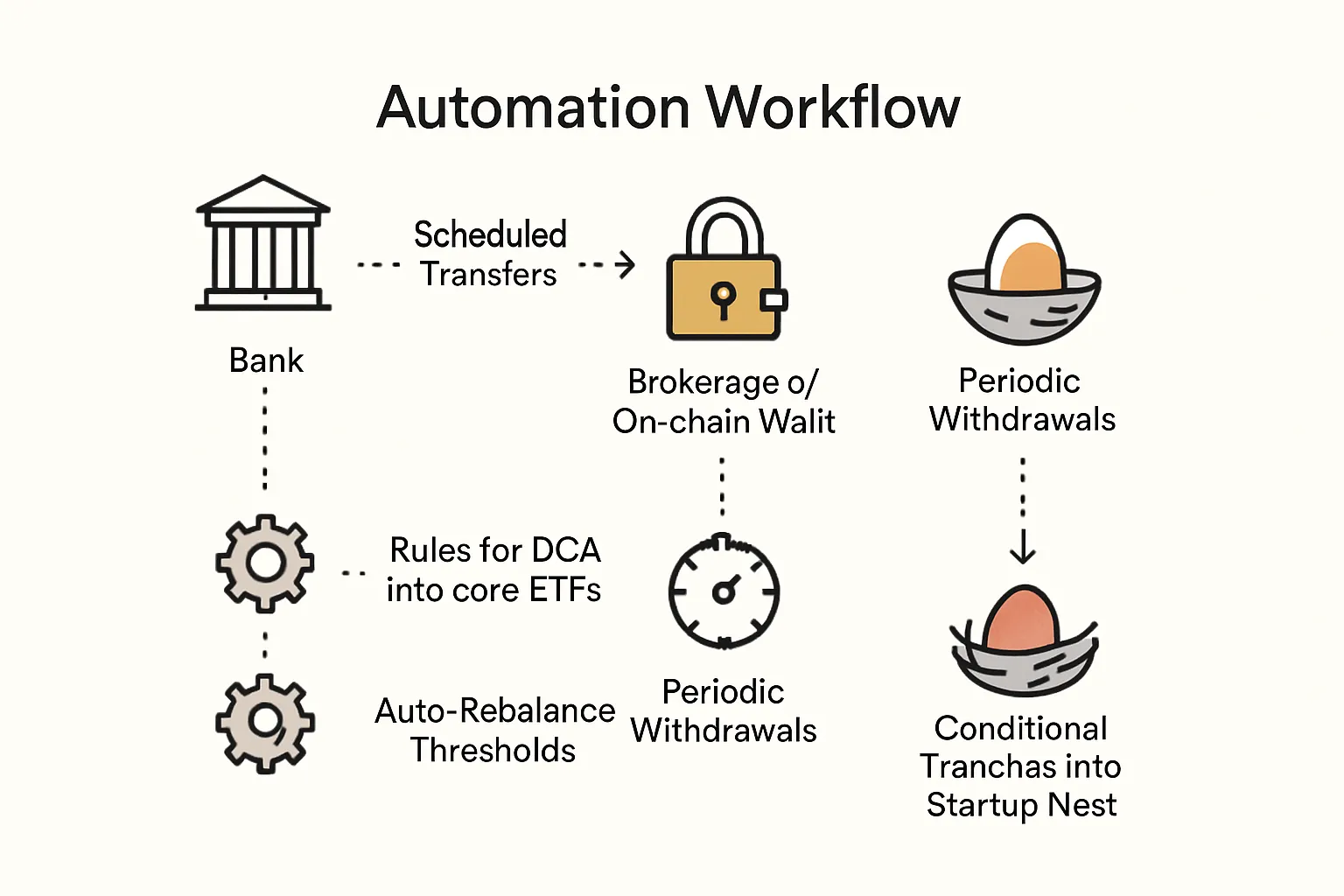

Automate buys (DCA), rebalancing, and cash‑to‑investment sweeps

Scheduled transfers: Move a fixed amount from your bank to brokerage/on‑chain wallet weekly or biweekly.

DCA rules: Auto-allocate contributions across core ETFs/global equity sleeve and Fund Nest staging per your IPS targets.

Auto‑rebalance: Use threshold bands (e.g., ±5%/±10%) with a quarterly check. In taxable accounts, prioritize new cash and dividends before selling.

Cash sweeps: After covering 6–12 months of expenses, sweep excess to Fund Nest for daily yield; trigger top‑ups to the Cash Buffer after withdrawals.

Guard against timing FOMO: pre-commit rules and checklists

Pre-commit: “I do not pause DCA or sell risk assets based on headlines.”

Checklist before any discretionary change:

Has a life event changed my horizon or cash flow by ≥25%?

Is an IPS trigger hit (band breach, risk budget overrun)?

Can I document the reason and expected impact in one paragraph?

72‑hour cooling-off period before execution.

Stay invested: why missing a handful of best days hurts long‑term compounding

Concentration risk in time: Big up days often cluster near big down days - market timers miss both.

Discipline over prediction: Your edge is process - consistent DCA, rebalance rules, and liquidity choreography via Fund Nest - so you capture recoveries without stress.

Deployment checklist for Startup Nest rounds (milestone verification, tranche size, stop‑rules)

Milestone verification:

On‑chain proof or verifiable evidence of builds shipped, users acquired, or revenue milestones met.

Independent validation: confirm data source and timestamp.

Tranche sizing:

Per‑deal cap: 1–3% of total portfolio.

Total venture cap: 10–20% per IPS and risk budget.

Pace: no more than one new deal per month/quarter to avoid concentration.

Funding rules:

Deploy from Fund Nest to Startup Nest on milestone unlock; keep next tranche staged in Fund Nest until proof.

Stop‑rules:

Skip tranche if milestone missed or data cannot be verified.

No averaging down outside the predefined tranche plan.

If portfolio drawdown breaches IPS max by >25% buffer, pause new venture commits until risk normalizes.

Make the hard decisions once. Write them into your IPS. Then let automation - DCA, rebalancing, cash sweeps, and milestone‑gated tranches - do the heavy lifting while you focus on evaluating proof, not price action.

Tax‑Aware Asset Location and Cashflow Design (Practical Tactics)

Taxes and cashflow are where performance quietly compounds - or leaks. Pair smart asset location with a simple cadence for funding and withdrawals. Use Zemyth’s Fund Nest to smooth liquidity and yield between Startup Nest tranches, and keep on‑chain records clean for basis, realized P/L, and governance.

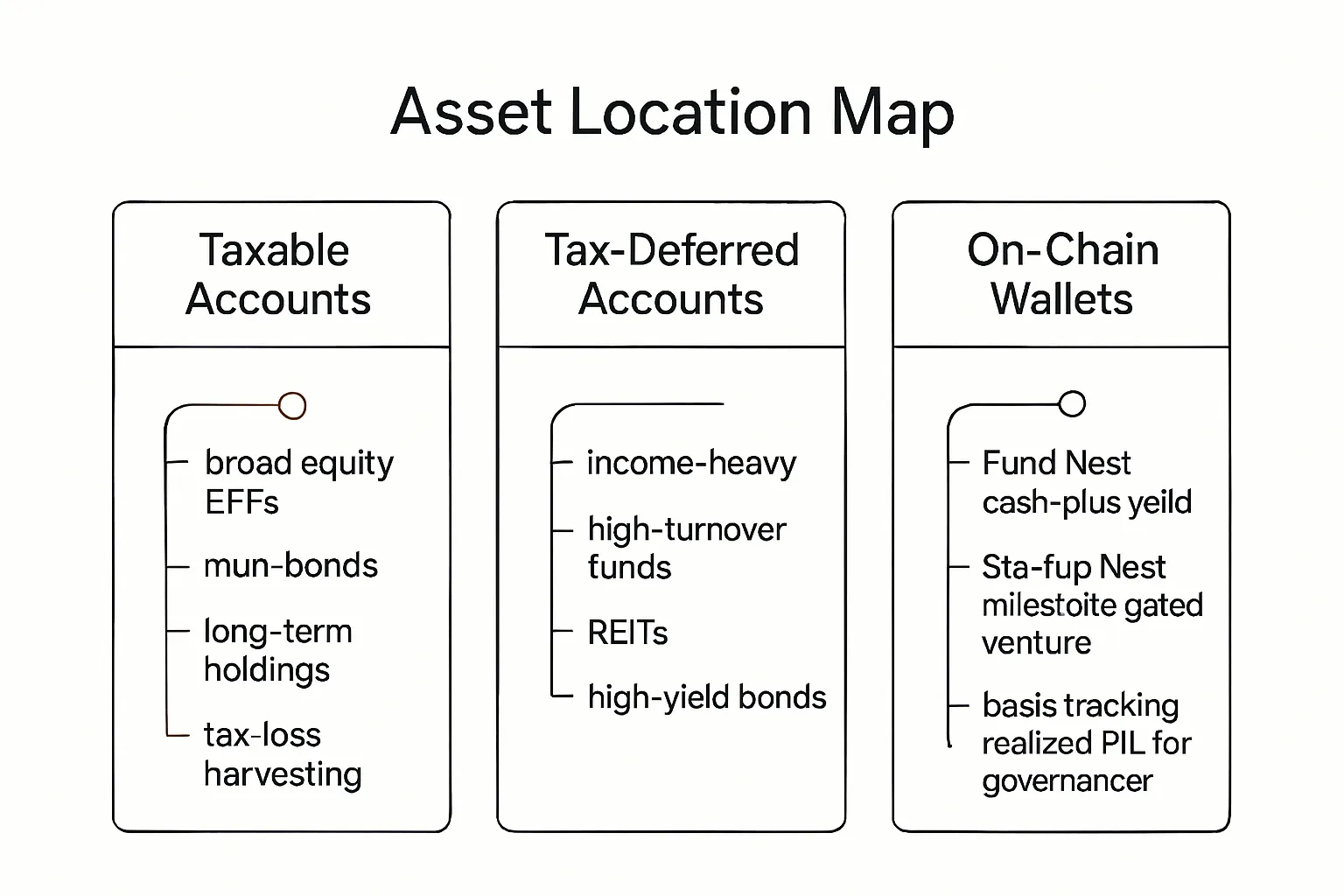

Asset location rules of thumb

Taxable (optimize for tax efficiency and flexibility)

Broad equity ETFs/indices with low turnover and qualified dividends.

Municipal bonds where taxable-equivalent yield is favorable.

Harvest losses tactically; direct new cash and distributions to underweight targets before selling.

Tax‑deferred (optimize for income and turnover)

Income‑heavy or high‑turnover strategies (credit funds, REITs, active factor funds).

Short/intermediate bond ladders where coupons would otherwise be taxed at ordinary income rates.

Rebalance here first to minimize taxable events.

On‑chain (optimize for transparency, liquidity, and proof)

Track basis and realized P/L; connect wallets to dashboards for governance/reward eligibility.

Use Startup Nest for milestone‑gated venture rounds with on‑chain verification.

Keep undeployed capital and cash buffer extensions earning in Fund Nest as a liquid “cash‑plus” layer.

Cash management layer

Park idle capital in Fund Nest for daily yield and smoother cash flow between rounds.

Automate sweeps:

Excess above your 6–12 month cash buffer moves to Fund Nest weekly.

After a Startup Nest tranche, automatically refill the buffer from Fund Nest yield and new contributions.

Withdrawal and funding cadence (quarterly vs. monthly) to minimize slippage and taxes

Funding cadence:

DCA weekly/biweekly into core allocations; route overflow to Fund Nest until thresholds hit, then deploy on schedule.

Stage venture dry powder in Fund Nest; release tranches only upon verified milestones.

Withdrawal cadence:

Prefer quarterly withdrawals for living expenses to reduce transaction frequency and potential slippage; pull from Fund Nest and near‑term sleeve.

In taxable accounts, use distributions and new cash first; sell highest‑basis lots when needed.

Rebalance cadence:

Threshold bands (±5% or ±10%) with a quarterly review; execute in tax‑deferred accounts first.

Governance hygiene:

Log each tax‑impacting action (lot ID, cost basis method) and on‑chain tranche event; reconcile realized P/L monthly to keep reporting clean.

Design the flows once, automate the rest. That way, taxes and liquidity work for you - quietly compounding while your IPS and milestone‑gated venture sleeve keep risk where it belongs.

Venture Tactics with Proof: Due Diligence for Milestone‑Gated Rounds

In venture, stories are cheap - proof is priceless. Zemyth hardwires proof into capital flow, so founders unlock tranches only when they ship, grow, and monetize with on‑chain evidence. Your job: design verifiable milestones, size positions with discipline, and source credible deals with aligned incentives.

"Running out of cash is the top‑cited reason startups fail (38%)." - Source

On‑chain proof that matters: shipped builds, active wallets/users, revenue on Solana

Shipped builds: Mainnet contracts deployed, program IDs, version tags, and audit hashes recorded on-chain; changelogs signed.

Active users: Daily/weekly active wallets, retention cohorts, and unit-level conversion captured via Solana analytics; filter out airdrop/insider wash activity.

Revenue proof: On-chain payments, fee flows, or subscription receipts tied to program addresses; verifiable gross revenue and take-rate.

Distribution evidence: Partnerships or integrations verified by signed messages or on-chain registry updates.

Fraud hygiene: Cross-check wallet clusters for sybils; reject vanity metrics that lack on-chain corroboration.

Milestone design: SMART metrics, tranche sizes, and verification oracles

SMART milestones: Specific, Measurable, Achievable, Relevant, Time-bound.

Example: “Ship v1 to mainnet with 3 audited contracts; reach 5k WAUs and $50k monthly protocol revenue within 120 days.”

Tranche sizing:

Tranche 0 (kickoff): 10–20% for shipping v1 and activating first users.

Tranche 1–3 (scale): 20–30% each tied to user growth, revenue, and retention quality.

Final tranche (moat): 10–20% for profitability path or strategic lock-ins.

Verification oracles:

Mix on-chain data feeds (program metrics), third‑party analytics, and DAO/committee attestations.

Require reproducible queries and timestamped snapshots; publish methods for community auditability.

Position sizing and portfolio construction across multiple deals (1–3% per deal, 8–20 positions)

Per‑deal cap: 1–3% of your total portfolio; increase toward 3% only with repeat proof and strong retention/revenue quality.

Portfolio breadth: Target 8–20 active positions to balance dispersion; accept that zeros are part of the game.

Pacing: No more than 1–2 new deals per month. Maintain 6–12 months of venture dry powder in Fund Nest.

Dynamic follow‑ons: Only via pre-set tranche unlocks - no ad‑hoc averaging down.

Kill switches: Missed milestones or integrity concerns halt further tranches; recycle capital to higher‑proof opportunities.

Affiliate‑driven deal flow: incentives and screening rules

Incentives:

Reward affiliates for sourcing founders who pass diligence and hit milestones (tiered payouts linked to tranche unlocks, not intros).

Reputation staking: affiliates with strong track records gain priority review.

Screening rules:

Founding team: ship history on-chain, domain experience, and velocity of iteration.

Market: painful, monetizable problem with clear Solana advantage (speed, fees, composability).

Traction quality: WAU/MAU ratios, cohort retention, revenue per active wallet, organic vs. incentivized growth mix.

Milestone clarity: verifiable, time-bound metrics; audit-ready data pipelines.

Transparency:

Publish milestone frameworks and tranche logic so founders and affiliates know the bar.

Post-mortem every miss publicly to strengthen community filters.

Proof first, capital second. That’s how you turn high dispersion into an edge - funding real execution instead of narratives, and compounding outcomes across a disciplined, milestone‑gated venture sleeve.

Risk Management You Can See: Scenarios, Buffers, and Drawdowns

Markets don’t care about your plan. Risk management makes sure your plan doesn’t care about markets either. Build visible buffers, run scenarios you can explain, and pre‑commit actions so you rebalance or de‑risk on rules - not vibes. Zemyth helps operationalize this: Fund Nest for liquidity and daily yield, Startup Nest for milestone‑gated venture so risk is released only when proof appears.

Stress‑test your plan: bull/base/bear scenarios; liquidity for 12–24 months of spend

Design three concrete scenarios and map actions to each:

Assumptions you’ll vary:

Return/volatility by sleeve (cash/bonds/equities/venture), correlations, and inflation.

Funding cadence/withdrawal rate changes (job loss, major purchase).

Venture mark‑to‑model haircuts and tranche delays.

Scenario grid:

Bull: Strong growth, low vol; check for band breaches on the upside (trim/rebalance), ensure you don’t over‑risk.

Base: Normal drift; ensure funding cadence (DCA, tranches) and rebalancing work as expected.

Bear: 20–40% equity drawdown, spread widening in credit, 50–70% venture markdown on paper, liquidity stress. Explicitly test 6, 12, and 18 months.

Liquidity runway:

Target 12–24 months of net spend covered between your Cash Buffer and Fund Nest (cash‑plus daily yield).

Priority of use in a drawdown: Cash Buffer → Fund Nest → coupons/dividends → only then consider selling risk assets.

Top‑up rules: If runway dips below 9 months, pause new risk deployment until refilled.

Monte Carlo for sequence risk and withdrawal safety (especially near retirement)

Sequence-of-returns risk can sink a plan even with okay long‑term averages. Simulate paths and throttle withdrawals with guardrails:

Inputs: Expected returns, vol, correlation; fee/tax drags; dynamic inflation.

Outputs to track:

Probability of not depleting assets over horizon.

Stressed success rate (bear scenario years front‑loaded).

Max drawdown and worst 12‑month loss by sleeve.

Guardrails for withdrawals:

Baseline rate (e.g., 3.5%–4% annualized of portfolio).

Raise/lower band: If portfolio up >20% from start, allow +0.25% step‑up; if down >20%, cut withdrawals by 10% until recovered.

Floor/ceiling: Never cut essential spending below a defined floor; use Fund Nest runway to bridge instead.

Drawdown budgets: when to cut risk vs. when to rebalance into weakness

Write drawdown rules so you’re never guessing:

Portfolio‑level budget:

Example: Max peak‑to‑trough = 18%. If drawdown ≤ budget and 12m runway intact → rebalance into weakness (buy risk from Fund Nest).

If drawdown > budget by 25% (e.g., 22.5%): activate staged de‑risking (reduce equity beta 10% over three weekly tranches), replenish buffers, then reassess.

Sleeve‑level budgets:

Near‑term (0–18m): ≤5% loss tolerance; refill immediately via Fund Nest and contributions.

Mid‑term (18–60m): ≤10%; rebalance bands at ±5%.

Long‑term (5–10y): 15–25% tolerance; band‑based rebalances at ±20% of target.

Rebalance sequence: Use new cash, dividends, and tax‑advantaged accounts first; only sell in taxable when necessary.

Regime triggers (rare):

Structural cashflow change (income −25% or +25%).

Horizon shift (major goal moves ≥12 months).

Governance breach (e.g., inability to hold through IPS-defined drawdown). Document and revise IPS; do not ad‑hoc toggle risk.

For venture sleeves: max portfolio loss thresholds and stop‑funding rules

High dispersion requires stricter rules - proof or pause.

Sizing and pacing:

Per‑deal cap: 1–3% of total portfolio.

Aggregate venture: 10–20% per IPS.

Pacing: 1–2 new deals/month; always keep 6–12 months of venture dry powder in Fund Nest.

Tranche discipline:

Unlocks only upon verified on‑chain milestones (builds shipped, active users/wallets, revenue).

No averaging down outside the tranche plan.

If a milestone is missed or data is non‑verifiable → skip tranche; reassess in next review window.

Loss thresholds:

Sleeve drawdown >35% (mark‑to‑market or verifiable markdowns): pause new commitments; fund only previously scheduled tranches that meet proof.

Portfolio drawdown exceeds IPS budget by 25%: freeze new venture deals; redirect yield and new cash to rebuild liquidity runway first.

Concentration guard: If any single deal >3% after appreciation, trim opportunistically (subject to liquidity/lockups) to re‑balance sleeve risk.

Post‑mortem and recycling:

Document failed milestones and recycle reserved capital to higher‑proof deals.

Update milestone templates/oracles to reduce false positives going forward.

Risk management isn’t a sidecar - it is the vehicle. With scenarios, buffers, and drawdown budgets defined in your IPS, Fund Nest supplies the liquidity to execute calmly, and Startup Nest ensures venture capital follows execution, not emotion.

Measure What Matters: KPIs, Reviews, and Iteration

If you can’t see it, you can’t steer it. Build a quarterly dashboard that connects your investment methodology to investment tactics and keeps your timeline investment on track. With Zemyth, you’ll track Fund Nest liquidity/yield and Startup Nest milestone execution with on‑chain clarity - so adjustments are data‑driven, not emotional.

Quarterly dashboard

Track these KPIs every quarter (set targets in your IPS, and define actions if off‑track):

Contribution rate

What it is: Percent of gross income automatically invested.

How to measure: Sum of automated DCA and Fund Nest sweeps ÷ gross income.

Target/action: Raise 1–2 percentage points annually until you hit your IPS goal; if below target, increase DCA or trim discretionary spend.

Cash buffer months

What it is: Months of essential spend covered by Cash Buffer + Fund Nest.

How to measure: (Cash Buffer + Fund Nest liquid balance) ÷ monthly essential expenses.

Target/action: 6–12 months. If <9 months, pause risk deployments and refill from contributions/yield.

Portfolio volatility and drawdown vs. budget

What it is: Realized volatility (90D/1Y) and current peak‑to‑trough drawdown.

How to measure: Rolling stdev of daily returns; track maximum decline from recent peak.

Target/action: Must sit within IPS risk budget. If drawdown ≤ budget and runway intact, rebalance into weakness; if > budget by 25%, activate staged de‑risking.

Tracking error vs. policy allocation

What it is: Deviation from your policy benchmark (core–satellite weights).

How to measure: Ex‑post tracking error; max sleeve drift from target.

Target/action: Rebalance when sleeves breach ±5% (conservative/balanced) or ±10% (growth) bands; use new cash first.

Rebalance status

What it is: When you last rebalanced; current largest drift.

Action: Execute threshold‑based rebalancing; confirm tax‑aware sequencing (tax‑deferred first).

Fund Nest KPIs

Daily yield: 7‑day annualized yield.

Utilization rate: Deployed ÷ available.

Idle‑capital days: Average days capital sits in Fund Nest before deployment.

Buffer coverage: Portion of Fund Nest earmarked for Cash Buffer top‑ups.

Actions: If utilization < target, tighten deployment cadence; if idle days high, pull forward scheduled tranches or core buys.

Startup Nest KPIs

Milestone completion rate: % milestones met on time.

Tranche release velocity: Days from verification to unlock.

Write‑ups/downs: Sleeve NAV change; realized vs. unrealized.

Concentration: # active positions (target 8–20), largest deal weight, top‑5 weight.

Proof hygiene: % of milestones with verifiable on‑chain data/oracle attestations.

Actions: If completion rate slips or verification fails, pause new deals and recycle to higher‑proof opportunities.

Tax and efficiency KPIs

Realized gains/losses YTD; after‑tax return vs. pre‑tax.

Asset location adherence: % of income‑heavy holdings in tax‑deferred.

Actions: Harvest losses opportunistically; migrate tax‑inefficient holdings to tax‑advantaged accounts during rebalances.

Scenario posture

Liquidity runway under bear case; stress success probability (from Monte Carlo).

Actions: If runway <12 months in bear case, build reserves via Fund Nest before new risk.

Change management: what triggers an IPS update vs. what doesn’t

Triggers an IPS update

Income or expense shift ≥25% (job change, new dependent, major recurring cost).

Goal timeline shift ≥12 months or goal added/removed.

Risk capacity change (can’t tolerate IPS‑defined drawdown without breaking rules).

Structural regime change (persistent inflation, tax law impacting asset location).

Venture sleeve breach (loss thresholds, concentration beyond caps, milestone integrity concerns).

Does not trigger an IPS update

Market headlines, short‑term volatility, or a single ugly month.

FOMO on a hot theme or influencer narrative.

Temporary underperformance of a sleeve within expected bands.

Isolated venture write‑down without proof integrity issues.

Document all IPS edits: the why, what changed, and the new guardrails. If it’s not written, it’s not the plan.

Annual reset: raise targets, refine tactics, re‑price risk as life changes

Once a year, run a full tune‑up so your investment and strategy stay aligned with reality:

Raise the bar

Increase contribution rate by 1–2 pts if feasible.

Lift automatic tranche caps modestly only if milestone reliability and portfolio liquidity improved.

Re‑price risk

Update expected returns/volatility/correlations; confirm risk budget and drawdown limits.

Revisit core–satellite weights and factor tilts; keep within IPS guardrails.

Refine tactics

Upgrade DCA cadence, rebalance bands, and cash‑to‑investment sweeps.

Tighten venture process: revise milestone templates, oracles, and verification SLAs based on last year’s post‑mortems.

Adjust position size caps (e.g., maintain 1–3% per deal; target 8–20 names).

Tax and location

Re-run asset location checks; migrate income‑heavy holdings to tax‑deferred.

Realize strategic gains/losses and update cost‑basis lots for next year’s playbook.

Reset dashboard targets

Set quarterly KPI goals: contribution %, buffer months, utilization, milestone completion rate, max drift, and allowed tracking error.

Schedule your quarterly business review (QBR): 60 minutes, decision‑focused, with pre‑reads from your dashboard.

Iteration is the compounding engine. Measure what matters, enforce the rules you wrote, and let automation handle the rest - Fund Nest for liquidity and yield, Startup Nest for milestone‑gated venture - so your investment methodology translates into consistent investment tactics and a durable, timeline‑first plan.

Put It to Work with Zemyth Today

You’ve got the plan - now give it rails. Zemyth operationalizes your investment methodology with timeline investment and investment tactics you can automate, measure, and refine on-chain.

Why Zemyth fits this methodology

Milestone‑gated venture rounds (execution over hype)

Startup Nest deploys capital in tranches tied to verifiable proof - builds shipped, active users, revenue. Your venture sleeve funds progress, not promises.

Fund Nest as your liquid base layer (daily yield while you wait)

Park idle cash and dry powder in a liquid, lower‑risk yield layer that compounds daily - smooth cash flows, refill buffers, and stage tranches without sitting idle.

On‑chain transparency and contributor reputation on Solana

Every tranche, milestone, and movement is verifiable. Reputation and progress are recorded on-chain so risk and results stay visible.

Education‑first Academy and affiliate network for smarter deal flow

Playbooks for founders and investors, plus aligned incentives for communities that surface credible teams - better screening, better outcomes.

Next steps

Create your IPS from this guide, set allocations, and open your Zemyth account

Write a one‑page policy with goals by horizon, risk budgets, and guardrails. Define sleeve targets (cash, bonds, equities, venture).

Park idle capital in Fund Nest; subscribe to Startup Nest deal flow

Fund your liquidity layer for daily yield and runway; follow milestone‑gated rounds and shortlist deals that match your thesis.

Start small, automate, and review quarterly

Turn on DCA and auto‑rebalance; size venture positions at 1–3% per deal; track KPIs (buffer months, utilization, milestone completion).

Deploy only on proof; keep tranches staged

Release capital tranche‑by‑tranche as milestones verify on-chain. If proof stalls, capital waits in Fund Nest - your risk stays bounded.

Iterate with data

Run your quarterly dashboard. If targets drift or life changes, update your IPS - investment and strategy stay in sync, timeline‑first.